Film Review of Fault Lines Doc on US Housing Crisis

Diunggah oleh

Prashant MauryaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Film Review of Fault Lines Doc on US Housing Crisis

Diunggah oleh

Prashant MauryaHak Cipta:

Format Tersedia

Film Review FAULT LINES For Sale - Fall of the American Dream

Subject Contracts II Submitted to Mr. Rajesh Kapoor Professor, Contract Law.

Submitted by Surya Karan Sambyal Second Year, Semester III Roll No. 2012-64

NALSAR University Of Law, Hyderabad

Contents I. Introduction ........................................................................................................................ 3

II. Contract of Guarantee ......................................................................................................... 4 III. IV. V. VII. The Documentary: Fault Lines ....................................................................................... 6 ANALYSIS ..................................................................................................................... 8 Conclusion ...................................................................................................................... 9 Bibliography ................................................................................................................ 10

I.

Introduction

Since time immemorial, owning a piece of land, especially a house, has been a cornerstone in anyones life. In the contemporary world of unprecedented increase in population and stagnant incomes, owning a house or a mere accommodation to live has gained paramount importance. Affordable housing has been an alarming concern for more than a decade across the globe. In recent years of globalisation, investors across the world have unfathomably developed the sector of real estate, aiding the state machineries to provide housing to people across the green. One such incident associated with the United States which has been regarded as the reason for economic meltdown across the nations is the Housing Bubble Crisis, the fall of American dream, that led to over two million foreclosures,1 leaving innumerable families with no place to go to. The most intriguing aspect of these crises is the role of the loan contracts that functioned as the catalysts to the bursting of the housing bubble. The government sponsored private investment companies such as Freddie Mac2 and Fannie Mae3 played a crucial role in the overturning of the real estates reality i.e. the unprecedented increase of the housing prices and the subsequent fall of the same to negligible values. Owing to the curiosity to know the various reasons that led to the economic meltdown, I came across the documentary, Fault Lines-Fall of American Dream which forms the base structure of my project around which revolves my entire research. The directors of the documentary have approached the entire issue of the Housing Bubble in a subtle manner eloquently foreshowing the role played by the private companies Freddie Mac and Fannie Mae through the Contract of Guarantee4. Through my project I will try to bring out the essential role played by the Contract of Guarantee in the overturning of the field of the real estate itself. The most crucial aspect of these contracts was the role played by these companies as the surety to the various low credit rated communities that led to the unprecedented increase in the housing prices creating a bubble which insured people of a house and huge profits to the companies; and subsequent collapse of the real estate market.

1. 2. 3. 4.

http://www.downsizinggovernment.org/hud/housing-finance-2008-financial-crisis www.freddiemac.com www.fanniemae.com Section 126 of the Indian Contract Act.

II.

Contract of Guarantee

First, I would explain the contract of guarantee in general and then I would proceed to the specificity of the contract under issue. According to section 126 of ICA5, a contract of guarantee essentially includes three parties6, namely, Principal Debtor (one who takes a loan), Creditor (one who lends the loan to the principal debtor) and Surety (one who guarantees the repayment of the principal amount in case of a default by Principal Debtor). Hence, the contract of guarantee is a trilateral contract, where the primary liability rests o n the principal debtor and the liability of the Surety is secondary as it is contingent to the default by the principal debtor. Usually, in a case of house loan, the principal debtor mortgages the house against which the loan is issued and in addition to it provides the creditor with a security, who in turn promises to pay the creditor in case of a default by the principal debtor in the repayment of a debt. The film revealed that the above companies stood as the sureties for the various low income families and settled the principal loan amount with the crediting banks even though there was no default in the repayment by the principal debtor as of then. This assured profits to the banks as well as the Freddie Mac and Fannie Mae. 7 Thus, the surety under section 140 of ICA8, steps into the shoes of the creditor and has same rights as the creditor had against the principal debtor.

5. 126. "Contract of guarantee", "surety", "principal debtor" and "creditor"- A "contract of guarantee" is a contract to perform the promise, or discharge the liability, of a third person in case of his default. The person who gives the guarantee is called the "surety", the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor". A guarantee may be either oral or written.

