Asset-Liability Management in Indian Private Sector Banks-A Canonical Correlati

Diunggah oleh

IAEME PublicationJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Asset-Liability Management in Indian Private Sector Banks-A Canonical Correlati

Diunggah oleh

IAEME PublicationHak Cipta:

Format Tersedia

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), INTERNATIONAL JOURNAL OF MANAGEMENT (IJM) Volume

e 4, Issue 5, September - October (2013)

ISSN 0976-6502 (Print) ISSN 0976-6510 (Online) Volume 4, Issue 5, September - October (2013), pp. 06-13 IAEME: www.iaeme.com/ijm.asp Journal Impact Factor (2013): 6.9071 (Calculated by GISI) www.jifactor.com

IJM

IAEME

ASSET-LIABILITY MANAGEMENT IN INDIAN PRIVATE SECTOR BANKS-A CANONICAL CORRELATION ANALYSIS

A. Karthigeyan*, Dr V. Mariappan** and Dr B. Rangaiah*** *Corresponding Author and Research Scholar, Department of Banking Technology, Pondicherry University, India ** Associate Professor, Department of Banking Technology, Pondicherry University, India *** Associate Professor, Department of Applied Psychology, Pondicherry University, India

ABSTRACT Banks generally mobilize resources in the form of deposits and lend them as loans and advances. The resources mobilized by the banks are generally short-term in nature and the deployments of funds are medium and long-term, hence there is always a mismatch between the maturity and repayment of funds in banks. The mismatch risk the banks due to the incurrent risks involved in the business mechanisms and leads to liquidity crunch and loss of margins at times. There are many risks involving the banking business - such as credit risk, liquidity risk, interest rate risk, operational risk, exchange risk, and regulatory risk. However, the major risks faced by the banks are liquidity risk and interest rate risk. A systematic management of assets and liability of the banks help the banks to address these risks effectively and leads the banks towards a sustainable growth. For this purpose, the sample of three Old & New generation Private sector Banks was taken and the Canonical correlation technique has been applied to capture the predictor variables, liability and predictive variables assets in these banks. The finding of the paper reveals that except ICICI banks, all other banks are in safer zone and mostly the predictor variables are long-term and the predictive variables are also long-term, and short- term in nature. Keywords: Asset-Liability Management, Canonical correlation, Deposits, Advances. INTRODUCTION Risk and risk taking is an inherent part of any business activity. Banking business due to its nature and presence is exposed to various types of risks. A country like India with a fast growing economy exposed to higher risks. In a competitive environment risk taking is an essential part of the

