Insurance in Construction Projects CATEGORIES PART I

Diunggah oleh

Abdul Rahman SabraJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Insurance in Construction Projects CATEGORIES PART I

Diunggah oleh

Abdul Rahman SabraHak Cipta:

Format Tersedia

SABRA, Abdul Rahman

CONTRACTS MANAGER

ROAD #4 GHANTOOT BUILDING FIRST FLOOR

Phone: +971 2 6414151 Fax: +971 2 6412010 Mobile: +971 50 6414151

ar.sabra@ghantootgroup.ae ar.sabra@me.com www.ghantootgroup.com

GHANTOOT TRANSPORT & GENERAL CONTRACTING EST. BUILDING DIV

INSURANCE IN CONSTRUCTION PROJECTS

Construction insurances are required on every single construction project. Construction insurances provides coverage for material, risks, natural disasters, employees and even defaults in design. However, the insurance industry along with the construction industry are always looking to comprehend and provide the latest coverage on every single and unique situation. Here you will find the most common insurances used in the construction industry.

A. INSURANCE UNDER FIDIC CLAUSES

INSURANCES Clause 15 15.1 Subcontractors Obligation to Insure 15.2 Contractors Obligation to Insure; Subcontract Works at Subcontractors Risk 15.3 Evidence of Insurance; Remedy on Failure to Insure

B. CATEGORIES

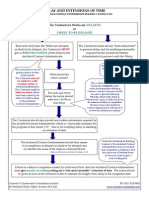

There are two main categories of insurance. The first relates to damage occurring to property or the works themselves during construction and is referred to as property or works insur ance policies. This category covers the property, contract work, materials, equipment and machinery connected with it. The second category is liability insurance dealing with claims by third parties for personal injury and property damage. The insurance market has then generated a range of discreet insurance products dealing with sub-divisions of these categories, and the insurance policies available in the market place may cover one or more of the sub-categories and even cover both main categories identified in table herein. The categories of insurance table set out in Table below identify the main insurance sub-divisions relating to construction work:

Reference: 8A CON.

2013

Property Insurance Or works insurance covers the property, damage to the contract works, materials, equipment and machinery connected with the works. DEVELOPER OWNER GOVERNMENT ENTITY 1. Covers any part of the works taken over 2. Latent defects 3. Loss of profit /rent

Liability Insurance Covers claims by third parties for personal injury and damage to their property.

1. employers liability 2. public liability for a limit in excess of that required by the contract, 3. or limit not indemnified by contractor 4. public liability for non- negligence 1. employers liability 2. public liability 3. professional indemnity 1. 2. 3. 4. Employers liability public liability public liability for non-negligence professional indemnity for design undertaken by contractor 5. motor insurance 6. marine insurance

DESIGNER

CONTRACTOR

1. contractors all risk CAR

Reference: 8A CON.

2013

Anda mungkin juga menyukai

- Contractor All Risks Insurance PDFDokumen6 halamanContractor All Risks Insurance PDFAnonymous 94TBTBRksBelum ada peringkat

- Contractor All Risks InsuranceDokumen6 halamanContractor All Risks InsuranceAbdul Rahman Sabra67% (3)

- Types of Construction InsuranceDokumen3 halamanTypes of Construction InsuranceThe UntamedBelum ada peringkat

- Cornes and Lupton's Design Liability in the Construction IndustryDari EverandCornes and Lupton's Design Liability in the Construction IndustryBelum ada peringkat

- Collateral Warranties: ... A Little Bit of LawDokumen4 halamanCollateral Warranties: ... A Little Bit of LawtdartnellBelum ada peringkat

- Design and BuildDokumen10 halamanDesign and BuildBluesinhaBelum ada peringkat

- Construction Project Controls Cost Schedule and Change ManagementDokumen20 halamanConstruction Project Controls Cost Schedule and Change ManagementFederico BrigatoBelum ada peringkat

- Construction Contract Types and Project Delivery MethodsDokumen28 halamanConstruction Contract Types and Project Delivery MethodsWilliam ZormeloBelum ada peringkat

