Accounting For Management

Diunggah oleh

Vivek KheparJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting For Management

Diunggah oleh

Vivek KheparHak Cipta:

Format Tersedia

Contents

Depreciation.................................................................................................................................................. 1

Amortization ............................................................................................................................................. 1

Depletion................................................................................................................................................... 1

Goodwill ........................................................................................................................................................ 1

IFRS (international Financial Reporting Standards) ...................................................................................... 1

Ind-As ........................................................................................................................................................ 1

Revenue Recognition ............................................................................................................................ 2

Depreciation

Reduction of the value of any tangible asset

Charged on 2 basis

o Straight line

o Original

o Fixed installment method

Depreciation=(Cost-scrap)/life

Provided the same amount of depreciating value is invested it adds up to the cash value

Amortization

A reduction in the value of an intangible assets

Depletion

Reduction of value of wasting asset (Natural resources)

Goodwill

If it is self-acquired not recorded in balance sheet

IFRS (international Financial Reporting Standards)

Worldwide recognize

Normally applicable for European countries

Ind-As

Indian version of IFSR

Adopted 90%

Starting from 2014 it would be mandatory to use Ind-As

Revenue Recognition

Measurement of revenue is done on fair value

Done on sales of goods, services, interest, dividend, Royalty

Revenue is only booked once risk & reward is transferred

Interest is booked on accrual basis

Royalty is booked on the agreement basis

Dividend is recorded in when declared at AGM(annual general meeting

Ind AS 10 (events after Reporting Period)

Within 6 months AGM should be conducted

At least 21 days before the AGM annual report should reach the share holders

o Adjusting event

Condition exist on the balance sheet period (e.g. Recession, Insolvency of the

debtors-make provision)

o Non-Adjusting event

Condition does not exist on the balance sheet period (Loss by fire etc.)

Going concern

Dividend

o Is non-adjusting event

Anda mungkin juga menyukai

- KK - DepositoryDokumen36 halamanKK - DepositoryVivek KheparBelum ada peringkat

- Hedge Fund AccountingDokumen14 halamanHedge Fund AccountingVivek KheparBelum ada peringkat

- Hedge FundsDokumen25 halamanHedge FundsVivek KheparBelum ada peringkat

- Export Finance - Shivali MehtaDokumen91 halamanExport Finance - Shivali MehtaVivek KheparBelum ada peringkat

- Form QuotDokumen7 halamanForm Quotsaravanan_c1Belum ada peringkat

- Assignment of AccountsDokumen26 halamanAssignment of AccountsVivek KheparBelum ada peringkat

- Starting PageDokumen8 halamanStarting PageVivek KheparBelum ada peringkat

- Fine Tippy Golden Flowery Orange PekoeDokumen2 halamanFine Tippy Golden Flowery Orange PekoeVivek KheparBelum ada peringkat

- Abcd PDFDokumen72 halamanAbcd PDFVivek KheparBelum ada peringkat

- Social MediaDokumen2 halamanSocial MediaVivek Khepar100% (1)

- Customer EngagementDokumen5 halamanCustomer EngagementVivek KheparBelum ada peringkat

- Risk ReturnDokumen2 halamanRisk ReturnVivek KheparBelum ada peringkat

- Activity Based CostingDokumen2 halamanActivity Based CostingVivek KheparBelum ada peringkat

- Amruta - Tamhankar - Export Import Transactions in BankDokumen84 halamanAmruta - Tamhankar - Export Import Transactions in BankVivek KheparBelum ada peringkat

- Time Series and ForecastingDokumen20 halamanTime Series and ForecastingVivek KheparBelum ada peringkat

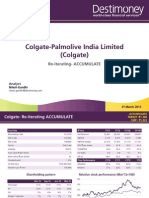

- Colgate Palmolive - Re-Iterate Accumulate Mar 21 2013Dokumen14 halamanColgate Palmolive - Re-Iterate Accumulate Mar 21 2013Vivek KheparBelum ada peringkat

- Risk MGMTDokumen126 halamanRisk MGMTAndrés Vargas NavaBelum ada peringkat

- Asset 24oct07Dokumen9 halamanAsset 24oct07Faith RiderBelum ada peringkat

- 7 - 4-Managing Market Risk PDFDokumen17 halaman7 - 4-Managing Market Risk PDFVivek KheparBelum ada peringkat

- 7 - 3-Measurement of Market Risk PDFDokumen42 halaman7 - 3-Measurement of Market Risk PDFVivek KheparBelum ada peringkat

- ECGC Cla PDFDokumen9 halamanECGC Cla PDFVivek KheparBelum ada peringkat

- 7 - 2-Basel Committee Recomendations PDFDokumen23 halaman7 - 2-Basel Committee Recomendations PDFVivek KheparBelum ada peringkat

- Market Risk Definition, Measurement, and ManagementDokumen15 halamanMarket Risk Definition, Measurement, and ManagementVivek KheparBelum ada peringkat

- Summer Report FormatDokumen8 halamanSummer Report FormatSahilJainBelum ada peringkat

- 7-Market Risk Management PDFDokumen7 halaman7-Market Risk Management PDFVivek KheparBelum ada peringkat

- PROJECTDokumen16 halamanPROJECTVivek KheparBelum ada peringkat

- ProjectDokumen1 halamanProjectVivek KheparBelum ada peringkat

- Underlined) : Annex 1 and Paragraph 1.4 of Annex 2 RespectivelyDokumen6 halamanUnderlined) : Annex 1 and Paragraph 1.4 of Annex 2 RespectivelyVivek KheparBelum ada peringkat

- Banking Risk Management and RBI Supervision in IndiaDokumen26 halamanBanking Risk Management and RBI Supervision in IndiamkrmadBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)