6

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

financial decision for the survival and grow of the entity. Recognizing the need of asset liability management to develop a strong and sound banking system, the RBI introduced ALM guidelines for banks and financial institutions in April 1999. There are separate norms prescribed for Scheduled Commercial Banks and RRBs and for financial institutions for best management of banks resources. The objective of the efforts is to effective management of banks resources and to optimize the returns by minimizing the risk. While sound financial system is considered as the backbone of any country and its economy, safety and stability of the financial institutions are even most important for the growth of the industry, economy and economic well-being of the people. Though world over all Governments and their respective Central Banks are aware of these truths and put in place necessary risk management policies and procedures to protect their financial system and economy, certain unforeseeable risks inherent in the business of banks shaken the countries economies in the past. The recent failure of banks and banking system in parts of Europe and USA is a telling evidence of these facts. IMPORTANT RISKS IN BANKING BUSINESS Due to the increased competition and expansion of business activities across geographies, banks today are exposed to several risks - such as credit risk, market risk, liquidity risk, operational risk, foreign exchange risk, technology risk, regulatory risk, country risk, reputation risk and so on. However, most of the major risks confronted by banks across the globe are covered under few risk categories such as credit risk, market risk and operational risk. Credit Risk Credit risk arises from a banks dealings with an individual customer, corporate companies, banks, financial institutions or a sovereign. Credit Risk is inherent to banking and it is as old as banking business itself. Credit risk in simple terms is the potential of the borrower fail to meet their obligations; as a result the loan facility becomes default due to non repayment. Later, the focus turned towards ownership, that the private ownership is performing better than public ownership. The focus on the ownership and financial performance of banks in emerging markets concern mainly about the possibility of inefficient allocation of banks financial resources, its because of external threats like political interventions and public sector bank officials references to the disbursement of loans. It leads to significant accumulation of nonperforming assets (NPAs) in the banking book. There is evidence in Latin America, the foreign banks are risk averse, market penetration by these banks is significant and it affects developing economy in the context of credit disbursal to small and medium enterprises (Clarke, Cull, DAmato and Molinari, 1999; Clarke, Cull, and Peria 2001; Clarke, Cull, Peria and Sanchez, 2002). Banerjee and Duflo (2002) came with an excellent argument by using Indian data, they showed that, whether it is public or private the behaviour of banks in emerging economy ownership does not affect or change the performance of credit market. However data used by Banerjee and Duflo is limited it is restricted to one Indian public sector bank that accounted for about 5 percent of banking sector assets. Sumon Kumar Bhaumik and Jenifer Piesse (2005) estimated a model that expresses credit-to-deposit ratio (CDR) as a function of the credit risk associated with the banks potential borrower pool, and the risk averseness of the banks. B S Bodla and Richa Verma (2009) had analysed Credit Risk Management framework of Scheduled commercial banks (SCB) in India. Risk rating, credit administration, prudential limits and loan review mechanisms are very important instruments of credit risk management.

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

Market risk Market risk is primarily concerned with describing uncertainty about prices or returns due to market price fluctuations. The value of on-/off-balance sheet positions get affected adversely by movements in equity and interest rate markets, currency exchange rates and commodity prices. The banks today require a strong market risk management policy for a comprehensive and dynamic frame work for measuring, monitoring and managing liquidity, interest rate, foreign exchange and equity as well as commodity price risk. The market risk management needs to be closely integrated with the banks business strategy. Ila Patnaik & Ajay Shah (2002) had analysed the Interest-Rate Risk in the Indian Banking System by measuring the interest rate risk profile of major banks in India. It consists of estimating the impact upon equity capital of standardized interest rate shocks and measuring the elasticity of bank stock prices to fluctuations in interest rates. They found that the BIS notion of a 99% percentile movement on a oneyear holding period implies a shock of 320 bps in assessing interest-rate risk. Finally, they suggested that, the banks and their supervisors may benefit from computing interest rate exposure through these two approaches. But they have used structural liquidity report for calculating interest rate risk; there is a huge difference between these two reports. Ahmed.S, Anne Beatty, and Carolyn Takeda (1997) made a study of the Interest Rate Risk management activities of commercial banks including their use of derivatives. The study had shown that the banks primarily focus on managing interest rate sensitivity of net income rather than the interest rate sensitivity of stock returns and the level of Interest rate risk taken by banks is directly related to liquidity, and inversely related to managerial quality and bank size. It also reveals that derivative users as a group have lower mean and median exposure than non-users, and derivative usage reduces exposure. But most of our Indian banks not familiar in using Derivatives. Still it is in nascent stage in Indian financial market. Operational Risk Operational Risk is defined as the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events. This definition includes legal risk, but excludes strategic and reputational risk, [Basel Committee (2004)]. As operational risk is inherent in all business processes, the evolving banking practices highlight the importance of focusing on management of operational risk separately. Globalization of financial services with growing sophistication of financial technology and deregulation, as well as corporate restructuring had a large impact on the activities of the bank more complex. Usha Janakiraman (2008) assessed the status of operational risk management in Indian banking system in the context of Basel II. Survey result shows that majority of the banks using selfassessment- a qualitative factor, as an important tool in their operational risk framework. Many banks had started the operational risk loss data collection exercise for moving over to the advanced approaches through these internal assessments. But, in Indian scenario internal assessment/audit is not in full fledged, still in the formative stages. Laviada (2007) emphasises that, the role of internal audit and its effective implementation in managing operational risk. Laker (2006) argues that greater complexity of banking activity and increasing dependence on technology and specialist skills has made operational risk as one of the most important risk, faced by the banking institutions. According to the author, outsourcing and technology are two major sources of operational risk.

