Unified Accounts Code Structure (UACS)

Diunggah oleh

Hammurabi BugtaiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Unified Accounts Code Structure (UACS)

Diunggah oleh

Hammurabi BugtaiHak Cipta:

Format Tersedia

:&puMk of, t& 9'fUlippine.

6 COMMISSION ON AUDIT DEPARTMENT OF BUDGET AND MANAGEMENT DEPARTMENT OF FINANCE

JOINT CIRCULAR NO.

A"gust 6

2013-1

,2013

FOR

: All Heads of Departments, Agencies, Bureaus, Offices, Commissions, State Universities and Colleges, Heads of Government-Owned and/or Controlled Corporations with Budgetary. Support from the National Government, including those maintaining Special Accounts in the General Fund, and Other Instrumentalities of the Government, Chiefs . of Financial and Management Services, COA Auditors and all Others Concerned UNIFIED ACCOUNTS CODE STRUCTURE (UACS)

SUBJECT: 1.0'

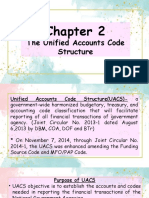

POLICY STATEMENT Consistent with the Public Financial Management Reforms Roadmap, the Department of Budget and Management (DBM), Commission on Audit (COA), Department of Finance (DOF), and Bureau of the Treasury jointly developed the Unified Accounts Code Structure (UACS), a government-wide coding framework, to provide a. harmonized budgetary and accounting code classification that will facilitate the efficient and accurate financial reporting of actual revenue collections and expenditures compared with programmed revenues and expenditures, respectively, starting FiscalYear (FY) 2014. The. UACS Manual accompanying this Circular contains the' accounts and codes to be adopted in identifying, aggregating, budgeting, accounting, auditing and reporting the financial transactions of the government.

2.0

PURPOSE

..

2.1

To prescribe the implementing guidelines, rules and regulations on the use of the UACS that harmonizes budgetary and accounting classifications and structures for simplifying and consolidating financial reports. To enhance the quality and timeliness of financial data for the generation of the required reports and analysis of the same by:

2.2

Page 1 of4

2.2.1

Providing easy access to real-time financial data as required by the oversight agencies and heads of departments/agencies; and Ensuring consistency with the classification system of the Public Sector Accounting Standards (Philippines and International standards), and the Government Finance Statistics.

2.2.2

2.3

To strengthen financial controls and accountability.

3.0

COVERAGE

This Circular covers all agencies, Constitutional Commissions/Offices, State Universities and Colleges, Government-owned and/or Controlled Corporations with budgetary support from the National Government, including those maintaining special accounts in the General Fund, and other instrumentalities of the national government.

4.0

KEY ELEMENTSOF THE UACS

The key elements of the UACS are as follows: 4.1' Funding Source codes - Six-digit code to reflect the Financing Source, Authorization and Fund Category (Chapter 1 of the Manual); Organization codes - Twelve-digit code to reflect the Department, Agency and Sub-Agency or Operating Unit/ Revenue Collecting Unit (Chapter 2 of the Manual); Location codes Nine-digit code to reflect the Region/ Province/ Municipality/ Barangay following the Philippine Standard Geographic Code prescribed by the National Statistical Coordination Board (Chapter 3 of the Manual); Major Final Output (MFO)/ Program, Activity and Project (PAP) codes Nine-digit code to reflect the MFO/PAP code (Chapter 4 of the Manual); and 4.5 Object Codes - Eight-digit code to reflect the Assets, Liabilities, Equity, Income, and Expense accounts by object following the Revised Chart of Accounts and two-digit code to reflect sub-object codes provided by the Bureau of the Treasury (BTr) for the Cash in Bank Accounts, the Bureau of Internal Revenue (BIR) for the Tax Revenue Accounts, Bureau of Customs for the Import Duties Accounts, the DOF for the Non-Tax Revenue Accounts and the DBM for the Expense Accounts (Chapter 5 of the Manual).

