Chapter 3 - Sensitivity Analysis Additional Questions

Diunggah oleh

Brian MoreDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 3 - Sensitivity Analysis Additional Questions

Diunggah oleh

Brian MoreHak Cipta:

Format Tersedia

Chapter 3 Sensitivity analysis Additional Questions

The questions that follow should be added to the text assignment of chapter 3. To answer these sensitivity analysis questions you need to first run the models in Excel. Solutions for these questions appear in the solution document, and can be reached from the assignment link. 2. (i) (ii) (iii) (iv) (v) Suppose the unit profit for a stove increases by 50%. What will happen to the profit? Answer without resolving the problem. If Kemper considers the allocation of overtime to enhance one production process, which process should be selected? Why? If more hours will be allocated to the stove assembly, what would be the new profit? Answer without resolving the problem if possible for the following two cases: (i) Additional 4 hours (ii) Additional 5 hours. Would the optimal production plan change if 5 hours will be taken away from the time available for the assembly of washers and dryers? Answer without resolving the problem. Would Kemper be better off adding 4 hours to the time available for the stove assembly, at the expense of reducing the time available for the molding and pressing process by one hour? Answer without resolving the problem. (Apply the 100% rule if you are familiar with it). How much should the cost of cheese be dropped before it becomes optimal to include it in Jims lunch or dinner? If Jim decides to change the maximum calories intake allowed daily to 1900, would the amount of fat consumed reduce? Why? Answer without resolving the problem. If Jim decides to spoil himself a bit more, and change the minimum calories intake required daily to 1900, what will happen to the amount of fat consumed? If Jim decides to allow a maximum of 35 grams of carbohydrate be included in his meals daily, how much fat will he consume during lunch and dinner of the day discussed? Answer without resolving the problem. Assume the changes discussed in part (iii) and (iv) above are now made simultaneously. Would the shadow prices change? If not, find the minimum amount of fat consumed at the day discussed in the problem, without resolving the problem. (Apply the 100% rule if you are familiar with it). Assume the requirement that at least $5 million are kept in a saving account is relaxed. Particularly, only $4 million at least are now required to be in the saving account. What happens to the return under this condition? Answer without re-solving the problem.

6. (i) (ii) (iii) (iv) (v)

13. (i)

(ii)

An amount of $.5 million added to the funds available for investment. What is the effect of this amount on the total return? If this money could be borrowed, what is the maximum interest rate Tritech should be willing to pay?

Anda mungkin juga menyukai

- Change Management for Beginners: Understanding Change Processes and Actively Shaping ThemDari EverandChange Management for Beginners: Understanding Change Processes and Actively Shaping ThemPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Assignmnet 2 QuestionsDokumen5 halamanAssignmnet 2 QuestionsNityaBelum ada peringkat

- DgsdfsbcsdhsfsDokumen12 halamanDgsdfsbcsdhsfsbabylovelylovelyBelum ada peringkat

- Programming with Structured Flowcharts and Essential PythonDari EverandProgramming with Structured Flowcharts and Essential PythonBelum ada peringkat

- Case On Home-Style Cookies: Questions and AnswersDokumen3 halamanCase On Home-Style Cookies: Questions and AnswersWan Shahrul AmriBelum ada peringkat

- Home Workout For Beginners - The Complete Guide To Lose Weight And Gain Muscle At HomeDari EverandHome Workout For Beginners - The Complete Guide To Lose Weight And Gain Muscle At HomePenilaian: 5 dari 5 bintang5/5 (3)

- CapacityDokumen3 halamanCapacityQuang Ta MinhBelum ada peringkat

- 15.053 - Optimization Methods in Management Science (Spring 2007) Problem Set 1Dokumen10 halaman15.053 - Optimization Methods in Management Science (Spring 2007) Problem Set 1Ehsan SpencerBelum ada peringkat

