PROBLEM About Adjusting Entries: Roblems AS PER Ectures

Diunggah oleh

Morshed Chowdhury ZishanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PROBLEM About Adjusting Entries: Roblems AS PER Ectures

Diunggah oleh

Morshed Chowdhury ZishanHak Cipta:

Format Tersedia

C#503 PROBLEMS AS PER LECTURES LEC#07 PROBLEM about Adjusting Entries Question: ABC Ltd. is a provider of taxation services.

The following unadjusted trial balance has been taken from the books of accounts the company. ABC Ltd. Trial Balance January 31, 2010 Account Title Cash Accounts Receivable Pre-paid Insurance Supplies Equipment Notes payable (12%) Accounts Payable Capital Drawings Consulting Fees Salary Expense Utilities Expense Advertising Expense Total Debit (Tk.) 5,400 2,800 2,400 1,300 60,000 Credit (Tk.)

30,000 2,400 30,000 1,000 14,900 3,200 800 400 77,300

77,300

Adjustments: a) Insurance expires at the rate of Tk.150 per month b) Supplies on hand at the end of the month Tk.300 c) Monthly depreciation on equipment is Tk.1,000 d) Salaries accrued Tk.1,000 e) Consultancy service provided it has not been recorded Tk.1,000 Requirements: 1. Journalize the adjusting entries for the month in the books of ABC Ltd. 2. Post the adjusting entries into ledger accounts. 3. Prepare adjusted trial balance as at January 31, 2010.

MOstofa, MBM 16th Batch, BIBM

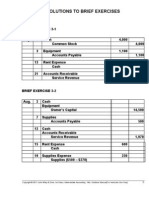

C#503 PROBLEMS AS PER LECTURES Solution-1: ABC Ltd. Adjusting Journal

Date/ SRL No. a) Explanation Insurance Expense A/C Dr. Pre-paid Insurance A/C Cr. [Pre-paid Insurance as worth Tk.150 has been expired during the month] Supplies Expense A/C Dr. Supplies A/C Cr. [Supplies expensed Tk.1000] Depreciation A/C Dr. Equipment A/C Cr. [Depreciation on equipment for the month was Tk.1000] Salaries Expense A/C Dr. Salaries Payable A/C Cr. [Salaries accrued Tk.1000] Cash A/C Dr. Consulting Fees A/C Cr. [Consulting fees was not recorded] Interest Expense A/C Dr. Interest Payable A/C Cr. [Interest rate on notes payable is 12%] Total Ref. Debit (Tk.) 150 Credit (Tk.) 150 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 300 300 4,450 4,450

b)

c)

d)

e)

f)

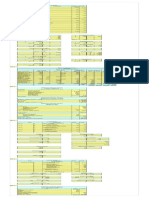

Solution-2: ABC Ltd. Adjusting Ledger

Insurance Expense A/C A/C No.: Dr. Pre-paid Insurance Cr. 150 Dr. Balance on Jan 31,2010 Pre-paid Insurance A/C A/C No.: Cr. 2400 Insurance Exp. 150

Adj. Balance 150

150 150 2400

Adj. Balance

2250 2400

Supplies Expense A/C A/C No.: Dr. Supplies A/C Cr. 1000 Dr. Balance on Jan 31,2010

Supplies A/C A/C No.: Cr. 1300 Supplies Exp. 1000

Dr.

Insurance Depreciation Expense A/C A/C A/C Adj. Balance A/C A/C No.: 1000 150

1000 1000 Cr. Dr.

Insurance Equipment Expense A/C A/C Adj. Balance A/C No.: 1300

300 1300 Cr.

