Gat Cost Acct Nov 2006

Diunggah oleh

samuel_dwumfourHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Gat Cost Acct Nov 2006

Diunggah oleh

samuel_dwumfourHak Cipta:

Format Tersedia

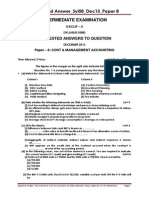

GAT COST ACCT & BUDGETING NOV 2006 Question 1 a) i.

Steps in the materials purchasing process: Identify various suppliers of the material and obtain quotation from each of them. minimum of three quotations must be obtained. ii. Analyse the quotations in order to identify the supplier that gives best value for money. Consider the following factors iii. iv. v. prices of materials quantities of material quality and specification of materials terms of payments discounts offered delivery period A

Select the supplier that offers the best mix of the above. Price is not necessarily the overriding factor. Place the order with the selected supplier and take delivery of the items Continuously review the supplier to ascertain whether or not there is need to charge the supplier. Economic order quantity i. The quantity of material to order any time an order is placed. _________ EOQ = 2Doc cc when D = annual demand Oc = order Cost per unit cc = average carrying cost

b)

ii.

Re-order level The level of stock at which a new order should be placed. Re-order level = Maximum x maximum Usage delivery period

iii.

Maximum Stock level The level of stock above which stock should be allowed to move holding stock in excess of this level imply holding excessive stock. It is the largest quantity of stock that could be in store at any point in time. Maximum stock level = Re-order level + Economic order qty (minimum x minimum) Usage lead time Minimum stock level This is the lowest level at which stock may be allowed to fall. It is not prudent to maintain stock below the minimum level. Minimum Stock level = Re-order Stock level (average x delivery) usage period

iv.

a)

Average stock The quantity of stock that on average, is maintained by an entity at any point in time it is calculated as: Average stock = maximum stock + minimum stock 2 Process C Account

Units

Unit Price Value Units Unit Price Value

Balance b/d Process B Materials Cost Conversion Cost Balance b/d

3,200 36,000

39,200 4,000

000 4,800 Abnormal Loss 43,200 Finished goods 20,928 W.I.P. c/d 10,272 79,200 7,440

2,400 32,800 4,000 39,200

000 4,032 67,728 7,440 79,200

b)

Abnormal Loss Account

Units

Unit Price

Value

Units

Unit Price

Value

Process a/d

2,400 39,200

000 4,032 4,032

Bank a/c P & L a/c

2,400 2,400

500

000 1,200 2,832 4,032

c)

Statement of Equivalent Units

Opening WIP % Units 3,200 100 3,200 ____ 3,200 000 4,800 4,800,000 3,200 1,500 000 4,800 29,600 29,600 100 2,400 100 4,000 _____ 36,000 000 43,200 43,200,000 36,000 1,200 000 35,520 2,880 4,800 Materials Cost % Units 20 100 Conversion Cost % Units

Units Completed Units: W.I.P. b/d Started and finished Abnormal loss Closing W.I.P Equivalent Units Cost incurred Cost per equivalent unit

Process B % Units

Total 000

3,200 100 29,600 32,800 2,400 4,000 39,200

640 40 1,280 29,600 100 29,600 30,240 30,880 60 1,440 40 960 80 3,200 60 2,400 _____ _____ 34,880 34,240 000 000 20,928 10,272 20,928,000 10,272 34,880 34,240 600 300 000 18,144 864 1,920 000 9,264 288 720 00 37,72.. 4,03 7,44

Valuation: Finished goods Abnormal loss W.I.P. c/d

Question 3 (i) An ideal standard is a standard based on Perfect conditions. No allowance is made for expected variations. But an attainable standard is based on achievable working conditions after sufficient allowance has been made for expected variations.

(ii)

A current standard is a standard modified to take account of current charges in the operating environment, whilst a basic standard is a standard set as a base for comparison with actual costs over a period of time. Current standards are used to assess current operating performance whilst Basic Standards are use to ascertain the trend f performance.

