India Mineral Yearbook 2011 - Ilmenite Rutile

Diunggah oleh

Le Hoang LongHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

India Mineral Yearbook 2011 - Ilmenite Rutile

Diunggah oleh

Le Hoang LongHak Cipta:

Format Tersedia

Indian Minerals Yearbook 2011

(Part- II) 50th Edition

ILMENITE & RUTILE

(ADVANCE RELEASE)

GOVERNMENT OF INDIA MINISTRY OF MINES INDIAN BUREAU OF MINES

Indira Bhavan, Civil Lines, NAGPUR 440 102

PHONE/FAX NO. (0712) 2565471 PBX : (0712) 2562649, 2560544, 2560648

E-MAIL : cme@ibm.gov.in

Website: www.ibm.gov.in October 2012

ILMENITE AND RUTILE

46 Ilmenite & Rutile

ndia is endowed with large resources of heavy minerals which occur mainly along coastal stretches of the country and also in inland placers. Heavy mineral sands comprise a group of seven minerals, viz, ilmenite, leucoxene (brown ilmenite), rutile, zircon, sillimanite, garnet and monazite. Ilmenite (FeO.TiO2) and rutile (TiO2) are the two chief minerals of titanium. Titanium dioxide occurs in polymorphic forms as rutile, anatase (octahedrite) and brookite. Though Brookite is not found on a large-scale in nature, it is an alteration product of other titanium minerals. Leucoxene is an alteration product of ilmenite and found associated with ilmenite.

million tonnes to 520.38 million tonnes (including leucoxene), inclusive of indicated, inferred and speculative categories. Resource estimation for the areas explored during 2006 to 2011 is under progress. The most significant deposits which are readily available and attract attention of industry for largescale operations are as follows:

State/Deposit Andhra Pradesh 1 . Amalapuram 2 . Bhavanapadu Hukumpet 3 . Kakinada (Phase I-VII) 4 . Kalingapatnam 5 . Narasapur 6 . Nizampatnam 7 . Srikurman 8 . Visakhapatnam Kerala 1 . Chavara 2 . Chavara Eastern Extension 3 . Chavara (Phase II) Maharashtra Ratnagiri Odisha 1 . Brahmagiri 2 . Chatrapur Tamil 1. 2. 3. Nadu Kudiraimozhi Navaladi-Periatalai Sattankulam Ilmenite reserve (In million tonnes) 15.57 10.18 29.62 7.63 2.92 19.26 14.18 3.60 13.00 17.00 49.00 3.04 61.10 26.72 23.00 24.00 14.48

RESOURCES

Ilmenite and rutile along with other heavy minerals are important constituents of beach sand deposits found right from Ratnagiri coast (Maharashtra) in the west to Odisha coast in the east. These minerals are concentrated in five well defined zones: * Over a stretch of 22 km between Neendakara and Kayamkulam, Kollam district, Kerala (known as 'Chavara' deposit after the main mining centre). * Over a stretch of 6 km from the mouth of Valliyar river to Colachal, Manavalakurichi and little beyond in Kanyakumari district, Tamil Nadu (known as MK deposit). * On Chatrapur coast stretching for 18 km between Rushikulya river mouth and Gopalpur lighthouse with an average width of 1.4 km in Ganjam district, Odisha (known as 'OSCOM' deposit after IREL's Orissa Sands Complex). * Brahmagiri deposit stretches for 30 km from Girala nala to Bhabunia villages with an average width of 1.91 km in Puri district, Odisha. * Bhavanapadu coast between Nilarevu and Sandipeta with 25 km length and 700 m average width in Srikakulam district, Andhra Pradesh. The AMD of the Department of Atomic Energy has been carrying out exploration of these mineral deposits. So far, about 3,579 km coastal tract and 128.92 sq km in the inland areas in Tamil Nadu and West Bengal have been investigated for over six decades by AMD. The ilmenite resource estimation for the areas explored up to 2006 has been almost completed and the resources are up from 461.37

Source: Department of Atomic Energy, Mumbai.

Table 1 : Resources of Ilmenite and Rutile

(In million tonnes) State I l m e n i t e * : To t a l Andhra Pradesh Bihar Kerala Maharashtra Odisha Tamil Nadu West Bengal R u t i l e : To t a l Andhra Pradesh Bihar Kerala Odisha Tamil Nadu West Bengal To t a l in situ # 520.38 171.04 0.73 117.52 3.74 108.23 117.07 2.05 2 9 . 11 10.30 0.01 7.24 6.06 5.31 0.19

Source: Department of Atomic Energy, Mumbai. # Inclusive of indicated, inferred and speculative categories. * Including leucoxene.

46-2

ILMENITE AND RUTILE

The average grade of total heavy minerals in these deposits is 10-25% of which 30-35% is ilmenite. The overall statewise reserves of ilmenite and rutile which occur together in beach sand deposits are given in Table - 1. As per the UNFC system as on 1.4.2010 compiled by National Mineral Inventory (NMI) Unit of IBM, the total resources of titanium minerals are placed at 394 million tonnes comprising ilmenite (335.6 million tonnes), rutile (13.4 million tonnes), leucoxene (1.0 million tonnes), anatase (3.3 million tonnes) and titaniferous magnetite (40.6 million tonnes).

scale was conducted along with 2,060 m auger drilling and collection of same number of samples during the year. Heavy mineral investigations were also taken up during 2010-11 in a 27-km long coastal tract in Balikunda block of Jagatsinghpur district. A total of 39 line km survey and 1,229 m in auger drilling were conducted and 659 samples were collected for heavy mineral study. Resources in the above areas are to be assessed. The survey and exploration carried out by AMD during 2008-09, 2009-10 and 2010-11 included parts of West Bengal, Odisha, Andhra Pradesh, Tamil Nadu, Kerala, Karnataka, Gujarat and Maharashtra. The details of exploration activities carried out by AMD during 2010-11 are furnished in Table-2.

EXPLORATION & DEVELOPMENT

GSI carried out placer mineral investigations within the territorial waters of India in 2010-11. The surveys were conducted off Bhimunipatnam, Andhra Pradesh; and off Palur-Malud, Odisha. Directorate of Geology, Odisha took up investigation during 2010-11 for heavy minerals (ilmenite, rutile, zircon, garnet, sillimanite, monazite, etc.) in beach sands in village Hunda, Krushnaprasad block in Puri district. Mapping over 1.04 sq km area on 1:2,000

PRODUCTION AND PRICES

Ilmenite The production of ilmenite at 663 thousand tonnes in 2010-11 decreased by 7% as compared to that in the preceding year. Tamil Nadu was the leading producer of ilmenite during the year under review, contributing 52% production followed by Odisha 31% and Kerala 17%.

Table 2: Exploration Activities by AMD for Ilmenite, Rutile, Monazite, Zircon and other Heavy Minerals, 2010-11

Activity Location Reconnaissance survey (sq km) 253.8 (Coastal tracts and) inland areas Detailed survey (sq km) 8.28 Results

Parts of West Bengal, Odisha, Karnataka, Andhra Pradesh, Tamil Nadu and Gujarat

Reconnaissance survey was undertaken to delineate potential heavy mineral concentrations along the coastal tracts: (a) Ghoga and Gopnath coast, Bhavnagar district, Gujarat - very narrow beaches with surfacial heavy mineral (HM) concentration of 5 to 20%. (b) Digha-Birampur coast, Midnapore district, West Bengal recorded HM concentration up to 10%; inland palaeo placers of this coast recorded concentration between 5-10%. (c) Beach sand between Gimagaria and Subarnarekha river, Balasore district, Odisha showed HM 5-15%. (d) Beach sand between Ennore and Pulicat Lake, Tiruvallur district, Tamil Nadu has 30% HM concentration. (e) Two to eight percent HM recorded along Bengre-Mulki coast, Mangalore & Dakshin Kannada districts, Karnataka. In addition to reconnaissance surveys, detailed survey was carried out in Malikipuram deposit, East Godavari district, Andhra Pradesh to upgrade the resources from inferred to indicated category. Further work is in progress.

Source: Department of Atomic Energy, Mumbai.

