RBI Measure To Address Market Conditions 20 August 2013

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

RBI Measure To Address Market Conditions 20 August 2013

Hak Cipta:

Format Tersedia

PRESSRELEASE

, ,...,400001

_____________________________________________________________________________________________________________________

RESERVEBANKOFINDIA

DEPARTMENTOFCOMMUNICATION,CentralOffice,S.B.S.Marg,Mumbai400001 /Phone:9122 22660502 /Fax:9122 22660358

:www.rbi.org.in/hindi Website:www.rbi.org.in email: helpdoc@rbi.org.in

August 20, 2013 RBI announces Measures to address Market Conditions On July 15, 2013, the Reserve Bank of India had announced measures for liquidity tightening in order to raise the short-term interest rate and thereby curb volatility in the exchange rate. These measures were recalibrated on July 23, 2013. A review of these measures suggests that the immediate objective of raising the shortterm interest rates has substantially been achieved as evidenced by the money market rates anchoring to the marginal standing facility (MSF) rate of 10.25 per cent. Going forward, the Reserve Bank will calibrate the issue of cash management bills (CMBs), including scaling it down as may be necessary, to keep the money market rates around MSF rate until the volatility of rupee eases. It is important to address the risks to macroeconomic stability from external sector imbalances. At the same time, it is also important to ensure that the liquidity tightening does not harden longer term yields sharply and adversely impact the flow of credit to the productive sectors of the economy. It may be recalled that in its first quarter monetary policy statement of July 30, 2013, the Reserve Bank had said that the stance of its monetary policy is intended, among other things, to manage liquidity conditions to ensure adequate credit flow to the productive sectors of the economy. In pursuance of this objective, it has been decided that: The Reserve Bank will conduct open market purchase operations (OMOs) of long dated Government of India Securities of Rs.8,000 crore on August 23, 2013, and thereafter calibrate them both in terms of quantum and frequency, as may be warranted by the evolving market conditions.

The hardening of long term yields has resulted in banks incurring large markto-market (MTM) losses in their investment portfolio. Since these MTM losses are partly resulting from abnormal market conditions and could be expected to be largely recouped going forward, the Reserve Bank has decided to provide the following prudential adjustments for a limited period: Current regulations require banks to bring down their statutory liquidity ratio (SLR) securities in held to maturity (HTM) category from 25 per cent to 23 per cent of their Net Demand and Time Liabilities (NDTL) in a progressive manner in a prescribed time frame. The requirement stood at 24.5 per cent as at end June 2013. It has now been decided to relax this requirement by allowing banks to retain SLR holdings in HTM category at 24.5 per cent until further instructions.

2 Further, banks will now be allowed to transfer SLR securities to HTM category from available for sale (AFS) / held for trading (HFT) categories up to the limit of 24.5 per cent as a one-time measure. Such transfer of securities from AFS/HFT category to HTM category should be made at the lower of the book value or market value. Banks have the option of valuing these securities for the purpose of such transfer as at the close of business of July 15, 2013. In addition, banks can spread over the net depreciation, if any, on account of MTM valuation of securities held under AFS/HFT categories over the remaining period of the current financial year in equal instalments.

A detailed circular in this regard will be issued shortly.

Press Release : 2013-2014/355

Alpana Killawala Principal Chief General Manager

Anda mungkin juga menyukai

- The Magnificent 10 For Men by MrLocario-1Dokumen31 halamanThe Magnificent 10 For Men by MrLocario-1Mauricio Cesar Molina Arteta100% (1)

- Emilia Perroni-Play - Psychoanalytic Perspectives, Survival and Human Development-Routledge (2013) PDFDokumen262 halamanEmilia Perroni-Play - Psychoanalytic Perspectives, Survival and Human Development-Routledge (2013) PDFMihaela Ioana MoldovanBelum ada peringkat

- Cancer of LarynxDokumen29 halamanCancer of LarynxQasim HaleimiBelum ada peringkat

- Economics Project - Docx 2Dokumen7 halamanEconomics Project - Docx 2Gurpreet Singh100% (2)

- AIX For System Administrators - AdaptersDokumen2 halamanAIX For System Administrators - Adaptersdanielvp21Belum ada peringkat

- Mini Lecture and Activity Sheets in English For Academic and Professional Purposes Quarter 4, Week 5Dokumen11 halamanMini Lecture and Activity Sheets in English For Academic and Professional Purposes Quarter 4, Week 5EllaBelum ada peringkat