(i)

Direct materials cost variance Standard materials cost for the actual production 000 6,000 Units @ 90,000 = Actual materials cost 120,000 70,400 49,600 F

(ii)

Direct materials price variance (Standard Actual price) Actual quantity purchased (2,000 2,200) 32,000 kg = 6,400,000 A

(iii)

Direct materials usage variance = = Standard quantity Actual allowed for actual product - qty used (60,000 32,000) 2,000 = 56,000,000 F Standard material Price

(iv)

Direct labour cost variance Standard labour cost - Actual labour cost for actual production = = = (36,000 x 6,000) - 192,000 216,000,000 - 1492,000,000 24,000,000 F

(v)

Direct labour rate variance = = = (Standard rate - Actual rate) Actual Hours (7,200 7,500) 25,600 hrs 7,680,000 A

(vi)

Direct labour efficiency variance = (Standard Hours produced - Actual Hours) Standard rate 4

= =

[ (5 hrs x 6,000) - 25,00] 7,200 31,680,000 F

Question 4 (i) Product Sales value Selling Price Sales Budget-quantity Sales Budget

Babatu Co. Ltd.

Pano 600,000,000 50,000 600,000,000 50,000 = 12,000 Units Pano Units 12,000 9,000 21,000 7,00 0 14,00 0

Brodo 1,200,000,000 80,000 1,200,000,000 80,000 = 15,000,Units Brodo Units 15,000 10,000 25,000 8,000 14,000

Dupain 1,500,000,000 150,000 1,500,000,000 150,000 = 10,000 Units Dupain Units 10,000 4,000 14,000 6,000 8,000

(ii)

Product Budget

Sales Closing stock Opening stock Budgeted production units

(iii)

Materials Usage Budget Units of Product (14,000) (17,000) (8,000) Sugar Kg 28,000 17,000 24,000 69,000 600 41,400,000 Magerine Kg 42,000 68,000 16,000 126,000 800 100,800,000 Flour Kg 140,000 153,000 96,000 389,000 1,000 309,000,000 Total

Materials Required for Pano Required for Brodo Required for Dupain Price per kg. Budgeted cost of materials (iv)

000 531,200

Materials purchases budget 5

Materials Required for production Closing materials Opening materials Materials to be purchased Cost per kg Cost of purchases Question 5 a) i. Okokroko Ltd

Sugar Kg 69,000 22,000 19,000 15,000 76,000 600 45,600,000

Magerine Kg 126,000 25,000 151,000 20,000 131,000 800 104,800,000

Flour Kg 389,000 50,000 439,000 35,000 404,000 1,000 404,000,000

Total

000 554,400

Marginal Costing Profit Statement 000 Sales 12,500 @ 1,000 Marginal cost of Sales: Direct materials 15,000 @ 250 Direct wages 15,000 @ 375 Royalties 15,000 @ 125 Closing stock 2500 x 11,250 15,000 Variable production cost Variable selling cost Variable administrative cost Contribution Less Fixed Cost: Depreciation Factory rent and rates Factory lightly & heating Other factory overheads Fixed selling expenses Fixed administrative and general exp Net Profit ii. 000 12,000 3,750 5,625 1,875 11,250 (1,875) 9,375 100 125 300 325 350 150 75 175

9,600 2,900

1,375 1,525

Okokroko Ltd Absorption Costing Profit Statement 000 000 000

Sales (12,500 @ 1,000 Cost of sales: Direct materials Direct wages Royalties Prime Cost Factory overheads: Depreciation Factory rent and rates Factory lighting & heating Other factory overheads Total production cost Less closing stock (2500 x 12375) 15,000 Gross profit Less selling expenses Cost: Variable selling expenses Fixed selling expenses Variable administrative exp. Fixed admin cost Net profit b)

12,500 3,750 5,625 1,875 11,250 300 325 350 150

1,125 12,375 2,062.5

10,312.5 2,187.5

100 75 125 175

175 300 475.0 1,712.5

For purposes of financial reporting, the accounting standards recommend the use of Absorption Costing the accounting standards do not allow the use of marginal costing approach for reporting purposes. This is because stocks should be valued at full cost including fixed cost.

