ACT3391 Spring 2013 Traditional HWItem Nos 1 To 5 Solutions

Diunggah oleh

Adrianna Nicole HatcherJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ACT3391 Spring 2013 Traditional HWItem Nos 1 To 5 Solutions

Diunggah oleh

Adrianna Nicole HatcherHak Cipta:

Format Tersedia

HOMEWORK - SPRING 2013 - ACT 3391

1. (0.5 point) Of what value is a common set of standards in financial accounting and reporting? A common set of standards applied by all businesses and entities provides financial statements that are reasonably comparable. 2. (1.5 points) a. Who issued Accounting Research Bulletins? The Committee on Accounting Procedure b. Who issued Opinions? The Accounting Principles Board c. Who issued Statements of Financial Accounting Standards? The Financial Accounting Standards Board 3. (0.5 point each) Write the best accounting word/phrase that describes the following. Write ONLY ONE word/phrase next to each item. A word/phrase can be used more than once. DO NOT ABBREVIATE. a. The national professional organization of practicing Certified Public Accountants (CPAs). American Institute of Certified Public Accountants b. This group is comprised of representatives from CPA firms and financial statement preparers. The groups purposes is to reach consensus on how to account for new and unusual financial transactions that may create differing financial reporting practices. Emerging Issues Task Force c. The common set of financial accounting standards. Generally Accepted Accounting Principles d. This term means that a company applies the same accounting treatment to similar events from period to period.

Consistency

4. (1 point) What was the FASBs primary goal in developing the Codification? To provide in one place all the authoritative literature related to a particular topic. 5. (8 points) Lobnitz Service Companys balance sheet as of 01-01-11 is presented below: a) Paid back 10% of its long-term debt. L Long-term debt $50,000 A Cash $50,000 b) Received $25,000 for the issuance of an additional 1,000 shares of common stock. A Cash $25,000 EQ Common stock and additional paid-in-capital $25,000 c) Purchased $50,000 of office furniture (property, plant, and equipment) on a credit basis. A Property, plant, and equipment $50,000 L Accounts payable $50,000 d) Performed $200,000 of services for customers on a cash basis. A Cash $200,000 R Service revenue $200,000 e) Performed $800,000 of services for customers on a credit basis. A Accounts receivalbe $800,000 R Service revenue $800,000 f) Incurred and paid $175,000 of wage and salary expenses. EX Wage and salary expenses $175,000 A Cash $175,000 g) Paid off 100% of the outstanding accrued property taxes payable. L Accrued property taxes payable $20,000 A Cash $20,000

1

h) Used up 80% of the prepaid office supplies. Office supplies expense $20,000 Prepaid office supplies $20,000 i) Performed the necessary services to earn 75% of its unearned service revenue balance. L Unearned service revenue $30,000 R Service revenue $30,000 j) Collected $900,000 of accounts receivable. A Cash $900,000 A Accounts receivable $900,000 k) Recorded $25,000 of depreciation expense. EX Depreciation expense $25,000 A Accumulated depreciation $25,000 l) Incurred and paid $20,000 of interest expense. EX Interest expense $20,000 A Cash $20,000 m) Declared and paid $15,000 of dividends on its common stock. EQ Retained earnings $15,000 A Cash $15,000 Lobnitz Service Company Income Statement For the year ended December 31, 2011 EX A Service revenue Wage and salary expenses Office supplies expense Depreciation expense Interest expense Net income $1,030,000 175,000 20,000 25,000 20,000 $ 790,000 Lobnitz Service Company Balance Sheet As of December 31, 2011 Current assets Cash Accounts receivable Prepaid office supplies Non-current assets Property, plant, and equipment at cost Accumulated depreciation TOTAL ASSETS

$1,245,000 200,000 5,000 850,000 $ 150,000 $2,150,000

Current liabilities Accounts payable $ 310,000 Unearned service revenue 10,000 Non-current liabilities Long-term debt 450,000 Stockholders equity Common stock and additional paid-in-capital 225,000 Retained earnings 1,155,000 TOTAL LIABILITIES AND STOCKHOLDERS EQUITY $2,150,000

