Return of Total Income/Statement of Final Taxation

Diunggah oleh

Jazzy BadshahJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Return of Total Income/Statement of Final Taxation

Diunggah oleh

Jazzy BadshahHak Cipta:

Format Tersedia

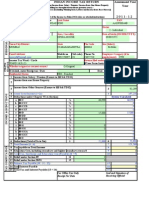

RETURN OF TOTAL INCOME/STATEMENT OF FINAL TAXATION

UNDER THE INCOME TAX ORDINANCE, 2001 (FOR INDIVIDUAL / AOP) Taxpayer's Name

CNIC (for Individual) Business Name

IT-2 (Page 1 of 2)

N NTN

Gender Year Ending Tax Year Person Male Female

Registration

Business Address Res. Address E-Mail Address Principal Activity Employer Representative Authorized Rep.

NTN NTN NTN Name Name Name Phone Code

2012

IND

Non-Res.

AOP

Resident

Res. Status Birth Date Filing Section

RTO/LTU

Is authorized Rep. applicable?

Yes

No

NTN Ownership

Proprietor/Member/Partners' Name

% in Capital

Capital Amount

Others Total Items

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16

Net Sales (excluding Sales Tax/ Federal Excise Duty & Net of Commission/ Brokerage) Cost of Sales [3 + 4 + 5 - 6] Opening Stock Net Purchases (excluding Sales Tax/ Federal Excise Duty & Net of Commission/ Brokerage) Other Manufacturing/ Trading Expenses Closing Stock Gross Profit/ (Loss) [1-2] Transport Services U/S 153(1)(b) (Transferred from 40(c)) Other Services U/S 153(1)(b) (Transferred from 40(d)) Other Revenues/ Fee/ Charges for Professional and Other Services/ Commission Profit & Loss Expenses Net Profit/ (Loss) [(7 + 8 + 9 + 10) - 11] Inadmissible Deductions Admissible Deductions Unadjusted Loss from business for previous year(s) Un-absorbed Tax Depreciation for previous/ current year(s)

[to be reconciled with Annex-C] [to be reconciled with Annex-C]

[ Transfer from Sr-7 of Annex-G] [ to be reconciled with Annex-C ]

Transfer from Sr-24 of Annex-G] [Transfer from Sr-22 of Annex-E] [to be reconciled with Annex-E] [Transfer from Sr. 27 of Annex-A] [Transfer from Sr. 27 of Annex-A]

17 Total Income [Sum of 18 to 23] 18 Salary Income 19 20 21 22 23

Total / Taxable Income Computation

Business Income/ (Loss) [ (12 + 13) - 14 - 15 - 16 ] Share from AOP [Income/(Loss)] Capital Gains/(Loss) u/s 37 Other Sources Income/ (Loss) Foreign Income/ (Loss)

24 Deductible Allowances [25 + 26 + 27 + 28] 25 Zakat 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40

Workers Welfare Fund (WWF) Workers Profit Participation Fund (WPPF) Charitable donations admissible as straight deduction Taxable Income/ (Loss) [17 - 24] Exempt Income/ (Loss) [Sum of 31 to 37] Salary Income Property Income Business Income/ (Loss) Capital Gains/(Loss) Agriculture Income Foreign Remittances (Attach Evidence) Other Sources Income/ (Loss) Tax chargeable on Taxable Income Tax Reductions/Credits/Averaging (including rebate on Bahbood Certificates, etc.) Difference of minimum Tax Chargeable on business transactions [40(e)(v) minus 40(e)(iii)] (i) (ii) (iii)

Import Value/Services receipts subject to collection or deduction of tax at source

100% Code 3103 3116 3117 3106 3111 3118 3119 3121 3122 3131 3189 3190 3191 3192 3902 3988 9099 1999 3999 312021 4999 5999 6399 9139 9121 9122 9123 9124 9199 6199 6101 6102 6103 6104 6106 6107 6105 9201 9249

Total

Adjustments

Manufacturing/ Trading, Profit & Loss Account ( including Final/Fixed Tax)

(iv) Rate 3% 5% 2% 6%

Minimum tax

(v)

Higher of (iii) or (iv)

Proportionate Chargeable income

Proportionate tax*

9303

Tax Computation

(a) (b) (c) (d) (e)

Import of Edible Oil U/S 148(8) Import of Packing Material U/S 148(8) Transport Services U/S 153(1)(b) Other Services U/S 153(1)(b)