7. For e.g. when the interest amount is less the company paid off the total amount and entered into the shoes of the creditor and gained profits out of the principal amount and the interest levied on it. 8. Section 140 Indian Contract Act - Where a guaranteed debt has become due, or default of the principal debtor to perform a guaranteed duty has taken place, the surety upon payment or performance of all that he is liable for, is invested with all the rights which the creditor had against the principal debtor.

III.

The Documentary: Fault Lines9

The documentary begins with an assumption owning a home has been the central piece of the American dream. After the foreclosure crises, a cumulative of 75% of the American owed more to their mortgages than their houses were worth. The episteme of the crises lie in the stature accorded to real estate in America. The real estate has been long considered as the backbone of the American economy. For decades, any surplus wealth of an individual was invested in real estate. The government of America incentivised the owning of the houses by backing the companies like Freddie Mac and Fannie Mae. Their operational structure formed the nucleus of the collapse of the real estate. The banks in the present structure sold off the mortgages to the investment companies and hence had no risk at all. All the risk was transferred upon these companies. These companies followed this practise in all the loans where they stood as the suretys creating the phenomena known as the Sub Prime Mortgages (SBM). In SBMs, the interest rates were brought down significantly from 10% to almost 6% backed by the government assistance. This involved a lot of risk to the investors due to the low credit worthiness as most of the houses owned under the plan were by low income communities. It is imperative to bring forth the fact, that most of these families had applied under this scheme to re finance their existing debt bonds. With stagnant real incomes and increasing prices of the real estate, the returns became impossible and large number of them defaulted on their returns. As the number of the defaulters increased manifolds, the companys profits soared and hence, they were bailed out. The inconsistency in the payments by the principal debtors led to over 2.2 million foreclosures over a financial year, as a result of which this housing bubble busted and the value of the houses soared immensely. Once the foreclosures became the norm of the US housing reality, there was no refuge for the economy to bounce back. The houses were auctioned at throw away prices to the vulture investors.10 The documentary has lucidly brought forth an important aspect of the entire Sub Prime Mortgage Crises (SBMs), that the unintended target of the bubble burst were the communities with low credit rating as the banks in a way sold of their loan contracts to the investors, the status of the bank thus reduced to a mere servicer.

9. 10. http://www.youtube.com/watch?v=S3rzN42HE00 The investors who bought the auctioned houses at throw away prices from the banks.

Once the loan contracts were sold by the Banks in America to these private investors, they ceased to have a say in the foreclosures. These companies, at their volition decided the houses that were to be foreclosed upon. Hence, indirectly the government didnt have any say in the matters of foreclosure. The documentary in particular has extensively studied the impact of the housing bubble crises in California. The state of California had largest number of foreclosures as almost 60% of the housing market in California was owned by the company Freddie Mac and Fannie Mae. There was no legislation in California that could regulate the functioning and action of these companies which didnt take into consideration the welfare of the general population.

IV.

ANALYSIS

In this part of my project, I would majorly focus on the role of contracts of guarantee that led to the housing bubble crises that triggered the worst financial crises that the world had ever seen. The dealing in regard to the loan agreements were fundamentally manipulated, as the banks sold off the debt bonds to the private investors who bought these loan bonds in bulk and created a box which is regarded as the CDO (collateralized Debt Obligation) which were the outcome of subprime mortgages. This increased the risk of these companies to unprecedented levels as the CDOs mostly consisted of the subprime mortgages of the low credit rating communities. As the prices of the housing market first increased enormously and subsequently crashed to negligible values, the defaults by the principle debtor became usual, overturning the profits of Freddie Mac and Fannie Mae into huge losses. Once the investors bought the loan bonds, they stepped into the shoes of the creditor under section 140 of the Indian Contract Act, exercising all the rights available to creditor in case of a default by the Principal Debtor. Once the defaults rose to unexpected levels and the investors bailed out the opted to foreclosures, evicting the families out of their dream homes on a short notice and putting them for sale. Foreclosures, thus, became the norm of the American reality and the rose to 2.2 millions in a financial year. The values of these homes dipped and were auctioned at throw away prices. Another reason for the financial meltdown lay in the policies of the then government. There was no law that could restrict the whims and fancies of the investors and they recklessly sold their shares and auctioned innumerable prices. The documentary meticulously revealed the bursting of the housing from the perspective of a lay man, explaining the complex in the most simplistic manner. Once these companies bailed out and the national economy accumulated debts, the financial meltdown became inevitable. This situation and the loss caused to the structural power of the American state could have been mitigated if the interest rates remained constant and if the loan agreements were acted upon in the usual manner.