4.2

4.3

4.4

Page 2 of 4

5.0

ADOPTION/IMPLEMENTATION OF THE UACS

5.1 Starting FY 2014, the UACS shall be the coding framework for the national government's financial transactions in all phases of the budget cycle, namely: budget preparation, legislation, execution and accountability. The UACS Manual and its Appendices shall provide guidance on the assigned codes to be used by all Departments and Agencies in their financial transactions. An orientation and training program on the adoption of the UACS shall be conducted for all finance (accounting and budget) personnel of Departments/Agencies, COA auditing personnel, and other users.

5.2

5.3

6.0

RESPONSIBILITIES

6.1 All heads of departments/agencies and chiefs of financial and management services shall ensure the proper adoption of all accounts classification and coding in the attached UACS Manual.

I

6.2

Resolution of issues relative to: 6.2.1 Validation and assignment of new codes for funding source, organization, sub-object codes for expenditure items shall be the responsibility of the DBM Consistency of account classification and coding structure with the Revised Chart of Accounts shall be the responsibility of the COA Consistency of account classification and coding standards with the Government Finance Statistics shall be the responsibility of the DOF - BTr Validation and assignment of new Program, Activity, Project Codes shall be decided jointly by the proponent agency and the DBM

6.2.2

6.2.3

6.2.4

7.0

REPEALING CLAUSE

All codes issued under the National Standard Agency Coding System shall continue to be used until December 31, 2013 only. Upon effectivity of this Joint Circular, all existing guidelines on Funding Source Codes, Organization Codes, Location Codes, MFa/PAP Codes and Object Codes which are inconsistent herewith, are deemed repealed.

Page 3 of 4

8.0

EFFECTIVITY

This Joint Circular takes effect on January 1, 2014. In anticipation of the effectivity of this Joint Circular, the UACS is already

adopted in the preparation of the FY 2014 budget.

r~~

FLORENCIO B. ABAD

Secretary

CE~~SIMA

Secretary Department of Finance

Department of Budget and Management

UL

{\ ''"'18.c ... '\ r.

l~~

MA.GRACI~.~TAN

C~~~~~~:

Commission on Audit

Page 4 of 4

Anda mungkin juga menyukai

- Repealed PD 692 Known As Revised Accountancy LawDokumen8 halamanRepealed PD 692 Known As Revised Accountancy LawLian RamirezBelum ada peringkat

- 1.1 The Accountancy ProfessionDokumen4 halaman1.1 The Accountancy ProfessionBrian VillaluzBelum ada peringkat

- BS ACCOUNTANCY TRUE OR FALSE STATEMENTSDokumen1 halamanBS ACCOUNTANCY TRUE OR FALSE STATEMENTSSheena ClataBelum ada peringkat

- CF Qualitative CharacteristicsDokumen3 halamanCF Qualitative Characteristicspanda 1Belum ada peringkat

- AFAR 2 SyllabusDokumen11 halamanAFAR 2 SyllabusLawrence YusiBelum ada peringkat

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25Dokumen1 halaman(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 1 (Partnership) - Answers On Multiple Choice Computation #21 To 25John Carlos DoringoBelum ada peringkat

- Chapter 4 v4Dokumen18 halamanChapter 4 v4Sheilamae Sernadilla GregorioBelum ada peringkat

- Chan - A Comparison of Government Accounting and Business AccountingDokumen10 halamanChan - A Comparison of Government Accounting and Business AccountingInternational Consortium on Governmental Financial Management100% (4)

- Sec Code of Corporate Governance AnswerDokumen3 halamanSec Code of Corporate Governance AnswerHechel DatinguinooBelum ada peringkat

- CfasDokumen32 halamanCfasLouiseBelum ada peringkat

- AC - Acctg Gov Quiz 01Dokumen2 halamanAC - Acctg Gov Quiz 01Erjohn PapaBelum ada peringkat

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDokumen4 halaman06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoBelum ada peringkat