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

Liquidity Risk Liquidity risk is one of the major risks faced by banks in addition to credit risk, market risk and operating risk. Yoram Landskroner and Jacob Paroush (2008) had studied the relationship between the banks liquidity position and competition among the banks. They formulated a stylized model of bank management, where the asset and liabilities structures are key factors in determining the bank's exposure to liquidity risk. The main results of this model are that liquidity risk increases when competition in the credit market increases, which means that more demand in the credit market increases the lending rate which results in increase in spread i.e. interest margin. While increasing competition in the deposit market will decrease the liquidity shortage. This means that mobilization of resources in the form of deposit will increase the liquidity position of the bank. They concluded that, the banks faced increased liquidity risk due to the recent developments in the financial markets. NEED FOR THE STUDY Banking sector in the current scenario have undergone lot of changes, deregulation has opened up lot of business avenues. Risk and risk taking are the inherent part of any business activity. It has been a universal observation that banks do not show much cautious while managing this risk, especially the interest rate risk and liquidity risk have crumbled without giving adequate notice to the management, regulator and the depositors. However still, the level of awareness regarding Asset liability management in the Indian Banks is almost negligible. Risk management is the core activity of ALM. So, ALM is of great significance to organizations in the financial sector. So the present study evaluates the changing perspectives of the select private sector banks in identifying and facing the risks and also maintaining the asset quality to ensure profitability by using asset-liability management techniques. DATA AND METHODOLOGY The study is basically rests on secondary data collected from the select banks records and CMIE data bank and other secondary sources. A sample of three Old and New generation private sector banks will be selected for the study. The collected secondary data were put to a critical statistical examination with help of Canonical Correlation, a Multivariate Statistical tool. The study uses canonical correlation analysis to assess the nature and strength of asset-liability management of different bank groups, as described in Seema Jaiswal (2010), Suman Chakraborty and Subhalaxmi Mohapatra (2009) Mihir dash and Ravi pathak (2008), P. K. Jain and v. Gupta (2004). To this end, the assets and liabilities of the banks were first reclassified as discussed below. The canonical correlation technique was applied to these reclassified assets and liabilities. The results of the canonical correlation analysis were then interpreted in terms of their implications on profitability, liquidity, and interest rate sensitivity. RECLASSIFICATION OF ASSETS & LIABILITIES The assets and the liabilities of the banks were regrouped into various sub-heads, guided by the liquidity-return profile of the assets and the maturity-cost profile of the liabilities (P. K. Jain and v. Gupta (2004)). The reclassified assets and liabilities covered in the study excluded other assets on the asset side and other liabilities on the liabilities side. This was necessary to deal with the problem of singularity - a situation that produces perfect correlation within sets and makes

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

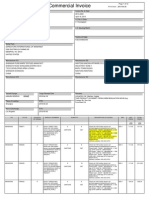

correlation between sets meaningless. For example, the assets and liabilities for private banks for year 2002-12 have been reclassified and presented in Tables 1 and 2. Table 1: Classification of Assets Fixed Assets Cash in hand, Balances with RBI, Balances with other banks, Money at call and short notice Term loan Advances not in term loans, Bills purchased and discounted, Cash credits, Overdrafts and loans Other than SLR like shares, debentures, bonds etc Govt. securities and other approved securities Table 2: Classification of Liabilities Capital , Reserve and Surplus Saving bank deposits and Demand deposits Deposits not included in short term From RBI, other banks, other financial institutions both from India and abroad

Fixed Assets Liquid Assets Term Loans Short term loans Investments SLR Securities

