Corporations - Assignment

Diunggah oleh

Zoeybird101Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Corporations - Assignment

Diunggah oleh

Zoeybird101Hak Cipta:

Format Tersedia

BAT 4M1 On-Line Course Name: Question 1:

Corporations - Assignment

Hannaman Industries was incorporated in 2009 in Port Perry, ON. The corporation was authorized to issue unlimited shares on no-par value common stock and unlimited shares of $10, cumulative, $100 par-value preferred stock. The Municipality of Scugog donated land worth $420,000 to Hannaman Industries to locate in the town. Twenty thousand shares of the preferred stock were issued for a total of $2,625,000 and 100,000 shares of common stock were issued at $8 per share. During the first 2 years of its existence, Hannaman lost a total of $568,000 and paid no yearly dividends. In 2011 a dividend of $500,000 was paid based on earnings of $1,300,000 and in 2012, the corporation paid a dividend of $319,000 based on earnings of $1,120,000. Show below, the dividend that would be payable each year to the preferred and common shareholders. (10 marks) Preferred Shares 2009 $0.00 2010 $0.00 2011 $160,000.00 2012 $160,000.00 Total Paid $320,000.00

Common Shares

$0.00

$0.00

$340,000.00

$159,000.00

$499,000.00

a) For 2011, prepare the following journal entries: a. Dividend Date of Declaration Aug. 15 (4 marks) Date AUG/1 5 Particulars Cash Dividends-Preferred Stock Cash Dividends-Common Shares Dividends Payable P R Debit $160,000.00 $340,000.00 $500,000. 00 Credit A

b. Dividend Date of Payment Sept. 29 (4 marks) Date SEPT/2 9 Particulars Dividend Payable Cash P R Debit $500,000.00 $500,000. 00 Credit

BAT 4M1 On-Line Course

Corporations - Assignment

b) Based on your calculations in part (a) and the information in the case, what would the balance be in the retained earnings account at the end of 2012? (6 marks) Earnings (1,120,000) Dividends Paid (320,000+499,000) Loss (568,000)= (267,000)

c) Prepare the Shareholders Equity section of the Balance Sheet as at Dec. 31, 2012. (22 marks) Hannaman Industries Partial Balance Sheet Dec.21,2012 Shareholders Equity Contributed Capital $8 Preferred Stock, $100 Par value, 20,000 shares outstanding Common Stock, No-Par value, 100,000 shares outstanding Total Share Capital Additional Share Capital Contributed Capital in Excess of Stated Value- Preferred Stock Total Contributed Capital Retained Loss Total Shareholder's Equity

$2,000,000.0 0 $800,000.00 $2,800,000.0 0 625000 3425000 -267000 $3,158,000.0 0

Question 2: Record the following transactions for Hannaman Industries. The company is authorized to issue 500,000 shares of $2, convertible, $20 par value preferred stock and unlimited shares of no-par common stock. The preferred shares can be converted into common shares at a ratio of 1:10. (44 marks) July 2 Paid $4,000 to the Province of Ontario and $3,700 to the Scugog Law Office to obtain the articles of incorporation and file the necessary documents related to the incorporation of the company. The law office requested to receive common stock instead of cash and 1,000 shares were issued to the law office.

BAT 4M1 On-Line Course Corporations - Assignment July 4 Issued 500 shares of common stock to the promoters of the company. Their fee was $1,500. July 14 July 17 July 20 July 25 July 27 Aug. 15 Date July 2 Issued 200 shares of preferred stock for $47,000 cash. Accepted subscriptions for 10,000 shares of common stock at $3 per share and received a down payment of $12,000. Issued 8,000 shares of common stock in exchange for equipment valued at $20,000. Collected the remaining amount of the stock subscription and issued the common stock. Declare a $2,500 dividend. Pay the dividend owing. Particulars Organization Costs Bank Common Stocks -1,000 shares Organization Costs Common Stocks -500 shares Bank Preferred Stocks Contributed Capital in Excess of Par Value -200 Shares 17 Bank Subscription Receivable - Common Common Stock Subscribed -10,000 Shares Subscribed Equipment Common Stocks -8000 Shares Common Stock Subscribed Common Stocks -1,000 Shares Subscribed Cash Dividend- Preferred Cash Dividend- Common Dividend Payable 12000 18000 30000 20000 20000 30000 30000 500 2000 2500 P R Debit $9,700.00 $7,700.00 2000 1500 1500 47000 4000 43000 Credit