- Foreign Direct Investment in Equity Market in IndiaDokumen4 halamanForeign Direct Investment in Equity Market in IndiaJhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Rbi PR 31-07-12Dokumen1 halamanRbi PR 31-07-12Sandeep BhandariBelum ada peringkat

- Press Release (RBI)Dokumen1 halamanPress Release (RBI)deepak1126Belum ada peringkat

- IIBF Vision February 2016 For WebDokumen8 halamanIIBF Vision February 2016 For WebparulvrmBelum ada peringkat

- Financial Sector Reforms in India Since 1991Dokumen11 halamanFinancial Sector Reforms in India Since 1991AMAN KUMAR SINGHBelum ada peringkat

- ACFrOgAIPqeduC6xn4YwZGZULnMkaBXsvoe10JiZ-5Gnt4qvbUJXSXRHFCv6h5nRQP2TLyrabhEZf-59scu6F351RDSAZxite5CfZhqyGduD7KdgdhzTwKMK4QoI9hB6T8PAPD3ipWT0lTuM-y5husUPIYygwxVMlMXT-K2USA==Dokumen12 halamanACFrOgAIPqeduC6xn4YwZGZULnMkaBXsvoe10JiZ-5Gnt4qvbUJXSXRHFCv6h5nRQP2TLyrabhEZf-59scu6F351RDSAZxite5CfZhqyGduD7KdgdhzTwKMK4QoI9hB6T8PAPD3ipWT0lTuM-y5husUPIYygwxVMlMXT-K2USA==Manleen KaurBelum ada peringkat

- Key Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020Dokumen9 halamanKey Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020go4ibibo 15Belum ada peringkat

- Beepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Dokumen46 halamanBeepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Sahil KalerBelum ada peringkat

- Inclusion of NBFC As BC's - CircularDokumen2 halamanInclusion of NBFC As BC's - CircularSHREYA GBelum ada peringkat

- Measured by Rajan PDFDokumen2 halamanMeasured by Rajan PDFAshutosh JaiswalBelum ada peringkat

- CAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020Dokumen15 halamanCAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020SATISHBelum ada peringkat

- Reserve Bank of IndiaDokumen57 halamanReserve Bank of IndiaAjinkya AghamkarBelum ada peringkat

- RBI Launches Market Stabilisation SchemeDokumen1 halamanRBI Launches Market Stabilisation SchemeDevesh SharmaBelum ada peringkat

- RBI Notifications - December Lyst3017 PDFDokumen11 halamanRBI Notifications - December Lyst3017 PDFAnkita TiwariBelum ada peringkat

- Indian financial reforms focused on banking sectorDokumen10 halamanIndian financial reforms focused on banking sectornagendra yanamalaBelum ada peringkat

- 66 - Banks - Sector UpdateDokumen3 halaman66 - Banks - Sector UpdategirishrajsBelum ada peringkat

- Monetary Policy of IndiaDokumen34 halamanMonetary Policy of IndiaJhankar MishraBelum ada peringkat

- Master Circular - Deendayal Antyodaya Yojana - National Rural Livelihoods Mission (DAY-NRLM)Dokumen29 halamanMaster Circular - Deendayal Antyodaya Yojana - National Rural Livelihoods Mission (DAY-NRLM)Vasu Ram JayanthBelum ada peringkat

- Prepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADDokumen29 halamanPrepared by M Suresh Kumar, Chief Manager Faculty, SBILD HYDERABADBino JosephBelum ada peringkat

- Banking Reforms - The Right Direction: PrefaceDokumen10 halamanBanking Reforms - The Right Direction: PrefaceiitmrahulsBelum ada peringkat

- Beepedia Monthly Current Affairs (Beepedia) November 2023Dokumen141 halamanBeepedia Monthly Current Affairs (Beepedia) November 2023Vikram SharmaBelum ada peringkat

- Beepedia Monthly Current Affairs (Beepedia) October 2023Dokumen121 halamanBeepedia Monthly Current Affairs (Beepedia) October 2023Vikram SharmaBelum ada peringkat

- Banking NewsDokumen22 halamanBanking Newsyerra likhitaBelum ada peringkat

- Interim Union Budget Proposals: 2014-15Dokumen8 halamanInterim Union Budget Proposals: 2014-15Mohit AnandBelum ada peringkat

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023Dokumen48 halamanBeepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023SHANTANU MISHRABelum ada peringkat

- RBI cuts repo rate by 50 bps to 7.5% amid recession cloudsDokumen4 halamanRBI cuts repo rate by 50 bps to 7.5% amid recession cloudsnikhil6710349Belum ada peringkat