Anda mungkin juga menyukai

- Econ 3a Midterm 1 WorksheetDokumen21 halamanEcon 3a Midterm 1 WorksheetZyania LizarragaBelum ada peringkat

- Ac550 FinalDokumen4 halamanAc550 FinalGil SuarezBelum ada peringkat

- T1.Tutorials 1 Introduction To Fin STMDokumen4 halamanT1.Tutorials 1 Introduction To Fin STMmohammad alawadhiBelum ada peringkat

- Exam 1Dokumen17 halamanExam 1chel5353Belum ada peringkat

- Review of Ch 1 & 2 Key ConceptsDokumen46 halamanReview of Ch 1 & 2 Key ConceptsBookAddict721Belum ada peringkat

- Practice Exam 1gdfgdfDokumen49 halamanPractice Exam 1gdfgdfredearth2929100% (1)

- Financial Statements ExplainedDokumen36 halamanFinancial Statements ExplainedTakouhiBelum ada peringkat

- Assignment 01 Financial StatementsDokumen5 halamanAssignment 01 Financial StatementsAzra MakasBelum ada peringkat

- ACC121 FinalExamDokumen13 halamanACC121 FinalExamTia1977Belum ada peringkat

- Financial Accounting11Dokumen14 halamanFinancial Accounting11AleciafyBelum ada peringkat

- SOLUTIONS - Practice Final ExamDokumen12 halamanSOLUTIONS - Practice Final ExamsebmccabeeBelum ada peringkat

- Accounting Assignment PDFDokumen18 halamanAccounting Assignment PDFMohammed SafwatBelum ada peringkat

- ACCT5101Pretest PDFDokumen18 halamanACCT5101Pretest PDFArah OpalecBelum ada peringkat

- Module 4 - Balance Sheet and Income StatementDokumen23 halamanModule 4 - Balance Sheet and Income StatementMiel Ross Jader100% (1)

- CH 1 ProblemsDokumen8 halamanCH 1 Problemsbangun7770% (1)

- Accounting Week 1Dokumen4 halamanAccounting Week 1Muhammad Fikri MaulanaBelum ada peringkat

- ACCT 310 Fall 2011 Midterm ExamDokumen12 halamanACCT 310 Fall 2011 Midterm ExamPrince HakeemBelum ada peringkat

- Module 4 Balance Sheet and Income StatementDokumen23 halamanModule 4 Balance Sheet and Income StatementAna BretañaBelum ada peringkat

- Chapter 4 Sample BankDokumen18 halamanChapter 4 Sample BankWillyNoBrainsBelum ada peringkat

- Acct101 Practice Exam Chapters 1 and 2Dokumen15 halamanAcct101 Practice Exam Chapters 1 and 2leoeoa100% (2)

- Practice 4 - Statement of Cash FlowsDokumen8 halamanPractice 4 - Statement of Cash FlowsLLBelum ada peringkat

- Accounting 201 Midterm Practice ProblemsDokumen9 halamanAccounting 201 Midterm Practice ProblemsLương Thế CườngBelum ada peringkat

- Hho9e Ch01 SMDokumen101 halamanHho9e Ch01 SMWhitney NuckolsBelum ada peringkat

- Assignment # 2 MBA Financial and Managerial AccountingDokumen7 halamanAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenBelum ada peringkat

- ACC201 Seminar 1 Outline - Student Version - PDFDokumen4 halamanACC201 Seminar 1 Outline - Student Version - PDFmegankoh21Belum ada peringkat

- False (Only Profit Increases Owner's Equity Not Cash Flow)Dokumen6 halamanFalse (Only Profit Increases Owner's Equity Not Cash Flow)Sarah GherdaouiBelum ada peringkat

- Chapter3 Review QuestionsDokumen6 halamanChapter3 Review QuestionsMohamed HanyBelum ada peringkat

- Answers Chapter 4 QuizDokumen2 halamanAnswers Chapter 4 QuizZenni T XinBelum ada peringkat

- Introduction To Financial Accounting: Key Terms and Concepts To KnowDokumen16 halamanIntroduction To Financial Accounting: Key Terms and Concepts To KnowAmit SharmaBelum ada peringkat

- Famba6e Quiz Mod02 032014Dokumen4 halamanFamba6e Quiz Mod02 032014aparna jethaniBelum ada peringkat