- Construction Contracts ManagementDokumen7 halamanConstruction Contracts ManagementNihar ReddyBelum ada peringkat

- Contract FormsDokumen70 halamanContract Formstricia mendoza100% (1)

- Pre Contract Cost Planning and Cost Controlling Construction EssayDokumen7 halamanPre Contract Cost Planning and Cost Controlling Construction EssayrachuBelum ada peringkat

- Case Study For Contract Management - Hydro Power Projects PDFDokumen4 halamanCase Study For Contract Management - Hydro Power Projects PDFpradeepsharma62100% (1)

- Eot Claims ReferencesDokumen75 halamanEot Claims ReferencesRose Ann JavilinarBelum ada peringkat

- The Prevention Principle, Liquidated Damages and Concurrent DelaysDokumen17 halamanThe Prevention Principle, Liquidated Damages and Concurrent DelaysNihmathullah Kalanther LebbeBelum ada peringkat

- Contract ConstructionDokumen115 halamanContract ConstructionGing LimjocoBelum ada peringkat

- Construction and Contract LawDokumen8 halamanConstruction and Contract Lawasif iqbalBelum ada peringkat

- DR 03 ConcurrencyDokumen3 halamanDR 03 ConcurrencyMazuan LinBelum ada peringkat

- FIDIC: Termination by The Employer Under The Red and Yellow BooksDokumen8 halamanFIDIC: Termination by The Employer Under The Red and Yellow BookssaihereBelum ada peringkat

- IMPLICATIONS OF DIFFERENT TYPES OF VARIATIONS UNDER FIDIC 1999 REDBOOKDokumen13 halamanIMPLICATIONS OF DIFFERENT TYPES OF VARIATIONS UNDER FIDIC 1999 REDBOOKHoussam50% (2)

- What Are Contractors' Entitlements For Client DefaultsDokumen4 halamanWhat Are Contractors' Entitlements For Client DefaultsAbdul Rahman SabraBelum ada peringkat

- Contract AdministrationDokumen13 halamanContract AdministrationQuratulain BaigBelum ada peringkat

- Termination Suspension Risks and InsuranceDokumen33 halamanTermination Suspension Risks and InsuranceHaneef MohamedBelum ada peringkat

- Delays and Disruptions Under FIDIC 1992Dokumen3 halamanDelays and Disruptions Under FIDIC 1992arabi1Belum ada peringkat

- Contractors' All Risks InsuranceDokumen15 halamanContractors' All Risks InsuranceJamal Al-GhamdiBelum ada peringkat

- Insuring Risk in Construction ProjectsDokumen25 halamanInsuring Risk in Construction ProjectsPuneet Arora100% (1)

- An Introduction To FIDIC and FIDIC Contract BooksDokumen15 halamanAn Introduction To FIDIC and FIDIC Contract Booksaniket100% (1)

- Cost Value ReconciliationDokumen18 halamanCost Value ReconciliationNeminda Dhanushka Kumaradasa0% (1)

- Advanced Construction Law - Q2Dokumen4 halamanAdvanced Construction Law - Q2Neville OkumuBelum ada peringkat

- Late Payment - What Can We Do When We Don't Get Paid - Claims ClassDokumen4 halamanLate Payment - What Can We Do When We Don't Get Paid - Claims ClassChelimilla Ranga ReddyBelum ada peringkat

- Managing Middle East construction contracts amid COVID-19Dokumen24 halamanManaging Middle East construction contracts amid COVID-19yoniBelum ada peringkat

- Delay and Disruption Claims Martin Waldron BL March 2014 PDFDokumen32 halamanDelay and Disruption Claims Martin Waldron BL March 2014 PDFMumthaz ahamedBelum ada peringkat

- Construction InsurancesDokumen76 halamanConstruction Insuranceskmid2003100% (1)

- Construction Project Planning and ManagementDokumen32 halamanConstruction Project Planning and Managementሽታ ዓለሜ100% (1)

- LEAD Claims Material 2010Dokumen100 halamanLEAD Claims Material 2010Manoj LankaBelum ada peringkat