Total

* [(38 minus 39) divided by 29 multiply by 40(a)(ii) or 40(b)(ii) or 40(c)(ii) or 40(d)(ii), as the case may be]

41 Minimum tax on electricity consumption under section 235(4) Amount of tax collected along with electricity bill where the monthly bill amount is up to Rs. 30,000 42 Balance tax chargeable [ (38 minus 39 plus 40) or 41, whichever is higher 43 Minimum Tax Payable U/S 113 [43(iv) minus 41, if greater than zero, else zero]

9304 9305 9306 9307 9499 9999 9998 6109

Total Turnover (i) (ii) Minimum tax @ 1% 44 Net tax chargeable [42 + 43 + 90] 45 Total Tax Payments (Transfer from Sr. 28 of Annex-B)

47 Refund Adjustments (not exceeding current year's tax payable)

(iii) (iv)

Reduction @

Net Minimum tax

46 Tax Payable/ Refundable [44 - 45 + WWF Payable from Sr. 29 of Annex-B]

48 Annual personal expenses for individual only (transfer from Sr. 12 of Annex-D)

Net Tax Refundable, may be credited to my bank account as under:

Refund

A/C No. Bank

Branch Name & Code

Signature

Anda mungkin juga menyukai

- 201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFDokumen7 halaman201111320114552152IT-2 2011withSurchargeWithoutformulawithPEFOmer PashaBelum ada peringkat

- IT-2 2011 With Formula and Surcharge and Annex DDokumen15 halamanIT-2 2011 With Formula and Surcharge and Annex DPatti DaudBelum ada peringkat

- NTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage CapitalDokumen5 halamanNTN Top 10 Share Holder's Name Percentage Capital NTN Top 10 Share Holder's Name Percentage Capitalhati1Belum ada peringkat

- Return ChallanDokumen20 halamanReturn Challansyedfaisal_sBelum ada peringkat

- Tax ReturnDokumen7 halamanTax Returnsyedfaisal_sBelum ada peringkat

- Akhtar Tax ReturnDokumen7 halamanAkhtar Tax Returnsyedfaisal_sBelum ada peringkat

- "Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1Dokumen6 halaman"Part-I B: Return of Total Income/Statement of Final Taxation Under The Income Tax Ordinance, 2001 (For Company) IT-1hina08855Belum ada peringkat

- Bir Form 1702-ExDokumen7 halamanBir Form 1702-ExdignaBelum ada peringkat

- 2011 - ITR2 - r6Dokumen33 halaman2011 - ITR2 - r6Bathina Srinivasa RaoBelum ada peringkat

- IT Return 2011 2012Dokumen3 halamanIT Return 2011 2012swapnil6121986Belum ada peringkat

- IT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Dokumen7 halamanIT-11GHA: Return of Income Under The Income Tax ORDINANCE, 1984 (XXXVI OF 1984)Amanat AhmedBelum ada peringkat

- Indian Income Tax Return Assessment Year SahajDokumen7 halamanIndian Income Tax Return Assessment Year SahajSubrata BiswasBelum ada peringkat

- Assessment Year Indian Income Tax Return: I - IndividualDokumen6 halamanAssessment Year Indian Income Tax Return: I - IndividualManjunath YvBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen12 halamanITR-3 Indian Income Tax Return: Part A-GENmehtakvijayBelum ada peringkat

- Schedule'C'Form With AnnexinstructionsDokumen4 halamanSchedule'C'Form With AnnexinstructionsAmanuelBelum ada peringkat

- BIR Form 1702-ExDokumen7 halamanBIR Form 1702-ExShiela PilarBelum ada peringkat

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDokumen11 halamanITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranBelum ada peringkat

- Income TaxDokumen6 halamanIncome TaxKuldeep HoodaBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen7 halamanITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeBelum ada peringkat

- Assessment Year Indian Income Tax Return SahajDokumen7 halamanAssessment Year Indian Income Tax Return SahajallipraBelum ada peringkat

- Gross Total Income (1+2c) 4: Import Previous VersionDokumen4 halamanGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailBelum ada peringkat

- Sachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Dokumen3 halamanSachin4kumar@yahoo - Co.in: Gross Total Income (1+2c) 4Sachin KumarBelum ada peringkat

- Bir Form 1702-RtDokumen8 halamanBir Form 1702-RtShiela PilarBelum ada peringkat

