Fractal Wave Algorithm For Trading Stocks Market

Diunggah oleh

taiyawutJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Fractal Wave Algorithm For Trading Stocks Market

Diunggah oleh

taiyawutHak Cipta:

Format Tersedia

FI 4 9 8S Golden Gate University W.H.C.

Bassetti Adj Prof Finance & Econom ics July 2 007

FRACTAL WAVES in STOCK MARKET PRICES

A New Tool for Technical Analysis

Arthur von Waldburg, A&M Trading Company, Inc.

FRACTAL WAVES in STOCK MARKET PRICES A New Tool for Technical Analy sis Arthur v on Waldburg, A&M Trading Com pany , Inc. Abstract An argument is m ade that the stock m arket bears sim ilarities to non-linear dy namic processes which giv e rise to fractal structures. Stock price sequences are thought to be fractal in nature. A Fractal Wav e Algorithm (FWA) for identify ing the fractal structure of a serial stream of price data is presented in the context of a "classic" Elliott Wav e form ation. The FWA is used to determ ine the wav e structure of recent Dow Jones Industrial Av erage (DJIA) prices based on hourly data from January 2 , 1 9 9 0. The FWA is shown to hav e v alue as a technical trading tool on hourly DJIA data from March, 1 9 87 and on daily DJIA data from 1 885.

Non-Linear Dy namic Processes and the Stock Market It is com m on for securities and com m odities analysts to assume that m uch of the observ ed price fluctuations in these m arkets are due to random processes acting on the price in the presence of longer term trends and changes in price equilibrium due to changes in fundam ental supply and dem and factors. This is a norm al assumption to m ake because, after subtracting out underly ing trends, the price m ov ements do indeed appear random . It is also worth considering that these price m ov ements m ay be the result of nonlinear processes in the m arket place. There are a great m any m arket participants, with com plex sets of hum an relationships, m otivations, and reactions. It would be astounding if all these hum an factors av eraged out to a linear price m echanism . If price m ov ements near equilibrium were ruled by linear feedback m echanism s, price adjustm ents would be sim ply proportional to the am ount the price were abov e or below equilibrium . The response of a linear sy stem to sm all changes is usually sm ooth. The response to an external shock is generally a series of oscillations which decay in am plitude until equilibrium is again reached. Nonlinear sy stem s, however, often show transitions from sm ooth m otion to chaotic, erratic, or apparently random behavior. The response of a nonlinear dy namic sy stem to an external shock can take the form of persistent structures. 2

The possible behaviors of nonlinear sy stem s m ay be extrem ely rich and com plex. In particular, a series of num bers generated by a com pletely determ inistic, but nonlinear, sy stem could appear to be com pletely random when there is no noise in the sy stem .

Professor Robert Sav it of the Univ ersity of Michigan pointed out in a recent article in The Journal of Futures Markets (Vol. 8, No. 3 , 2 7 1 -289 ) that a sim ple non-linear m odel of price m ov ement can generate a price sequence that looks superficially random but is in fact chaotic, containing a good deal of hidden order. The inform ation in the chaotic sequence m ay not be accessible to the researcher who uses traditional statistical m ethods which attempt to "sm ooth" noise out of the data. Other m ethods appropriate to nonlinear, chaotic sy stem s, m ethods which take adv antage of the "jum piness" and "apparent disorder," m ay be m ore useful. The adv ent of relativ ely cheap and powerful com puters in the last ten to fifteen y ears has facilitated the study of prev iously intractable nonlinear sy stem s. In fact the term , "experim ental m athem atics" has been coined to describe com puterbased inv estigations of problem s inaccessible to analytic m ethods. Many researchers m aking use of experim ental m athem atical techniques hav e discov ered a relationship between nonlinear dy namic sy stem s and the form ation of "fractal" patterns. These patterns, which exhibit self-sim ilarity at m any scales, show up in the study of turbulent flow, the geology of oil recovery , dendritic growth in a solidification process, the dev elopm ent of m esoscale structures in m etallurgy , the spread of disease, and the dy namic "rhy thm s" of the hum an heart. The Fractal Wav e Algorithm One of the m ost widely followed m ethods of technical analysis of stock prices in the last decade, Elliott Wav e Theory , m akes reference to a "wav es within wav es within wav es" structure of price m ov ement. This concept of self-sim ilarity at m any scales in price structure is the sam e concept biologists and phy sicists are finding in the research m entioned abov e. While I m ake no claim to being an expert at doing Elliott Wav e analysis, m y lim ited reading about the theory suggests that it is a "finite" theory , defining a lim ited num ber of price form ations, which can be catalogued. This catalogue can be used to identify price patterns as they occur in the m arketplace. Based on the current pattern being traced out at each scale, or "degree," future price m ov ement can to som e extent be predicted assuming the pattern currently being form ed continues to com pletion. My own attempts to anticipate the Elliott Wav e analysis of one of the leading proponents of the theory hav e been unsuccessful, no doubt due in large part to m y own lack of technical knowledge in the Elliott Wav e science. Many followers of the Elliott Wav e theory feel their own analysis is m eaningful. There is often disagreem ent am ong the Elliott Wav e analysts, however, leading m e to believ e it m ay require som e art as well as science.