Net Worth Short term deposits Long term deposits Borrowings

CANONICAL CORRELATION Canonical correlation is a multivariate statistical technique that has been used to assess the correlation between each set of assets and each set of liabilities, which indicates the relationship between assets and liabilities. Hotelling (1935) was the first to describe the mathematics of canonical correlation. An excellent introduction into this procedure was given by Marinell (1990), Thompson (1984), Hair et al. (1998), and Stevens (2002). The main objective of the canonical correlation procedure is to identify significant relationships between two sets of variables. Each of these sets consists of at least two variables. Being a true multivariate approach for both sides of the equation, it has clear advantages compared to the more commonly used pair-wise correlations or multiple regressions. Canonical correlation provides a means to explore all of the correlations concurrently. The technique reduces the relationship into a few significant relationships. The essence of canonical correlation measures the strength of relationship between two sets of variables by establishing linear combination of variables in one set and linear combination of variables in other set. It produces an output that shows the strength of relationship between two variates as well as individual variables accounting for variance in the other set. This is expressed mathematically as: A =A1 *(Liquid Assets) + A2 * (SLR securities) + A3 * (Investments) + A4 * Long-term Loans) + A5 * (Short-term Loans) + A6 * (Fixed Assets) and L= L1 * (Net worth) + L2 *(Short- term Deposits) + L3 * (Long-term Deposits) + L4*(Borrowings). To begin with, A and L (called canonical variates) are unknown. The technique tries to compute the values of Ai and Li such that the correlation between A and L is maximized.

10

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

Table 3 canonical correlation analysis for Axis Bank

Axis Bank Wilks Lambda Squared Canonical Correlation (Rc2) 0.000 HDFC Bank 0.000 ICICI Bank 0.000 Karur Vysya Bank 0.000 Lakshmi Vilas Bank 0.000 City Union Bank 0.000 Overall 0.000

0.999

0.999

0.9997

0.999

0.9999

0.999

0.9997

Canonical Loadings: ASSETS Liquid Assets SLR Securities Investment Short-term Loan Long-term Loan Fixed Asset -0.05318 -0.16253 -0.11657 -0.45307 -0.21426 -0.00891 -0.13477 -0.20487 -0.05079 -0.31714 -0.27159 -0.06384 0.00385 -0.23661 -0.97919 -0.05886 0.20787 0.1174 -0.02587 -0.26052 -0.02407 -0.10983 -0.56578 -0.02776 0.00038 -0.20651 0.00729 -0.35582 -0.44342 -0.00658 -0.04402 -0.1806 -0.05161 -0.29553 -0.44576 0.00098 -0.09183 -0.22585 -0.15671 -0.45244 -0.12398 0.01689

Canonical Loadings: LIABILITIES Net worth Short-term Deposits Long-term Deposits Borrowing -0.12513 -0.32087 -0.44515 -0.11245 -0.25075 -0.45186 -0.31549 0.01417 -0.03371 -0.93869 0.27427 -0.24128 -0.0641 -0.16417 -0.73518 -0.05077 0.03807 -0.30452 -0.75359 0.01601 -0.19197 -0.11586 -0.66806 -0.03111 -0.12171 -0.36405 -0.3555 -0.21866

ASSETS (A) LIABILITIES (L) Independent Set Dependent Set

0.049015 0.082355

0.040188 0.091697

Redundancy 0.179211561 0.06701 0.253929 0.143531

0.0609954 0.165584

0.053876 0.124387

0.050726 0.080385

Cause- Effect Relationship A L A L A L A L A L A L A L

ANALYSIS AND INTERPRETATION The analyses for the present data have been presented in the above table, which shows the results of canonical correlation. The criterion variables were net worth, Short-term loan, Long-term loan, and Borrowings; whereas predictive variables were Liquid asset, SLR securities, Investment,

