Linear Programming On Excel: Problems and Solutions

Diunggah oleh

acetinkaya92Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Linear Programming On Excel: Problems and Solutions

Diunggah oleh

acetinkaya92Hak Cipta:

Format Tersedia

178116163.xlsx.

ms_office

A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

RMC

Fuel Additive Solvent Base Solution 25 20 <-- Optimal solution Total Profit =SUMPRODUCT(B8:C8,B$4:C$4) Objective Function 40 30 1600 <-- Optimal objective value LHS RHS Slack Mtrl 1 0.4 0.5 20 <= 20 0 Mtrl 2 0.2 4 <= 5 1 Mtrl 3 0.6 0.3 21 <= 21 0

Questions 1. According to the LP result, how much of each product should be produced? What is the maximum possible profit?

2. Will there be any materials left?

3. If 3 additional tons of material 3 becomes available, what will be the effect on the maximum profit? 4. What will happen to the maximum profit if we have 2 tons less material 3 than we thought?

LP Model: Maximize profit = 40F + 30 S subject to: 0.4F + 0.5S 20 0.2S 5 0.6F + 0.3S 21 F, S 0

5. How about if we have 2 more tons of material 2? Produce 25 tons of Fuel Additive and 20 tons of Solvent Base. This will yield the max profit of $1600. 6. What if the unit profit of fuel additive is actually $30 (rather than $40)? Will this change the optimal solution? 7. What if the unit profit of fuel additive is actually $22?

Page 1

178116163.xlsx.ms_office

A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26

Electronic Communications

Distribution Channels Solution Total Profit Advertising Budget Salesforce Availability Production Level Retail Stores Req. Marine Business 25 90 10 2 1 425 84 8 3 1 Retail Direct Mail 150 0 70 9 3 1 1 60 LHS 15 1 5000 1775 600 150 <= <= = >= 48450 RHS Slack 5000 0 1800 25 600 0 150 0

LP Model: Maximize profit = 90M + 84B + 70R + 60D subject to: 10M + 8B + 9R + 15D 5000 2 M + 3B + 3R 1800 M + B + R + D = 600 R 150 M, B, R, D 0

Page 2

178116163.xlsx.ms_office A 1 2 3 B C D E F G H I J K L M N O

Advertising

AI American Idol SF Sunday Night Football TO The Office SM Sixty Minutes LO Law & Order 5 3

Note: All monetary values are in $1000s, and all exposures to ads are in millions of exposures.

4 5 Ads Purchased 6

Total Cost

Cost/ad 7 ($thousands)

8

475

342

179

122

105

3300

LHS<= RHS SLack =RHS-HS LHS>=RHS Surplus=LHS-RHS

Reqd Exposures Surplus

9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31

Exposures/ad Men 18-49 Men 50+ Women 18-49 Women 50+ Total viewers Cost/Viewer

Actual Exposures

We want integer solutions, so try rounding. AI=5, SM=5==>infeasible soln try AI=6, SM=5==>feasible TC=3460 adding int constraint gives AI=5, SM=5, LO=3 and TC=3300

7 2 10 6.8 25.8 18.411

14 2 5 1.9 5 1 5 1 3 1.8 2 1.9 2 0.5 3 1 24 5.3 15 5.8 14.25 33.774 8.1333 18.103

65.700 38.000 65.700 52.000

221.400

>= >= >= >=

65 20 65 20

0.700 18.000 0.700 32.000

LP Model:

Minimize subject to 475 AI + 342 SF + 179 TO + 122 SM + 105 LO (cost objective)

7 AI + 14 SF + 2 TO + 5 SM + 1.9 LO

65

(Men 18-49) (Men 50+) (Women 18-49)

(Women 50+)