- Daily Current Affairs Today 8th August PDF DownloadDokumen22 halamanDaily Current Affairs Today 8th August PDF Downloadwarwizard06012001Belum ada peringkat

- Beepedia Monthly Current Affairs (Beepedia) April 2023 PDFDokumen134 halamanBeepedia Monthly Current Affairs (Beepedia) April 2023 PDFSAI CHARAN VBelum ada peringkat

- Monthly BeePedia June 2021Dokumen100 halamanMonthly BeePedia June 2021convey2rohit2190Belum ada peringkat

- Monetary Policy 2Dokumen4 halamanMonetary Policy 2Abhishek KarekarBelum ada peringkat

- Current Affairs: 01st Feb 2022 To 10th Feb 2022 CADokumen47 halamanCurrent Affairs: 01st Feb 2022 To 10th Feb 2022 CAShubhendu VermaBelum ada peringkat

- RBI Monetary Policy Highlights and Other Banking UpdatesDokumen45 halamanRBI Monetary Policy Highlights and Other Banking Updateschethan mahadevBelum ada peringkat

- Bank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)Dokumen30 halamanBank Exam 2019: Special Class On Banking and Economic Affairs (1-15 AUG)jyottsnaBelum ada peringkat

- Concept Paper On Card Acceptance Infrastructure Emailed: Press ReleaseDokumen1 halamanConcept Paper On Card Acceptance Infrastructure Emailed: Press ReleasedotpolkaBelum ada peringkat

- Pest Analysis of Indian Banking Industry:: Files Without This Message by Purchasing Novapdf PrinterDokumen12 halamanPest Analysis of Indian Banking Industry:: Files Without This Message by Purchasing Novapdf PrinterBhasvanth SrivastavBelum ada peringkat

- 8-MM 8A-MSME FinancingDokumen42 halaman8-MM 8A-MSME Financingsenthamarai krishnan0% (1)

- (A) Quantitative Instruments or General ToolsDokumen5 halaman(A) Quantitative Instruments or General ToolsSiddh Shah ⎝⎝⏠⏝⏠⎠⎠Belum ada peringkat

- Reserve Bank of IndiaDokumen3 halamanReserve Bank of IndiaVasu Ram JayanthBelum ada peringkat

- Clerk Competition BoosterDokumen70 halamanClerk Competition Boosterdheeru0071Belum ada peringkat

- Banking policy and structural changes e-magazineDokumen22 halamanBanking policy and structural changes e-magazineApurva JhaBelum ada peringkat

- Management of Advance by RBI 2005Dokumen53 halamanManagement of Advance by RBI 2005Ramkumar SankerBelum ada peringkat

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Dokumen39 halamanBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYBelum ada peringkat

- RBI's LTRO and TLTRO ExplainedDokumen2 halamanRBI's LTRO and TLTRO ExplainedSanjana KrishnakumarBelum ada peringkat

- Project Report: Banking ReformsDokumen9 halamanProject Report: Banking ReformsS.S.Rules100% (1)

- Monthly Beepedia July 2022Dokumen132 halamanMonthly Beepedia July 2022not youBelum ada peringkat

- BC Model 2Dokumen6 halamanBC Model 2Prafulla PawarBelum ada peringkat

- Nayak Committee Recommendations on SSI Sector FinancingDokumen4 halamanNayak Committee Recommendations on SSI Sector FinancingSubhasis MohapatraBelum ada peringkat

- CBS Selection - GartnerDokumen6 halamanCBS Selection - GartnerSIYONA CHAMOLABelum ada peringkat

- 4163IIBF Vision March 2015Dokumen8 halaman4163IIBF Vision March 2015Madhumita PandeyBelum ada peringkat

- RBI circular 14Dokumen8 halamanRBI circular 14gauravdjain05Belum ada peringkat

- Recruitment of Specialist OfficersDokumen13 halamanRecruitment of Specialist Officerssanjeet_verma4677Belum ada peringkat

- Nil 9 OCT 2020: 11th & 12th October 2020Dokumen24 halamanNil 9 OCT 2020: 11th & 12th October 2020vikramv501Belum ada peringkat

- RBI issues framework for outsourcing activities by payment operatorsDokumen73 halamanRBI issues framework for outsourcing activities by payment operatorsAbhinav PandeyBelum ada peringkat

- Bank Credit To MsmesDokumen10 halamanBank Credit To MsmesAarthi ManoharanBelum ada peringkat