46-3

ILMENITE AND RUTILE

Rutile The production of rutile at 27 thousand tonnes in 2010-11 increased by 43% as compared to that in the previous year. Tamil Nadu was the leading producer of rutile accounting for 47% production followed by Odisha 30% and Kerala 23%. Production and prices of ilmenite and rutile are furnished in Tables - 3 to 5. Table 3: Production of Ilmenite and Rutile 2008-09 to 2010-11 (By States)

(In tonnes) State ILMENITE India : Total Kerala Odisha Tamil Nadu RUTILE India : Total Kerala Odisha Tamil Nadu 2008-09 2009-10 2010-11(P)

Table 5: Prices of Ilmenite 2008-09 to 2010-11

( ` per tonne) Period IREL w.e.f. 1.4.2008 Grade Q Q MK MK OR Q Q MK MK OR Q Q MK Q MK OR Q MK OR Q MK OR Q MK OR Q MK OR Q MK OR Price 4100 3775 3875 3550 3225 4500 4175 4275 3950 4625 5100 4700 4450 4700 4450 5000 4700 4450 4000 6000 5000 4000 5300 5000 4000 5700 5400 4000 5700 5400 4250 3427 NA NA 2905 3009 5940 Remarks Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, bagged loose bagged loose loose bagged loose bagged loose loose

w.e.f. 9.1.2009

w.e.f. 14.2.2009

Ex-works, bagged Ex-works, loose Ex-works, loose Ex-works, bagged Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose Ex-works, loose f.o.b.Thoothukudi

588127 51151 200056 336920

713605 133832 210031 369742

663217 113240 206139 343838

w.e.f. 7.4..2009

w.e.f. 1.4.2010

19098 3859 10319 4920

18573 6607 8033 3933

26593 5969 8044 12581

w.e.f. 1.5.2010

w.e.f. 2.6.2010

Table 4 : Prices of Rutile 2008-09 to 2010-11

(` per tonne) Year IREL 2008-09 (w.e.f. 29.5.2008) (w.e.f. 1.7.2008) (w.e.f. 1.9.2008) (w.e.f. 15.11.2008) 2009-10 (w.e.f. 7.4.2009) 2010-11 (w.e.f. 1.4.2010) (w.e.f. 1.5.2010) (w.e.f. 11.2.2011) KMML 2008-09 2009-10 Q/MK/OR Q/MK/OR Q/MK/OR Q/MK/OR Q/MK/OR 28000 30000 32000 34000 37000 Ex-works, Ex-works, Ex-works, Ex-works, Ex-works, bagged bagged bagged bagged bagged Grade Price Remarks

w.e.f. 11.2.2011

w.e.f. 1.3.2010 KMML 2008-09 2009-10 2010-11

59.88% TiO 2 NA NA

Q/MK/OR 37000 Q/MK/OR 41000

Ex-works, bagged Ex-works, bagged

V.V. Mineral (Average) 2008-09 Not specified 2009-10 Not specified 2010-11 NA BMC 2008-09

Q/MK/OR 41000 Q/MK/OR 35000 Q/MK/OR 37500

Ex-works, bagged Ex-works, bagged Ex-works, bagged 2009-10

TiO 2 : 48-50% 4 7 0 0 (US$100) TiO2 : >51% 5640 (US$120) TiO 2 : 48-50% 4 0 5 0 (US$90) TiO2 : >51% 4950 (US$110) TiO 2 : 48-50% 4 5 0 0 (US$100) TiO2 : >51% 5400 (US$110) NA NA NA 4435 4825 6375

f.o.b.Thoothukudi

94.85% TiO2 94.85% TiO2 -

2010-11 V.V. Mineral (Average) 2008-09 NA 2009-10 NA 2010-11 NA

31007 44500 to 50000 NA

DCW Ltd 2008-09 2009-10 2010-11 2010-11

f.o.b.Thoothukudi

26613 34475 37565

Source: Department of Atomic Energy, Mumbai. Note: Q : Quilon; MK: Manavalakurichi; OR: Odisha

Source: Department of Atomic Energy, Mumbai. Note: Q: Quilon; MK: Manavalakurichi; OR: Odisha

46-4

ILMENITE AND RUTILE

MINING & PROCESSING

Mining and processing of beach sand is carried out by the IREL, a Government of India undertaking, KMML, a Kerala State Government undertaking and two private sector producers; viz, M/s V. V. Mineral, Thoothukudi (Tamil Nadu) and M/s Beach Minerals Co. Pvt. Ltd, Kuttam (Tamil Nadu). IREL is exploiting beach sand deposits located at Chavara in Kerala, Gopalpur in Odisha and Manavalakurichi in Tamil Nadu. At IREL, Chavara, beach washings are inadequate to meet the full requirement of the plant. The unit, therefore, has adopted wet mining operations involving use of two Dredge and Wet Concentrator (DWC) of 100 tph capacity each to exploit the inland deposits away from the beaches. Chavara ilmenite is richest in TiO2 content (75.8% TiO2) and has great demand in India and abroad for manufacture of pigments. At Manavalakurichi, deposit is spread over 300 hectares at Thuthoor-Ezudesam villages, Vilavancode tehsil, Kanyakumari district, Tamil Nadu. All the raw sand required to operate the separation plant at its full capacity is collected from nearby beaches by the fishermen of surrounding villages and supplied to the unit at cost. Deposits are also exploited by DWC of 100 tph capacity. Manavalakurichi is next to Chavara in terms of TiO2 content which is more than 55%. The sand deposits of OSCOM at Chatrapur in Ganjam district extend along the coast of Bay of Bengal with an average width of 1.4 km and average depth of 7.5 m. Mining operations involve suction dredging to 6 m depth below water level on a much larger scale (500 tph) augmented by a smaller sized (100 tph) supplementary. The ilmenite from OSCOM is inferior in grade in terms of TiO2 content (50%) in comparison to Chavara and Manavalakurichi. The Synthetic Rutile Plant of OSCOM is presently not working. As a result, the majority of OSCOM ilmenite produced today is finding its way in the international market as feed stock for production of both slag grade and anatase grade pigment. In dry mining, beach washings laden with 40-70% Heavy Minerals (HM) are collected through front end loaders and bulldozers for further concentration to 90% HM at land-based concentrators. Dry mining is very simple and economic as well. However, it is facing opposition by local people on the ground that removal of sand causes sea erosion. Therefore, collection of beach washings has reduced significantly in recent past. As an alternate approach, IREL has adoptped wet mining involving dredging and wet concentration

(DWC) from inland areas away from the beach lines. In this mode, an artificial pond is created, the sand bed is cut and the slurry is pumped to spiral concentrator for removal of quartz. Manavalakurichi was the first plant to install a DWC (100 tph) followed by one (500 tph) at OSCOM and two (each 100 tph) at Chavara. The concentrate (90% HM) of beach washing plant from DWC is further upgraded to 97% HM grade at a Concentrate Upgradation Plant (CUP) before sending it to Mineral Separation Plant (MSP). KMML collects seasonal accretions of heavy mineral sand from the beach front. The pit so formed gets filled by fresh accretions of heavy mineral sand. The mineral sand is collected using bulldozers and wheel loaders and transported in tippers to Mineral Separation Plant. In the Mineral Separation Unit Project of KMML, a new spiral concentrator was installed in 2008-09. The mineral separation plants use variety of equipment such as gravity concentrators, high tension electrostatic separators and magnetic separators. Making use of difference in physical properties like electrical conductivity, magnetic susceptibility and difference in specific gravity, etc., individual minerals like ilmenite, rutile, zircon, sillimanite and garnet are separated. The mined beach sands are pre-concentrated and dried after sieving (30-mesh) to separate the heavies from rejects. The heavy minerals are passed through electrostatic separators where conducting minerals ilmenite and rutile are separated from other non-conducting minerals. Ilmenite and rutile are further subjected to low-intensity magnetic separators where magnetic fraction - ilmenite is separated from rutile. Similarly, non-conducting fractions are subjected to highintensity magnetic separators where weakly magnetic fraction (monazite and garnet) is separated from nonmagnetic fraction (zircon and sillimanite). The fractions are further processed on wind tables to separate garnet from monazite and sillimanite from zircon. IREL carried out trial runs of expansion of capacity of ilmenite to 200,000 tonnes at Chavara plant in Kerala and has commissioned it successfully. The company has plans to expand MSP capacity at OSCOM to produce 5 lakh tonnes of ilmenite and associated minerals by the end of 2013. Trimex Group is understood to be gearing up to begin its 200,000 tpy ilmenite and 6,000 tpy rutile project in Srikakulam district, Andhra Pradesh. Installed capacity and production of ilmenite, rutile and other associated heavy minerals by various separation plants are furnished in Table-6.