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDokumen7 halamanItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen7 halamanITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996Belum ada peringkat

- 2550Mv 2Dokumen7 halaman2550Mv 2nelsonBelum ada peringkat

- IT Return IT1 WithAnnexure 23454434Dokumen3 halamanIT Return IT1 WithAnnexure 23454434khurramacaaBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen7 halamanITR-3 Indian Income Tax Return: Part A-GENAvani GadaBelum ada peringkat

- Bir Form 1701Dokumen12 halamanBir Form 1701miles1280Belum ada peringkat

- 2016 Itr4 PR3Dokumen165 halaman2016 Itr4 PR3TejasBelum ada peringkat

- Form2FandInstructions 06062006Dokumen11 halamanForm2FandInstructions 06062006Mnaoj PatelBelum ada peringkat

- Indian Numbering SystemDokumen8 halamanIndian Numbering SystemelangomduBelum ada peringkat

- Profit Loss Account 08 09Dokumen1 halamanProfit Loss Account 08 09lulughoshBelum ada peringkat

- ITR-2 Indian Income Tax Return: Part A-GENDokumen10 halamanITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalBelum ada peringkat

- Assessment Year Sahaj Indian Income Tax ReturnDokumen7 halamanAssessment Year Sahaj Indian Income Tax Returnrajshri58Belum ada peringkat

- Source Code: Govt. ServantDokumen6 halamanSource Code: Govt. ServantmujebaliBelum ada peringkat

- ITR-3 Indian Income Tax Return: Part A-GENDokumen8 halamanITR-3 Indian Income Tax Return: Part A-GENRahul SharmaBelum ada peringkat

- Trinidad and Tobago Emolument Income Tax 2012Dokumen5 halamanTrinidad and Tobago Emolument Income Tax 2012Anand RockerBelum ada peringkat

- Computation Format PDFDokumen2 halamanComputation Format PDFRajesh Jaiswal100% (1)

- Monthly Value-Added Tax DeclarationDokumen17 halamanMonthly Value-Added Tax DeclarationMIRAHNELBelum ada peringkat

- 2012 Itr1 Pr21Dokumen5 halaman2012 Itr1 Pr21MRLogan123Belum ada peringkat

- 82202BIR Form 1702-MXDokumen9 halaman82202BIR Form 1702-MXJp AlvarezBelum ada peringkat

- NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014Dokumen24 halamanNDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014junkyBelum ada peringkat

- Quarterly Tax Value-Added Return: Kawanihan NG Rentas InternasDokumen5 halamanQuarterly Tax Value-Added Return: Kawanihan NG Rentas InternasStephanie LayloBelum ada peringkat

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDokumen3 halamanAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinBelum ada peringkat

- Schedule C Form With AnnexDokumen4 halamanSchedule C Form With Annexgirma1299Belum ada peringkat

- Form PDF 992301420310723Dokumen10 halamanForm PDF 992301420310723tax advisorBelum ada peringkat

- Format of The Revised Schedule VIDokumen2 halamanFormat of The Revised Schedule VIJoydip DasBelum ada peringkat

- ITR-2 Indian Income Tax Return: Part A-GENDokumen12 halamanITR-2 Indian Income Tax Return: Part A-GENMankamesachinBelum ada peringkat

- 82202BIR Form 1702-MXDokumen9 halaman82202BIR Form 1702-MXRen A EleponioBelum ada peringkat

- Gross Total Income (1+2c) 4: System CalculatedDokumen3 halamanGross Total Income (1+2c) 4: System CalculatedDHARAMSONIBelum ada peringkat

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDari EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesBelum ada peringkat

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1Dari EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Belum ada peringkat

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryDari EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Commercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryDari EverandCommercial & Service Industry Machinery, Miscellaneous World Summary: Market Values & Financials by CountryBelum ada peringkat

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryDari EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Commercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryDari EverandCommercial & Industrial Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Transportation Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryDari EverandTransportation Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- Civil Service Reforms and The 18th AmendmentDokumen19 halamanCivil Service Reforms and The 18th AmendmentJazzy BadshahBelum ada peringkat

- 18 Problems of Women Entrepreneurs in PakistanDokumen7 halaman18 Problems of Women Entrepreneurs in PakistanJazzy BadshahBelum ada peringkat

- Railway ReformDokumen134 halamanRailway ReformJazzy Badshah100% (2)

- For Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearDokumen1 halamanFor Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearJazzy BadshahBelum ada peringkat