- Tutorial 5 QuestionsDokumen13 halamanTutorial 5 QuestionsJudah SaliniBelum ada peringkat

- FALL 2012 Makeup ExamDokumen10 halamanFALL 2012 Makeup ExamUFECO2023Belum ada peringkat

- Case On HomeDokumen3 halamanCase On Homeuikeyneeraj12325% (4)

- Characteristic Product 1 Product 2: Assignment-II-part IDokumen3 halamanCharacteristic Product 1 Product 2: Assignment-II-part IViralbhai GamitBelum ada peringkat

- F5 Mapit Workbook Questions & Solutions PDFDokumen11 halamanF5 Mapit Workbook Questions & Solutions PDFMarlyn Richards100% (1)

- 6750 1Dokumen2 halaman6750 1G00GLRBelum ada peringkat

- Module 03 Review Perf CompDokumen5 halamanModule 03 Review Perf CompTrang PhamBelum ada peringkat

- CE40 Exercise 01 (With Answers)Dokumen3 halamanCE40 Exercise 01 (With Answers)AydinAkhtarpour33% (6)

- MOCK Questions IMB5 RED Class With SolutionsDokumen4 halamanMOCK Questions IMB5 RED Class With SolutionsAKHILESH HEBBARBelum ada peringkat

- Red Brand CannersDokumen2 halamanRed Brand Cannersprateek_goyal20910% (1)

- Solution 1 and 2Dokumen7 halamanSolution 1 and 2waleedehsan077Belum ada peringkat

- Tutorial 4 (18 Mar - 22 Mar)Dokumen3 halamanTutorial 4 (18 Mar - 22 Mar)mdumiseni.phezisaBelum ada peringkat

- Case 1,2,3 FeedbackDokumen2 halamanCase 1,2,3 FeedbackArup DasBelum ada peringkat

- Operation Management AssignmentDokumen4 halamanOperation Management AssignmentSaad NiaziBelum ada peringkat

- Case Questions 2019Dokumen5 halamanCase Questions 2019Dark HamsterBelum ada peringkat

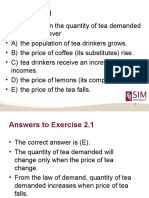

- Econ CH 01Dokumen20 halamanEcon CH 01RI NABelum ada peringkat

- Lesson 13 RIsks and SurprisesDokumen2 halamanLesson 13 RIsks and Surprisesmaxcann091Belum ada peringkat

- Quiz 1Dokumen4 halamanQuiz 1soldiersmithBelum ada peringkat

- IGCSE Business 1 Answer PDFDokumen2 halamanIGCSE Business 1 Answer PDFGamer4886% (7)

- IGCSE Business 1 AnswerDokumen2 halamanIGCSE Business 1 AnswerDalubuhle Duncan88% (26)

- Econ 102 Homework Week1 TwymanDokumen9 halamanEcon 102 Homework Week1 TwymanChristopher TwymanBelum ada peringkat

- MGT 3200 Quiz 1Dokumen10 halamanMGT 3200 Quiz 1BigBoy45Belum ada peringkat

- MANAC II - Morrissey Forgings CaseDokumen8 halamanMANAC II - Morrissey Forgings CaseKaran Oberoi100% (1)

- Addmath AngahDokumen9 halamanAddmath AngahNurul SyafiraBelum ada peringkat

- Chapter 2 Questions For Review QuestionsDokumen3 halamanChapter 2 Questions For Review QuestionsAlireza KafaeiBelum ada peringkat

- Homework 1 - AKDokumen13 halamanHomework 1 - AKJerry WildingBelum ada peringkat

- Assignment 0dasdasdasDokumen5 halamanAssignment 0dasdasdasPrateek GuptaBelum ada peringkat

- Respostas e Aplicações em InglêsDokumen193 halamanRespostas e Aplicações em InglêsRPDPBelum ada peringkat