- Old Exam Packet - Acct 284 ExamsDokumen25 halamanOld Exam Packet - Acct 284 ExamsHemu JainBelum ada peringkat

- FIN TestDokumen7 halamanFIN Testisidro3791Belum ada peringkat

- Aka Balance SheetDokumen5 halamanAka Balance Sheetmaj thuanBelum ada peringkat

- Chapter 1 AccountingDokumen9 halamanChapter 1 Accountingmoon loverBelum ada peringkat

- Lecture Notes Chapters 1-4Dokumen28 halamanLecture Notes Chapters 1-4BlueFireOblivionBelum ada peringkat

- Quiz 2Dokumen54 halamanQuiz 2Karthik Vee33% (3)

- Lecture 1 - Seminar QuestionsDokumen5 halamanLecture 1 - Seminar Questionsbehzadji7Belum ada peringkat

- NVCC Accounting ACC 211 EXAM 1 PracticeDokumen12 halamanNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2Belum ada peringkat

- CAT CUP 1 ELIMINATION ROUND RESULTSDokumen55 halamanCAT CUP 1 ELIMINATION ROUND RESULTSPeter PiperBelum ada peringkat

- Final - Problem Set FM FinalDokumen25 halamanFinal - Problem Set FM FinalAzhar Hussain50% (2)

- Revenue Recognition RulesDokumen9 halamanRevenue Recognition RulesShreeraj PawarBelum ada peringkat

- Additional Exam Practice QUESTIONSDokumen8 halamanAdditional Exam Practice QUESTIONSShaunny BravoBelum ada peringkat

- Dennis DePugh Accounting212Dokumen14 halamanDennis DePugh Accounting212John Perkins0% (1)

- Elliott Homework Week1Dokumen8 halamanElliott Homework Week1Juli ElliottBelum ada peringkat

- Exam 1 SI ReviewDokumen11 halamanExam 1 SI ReviewBukky AdeofeBelum ada peringkat

- BE210 TMA Financial AccountingDokumen9 halamanBE210 TMA Financial AccountingMuhammad Yaseen LakhaBelum ada peringkat

- 00-Text-Ch1 Additional Problems UpdatedDokumen3 halaman00-Text-Ch1 Additional Problems Updatedzombies_meBelum ada peringkat

- Accounting Chapter 1Dokumen5 halamanAccounting Chapter 1EthanBelum ada peringkat

- Kuis 1 Dira Septiani 4132101007Dokumen3 halamanKuis 1 Dira Septiani 4132101007Teresia AgustinaBelum ada peringkat

- IFRS Chapter 9 The Consolidated Statement of Financial PositonDokumen44 halamanIFRS Chapter 9 The Consolidated Statement of Financial PositonMahvish Memon0% (1)

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDokumen6 halamanManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariBelum ada peringkat

- Problems-Finance Fall, 2014Dokumen22 halamanProblems-Finance Fall, 2014jyoon2140% (1)

- Paper12 SolutionDokumen21 halamanPaper12 SolutionTW ALWINBelum ada peringkat

- Week 3Dokumen14 halamanWeek 3John PerkinsBelum ada peringkat

- 70259Dokumen6 halaman70259Mega Pop LockerBelum ada peringkat

- 3 - Analysis of Financial Statements 2Dokumen2 halaman3 - Analysis of Financial Statements 2Axce1996Belum ada peringkat

- Statement of Cash Flows: Preparation, Presentation, and UseDari EverandStatement of Cash Flows: Preparation, Presentation, and UseBelum ada peringkat

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionDari EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionBelum ada peringkat

- Governmental Accounting Agency Funds and Cash and Investment PoolsDokumen4 halamanGovernmental Accounting Agency Funds and Cash and Investment PoolsAdrianna Nicole HatcherBelum ada peringkat

- PresentationDokumen1 halamanPresentationAdrianna Nicole HatcherBelum ada peringkat