- Corporate LiquidationDokumen7 halamanCorporate LiquidationAcads PurposesBelum ada peringkat

- INTGR TAX 005 Compensation IncomeDokumen5 halamanINTGR TAX 005 Compensation IncomeZatsumono YamamotoBelum ada peringkat

- JPIA Manual Membership SystemDokumen50 halamanJPIA Manual Membership SystemEdita Lamp DizonBelum ada peringkat

- Specialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryDokumen10 halamanSpecialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryCaptain ObviousBelum ada peringkat

- PRACTICE SET LIABILITIESDokumen12 halamanPRACTICE SET LIABILITIESKayla MirandaBelum ada peringkat

- 6 - Pat & Sat Co. - PALACIODokumen7 halaman6 - Pat & Sat Co. - PALACIOPinky DaisiesBelum ada peringkat

- Home Office Chap. 1Dokumen20 halamanHome Office Chap. 1Rei GaculaBelum ada peringkat

- AssignmentDokumen9 halamanAssignmentBaekhunnie ByunBelum ada peringkat

- Audit Theory Chapter 7 Overview of FS Audit ProcessDokumen13 halamanAudit Theory Chapter 7 Overview of FS Audit ProcessAdam SmithBelum ada peringkat

- NGA - JE ExercisesDokumen3 halamanNGA - JE ExercisesShannise Dayne ChuaBelum ada peringkat

- CHAPTER 2 - The Unified Account Code StructureDokumen87 halamanCHAPTER 2 - The Unified Account Code StructureJenny Jean Lelis100% (1)

- Total Assets 402,000 96,000 430,800Dokumen2 halamanTotal Assets 402,000 96,000 430,800Melwin CalubayanBelum ada peringkat

- Caltech Ventures Performance AgreementDokumen3 halamanCaltech Ventures Performance AgreementAnita WilliamsBelum ada peringkat

- InterAcc 14-33Dokumen11 halamanInterAcc 14-33Marinella LosaBelum ada peringkat

- Basic Concepts of PartnershipDokumen7 halamanBasic Concepts of PartnershipKhim CortezBelum ada peringkat

- SolMan (Advanced Accounting)Dokumen190 halamanSolMan (Advanced Accounting)Jinx Cyrus RodilloBelum ada peringkat

- Proof of Cash+2-1Dokumen35 halamanProof of Cash+2-1Eunice FulgencioBelum ada peringkat

- Afar 02 Partnership Dissolution LiquidationDokumen16 halamanAfar 02 Partnership Dissolution LiquidationMikael James VillanuevaBelum ada peringkat

- Accounting For Special TransactionsDokumen13 halamanAccounting For Special Transactionsviva nazarenoBelum ada peringkat

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTDokumen21 halamanStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynBelum ada peringkat

- LS 1.30 - PSA 200 Overall Objectives of The Independent Auditor and The Conduct of Audit in Accordance With PSADokumen5 halamanLS 1.30 - PSA 200 Overall Objectives of The Independent Auditor and The Conduct of Audit in Accordance With PSASkye LeeBelum ada peringkat

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Dokumen16 halamanACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lanceBelum ada peringkat

- ACC 106 Intermediate Accounting 1 Cash and Cash EquivalentsDokumen12 halamanACC 106 Intermediate Accounting 1 Cash and Cash Equivalentshello millieBelum ada peringkat

- Chapter 7 - Regular Output VATDokumen17 halamanChapter 7 - Regular Output VATSelene DimlaBelum ada peringkat

- AC17-602P-REGUNAYAN-End of Chapter 1 ExercisesDokumen15 halamanAC17-602P-REGUNAYAN-End of Chapter 1 ExercisesMarco RegunayanBelum ada peringkat

- Management Accounting: Instructors' ManualDokumen11 halamanManagement Accounting: Instructors' ManualJane Michelle EmanBelum ada peringkat

- Ast-Chapter 1 p3, p5, p6Dokumen8 halamanAst-Chapter 1 p3, p5, p6Geminah BellenBelum ada peringkat