My experience is that the price patterns produced by the stock m arket (the research discussed here will be lim ited to the Dow Jones Industrial Av erage, DJIA) hav e an elem ent of perpetual nov elty which is inconsistent with a finite theory . I do believ e, however, that the concept of self-sim ilarity at m any scales is extrem ely im portant and appropriate to the study of m arket price m ov ements. I believ e that price m ov ements m ay be usefully studied as fractal structures arising in the context of nonlinear dy namics. I hav e dev eloped a m ethod of identify ing a fractal structure in stock price m ov ement which borrows the concept of self-sim ilar wav es at m any scales from Elliott Wav e theory . This m ethod, which I call the Fractal Wav e Algorithm (FWA), starts with the lowest scale data av ailable and "m arks" the extrem e high and low prices as wav e points of higher scales on the basis of the num ber of lay ers of self-sim ilarity between the wav e points. An exam ple of a well-known "regular" fractal curv e will help describe the concept of the FWA. The solid lines in Figure 1 com prise an equilateral triangle, the first step in dev elopm ent of a Koch Triadic Snowflake curv e. The dashed lines illustrate the construction of the second step, wherein each side of the triangle is replaced by four line segm ents. Each of the new line segm ents is one-third the length of the side of the triangle and the four segm ents are arranged so that a new equilateral triangle projects from the m iddle of each of the old sides.

Figure 1 . First Step in Koch Snowflake Dev elopm ent 5

If the process of replacing each side is repeated m any tim es, the Koch snowflake curv e is form ed. Figure 2 shows the dev elopm ent carried a few m ore steps.

Figure 2 . Koch Snowflake After Three Steps The FWA is based on m arking price curv es such that a consecutiv e high and low pair m arked as belonging at the sam e scale will hav e the sam e num ber of lay ers of self-sim ilarity between them as any other consecutiv e pair m arked at that scale. In Figure 2 , the points labeled "A" and "B" could be said to hav e two lay ers of self-sim ilar patterns between them . The pair of points labeled "B" and "C" also hav e two lay ers of self-sim ilarity between them . The points labeled "1 " and "2 ", however hav e three lay ers of self-sim ilarity between them , the points "A", "B", and "C" m ake up that additional lay er of self-sim ilar pattern. The FWA is a set of a few sim ple rules which allows any person m arking a price curv e to identify high and low wav e points at m any scales such that consecutiv e points identified at the sam e scale contain the sam e num ber of lay ers of selfsim ilarity between them as any other consecutiv e points at the sam e scale. 6

We present here the rules of the FWA in the context of a "classic" Elliott Wav e curv e, to show that the FWA is a based on a general fractal wav e approach within which the pattern analysis of Elliott Wav e theory m ight be considered a m ore tightly specified area.

Figure 3 shows an idealization of an Elliott Wav e curv e constructed in a process like the one used to construct the Koch Snowflake. The solid lines represent a price adv ance followed by a price decline. The dashed lines show that the adv ance was m ade up of a "classic" fiv e wav es up and the decline was m ade up of three wav es down. The wav es are num bered "1 -2 -3 -4 -5-A-B-C." All of these wav e points m ay be considered to be at the sam e scale. Points "0", "5", and "C" are significant at the next highest scale.

Figure 3 . Classic Elliott Wav e Dev elopm ent If we continue the dev elopm ent of the Elliott Wav e curv e as we did the snowflake, we div ide wav es 1 , 3 , 5, A, and C into fiv e wav es each because they are in the direction of the wav e at the next higher scale; and, we div ide wav es 2 , 4 , and B into three wav es each because they are corrections to the wav e at the next higher scale. The result is shown in Figure 4 . In dev eloping the FWA, I focused on the fact that in the "classic" Elliott Wav e, each adv ance was com posed of a series of wav es alternately m aking new highs and declining but not m aking new lows. Sim ilarly , the correctiv e wav es are m ade up of a series of wav es alternately m aking new lows and rallying back, but not to new highs. Ignoring the num ber of wav es required, y ou can see in Figure 3 that the wav e up to point "5" is com posed of "zig-zags" in the "up" direction and the wav e from "5" down to "C" is com posed of "zig-zags" in the "down" direction. 8

The FWA recognizes a "higher" scale wav e by the fact that it is com posed of "zigzags" in one direction. When the first zig-zag in the opposite direction is com pleted, a new "higher" scale wav e in the opposite direction has begun. The num ber of zigzags at the lower scale in either direction is not relevant in the FWA. In fact, ignoring the num ber of wav es "required" in each direction is a sim plification of Elliott Wav e theory which allows the Fractal Wav e concept to form the basis of a generalized wav e theory ; at the sam e tim e strictly determ ined so that any two analysts will m ark a price curv e the sam e, and less constrained so that any nov el price form ation that occurs is cov ered by the theory . The second key elem ent of the FWA is the recursiv e m anner in which it is applied to a price series so that wav e points at all degrees are identified as soon as lower scale lay ers of self-sim ilarity become apparent. We can use Figure 4 , below, to illustrate.