V.

Conclusion

The documentary has very eloquently portrayed the reality of the real estate market in America during 2006-07. We can relate the emergence of the housing bubble crises in the deviance of the banks from the orthodox form of the contract of guarantee. Once the banks sold the debt bonds to the private investors they manipulated the loop between the three parties to the loan contract namely the Principal Debtor, Creditor and Surety. The settlement of total amount with the banks by these private investors in a number of cases led to the creation of Collateralized Debt Obligations (CDOs) which involved high risk stakes as these were comprised of low credit rated principal debtors. In many cases the subprime mortgage provided a large section of the society especially in California to refinance their existing loans as the interest rates were brought down to almost 6%. As noted above, the real income for most of the Americans had remained stagnant since late 1970s and looming prices of the housing industry made it nearly impossible for the principal debtors to pay monthly instalments resulting in defaults. Once these defaults took place in large numbers, the companies made huge losses and eventually bailed out. This was followed by foreclosure whose number went up to 2.2 million and people were evicted on short notices. To minimize the losses, these companies especially Freddie Mac and Fannie Mae auctioned the foreclosed houses at throw away prices. Thus, happened the housing bubble burst leaving millions of Americans homeless and without a shelter. The Subprime Mortgages, CDOs and the manipulation of the Contracts of Guarantee provide for the most devastating recession the world had ever seen. The major question that remained unanswered was that In reference to ultimate social reality, was it actually the companies that were bailed out or was it the general population that was actually bailed out?

VII.

Bibliography

1. www.youtube.com 2. http://www.rhsmith.umd.edu/cfp/events/2011/GSE2011/papers/Explaining_the_Housi ng_Bubble.pdf 3. http://www.milkeninstitute.org/pdf/riseandfallexcerpt.pdf 4. http://www.forbes.com/fdc/welcome_mjx.shtml

Anda mungkin juga menyukai

- The Great Recession: The burst of the property bubble and the excesses of speculationDari EverandThe Great Recession: The burst of the property bubble and the excesses of speculationBelum ada peringkat

- Shelter from the Storm: How a COVID Mortgage Meltdown Was AvertedDari EverandShelter from the Storm: How a COVID Mortgage Meltdown Was AvertedBelum ada peringkat

- Decoding the New Mortgage Market: Insider Secrets for Getting the Best Loan Without Getting Ripped OffDari EverandDecoding the New Mortgage Market: Insider Secrets for Getting the Best Loan Without Getting Ripped OffBelum ada peringkat

- Michael Burry and Mark BaumDokumen13 halamanMichael Burry and Mark BaumMario Nakhleh0% (1)

- Macro PaperDokumen8 halamanMacro Paperapi-284111637Belum ada peringkat

- NINJA Loans To Blame For Financial CrisisDokumen25 halamanNINJA Loans To Blame For Financial Crisischapy86Belum ada peringkat

- Crisis FinancieraDokumen4 halamanCrisis Financierahawk91Belum ada peringkat

- What Is A Subprime Mortgage?Dokumen5 halamanWhat Is A Subprime Mortgage?Chigo RamosBelum ada peringkat

- Summary and Analysis of The Big Short: Inside the Doomsday Machine: Based on the Book by Michael LewisDari EverandSummary and Analysis of The Big Short: Inside the Doomsday Machine: Based on the Book by Michael LewisBelum ada peringkat

- Case Study On Subprime CrisisDokumen24 halamanCase Study On Subprime CrisisNakul SainiBelum ada peringkat

- The Anatomy of A Crisis: Speculative BubbleDokumen3 halamanThe Anatomy of A Crisis: Speculative BubbleVbiidbdiaan ExistimeBelum ada peringkat