- Assignment 3Dokumen6 halamanAssignment 3Triechia LaudBelum ada peringkat

- Notes On Partnership FormationDokumen11 halamanNotes On Partnership FormationSarah Mae EscutonBelum ada peringkat

- Comprehensive FAR Part 3 ReviewDokumen21 halamanComprehensive FAR Part 3 ReviewLabLab ChattoBelum ada peringkat

- Activity - Consolidated Financial Statement Part 1Dokumen10 halamanActivity - Consolidated Financial Statement Part 1PaupauBelum ada peringkat

- CFR-40C Financial Reporting StandardsDokumen6 halamanCFR-40C Financial Reporting StandardsedrianclydeBelum ada peringkat

- 85184767Dokumen9 halaman85184767Garp BarrocaBelum ada peringkat

- Module 3 Illustrations Ans KeyDokumen11 halamanModule 3 Illustrations Ans KeyKirstine LabuguinBelum ada peringkat

- Diana May Company IssuedDokumen1 halamanDiana May Company IssuedQueen ValleBelum ada peringkat

- PRACTICAL ACCOUNTING 1 Part 2Dokumen9 halamanPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagBelum ada peringkat

- 11 Chapter ModelDokumen12 halaman11 Chapter ModelKnighterrant VogabondBelum ada peringkat

- Mantuano DeducDokumen28 halamanMantuano DeducDonita MantuanoBelum ada peringkat

- Exercise 2Dokumen2 halamanExercise 2sharielles /Belum ada peringkat

- Ai-1 RM8Dokumen5 halamanAi-1 RM8Sheena0% (1)

- RAPPLER HOLDINGS CORPORATION'S Accounts Receivable Subsidiary Ledger Shows The FollowingDokumen2 halamanRAPPLER HOLDINGS CORPORATION'S Accounts Receivable Subsidiary Ledger Shows The FollowingAlvinDumanggasBelum ada peringkat

- Chapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDokumen3 halamanChapter 4 - Seat Work - Assignment #4 - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosBelum ada peringkat

- Chapter 22 - Retained EarningsDokumen8 halamanChapter 22 - Retained EarningsOJERA, Allyna Rose V. BSA-1BBelum ada peringkat

- Intermediate Accounting FormulasDokumen2 halamanIntermediate Accounting FormulasBlee13Belum ada peringkat

- Friendship CoDokumen3 halamanFriendship CoKeahlyn BoticarioBelum ada peringkat

- Government's unified accounts code structure (UACS) explainedDokumen5 halamanGovernment's unified accounts code structure (UACS) explainedRuiz, CherryjaneBelum ada peringkat

- Unified Accounts Code StructureDokumen3 halamanUnified Accounts Code Structurenica leeBelum ada peringkat

- A. UACS Definition: 1. What Is The UACS?Dokumen28 halamanA. UACS Definition: 1. What Is The UACS?BeomiBelum ada peringkat

- Stregthening PDAODokumen27 halamanStregthening PDAOHammurabi BugtaiBelum ada peringkat

- Handbook On Case Digests On Local Budgeting and Other Related Matters PDFDokumen248 halamanHandbook On Case Digests On Local Budgeting and Other Related Matters PDFVince SardinaBelum ada peringkat

- Capdev ToolkitDokumen96 halamanCapdev ToolkitMarky Olorvida50% (2)

- 1 Localization FrameworkDokumen31 halaman1 Localization FrameworkHammurabi BugtaiBelum ada peringkat

- Journalists' Safety: Involving Media OwnersDokumen46 halamanJournalists' Safety: Involving Media OwnersCenter for Media Freedom & ResponsibilityBelum ada peringkat

- $ROGSYVSDokumen139 halaman$ROGSYVSismaelBelum ada peringkat

- 2016 Rules Seabased PDFDokumen88 halaman2016 Rules Seabased PDFjaine0305Belum ada peringkat

- RED BookDokumen85 halamanRED BookGay Dugang-Ibañez100% (1)