46-5

ILMENITE AND RUTILE

Table 6 : Installed Capacity & Production of Ilmenite, Rutile and Other Heavy Minerals, 2008-09 to 2010-11

(In tonnes) Company/ Location Mineral Specification Installed capacity (tpy) Production 2008-09 2009-10 2010-11

Indian Rare Earths Ltd Manavalakurichi, Kanyakumari dist., Tamil Nadu. Ilmenite Rutile Zircon Sillimanite Monazite Garnet Chavara, Kollam dist., Kerala. Ilmenite Rutile Zircon Rare Earths Sillimanite Leucoxene Zirflor Microzir Orissa Sands Complex, Ilmenite Ganjam dist., Odisha. Rutile Zircon Sillimanite Garnet Kerala Minerals & Metals Ltd Chavara, Kollam dist., Kerala. Ilmenite Rutile Zircon Leucoxene Monazite V.V. Mineral Thoothukudi, Tamil Nadu. Ilmenite Rutile Zircon Garnet Beach Minerals Co. Pvt. Ltd Kuttam, Tirunelveli dist., Tamil Nadu. Source: Depar tment of Atomic Energy, Mumbai and IREL. * In terms of rare earths chloride. ** Mainly Rare Earths Fluoride, Cerium Oxide and Cerium Hydrate from conversion of Rare Earths Chloride. @ Besides, 7,900 tonnes production of zircon-sillimanite is also reported. + Expansion of capacity to 200,000 tonnes under trial runs was commissioned successfully. Ilmenite KU grade 49-51% TiO2 150000 61932 53000 34000 Zircon-sillimanite 51.0-52.5% TiO2 95% TiO2 (min) 66% ZrO2 +HfO2 (min) NA NA NA 520000 (Total Heavy Minerals) 215221 2952 7321 316200 2100 6900 7900 NA 372000 6750 13350 8200 NA 59.88% TiO 2 93.20% TiO 2 64.81% ZrO2 NA NA 51600 3400 2500 300 240 42510 2690 2445 44300 3335 2592 38920 2413 2838 55% TiO2 (min) 94% TiO2 (min) 65% ZrO2 +HfO2 (min) 58% Al2O3 96% pure 97% pure (min) 59% TiO2 (min) 95% TiO2 (min) 65% ZrO2 +HfO2 (min) 58% Al2O 3 (min) -200 mesh -300 mesh 1-3 micron 50.25% TiO 2 (min) 94.25% TiO 2 (min) 64.25% ZrO2 +HfO2 (min) 56.5% Al 2O3 (min) 93.5% garnet (min) 500 220000 10000 5000 10000 24000 200256 7629 5807 13878 11455 208781 8034 5906 14117 11080 1627 206138 8044 5979 17889 18474 90000 4000 10000 6000 8500 154000 + 10000 12000 4500* 10000 6000 69681 2368 5813 270 14527 86403 3859 7772 22** 10443 198 1686 55542 1833 4527 67 13358 89532 3273 8124 16** 7935 198 1444 43222 1628 3542 150 14909 74320 3556 7500 NA 8243 110 918

46-6

ILMENITE AND RUTILE

INDUSTRY

For manufacture of titanium dioxide pigment, ilmenite is first treated chemically to obtain upgraded ilmenite, commonly called as synthetic rutile. There are two major pigment production processes namely chloride process and sulphate process depending on different operating characteristics and feedstock requirements. Plants employing chloride process consume high TiO2 content feedstocks like synthetic rutile and chloride slag. On the other hand, plants employing the sulphate process use lower grade ilmenite and sulphate slags. Ilmenite obtained from Mineral Separation Plant (MSP) is chemically treated to remove impurities such as iron to obtain synthetic rutile (90% TiO2) in Synthetic Rutile Plant (SRP). Indian Synthetic Rutile Plants are based on reduction roasting followed by acid leaching with or without generation of hydrochloric acid. Plants of IREL (OSCOM) and KMML depend on acid regeneration from the leach liquor while those of Cochin Minerals & Rutile Ltd (CMRL) and DCW use fresh acid and recover ferric chloride from the leach liquor for its use in water purification. At OSCOM plant of IREL, reduction-roasting of ilmenite with coal is followed by leaching with HCl to separate iron as soluble ferrous chloride. The leached ilmenite is calcined to yield synthetic rutile and the acidic leach liquor is treated in an acid regeneration plant to recover HCl for recycling with iron oxide as waste. The unit stopped production in 1997 as it was not viable economically. The KMML is manufacturing rutile grade titanium dioxide pigment by chloride route at its Sankaramangalam plant near Chavara in Kerala. The project for the production of one lakh tonnes of TiO2 in a phased manner is under implementation. The company also has plans to enhance pigment capacity to 60,000 tpy for which detailed project report is under preparation. In 2009, the company had developed Nano Titanium Dioxide particles on laboratory scale and in July 2011, India's first comercial plant for synthesis of nano-titanium dioxide was commissioned. The DCW Ltd procures ilmenite from Manavalakurichi which is then roasted with coke fines to convert Fe2O3 into FeO. The reduced ore is leached with concentrated hydrochloric acid to remove oxides of iron and other metals. The leached ore is washed and calcined to get upgraded ilmenite which contains more than 95% TiO2 . The upgraded ilmenite is micronised to 2 microns by using high-pressure steam. This is marketed as Titox. The liquor from ilmenite leaching process contains fine TiO2 particles and

chlorides. The TiO2 recovered by filtration & washing in filter presses is marketed as Utox. The company has plans to increase the capacity of plant to 36,000 tpy and also to install facilities for the manufacture of ferrite grade iron oxide from the effluent of the ilmenite plant. Cochin Minerals and Rutile Ltd (CMRL), which began production at its 10,000 tpy synthetic rutile plant in Kerala in 1990 as a 100% EOU, has gradually raised the production capacity to around 45,000 tpy since 2008-09 for exports. It also has ferric chloride & ferrous chloride plants having capacities 24,000 tpy & 72,000 tpy, respectively. The Travancore Titanium Products Ltd (TTPL), a Kerala State Govt. Undertaking, manufactures titanium dioxide pigment by sulphate process at its plant at Kochuveli, Thiruvananthapuram. Ilmenite is reacted with sulphuric acid in digesters and a porous cake is formed. The mass in the solid form is dissolved in dilute sulphuric acid to get titanium in solution as titanium oxysulphate along with other metallic ingredients in ilmenite as their sulphate. The liquor is reduced using scrap iron, when ferric iron gets completly reduced to the ferrous state. The liquor is clarified, concentrated and boiled to precipitate the titanium content as hydrated titania which is then filtered by vacuum filters and calcined. Sulphuric acid required for captive consumption is produced at site using elemental sulphur. Till recently TTPL was the only unit producing anatase grade titanium dioxide pigment in India. TTPL has proposals to expand its capacity to 27,000 tpy, modernise and diversify in stages to produce both anatase and rutile grades titanium dioxide pigment. DCW Ltd has plans to expand the synthetic rutile capacity to 70,000 tpy after installation of Iron Oxide Plant. Iron oxide pigment will be a value-added product from waste leach liquor. Tata Steel has proposed a project to produce 1,00,000 tonnes per year titanium dioxide from ilmenite mined from beach sands of Tirunelveli and Thoothukudi districts in southern Tamil Nadu. The NMDC has signed an MoU with KSIDC and IREL for setting up a synthetic rutile plant in Kerala. The company has applied for prospecting licences in various areas in Odisha, Kerala and Tamil Nadu and sought Swedish technology for mineral separation plant. The Beach Minerals Co. Pvt. Ltd also has plans for production of synthetic rutile from ilmenite. Presently, it only has facility of pilot plant. M/s V. V. Mineral has plans to set up a 5 lakh tpy titanium pigment plant. The project is at approval stage.

46-7

ILMENITE AND RUTILE

Present domestic titanium metal production is negligible. KMML has set up a 500 tpy titanium sponge plant with Defence Metallurgical Research Laboratory (DMRL) technology and first batch of titanium was delivered in September 2011. The plant will be further expanded to 1,000 tpy. IREL is to set up a 10,000 tpy titanium sponge plant at OSCOM for which proposals have been invited on build, operate and own basis. IREL intends to set up titanium slag plant based on ilmenite from OSCOM, Odisha and has signed an MoU with NALCO for this purpose.

Depending upon feasibility, further value addition to TiO 2 pigment and titanium sponge will be taken up subsequently. Titanium sponge is imported by Midhani for further processing in the country. The available data on plantwise capacities & production of synthetic rutile and TiO 2 pigement from 2008-09 to 2010-11are given in Table-7. However, domestic production of synthetic rutile and TiO 2 pigment is estimated at 100,000 tpy and 60,000 tpy, respectively.