- The Big Short Movie AnalysisDokumen8 halamanThe Big Short Movie AnalysisMoses MachariaBelum ada peringkat

- U.S. Subprime Mortgage Crisis (A & B)Dokumen8 halamanU.S. Subprime Mortgage Crisis (A & B)prabhat kumarBelum ada peringkat

- The Financial Crisis of 2008: What Happened in Simple TermsDokumen2 halamanThe Financial Crisis of 2008: What Happened in Simple TermsBig ALBelum ada peringkat

- US Subprime MortgageDokumen9 halamanUS Subprime MortgageN MBelum ada peringkat

- This Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCDokumen28 halamanThis Content Downloaded From 141.211.4.224 On Wed, 05 Aug 2020 17:16:17 UTCRaymond Behnke [STUDENT]Belum ada peringkat

- Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceDari EverandGuaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinancePenilaian: 2 dari 5 bintang2/5 (1)

- Summary of Bethany McLean & Joe Nocera's All the Devils Are HereDari EverandSummary of Bethany McLean & Joe Nocera's All the Devils Are HereBelum ada peringkat

- Explanation and Overview of The Loan Securitization Process GenericDokumen8 halamanExplanation and Overview of The Loan Securitization Process GenericChemtrails Equals Treason100% (2)

- Why Procedural Requirements Are Necessary To Prevent Further Loss To HomeownersDokumen34 halamanWhy Procedural Requirements Are Necessary To Prevent Further Loss To HomeownersForeclosure Fraud100% (3)

- Factors That Led To Global Financial CrisisDokumen3 halamanFactors That Led To Global Financial CrisisCharles GarrettBelum ada peringkat

- Term Paper FinalDokumen5 halamanTerm Paper Finalapi-301896412Belum ada peringkat

- Financial Service: Project On: Economic MeltdownDokumen40 halamanFinancial Service: Project On: Economic MeltdownJas777Belum ada peringkat

- Other People's Houses: How Decades of Bailouts, Captive Regulators, and Toxic Bankers Made Home Mortgages a Thrilling BusinessDari EverandOther People's Houses: How Decades of Bailouts, Captive Regulators, and Toxic Bankers Made Home Mortgages a Thrilling BusinessPenilaian: 4 dari 5 bintang4/5 (2)

- Asymmetric Information and Financial Crises: By: Tayyaba Rehman Arishma Khurram Sufyan Khan Aniqa JavedDokumen12 halamanAsymmetric Information and Financial Crises: By: Tayyaba Rehman Arishma Khurram Sufyan Khan Aniqa JavedTayyaba RehmanBelum ada peringkat

- The Mortgage Crisis, MERS, and Chapter 13Dokumen16 halamanThe Mortgage Crisis, MERS, and Chapter 13DinSFLA100% (1)

- The Financial Crisis of 2007 - Roles of CDOs, CDSs and Subprime MortgagesDokumen25 halamanThe Financial Crisis of 2007 - Roles of CDOs, CDSs and Subprime MortgagesSertaç Yay100% (1)

- Objection To Settlement of Predatory Mortgage Lending Class ActionDokumen31 halamanObjection To Settlement of Predatory Mortgage Lending Class ActionCharlton ButlerBelum ada peringkat

- Name: Syed Sikander Hussain Shah Course: Eco 607 Topic: Mortgage Crisis STUDENT ID: 024003260Dokumen7 halamanName: Syed Sikander Hussain Shah Course: Eco 607 Topic: Mortgage Crisis STUDENT ID: 024003260Sam GitongaBelum ada peringkat

- The Big ShortDokumen4 halamanThe Big ShortHads LunaBelum ada peringkat

- How Subprime Mortgages Fueled the Housing CrisisDokumen5 halamanHow Subprime Mortgages Fueled the Housing CrisisRoentgen Djon Kaiser IgnacioBelum ada peringkat

- 1.11.10 5:00 P.M.Dokumen13 halaman1.11.10 5:00 P.M.ga082003Belum ada peringkat

- Subprime Crisis FeiDokumen13 halamanSubprime Crisis FeiDavuluri SasiBelum ada peringkat

