UM Tax 1 Case List

Diunggah oleh

Irysh BostonHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

UM Tax 1 Case List

Diunggah oleh

Irysh BostonHak Cipta:

Format Tersedia

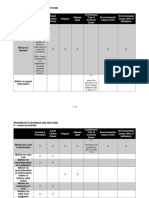

Case List Tax I INCOME TAX

1. GENERAL PRINCIPLES Sison v. Commissioner (GR L-59431, 25 JULY 1984) CIR v. Estate of Toda (14 SEPTEMBER 2004) 2. INCOME TAXATION

CIR v. Manning (6 August 1975) From whatever source James vs. United States, 366 US 213 (May 15, 1961) Convenience of the Employer Rule Henderson v. Collector, I SCRA 649 Exclusions Retirement benefits, etc. Commissioner of Internal Revenue vs. Court of Appeals (March 23, 1992) Commissioner of Internal Revenue vs. Court of Appeals (October 17, 1991) Re: Request of Atty. Bernardo Zialcita (October 18, 1990) Intercontinental Broadcasting Corporation vs. Amarilla (October 27, 2006) Income derived by foreign government Commissioner of Internal Revenue vs. Mitsubishi Metal Corporation (January 22, 1990) Gifts, Bequests, Devices CIR v. Deberstein, 363 U.S. 278 (1960) Compensation for Injuries or Sickness OGilvie v. U.S., 519 U.S. 79 (1996) Murphy v. U.S., No. 05-5139 (D.C. Cir. Aug. 22, 2006) Murphy v. U.S., No. 05-5139 (D.C. Cir. July 3, 2007) (on rehearing) Gains from Sale of Bonds and other Certificates of Indebtedness Nippon Life Ins. Co., Inc. v. CIR, CTA Case No. 6142 (Feb. 4, 2002)

Definitions Resident citizens and resident aliens Garrison vs. Court of Appeals (July 19, 1990) Ramnani v. CIR, CTA Case No. 5108 (September 13, 1996) Corporations AFISCO Insurance Corporation vs. Court of Appeals (January 25, 1999) Pascual vs. Commissioner of Internal Revenue (October 18, 1988) Obillos vs. Commissioner of Internal Revenue (October 29, 1985) Oa vs. Commissioner of Internal Revenue (May 25, 1972) Commissioner v. Batangas Tayabas Bus Co. (102 Phil. 822) Income In general Madrigal vs. Rafferty (August 7, 1918) Fisher vs. Trinidad (October 30, 1922) Limpan Investment Corporation vs. Commissioner of Internal Revenue (July 26, 1966) Conwi vs. Court of Tax Appeals ( August 31, 1992) Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (March 28, 1955) Murphy vs. Internal Revenue Service 460 F3rd 79 D.C. Circuit Court

3. Source of Income Rules Income from any source whatever Gutierrez v. Collector, 101 Phil. 743 Gross income from sources within Phils. Commissioner of Internal Revenue vs. Marubeni Corporation (December 18, 2001) Commissioner of Internal Revenue vs. BOAC (April 30, 1987) Commissioner v. CTA and Smith Kline & French Overseas (January 17, 1984) Philippine Guaranty Co., Inc. vs. Commissioner of Internal Revenue (April 30, 1965) Howden & Co., Ltd. Vs. Collector of Internal Revenue (April 14, 1965) Philippine American Life Insurance Company, Inc. vs. Court of Tax Appeals CA-GR Sp. No. 31283 (April 25, 1995) Commissioner of Internal Revenue vs. Baier-Nickel (August 29, 2006) Quill Corp. vs. North Dakota, 504 US 298 (May 26, 1992) 4. Individuals

(August 22, 2006)

Statutory inclusions Compensation for services Old Colony Trust Co. vs. Commissioner of Internal Revenue, 279 US 716 Rudolph v. US, 370 US 269 (1962) Rents Helvering vs. Bruun, 309 US 461 (March 25, 1940) Dividends Commissioner of Internal Revenue vs. Court of Appeals (January 20, 1999) Wise & Co., Inc. vs. Meer (June 30, 1947)

(June 3, 1929)