Table 7 : Installed Capacity and Production of Synthetic Rutile/Titanium Dioxide Pigement, 2008-09 to 2010-11

(In tonnes) Plant Location Specification Installed capacity (tpy) 2008-09 Total 243000 (Synthetic rutile) 75300 (TiO2 Pigment) Orissa Sands Complex, Dist. Ganjam, Odisha. Chavara, Dist. Kollam, Kerala. 90.5% TiO2 (min) 92%-93% TiO2 100000 (Synthetic rutile) 62169 54145 NA 35486 27566 Production 2009-10 70584 61498 NA 35908 36384 2010-11 80936 49586# NA 36879 44761

IREL KMML

50000 (Synthetic rutile) 40000@ (TiO2-Chloride Process) 48000 (Synthetic rutile) 45000 (Synthetic rutile)

DCW Ltd

Sahupuram, Dist. Thoothukudi, Tamil Nadu. Edayar, Dist. Ernakulam, Kerala.

95% TiO2

CMRL

96.5% TiO2

34603

34200

36175

TTPL

17500 Kochuveli, Dist. 97.5% TiO2 Thiruvananthapuram, Kerala. (TiO2-Sulphate Process) 13000 98% TiO2 (min) (TiO2-Sulphate Process) NA 4800 (TiO2-Sulphate Process)

7731 10928

12686 12460

12383 NA

VVTi Pigments Thoothukudi, Tamil Nadu. Pvt. Ltd* (formerly Kilburn Chemicals) Kolmak Chemicals Ltd Kalyani, Dist. Nadia, West Bengal.

Nil

444

324

Source: Department of Atomic Energy, Mumbai and individual companies. Note: KMML captively consumes synthetic rutile while CMRL and DCW export synthetic rutile. * Data relates to calendar year. @ Under expansion to 60,000 tpy capacity. # Excluding Kilburn Chemicals.

USES

Ilmenite is used mainly for the manufacture of ferrotitanium and synthetic rutile; i.e., titanium dioxide, a white pigment. Because of a unique combination of its superior properties of high refractive index, low specific gravity, high hiding power and opacity and non-toxicity, titanium dioxide finds application for the manufacture of all types of white and pastle shades of paints, whitewalled tyres, glazed papers, plastics, printed fabrics, flooring materials like linoleum, pharmaceuticals, soaps, face powders and other cosmetic products, etc. Because of its non-toxic nature, it is used in cosmetics,

pharmaceuticals, and even added to foodstuffs as well as in toothpastes to improve their brightness. Titanium dioxide is used in the manufacture of many sunscreen lotions and creams because of its non-toxicity and ultra violet absorption properties. Synthetic rutile is used for coating welding electrodes as flux component and for manufacture of titanium tetrachloride which in turn is used in making titanium sponge. Synthetic rutile is also used as ingredient of special abrasives. Titanium metal is a versatile material with exceptional characteristics. The lightness, strength and durability of the metal make it an essential metal for the aerospace industry. It is also used in desalination and power

46-8

ILMENITE AND RUTILE

generation plants and corrosive chemical industries because of its inertness and resistance to corrosion and high thermal conductivity. Its non-reactive property makes titanium metal one of the few materials that can be used in the human body for orthopaedic use and in pacemakers.

private sector with or without foreign companies subject to conditions stipulated. This will encourage further exploitation of mineral deposits through a judicious mix of public & private sector participation including foreign collaboration. The ceiling on FDI on mining of titanium minerals has been raised to 100 percent. Joint ventures with foreign participation were being pursued by IREL for production of valueadded products, keeping in view the Beach Sand Mineral Policy of the Government. The minerals ilmenite and rutile were grouped as 'prescribed substances' as per notifications issued under the Atomic Energy Act, 1962. However, as per the revised list of Prescribed Substances, Prescribed Equipment and Technology notified by Department of Atomic Energy vide S.O.No.61(E), dated 20.1.2006, the titanium ore minerals like ilmenite, rutile and leucoxene have been delisted as prescribed substances by the Department of Atomic Energy subject to the note as below: "These minerals shall remain prescribed substances only till such time the policy on Exploration of Beach Sand Minerals notified vide Resolution No.8/1(1)/97PSU/1422, dated 6.10.1998, is adopted/revised/modified by the Ministry of Mines or till 1.1.2007, whichever occurs earlier and shall cease to be so thereafter". As per the Foreign Trade Policy, 2009-2014 and the policy on export and import, titanium ores and concentrates under heading 2614 (comprising ilmenite unprocessed and upgraded; i.e., beneficiated ilmenite including ground ilmenite) and rutile sand can be imported/exported freely.

CONSUMPTION

The reported ilmenite consumption decreased to 189,900 tonnes in 2010-11 as compared to 208,900 tonnes in 2009-10. Bulk ilmenite was consumed for manufacturing synthetic rutile (99.7%), followed by ferro-alloys and welding electrode industry. The reported consumption of rutile in 2010-11 was 18,700 tonnes compared to 18,600 tonnes in 2009-10. Bulk consumption was in paint industry followed by electrode industry. In 2010-11, the reported consumption of ferro-titanium was 1,250 tonnes. About 82% consumption was in iron and steel industry and 18% in alloy steel and foundry industries (Table - 8). Table 8 : Consumption of Ilmenite, Rutile and Ferro-Titanium, 2008-09 to 2010-11 (By Industries)

(In tonnes) Industry ILMENITE All Industries Electrode Ferro-alloys Iron & Steel Paint Refractory Synthetic rutile (Chemical) 116300 300(5) 300(3) 800(1) ++(2) ++(1) 114900(4) 208900 300(5) 300(4) (1) ++(2) ++(1) 208300(5) 18600 1700(12) 16300(10) 300(3) 300(13) 1117 154(7) 963(9) 189900 300(5) 300(4) (1) ++(2) ++(1) 189300(5) 18700 1700(12) 16400(11) 300(3) 300(13) 1250 220(7) 1030(9) 2008-09 2009-10(R) 2010-11(P)

SUBSTITUTES

There are no cost-effective substitutes for titanium dioxide pigments. Synthetic rutile made from ilmenite can be substituted for natural rutile. Nickel steels, stainless steels and some non-ferrous metal alloys can sometimes replace titanium alloys in industrial uses although at the expense of performance or economics. Tungsten carbide competes with titanium carbide for surface cutting machine tools. Titanium slag competes with ilmenite and rutile. Environmental awareness indicates that titanium dioxide plants are likely to use chloride technology in future as it produces much less quantity of waste products. Synthetic rutile or slag (made from ilmenite) is likely to be used as feed in increasing amount. There is also a strong pressure to reduce the radioactive content of feed stocks because it affects the marketability of beach sand ilmenite. Titanium alloys may be replaced in aerospace applications by lithiumaluminium alloys or carbon-epoxy composites.

RUTILE All Industries 18300 Electrode 1700(12) Paint 16100(10) Paper 300(3) Others (Cosmetic, electrical, rubber) 200(13) FERRO-TITANIUM All Industries 1284 Alloy steel & foundry 244(7) Iron & steel 1040(8)

Figures rounded off. Data collected on non-statutory basis. Figures in parentheses denote the number of units in organised sector reporting* consumption. (*Includes actual reported consumption and/or estimates made wherever required).

POLICY

The Government of India had notified in October 1998, a policy on exploitation of beach sand minerals in the country, which inter alia allows participation of

46-9

ILMENITE AND RUTILE

WORLD REVIEW

World resources of anatase, ilmenite and rutile are more than 2 billion tonnes. World reserves of ilmenite are estimated at 650 million tonnes in terms of TiO2 content. Major reserves are in China (31%), Australia (15%), India (13%), South Africa (10%), Brazil (7% ), Madagascar and Norway (6% each ) and Mozambique (2%). The world reserves of rutile are 42 million tonnes in terms of TiO2 content. Major rutile reserves are located in Australia (43%), followed by South Africa (20%), India (18%), Siera Leone (9%) and Ukraine (6%). World production of ilmenite and rutile concentrates was 10.3 million and 0.8 million tonnes, respectively, in 2010. Canada contributed 23% of ilmenite production, followed by Australia (13%) and South Africa (12%) . Australia produced 54% of world rutile output, followed by South Africa with 17% and Ukraine 13%. World reserves and production of titanium minerals; viz, ilmenite and rutile, are furnished in Tables - 9 to 11, respectively. Table 9 : World Reserves of Ilmenite and Rutile (By Principal Countries)

(In '000 tonnes of contained TiO 2 ) Country Reserves Ilmenite Wo r l d : To t a l ( I l m e n i t e + R u t i l e ) World : Total (Rounded) Australia Brazil Canada China India* Madagascar Mozambique Siera Leone Norway South Africa Ukraine USA Vietnam Other countries : 690000 42000 18000 1200 7400 480 3800 8300 2500 @ 400 Rutile

Table 10 : World Production of Ilmenite (By Principal Countries)

(In '000 tonnes) Country World: Total (wt. of concs) All form of TiO 2

(e)

2008 11100 5900 2060 126 2600 1080 676 329 915 1360 600 200 1154

2009 10000 5400 1626 137 2000 900 680 471 671 1445 600 200 1270

2010 10300 5700 1313 160 2400 1000 680 678 864 1200 e 600 200 1205

Australia Ilmenite Leucoxene Canada China (e) India* Mozambique Norway South Africa Ukraine USA

(e) (e) e#@

Other countries

Source : World Mineral Production, 2006-2010. Note : Some ilmenite is converted to synthetic rutile in Australia, India, Japan, Taiwan and USA. @ Canada produces some ilmenite which is sold as such and not processed into slag; but tonnages are small. * India's production of ilmenite in 2008-09, 2009-10 a n d 2 0 1 0 - 11 w a s 5 8 8 , 1 2 7 t o n n e s , 7 1 3 , 6 0 5 t o n n e s and 663,217 tonnes, respectively.