- Essential Elements Successful Construction ClaimDokumen5 halamanEssential Elements Successful Construction ClaimMuhammad ArslanBelum ada peringkat

- Part 10 Rics Retention DWL Black BookDokumen26 halamanPart 10 Rics Retention DWL Black BookChris Gonzales100% (1)

- Critical Analysis of Residential Project Delays and Cost OverrunsDokumen16 halamanCritical Analysis of Residential Project Delays and Cost OverrunsAinobushoborozi Antony100% (1)

- Construction Disputes: Causes and ResolutionsDokumen73 halamanConstruction Disputes: Causes and ResolutionsMariel Villaluna100% (2)

- BAA Chooses NEC3 For Heathrow Terminal 2Dokumen8 halamanBAA Chooses NEC3 For Heathrow Terminal 2Chris BallBelum ada peringkat

- Extension of Time Under JCT (Illustration)Dokumen1 halamanExtension of Time Under JCT (Illustration)LGBelum ada peringkat

- FIDIC - 10 Things To KnowDokumen7 halamanFIDIC - 10 Things To KnowSheron AnushkeBelum ada peringkat

- Delay and DisruptionDokumen3 halamanDelay and DisruptionalexanderzulkarnaenBelum ada peringkat

- An Owner's Guide To Construction ManagementDokumen20 halamanAn Owner's Guide To Construction ManagementhymerchmidtBelum ada peringkat

- Outturn Cost: Find Out MoreDokumen5 halamanOutturn Cost: Find Out MoreMohamed BahkirBelum ada peringkat

- Construction LawDokumen135 halamanConstruction Lawmesfin niguse100% (1)

- Ucem PDFDokumen7 halamanUcem PDFAkber HassanBelum ada peringkat

- Design Build ContractDokumen6 halamanDesign Build Contractrafinoor100% (1)

- LIQUIDATED-DAMAGES-Case Studies-Anamul HoqueDokumen11 halamanLIQUIDATED-DAMAGES-Case Studies-Anamul HoqueMuhammad Anamul HoqueBelum ada peringkat

- DM Construction ClaimsDokumen56 halamanDM Construction Claimsmohammad100% (1)

- Contract Administration Core Curriculum Participant's Manual and Reference Guide 2006Dokumen198 halamanContract Administration Core Curriculum Participant's Manual and Reference Guide 2006Larry Lyon100% (1)

- Contract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalDari EverandContract Administration Pitfalls and Solutions for Architect-Engineering Projects: A JournalBelum ada peringkat

- Project Delivery Method A Complete Guide - 2020 EditionDari EverandProject Delivery Method A Complete Guide - 2020 EditionBelum ada peringkat

- Construction Law in the United Arab Emirates and the GulfDari EverandConstruction Law in the United Arab Emirates and the GulfPenilaian: 4 dari 5 bintang4/5 (1)

- Construction Legal Practice Assignment InsightsDokumen17 halamanConstruction Legal Practice Assignment Insightssyaza100% (3)

- Insurance and SecuritiesDokumen50 halamanInsurance and Securitiesobengloloision2022Belum ada peringkat

- Lecture 7 - Insurance - 02.12.2022Dokumen4 halamanLecture 7 - Insurance - 02.12.2022Timothy GodwinBelum ada peringkat

- Contractors All Risk Insurance ProspectusDokumen6 halamanContractors All Risk Insurance Prospectusaakashgupta viaanshBelum ada peringkat

- Lecture 5Dokumen64 halamanLecture 5Tadesse MegersaBelum ada peringkat

- Why An Insurance Policy Matters in Construction ProjectsDokumen2 halamanWhy An Insurance Policy Matters in Construction ProjectsIzo SeremBelum ada peringkat

- Chapter 6 Insurance in Construction Industry Lecture 7Dokumen17 halamanChapter 6 Insurance in Construction Industry Lecture 7Tsegaye Kebede100% (1)