Question 6 a) 1) Advantages of individual incentive schemes i. ii. iii. i. ii. iii. 2) it promotes competition among employees and may thus enhance productivity hardwork and the individuals effort is rewarded. Relatively cheaper to be operated by on organization it may bread unhealthy rivalry and competition quality of output may be compromised it does not promote corporate cohesiveness and unity

Disadvantages of individual incentive schemes:

Advantages of group incentive schemes 7

i. ii. iii. i. ii. iii.

it promotes good team spirit and corporate unity it avoids unhealthy competition and rivalry among employees it does not compromise on quality of output it is not a fair method of remuneration since hard working group members and lazy group members will be equally rewarded it does not encourage competitions and extra effort from individuals it is relatively more expensive to operate a group incentive scheme than to operate individual incentive schemes.

Disadvantages of group incentive schemes:

b)

Labour turnover refers to the rate at which employees leave an organisation A number of factors may account for a high labour turnover. These include: i) ii) iii) iv) v) vi) poor wages and salaries unattractive conditions of service lack of for career progression and development conflict between supervisor and employee or autocratic and domineering supervisors ilhealth marriage and relocation

c)

Labour turnover cost may be classified under the following headings: i) removal costs the cost of sending off employees who have resigned. ii) iii) iv) v) transport expenses termination benefits

recruitment and training cost of new employees cost of dissatisfaction and low morale among the remaining employees high wastage, spoilage and low productivity of newly engaged employees low productivity of employees when they have decided to leave

Question 7 a) i. Contribution to sales ratio = Contribution x 100 8

Sales Abindada Profit Add fixed cost Contribution Add variable cost Sales ii. c/s ratio 11,250 11,250 22,500 90,000 112,500 Otoolege 11,750 26,250 38,000 75,000 113,000

22,500 x 100 38,000 x 100 112,500 = 20% 113,000 = 33.6% 26,250 0.336 = 78,125,000

iii.

Break even point revenue = Fixed cost 11,250 c/s ratio 0.2 = 56,250,000

iv.

Margin of safely = Budget sales Break even sales: 000 Budget sales 112,500 Less Break even sales 56,250 Margin of safety 56,250

000 113,000 78,125 34,875

b) i. when there is high demand for the product Otoolege Ltd will earn greater profits because it has a higher contribution for each cedi f sale made. when there is low demand, Abindada Ltd stands to make move profit than Otoolege Ltd because its break even level is low at 56,250,000 as compared to that of Otoolege of 78,125,000 d) The following are the assumption that underlie breakeven analysis: i. ii. Total fixed cost is constant for the relevant range of activity. Variable cost per unit is constant for every unit produced. Therefore total variable cost vary linearly with production 9

ii.

iii. iv. v. vi. vii.

If the company produces more than one unit, then the production is at a constant mix Profits are calculated on a marginal costing basis Cost and revenue are linear functions of output The analysis applies only to the relevant range Cost can be accurately separated into fixed and variable.

10

Anda mungkin juga menyukai

- Cost AccountingDokumen54 halamanCost AccountingAlankar SharmaBelum ada peringkat

- Cost Acc Unit 1 AssignmentDokumen7 halamanCost Acc Unit 1 AssignmentPrasant EkkaBelum ada peringkat

- 16-500 Mcqs of Fundamentals of Accounting PDF For All ExamsDokumen50 halaman16-500 Mcqs of Fundamentals of Accounting PDF For All ExamsQasim AliBelum ada peringkat

- Management Accounting: Level 3Dokumen16 halamanManagement Accounting: Level 3Hein Linn Kyaw100% (1)

- Cost Questions For Review 2020Dokumen16 halamanCost Questions For Review 2020omarBelum ada peringkat

- Topic 2 Cost Concepts and Analysis HandoutsDokumen5 halamanTopic 2 Cost Concepts and Analysis HandoutsJohn Kenneth ColarinaBelum ada peringkat