- 632dea5fbb6c8 Sample Question Booklet NEO 2022Dokumen59 halaman632dea5fbb6c8 Sample Question Booklet NEO 2022HariniBelum ada peringkat

- ECO121 - Individua - assignment - Nguyễn Như Cường - HS153103Dokumen3 halamanECO121 - Individua - assignment - Nguyễn Như Cường - HS153103Nguyen Thanh Tung (K15 HL)Belum ada peringkat

- Chapter 4Dokumen1 halamanChapter 4Shayan AneesBelum ada peringkat

- Microeconomics 1st Edition Acemoglu Test BankDokumen43 halamanMicroeconomics 1st Edition Acemoglu Test Bankzacharymeliora0h86100% (30)

- P370 Sample Questions Midterm: TH TH TH STDokumen5 halamanP370 Sample Questions Midterm: TH TH TH STSehoon OhBelum ada peringkat

- Forecasting Solved ProblemsDokumen6 halamanForecasting Solved Problemsnidal1970Belum ada peringkat

- Name - Eco200: Practice Test 3A Covering Chapters 16, 18-21Dokumen6 halamanName - Eco200: Practice Test 3A Covering Chapters 16, 18-21Thiện ThảoBelum ada peringkat

- Unit 1 ExamDokumen7 halamanUnit 1 ExamromroestBelum ada peringkat

- Introduction To Economics I Dr. Ka-Fu WONG: ECON 1001 ABDokumen29 halamanIntroduction To Economics I Dr. Ka-Fu WONG: ECON 1001 ABSurya PanwarBelum ada peringkat

- Fia Ma1 Management Information Final Mock Examination: InstructionsDokumen7 halamanFia Ma1 Management Information Final Mock Examination: InstructionsHayatullah SahakBelum ada peringkat

- OM1 Practice Exam2Dokumen5 halamanOM1 Practice Exam2nonysinghBelum ada peringkat

- Scharffen Berger Chocolate Maker CaseDokumen8 halamanScharffen Berger Chocolate Maker CaseKelvin WongBelum ada peringkat

- 01A LP (Graphical)Dokumen2 halaman01A LP (Graphical)John Carlo AmodiaBelum ada peringkat

- Tutorial 7Dokumen3 halamanTutorial 7che bungaBelum ada peringkat

- Microeconomics Question Bank - MRU (Without Answers) PDFDokumen136 halamanMicroeconomics Question Bank - MRU (Without Answers) PDF123100% (1)

- Furniture City Stocking Sets CaseDokumen8 halamanFurniture City Stocking Sets CaseDiana Paola Muñoz Garcia100% (2)

- Lal Bahadur Shastri Institute of Management, Delhi: PGDM - (General/R&BA/Finance Term-III) End-Term Exam, April 2021Dokumen4 halamanLal Bahadur Shastri Institute of Management, Delhi: PGDM - (General/R&BA/Finance Term-III) End-Term Exam, April 2021Nishit SrivastavBelum ada peringkat

- Assignment 1Dokumen6 halamanAssignment 1John Does0% (1)

- Managerial Accounting Workbook Version 3Dokumen107 halamanManagerial Accounting Workbook Version 3little psychopathBelum ada peringkat

- Lean Body HacksDokumen5 halamanLean Body HacksBody HackBelum ada peringkat

- 2 Week: 1 PointDokumen17 halaman2 Week: 1 PointSiddharth TandonBelum ada peringkat

- Final Exam, s2, 2017-FinalDokumen16 halamanFinal Exam, s2, 2017-FinalShiv AchariBelum ada peringkat

- GE RT 3200 Advantage III Quick GuideDokumen78 halamanGE RT 3200 Advantage III Quick GuideluisBelum ada peringkat

- 14th ROMAN 4.2Dokumen7 halaman14th ROMAN 4.2Dhruv BajajBelum ada peringkat

- AutoSPRINK12InstallationWalkthrough PDFDokumen2 halamanAutoSPRINK12InstallationWalkthrough PDFHai PhamBelum ada peringkat