- RBI Master CircularDokumen42 halamanRBI Master CircularDeep Singh PariharBelum ada peringkat

- Micro FinanceDokumen17 halamanMicro FinanceAbhishek ThakurBelum ada peringkat

- RBI updates mandatory leave policyDokumen2 halamanRBI updates mandatory leave policyVasu Ram JayanthBelum ada peringkat

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Dari EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Belum ada peringkat

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanDari EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanBelum ada peringkat

- #IndiaStockExchange #BSE Update On 24th June 2015Dokumen2 halaman#IndiaStockExchange #BSE Update On 24th June 2015Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

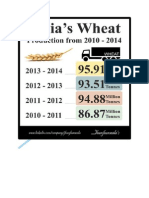

- India's Wheat Production From 2010 To 2014Dokumen4 halamanIndia's Wheat Production From 2010 To 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Foreign Institutional Investors Investment in India During 2014-15 Until 27th November 2014Dokumen3 halamanForeign Institutional Investors Investment in India During 2014-15 Until 27th November 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Diamond Reserves With Diamond Trade Update For 2014Dokumen6 halamanIndia's Diamond Reserves With Diamond Trade Update For 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India Coir Trade From April To October 2014Dokumen4 halamanIndia Coir Trade From April To October 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Commercially Operating Nuclear Reactors in The World at The End of 2013Dokumen4 halamanCommercially Operating Nuclear Reactors in The World at The End of 2013Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Per Capita Food Grain For 2014Dokumen3 halamanIndia's Per Capita Food Grain For 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- MSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Dokumen4 halamanMSMEs or Micro Small and Medium Enterprses Share in India Exports 2013-2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's UREA Trade On 2013-14 and 2014-15 Up To November 2014.Dokumen3 halamanIndia's UREA Trade On 2013-14 and 2014-15 Up To November 2014.Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

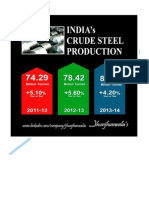

- India Crude Steel Production From 2011-2014Dokumen4 halamanIndia Crude Steel Production From 2011-2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Rice Trade For 2014Dokumen5 halamanIndia's Rice Trade For 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Methane Hydrates Reserves 25th November 2014Dokumen3 halamanIndia's Methane Hydrates Reserves 25th November 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Coal Production For Last 5 Years Upto October 2014Dokumen2 halamanIndia's Coal Production For Last 5 Years Upto October 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Coal Bed Methane Production For Last 3 Years With Current Year 2014-15 (Upto 31 Oct 2014)Dokumen3 halamanIndia's Coal Bed Methane Production For Last 3 Years With Current Year 2014-15 (Upto 31 Oct 2014)Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Crude Steel Production Estimate For 2014 To 2017Dokumen3 halamanIndia's Crude Steel Production Estimate For 2014 To 2017Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Kharif and Rabi Crops Area Coverage For October and January 2014Dokumen10 halamanIndia's Kharif and Rabi Crops Area Coverage For October and January 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Coal Reserves To Last 100 YearsDokumen3 halamanIndia's Coal Reserves To Last 100 YearsJhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Foreign Investment Promotion Board Approves 12 Proposals of Foreign Direct Investment in India As On 19th December 2014Dokumen27 halamanForeign Investment Promotion Board Approves 12 Proposals of Foreign Direct Investment in India As On 19th December 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Mineral Production in Month of August 2014Dokumen3 halamanIndia's Mineral Production in Month of August 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Fuel Price Change For Petrol, Diesel, and JetFuel in IndiaDokumen11 halamanFuel Price Change For Petrol, Diesel, and JetFuel in IndiaJhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Import and Export Update For September and December 2014Dokumen16 halamanIndia's Import and Export Update For September and December 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India Tax Collection From April To November 2014Dokumen11 halamanIndia Tax Collection From April To November 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Global Central Banks Highlights For Monetary Policy Rates For October 2014Dokumen31 halamanGlobal Central Banks Highlights For Monetary Policy Rates For October 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Index of Eight Core Industries From June To November 2014Dokumen57 halamanIndia's Index of Eight Core Industries From June To November 2014Jhunjhunwalas Digital Finance & Business Info Library100% (1)

- Indian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Dokumen5 halamanIndian Currency Rupee Exchange Rate of 19 Foreign Currencies Relating To Import and Export Goods From July To September 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Indians Railways Revenue Earnings With Freight Traffic During April To October 2014Dokumen18 halamanIndians Railways Revenue Earnings With Freight Traffic During April To October 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India's Tourism Sector Performance For January and October 2014Dokumen15 halamanIndia's Tourism Sector Performance For January and October 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