Figure 4 . Classic Elliott Wav e, A Few More Steps Im agine the price curv e in Figure 4 being traced out in real tim e. Let us call the data shown in the figure, "lev el-0" data. We will label successiv e highs and lows in the lev el-0 data as lev el-0 wav e points. We will use the lev el-0 wav e points to identify self-sim ilar wav es at "lev el-1 ". Lev el-1 wav e points which com plete zigzags in one direction or the other will identify lev el-2 wav e points. Etc., etc. 9

Starting from T 0 in Figure 4 , the price adv ances upwards in zig-zag wav es to P1. The first zig-zag in the up direction is com pleted about half way to T 1. At the tim e when the first zig-zag of lev el-0 wav e points is com pleted, we know the point at P0 is a wav e point at the next highest lev el, lev el-1 . At P1 the price falls, then for the first tim e rises and falls again without m aking a new high. By tim e T 2, the price has com pleted a lev el-0 zig-zag in the down direction at price, P2 . When the zig-zag of lev el-0 wav e points is com pleted in the down direction, we can m ark the price, P1, as a lev el-1 wav e point. Now we hav e two lev el-1 wav e points, P0 and P1. A v ery im portant pattern occurs about half way between T 2 and T 3: As the price in Figure 4 com pletes a zig-zag up from point, P2 we can m ark P2 as a lev el-1 wav e point. At the sam e tim e, we hav e three lev el-1 wav e points, P0, P1, and P2, and a current price higher than P1. A lev el-1 wav e point at the current price or higher would com plete a lev el-1 zig-zag in the up direction. We can anticipate with certainty that there will be a lev el-1 point at the current price or higher, so we can im m ediately m ark the point at P0 as a lev el-2 wav e point. Re-read the prev ious paragraph to m ake sure y ou understand how com pletion of a pattern at the lowest lev el stim ulates the m arking of wav e points at higher lev els. The com pletion of the lev el-0 zig-zag between T 2 and T 3 identifies the point at P2 as a lev el-1 wav epoint, which contributes to the identification of P0 as a lev el2 wav epoint. Obv iously , the greater the significance (lev el) of a price high or low, the m ore subsequent price pattern is required for the significance to be recognized. The im portant thing about the FWA is that the lag required to recognize the im portance of a high or low is dependent on lay ers of self-sim ilarity in price pattern, not tim e. The FWA does not depend on scaler parameters such as 1 2 week cy cles, fiv e percent filters, 2 00 day m ov ing av erages or the like. It depends on pure pattern. To continue with the exam ple in Figure 4 , note that the point at P5 is recognized as a wav epoint at lev el-2 when the first zig-zag in the down direction is com pleted after the point at P7. If the price were to adv ance in a sim ilar fashion after P8, and rise abov e the price at P5, then P8 would become a lev el-2 wav epoint and the required pattern elem ents to recognize P0 as a lev el-3 wav epoint would be in place. To sum m arize the FWA rules: Accept an av ailable stream of price data as lev el0 data. Mark alternating highs and lows in the price stream as lev el-0 wav epoints. When a lev el-0 zig-zag is com pleted in the up direction, m ark the appropriate lev el-0 low as a lev el-1 wav epoint. Sim ilarly , when lev el-0 zig-zags are com pleted in the down direction, m ark the appropriate lev el-0 high as a lev el10

1 wav epoint. wav epoints.

In the sam e way , use lev el-"k" zig-zags to identify lev el-"k+ 1 "

11

Fractal Wav es in the Dow Jones Industrial Av erage The prev ious section presented the FWA in the context of a "classic" Elliott Wav e price curv e. Ev ery technical analyst, Elliott Wav e follower or not, is aware that the m arkets rarely trace out price patterns in that classic form . Figure 5 is a chart of the Dow Jones Industrial Av erage (DJIA) based on a stream of prices recorded each hour from January 2 , 1 9 9 0 through January 2 6 , 1 9 9 0. Opening prices were not recorded; the first price recorded after the prev ious close was the 1 0:00 am (New York) price.