- Using Transistor As A Switch - ErmicroblogDokumen24 halamanUsing Transistor As A Switch - ErmicroblogRKMBelum ada peringkat

- Prep 2015Dokumen792 halamanPrep 2015Imran A. IsaacBelum ada peringkat

- Marijuana Security BlackbookDokumen34 halamanMarijuana Security BlackbookLouhan NieuwoudtBelum ada peringkat

- R2900G JLK01211 ConfigurationDokumen2 halamanR2900G JLK01211 Configurationjc villongcoBelum ada peringkat

- Certificate of Final Electrical Inspection - 0Dokumen3 halamanCertificate of Final Electrical Inspection - 0RM DulawanBelum ada peringkat

- Calcium Silicate Bricks or Sand Lime BricksDokumen4 halamanCalcium Silicate Bricks or Sand Lime Bricksmanhal alnoaimyBelum ada peringkat

- Portable UltrasoundDokumen14 halamanPortable Ultrasoundnabil visaBelum ada peringkat

- Learning-Activity-sheets - Gbio1 q2 HomeworkDokumen23 halamanLearning-Activity-sheets - Gbio1 q2 HomeworkChad Laurence Vinson CandelonBelum ada peringkat

- Naturex Rapport DD BDDokumen22 halamanNaturex Rapport DD BDedddson88Belum ada peringkat

- Algebra 2 Quarter 3 Do NowsDokumen50 halamanAlgebra 2 Quarter 3 Do Nowsapi-214128188Belum ada peringkat

- DME Manufacturing Process ofDokumen12 halamanDME Manufacturing Process ofzainahmedscribdBelum ada peringkat

- Abc Stock AcquisitionDokumen13 halamanAbc Stock AcquisitionMary Joy AlbandiaBelum ada peringkat

- Literature Review Template UnisaDokumen7 halamanLiterature Review Template Unisaafmzvjvjzoeqtg100% (1)

- GUIA Inglés 2 ADV ExtraordinarioDokumen2 halamanGUIA Inglés 2 ADV ExtraordinarioPaulo GallegosBelum ada peringkat

- WHLP12 Quarter 1Dokumen8 halamanWHLP12 Quarter 1rhaineBelum ada peringkat

- Openshift LabDokumen23 halamanOpenshift LabSriharshi YarraBelum ada peringkat

- Presentation 5Dokumen18 halamanPresentation 5Hazel Halili100% (1)

- PARTES - TurbineMeterManual212FDokumen16 halamanPARTES - TurbineMeterManual212FronaldBelum ada peringkat

- ST M48T86 Real Time Clock IC DatasheetDokumen29 halamanST M48T86 Real Time Clock IC DatasheetIvan PetrofBelum ada peringkat

- 3 HACCP Overview Training DemoDokumen17 halaman3 HACCP Overview Training Demoammy_75Belum ada peringkat

- Bridge Bearing & Expamnsion Joints PDFDokumen222 halamanBridge Bearing & Expamnsion Joints PDFmekkawi665086% (7)

- What Are The Benefits of Fashion Industry in Our Society TodayDokumen13 halamanWhat Are The Benefits of Fashion Industry in Our Society TodayparoothiBelum ada peringkat

- Comparison... Lesson PlanDokumen4 halamanComparison... Lesson PlanHicham EljarrariBelum ada peringkat

- Economics NotesDokumen21 halamanEconomics NotesBARSHABelum ada peringkat

- General Physics ExercisesDokumen49 halamanGeneral Physics ExercisesaloBelum ada peringkat

- Concept Exercise - Cons. BehaviourDokumen17 halamanConcept Exercise - Cons. BehaviourAina ZalinaBelum ada peringkat

- Modern Family S2e8 Worksheet 4eDokumen2 halamanModern Family S2e8 Worksheet 4eMario Nava Ibáñez100% (1)