11

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

Short-term deposits, Long-term deposits, and Fixed assets. The Rc2 was found to be significant for each bank as well as for the overall data. The present analysis was done for two set of canonical variables. The overall model was found to be significant with Wilks = .002 criterion, F (24, 765.21) = 712.15, p >.000. Table 3 presents standardized canonical function coefficients for the first function for various banks mentioned above. The careful observation of the table reveals that for the Axis bank the relevant criterion variables were primarily short term loan, with long term loan being secondary. Regarding to predictor variables the primary contributors was long term deposits with short term deposits as secondary contributor. The predictive variables were positively related with criterion set. Long term deposits related with short term loan, followed by long term loan. This explains that Axis bank asset liability management related to long term deposit with short term loan. The study reveals that for HDFC bank, the appropriate criterion variables were primarily same as like that of Axis bank short-term loan, with long-term loan being secondary. The primary contributor was short term deposits with long term deposits as secondary contributor for predictor variable. The predictive variables were positively related with criterion set. Short term deposits related with short term loan, followed by long term loan. This explains that HDFC bank asset liability management related to short term deposit with short term loan, which is different from Axis Bank. For ICICI bank the relationship between assets and liabilities revealed that the banks appropriate criterion variable was primarily very high Investment, with Net worth being secondary contributor. Regarding to predictor variable the primary contributor was short term deposits with long term deposits as secondary contributor. The predictive variables were positively related with criterion set. Short term deposits related with Investment, followed by Net worth. This explains that ICICI bank asset liability management related to short term deposit with Investment. The careful observation of the table reveals that for the Karur Vysya bank the relevant criterion variable was primarily Long-term loan, with SLR securities being secondary contributor. Regarding to predictor variables the primary contributor was long term deposits with short term deposits as secondary contributor. The predictive variables were positively related with criterion set. Long-term deposits related with Long-term loan, followed by SLR securities. This explains that Karur Vysya bank asset liability management related to long-term deposit with long-term loan. For Lakshmi Vilas bank, the nature and strength of relationship between assets and liabilities suggest us that the relevant criterion variable was primarily Long-term loan, with short-term loan being secondary contributor. Regarding to predictor variables the primary contributor was long term deposits. The predictive variables were positively related with criterion set. Long-term deposits related with Long-term loan, followed by short-term loan. This explains that Lakshmi Vilas bank asset liability management related to long-term deposit with long-term loan. For City Union bank, the careful observation of the table reveals that for the bank the relevant criterion variable was primarily long-term loan. Regarding to predictor variables the primary contributor was long term deposits. The predictive variables were positively related with criterion set. Long-term deposits related with long-term loan. This explains that City Union bank asset liability management related to long term deposit with long-term loan. The above table reveals that on the whole, overall results show that the primary criterion variable was short term loan with Slr securitites being the secondary contributor. With regard to the predictor variable short term deposit behaved as a primary contributor, where as long term deposit as a secondary contributor. Hence, overall banks asset-liability management was related to short term deposits with short term loans. However, there are differences in the focus of each bank, which has been portrayed in the table 3 as well as the explanation in the preceding paragraphs. Further, a similar cause-effect relationships have been found in the redundancy effects.

12

International Journal of Management (IJM), ISSN 0976 6502(Print), ISSN 0976 - 6510(Online), Volume 4, Issue 5, September - October (2013)