Figure 5. DJIA Lev el-1 Fractal Wav es Based on hourly data, there are 2 3 7 lev el-0 wav es in the DJIA from January 2 , 1 9 9 0 till February 1 6 , 1 9 9 0. In Figure 5 only the lev el-1 wav e points hav e been plotted. There are only 1 9 wav es at lev el-1 . As y ou look at Figure 5, rem ember that on the av erage, each wav e shown is m ade up of twelve zig-zags running in the direction of the wav e and no zig-zags in the opposite direction. Since there is a series of lev el-1 zig-zags in the down direction from the January 3 rd high at 2 82 0.6 1 , that point is a lev el-2 wav epoint, denoted by a square sy m bol at the point. There are two m ore lev el-2 wav epoints m arked in Figure 5, the m ost recent on February 8 at 2 6 55.6 3 . Note that a penetration of lev el-2 low 12

at 2 53 3 .1 1 on January 2 6 would raise the significance of the January 3 rd high to lev el-3 .

13

Value of Fractal Wav e Structure as a Predictiv e Tool The Stock Market m ay be driv en by non-linear dy namic processes which giv e rise to fractal price structures. The FWA is a generalized technique for labeling price highs and lows as to their significance within a fractal price structure. The practical question is, "Does this discov ered fractal structure prov ide inform ation in real tim e which can be used to m ake m oney in the stock m arket?" In an attempt to shed som e light on that question, I hav e conducted a series of research studies using hourly DJIA data from April, 1 9 87 to February , 1 9 9 0, and daily DJIA data from 1 885 to February , 1 9 9 0. My conjecture is that a wav epoint identified by the FWA as a lev el "K" high is a significant indication that prices will m ov e lower; that a wav epoint identified by the FWA as a lev el "K" low is a significant indication that prices will m ov e higher. Of course, by the design of the algorithm , the highs are higher than the lows; as with all trading tools, the success hinges on whether these highs and lows are identified in tim e to prov ide successful trading opportunities. To test this conjecture, the DJIA data was run through the FWA. Each wav e lev el was tested in the sam e fashion, sim ultaneously , according to the following rules: At lev el "K": Take the m ost recent wav epoint at lev el "K+ 1 " to indicate the price trend. Take the m ost recent wav epoint at lev el "K" to indicate a "buy " or "sell" signal. Be "long" if the "K+ 1 " trend is up and the "K" signal is "buy ." Be "short" if the "K+ 1 " trend is down and the "K" signal is "sell." Hourly DJIA Data The results for hourly data from March, 1 9 87 are giv en in Table 1 . You should note that there was a + 3 52 point bias in the hourly data. That is, the first price was 3 52 points Wav e Lev el Points) 0 1 2 1 4 02 266 62 1 6 59 1 04 0 3 14 Num ber of "Trades" Score (DJIA

3 4

11 1

56 1 59 3

Table 1 . FWA Predictiv e Score: DJIA Hourly from March, 1 9 87 lower than the final price. The lowest price was 1 7 4 7 ; the highest price was 2 81 4 . There were no

15

identified wav epoints at lev el 5 or higher. Only one wav epoint was identified as lev el 4 , the low at 1 7 4 7 . There were 1 1 trades identified at lev el 3 . The total score for being long or short with the lev el 3 direction, when it was in the direction of the lev el 4 wav e was 56 1 Dow points. The av erage trade at lev el 3 resulted in a 51 point profit. Fiv e of the lev el 3 trades were profitable. The av erage gain was 2 3 3 points; the av erage loss was 1 01 points. This would appear to be potentially useful inform ation, ev en after allowing for "trading costs" such as execution slippage and com m issions. The addition of standard stop loss techniques could possibly y ield an attractiv e trading m ethod. The results for lev els lower than lev el 3 are sim ilar at each lev el. In each case there are too m any "trades" identified with, on av erage, too little price m ov ement to prov ide attractiv e opportunities. The av erage gain or loss per trade is one to two Dow points. I would conclude on the basis of this sm all am ount of data that there is insufficient inform ation produced by the FWA at lev els 0, 1 , and 2 on hourly data to prov ide profitable trading opportunities. Daily Data The results for daily data from 1 885 are giv en in Table 2 . We see a sim ilar pattern to that obtained from the hourly data: The num ber of trades decreases as would be expected with increasing wav e lev el, and the "score" decreases to a m inimum , then increases with increasing wav e lev el. For the results shown here significant trading opportunities from daily data em erge at lev el 4 , where the av erage score per trade is alm ost 2 00 Dow points. Wav e Lev el 0 1 2 3 4 5 Num ber of Trades 7 7 34 1 27 7 232 44 10 1 Score (DJIA Points) 51 6 1 624 1 05 1 059 1 9 86 2 52 6

Table 1 . FWA Predictiv e Value: DJIA Daily from 1 885

16

Sum m ary In sum m ary , I would conclude that it is possible to recognize profitable trading opportunities by identify ing a fractal wav e structure in stock m arket price data. The FWA is a useful addition to the arsenal of tools used by technical analysts. There are m any areas in which m y research is continuing, including analysis of "tick" data for a wide range of com m odity m arkets, dev elopm ent of m ore sophisticated trading "sy stem s", and real-tim e trading of som e prelim inary sy stem s.