14

20

25

27

BAT 4M1 On-Line Course Corporations - Assignment Aug 15 Dividend Payable Bank

2500 2500

Total Mark

/90

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Newer Fallen ChapDokumen5 halamanNewer Fallen ChapZoeybird101Belum ada peringkat

- Omg Thats The Love of My LifeDokumen1 halamanOmg Thats The Love of My LifeZoeybird101Belum ada peringkat

- Star OdtDokumen1 halamanStar OdtZoeybird101Belum ada peringkat

- Goodbye, Bonvoyage, U Will Not Be MissedsDokumen1 halamanGoodbye, Bonvoyage, U Will Not Be MissedsZoeybird101Belum ada peringkat

- It Is Always Fun To Read A Well Written BookDokumen1 halamanIt Is Always Fun To Read A Well Written BookZoeybird101Belum ada peringkat

- Proud Is The Father Who Holds His Head Up High When His Child Reaches Their True PotentialDokumen1 halamanProud Is The Father Who Holds His Head Up High When His Child Reaches Their True PotentialZoeybird101Belum ada peringkat

- I Watch The Sky Turn Night Blue, Its Not The Same Without YouDokumen1 halamanI Watch The Sky Turn Night Blue, Its Not The Same Without YouZoeybird101Belum ada peringkat

- Bossy People Live Hecktic Lives True FactDokumen1 halamanBossy People Live Hecktic Lives True FactZoeybird101Belum ada peringkat

- Stolen Kisses Are So Sweet, The Softness of Your Lips Against Mine The Roughness in The Push The Love in The Air Stolen Kisses Are So SweetDokumen1 halamanStolen Kisses Are So Sweet, The Softness of Your Lips Against Mine The Roughness in The Push The Love in The Air Stolen Kisses Are So SweetZoeybird101Belum ada peringkat

- Lost To The World Is The Soul That Is Unknown To Its OwnerDokumen1 halamanLost To The World Is The Soul That Is Unknown To Its OwnerZoeybird101Belum ada peringkat

- PainDokumen1 halamanPainZoeybird101Belum ada peringkat

- Untitled 1Dokumen1 halamanUntitled 1Zoeybird101Belum ada peringkat

- NeedDokumen1 halamanNeedZoeybird101Belum ada peringkat

- Dreams, They Come Out at Night, Distant But Yet So Close Visable Only in My Mind Believing What I See Is Real Dreams, So Touchable, Yet So Far Away Open, My Eyes and They Are GoneDokumen1 halamanDreams, They Come Out at Night, Distant But Yet So Close Visable Only in My Mind Believing What I See Is Real Dreams, So Touchable, Yet So Far Away Open, My Eyes and They Are GoneZoeybird101Belum ada peringkat

- FearDokumen1 halamanFearZoeybird101Belum ada peringkat

- Pain, Its All I've Ever Know, Hurt, Its All Ive Ever Been Love, Something Ive Never FeltDokumen1 halamanPain, Its All I've Ever Know, Hurt, Its All Ive Ever Been Love, Something Ive Never FeltZoeybird101Belum ada peringkat

- PoetryDokumen1 halamanPoetryZoeybird101Belum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Kiraan Supply Mesin AutomotifDokumen6 halamanKiraan Supply Mesin Automotifjamali sadatBelum ada peringkat

- Sage TutorialDokumen115 halamanSage TutorialChhakuli GiriBelum ada peringkat

- Blackbook 2Dokumen94 halamanBlackbook 2yogesh kumbharBelum ada peringkat

- Pen Pal Lesson Plan 3Dokumen3 halamanPen Pal Lesson Plan 3api-664582820Belum ada peringkat

- MegaMacho Drums BT READ MEDokumen14 halamanMegaMacho Drums BT READ MEMirkoSashaGoggoBelum ada peringkat

- Retail Branding and Store Loyalty - Analysis in The Context of Reciprocity, Store Accessibility, and Retail Formats (PDFDrive)Dokumen197 halamanRetail Branding and Store Loyalty - Analysis in The Context of Reciprocity, Store Accessibility, and Retail Formats (PDFDrive)Refu Se ShitBelum ada peringkat