Ordinary Income Passive Income Capital Gains Tax Supreme Transliner, Inc. vs. BPI Family Savings Bank, Inc. (February 23, 2011) OCWs/Senior Citizens/Disabled M.E. Holdings Corporation vs. CIR & CTA (March 3, 2008) Personal and additional exemptions/PERA Pansacola vs. Commissioner of Internal Revenue (November 16, 2006) Income Tax on NRA-ETB Higgins v. CIR, 312 US 212 (1941) Income Tax on NRA-NETB CIR v. Wodehouse, 337 US 369 (1949)

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Araneta vs. PerezDokumen1 halamanAraneta vs. PerezMildred Donaire Cañoneo-ClemeniaBelum ada peringkat

- Simple Rules - To Remove Judges in TexasDokumen22 halamanSimple Rules - To Remove Judges in Texasjbdage100% (1)

- Pennoyer Limits Jurisdiction Over Non-ResidentsDokumen2 halamanPennoyer Limits Jurisdiction Over Non-ResidentsAlexis Elaine BeaBelum ada peringkat

- Testate Estate of MARIANO MOLODokumen12 halamanTestate Estate of MARIANO MOLOIrysh BostonBelum ada peringkat

- Testate Estate of MARIANO MOLODokumen12 halamanTestate Estate of MARIANO MOLOIrysh BostonBelum ada peringkat

- Sison v. DavidDokumen3 halamanSison v. Davidcharmdelmo100% (1)

- Provisional Remedies ReviewerDokumen15 halamanProvisional Remedies ReviewerIrysh Boston100% (1)

- DEDUCTIONSDokumen31 halamanDEDUCTIONSIrysh BostonBelum ada peringkat

- Julian Penilla CaseDokumen7 halamanJulian Penilla CaseIrysh BostonBelum ada peringkat

- Municipality of MalabangDokumen1 halamanMunicipality of MalabangIrysh BostonBelum ada peringkat

- Nielson & Co. Inc. vs. Lepanto Consolidated Mining Co.: (GR L-21601, 28 December 1968) FactsDokumen4 halamanNielson & Co. Inc. vs. Lepanto Consolidated Mining Co.: (GR L-21601, 28 December 1968) FactsIrysh BostonBelum ada peringkat

- Supreme Court Rules Sale of Eternit Corp Land Null Due to Lack of Board ApprovalDokumen4 halamanSupreme Court Rules Sale of Eternit Corp Land Null Due to Lack of Board ApprovalIrysh BostonBelum ada peringkat

- NIELSON Vs LepantoDokumen1 halamanNIELSON Vs LepantoMa Gabriellen Quijada-TabuñagBelum ada peringkat

- International Business Transaction ClassDokumen2 halamanInternational Business Transaction ClassIrysh BostonBelum ada peringkat

- Article 1788 CasesDokumen17 halamanArticle 1788 CasesIrysh BostonBelum ada peringkat

- Income Taxation 1Dokumen145 halamanIncome Taxation 1Irysh BostonBelum ada peringkat

- Art 17Dokumen3 halamanArt 17Irysh BostonBelum ada peringkat

- Article 1788 CasesDokumen17 halamanArticle 1788 CasesIrysh BostonBelum ada peringkat

- Cir Vs Sutter Bus OrgDokumen5 halamanCir Vs Sutter Bus OrgIrysh BostonBelum ada peringkat

- Flores Vs MallareDokumen3 halamanFlores Vs MallareIrysh BostonBelum ada peringkat

- Election Digested CaseDokumen6 halamanElection Digested CaseIrysh BostonBelum ada peringkat

- Rule 129 Case DigestDokumen4 halamanRule 129 Case DigestIrysh BostonBelum ada peringkat

- Election Digested CaseDokumen6 halamanElection Digested CaseIrysh BostonBelum ada peringkat

- Donziger 2Dokumen2 halamanDonziger 2Carter WoodBelum ada peringkat

- SOUTHERN FINANCE CO BHD v. ZAMRUD PROPERTIES SDN BHD (NO 3) CLJ - 1999 - 4 - 754 PDFDokumen5 halamanSOUTHERN FINANCE CO BHD v. ZAMRUD PROPERTIES SDN BHD (NO 3) CLJ - 1999 - 4 - 754 PDFAlae KieferBelum ada peringkat

- G.R. No. 195670 December 3, 2012 WILLEM BEUMER, Petitioner, AVELINA AMORES, RespondentDokumen3 halamanG.R. No. 195670 December 3, 2012 WILLEM BEUMER, Petitioner, AVELINA AMORES, RespondentAnonymous wINMQaNBelum ada peringkat