17

Anda mungkin juga menyukai

- A Trader's Guide To Use FractalsDokumen6 halamanA Trader's Guide To Use Fractalsuser_in67% (3)

- Trend Qualification and Trading: Techniques To Identify the Best Trends to TradeDari EverandTrend Qualification and Trading: Techniques To Identify the Best Trends to TradePenilaian: 2 dari 5 bintang2/5 (1)

- Fractal Edge-The Best Trading System in The WorldDokumen191 halamanFractal Edge-The Best Trading System in The WorldLeng Jai91% (11)

- Trading Regime Analysis: The Probability of VolatilityDari EverandTrading Regime Analysis: The Probability of VolatilityPenilaian: 3 dari 5 bintang3/5 (1)

- Trade Range with Normalized Bollinger IndicatorDokumen7 halamanTrade Range with Normalized Bollinger IndicatorShreePanickerBelum ada peringkat

- Just a Trade a Day: Simple Ways to Profit from Predictable Market MovesDari EverandJust a Trade a Day: Simple Ways to Profit from Predictable Market MovesBelum ada peringkat

- Pitchforks: A guide to drawing and reading themDokumen64 halamanPitchforks: A guide to drawing and reading themGARO OHANOGLU100% (1)

- Ichimoku Kinko Hyo - A Japanese Technical ToolDokumen3 halamanIchimoku Kinko Hyo - A Japanese Technical ToolMadhu50% (2)

- Trading Summit: A Modern Look to Trading Strategies and MethodsDari EverandTrading Summit: A Modern Look to Trading Strategies and MethodsBelum ada peringkat

- Short Term Trading1Dokumen5 halamanShort Term Trading1LUCKYBelum ada peringkat

- Ehlers (Measuring Cycles)Dokumen7 halamanEhlers (Measuring Cycles)chauchauBelum ada peringkat

- DWMA and IDWMA Moving Averages for Time Series AnalysisTITLEDokumen6 halamanDWMA and IDWMA Moving Averages for Time Series AnalysisTITLEsuperbuddyBelum ada peringkat

- Introducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorDokumen9 halamanIntroducing Dinapoli On The Dollar/Yen: Chart 1 Dinapoli Macd PredictorMohammed Sadhik100% (1)

- Peter Aan - RSIDokumen4 halamanPeter Aan - RSIanalyst_anil14100% (1)

- Expert 4 XDokumen35 halamanExpert 4 Xstefandea100% (1)

- Mastering RSI: by @cryptocredDokumen17 halamanMastering RSI: by @cryptocredmahonyboy .01Belum ada peringkat

- Adaptive CciDokumen38 halamanAdaptive CciFábio TrevisanBelum ada peringkat

- KAMA: Understanding Kaufman's Adaptive Moving AverageDokumen8 halamanKAMA: Understanding Kaufman's Adaptive Moving AverageJayadevanTJ100% (1)

- Day Trading The Three Bar Reversal PatternDokumen5 halamanDay Trading The Three Bar Reversal PatternRed KnullBelum ada peringkat

- Andrews' Pitchfork (ChartSchool) PDFDokumen8 halamanAndrews' Pitchfork (ChartSchool) PDFMin Than HtutBelum ada peringkat

- (Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)Dokumen6 halaman(Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)sivakumar_appasamyBelum ada peringkat

- LocatinDokumen9 halamanLocatinivolatBelum ada peringkat

- Wolfe Wave PDFDokumen11 halamanWolfe Wave PDFJay Jobanputra100% (4)

- Weekly Breakout Box SystemDokumen3 halamanWeekly Breakout Box SystemMisterSimpleBelum ada peringkat

- John Ehlers - Left Brained Concepts For Traders in Their Right Minds - AfTA2007Dokumen33 halamanJohn Ehlers - Left Brained Concepts For Traders in Their Right Minds - AfTA2007roskenboy100% (1)

- Buzz CciDokumen19 halamanBuzz CciProust TrentaBelum ada peringkat

- Joseph Practical Applications of A Mechanical Trading System Using Simplified Elliott Wave AnalysisDokumen83 halamanJoseph Practical Applications of A Mechanical Trading System Using Simplified Elliott Wave Analysischemalasamy67% (3)

- Quant Strategies - Use of Fractals For Index Futures TradingDokumen9 halamanQuant Strategies - Use of Fractals For Index Futures Tradingajitk2003Belum ada peringkat

- 14 Strategies of A Millionaire TraderDokumen200 halaman14 Strategies of A Millionaire Traderpiyush_rathod_13100% (2)

- Trailing Stop PercentDokumen3 halamanTrailing Stop Percentchristophermrequinto100% (2)

- Wolfe Wave: Linda RaschkeDokumen32 halamanWolfe Wave: Linda RaschkeDasharath Patel100% (3)