650000 100000 43000 31000 200000 85000 40000 16000 37000 63000 5900 2000 1600 26000

Table 11 : World Production of Rutile (By Principal Countries)

(In '000 tonnes) Country World: Total (wt. of concs) Australia India* South Africa (e) Sierra Leone Ukraine (e) Other countries 2008 2009 2010

700 318 19 132 79 100 52

634 302 20

e

800 430 20 e 135 68 100 47

134 64 100 14

Source : Mineral Commodity Summaries, 2012 @ Included with ilmenite.. * As per the NMI Unit,IBM, the total resources of titanium minerals in India are estimated at about 394 million tonnes.

Source: World Mineral Production, 2006-2010. * India's production of rutile in 2008-09, 2009-10 a n d 2 0 1 0 - 11 w a s 1 9 , 0 9 8 t o n n e s , 1 8 , 5 7 3 t o n n e s , and 26,593 tonnes, respectively.

46-10

ILMENITE AND RUTILE

World production of TiO2 contained in titanium mineral concentrates increased by 13% compared with that of 2009. The leading sources of world imports of titanium mineral concentrates were Australia, Canada, and South Africa.

exploration and prefeasibility studies of its heavy mineral deposits in the Eucla Basin, also in Western Australia. Astron Ltds Donald mining project was approved by the Industries Department of Victoria, and mine and plant designs were completed during the year.

Metal

Commercial production of titanium metal involves the chlorination of titanium-containing mineral concentrates to produce titanium tetrachloride (TiCl4), which is reduced with magnesium (Kroll process) or sodium (Hunter process) to form a commercially pure form of titanium metal. As the metal is formed, it has a porous appearance and is referred to as sponge. Titanium ingot and slab are produced by melting titanium sponge or scrap or a combination of both, usually with various other alloying elements.

Canada

Titanium Corp. commissioned a demonstration pilot plant at Canmet testing facilities of the Canadian Government in Devon, Alberta. Pilot studies were conducted during 2010. Additional studies are planned for 2011. Argex Mining Inc. was proceeding with exploration and development of its La Blahe titaniferous magnetite project near Bai-Comeau in Quebec.

Chile

White Mountain Titanium Corp. (WMT) conducted drilling and pilot plant feasibility studies at its Cerro Blanco rutile deposit in 2010. In 2011, WMT was to conduct a final engineering feasibility study for a 5 to 6 million tpy mining operation.

Pigment

Global TiO2 pigment production capacity was estimated to be 5.7 million tonnes per year. TiO2 pigment produced by either process is categorised by crystal form as either anatase or rutile. Rutile pigment is less reactive with the binders in paint when exposed to sunlight than is the anatase pigment and is preferred to use in outdoor paints. Anatase pigment has a bluer tone than rutile, is somewhat softer, and is used mainly in indoor paints and in paper manufacturing. Depending on the manner in which it is produced and subsequently finished, TiO2 pigment can exhibit a wide range of functional properties, including dispersion, durability, opacity, and tinting.

China

As per the Chinese Titanium Association, the top 14 titanium sponge producers increased production capacity to 103,500 tpy in 2010 and produced 57,800 tonnes sponge, 42% more than that in 2009. Chinas ingot and mill products production capacity also increased. Increased consumption of titanium concentrates was supplemented by increased imports of titanium concentrates. In 2010, Chinas imports of titanium concentrates rose to 2.04 million tonnes from 1.07 million tonnes in 2009. Chinese authorities approved Panzhihua Groups plans to develop vanadium and titanium deposits in Sichuan Province. Panzhihua planned to increase production capacity of titanium mineral concentrates to 500,000 tpy, TiO2 pigment to 200,000 tpy and titanium sponge to 15,000 tpy.

Australia

Matilda Zircon Ltd continued development of heavy-minerals deposits in the Northern Territory and Western Australia. Matilda Zircon will supply Tricoastal Minerals Co. of China all heavy-mineral concentrate in exchange of assistance in development of the Lethbridge Mine, which began production in 2010. Mining at Keysbrook was expected to begin by 2010-end after approval from Western Australian Environment Ministry. Tiwest Pty Ltd commissioned a 40,000 tpy expansion project at its Kwinana TiO2 pigment plant in Western Australia, raising production capacity to 150,000 tpy. Gunson Resources Ltd completed a feasibility study for its Coburn heavy minerals project in Western Australia. Diatreme Resources Ltd was conducting

Japan

Toho Titanium Co. Ltd expanded its titanium sponge production capacity to 25,200 tpy and completed construction of a new 12,000 tpy plant at Wakamatsu in Fukuoka. OSAKA Titanium technologies Co. Ltd restarted plans to increase capacity at its Amagasaki titanium sponge plant to 38,000 tpy.

46-11

ILMENITE AND RUTILE

Kazakhstan

Ust-Kamenogorsk Titanium-Magnesium Plant (UKTMP) is the sole producer of titanium sponge in Kazakhstan. It commissioned a new 16,000 tpy capacity VAR ingot production plant producing commercially pure and alloy ingot in 2010 in eastern Kazakhstan.

Sierra Leone

Titanium Resources Group Ltd (TRG) (now renamed Sierra Rutile Ltd) had plans to expand its production. The expansion was expected to be completed in 2011 followed by a significant increase in production in 2012 as a result of the completion of process improvements.

Madagascar

QIT Madagascar Minerals SA (QMM) was ramping up its 700,000 tpy capacity mineral sands project near Mutamba. In 2010, QMM produced 287,000 tonnes ilmenite and planned to produce 473,000 tonnes in 2011.

South Africa

Rio Tintos tailings treatment facility at Richards Bay Minerals heavy minerals operation was nearing completion in 2010-end and was scheduled to begin production in early-2011. The facility will recover heavy mineral concentrates, including ilmenite and rutile from about 30 years' accumulation of mine tailings.

Mozambique

Kenmare Resources plc was increasing heavy minerals production at its Moma operation to capacity. At 2010-end, Kenmare was proceeding with another expansion plan to increase production capacity by about 50%.

Ukraine

Velta LLC plans to begin production at the Birzulvovske mining operation near Korobchino, Kirovograd Oblast in 2012 with initial capacity of 180,000 tpy ilmenite.

Norway

Nordic Mining ASA was developing a rutilebearing eclogite deposit at Engebfjellet in Sogn and Fjordane County.

FOREIGN TRADE

Exports

As per the data from DGCI&S, exports of titanium ores & conc. rose to 1.89 million tonnes in 2010-11 as compared to 0.46 million tonnes in the preceding year. Exports in 2010-11 comprised almost entirely ilmenite. Besides, rutile (3,688 tonnes) and other titanium ores (3,564 tonnes) were also exported. Main destinations were China (67%), Japan (17%) and Netherlands (6%). Exports of titanium and alloys (including waste & scrap) were 216 tonnes in 2010-11 as compared to 90 tonnes in the previous year. Exports were mainly to USA and UK. Exports of tiatinum oxide and dioxide (total) increased to 57,999 tonnes in 2010-11 from 28,142 tonnes in 2009-10. Out of total exports in 2010-11, those of titanium dioxide were 6,868 tonnes and other titanium oxides were 51,131 tonnes . Exports were mainly to Japan (34%), Singapore (33%) and China (15%) (Tables-12 to 19).