- Court Case On Dar AppmDokumen63 halamanCourt Case On Dar AppmIndian Railways Knowledge PortalBelum ada peringkat

- United States Court of Appeals Third CircuitDokumen9 halamanUnited States Court of Appeals Third CircuitScribd Government DocsBelum ada peringkat

- In RE WinshipDokumen27 halamanIn RE WinshipMasterboleroBelum ada peringkat

- Alston and GoodmanDokumen50 halamanAlston and GoodmanSara Dela Cruz AvillonBelum ada peringkat

- School of Law and Governance Law BLDG, Pelaez St. Cebu City 6000Dokumen10 halamanSchool of Law and Governance Law BLDG, Pelaez St. Cebu City 6000Maria Resper LagasBelum ada peringkat

- Stratasys v. Microboards TechnologyDokumen20 halamanStratasys v. Microboards TechnologyPriorSmartBelum ada peringkat

- Mendoza Vs CoaDokumen23 halamanMendoza Vs CoaErick Jay InokBelum ada peringkat

- Prohibited PleadingsDokumen8 halamanProhibited PleadingsRayn CagangBelum ada peringkat

- David J. Dillworth Dorothy Dillworth v. Andrew Gambardella, 970 F.2d 1113, 2d Cir. (1992)Dokumen14 halamanDavid J. Dillworth Dorothy Dillworth v. Andrew Gambardella, 970 F.2d 1113, 2d Cir. (1992)Scribd Government DocsBelum ada peringkat

- Compilation For FinalsDokumen25 halamanCompilation For FinalsIrish AnnBelum ada peringkat

- Jessup Moot Court Competition Windscale Islands DisputeDokumen19 halamanJessup Moot Court Competition Windscale Islands DisputeSamantha ReyesBelum ada peringkat

- FA-609 - en Enforce Physical PlacementDokumen2 halamanFA-609 - en Enforce Physical PlacementAutumn ShearerBelum ada peringkat

- Supreme Court: Francisco Rodriguez, For Appellants. Alfredo Chicote, For Private ProsecutorDokumen4 halamanSupreme Court: Francisco Rodriguez, For Appellants. Alfredo Chicote, For Private ProsecutorlenvfBelum ada peringkat

- Industrial Employment (Standing Orders) Act, 1946Dokumen47 halamanIndustrial Employment (Standing Orders) Act, 1946Dhaval Patel0% (1)

- IBP Vs Zamora G.R. No. 141284 August 15, 2000Dokumen19 halamanIBP Vs Zamora G.R. No. 141284 August 15, 2000Kenley MacandogBelum ada peringkat

- Quasi-Judicial Power and Due Process in Labor CasesDokumen2 halamanQuasi-Judicial Power and Due Process in Labor CasesJamesBelum ada peringkat

- Quisay v. People (2016): Lack of Prior Written Authority Renders Information DefectiveDokumen1 halamanQuisay v. People (2016): Lack of Prior Written Authority Renders Information DefectiveAndrea RioBelum ada peringkat

- Aytona vs. Castillo appointment challengeDokumen6 halamanAytona vs. Castillo appointment challengeAbigael SeverinoBelum ada peringkat

- Attorney Suspended for Excessive Contingency Fee in Labor CaseDokumen6 halamanAttorney Suspended for Excessive Contingency Fee in Labor CasePrncssbblgmBelum ada peringkat

- United States v. Michelle Mallard, 4th Cir. (2015)Dokumen6 halamanUnited States v. Michelle Mallard, 4th Cir. (2015)Scribd Government DocsBelum ada peringkat

- Bourdieu's Habitus, Dispositions, and Doxa in The Legalized Resolution of ConflictsDokumen13 halamanBourdieu's Habitus, Dispositions, and Doxa in The Legalized Resolution of ConflictsBenthe VermeulenBelum ada peringkat

- Lawsuit Filed in Death of Jemel RobersonDokumen4 halamanLawsuit Filed in Death of Jemel RobersonWGN Web DeskBelum ada peringkat

- Opposition To Coachella Preliminary InjunctionDokumen18 halamanOpposition To Coachella Preliminary InjunctionTHROnlineBelum ada peringkat