- IFTA Journal article summarizes Volume Zone Oscillator trading indicatorDokumen15 halamanIFTA Journal article summarizes Volume Zone Oscillator trading indicatorRoberto Rossi100% (1)

- Trading With RSI (2) Marke..Dokumen8 halamanTrading With RSI (2) Marke..pderby1Belum ada peringkat

- A Mehanical Trading System Tom Joseph PDFDokumen83 halamanA Mehanical Trading System Tom Joseph PDFDejan Jankuloski100% (1)

- (Trading) TD Early Trend Identification (John Ehlers, 2004, Stocks & Commodities)Dokumen9 halaman(Trading) TD Early Trend Identification (John Ehlers, 2004, Stocks & Commodities)Claudiu MaziluBelum ada peringkat

- MANAGING VOLATILITY WITH THE AVERAGE TRUE RANGE INDICATORDokumen3 halamanMANAGING VOLATILITY WITH THE AVERAGE TRUE RANGE INDICATORRaja RajBelum ada peringkat

- ASCTrendDokumen38 halamanASCTrendAndree W. KurniawanBelum ada peringkat

- Trade Trends with Ichimoku Cloud IndicatorDokumen6 halamanTrade Trends with Ichimoku Cloud IndicatorAnonymous sDnT9yu100% (1)

- New Trading System - GUNNER24 Trading ManualDokumen16 halamanNew Trading System - GUNNER24 Trading ManualGUNNER24 ForecastsBelum ada peringkat

- Volatility Based Envelopes VbeDokumen6 halamanVolatility Based Envelopes Vbedanielhsc100% (1)

- TASC Magazine January 2009Dokumen51 halamanTASC Magazine January 2009Trend Imperator100% (1)

- Best Fibonacci Ratio and Shape Ratio For Winning Technical AnalysisDokumen11 halamanBest Fibonacci Ratio and Shape Ratio For Winning Technical AnalysisYoungh SeoBelum ada peringkat

- Top-Down RSI Trend Line Analysis Identifies Short TradeDokumen6 halamanTop-Down RSI Trend Line Analysis Identifies Short TradeRayzwanRayzmanBelum ada peringkat

- How To Place Stop Losses Like A Pro TraderDokumen6 halamanHow To Place Stop Losses Like A Pro Tradernrepramita100% (2)

- Shane's StoryDokumen15 halamanShane's StorypericciaBelum ada peringkat

- Trading Chaos for EUR/USD TrendsDokumen7 halamanTrading Chaos for EUR/USD TrendsFirdaus100% (4)

- 14-In The Volume ZoneDokumen6 halaman14-In The Volume Zonewacana.wisnuBelum ada peringkat

- Bandpass Indicator Provides Leading Signal for Cyclical MarketsDokumen7 halamanBandpass Indicator Provides Leading Signal for Cyclical MarketsJim Baxter100% (1)

- Harmonic Patterns PDF FreeDokumen51 halamanHarmonic Patterns PDF FreeJuanPablodelaRegueraBelum ada peringkat

- Reverse Engineering MACDDokumen1 halamanReverse Engineering MACDNiltonBelum ada peringkat

- Forex Swing Trading CUDokumen6 halamanForex Swing Trading CUMohamed Saabkey HaajiBelum ada peringkat

- Excerpts, Contents & Prices: Elliott Wave TradingDokumen48 halamanExcerpts, Contents & Prices: Elliott Wave TradingCristian100% (2)

- Abonacci Trading v11-11Dokumen12 halamanAbonacci Trading v11-11ghcardenas100% (1)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDokumen148 halamanHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerBelum ada peringkat

- 192verv 1 PDFDokumen5 halaman192verv 1 PDFcasierraBelum ada peringkat

- AB CD PatternDokumen4 halamanAB CD Patternapi-2624705867% (3)

- DtcourseDokumen242 halamanDtcourseglov11Belum ada peringkat

- Volatility InsideDokumen4 halamanVolatility InsideMisterSimpleBelum ada peringkat

- Fractal Growth ProcessesDokumen5 halamanFractal Growth ProcessestaiyawutBelum ada peringkat

- High Voltage Power Pulse CircuitDokumen1 halamanHigh Voltage Power Pulse CircuittaiyawutBelum ada peringkat

- The Presentation of MagnetoHydrodynamicsDokumen28 halamanThe Presentation of MagnetoHydrodynamicstaiyawutBelum ada peringkat

- UPStart Quick Start GuideDokumen13 halamanUPStart Quick Start GuidetaiyawutBelum ada peringkat

- LM386 Low Voltage Audio Power AmplifierDokumen10 halamanLM386 Low Voltage Audio Power Amplifierapple.scotch.fool3550Belum ada peringkat

- HurstDokumen7 halamanHurstngocleasing75% (4)

- HTU Board For Sony VPH - D50Htu (MK Ii)Dokumen6 halamanHTU Board For Sony VPH - D50Htu (MK Ii)taiyawutBelum ada peringkat