DISCUSSION Based on the empirical findings, it can be concluded that the practices and implementation of ALM in private banks differs from category i.e. old generation and new generation private banks. The study finding shows in depth about the deployment of funds and its maturity of the select private banks. The redundancy factors shows that, the independent and dependent sets for select banks can be identified, select banks having assets as their independent set, which means that during the period 2002-2012, these banks were actively managing assets and liability was dependent upon how well the assets are managed; it reveals that the private sector banks throughout their course of business actively managing their assets. Careful observation of the table 3 presents that, when compared to Axis bank and HDFC bank, the ICICI bank follows aggressive ALM strategy; it uses short-term deposits for their Investment purpose. It is more risky, there should be a high possibility for the bank fall in liquidity risk. In other side, during the study period select old generation private banks like Lakshmi Vilas Bank, Karur Vysya Bank and City Union Bank were in safer side. The predictor variables are mostly long-term deposits and the predictive variables are long-term loans, it is less risky when compared to new generation banks, particularly, ICICI bank. Thus, study has shown the importance of assetliability management. However, the present study has had a few demerits also because the study data was secondary in nature, and it included only select private banks and not public and foreign banks. ACKNOWLEDGEMENTS We would like to thank Shri. Kadalarasane Touloucaname and Shri. Rameshbabu Tamarana, for their contribution in completion of this article. REFERENCES 1. Reserve Bank of India (2000). Asset Liability Management (ALM) System. Ref DBS.FID No. C-11 /01.02.00/99-2000. 2. Reserve Bank of India (2001). Asset Liability Management (ALM) System amendments to ALM Guidelines. Ref DBS.FID No. C.5 /01.02.00/ 2001-02 3. Bank for International Settlements (2004). International convergence of capital Measurement and capital standards: A revised framework, available at www.bis.org. 4. Reserve Bank of India (2006). Draft guidelines on improvements to banks Asset Liability Management framework. DBOD. No. BP. 7 / 21.04.098/ 2005-06. 5. Reserve Bank of India (2007). Guidelines on Asset-Liability Management (ALM) System amendments. DBOD. No. BP. BC. 38 / 21.04.098/ 2007-08. 6. Reserve Bank of India (2008). Guidelines on Asset-Liability Management (ALM) System. DBOD. No. BP. BC. 68 / 21.04.098/ 2007-08. 7. Reserve Bank of India (2011). Guidelines on Asset-Liability Management (ALM) System Draft Amendments. DBOD. No. BP. 256 / 21.04.098/ 2007-08. 8. Dr. C. Mahadeva Murthy and Prof. S.N. Pathi, Risk Management in Banking: A Study with Reference to State Bank of India (SBI) and Associates, International Journal of Management (IJM), Volume 4, Issue 4, 2013, pp. 119 - 130, ISSN Print: 0976-6502, ISSN Online: 0976-6510. 9. Dr. N. Kannan, Risk and Technology Management in Banking Industry, International Journal of Management (IJM), Volume 1, Issue 1, 2010, pp. 43 - 58, ISSN Print: 0976-6502, ISSN Online: 0976-6510.

13

Anda mungkin juga menyukai

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDokumen10 halamanImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationBelum ada peringkat

- Voice Based Atm For Visually Impaired Using ArduinoDokumen7 halamanVoice Based Atm For Visually Impaired Using ArduinoIAEME PublicationBelum ada peringkat

- Broad Unexposed Skills of Transgender EntrepreneursDokumen8 halamanBroad Unexposed Skills of Transgender EntrepreneursIAEME PublicationBelum ada peringkat

- A Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiDokumen16 halamanA Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiIAEME PublicationBelum ada peringkat

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDokumen9 halamanA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationBelum ada peringkat

- Modeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyDokumen14 halamanModeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyIAEME PublicationBelum ada peringkat

- A Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurDokumen7 halamanA Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurIAEME PublicationBelum ada peringkat

- Various Fuzzy Numbers and Their Various Ranking ApproachesDokumen10 halamanVarious Fuzzy Numbers and Their Various Ranking ApproachesIAEME PublicationBelum ada peringkat

- Influence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiDokumen16 halamanInfluence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiIAEME PublicationBelum ada peringkat

- A Multiple - Channel Queuing Models On Fuzzy EnvironmentDokumen13 halamanA Multiple - Channel Queuing Models On Fuzzy EnvironmentIAEME PublicationBelum ada peringkat

- Application of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDDokumen19 halamanApplication of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDIAEME PublicationBelum ada peringkat

- EXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESDokumen9 halamanEXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESIAEME PublicationBelum ada peringkat

- Attrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesDokumen15 halamanAttrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesIAEME PublicationBelum ada peringkat