Pre-paid Insurance

Pre-paid Insurance 150 MOstofa, MBM

16th Batch, BIBM

150 150

Adj. Adj. Balance Balance 150

150 150 150 150 150

Adj. Balance

C#503 PROBLEMS AS PER LECTURES

Salary Expense A/C A/C No.: Dr. Balance on Jan 31,2010 Salary Payable Cr. 3200 1000 Adj. Balance 4200 4200 4200 100 0 1000 1000 Dr. Salary Exp. Salary Payable A/C A/C No.: Cr. 1000

Adj. Balance

Depreciation A/C A/C No.: Dr. Equipment Cr. 1000 Dr. Balance on Jan 31,2010

Equipment A/C A/C No.: Cr. 6000 0 Depreciation 1000

Adj. Balance 1000

1000 1000 6000 0

Adj. Balance

5900 0 6000 0

Cash A/C A/C No.: Dr. Balance on Jan 31,2010 Consulting Fee Cr. 5400 1000 Adj. Balance 6400 6400 6400 Dr.

Consulting Fees A/C A/C No.: Balance on Jan 31,2010 Cash 1590 0 15900 1590 0 Cr. 1490 0 1000

Adj. Balance

Interest A/C A/C No.: Dr. Interest Payable Cr. 300 Dr.

Interest Payable A/C A/C No.: Cr. Interest Expense 300

Adj. Balance 300

300 300

Adj. Balance

300 300 300

MOstofa, MBM 16th Batch, BIBM

C#503 PROBLEMS AS PER LECTURES Solution-3:

ABC Ltd. Adjusted Trial Balance January 31, 2010 Account Title Cash Accounts Receivable Pre-paid Insurance Supplies Equipment Notes payable (12%) Accounts Payable Salary Payable Interest Payable Capital Drawings Consulting Fees Salary Expense Utilities Expense Advertising Expense Supplies Expense Insurance Expense Interest Expense Depreciation Total Debit (Tk.) 6,400 2,800 2,250 300 59,000 Credit (Tk.)

30,000 2,400 1,000 300 30,000 1,000 15,900 4,200 800 400 1,000 150 300 1,000 79,600

79,600

MOstofa, MBM 16th Batch, BIBM

C#503 PROBLEMS AS PER LECTURES Question (modified): XYZ Ltd. is a provider of taxation services. The following unadjusted trial balance has been taken from the books of accounts the company. XYZ Ltd. Trial Balance January 31, 2010 Account Title Cash Accounts Receivable Pre-paid Insurance FDR (10%) Supplies Equipment Notes payable (12%) Accounts Payable Capital Drawings Consulting Fees Salary Expense Utilities Expense Advertising Expense Total Debit (Tk.) 5,400 2,800 2,400 12,000 1,300 60,000 Credit (Tk.)

30,000 2,400 40,000 1,000 16,900 3,200 800 400 89,300

89,300

Adjustments: f) Insurance expires at the rate of Tk.150 per month g) Supplies on hand at the end of the month Tk.300 h) Monthly depreciation on equipment is Tk.1,000 i) Salaries accrued Tk.1,000 j) Consultancy service provided it has not been recorded Tk.1,000 Requirements: 4. Journalize the adjusting entries for the month in the books of XYZ Ltd. 5. Post the adjusting entries into ledger accounts. 6. Prepare adjusted trial balance as at January 31, 2010

MOstofa, MBM 16th Batch, BIBM

C#503 PROBLEMS AS PER LECTURES Solution-1: XYZ Ltd. Adjusting Journal

Date/ SRL No. a) Explanation Insurance Expense A/C Dr. Pre-paid Insurance A/C Cr. [Pre-paid Insurance as worth Tk.150 has been expired during the month] Supplies Expense A/C Dr. Supplies A/C Cr. [Supplies expensed Tk.1000] Depreciation A/C Dr. Equipment A/C Cr. [Depreciation on equipment for the month was Tk.1000 Salaries Expense A/C Dr. Salaries Payable A/C Cr. [Salaries accrued Tk.1000] Cash A/C Dr. Consulting Fees A/C Cr. [Consulting fees was not recorded] Interest Expense A/C Dr. Interest Payable A/C Cr. [Interest rate on notes payable is 12%] Interest Receivable A/C Dr. Interest Revenue Cr. [Interest rate on FDR is 10%] Total Ref. Debit (Tk.) 150 Credit (Tk.) 150 1,000 1,000 1,000 1,000 1,000 1,000 1,000 1,000 300 300 100 100 4,550 4,550

b)

c)

d)

e)

f)

g)