- Altmann 10 Month Perpetual Calendar ExplainedDokumen1 halamanAltmann 10 Month Perpetual Calendar ExplainedtaiyawutBelum ada peringkat

- Crystalio Vps 2300 User Guide 2Dokumen76 halamanCrystalio Vps 2300 User Guide 2taiyawutBelum ada peringkat

- 1N5711 Schottky Diode DatasheetDokumen4 halaman1N5711 Schottky Diode DatasheettaiyawutBelum ada peringkat

- 1N5711 Schottky Diode DatasheetDokumen4 halaman1N5711 Schottky Diode DatasheettaiyawutBelum ada peringkat

- SonyG70 BrochureDokumen12 halamanSonyG70 BrochuretaiyawutBelum ada peringkat

- MagnetronDokumen6 halamanMagnetrontaiyawutBelum ada peringkat

- 1N5711 Schottky Diode DatasheetDokumen4 halaman1N5711 Schottky Diode DatasheettaiyawutBelum ada peringkat

- 833 Tube SpecificationsDokumen9 halaman833 Tube SpecificationstaiyawutBelum ada peringkat

- Fractal Growth ProcessesDokumen5 halamanFractal Growth ProcessestaiyawutBelum ada peringkat

- 2N6284 DDokumen7 halaman2N6284 DCarlitosXDBelum ada peringkat

- 9 766 393 Capacitive Voltage Divider ForDokumen7 halaman9 766 393 Capacitive Voltage Divider FortaiyawutBelum ada peringkat

- DarlingtonDokumen5 halamanDarlingtontaiyawutBelum ada peringkat

- Antenna SystemDokumen2 halamanAntenna SystemtaiyawutBelum ada peringkat

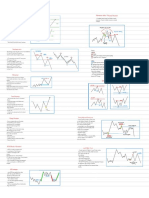

- Trading PatternsDokumen8 halamanTrading PatternsJR 18067% (3)

- Kevin Haggerty - Trading With The Generals 2002Dokumen233 halamanKevin Haggerty - Trading With The Generals 2002SIightly75% (4)

- Forex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesDokumen46 halamanForex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesArrow Builders100% (3)

- Introduction To Portfolio ManagementDokumen84 halamanIntroduction To Portfolio ManagementRadhika SivadiBelum ada peringkat

- FNCE4030 Fall 2012 Ch12 HandoutDokumen34 halamanFNCE4030 Fall 2012 Ch12 HandoutHayyin Nur Adisa100% (1)

- Pitchfork Trader Vol3 - ExcerptsDokumen42 halamanPitchfork Trader Vol3 - Excerptsmr.ajeetsingh100% (1)

- CandlesticksDokumen14 halamanCandlestickssatheb319429Belum ada peringkat

- Winning With Weekly Options: Schaeffer's Investment Research'sDokumen10 halamanWinning With Weekly Options: Schaeffer's Investment Research'sAdnan ShaukatBelum ada peringkat

- Tim Bost ManualDokumen10 halamanTim Bost ManualPrasanta Debnath50% (2)

- Bhavishya - Dow TheoryDokumen50 halamanBhavishya - Dow Theoryshivamantri100% (5)

- Triple Screen Trading SystemDokumen22 halamanTriple Screen Trading Systemalrog2000Belum ada peringkat

- Tutti: Structure and Time Momentum Shifts / Reversal StructureDokumen1 halamanTutti: Structure and Time Momentum Shifts / Reversal StructureMus'ab Abdullahi BulaleBelum ada peringkat

- 3116648Dokumen28 halaman3116648jeubank4Belum ada peringkat

- Profitable Candlestick PatternsDokumen53 halamanProfitable Candlestick Patternsaan_pkppk88% (17)

- Candle PatternsDokumen16 halamanCandle Patternsjai vanamalaBelum ada peringkat

- RTA Cabinet Market Trends and Customer SatisfactionDokumen4 halamanRTA Cabinet Market Trends and Customer SatisfactionUmair RazaBelum ada peringkat

- Candlestick Success Rate 60 PercentDokumen12 halamanCandlestick Success Rate 60 PercentClipper52aBelum ada peringkat

- The Link Between Bollinger Bands Amp Cci PDFDokumen5 halamanThe Link Between Bollinger Bands Amp Cci PDFbhupendra investorBelum ada peringkat

- Hancock (2010-03) Momentum - A Contrarian Case For Following The HerdDokumen13 halamanHancock (2010-03) Momentum - A Contrarian Case For Following The HerddrummondjacobBelum ada peringkat

- TWFX Forex Ict MMM Notes COMPLETODokumen110 halamanTWFX Forex Ict MMM Notes COMPLETOJHON CONTRERAS0% (1)

- Swing Trading Simplified Larry D Spears PDFDokumen115 halamanSwing Trading Simplified Larry D Spears PDFAmine Elghazi100% (4)