- Cost Accounting: Time Allowed: Two Hours Max. Marks: 165Dokumen4 halamanCost Accounting: Time Allowed: Two Hours Max. Marks: 165hj3012Belum ada peringkat

- Cost and Management AccountDokumen7 halamanCost and Management AccountMsKhan0078Belum ada peringkat

- Cost Accounting Progress AssignmentsDokumen6 halamanCost Accounting Progress AssignmentsWesleyBelum ada peringkat

- ADL 56 Cost & Management Accounting V2Dokumen8 halamanADL 56 Cost & Management Accounting V2solvedcareBelum ada peringkat

- Question Bank For Ma 1.4Dokumen25 halamanQuestion Bank For Ma 1.4Chitta LeeBelum ada peringkat

- AMA SET 36Dokumen6 halamanAMA SET 36uroojfatima21299Belum ada peringkat

- Cost & Management Accounting - MCQsDokumen44 halamanCost & Management Accounting - MCQsShahrukh Ali Naqvi95% (22)

- Paper - 4: Cost Accounting and Financial Management Part I: Cost AccountingDokumen0 halamanPaper - 4: Cost Accounting and Financial Management Part I: Cost AccountingP VenkatesanBelum ada peringkat

- 5Dokumen66 halaman5RAj BardHan100% (1)

- Revisionary Test Paper - Intermediate - Syllabus 2008 - June 2013: Paper - 8: Cost and Management AccountingDokumen70 halamanRevisionary Test Paper - Intermediate - Syllabus 2008 - June 2013: Paper - 8: Cost and Management AccountingsengurlulaBelum ada peringkat

- Strategic Cost ManagementDokumen21 halamanStrategic Cost ManagementDeepak ShettyBelum ada peringkat

- D) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryDokumen9 halamanD) Ending Work in Process Is Less Than The Amount of The Beginning Work in Process InventoryPhương Thảo HoàngBelum ada peringkat

- Quali ExamDokumen7 halamanQuali ExamLovenia Magpatoc50% (2)

- BOB Finance & Credit Specialist Officer SII Model Question Paper 4Dokumen147 halamanBOB Finance & Credit Specialist Officer SII Model Question Paper 4Pranav KumarBelum ada peringkat

- REVISIONARY TEST PAPER TITLEDokumen173 halamanREVISIONARY TEST PAPER TITLEvivek1929Belum ada peringkat

- ABC Analysis and EOQ CalculationDokumen17 halamanABC Analysis and EOQ CalculationNancy JainBelum ada peringkat

- Mock Test 2021 PMDokumen5 halamanMock Test 2021 PMBao Thy PhoBelum ada peringkat

- Ac Solve PaperDokumen59 halamanAc Solve PaperHaseeb ShadBelum ada peringkat

- Cost Accounting MCQ - MBADokumen22 halamanCost Accounting MCQ - MBATanvi BholeBelum ada peringkat

- Cost and Management Accounting Sample TestDokumen22 halamanCost and Management Accounting Sample TestSudip Issac Sam67% (3)

- Week 9 - 10 - OverheadDokumen44 halamanWeek 9 - 10 - OverheadMohammad EhsanBelum ada peringkat

- Review SessionDokumen10 halamanReview SessionMaajid Bashir0% (1)

- Gls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Dokumen12 halamanGls University'S Faculty of Commerce Semester - Iv Cost Accounting - 2 Objective Questions 2017-2018Archana0% (1)

- Cost and Managerial Accounting Assignments Amity CampusDokumen11 halamanCost and Managerial Accounting Assignments Amity CampusVincent Keys100% (1)

- Paper - 4: Cost Accounting and Financial Management All Questions Are CompulsoryDokumen24 halamanPaper - 4: Cost Accounting and Financial Management All Questions Are CompulsoryAkela FatimaBelum ada peringkat

- FM 2 ADokumen150 halamanFM 2 APurnima KapoorBelum ada peringkat

- Managerial Accounting Quiz 3 - 1Dokumen8 halamanManagerial Accounting Quiz 3 - 1Christian De LeonBelum ada peringkat