Russia

ARZM Uranium Holding Co. continued development of the Lukoyanovskoye heavy minerals sands deposit near Nizhny Novgorod. By 2014, the company planned to begin producing up to 35,000 tpy ilmenite and 5,000 tpy rutile. VSMPO-AVISMA Corp. has resumed plans to increase titanium sponge production capacity to 44,000 tpy by 2015.

Senegal

A feasibility study of Mineral Deposits Ltds Grande Cote heavy minerals deposit was completed in 2010. Construction of the mine and separation plants was expected to begin in 2011 and initial production was scheduled for 2013. On commissioning, the company expected to produce an average of 575,000 tpy ilmenite, 80,000 tpy zircon, 11,000 tpy leucoxene and 6,000 tpy rutile.

46-12

ILMENITE AND RUTILE

Imports

As per the data from DGCI&S, imports of titanium ores & conc. rose sharply to 66,759 tonnes in 2010-11 as compared to 32,104 tonnes in the preceding year. Out of total imports of titanium ores & conc. in 2010-11, those of ilmenite were 48,747 tonnes, rutile 13,390 tonnes and other titanium ores were 4,622 tonnes. Main suppliers were Mozambique (67%) and Australia (17%). Imports of titanium and alloys (including waste & scrap) were 822 tonnes in 2010-11 as compared to 1,745 tonnes in the previous year. Imports were mainly from Japan, China, USA and Russia. Imports of titatinum oxide and dioxide (total) were 18,694 tonnes in 2010-11 as compared to 15,453 tonnes in the preceding year. Bulk of these imports were of titanium dioxide (18,295 tonnes) and those of other oxides were 399 tonnes in 2010-11. Imports were mainly from China (24%), USA (18%), Germany (13%), Rep. of Korea (11%) and Czech Republic (6%) (Tables 20 to 27).

Table 13 : Exports of Titanium Ores & Conc. (Ilmenite) (U) (By Countries)

2009-10 Country Qty (t) All Countries China Japan Netherlands Malaysia Korea, Rep. of Poland Singapore Germany Nepal Chinese Taipei/ Taiwan Other countries 463625 248156 56725 102424 34800 12500 4120 4900 ++ Value (` '000) 2506478 932434 851783 407606 114018 57744 123037 19849 7 Qty (t) 1886469 1274808 326558 113860 68230 56260 40240 2338 4032 14 52 77 Value (` '000) 9517746 6148480 2044512 512555 317044 203452 194162 69896 24630 2058 467 490 2010-11

Source: DGCI & S, Kolkata. (U): Under Reference

Table 12 : Exports of Titanium Ores & Conc. : Total (U) (By Countries)

2009-10 Country Qty (t) All Countries China Japan Netherlands Malaysia Korea, Rep. of Poland Singapore Iran Bangladesh Germany 464947 249174 56767 102424 34980 12500 4120 26 20 4900 Value (`000) 2526109 940461 852670 407606 121309 57744 123037 786 827 19849 Qty (t) 1893721 1277686 326561 114049 68258 56380 40240 2338 1140 823 4134 Value (` '000) 9678965 6166717 2045138 519022 318027 208854 194162 69896 35900 31477 28694 2010-11

Table 14 : Exports of Titaniu m Ores & Conc. (Rutile) (U) (By Countries)

2009-10 Country Qty (t) All Countries Iran Bangladesh Ukraine Philippines Netherlands Saudi Arabia Korea, Rep. of Germany Kenya UAE Other countries 382 26 20 3 180 7 2 144 Value (` 000) 14399 786 827 137 7291 301 60 4997 Qty (t) 3688 1140 814 441 420 189 196 120 102 74 85 107 2010-11 Value (` 000) 132424 35900 31101 18037 14998 6467 6311 5401 4064 3069 2582 4494

Source: DGCI & S, Kolkata. (U): Under Reference

Source: DGCI & S, Kolkata. (U): Under Reference

46-13

ILMENITE AND RUTILE

Table15 : Exports of Titanium Ores & Conc. (Others) (U) (By Countries)

2009-10 Country Qty (t) All Countries China Russia Thailand Ukraine Japan Bangladesh Brazil Indonesia Other countries 940 918 ++ 22 Value (` '000) 5232 3930 107 1195 Qty (t) 3564 2850 140 480 48 3 9 24 10 ++ Value (` '000) 28795 17202 6067 2295 1900 626 376 263 65 1 2010-11

Table17 : Exports of Titanium Oxide & Dioxide : Total (By Countries)

2009-10 Country Qty (t) All Countries 28142 Japan Singapore China Turkey Italy USA Chinese Taipei/ Taiwan Spain Germany UAE Other countries ++ 517 ++ 175 3545 25 53012 14 22918 282982 3157 640 568 605 2007 115722 84581 73569 62727 177641 8649 10700 1281 78 952 2245 Value (` '000) 1330398 352356 317665 39753 4844 99069 157760 Qty (t) 57999 19464 18876 8480 1573 1100 1529 Value (` '000) 2426518 646630 561291 254182 195700 133415 121060 2010-11

Source: DGCI & S, Kolkata. (U): Under Reference

Table16 : Exports of Titanium & Alloys (Incl. Waste & Scrap) (By Countries)

2009-10 Country Qty (t) All Countries Thailand U SA Norway UK Philippines South Africa Brunei Saudi Arabia Singapore UAE Other countries 90 2 ++ 3 1 ++ ++ ++ 14 4 4 62 Value (` '000) 382639 3438 2500 37677 6527 3594 371 927 107219 22024 9526 188836 Qty (t) 216 15 95 2 61 1 29 ++ 2 2 3 6 Value (` '000) 185647 43037 32961 20999 20812 15799 7974 6207 5662 5459 4046 22691 2010-11

Source: DGCI & S, Kolkata.

Table18 : Exports of Titanium Dioxide (By Countries)

2009-10 Country Qty (t) All Countries Turkey Italy Japan Spain Germany UAE U SA Singapore Iran Portugal Other countries 5941 17 844 1058 517 169 1243 300 662 1131 Value (` '000) 579449 1097 87174 103341 53012 22530 92881 28831 69876 120707 Qty (t) 6868 1420 974 781 620 568 575 437 344 224 120 805 Value (` '000) 809501 186741 117802 86294 83905 73508 59874 37558 30833 24673 15101 93212 2010-11

Source: DGCI & S, Kolkata.

Source: DGCI & S, Kolkata.

46-14

ILMENITE AND RUTILE

Table19 : Exports of Titanium Oxides (Other than Titanium Dioxide) (By Countries)

2009-10 Country Qty (t) All Countries Japan Singapore China Chinese Taipei/Taiwan USA Malaysia Italy Nigeria Turkey Brazil Other countries 1002 624 108 142 61 1032 64879 36140 11896 4185 3745 56787 3157 1092 520 126 204 153 120 84 115722 83502 32351 15612 9680 8960 4015 4775 22201 7591 10400 1241 Value (` '000) 750949 249015 288834 35468 Qty (t) 51131 18683 18532 8460 Value ( ` '000) 1617017 560336 530458 251606 2010-11

Table21 : Imports of Titanium Ores & Conc. (Ilmenite) (By Countries)

2009-10 Country Qty (t) All Countries Mozambique Malaysia Sri Lanka Other countries 11137 8505 42 2080 510 Value (` '000) 68649 44581 1009 7560 15499 Qty (t) 48747 44578 1950 2219 Value (` '000) 287449 266494 12039 8916 2010-11

Source: DGCI & S, Kolkata.

Source: DGCI & S, Kolkata.

Table22 : Imports of Titanium Ores & Conc. (Rutile) (By Countries)

2009-10 Country Qty (t) All Countries Australia Sri Lanka 15239 7747 1436 828 3160 558 645 374 491 Value (` '000) 527866 264707 52157 28852 117681 20811 18811 8657 16190 Qty (t) 13390 9266 1425 1229 595 248 250 154 125 48 50 ++ Value (` '000) 432741 289832 47608 44417 25054 8324 6527 5179 4273 1079 419 29 2010-11

Table20 : Imports of Titanium Ores & Conc. : Total (By Countries)

2009-10 Country Qty (t) All Countries Australia Mozambique Sri Lanka South Africa Ukraine Malaysia Vietnam China Sierra Leone Saudi Arabia Other countries 32104 9918 8505 4999 1166 3564 488 970 558 1936 Value (` '000) 747639 331457 44581 81946 39217 131377 10804 27959 20811 59487 Qty (t) 66759 11550 44578 3818 1721 1616 1998 450 309 248 125 346 Value (` '000) 861652 358684 266494 62253 60318 57617 13118 11811 10799 8324 4273 7961 2010-11

South Africa Ukraine Sierra Leone Vietnam China Saudi Arabia Malaysia Germany Other countries

Source: DGCI & S, Kolkata.