- Role of Social Entrepreneurship in Rural Development of India - Problems and ChallengesDokumen18 halamanRole of Social Entrepreneurship in Rural Development of India - Problems and ChallengesIAEME PublicationBelum ada peringkat

- Financial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelDokumen9 halamanFinancial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelIAEME PublicationBelum ada peringkat

- Analysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsDokumen13 halamanAnalysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsIAEME PublicationBelum ada peringkat

- Knowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentDokumen8 halamanKnowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentIAEME PublicationBelum ada peringkat

- Optimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsDokumen13 halamanOptimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsIAEME PublicationBelum ada peringkat

- Moderating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorDokumen7 halamanModerating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorIAEME PublicationBelum ada peringkat

- Dealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsDokumen8 halamanDealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsIAEME PublicationBelum ada peringkat

- Analysis On Machine Cell Recognition and Detaching From Neural SystemsDokumen9 halamanAnalysis On Machine Cell Recognition and Detaching From Neural SystemsIAEME PublicationBelum ada peringkat

- A Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksDokumen10 halamanA Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksIAEME PublicationBelum ada peringkat

- Sentiment Analysis Approach in Natural Language Processing For Data ExtractionDokumen6 halamanSentiment Analysis Approach in Natural Language Processing For Data ExtractionIAEME PublicationBelum ada peringkat

- A Review of Particle Swarm Optimization (Pso) AlgorithmDokumen26 halamanA Review of Particle Swarm Optimization (Pso) AlgorithmIAEME PublicationBelum ada peringkat

- A Overview of The Rankin Cycle-Based Heat Exchanger Used in Internal Combustion Engines To Enhance Engine PerformanceDokumen5 halamanA Overview of The Rankin Cycle-Based Heat Exchanger Used in Internal Combustion Engines To Enhance Engine PerformanceIAEME PublicationBelum ada peringkat

- Formulation of The Problem of Mathematical Analysis of Cellular Communication Basic Stations in Residential Areas For Students of It-PreparationDokumen7 halamanFormulation of The Problem of Mathematical Analysis of Cellular Communication Basic Stations in Residential Areas For Students of It-PreparationIAEME PublicationBelum ada peringkat

- Quality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceDokumen7 halamanQuality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceIAEME PublicationBelum ada peringkat

- Prediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsDokumen13 halamanPrediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsIAEME PublicationBelum ada peringkat

- Ion Beams' Hydrodynamic Approach To The Generation of Surface PatternsDokumen10 halamanIon Beams' Hydrodynamic Approach To The Generation of Surface PatternsIAEME PublicationBelum ada peringkat

- Evaluation of The Concept of Human Resource Management Regarding The Employee's Performance For Obtaining Aim of EnterprisesDokumen6 halamanEvaluation of The Concept of Human Resource Management Regarding The Employee's Performance For Obtaining Aim of EnterprisesIAEME PublicationBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- How To Analyze Bank Stocks - PDFDokumen22 halamanHow To Analyze Bank Stocks - PDFRamasamyShenbagarajBelum ada peringkat

- Payment For HonorDokumen2 halamanPayment For HonorDaniel BrownBelum ada peringkat

- Credit Helper: The Complete Credit Restoration Guide & Pre-Typed Legal Letter SystemDokumen40 halamanCredit Helper: The Complete Credit Restoration Guide & Pre-Typed Legal Letter SystemTori Grayer100% (2)

- LC Business Overseas BranchesDokumen202 halamanLC Business Overseas BranchesSumalBelum ada peringkat

- Implementation of Door Step Banking Services (DSB) Through Universal Touch Points (UTP)Dokumen2 halamanImplementation of Door Step Banking Services (DSB) Through Universal Touch Points (UTP)AakashBelum ada peringkat

- 06 0229 0831742 00 - Statement - 2017 09 08Dokumen8 halaman06 0229 0831742 00 - Statement - 2017 09 08Pham Tuan Anh100% (3)