Solution-2: XYZ Ltd. Adjusting Ledger

Insurance Expense A/C A/C No.: Dr. Pre-paid Insurance Cr. 150 Dr. Balance on Jan 31,2010 Pre-paid Insurance A/C A/C No.: Cr. 2400 Insurance Exp. 150

Adj. Balance 150

150 150 2400

Adj. Balance

2250 2400

Supplies Expense A/C A/C No.: Dr. Supplies A/C Cr. 1000 Salary Expense A/C Insurance Depreciation Expense A/C A/C A/C A/C No.: A/C A/C No.: Adj. Balance Dr. Balance on Jan 31,2010

Supplies A/C A/C No.: Cr. 1300 Supplies Exp. 1000

Dr. Dr. on Jan 1000 Balance 31,2010 Pre-paid Insurance 3200 150 Salary Payable 1000

1000 Cr. Cr. 1000

Dr. Dr.

Salary Payable A/C Insurance Equipment Expense A/C A/C A/C No.: A/C No.: Adj. Balance 1300 150 Salary Exp.

300 Cr. Cr. 1300 1000

Pre-paid Insurance MOstofa,

MBM 16th Batch, BIBM

Adj. Balance 150 150 1000

Adj. Balance Adj. Adj. Balance Balance 4200 150

4200 150 150 4200 150 150

Adj. Balance

100 0 150 1000

C#503 PROBLEMS AS PER LECTURES

Depreciation A/C A/C No.: Dr. Equipment Cr. 1000 Dr. Balance on Jan 31,2010

Equipment A/C A/C No.: Cr. 6000 0 Depreciation 1000

Adj. Balance 1000

1000 1000 6000 0

Adj. Balance

5900 0 6000 0

Cash A/C A/C No.: Dr. Balance on Jan 31,2010 Consulting Fee Cr. 5400 1000 Adj. Balance 6400 6400 6400 Dr.

Consulting Fees A/C A/C No.: Balance on Jan 31,2010 Cash 1790 0 17900 1790 0 Cr. 1690 0 1000

Adj. Balance

Interest A/C A/C No.: Dr. Interest Payable Cr. 300 Dr.

Interest Payable A/C A/C No.: Cr. Interest Expense 300

Adj. Balance 300

300 300

Adj. Balance

300 300 300

Interest Receivable A/C A/C No.: Dr. Interest Revenue Cr. 100 Dr.

Interest Revenue A/C A/C No.: Cr. Interest Receivable 100

Adj. Balance 100

100 100

Adj. Balance

100 100 100

Solution-3:

MOstofa, MBM 16th Batch, BIBM

C#503 PROBLEMS AS PER LECTURES

XYZ Ltd. Adjusted Trial Balance January 31, 2010 Account Title Cash Accounts Receivable Interest Receivable Pre-paid Insurance Supplies FDR (10%) Equipment Notes payable (12%) Accounts Payable Salary Payable Interest Payable Capital Drawings Consulting Fees Interest Revenue Salary Expense Utilities Expense Advertising Expense Supplies Expense Insurance Expense Interest Expense Depreciation Total Debit (Tk.) 6,400 2,800 100 2,250 300 12,000 59,000 Credit (Tk.)