- Let Me Find Out 2 Many Why My Nigga Yaaaaaaaaaaaaaaaassssssssssssssssssss I'M So Bored UgggggggghhhhhhhhhhhhDokumen1 halamanLet Me Find Out 2 Many Why My Nigga Yaaaaaaaaaaaaaaaassssssssssssssssssss I'M So Bored UgggggggghhhhhhhhhhhhAdrianna Nicole HatcherBelum ada peringkat

- Soln 13Dokumen39 halamanSoln 13muhammad_akmal_39Belum ada peringkat

- Case Study 1Dokumen2 halamanCase Study 1Adrianna Nicole HatcherBelum ada peringkat

- 7 HomeworkDokumen3 halaman7 HomeworkAdrianna Nicole HatcherBelum ada peringkat

- Songs YASDokumen1 halamanSongs YASAdrianna Nicole HatcherBelum ada peringkat

- DB 1Dokumen1 halamanDB 1Adrianna Nicole HatcherBelum ada peringkat

- ACT3394 TDAA Fall 2012 Smithville InstructionsDokumen4 halamanACT3394 TDAA Fall 2012 Smithville InstructionsAdrianna Nicole HatcherBelum ada peringkat

- Soln 09Dokumen18 halamanSoln 09Adrianna Nicole HatcherBelum ada peringkat

- 2013 PreBusiness ChecksheetDokumen3 halaman2013 PreBusiness ChecksheetAdrianna Nicole HatcherBelum ada peringkat

- Traditional HW2Dokumen3 halamanTraditional HW2Adrianna Nicole HatcherBelum ada peringkat

- Chpater 6 - Debt Service FundDokumen7 halamanChpater 6 - Debt Service FundYinan LuBelum ada peringkat

- No Angel Song Favorite NowDokumen1 halamanNo Angel Song Favorite NowAdrianna Nicole HatcherBelum ada peringkat

- SongsDokumen1 halamanSongsAdrianna Nicole HatcherBelum ada peringkat

- 2013 PreBusiness ChecksheetDokumen3 halaman2013 PreBusiness ChecksheetAdrianna Nicole HatcherBelum ada peringkat

- Individual Written PaperDokumen8 halamanIndividual Written PaperAdrianna Nicole HatcherBelum ada peringkat

- Cos 2Dokumen2 halamanCos 2Adrianna Nicole HatcherBelum ada peringkat

- New TattooDokumen1 halamanNew TattooAdrianna Nicole HatcherBelum ada peringkat

- Chapter 9 SBMDokumen3 halamanChapter 9 SBMAdrianna Nicole HatcherBelum ada peringkat

- Qoutes From BookDokumen1 halamanQoutes From BookAdrianna Nicole HatcherBelum ada peringkat

- Philips NV Is A Dutch Company Founded in 1891 and Is One of The WorldDokumen5 halamanPhilips NV Is A Dutch Company Founded in 1891 and Is One of The WorldAdrianna Nicole HatcherBelum ada peringkat

- Int. Accounting 1Dokumen2 halamanInt. Accounting 1Adrianna Nicole HatcherBelum ada peringkat

- Philips NV Is A Dutch Company Founded in 1891 and Is One of The WorldDokumen5 halamanPhilips NV Is A Dutch Company Founded in 1891 and Is One of The WorldAdrianna Nicole HatcherBelum ada peringkat

- PresentationDokumen1 halamanPresentationAdrianna Nicole HatcherBelum ada peringkat

- Please Fill in The Requested Information and Submit To Me in The Appropriate Assignment AreaDokumen1 halamanPlease Fill in The Requested Information and Submit To Me in The Appropriate Assignment AreaAdrianna Nicole HatcherBelum ada peringkat

- Int. Accounting 2Dokumen1 halamanInt. Accounting 2Adrianna Nicole HatcherBelum ada peringkat

- ExcelDokumen2 halamanExcelAdrianna Nicole HatcherBelum ada peringkat

- Chapter 15 and 16 GADokumen2 halamanChapter 15 and 16 GAAdrianna Nicole HatcherBelum ada peringkat

- Financial ManagementDokumen76 halamanFinancial ManagementANISHA DUTTABelum ada peringkat

- 2-4 Audited Financial StatementsDokumen9 halaman2-4 Audited Financial StatementsJustine Joyce GabiaBelum ada peringkat