- Watkins Taum Sauk Gsa Branson CompressedDokumen42 halamanWatkins Taum Sauk Gsa Branson CompressedAbdul Rahman SabraBelum ada peringkat

- Explanations of Clause 52Dokumen3 halamanExplanations of Clause 52Abdul Rahman Sabra100% (4)

- Tender Analysis With Weighting Scored SystemDokumen14 halamanTender Analysis With Weighting Scored SystemAbdul Rahman SabraBelum ada peringkat

- Email Policy For A FirmDokumen4 halamanEmail Policy For A FirmAbdul Rahman SabraBelum ada peringkat

- EPC ContractsDokumen5 halamanEPC ContractsAbdul Rahman Sabra100% (1)

- Arbitration ProcedureDokumen5 halamanArbitration ProcedureAbdul Rahman Sabra100% (1)

- How To Build PrelminariesDokumen4 halamanHow To Build PrelminariesAbdul Rahman Sabra100% (2)

- How To Calculate Overhead Costs in Construction ProjectsDokumen8 halamanHow To Calculate Overhead Costs in Construction ProjectsAbdul Rahman Sabra100% (1)

- Reducing Overhead Cost PDFDokumen6 halamanReducing Overhead Cost PDFAbdul Rahman SabraBelum ada peringkat

- Guid To LCDokumen5 halamanGuid To LCAbdul Rahman SabraBelum ada peringkat

- Correlation AnalysesDokumen3 halamanCorrelation AnalysesAbdul Rahman SabraBelum ada peringkat

- Why Projects Fail?Dokumen2 halamanWhy Projects Fail?Abdul Rahman SabraBelum ada peringkat

- Code of Contract DocumentsDokumen2 halamanCode of Contract DocumentsAbdul Rahman SabraBelum ada peringkat

- Project Procurement Strategy: Sabra, Abdul RahmanDokumen2 halamanProject Procurement Strategy: Sabra, Abdul RahmanAbdul Rahman Sabra100% (1)

- Guide To Write Scope of WorksDokumen5 halamanGuide To Write Scope of WorksAbdul Rahman Sabra100% (2)

- Star Rate Breakdown of Mep ItemsDokumen2 halamanStar Rate Breakdown of Mep ItemsAbdul Rahman Sabra100% (1)

- The Golden RatioDokumen5 halamanThe Golden RatioAbdul Rahman SabraBelum ada peringkat

- Employment Application For StaffDokumen1 halamanEmployment Application For StaffAbdul Rahman SabraBelum ada peringkat

- What Is Outsourcing ?Dokumen1 halamanWhat Is Outsourcing ?Abdul Rahman SabraBelum ada peringkat

- Liquidated DamagesDokumen1 halamanLiquidated DamagesAbdul Rahman SabraBelum ada peringkat

- What Are Contractors' Entitlements For Client DefaultsDokumen4 halamanWhat Are Contractors' Entitlements For Client DefaultsAbdul Rahman SabraBelum ada peringkat

- Legal Frames of Disputes in UAEDokumen1 halamanLegal Frames of Disputes in UAEAbdul Rahman SabraBelum ada peringkat

- What Is Nominated ContractorDokumen4 halamanWhat Is Nominated ContractorAbdul Rahman Sabra100% (1)

- What Is Retention MoneyDokumen3 halamanWhat Is Retention MoneyAbdul Rahman Sabra100% (1)

- Types of Contracts in ConstructionDokumen2 halamanTypes of Contracts in ConstructionAbdul Rahman Sabra100% (2)

- Impact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaDokumen2 halamanImpact: Natalia Adler, Chief of Social Policy, UNICEF NicaraguaKundBelum ada peringkat

- Sons & Lovers Oedipus ComplexDokumen2 halamanSons & Lovers Oedipus ComplexAmna Rana100% (2)

- Rustan Vs IAC DigestDokumen2 halamanRustan Vs IAC DigesthectorjrBelum ada peringkat

- NirajDokumen3 halamanNirajNiraj SharmaBelum ada peringkat

- Foreign Policy National Interest and DiplomacyDokumen4 halamanForeign Policy National Interest and Diplomacyhizbullah chandioBelum ada peringkat