30,000 2,400 1,000 300 40,000 1,000 17,900 100 4,200 800 400 1,000 150 300 1,000 91,700

91,700

MOstofa, MBM 16th Batch, BIBM

Anda mungkin juga menyukai

- A S Sig N M E N T S: Accounting For Managers AssignmentDokumen20 halamanA S Sig N M E N T S: Accounting For Managers AssignmentgauravBelum ada peringkat

- Final Accounts - AdjustmentsDokumen12 halamanFinal Accounts - AdjustmentsSarthak Gupta100% (1)

- Chapter 3 SolutionsDokumen100 halamanChapter 3 SolutionssevtenBelum ada peringkat

- Work Sheet ExampleDokumen5 halamanWork Sheet Exampleosamasad100% (1)

- Answers S3T1P1Dokumen7 halamanAnswers S3T1P1mananleo88Belum ada peringkat

- Tutorial ACW 162 Chapter 3Dokumen13 halamanTutorial ACW 162 Chapter 3raye brahmBelum ada peringkat

- ch1 AdditionalandMissingValueQuestionsDokumen9 halamanch1 AdditionalandMissingValueQuestionsneervaan.dagar1Belum ada peringkat

- CH 04Dokumen4 halamanCH 04vivien33% (3)

- Accounting and Financial Management 1A Mid-Session ExamDokumen18 halamanAccounting and Financial Management 1A Mid-Session ExamSara LeeBelum ada peringkat

- CA IPCC Nov 2010 Accounts Solved AnswersDokumen13 halamanCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerBelum ada peringkat

- Additional Questions-2Dokumen6 halamanAdditional Questions-2NDA AspirantBelum ada peringkat

- Self Study Solutions Chapter 3Dokumen27 halamanSelf Study Solutions Chapter 3flowerkmBelum ada peringkat

- Associate Level Material: Adjusting Entries, Posting, and Preparing An Adjusted Trial BalanceDokumen8 halamanAssociate Level Material: Adjusting Entries, Posting, and Preparing An Adjusted Trial BalanceJean GilmoreBelum ada peringkat

- CH 03Dokumen4 halamanCH 03vivien50% (2)

- Exercise Chapter 3: Adjusting The AccountsDokumen9 halamanExercise Chapter 3: Adjusting The AccountsSeany Sukmawati100% (3)

- 1P91+F2012+Midterm Final+Draft+SolutionsDokumen10 halaman1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyBelum ada peringkat

- Fundamentals of Healthcare Accounting exam questionsDokumen10 halamanFundamentals of Healthcare Accounting exam questionsHellenNdegwaBelum ada peringkat

- Review questions on government accounting transactions and financial statementsDokumen8 halamanReview questions on government accounting transactions and financial statementsRALLISONBelum ada peringkat

- Comprehensive Problem 1-4Dokumen1 halamanComprehensive Problem 1-4Michelle Morrison80% (5)

- ACTBAS1 - Solution To Exercises (Adjusting Entries)Dokumen4 halamanACTBAS1 - Solution To Exercises (Adjusting Entries)Aris DiazBelum ada peringkat

- HOSP1860 4 AdjustingtheaccountsDokumen6 halamanHOSP1860 4 AdjustingtheaccountsLule RamaBelum ada peringkat

- Accounting CH 3Dokumen49 halamanAccounting CH 3mad76857700Belum ada peringkat

- Anderson LabDokumen8 halamanAnderson LabMike Hamm-DiazBelum ada peringkat

- Week 3 Individual AssignmentDokumen15 halamanWeek 3 Individual AssignmentMadmaxxdxxBelum ada peringkat

- All VouchersDokumen23 halamanAll VouchersSunandaBelum ada peringkat

- Week6 SampleExamQuestionDokumen16 halamanWeek6 SampleExamQuestionyow jing pei67% (3)

- Aidcom Financial Accounting AnalysisDokumen17 halamanAidcom Financial Accounting AnalysisAjmal K HussainBelum ada peringkat

- KPMBM - Bad Debts and Doubtful DebtsDokumen51 halamanKPMBM - Bad Debts and Doubtful DebtsAhmad Hafiz50% (2)

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Dokumen17 halamanAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianBelum ada peringkat

