10 Ways Wall Street Played You For A Chump - MarketWatch

Diunggah oleh

BaikaniDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

10 Ways Wall Street Played You For A Chump - MarketWatch

Diunggah oleh

BaikaniHak Cipta:

Format Tersedia

29.07.

13

10 ways Wall Street played you for a chump - MarketWatch

July 29, 2013, 6:15 a.m. EDT

10 ways Wall Street played you for a chump

By George Sisti

Never give a sucker an even break or smarten up a chump W.C. Fields in You Cant Cheat an Honest Man

On Wall Street, business as usual thrives on investor ignorance. It is not in its interest to have more astute clients. Here are 10 ways to see if youve been suckered into becoming a Wall Street chump.

1. Youre a chump if you believe that there is an investment that yields high returns with little or no risk. The astonishing amount of money lost in

financial scams is often the result of suckers believing promises of unrealistically high performance in investments that they dont understand.

2. Youre a chump if youve been fooled into believing that your financial success depends upon finding a smart money manager or guru who

knows what lies ahead in the capital markets. Dont be suckered into mistaking predictions for insight. Wall Streets fortunetellers have exchanged their crystal balls for charts and graphs and call themselves economic analysts. Its easy for them to proclaim certainty in an uncertain world when they have no skin in the game. The future is unpredictable. Anyone who makes predictions is a fool and anyone who listens to them is a sucker.

3. Youre a chump if you dont understand that Wall Street gets rich at your expense. In 1940, Fred Schwed wrote the book Where are the

Customers Yachts? This investment classic captures the essence of how Wall Street transfers dollars from customers pockets to their own. It should be required reading for all investors.

4. Youre a chump if youre searching for mutual fund managers who consistently outperform their peers. S&P has just released its semiannual

Persistence Scorecard which tracked the subsequent performance of top-half mutual funds over the three and five year periods ending March 31. The number of funds that maintained top half performance over three and five consecutive 12-month periods is below what we would expect from random chance alone. The obligatory disclaimer past performance is no guarantee of future results appears in every mutual fund advertisement, just below the chart that boasts about the funds past performance. Past performance can be used to compare the relative risk between two different investments but dont be suckered into believing that you can buy yesterdays performance.

5. Youre a chump if you think that I want the highest rate of return possible is a legitimate financial goal. I want to retire at 65 at my current

standard of living, inflation adjusted for a 25 year retirement is a legitimate goal because it has a calculable dollar value and a target date.

6. Only a sucker believes that active managers add value over the long term. According to S&P, 75% of large-cap domestic stock mutual funds,

90% of midcap funds and 83% of small-cap funds under performed their benchmark S&P index for the five years ending Dec. 31, 2012. Rather than adding value, most managers subtracted value. By owning a portfolio of tax efficient, low turnover, low cost index funds youll receive 99.8% of the returns of the stock and bond markets and remove the fruitless task of manager chasing from your to-do list.

7. Youre a chump if you believe that you can be a successful stock picker. It is virtually impossible for any investor to identify undervalued stocks,

no matter what the E-Trade baby says. Owning individual stocks adds unnecessary individual company risk to a portfolio. Youre a sucker if you believe that your financial adviser can do what most professional money managers cannot do find stocks that will outperform the market.

8. Youre a chump if you use the words investment and short-term gain in the same sentence. Wall Streets mouthpieces offer endless stock

recommendations and short-term market outlooks. Having a comprehensive and comprehensible investment strategy, one that is based on academic research and focused on the long-term is more important than anyones investment outlook.

9. Youre a chump if you accept specific, personal financial advice from someone who doesnt know your financial goals, risk tolerance, insurance

needs, employee benefits or tax bracket. An impersonal relationship with an adviser who creates a portfolio containing a hodgepodge of mutual funds and investment products isnt financial planning - it is retailing.