- Construction of A Seepage Cut-Off Wall Using Deep Soil Mixing and Jet GroutingDokumen13 halamanConstruction of A Seepage Cut-Off Wall Using Deep Soil Mixing and Jet GroutingJazzy BadshahBelum ada peringkat

- BrassCulvert-2 3 2-TechnicalManualDokumen33 halamanBrassCulvert-2 3 2-TechnicalManualJazzy BadshahBelum ada peringkat

- Sercu SolutionsDokumen155 halamanSercu SolutionsVassil StfnvBelum ada peringkat

- Pre Board 2 Economics XIIDokumen5 halamanPre Board 2 Economics XIIhardikBelum ada peringkat

- Prem BahadurDokumen3 halamanPrem BahadurAditya RajBelum ada peringkat

- Poland Eastern Europe's Economic MiracleDokumen1 halamanPoland Eastern Europe's Economic MiracleJERALDINE CANARIABelum ada peringkat

- China in Africa Research ProposalDokumen20 halamanChina in Africa Research ProposalFrancky VincentBelum ada peringkat

- Greenberg-Megaworld Demand LetterDokumen2 halamanGreenberg-Megaworld Demand LetterLilian RoqueBelum ada peringkat

- United States of America v. George PeltzDokumen10 halamanUnited States of America v. George PeltzWHYY NewsBelum ada peringkat

- "Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselDokumen101 halaman"Training and Action Research of Rural Development Academy (RDA), Bogra, Bangladesh." by Sheikh Md. RaselRasel89% (9)

- 8531Dokumen9 halaman8531Mudassar SaqiBelum ada peringkat

- PPF in SAP EWM 1Dokumen10 halamanPPF in SAP EWM 1Neulers0% (1)

- SaleDokumen1 halamanSaleMegan HerreraBelum ada peringkat

- Final Magazine APRIL ISSUE 2016 Final Winth Cover PageDokumen134 halamanFinal Magazine APRIL ISSUE 2016 Final Winth Cover PagePrasanna KumarBelum ada peringkat

- DELIVERY Transfer of Risk and Transfer of TitleDokumen2 halamanDELIVERY Transfer of Risk and Transfer of TitleLesterBelum ada peringkat

- FebruaryDokumen5 halamanFebruaryRamesh RamsBelum ada peringkat

- AgricultureDokumen40 halamanAgricultureLouise Maccloud100% (2)

- 2013-09-23 Rudin Management Company - James Capalino NYC Lobbyist & Client Search ResultDokumen4 halaman2013-09-23 Rudin Management Company - James Capalino NYC Lobbyist & Client Search ResultConnaissableBelum ada peringkat

- Reverse InnovationDokumen12 halamanReverse InnovationPrasanjeet Bhattacharjee0% (1)

- Frost & SullivanDokumen25 halamanFrost & SullivanAnonymous JyOeaZNiGBBelum ada peringkat

- 5 Examples of Arrangements of The GHS Label ElementsDokumen7 halaman5 Examples of Arrangements of The GHS Label ElementsBayu KristyonoBelum ada peringkat

- Levels ReactingDokumen17 halamanLevels Reactingvlad_adrian_775% (8)

- Neelam ReportDokumen86 halamanNeelam Reportrjjain07100% (2)

- Chapter 6Dokumen26 halamanChapter 6ANGEL MELLINDEZBelum ada peringkat

- Scaffold Tube Storage Racks: 1 of 6 August 2021Dokumen6 halamanScaffold Tube Storage Racks: 1 of 6 August 2021Matthew PowellBelum ada peringkat

- 80D Medical InsuranceDokumen3 halaman80D Medical InsuranceRafique ShaikhBelum ada peringkat

- Retailing in UkDokumen30 halamanRetailing in UkansafrahimBelum ada peringkat

- Acct Statement XX1924 01122022Dokumen10 halamanAcct Statement XX1924 01122022Yakshit YadavBelum ada peringkat

- Inflation AccountingDokumen9 halamanInflation AccountingyasheshgaglaniBelum ada peringkat

- Core Complexities Bharat SyntheticsDokumen4 halamanCore Complexities Bharat SyntheticsRohit SharmaBelum ada peringkat

- Dao29 2004Dokumen17 halamanDao29 2004Quinnee VallejosBelum ada peringkat

- Chapter 8Dokumen52 halamanChapter 8EffeBelum ada peringkat