- Adjusting Entries Justin Park CASEDokumen20 halamanAdjusting Entries Justin Park CASEDKzBelum ada peringkat

- Accrual AccountingDokumen7 halamanAccrual AccountingMUHAMMAD ARIF BASHIRBelum ada peringkat

- ACCO 310/4: Concordia University John Molson School of Business Department of AccountingDokumen10 halamanACCO 310/4: Concordia University John Molson School of Business Department of AccountingMiruna CiteaBelum ada peringkat

- Econ 3a Midterm 1 WorksheetDokumen21 halamanEcon 3a Midterm 1 WorksheetZyania LizarragaBelum ada peringkat

- Teamwork For Ibl1201Dokumen16 halamanTeamwork For Ibl1201Thanh Phat Nguyen MyBelum ada peringkat

- Adjusting entries for McGee CompanyDokumen139 halamanAdjusting entries for McGee Companybeenie manBelum ada peringkat

- Trading Account PDFDokumen9 halamanTrading Account PDFVijayaraj Jeyabalan100% (1)

- Finance Accounting 3 May 2012Dokumen15 halamanFinance Accounting 3 May 2012Prasad C MBelum ada peringkat

- Aka Balance SheetDokumen5 halamanAka Balance Sheetmaj thuanBelum ada peringkat

- Department of Business AdministrationDokumen9 halamanDepartment of Business AdministrationKannan NagaBelum ada peringkat

- Sample ACCT101 final exam questions and solutionsDokumen12 halamanSample ACCT101 final exam questions and solutionshappystoneBelum ada peringkat

- Mpu3123 Titas c2Dokumen36 halamanMpu3123 Titas c2Beatrice Tan100% (2)

- 11 CaipccaccountsDokumen19 halaman11 Caipccaccountsapi-206947225Belum ada peringkat

- CH 03Dokumen8 halamanCH 03waresh360% (1)

- Exercise 13Dokumen83 halamanExercise 13Lê Thành TrungBelum ada peringkat

- Week 6 - Solutions (Some Revision Questions)Dokumen13 halamanWeek 6 - Solutions (Some Revision Questions)Jason0% (1)

- CPA review center pre-board examDokumen13 halamanCPA review center pre-board exammjc24100% (7)

- Documents Subject Accounts Form4 9PartnershipAccountsDokumen16 halamanDocuments Subject Accounts Form4 9PartnershipAccountsCartello008Belum ada peringkat

- CH 04Dokumen4 halamanCH 04Nusirwan Mz50% (2)

- Additional Illustratiions 2Dokumen14 halamanAdditional Illustratiions 2Naman ChotiaBelum ada peringkat

- Acctg Cycle Problem On Mal-Natalie BigelowDokumen19 halamanAcctg Cycle Problem On Mal-Natalie Bigelowapi-320908944Belum ada peringkat

- Financial Accounting11Dokumen14 halamanFinancial Accounting11AleciafyBelum ada peringkat

- DepreciationDokumen21 halamanDepreciationxvfidxwmgBelum ada peringkat

- Vol 2 CH 1Dokumen20 halamanVol 2 CH 1lee jong sukBelum ada peringkat

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionBelum ada peringkat

- Economic & Budget Forecast Workbook: Economic workbook with worksheetDari EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetBelum ada peringkat

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDari EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionBelum ada peringkat

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Dari EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Penilaian: 1 dari 5 bintang1/5 (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDari EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionBelum ada peringkat

- Application For InattendenceDokumen1 halamanApplication For InattendenceMorshed Chowdhury ZishanBelum ada peringkat

- Measuring and Estimating Current and Future Market DemandDokumen15 halamanMeasuring and Estimating Current and Future Market DemandMorshed Chowdhury ZishanBelum ada peringkat

- Cryptography PKI EncryptionDokumen23 halamanCryptography PKI EncryptionMorshed Chowdhury ZishanBelum ada peringkat