- Fundamentals of Accounting MCQsDokumen111 halamanFundamentals of Accounting MCQssrikar dasaradhi100% (2)

- 462 2Dokumen9 halaman462 2M Noaman AkbarBelum ada peringkat

- Activity-based costing testDokumen8 halamanActivity-based costing testLey EsguerraBelum ada peringkat

- Suggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationDokumen13 halamanSuggested Answer - Syl08 - Dec13 - Paper 8 Intermediate ExaminationBalaji RajagopalBelum ada peringkat

- Ejers Tema 2Dokumen17 halamanEjers Tema 2David MajánBelum ada peringkat

- PMBA Cost Accounting Assignment AnalysisDokumen8 halamanPMBA Cost Accounting Assignment AnalysisLabib SafeenBelum ada peringkat

- Cost Classification: Total Product/ ServiceDokumen21 halamanCost Classification: Total Product/ ServiceThureinBelum ada peringkat

- AkbiDokumen37 halamanAkbiCenxi TVBelum ada peringkat

- Chapter 4 QuestionsDokumen8 halamanChapter 4 Questionsreicelle vejerano100% (1)

- MTP 17 51 Questions 1710158898Dokumen11 halamanMTP 17 51 Questions 1710158898Naveen R HegadeBelum ada peringkat

- ABC MCQ'sDokumen10 halamanABC MCQ'sMuhammad FaizanBelum ada peringkat

- Chapter 2 Activity Based Costing: 1. ObjectivesDokumen13 halamanChapter 2 Activity Based Costing: 1. ObjectivesNilda CorpuzBelum ada peringkat

- Cost Accounting RTP CAP-II June 2016Dokumen31 halamanCost Accounting RTP CAP-II June 2016Artha sarokarBelum ada peringkat

- Exam Review Unit I - Chapters 1-3Dokumen24 halamanExam Review Unit I - Chapters 1-3Aaron DownsBelum ada peringkat

- Chapter 8Dokumen71 halamanChapter 8MAN HIN NGAI100% (2)

- Handout 1 Cost ManagementDokumen9 halamanHandout 1 Cost ManagementPatricia AtienzaBelum ada peringkat

- Sem VI - Cost Accounting - TY. BcomDokumen7 halamanSem VI - Cost Accounting - TY. Bcommahesh patilBelum ada peringkat

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageDari EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantagePenilaian: 5 dari 5 bintang5/5 (1)

- Cost Management: A Case for Business Process Re-engineeringDari EverandCost Management: A Case for Business Process Re-engineeringBelum ada peringkat

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesDari EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Make It! The Engineering Manufacturing Solution: Engineering the Manufacturing SolutionDari EverandMake It! The Engineering Manufacturing Solution: Engineering the Manufacturing SolutionBelum ada peringkat

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesDari EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesBelum ada peringkat

- Cost & Managerial Accounting II EssentialsDari EverandCost & Managerial Accounting II EssentialsPenilaian: 4 dari 5 bintang4/5 (1)

- Chapter 23 Ratio Analysis: 1. ObjectivesDokumen26 halamanChapter 23 Ratio Analysis: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Ch22 AnsDokumen4 halamanCh22 Anssamuel_dwumfourBelum ada peringkat

- Consolidated Statement of Financial Position with Intra-Group AdjustmentsDokumen17 halamanConsolidated Statement of Financial Position with Intra-Group Adjustmentssamuel_dwumfourBelum ada peringkat

- Ch13 HKAS20Dokumen9 halamanCh13 HKAS20samuel_dwumfourBelum ada peringkat

- Chapter 21 Associates: 1. ObjectivesDokumen29 halamanChapter 21 Associates: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Ch11 HKAS36Dokumen16 halamanCh11 HKAS36samuel_dwumfourBelum ada peringkat

- Ch14 AnsDokumen5 halamanCh14 Anssamuel_dwumfourBelum ada peringkat

- Chapter 20 Consolidated Income Statement: 1. ObjectivesDokumen13 halamanChapter 20 Consolidated Income Statement: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Ch12 AnsDokumen4 halamanCh12 Anssamuel_dwumfourBelum ada peringkat