- ABC Co Acquisition of XYZ Inc ConsolidationDokumen3 halamanABC Co Acquisition of XYZ Inc ConsolidationLabLab ChattoBelum ada peringkat

- Module #01 - An Overview of Financial ManagementDokumen12 halamanModule #01 - An Overview of Financial ManagementRhesus UrbanoBelum ada peringkat

- Excel Solutions - CasesDokumen25 halamanExcel Solutions - CasesJerry Ramos CasanaBelum ada peringkat

- Business Combinations ExplainedDokumen8 halamanBusiness Combinations ExplainedLabLab ChattoBelum ada peringkat

- Discussion Problems and Solutions On Module 3, Part 1Dokumen28 halamanDiscussion Problems and Solutions On Module 3, Part 1AJ Biagan MoraBelum ada peringkat

- Ch1 4e - Acc in Action 2021Dokumen50 halamanCh1 4e - Acc in Action 2021K59 Vu Thi Thu HienBelum ada peringkat

- Shareholder's EquityDokumen3 halamanShareholder's EquityJyznareth Tapia100% (1)

- ch13 PDFDokumen20 halamanch13 PDFJAY AUBREY PINEDABelum ada peringkat

- Sustainable Growth Rate & Maximum Sales IncreaseDokumen10 halamanSustainable Growth Rate & Maximum Sales IncreaseRey HandumonBelum ada peringkat

- 3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsDokumen32 halaman3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsGaith1 AldaajahBelum ada peringkat

- Volume 3 Answers Volume 3 AnswersDokumen105 halamanVolume 3 Answers Volume 3 AnswersBrice AldanaBelum ada peringkat

- Quiz 4 Ch7 Questions SentDokumen2 halamanQuiz 4 Ch7 Questions SentLiandra AmorBelum ada peringkat

- Financial Model Forecasting - Case StudyDokumen15 halamanFinancial Model Forecasting - Case Study唐鹏飞Belum ada peringkat

- Presentation of Financial StatementsDokumen66 halamanPresentation of Financial StatementsCherryvic Alaska - KotlerBelum ada peringkat

- 2, Questions and Answers 2, Questions and AnswersDokumen35 halaman2, Questions and Answers 2, Questions and AnswersCarlos John Talania 1923Belum ada peringkat

- CH 11Dokumen46 halamanCH 11kevin echiverriBelum ada peringkat

- Shareholder S' EquityDokumen55 halamanShareholder S' EquityRojParconBelum ada peringkat

- Cornerstones of Financial Accounting Canadian 1st Edition Rich Test BankDokumen72 halamanCornerstones of Financial Accounting Canadian 1st Edition Rich Test Banktaradavisszgmptyfkq100% (13)

- Solution Manual For Financial Management Theory and Practice Third Canadian EditionDokumen36 halamanSolution Manual For Financial Management Theory and Practice Third Canadian Editionejecthalibutudoh0100% (30)

- Fsibl Annual Report 2019 PDFDokumen320 halamanFsibl Annual Report 2019 PDFRaihan AKILBelum ada peringkat

- Tax Alert Sept - PMK 169 - Thin Capitalization in IndonesiaDokumen5 halamanTax Alert Sept - PMK 169 - Thin Capitalization in IndonesiaEddy UtamaBelum ada peringkat

- Exercise 2.2Dokumen18 halamanExercise 2.2Stephanie Xie100% (1)

- 1BSA Final ExamDokumen11 halaman1BSA Final ExamcamillaBelum ada peringkat

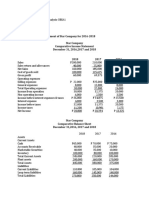

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Dokumen5 halamanComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellBelum ada peringkat

- Template-FinStatement Analysis v8 1Dokumen14 halamanTemplate-FinStatement Analysis v8 1maahi7Belum ada peringkat

- TB 15Dokumen82 halamanTB 15Hasan100% (2)

- Take Home Quiz-FS and Cash FlowDokumen9 halamanTake Home Quiz-FS and Cash FlowVergel MartinezBelum ada peringkat

- Chen Company's Income Statement and Financial AnalysisDokumen13 halamanChen Company's Income Statement and Financial AnalysiserniBelum ada peringkat