- Code of Professional Responsibility Voluntary Arbitrators Dole NLRC PDFDokumen4 halamanCode of Professional Responsibility Voluntary Arbitrators Dole NLRC PDFHammurabi BugtaiBelum ada peringkat

- SB Rules 2003Dokumen45 halamanSB Rules 2003DO SOLBelum ada peringkat

- BpatmanualDokumen35 halamanBpatmanualRicky Joharie PapandayanBelum ada peringkat

- 57 Social Accountability StocktakingDokumen30 halaman57 Social Accountability StocktakingHammurabi BugtaiBelum ada peringkat

- Environmental Education FinalDokumen53 halamanEnvironmental Education FinalHammurabi BugtaiBelum ada peringkat

- D. Disaster Preparedness Checklist For LGUsDokumen16 halamanD. Disaster Preparedness Checklist For LGUsHammurabi BugtaiBelum ada peringkat

- COA C2012 001 SupportingDokumen58 halamanCOA C2012 001 Supportingvocks_200096% (28)

- DAP ProjectsDokumen19 halamanDAP ProjectsHammurabi BugtaiBelum ada peringkat

- Journalists' Safety: Involving Media OwnersDokumen46 halamanJournalists' Safety: Involving Media OwnersCenter for Media Freedom & ResponsibilityBelum ada peringkat

- Kaplinsky y Morris - A Handbook For Value Chain ResearchDokumen113 halamanKaplinsky y Morris - A Handbook For Value Chain Researchhobbesm198567% (3)

- Protecting Your Health EmergencyDokumen28 halamanProtecting Your Health EmergencyHammurabi BugtaiBelum ada peringkat

- Preparing for Media in School CrisesDokumen10 halamanPreparing for Media in School CrisesHammurabi BugtaiBelum ada peringkat

- PNP Hostage Negotiation HandbookDokumen111 halamanPNP Hostage Negotiation Handbookharrison rojas100% (1)

- Gender-Based Violence Manual for Police RespondersDokumen69 halamanGender-Based Violence Manual for Police RespondersCristina Joy Vicente Cruz100% (3)

- Child FriendlyhdfhDokumen3 halamanChild FriendlyhdfhHammurabi BugtaiBelum ada peringkat

- McDanielM MastersThesisDokumen136 halamanMcDanielM MastersThesisHammurabi BugtaiBelum ada peringkat

- Crisis ManagementDokumen12 halamanCrisis ManagementAhmed ZidanBelum ada peringkat

- Volunteer Managers HandbookDokumen168 halamanVolunteer Managers HandbookHammurabi Bugtai75% (4)

- Crisis ManualDokumen21 halamanCrisis ManualHammurabi BugtaiBelum ada peringkat

- Proactive Action in El Nino PDFDokumen3 halamanProactive Action in El Nino PDFHammurabi BugtaiBelum ada peringkat

- When The Ground Begins To Shake: WWW - Getthru.govt - NZDokumen1 halamanWhen The Ground Begins To Shake: WWW - Getthru.govt - NZHammurabi BugtaiBelum ada peringkat

- SARTECH I Criteria 02 2003 PDFDokumen37 halamanSARTECH I Criteria 02 2003 PDFHammurabi BugtaiBelum ada peringkat

- ILO and Social Security (GROUP B)Dokumen13 halamanILO and Social Security (GROUP B)Dhiren VairagadeBelum ada peringkat

- University of Wisconsin Proposal TemplateDokumen5 halamanUniversity of Wisconsin Proposal TemplateLuke TilleyBelum ada peringkat

- Bpoc Creation Ex-OrderDokumen4 halamanBpoc Creation Ex-OrderGalileo Tampus Roma Jr.100% (7)

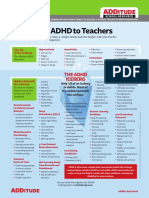

- Explaining ADHD To TeachersDokumen1 halamanExplaining ADHD To TeachersChris100% (2)