Source: DGCI & S, Kolkata.

46-15

ILMENITE AND RUTILE

Table23 : Imports of Titanium Ores & Conc. (Others) (By Countries)

2009-10 Country Qty (t) All Countries Australia Ukraine South Africa Sri Lanka China Vietnam Thailand UAE Canada Unspecified Other countries 5728 2009 404 314 1483 325 1046 75 72 Value (` '000) 151124 62133 13696 9575 22230 9148 31031 2173 1138 Qty (t) 4622 2284 1021 492 174 155 200 141 50 26 56 23 Value ( ` '000) 141462 68852 32563 15901 5728 5620 5284 2892 1216 873 1837 696 2010-11

Table25 : Imports of Titanium Oxide & Dioxide: (By Countries)

2009-10 Country Qty (t) All Countries USA China Germany Korea, Rep. of Japan Czech Republic Australia Chinese Taipei/Taiwan Malaysia Singapore 522 642 501 1876 58000 66809 56049 177176 566 506 435 2126 71122 61048 52326 246044 15453 2812 1918 2361 2237 600 1339 645 Value (` '000) 1691888 323938 147842 335215 222724 90157 143129 70849 Qty (t) 18694 3416 4344 2510 1984 871 1163 773 Value ( ` '000) 2148503 432564 392807 337573 204507 134008 123491 93013 2010-11

Source: DGCI & S, Kolkata.

Other countries

Source : DGCI & S, Kolkata.

Table24 : Imports of Titanium & Alloys (Incl. Waste & Scrap) (By Countries)

2009-10 Country Qty (t) All Countries China USA Japan Ukraine Russia Belgium France UK Italy Germany Other countries 1745 158 473 665 6 118 3 209 35 30 12 36 Value (` '000) 3069414 195326 524724 1385706 13162 167780 2373 509963 74549 96013 25557 74261 Qty (t) 822 224 78 254 35 64 17 12 16 32 13 77 Value (` '000) 1135500 226013 204967 194795 155480 86906 58999 37497 32201 29434 22058 87150 2010-11

Table26 : Imports of Titanium Dioxide (By Countries)

2009-10 Country Qty (t) All Countries USA China Germany Korea, Rep. of Japan Czech Republic Australia Chinese Taipei/Taiwan Malaysia Singapore Other countries 522 642 500 1716 58000 66809 54770 168548 546 506 435 1925 68404 61048 52320 222996 15174 2771 1917 2289 2237 596 1339 645 Value (` '000) 1656308 318532 143888 323630 222647 85506 143129 70849 Qty (t) 18295 3356 4343 2426 1964 868 1163 763 Value (` '000) 2093764 424521 389550 324789 202791 132145 123491 91709 2010-11

Source: DGCI & S, Kolkata.

Source: DGCI & S, Kolkata.

46-16

ILMENITE AND RUTILE

Table27 : Imports of Titanium Oxides (Other than Titanium Dioxides) (By Countries)

2009-10 Country Qty (t) All Countries France Germany USA China Italy 279 72 41 1 120 Value (` '000) 35580 11585 5405 3954 4918 4651 77 37 4953 Qty (t) 399 111 84 60 1 88 20 3 20 10 1 1 Value (` '000) 54739 19627 12784 8043 3257 3066 2718 1863 1715 1304 185 177 2010-11

FUTURE OUTLOOK

The major chunk of consumption of ilmenite is for the manufacture of synthetic rutile. The future demand of ilmenite during the 12th Plan Period at the GDP growth rate of 8%, 9% and 10% is estimated at 3.19 lakh, 3.27 lakh and 3.35 lakh tonnes, respectively, as per the Report of Working Group on Mineral Exploration and Development (other than coal & lignite) for the 12th Five Year Plan (2012 - 17); Planning Commission of India. Demand for rutile for next five years is projected at 44,000 tpy to 45,000 tpy as per the GDP growth rate of 8%, 9% and 10%. The production projected is 30,000 tpy as per the Working Group. The Working Group has observed that no substantial progress in exploration activities for Beach Minerals was witnessed during the 11th Plan and has stressed on the need to take substantive steps to develop beach sand reserves of the country to its full potential by adopting suitable exploration strategy with modern techniques.

Chinese Taipei/Taiwan Japan Korea, Rep. of Australia UK Other countries 4 ++ ++ 41

Source: DGCI & S, Kolkata.

46-17

Anda mungkin juga menyukai

- Solutions Manual to accompany Engineering Materials ScienceDari EverandSolutions Manual to accompany Engineering Materials SciencePenilaian: 4 dari 5 bintang4/5 (1)

- Alumina to Zirconia: The History of the CSIRO Division of Mineral ChemistryDari EverandAlumina to Zirconia: The History of the CSIRO Division of Mineral ChemistryPenilaian: 1 dari 5 bintang1/5 (1)

- AJISH ProjectDokumen70 halamanAJISH ProjectveeerajBelum ada peringkat

- Indian Minerals Yearbook 2011 Provides Details on Laterite Resources and ProductionDokumen10 halamanIndian Minerals Yearbook 2011 Provides Details on Laterite Resources and Productiongoutham.n9307Belum ada peringkat

- Chapter Viii MiningDokumen21 halamanChapter Viii Miningsudiptoghosh1977Belum ada peringkat

- CHAPTER-4. Land Degradation - Mining and Quarrying - Edited version-DS PDFDokumen30 halamanCHAPTER-4. Land Degradation - Mining and Quarrying - Edited version-DS PDFRoshanRSVBelum ada peringkat

- E Book On Mining SectorDokumen70 halamanE Book On Mining Sectordpu2717Belum ada peringkat

- E-Book on Mining Sector: Structure, Role, and PoliciesDokumen70 halamanE-Book on Mining Sector: Structure, Role, and PoliciesKPrasanna Kumar VarmaBelum ada peringkat

- China Clay & Bauxite Mining in OrissaDokumen19 halamanChina Clay & Bauxite Mining in OrissaHimansu S M100% (1)

- Ch. 5 Minerals and Energy Resources Flash CardsDokumen36 halamanCh. 5 Minerals and Energy Resources Flash CardsSAIJEEVAN SATHISHBelum ada peringkat

- IMYB 2011 - Corundum & SapphireDokumen5 halamanIMYB 2011 - Corundum & SapphireAamr BkBelum ada peringkat

- DID Bauxite WMDokumen69 halamanDID Bauxite WMGeo Khader Abdul100% (1)

- Mining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaDokumen7 halamanMining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaIJAERS JOURNALBelum ada peringkat

- MRP MiningDokumen32 halamanMRP MiningAshish PatelBelum ada peringkat

- A Review of Seabed and Placer Mining Deposits in IndiaDokumen60 halamanA Review of Seabed and Placer Mining Deposits in IndiaSubin JoseBelum ada peringkat

- Imyb2011 - Expln & DevlptDokumen61 halamanImyb2011 - Expln & Devlptmujib uddin siddiquiBelum ada peringkat

- Economics Project ReportDokumen7 halamanEconomics Project ReportSnehal JoshiBelum ada peringkat

- Beach Mineral 109MN0585 PDFDokumen66 halamanBeach Mineral 109MN0585 PDFmanipalaniusaBelum ada peringkat

- 0 0 06 Jul 2015 1631449471prefeasibilityreportDokumen8 halaman0 0 06 Jul 2015 1631449471prefeasibilityreportHemant SharmaBelum ada peringkat

- Ibm - Gov.in - IMYB 2011 - Iron Ore PDFDokumen35 halamanIbm - Gov.in - IMYB 2011 - Iron Ore PDFdrrcc0761Belum ada peringkat

- Rare Earth Minerals Mining, Mineral Separation, and Its Value Addition in Kerala - An Overview T KarthikeyanDokumen6 halamanRare Earth Minerals Mining, Mineral Separation, and Its Value Addition in Kerala - An Overview T KarthikeyanS.Alec KnowleBelum ada peringkat

- Mining Industry ReportDokumen86 halamanMining Industry ReportanandvisBelum ada peringkat

- IJCRT2102369Dokumen12 halamanIJCRT2102369Sundar RajBelum ada peringkat

- WAWADokumen11 halamanWAWAkolo boloBelum ada peringkat

- Mining Sector in India: By:-Ritesh KumarDokumen7 halamanMining Sector in India: By:-Ritesh KumarRitesh KumarBelum ada peringkat