10. Wall Street is about to give you a new opportunity to become a chump. The same week that Bloomberg Businessweek had a cover story

exposing hedge funds as one of the most over promising and under delivering investments of recent times, the SEC eliminated its long-standing ban on hedge fund advertising. Soon, youll be offered the opportunity to lose money hand over fist just like the superrich. Forewarned is forearmed. There will always be enough suckers and chumps to keep Wall Street rolling in dough. Make sure that youre not among them. Be it resolved chumps no more from this day forward.

www.marketwatch.com/Story/story/print?guid=2300641D-B90B-48B5-A35F-AC4263BA561E

1/2

29.07.13

10 ways Wall Street played you for a chump - MarketWatch

Copy right 2013 MarketWatch, Inc. All rights reserv ed. By using this site, y ou agree to the Terms of Serv ice and Priv acy Policy - UPDATED 10/18/2011. Intraday Data prov ided by SIX Financial Inf ormation and subject to terms of use. Historical and current end-of -day data prov ided by SIX Financial Inf ormation. Intraday data delay ed per exchange requirements. S&P/Dow Jones Indices (SM) f rom Dow Jones & Company , Inc. All quotes are in local exchange time. Real time last sale data prov ided by NASDAQ. More inf ormation on NASDAQ traded sy mbols and their current f inancial status. Intraday data delay ed 15 minutes f or Nasdaq, and 20 minutes f or other exchanges. S&P/Dow Jones Indices (SM) f rom Dow Jones & Company , Inc. SEHK intraday data is prov ided by SIX Financial Inf ormation and is at least 60-minutes delay ed. All quotes are in local exchange time.

www.marketwatch.com/Story/story/print?guid=2300641D-B90B-48B5-A35F-AC4263BA561E

2/2

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Most Powerful Trader On Wall Street You'Ve Never Heard of - BusinessweekDokumen5 halamanThe Most Powerful Trader On Wall Street You'Ve Never Heard of - BusinessweekBaikaniBelum ada peringkat

- 656 - Hong Kong Stock Quote - Fosun International LTD - BloombergDokumen3 halaman656 - Hong Kong Stock Quote - Fosun International LTD - BloombergBaikaniBelum ada peringkat

- Gold Is Money All Else Is FiatDokumen15 halamanGold Is Money All Else Is FiatBaikaniBelum ada peringkat

- TSLA Stock Quote - Tesla Motors IncDokumen2 halamanTSLA Stock Quote - Tesla Motors IncBaikaniBelum ada peringkat

- Documents Research Persistence Scorecard July 2013Dokumen8 halamanDocuments Research Persistence Scorecard July 2013BaikaniBelum ada peringkat

- 10 20F - 516878aDokumen349 halaman10 20F - 516878aBaikaniBelum ada peringkat

- IVA Worldwide QR 2Q13Dokumen2 halamanIVA Worldwide QR 2Q13BaikaniBelum ada peringkat

- Ben Graham Would Be Proud Self-EvidentDokumen3 halamanBen Graham Would Be Proud Self-EvidentBaikaniBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Taxation As A Fiscal Policy FinalDokumen34 halamanTaxation As A Fiscal Policy FinalLetsah BrightBelum ada peringkat

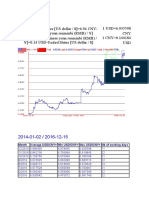

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysDokumen3 halamanMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyBelum ada peringkat

- Rethinking Social Protection Paradigm-1Dokumen22 halamanRethinking Social Protection Paradigm-1herryansharyBelum ada peringkat

- Certificate of Origin: Issued by The Busan Chamber of Commerce & IndustryDokumen11 halamanCertificate of Origin: Issued by The Busan Chamber of Commerce & IndustryVu Thuy LinhBelum ada peringkat

- The United States Edition of Marketing Management, 14e. 1-1Dokumen133 halamanThe United States Edition of Marketing Management, 14e. 1-1Tauhid Ahmed BappyBelum ada peringkat

- Fundamental Analysis of Ultratech Cement: Presented By:-Rishav MalikDokumen15 halamanFundamental Analysis of Ultratech Cement: Presented By:-Rishav MalikRishav MalikBelum ada peringkat