- PDF DocumentDokumen9 halamanPDF DocumentnahidahcomBelum ada peringkat

- AmericanExpressCompany 10K 20120224Dokumen306 halamanAmericanExpressCompany 10K 20120224technoxplorer100% (1)

- As 4910-2002 (Reference Use Only) General Conditions of Contract For The Supply of Equipment With InstallatioDokumen7 halamanAs 4910-2002 (Reference Use Only) General Conditions of Contract For The Supply of Equipment With InstallatioSAI Global - APAC100% (1)

- Audit of Sales and Account ReceivablesDokumen26 halamanAudit of Sales and Account ReceivablesnikoBelum ada peringkat

- Disbursement Voucher DORELCODokumen1 halamanDisbursement Voucher DORELCOBhen AlmodalBelum ada peringkat

- Performance of Banks With Special Reference To BangladeshDokumen15 halamanPerformance of Banks With Special Reference To BangladeshMd. Mesbah UddinBelum ada peringkat

- PDFDokumen10 halamanPDFManasa M JBelum ada peringkat

- CAT 2019 Media Release PDFDokumen1 halamanCAT 2019 Media Release PDFRao SBelum ada peringkat

- Non Performing Assets - Challenges To Public Sector Bank-1Dokumen96 halamanNon Performing Assets - Challenges To Public Sector Bank-1nimittpathak1989Belum ada peringkat

- Force Majeure Clauses in ICC Rules 1559904833 PDFDokumen27 halamanForce Majeure Clauses in ICC Rules 1559904833 PDFReena TahirBelum ada peringkat

- ISDA Standard CDS Contract Converter Specification - Sept 4, 2009Dokumen4 halamanISDA Standard CDS Contract Converter Specification - Sept 4, 2009Ymae AlmonteBelum ada peringkat

- SBI Calendar 2018, Download State Bank of India Holidays ListDokumen1 halamanSBI Calendar 2018, Download State Bank of India Holidays ListGirinathBelum ada peringkat

- GP Fund Rules (U)Dokumen413 halamanGP Fund Rules (U)Humayoun Ahmad Farooqi75% (4)

- Commercial Invoice: Consignee L/C Issuing BankDokumen12 halamanCommercial Invoice: Consignee L/C Issuing Bankmz007Belum ada peringkat

- Final Exam - ABM 2Dokumen2 halamanFinal Exam - ABM 2Charry VonBelum ada peringkat

- Revenue Memorandum Orders PDFDokumen88 halamanRevenue Memorandum Orders PDFbogzmaliBelum ada peringkat

- Lessons From Muhammad Yunus and The Grameen Bank: Leading Long-Term Organizational Change SuccessfullyDokumen6 halamanLessons From Muhammad Yunus and The Grameen Bank: Leading Long-Term Organizational Change Successfullygrahma96Belum ada peringkat

- Navig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFDokumen2 halamanNavig8 Almandine - Inv No 2019-002 - Santa Barbara Invoice + Voucher PDFAnonymous MoQ28DEBPBelum ada peringkat

- State Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?Dokumen30 halamanState Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?boyburger17Belum ada peringkat

- Inventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrenceDokumen4 halamanInventories: Assertions Audit Objectives Audit Procedures I. Existence/ OccurrencekrizzmaaaayBelum ada peringkat

- Sap C TSCM62 64 PDFDokumen24 halamanSap C TSCM62 64 PDFjpcupcupin23100% (2)

- TN Comptroller's Report: Volunteer Energy CooperativeDokumen6 halamanTN Comptroller's Report: Volunteer Energy CooperativeDan LehrBelum ada peringkat

- Money Banking Generic Elective Third Sem. 5.5 PDFDokumen3 halamanMoney Banking Generic Elective Third Sem. 5.5 PDFAkistaaBelum ada peringkat

- Project Report: Executive SummaryDokumen32 halamanProject Report: Executive SummaryAbhijit PhoenixBelum ada peringkat