- FSS AbcDokumen10 halamanFSS AbcMorshed Chowdhury ZishanBelum ada peringkat

- Case Ahmed ToysDokumen4 halamanCase Ahmed ToysMorshed Chowdhury ZishanBelum ada peringkat

- Forex MarketDokumen44 halamanForex MarketMorshed Chowdhury ZishanBelum ada peringkat

- URR SEpt 2010Dokumen30 halamanURR SEpt 2010Morshed Chowdhury ZishanBelum ada peringkat

- Business & Economic ForecastingDokumen27 halamanBusiness & Economic ForecastingMorshed Chowdhury ZishanBelum ada peringkat

- Financial Institution ACT and Security Exchange, 1993.Dokumen13 halamanFinancial Institution ACT and Security Exchange, 1993.Morshed Chowdhury ZishanBelum ada peringkat

- Basel CPDokumen16 halamanBasel CPMorshed Chowdhury ZishanBelum ada peringkat

- ALM Maturity ProfileDokumen16 halamanALM Maturity ProfileMorshed Chowdhury ZishanBelum ada peringkat

- FSS Comparative TheoryDokumen2 halamanFSS Comparative TheoryMorshed Chowdhury ZishanBelum ada peringkat

- History of Economic Growth of Pak.Dokumen60 halamanHistory of Economic Growth of Pak.Syed Ikram Ullah ShahBelum ada peringkat

- PROBLEM About Adjusting Entries: Roblems AS PER EcturesDokumen8 halamanPROBLEM About Adjusting Entries: Roblems AS PER EcturesMorshed Chowdhury ZishanBelum ada peringkat

- Management AccountingDokumen7 halamanManagement AccountingAyaz AkhtarBelum ada peringkat

- Use Free Internet With High SpeedDokumen3 halamanUse Free Internet With High SpeedMorshed Chowdhury ZishanBelum ada peringkat

- Chapter 8 - Fixed AssetsDokumen43 halamanChapter 8 - Fixed AssetsMorshed Chowdhury ZishanBelum ada peringkat

- Basic Financial Statements: Stofa, MBM 16 Batch, BIBMDokumen43 halamanBasic Financial Statements: Stofa, MBM 16 Batch, BIBMMorshed Chowdhury ZishanBelum ada peringkat

- 01 Abastract of A Doctoral ThesisDokumen14 halaman01 Abastract of A Doctoral ThesisMahamudul HasanBelum ada peringkat

- Principles of Accounting Lecture on Defining Transactions, Events and the Accounting CycleDokumen4 halamanPrinciples of Accounting Lecture on Defining Transactions, Events and the Accounting CycleMorshed Chowdhury ZishanBelum ada peringkat

- Solution#P7-1A: Lewis Company C R JDokumen2 halamanSolution#P7-1A: Lewis Company C R JMorshed Chowdhury ZishanBelum ada peringkat

- Narail Paper Mills OverviewDokumen16 halamanNarail Paper Mills OverviewMorshed Chowdhury ZishanBelum ada peringkat

- Bangladesh Power DataDokumen54 halamanBangladesh Power Datamax4risk5357Belum ada peringkat

- Resume Template 2012Dokumen1 halamanResume Template 2012Morshed Chowdhury ZishanBelum ada peringkat

- 7-236-1-PB ExDokumen14 halaman7-236-1-PB ExRehen KhanBelum ada peringkat

- Eco Math StatsDokumen2 halamanEco Math StatsMorshed Chowdhury ZishanBelum ada peringkat

- Valuation of Shares & Bonds Lecture NotesDokumen8 halamanValuation of Shares & Bonds Lecture NotesNiket R. ShahBelum ada peringkat

- Chief Executive Officer CEO Turnaround in San Diego CA Resume Robert CampbellDokumen2 halamanChief Executive Officer CEO Turnaround in San Diego CA Resume Robert CampbellRobertCampbell1Belum ada peringkat