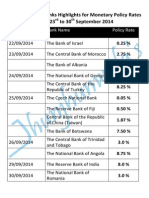

- Global Central Banks Highlights For Monetary Policy Rates From 23rd To 30th September 2014Dokumen11 halamanGlobal Central Banks Highlights For Monetary Policy Rates From 23rd To 30th September 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- India 'S Total Kharif Crop Sowing Area As On July and August 2014Dokumen6 halamanIndia 'S Total Kharif Crop Sowing Area As On July and August 2014Jhunjhunwalas Digital Finance & Business Info LibraryBelum ada peringkat

- Final Revised ResearchDokumen35 halamanFinal Revised ResearchRia Joy SanchezBelum ada peringkat

- Bach Invention No9 in F Minor - pdf845725625Dokumen2 halamanBach Invention No9 in F Minor - pdf845725625ArocatrumpetBelum ada peringkat

- Unit 2 - BT MLH 11 - KeyDokumen2 halamanUnit 2 - BT MLH 11 - KeyttyannieBelum ada peringkat

- Mixed-Use Proposal Dormitory and Hotel High-RiseDokumen14 halamanMixed-Use Proposal Dormitory and Hotel High-RiseShanaia BualBelum ada peringkat

- 3 CRIM LAW 2 CASES TO BE DIGESTED Gambling Malfeasance Misfeasance Bribery Graft Corruption and MalversationDokumen130 halaman3 CRIM LAW 2 CASES TO BE DIGESTED Gambling Malfeasance Misfeasance Bribery Graft Corruption and MalversationElma MalagionaBelum ada peringkat

- Destination Management OverviewDokumen5 halamanDestination Management OverviewMd. Mamun Hasan BiddutBelum ada peringkat

- Real Vs Nominal Values (Blank)Dokumen4 halamanReal Vs Nominal Values (Blank)Prineet AnandBelum ada peringkat

- IT WorkShop Lab ManualDokumen74 halamanIT WorkShop Lab ManualcomputerstudentBelum ada peringkat

- Burton Gershfield Oral History TranscriptDokumen36 halamanBurton Gershfield Oral History TranscriptAnonymous rdyFWm9Belum ada peringkat

- RQQDokumen3 halamanRQQRazerrdooBelum ada peringkat

- Abhivyakti Yearbook 2019 20Dokumen316 halamanAbhivyakti Yearbook 2019 20desaisarkarrajvardhanBelum ada peringkat

- B767 WikipediaDokumen18 halamanB767 WikipediaxXxJaspiexXx100% (1)

- Q3 Week 7 Day 2Dokumen23 halamanQ3 Week 7 Day 2Ran MarBelum ada peringkat

- Traditional Knowledge - The Changing Scenario in India PDFDokumen9 halamanTraditional Knowledge - The Changing Scenario in India PDFashutosh srivastavaBelum ada peringkat

- Untitled Document 3Dokumen10 halamanUntitled Document 3api-457501806Belum ada peringkat

- Ethanox 330 Antioxidant: Safety Data SheetDokumen7 halamanEthanox 330 Antioxidant: Safety Data Sheetafryan azhar kurniawanBelum ada peringkat

- Ajaz CVDokumen1 halamanAjaz CVAjazBelum ada peringkat

- Wallace, 2009Dokumen20 halamanWallace, 2009florBelum ada peringkat

- Jhansi Aptc Form 40 A 1Dokumen1 halamanJhansi Aptc Form 40 A 1Siva KumarBelum ada peringkat

- A StarDokumen59 halamanA Starshahjaydip19912103Belum ada peringkat

- Abalone Report InfographicDokumen1 halamanAbalone Report InfographicjanetBelum ada peringkat

- Amnesia: A Game of Remembering YourselfDokumen11 halamanAmnesia: A Game of Remembering YourselfNina JonesBelum ada peringkat

- NAS Drive User ManualDokumen59 halamanNAS Drive User ManualCristian ScarlatBelum ada peringkat

- Reaction PaperDokumen1 halamanReaction Papermarvin125Belum ada peringkat

- TOTAL Income: POSSTORE JERTEH - Account For 2021 Start Date 8/1/2021 End Date 8/31/2021Dokumen9 halamanTOTAL Income: POSSTORE JERTEH - Account For 2021 Start Date 8/1/2021 End Date 8/31/2021Alice NguBelum ada peringkat