- Chapter 16 Financial Assets and Liabilities: 1. ObjectivesDokumen13 halamanChapter 16 Financial Assets and Liabilities: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Accounting for Government GrantsDokumen2 halamanAccounting for Government Grantssamuel_dwumfourBelum ada peringkat

- Chapter 7 Accounting For Provisions, Contingencies and Events After The Reporting PeriodDokumen30 halamanChapter 7 Accounting For Provisions, Contingencies and Events After The Reporting Periodsamuel_dwumfourBelum ada peringkat

- Ch11 HKAS36Dokumen16 halamanCh11 HKAS36samuel_dwumfourBelum ada peringkat

- Chapter22 CFSDokumen21 halamanChapter22 CFSsamuel_dwumfourBelum ada peringkat

- Ch10 AnsDokumen5 halamanCh10 Anssamuel_dwumfourBelum ada peringkat

- Ch9 HKAS40Dokumen10 halamanCh9 HKAS40samuel_dwumfourBelum ada peringkat

- Chapter 11 HKAS 36 Impairment of Assets: Answer 1Dokumen3 halamanChapter 11 HKAS 36 Impairment of Assets: Answer 1samuel_dwumfourBelum ada peringkat

- Ch7 AnsDokumen12 halamanCh7 Anssamuel_dwumfourBelum ada peringkat

- Chapter 8 HKAS 16 Property, Plant and Equipment: 1. ObjectivesDokumen29 halamanChapter 8 HKAS 16 Property, Plant and Equipment: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Ch9 HKAS40Dokumen10 halamanCh9 HKAS40samuel_dwumfourBelum ada peringkat

- Ch5 HKAS8Dokumen20 halamanCh5 HKAS8samuel_dwumfourBelum ada peringkat

- Ch6 HKAS17Dokumen34 halamanCh6 HKAS17samuel_dwumfourBelum ada peringkat

- Ch8 AnsDokumen12 halamanCh8 Anssamuel_dwumfourBelum ada peringkat

- Ch10 AnsDokumen5 halamanCh10 Anssamuel_dwumfourBelum ada peringkat

- Ch7 AnsDokumen12 halamanCh7 Anssamuel_dwumfourBelum ada peringkat

- Ch5 AnsDokumen9 halamanCh5 Anssamuel_dwumfourBelum ada peringkat

- Ch4 RevenueDokumen19 halamanCh4 Revenuesamuel_dwumfourBelum ada peringkat

- Ch4 RevenueDokumen19 halamanCh4 Revenuesamuel_dwumfourBelum ada peringkat

- Ch6 AnsDokumen13 halamanCh6 Anssamuel_dwumfourBelum ada peringkat

- Ch5 AnsDokumen9 halamanCh5 Anssamuel_dwumfourBelum ada peringkat

- Project Feasibility Study and Evaluation 2011 Sports ComplexDokumen264 halamanProject Feasibility Study and Evaluation 2011 Sports ComplexFongbeerBelum ada peringkat

- Civil Engineering 4-Year PlanDokumen4 halamanCivil Engineering 4-Year PlanLorna BacligBelum ada peringkat

- Syll FM 15 2023 29052023Dokumen2 halamanSyll FM 15 2023 29052023ujjal kr nathBelum ada peringkat

- Ginzberg, The Legends of The Jews, Vol. 5 OCR PDFDokumen470 halamanGinzberg, The Legends of The Jews, Vol. 5 OCR PDFd-fbuser-59671747Belum ada peringkat

- El Prezente: Journal For Sephardic Studies Jurnal de Estudios SefaradisDokumen19 halamanEl Prezente: Journal For Sephardic Studies Jurnal de Estudios SefaradisEliezer PapoBelum ada peringkat

- Heavenly Nails Business Plan: Heaven SmithDokumen13 halamanHeavenly Nails Business Plan: Heaven Smithapi-285956102Belum ada peringkat