- US Housing BubbleDokumen6 halamanUS Housing BubbleAnil NandyalaBelum ada peringkat

- For Closure Note Supreme Court DecisionDokumen3 halamanFor Closure Note Supreme Court DecisionJulio Cesar NavasBelum ada peringkat

- Enforcement Issues For A Creditor Holding Multiple Deeds of Trust On The Same Property (2009)Dokumen12 halamanEnforcement Issues For A Creditor Holding Multiple Deeds of Trust On The Same Property (2009)mtandrewBelum ada peringkat

- Anatomy of the Subprime CrisisDokumen49 halamanAnatomy of the Subprime CrisisAbhay ManeBelum ada peringkat

- Foreclosure Fraud in A NutshellDokumen8 halamanForeclosure Fraud in A NutshellMichael Kovach100% (7)

- Global Recession PresentationDokumen23 halamanGlobal Recession PresentationkeshatBelum ada peringkat

- Mortgage Credit CrisisDokumen5 halamanMortgage Credit Crisisasfand yar waliBelum ada peringkat

- Cashing in Chapter 7Dokumen19 halamanCashing in Chapter 7cismercBelum ada peringkat

- NAACP Remarks - Understanding The Foreclosure CrisisDokumen10 halamanNAACP Remarks - Understanding The Foreclosure CrisisJH_CarrBelum ada peringkat

- Case Study 1 - What Was The Financial Crisis of 2007-2008Dokumen4 halamanCase Study 1 - What Was The Financial Crisis of 2007-2008Anh NguyenBelum ada peringkat

- Subprime Mortgage CrisisDokumen18 halamanSubprime Mortgage Crisisredheattauras0% (1)

- Credit Derivatives Not InsuranceDokumen59 halamanCredit Derivatives Not InsuranceGlobalMacroForumBelum ada peringkat

- Global RecessionDokumen15 halamanGlobal RecessionsureshsusiBelum ada peringkat

- Gods at War: Shotgun Takeovers, Government by Deal, and the Private Equity ImplosionDari EverandGods at War: Shotgun Takeovers, Government by Deal, and the Private Equity ImplosionPenilaian: 4 dari 5 bintang4/5 (2)

- Assignment Subprime MortgageDokumen6 halamanAssignment Subprime MortgagemypinkladyBelum ada peringkat

- Landmark Decision ArticleDokumen3 halamanLandmark Decision ArticleEaton GoodeBelum ada peringkat

- Where to Put Your Money NOW: How to Make Super-Safe Investments and Secure Your FutureDari EverandWhere to Put Your Money NOW: How to Make Super-Safe Investments and Secure Your FutureBelum ada peringkat

- Goldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisDokumen14 halamanGoldman Sachs Abacus 2007 Ac1 An Outline of The Financial CrisisAkanksha BehlBelum ada peringkat

- Congressional Foreclosure ReportDokumen26 halamanCongressional Foreclosure ReportNetClarity100% (1)

- Assignment 3 FINMARDokumen2 halamanAssignment 3 FINMARKimberly Mae DuetesBelum ada peringkat

- Financial Instruments Responsible For Global Financial CrisisDokumen15 halamanFinancial Instruments Responsible For Global Financial Crisisabhishek gupte100% (4)

- Toxic Document Fallout 10-12-10Dokumen14 halamanToxic Document Fallout 10-12-10Richard Franklin KesslerBelum ada peringkat

- Custom and PracticeDokumen5 halamanCustom and PracticeRichard Franklin KesslerBelum ada peringkat

- MERS® - Good Strawman or Bad Strawman?: by Phillip C. Querin, QUERIN LAW, LLC Contact InfoDokumen8 halamanMERS® - Good Strawman or Bad Strawman?: by Phillip C. Querin, QUERIN LAW, LLC Contact InfoQuerpBelum ada peringkat

- Analysis of Merger Control Under Indian Competition Law by Tejas K. MotwanDokumen29 halamanAnalysis of Merger Control Under Indian Competition Law by Tejas K. MotwanPrashant MauryaBelum ada peringkat

- The Shift From FERA To FEMADokumen3 halamanThe Shift From FERA To FEMAPrashant MauryaBelum ada peringkat