- Technical Contract for 0.5-4X1300 Slitting LineDokumen12 halamanTechnical Contract for 0.5-4X1300 Slitting LineTjBelum ada peringkat

- Summer Internship ReportDokumen135 halamanSummer Internship Reportsonal chandra0% (1)

- Examination of InvitationDokumen3 halamanExamination of InvitationChoi Rinna62% (13)

- Year 11 Economics Introduction NotesDokumen9 halamanYear 11 Economics Introduction Notesanon_3154664060% (1)

- Settlement of Piled Foundations Using Equivalent Raft ApproachDokumen17 halamanSettlement of Piled Foundations Using Equivalent Raft ApproachSebastian DraghiciBelum ada peringkat

- Popular Painters & Other Visionaries. Museo Del BarrioDokumen18 halamanPopular Painters & Other Visionaries. Museo Del BarrioRenato MenezesBelum ada peringkat

- Political Philosophy and Political Science: Complex RelationshipsDokumen15 halamanPolitical Philosophy and Political Science: Complex RelationshipsVane ValienteBelum ada peringkat

- Toshiba l645 l650 l655 Dabl6dmb8f0 OkDokumen43 halamanToshiba l645 l650 l655 Dabl6dmb8f0 OkJaspreet Singh0% (1)

- TorricelliDokumen35 halamanTorricelliAdinda Kayla Salsabila PutriBelum ada peringkat

- Exámenes Trinity C1 Ejemplos - Modelo Completos de Examen PDFDokumen6 halamanExámenes Trinity C1 Ejemplos - Modelo Completos de Examen PDFM AngelesBelum ada peringkat

- Equity Valuation Concepts and Basic Tools (CFA) CH 10Dokumen28 halamanEquity Valuation Concepts and Basic Tools (CFA) CH 10nadeem.aftab1177Belum ada peringkat

- All Forms of Gerunds and InfinitivesDokumen4 halamanAll Forms of Gerunds and InfinitivesNagimaBelum ada peringkat

- Set up pfSense transparent Web proxy with multi-WAN failoverDokumen8 halamanSet up pfSense transparent Web proxy with multi-WAN failoverAlicia SmithBelum ada peringkat

- Final Key 2519Dokumen2 halamanFinal Key 2519DanielchrsBelum ada peringkat

- Supply Chain AssignmentDokumen29 halamanSupply Chain AssignmentHisham JackBelum ada peringkat

- Contract Costing and Operating CostingDokumen13 halamanContract Costing and Operating CostingGaurav AggarwalBelum ada peringkat

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDokumen43 halamanLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesBelum ada peringkat

- Faxphone l100 Faxl170 l150 I-Sensys Faxl170 l150 Canofax L250seriesDokumen46 halamanFaxphone l100 Faxl170 l150 I-Sensys Faxl170 l150 Canofax L250seriesIon JardelBelum ada peringkat

- Passive Voice Exercises EnglishDokumen1 halamanPassive Voice Exercises EnglishPaulo AbrantesBelum ada peringkat

- Ejercicio 1.4. Passion Into ProfitDokumen4 halamanEjercicio 1.4. Passion Into ProfitsrsuaveeeBelum ada peringkat

- Developing An Instructional Plan in ArtDokumen12 halamanDeveloping An Instructional Plan in ArtEunice FernandezBelum ada peringkat

- Write a composition on tax evasionDokumen7 halamanWrite a composition on tax evasionLii JaaBelum ada peringkat

- Obtaining Workplace InformationDokumen4 halamanObtaining Workplace InformationJessica CarismaBelum ada peringkat

- Oyo Rooms-Case StudyDokumen13 halamanOyo Rooms-Case StudySHAMIK SHETTY50% (4)

- Strategies To Promote ConcordanceDokumen4 halamanStrategies To Promote ConcordanceDem BertoBelum ada peringkat

- Codilla Vs MartinezDokumen3 halamanCodilla Vs MartinezMaria Recheille Banac KinazoBelum ada peringkat