- Newman v. DoreDokumen5 halamanNewman v. DoreCelina Marie PanaliganBelum ada peringkat

- Pangcatan Vs MaghuyopDokumen2 halamanPangcatan Vs MaghuyopAngelDelaCruz75% (4)

- F IndemnityGuaranteeDokumen11 halamanF IndemnityGuaranteeNeha BhayaniBelum ada peringkat

- Abortion and Islam: Policies and PracticeDokumen10 halamanAbortion and Islam: Policies and Practicekiedd_04100% (3)

- The Law of Trusts (Core Texts Series)Dokumen539 halamanThe Law of Trusts (Core Texts Series)faiz95% (19)

- Stimson, Between Inside and Out, 2013Dokumen28 halamanStimson, Between Inside and Out, 2013bstimsonBelum ada peringkat

- Consumerism and Ethical ResponsibilityDokumen18 halamanConsumerism and Ethical ResponsibilityAdityaBelum ada peringkat

- Mitsubishi CaseDokumen8 halamanMitsubishi CaseNugroho Atma HadiBelum ada peringkat

- Test Bank For Sport and Exercise Psychology A Canadian Perspective 3rd Edition by CrockerDokumen13 halamanTest Bank For Sport and Exercise Psychology A Canadian Perspective 3rd Edition by CrockerMary Smith100% (25)

- Contract Exam 2015 (Resit) ABDokumen5 halamanContract Exam 2015 (Resit) ABsrvshBelum ada peringkat

- Critical Analysis of Law of Temporary Injunction - Dr. Rajesh KumarDokumen12 halamanCritical Analysis of Law of Temporary Injunction - Dr. Rajesh KumarSonali SinghBelum ada peringkat

- Abraham Cowley PDFDokumen480 halamanAbraham Cowley PDFVladDolghiBelum ada peringkat

- Special power attorneyDokumen2 halamanSpecial power attorneyJson GalvezBelum ada peringkat

- Mount Everest-1996 Case AnalysisDokumen12 halamanMount Everest-1996 Case AnalysisHEM BANSAL100% (1)

- The Attachment Theory Perspective On Mother-Child SeparationDokumen2 halamanThe Attachment Theory Perspective On Mother-Child SeparationHarianurBelum ada peringkat

- Chapter Five: Consumer Markets and Consumer Buyer BehaviorDokumen19 halamanChapter Five: Consumer Markets and Consumer Buyer BehaviorABRAHAMBelum ada peringkat

- Microeconomics NVM Lec 2 PrefrencesDokumen67 halamanMicroeconomics NVM Lec 2 Prefrencessatyam91Belum ada peringkat

- Civ2 CasesDokumen65 halamanCiv2 CasesJunjun AlvarBelum ada peringkat

- Oblicon Audio LectureDokumen3 halamanOblicon Audio LectureJohn Ramil Rabe100% (1)

- 05 - Consumer Markets and Consumer Buying BehaviourDokumen18 halaman05 - Consumer Markets and Consumer Buying BehaviourtinkubipuBelum ada peringkat

- Social Psychology - Symbolic Interaction - Group 4Dokumen31 halamanSocial Psychology - Symbolic Interaction - Group 4bhumishahBelum ada peringkat

- Alabang Country Club terminates food department due to lossesDokumen1 halamanAlabang Country Club terminates food department due to lossespiptipaybBelum ada peringkat

- Segregate" Test) And: PRELIMS-RFLIB-03-03Dokumen11 halamanSegregate" Test) And: PRELIMS-RFLIB-03-03VatchdemonBelum ada peringkat

- Court rules on writ of amparo and habeas data casesDokumen114 halamanCourt rules on writ of amparo and habeas data casesCamille BugtasBelum ada peringkat

- Philippines Supreme Court Rules Theft of Two Roosters Constitutes Single CrimeDokumen9 halamanPhilippines Supreme Court Rules Theft of Two Roosters Constitutes Single CrimejacuntapayBelum ada peringkat