- Environment TopicsDokumen4 halamanEnvironment TopicsPrashant MauryaBelum ada peringkat

- Filth) : Omic Times. 20 DecemberDokumen1 halamanFilth) : Omic Times. 20 DecemberPrashant MauryaBelum ada peringkat

- Abul F.M. Maniruzzaman Lex Mer & Intl Contracts (80 P) PDFDokumen79 halamanAbul F.M. Maniruzzaman Lex Mer & Intl Contracts (80 P) PDFPrashant MauryaBelum ada peringkat

- Attly ArbitrationDokumen11 halamanAttly ArbitrationPrashant MauryaBelum ada peringkat

- Wto CasesDokumen84 halamanWto CasesPrashant MauryaBelum ada peringkat

- Promise of International Commercial MediationDokumen31 halamanPromise of International Commercial MediationPrashant MauryaBelum ada peringkat

- AttlyDokumen2 halamanAttlyPrashant MauryaBelum ada peringkat

- Surya - Law & LitDokumen7 halamanSurya - Law & LitPrashant MauryaBelum ada peringkat

- Globalization in Aviation Sector: India's ExperienceDokumen22 halamanGlobalization in Aviation Sector: India's ExperiencePrashant Maurya100% (1)

- M A Due Diligence PDFDokumen7 halamanM A Due Diligence PDFPrashant MauryaBelum ada peringkat

- Modes of Entering International Business GuideDokumen32 halamanModes of Entering International Business GuidePrashant MauryaBelum ada peringkat

- 36smriti PPTDokumen48 halaman36smriti PPTPrashant MauryaBelum ada peringkat

- BankingDokumen19 halamanBankingPrashant MauryaBelum ada peringkat

- Lex Mercatoria and Aviation PDFDokumen19 halamanLex Mercatoria and Aviation PDFPrashant MauryaBelum ada peringkat

- White Collar Crime - Cases, Materials, and ProblemsDokumen72 halamanWhite Collar Crime - Cases, Materials, and ProblemsS. Bala DahiyaBelum ada peringkat

- CISG Vs UCC PDFDokumen13 halamanCISG Vs UCC PDFPrashant MauryaBelum ada peringkat

- Singapore International Arbitration Centre: Ratifying The CISG - India's OptionsDokumen8 halamanSingapore International Arbitration Centre: Ratifying The CISG - India's OptionsPrashant Maurya100% (1)

- Project M&ADokumen59 halamanProject M&APrashant MauryaBelum ada peringkat

- Insurance ProjectDokumen22 halamanInsurance ProjectPrashant Maurya100% (1)

- Cisg and inDokumen4 halamanCisg and inPrashant MauryaBelum ada peringkat

- IMp. Cases of ICAO PDFDokumen75 halamanIMp. Cases of ICAO PDFPrashant MauryaBelum ada peringkat

- Fdi in Retail SecDokumen9 halamanFdi in Retail SecPrashant MauryaBelum ada peringkat

- Fdi in Multi-Brand RetailingDokumen21 halamanFdi in Multi-Brand RetailingHitesh GoyalBelum ada peringkat

- Globalization in Aviation Sector: India's ExperienceDokumen22 halamanGlobalization in Aviation Sector: India's ExperiencePrashant Maurya100% (1)

- LLPDokumen24 halamanLLPPrashant MauryaBelum ada peringkat

- Euthanasia in IndiaDokumen3 halamanEuthanasia in IndiaPrashant MauryaBelum ada peringkat

- DTaa AGREEMETDokumen13 halamanDTaa AGREEMETPrashant MauryaBelum ada peringkat

- Lukas Foutz - w6 Personal Finance Project - 5375624Dokumen12 halamanLukas Foutz - w6 Personal Finance Project - 5375624api-393000194Belum ada peringkat

- Berar Finance LimitedDokumen9 halamanBerar Finance LimitedKamlakar AvhadBelum ada peringkat

- Business Law TeacherDokumen3 halamanBusiness Law TeacherAMIN BUHARI ABDUL KHADER100% (1)