- Gelano Vs Ca (Corporation Law)Dokumen3 halamanGelano Vs Ca (Corporation Law)stargazer0732Belum ada peringkat

- Numerical On Credit RiskDokumen4 halamanNumerical On Credit RiskLeo SaimBelum ada peringkat

- LBO ModelingDokumen31 halamanLBO Modelingricoman1989Belum ada peringkat

- Unlawful Detainer AnswerDokumen3 halamanUnlawful Detainer AnswerVan L. LledoBelum ada peringkat

- ACCP 5000 Test 2 Review ClassDokumen26 halamanACCP 5000 Test 2 Review ClassDang ThanhBelum ada peringkat

- Kajal Gupta (Recovered)Dokumen50 halamanKajal Gupta (Recovered)PawanJainBelum ada peringkat

- Islamic Finance Sweden 201Dokumen38 halamanIslamic Finance Sweden 201Khin SweBelum ada peringkat

- Ibo-6 Unit-1 International Monetary Systems and InstitutionsDokumen7 halamanIbo-6 Unit-1 International Monetary Systems and InstitutionsGaytri KochharBelum ada peringkat

- Tata AIG Life Insurance Company LTDDokumen98 halamanTata AIG Life Insurance Company LTDbitturaja0% (1)

- Establishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesDokumen7 halamanEstablishing A Stock Exchange in Emerging Economies: Challenges and OpportunitiesJean Placide BarekeBelum ada peringkat

- Money Laundering and Financing of TerrorismDokumen16 halamanMoney Laundering and Financing of TerrorismHussein AnoshBelum ada peringkat

- Peak Sport Products (1968 HK) : Solid AchievementsDokumen9 halamanPeak Sport Products (1968 HK) : Solid AchievementsSai Kei LeeBelum ada peringkat

- Minsupala Trading Corporation (Workbook)Dokumen14 halamanMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Amendment To The A.P. Housing BoardDokumen2 halamanAmendment To The A.P. Housing BoardRaghu Ram100% (1)

- Qatar Law No. 6 of 1987Dokumen4 halamanQatar Law No. 6 of 1987Lester Cabrera IcoBelum ada peringkat

- Prac 1 Tua LiabilitiesDokumen7 halamanPrac 1 Tua LiabilitiesKrisan Rivera0% (1)

- Real Estate Loan Exam ProceduresDokumen1 halamanReal Estate Loan Exam Proceduresmimu xuBelum ada peringkat

- University of Luzon College of AccountancyDokumen3 halamanUniversity of Luzon College of AccountancyJonalyn May De VeraBelum ada peringkat

- Bharat Credit CardDokumen2 halamanBharat Credit Cardrizanaqvi0% (1)

- Manage credit risk with CRMDokumen2 halamanManage credit risk with CRMdeepbisht007Belum ada peringkat

- RSRM IpoDokumen4 halamanRSRM IpoMohammad Jubayer AhmedBelum ada peringkat

- 9 Fisher PDFDokumen11 halaman9 Fisher PDFdbr trackdBelum ada peringkat

- The Efficient Contracting Approach To Decision UsefulnessDokumen10 halamanThe Efficient Contracting Approach To Decision UsefulnessMulia TantraBelum ada peringkat

- Merchant of Venice EssayDokumen3 halamanMerchant of Venice Essayapi-293642408Belum ada peringkat

- Indemnity AgreementDokumen4 halamanIndemnity AgreementRLO1Belum ada peringkat

- Demo Q2 First DemoDokumen23 halamanDemo Q2 First DemoAlexander LoyloyBelum ada peringkat

- Project Proposal DraftDokumen12 halamanProject Proposal DraftraderpinaBelum ada peringkat

- Reparations Commission v. Universal Deep Sea Fishing, 83 SCRA 764 (1978)Dokumen7 halamanReparations Commission v. Universal Deep Sea Fishing, 83 SCRA 764 (1978)Fides DamascoBelum ada peringkat