- English: Quarter 1 - Module 1: Information Gathering For Through Listening For Everyday Life UsageDokumen22 halamanEnglish: Quarter 1 - Module 1: Information Gathering For Through Listening For Everyday Life UsageGrayson RicardoBelum ada peringkat

- National Institute of Technology Durgapur: Mahatma Gandhi Avenue, Durgapur 713 209, West Bengal, IndiaDokumen2 halamanNational Institute of Technology Durgapur: Mahatma Gandhi Avenue, Durgapur 713 209, West Bengal, IndiavivekBelum ada peringkat

- Envelope Size ChartDokumen2 halamanEnvelope Size ChartonjusBelum ada peringkat

- Chapter 4 Case Study Southwestern University's Options: Game 1 Attendance ForecastDokumen3 halamanChapter 4 Case Study Southwestern University's Options: Game 1 Attendance ForecastFathul Crusher55Belum ada peringkat

- English Week Online for Fun and ProficiencyDokumen1 halamanEnglish Week Online for Fun and ProficiencypuspagobiBelum ada peringkat

- Franchise AccountingDokumen20 halamanFranchise AccountingJerichoPedragosa60% (5)

- HDFC Life Click 2 Invest ULIP illustrationDokumen3 halamanHDFC Life Click 2 Invest ULIP illustrationanon_315406837Belum ada peringkat

- ICG Change Magazine 1 - 2019Dokumen156 halamanICG Change Magazine 1 - 2019Jozsef KosztandiBelum ada peringkat

- Population: Lebanon State of The Environment Report Ministry of Environment/LEDODokumen7 halamanPopulation: Lebanon State of The Environment Report Ministry of Environment/LEDO420Belum ada peringkat

- Grady v. Iacullo Aka Shiznit88 - Amended Opinion PDFDokumen17 halamanGrady v. Iacullo Aka Shiznit88 - Amended Opinion PDFMark JaffeBelum ada peringkat

- Annauniversity 2017 Mba Syllabus PDFDokumen86 halamanAnnauniversity 2017 Mba Syllabus PDFSHAHULBelum ada peringkat

- Common Law Equity EssayDokumen3 halamanCommon Law Equity EssayJaycee HowBelum ada peringkat

- Investor Diary Stock Analysis Excel: How To Use This Spreadsheet?Dokumen57 halamanInvestor Diary Stock Analysis Excel: How To Use This Spreadsheet?anuBelum ada peringkat

- Credit/Debit Card Auto Debit AgreementDokumen1 halamanCredit/Debit Card Auto Debit AgreementMandy ChanBelum ada peringkat

- Ma'aden Aluminium Complex WaterproofedDokumen3 halamanMa'aden Aluminium Complex WaterproofedSHAIK ASIMUDDINBelum ada peringkat

- Cook & Zumla - Manson's Tropical DiseasesDokumen98 halamanCook & Zumla - Manson's Tropical DiseasessDamnBelum ada peringkat

- Vendor Directory HC IVC 500Dokumen6 halamanVendor Directory HC IVC 500മിസ്റ്റർ പോഞ്ഞിക്കരBelum ada peringkat

- 2.tutorial - D V SDokumen2 halaman2.tutorial - D V SVivek MenonBelum ada peringkat

- Doing Business in Kuwait 2019Dokumen30 halamanDoing Business in Kuwait 2019munaftBelum ada peringkat

- Charles DickensDokumen2 halamanCharles DickensNour HishamBelum ada peringkat

- Rosemarys Comment Letter On Gas and Oil in HobackDokumen3 halamanRosemarys Comment Letter On Gas and Oil in Hobackapi-23780829Belum ada peringkat

- Final Gaurav FairsDokumen83 halamanFinal Gaurav Fairsgloballine4u2404Belum ada peringkat

- Ba English Adp English Part.1 & 2 Notes, Pu, Uos, Iub-Associate Degree ProgramDokumen7 halamanBa English Adp English Part.1 & 2 Notes, Pu, Uos, Iub-Associate Degree ProgramFile Download100% (1)

- Pdpa Cra-1 PDFDokumen4 halamanPdpa Cra-1 PDFAin NajwaBelum ada peringkat