- Mineral Resources of Telangana State, India: The Way ForwardDokumen10 halamanMineral Resources of Telangana State, India: The Way ForwardSudheer DebbatiBelum ada peringkat

- 02 Jurnal IMJ June 2008Dokumen53 halaman02 Jurnal IMJ June 2008Laura JohnsonBelum ada peringkat

- A Study On The Ratio AnalysisDokumen81 halamanA Study On The Ratio AnalysisSujay SuranBelum ada peringkat

- Mineral and Power Resources LongDokumen7 halamanMineral and Power Resources Longsukritsarkar27Belum ada peringkat

- Discover the Resources of Laterite RockDokumen10 halamanDiscover the Resources of Laterite RockSubeesh SurendranBelum ada peringkat

- Mining Industry in India - An Overview: Mining Is The Extraction of Valuable Minerals or Other Geologicalmaterials FromDokumen14 halamanMining Industry in India - An Overview: Mining Is The Extraction of Valuable Minerals or Other Geologicalmaterials FromSaurabh MalooBelum ada peringkat

- Indian Minerals YearbookDokumen20 halamanIndian Minerals YearbookFarid RozaqBelum ada peringkat

- 01192015115007IMYB - 2013 - Vol III - Limestone 2013 PDFDokumen34 halaman01192015115007IMYB - 2013 - Vol III - Limestone 2013 PDFNishtha JainBelum ada peringkat

- Imyb2011 (03) - Arunachal PradeshDokumen3 halamanImyb2011 (03) - Arunachal Pradeshmujib uddin siddiquiBelum ada peringkat

- Mrunal (Yearbook) Thorium Mining For Nuclear Energy PrintDokumen2 halamanMrunal (Yearbook) Thorium Mining For Nuclear Energy Printrockstar104Belum ada peringkat

- Tungsten Mining and Production in IndiaDokumen8 halamanTungsten Mining and Production in IndiaVipin MohanBelum ada peringkat

- Exploration and Extraction of Minerals Mining LawDokumen25 halamanExploration and Extraction of Minerals Mining LawarjunBelum ada peringkat

- Minerals NcertDokumen19 halamanMinerals NcertSaiyan VegetaBelum ada peringkat

- Bhandara Dips 12-13Dokumen21 halamanBhandara Dips 12-13someshwar swamyBelum ada peringkat

- The Way Forward - Vision 2020Dokumen9 halamanThe Way Forward - Vision 2020Animesh SharmaBelum ada peringkat

- Mining in IndiaDokumen7 halamanMining in IndiaVivek DograBelum ada peringkat

- ©ncert Not To Be Republished: Appendix-IDokumen5 halaman©ncert Not To Be Republished: Appendix-IShreya SharmaBelum ada peringkat

- Indian Minerals Yearbook 2013: (Part-III: Mineral Reviews)Dokumen10 halamanIndian Minerals Yearbook 2013: (Part-III: Mineral Reviews)Ayush jhaBelum ada peringkat

- Limestone Mining RE LanareDokumen14 halamanLimestone Mining RE LanareChad DhirajBelum ada peringkat

- Mineral ResourcesDokumen33 halamanMineral ResourcesSubburaj ThiruvengadamBelum ada peringkat

- ChromiteDokumen16 halamanChromitebvhanji100% (2)

- Economic Mineral Deposits of PakistanDokumen12 halamanEconomic Mineral Deposits of PakistanOolasyar Khattak67% (12)

- India Mineral Report PDFDokumen38 halamanIndia Mineral Report PDFRohan KumarBelum ada peringkat

- 2013 - Vol III - Laterite 2013Dokumen9 halaman2013 - Vol III - Laterite 2013Zaheer AbbasBelum ada peringkat

- Chapter-5-Minerals and Energy Resources 1. What Are Minerals? What Is Its Importance?Dokumen25 halamanChapter-5-Minerals and Energy Resources 1. What Are Minerals? What Is Its Importance?Alok Kumar JhaBelum ada peringkat

- Karur District Industrial ProfileDokumen25 halamanKarur District Industrial ProfileMadhusudhanan RamaiahBelum ada peringkat

- The Indian Mining Sector: Effects On The Environment & FDI InflowsDokumen10 halamanThe Indian Mining Sector: Effects On The Environment & FDI InflowsMehul MandanakaBelum ada peringkat

- Beneficiation of Indian Heavy Mineral Sands - Some New Possibilities Identified by Tata SteelDokumen8 halamanBeneficiation of Indian Heavy Mineral Sands - Some New Possibilities Identified by Tata SteelSakthi KarthikyanBelum ada peringkat

- Ml-Ckl-I-Lime Stone-01Dokumen16 halamanMl-Ckl-I-Lime Stone-01Zubair KhanBelum ada peringkat

- Himachal Pradesh Mineral Policy, 2013Dokumen40 halamanHimachal Pradesh Mineral Policy, 2013BIJAY KRISHNA DASBelum ada peringkat

- Minerals Introduction GuideDokumen11 halamanMinerals Introduction GuideMonika JasujaBelum ada peringkat

- Summary of Part-1: Mining Industry in IndiaDokumen15 halamanSummary of Part-1: Mining Industry in IndiaRachelle A. ReadBelum ada peringkat

- Extractive Metallurgy 2: Metallurgical Reaction ProcessesDari EverandExtractive Metallurgy 2: Metallurgical Reaction ProcessesPenilaian: 5 dari 5 bintang5/5 (1)

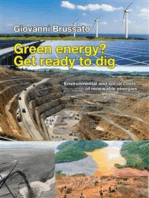

- Green energy? Get ready to dig.: Environmental and social costs of renewable energies.Dari EverandGreen energy? Get ready to dig.: Environmental and social costs of renewable energies.Penilaian: 5 dari 5 bintang5/5 (1)

- Atomic MineralsDokumen17 halamanAtomic MineralsMohan RajBelum ada peringkat

- A Study On Quality of Work Life Balance Among Employees in India Rare Earth Limited (IREL), Manavala KurichiDokumen11 halamanA Study On Quality of Work Life Balance Among Employees in India Rare Earth Limited (IREL), Manavala Kurichismilingeyes_nicBelum ada peringkat

- India's Major Mineral Resources and RegionsDokumen24 halamanIndia's Major Mineral Resources and Regionsayan mitraBelum ada peringkat

- India Mineral Yearbook 2011 - Ilmenite RutileDokumen17 halamanIndia Mineral Yearbook 2011 - Ilmenite RutileLe Hoang LongBelum ada peringkat

- Recruitment and Selection Process of Irel, Oscom: Under The Guidance ofDokumen19 halamanRecruitment and Selection Process of Irel, Oscom: Under The Guidance ofManoranjan BisoyiBelum ada peringkat

- A Project Report ON Working Capital Management & Financial Statement Analysis ATDokumen7 halamanA Project Report ON Working Capital Management & Financial Statement Analysis ATRohit PandeyBelum ada peringkat

- Industrial Visit of IreDokumen28 halamanIndustrial Visit of IreMILANBelum ada peringkat

- IrelDokumen29 halamanIrelvarghis_k_thomasBelum ada peringkat

- 24-30 AugustDokumen16 halaman24-30 AugustpratidinBelum ada peringkat

- Column Flotation TechnologyDokumen10 halamanColumn Flotation TechnologyCarlos de la TorreBelum ada peringkat

- Organization Study at Indian Rare Earths LTDDokumen63 halamanOrganization Study at Indian Rare Earths LTDBASIL GEORGE100% (4)

- IREL - Nuclear IndiaDokumen28 halamanIREL - Nuclear IndiaGanesh B NairBelum ada peringkat

- A Study On The Ratio AnalysisDokumen81 halamanA Study On The Ratio AnalysisSujay SuranBelum ada peringkat

- Indian Minerals Yearbook 2019: Kyanite, Sillimanite and AndalusiteDokumen13 halamanIndian Minerals Yearbook 2019: Kyanite, Sillimanite and AndalusiteChanduSaiHemanthBelum ada peringkat

- Uranium Thorium Indian Rare Earths IREDokumen16 halamanUranium Thorium Indian Rare Earths IRES.Alec KnowleBelum ada peringkat

- Beach Mineral 109MN0585 PDFDokumen66 halamanBeach Mineral 109MN0585 PDFmanipalaniusaBelum ada peringkat

- MonaziteDokumen20 halamanMonaziteachint GoelBelum ada peringkat

- Performance Management and PRP PresentationDokumen21 halamanPerformance Management and PRP PresentationSahil GouthamBelum ada peringkat

- HRM practices in a public sector case studyDokumen26 halamanHRM practices in a public sector case studyKothapalli SumanBelum ada peringkat