- Contoh Report TextDokumen1 halamanContoh Report TextRandi naufBelum ada peringkat

- The Racist Roots of Welfare Reform - The New RepublicDokumen6 halamanThe Racist Roots of Welfare Reform - The New Republicadr1969Belum ada peringkat

- Anser Key For Class 8 Social Science SA 2 PDFDokumen5 halamanAnser Key For Class 8 Social Science SA 2 PDFSoumitraBagBelum ada peringkat

- Ibm 530Dokumen6 halamanIbm 530Muhamad NasirBelum ada peringkat

- Feu LQ #1 Answer Key Income Taxation Feu Makati Dec.4, 2012Dokumen23 halamanFeu LQ #1 Answer Key Income Taxation Feu Makati Dec.4, 2012anggandakonohBelum ada peringkat

- Managerial Economics - Concepts and ToolsDokumen20 halamanManagerial Economics - Concepts and ToolsBopzilla0911100% (1)

- Extracted Pages From May-2023Dokumen4 halamanExtracted Pages From May-2023Muhammad UsmanBelum ada peringkat

- Abstract, Attestation & AcknowledgementDokumen6 halamanAbstract, Attestation & AcknowledgementDeedar.RaheemBelum ada peringkat

- Kendriya Vidyalaya Island Grounds: Cluster Level-1 Session Ending Examination - 2008 Model Question PaperDokumen20 halamanKendriya Vidyalaya Island Grounds: Cluster Level-1 Session Ending Examination - 2008 Model Question Paperbiswajit1990Belum ada peringkat

- Itinerario Cosco ShippingDokumen2 halamanItinerario Cosco ShippingRelly CarrascoBelum ada peringkat

- Comparative Cost AdvantageDokumen4 halamanComparative Cost AdvantageSrutiBelum ada peringkat

- Middle East June 11 Full 1307632987869Dokumen2 halamanMiddle East June 11 Full 1307632987869kennethnacBelum ada peringkat

- Us Cons Job Architecture 041315Dokumen11 halamanUs Cons Job Architecture 041315Karan Pratap Singh100% (1)

- Team Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Dokumen5 halamanTeam Energy Corporation, V. Cir G.R. No. 197770, March 14, 2018 Cir V. Covanta Energy Philippine Holdings, Inc., G.R. No. 203160, January 24, 2018Raymarc Elizer AsuncionBelum ada peringkat

- Travel Through SpainDokumen491 halamanTravel Through SpainFrancisco Javier SpínolaBelum ada peringkat

- The Making of A Smart City - Best Practices Across EuropeDokumen256 halamanThe Making of A Smart City - Best Practices Across Europefionarml4419Belum ada peringkat

- 2.01 Economic SystemsDokumen16 halaman2.01 Economic SystemsRessie Joy Catherine FelicesBelum ada peringkat

- Lec 7 Determination of Market PriceDokumen13 halamanLec 7 Determination of Market PriceNEERAJA UNNIBelum ada peringkat

- de Thi Chon HSG 8 - inDokumen4 halamande Thi Chon HSG 8 - inPhương Chi NguyễnBelum ada peringkat

- University of Mumbai Project On Investment Banking Bachelor of CommerceDokumen6 halamanUniversity of Mumbai Project On Investment Banking Bachelor of CommerceParag MoreBelum ada peringkat

- (MP) Platinum Ex Factory Price ListDokumen1 halaman(MP) Platinum Ex Factory Price ListSaurabh JainBelum ada peringkat

- Table of ContentsDokumen6 halamanTable of ContentsRakeshKumarBelum ada peringkat

- 8 Trdln0610saudiDokumen40 halaman8 Trdln0610saudiJad SoaiBelum ada peringkat

- IELTS Writing Task 1 Sample - Bar Chart - ZIMDokumen28 halamanIELTS Writing Task 1 Sample - Bar Chart - ZIMPhương Thư Nguyễn HoàngBelum ada peringkat