- Chronology of Data Breaches - Privacy Rights Clearinghouse - June 4, 2014Dokumen558 halamanChronology of Data Breaches - Privacy Rights Clearinghouse - June 4, 2014St. Louis Public RadioBelum ada peringkat

- Introduction AstralDokumen12 halamanIntroduction AstralMbavhalelo100% (1)

- A Project Report On BajajDokumen17 halamanA Project Report On BajajSandeep Tripathi71% (7)

- Bajaj Finance Fixed Deposit ReviewDokumen35 halamanBajaj Finance Fixed Deposit ReviewAlok ShuklaBelum ada peringkat

- How Open Banking Can Support SME FinanceDokumen13 halamanHow Open Banking Can Support SME FinanceADBI EventsBelum ada peringkat

- Week 2 Practice SolutionDokumen1 halamanWeek 2 Practice SolutionalexandraBelum ada peringkat

- Working Capital ReportDokumen22 halamanWorking Capital Reportdivyansh khandujaBelum ada peringkat

- Bureau of Internal RevenueDokumen5 halamanBureau of Internal RevenuegelskBelum ada peringkat

- Chapter 2 Governance and ManagementDokumen32 halamanChapter 2 Governance and Managementlmmh100% (2)

- Bill Gross Investment Outlook May - 07Dokumen9 halamanBill Gross Investment Outlook May - 07Brian McMorrisBelum ada peringkat

- Export Credit Agencies - The Unsung Giants of International Trade and FinanceDokumen207 halamanExport Credit Agencies - The Unsung Giants of International Trade and Financeace187Belum ada peringkat

- Phil. Sugar Estates Dev. Co. v. PoizatDokumen3 halamanPhil. Sugar Estates Dev. Co. v. PoizatElle Mich100% (1)

- The Credit Anstalt Crisis of 1931 Studies in Macroeconomic HistoryDokumen222 halamanThe Credit Anstalt Crisis of 1931 Studies in Macroeconomic HistoryKristoferson BadeaBelum ada peringkat

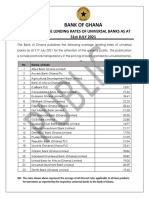

- Average Lending Rates As at July 2021Dokumen1 halamanAverage Lending Rates As at July 2021Fuaad DodooBelum ada peringkat

- 7 Milan V NLRC DigestDokumen2 halaman7 Milan V NLRC DigestJM Ragaza0% (1)

- Business Plan ALGOJODokumen65 halamanBusiness Plan ALGOJOMuhd AmirulBelum ada peringkat

- Summary Economics of Money Banking and Financial Markets Frederic S Mishkin PDFDokumen143 halamanSummary Economics of Money Banking and Financial Markets Frederic S Mishkin PDFJohn StephensBelum ada peringkat

- Assignment On IASDokumen6 halamanAssignment On IASAsif AzadBelum ada peringkat

- SEC V Laigo DigestDokumen3 halamanSEC V Laigo DigestClarence ProtacioBelum ada peringkat

- Model Paper: D (KK D (KK D (KK D (KK D (KK - Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKLDokumen39 halamanModel Paper: D (KK D (KK D (KK D (KK D (KK - Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKL Ys (KK'KKLTezendra SinghBelum ada peringkat

- AccA P4/3.7 - 2002 - Dec - QDokumen12 halamanAccA P4/3.7 - 2002 - Dec - Qroker_m3Belum ada peringkat

- 1-5 To Do An Audit, There Must Be Information in A Verifiable Form and SomeDokumen18 halaman1-5 To Do An Audit, There Must Be Information in A Verifiable Form and Somejulivio mewohBelum ada peringkat

- Project Appraisal - Stages FlowchartDokumen6 halamanProject Appraisal - Stages FlowchartAshokBelum ada peringkat

- Accounting For LeaseDokumen75 halamanAccounting For LeaseRonnie Salazar53% (15)

- Case Dismissals For Lack of Standing To ForecloseDokumen28 halamanCase Dismissals For Lack of Standing To Foreclosejacque zidane100% (1)

- Arceo, Jr. Vs People of The PHDokumen2 halamanArceo, Jr. Vs People of The PHToni CalsadoBelum ada peringkat