- MSCM Dormitory Housing WEB UpdateDokumen12 halamanMSCM Dormitory Housing WEB Updatemax05XIIIBelum ada peringkat

- 5 Ways To Foster A Global Mindset in Your CompanyDokumen5 halaman5 Ways To Foster A Global Mindset in Your CompanyGurmeet Singh KapoorBelum ada peringkat

- Army Aviation Digest - Apr 1971Dokumen68 halamanArmy Aviation Digest - Apr 1971Aviation/Space History LibraryBelum ada peringkat

- Affidavit of Co OwnershipDokumen2 halamanAffidavit of Co OwnershipEmer MartinBelum ada peringkat

- Fin Accounting IFRS 2e Ch13Dokumen62 halamanFin Accounting IFRS 2e Ch13Nguyễn Vinh QuangBelum ada peringkat

- Eje Delantero Fxl14 (1) .6Dokumen2 halamanEje Delantero Fxl14 (1) .6Lenny VirgoBelum ada peringkat

- Guidelines For Doing Business in Grenada & OECSDokumen14 halamanGuidelines For Doing Business in Grenada & OECSCharcoals Caribbean GrillBelum ada peringkat

- Prediction of CBR From Index Properties of Cohesive Soils: Magdi ZumrawiDokumen1 halamanPrediction of CBR From Index Properties of Cohesive Soils: Magdi Zumrawidruwid6Belum ada peringkat

- Bill of Quantities 16FI0009Dokumen1 halamanBill of Quantities 16FI0009AJothamChristianBelum ada peringkat

- Communicating Value - PatamilkaDokumen12 halamanCommunicating Value - PatamilkaNeha ArumallaBelum ada peringkat

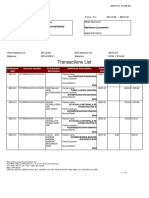

- Transactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinDokumen12 halamanTransactions List: Marilena Constantin RO75BRDE445SV93146784450 RON Marilena ConstantinConstantin MarilenaBelum ada peringkat

- Vest3000mkii TurntableDokumen16 halamanVest3000mkii TurntableElkin BabiloniaBelum ada peringkat

- Payment of Wages 1936Dokumen4 halamanPayment of Wages 1936Anand ReddyBelum ada peringkat

- 4039-Texto Del Artículo-12948-3-10-20211123Dokumen14 halaman4039-Texto Del Artículo-12948-3-10-20211123Ricardo ApazaBelum ada peringkat

- Partnership Digest Obillos Vs CIRDokumen2 halamanPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

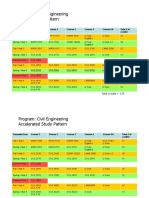

- HKUST 4Y Curriculum Diagram CIVLDokumen4 halamanHKUST 4Y Curriculum Diagram CIVLfrevBelum ada peringkat

- Handbook of Storage Tank Systems: Codes, Regulations, and DesignsDokumen4 halamanHandbook of Storage Tank Systems: Codes, Regulations, and DesignsAndi RachmanBelum ada peringkat

- Punches and Kicks Are Tools To Kill The Ego.Dokumen1 halamanPunches and Kicks Are Tools To Kill The Ego.arunpandey1686Belum ada peringkat

- Intro To MavenDokumen18 halamanIntro To MavenDaniel ReckerthBelum ada peringkat

- The Original Lists of Persons of Quality Emigrants Religious Exiles Political Rebels Serving Men Sold For A Term of Years Apprentices Children Stolen Maidens Pressed and OthersDokumen609 halamanThe Original Lists of Persons of Quality Emigrants Religious Exiles Political Rebels Serving Men Sold For A Term of Years Apprentices Children Stolen Maidens Pressed and OthersShakir Daddy-Phatstacks Cannon100% (1)

- ABHA Coil ProportionsDokumen5 halamanABHA Coil ProportionsOctav OctavianBelum ada peringkat

- Learning Competency PDFDokumen1 halamanLearning Competency PDFLEOMAR PEUGALBelum ada peringkat

- Agrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319Dokumen7 halamanAgrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319mustakim mohamadBelum ada peringkat

- Abas Drug Study Nicu PDFDokumen4 halamanAbas Drug Study Nicu PDFAlexander Miguel M. AbasBelum ada peringkat