- Candle Stic PatternDokumen17 halamanCandle Stic PatternAnonymous fE2l3Dzl100% (1)

- TDI Crossover Strategy For MT5 by HusniFXDokumen5 halamanTDI Crossover Strategy For MT5 by HusniFXKAMER SOLUTIONBelum ada peringkat

- John F Carter - How I Trade FoDokumen259 halamanJohn F Carter - How I Trade FoEma Em87% (15)

- Advanced Fibonacci ApplicationsDokumen4 halamanAdvanced Fibonacci Applicationsapi-383957775% (4)

- Technical Analysis Technical IndicatorsDokumen20 halamanTechnical Analysis Technical IndicatorsAtikah27Belum ada peringkat

- Market Cycle Timing and Trend Direction are Keys to Trading SuccessDokumen22 halamanMarket Cycle Timing and Trend Direction are Keys to Trading SuccesspravinyBelum ada peringkat

- Aroon Indicator GuideDokumen9 halamanAroon Indicator Guideselozok1Belum ada peringkat

- Assignment 01obaidDokumen3 halamanAssignment 01obaidZekoBelum ada peringkat

- Summer Internship ProjectDokumen25 halamanSummer Internship ProjectGAurav MeHareesh SharmaBelum ada peringkat

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Dari EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Penilaian: 5 dari 5 bintang5/5 (1)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobDari EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobPenilaian: 4.5 dari 5 bintang4.5/5 (36)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverDari EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverPenilaian: 4.5 dari 5 bintang4.5/5 (186)

- The First Minute: How to start conversations that get resultsDari EverandThe First Minute: How to start conversations that get resultsPenilaian: 4.5 dari 5 bintang4.5/5 (55)

- How the World Sees You: Discover Your Highest Value Through the Science of FascinationDari EverandHow the World Sees You: Discover Your Highest Value Through the Science of FascinationPenilaian: 4 dari 5 bintang4/5 (7)

- The 7 Habits of Highly Effective PeopleDari EverandThe 7 Habits of Highly Effective PeoplePenilaian: 4 dari 5 bintang4/5 (2564)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4 dari 5 bintang4/5 (1)

- The Introverted Leader: Building on Your Quiet StrengthDari EverandThe Introverted Leader: Building on Your Quiet StrengthPenilaian: 4.5 dari 5 bintang4.5/5 (35)

- Spark: How to Lead Yourself and Others to Greater SuccessDari EverandSpark: How to Lead Yourself and Others to Greater SuccessPenilaian: 4.5 dari 5 bintang4.5/5 (130)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsDari EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsPenilaian: 4.5 dari 5 bintang4.5/5 (52)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthDari Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthPenilaian: 5 dari 5 bintang5/5 (51)

- The 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsDari EverandThe 4 Disciplines of Execution: Revised and Updated: Achieving Your Wildly Important GoalsPenilaian: 4.5 dari 5 bintang4.5/5 (48)

- Transformed: Moving to the Product Operating ModelDari EverandTransformed: Moving to the Product Operating ModelPenilaian: 4 dari 5 bintang4/5 (1)

- Leadership Skills that Inspire Incredible ResultsDari EverandLeadership Skills that Inspire Incredible ResultsPenilaian: 4.5 dari 5 bintang4.5/5 (11)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersDari EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersPenilaian: 4.5 dari 5 bintang4.5/5 (94)

- Get Scalable: The Operating System Your Business Needs To Run and Scale Without YouDari EverandGet Scalable: The Operating System Your Business Needs To Run and Scale Without YouPenilaian: 5 dari 5 bintang5/5 (1)

- Work Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkDari EverandWork Stronger: Habits for More Energy, Less Stress, and Higher Performance at WorkPenilaian: 4.5 dari 5 bintang4.5/5 (12)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceDari EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformancePenilaian: 5 dari 5 bintang5/5 (22)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsDari EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsPenilaian: 4.5 dari 5 bintang4.5/5 (27)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsDari EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsPenilaian: 4.5 dari 5 bintang4.5/5 (411)

- The 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsDari EverandThe 12 Week Year: Get More Done in 12 Weeks than Others Do in 12 MonthsPenilaian: 4.5 dari 5 bintang4.5/5 (90)

- Sustainability Management: Global Perspectives on Concepts, Instruments, and StakeholdersDari EverandSustainability Management: Global Perspectives on Concepts, Instruments, and StakeholdersPenilaian: 5 dari 5 bintang5/5 (1)

- The Emotionally Intelligent LeaderDari EverandThe Emotionally Intelligent LeaderPenilaian: 4.5 dari 5 bintang4.5/5 (204)

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Dari EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't (Rockefeller Habits 2.0 Revised Edition)Penilaian: 4.5 dari 5 bintang4.5/5 (13)

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowDari EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowPenilaian: 4.5 dari 5 bintang4.5/5 (27)