2 AI + 5 SF + 1 TO + 5 SM + 1 LO 20 10 AI + 3 SF + 1.8 TO + 2 SM + 1.9 LO 65

6.8 AI + 2 SF + 0.5 TO + 3 SM + 1 LO

20

AI, SF, TO, SM, LO 0

C integer

178116163.xlsx.ms_office

A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27

Welte Mutual Funds

Invested Amt. Total Annual Return Total Funds Oil Limit Steel Limit Bonds Req. Pacific Oil Limit Atlantic Oil Pacific Oil MW Steel Huber Steel Govt Bonds 20000 30000 0 40000 10000 0.073 1 1 0.103 1 1 0.064 1 1 -0.25 -0.6 0.4 0.075 1 1 -0.25 0.045 8000 LHS 1 100000 50000 40000 1 0 -1.82E-12

Questions 1. What is the rate of return from this portfolio? What is the marginal rate of return from this portfolio (i.e., if you invest a $1 more, what is the additional return)?

RHS Slack 100000 0 50000 0 50000 10000 0 0 0 1.8E-12

= <= <= >= <=

2. Suppose Pacific Oils rate of return is decreased. By how much will it have to decrease for it to make a difference in the investment recommendation? 3. Suppose the total amount to invest is $200,000 instead of $100,000. In addition to changing the RHS value of the first constraint, what other RHS value(s) should be changed for the model to make sense? 4. Let the decision variables be the proportion invested instead of $ invested. Change the model appropriately and solve. Is the result consistent with the original result?

LP Model: Maximize 0.073A + 0.103P + 0.064M + 0.075H + 0.045G subject to (1) A + P + M + H + G = 100,000 (2) A + P 50,000 (3) M+ H 50,000 (4) -0.25M 0.25H + G 0 (5) -0.6A + 0.4P 0 A, P, M, H, G 0

1. ROR:8000/100000=8%; if 100,001 you would put solver and resolve the problem..return would go up .069 or 6.9 cents. (6.9%) 2.PO's ROR would have to decrease to less than .073(AO's ROR) to make a difference.

Page 4

178116163.xlsx.ms_office

A 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

National Insurance

Data Stock Annual rate of return Risk measure/$ invested Total amt to invest Min acceptable return Max proportion of stock A 0.12 0.1 $200,000 9% 50% B 0.08 0.07 C 0.06 0.05 D 0.1 0.08

LP Model: Minimize 0.1 A + 0.07 B + 0.05 C + 0.08 D subj. to: A+B+C+D = 200,000 0.12 A + 0.08 B + 0.06 C + 0.1 D 18,000 A 100,000 B 100,000 C 100,000 D 100,000 A, B, C, D 0

Model A Solution Risk Total Invested Return Limit on A Limit on B Limit on C Limit on D 33333.33 0.1 1 0.12 1 B 0.00 0.07 1 0.08 1 1 C 66666.67 0.05 1 0.06 D 100000.00 0.08 Total 14666.67 LHS 1 200000 0.1 18000 33333.33333 0 66666.66667 1 100000 Risk of Portfolio 7.3% RHS Slack 200000 0 18000 0 100000 66666.66667 100000 100000 100000 100000 0

= >= <= <= <= <=

Anda mungkin juga menyukai

- Implementing The Account and Financial Dimensions Framework AX2012Dokumen43 halamanImplementing The Account and Financial Dimensions Framework AX2012Sky Boon Kok LeongBelum ada peringkat

- 3.NPER Function Excel Template 1Dokumen9 halaman3.NPER Function Excel Template 1w_fibBelum ada peringkat

- CFA Level I Three-Month Study PlanDokumen9 halamanCFA Level I Three-Month Study Plansashavlad100% (1)

- Standing Operating Procedure-FinalDokumen5 halamanStanding Operating Procedure-FinalRaheel KhanBelum ada peringkat

- Data-Analytic Thinking for Business Problem SolvingDokumen24 halamanData-Analytic Thinking for Business Problem SolvingLUIGIABelum ada peringkat

- SEEP FRAME Tool, Version 2.02Dokumen159 halamanSEEP FRAME Tool, Version 2.02anish-kc-8151Belum ada peringkat

- FRM Index (Revised)Dokumen28 halamanFRM Index (Revised)api-3717306Belum ada peringkat

- 3 Ways To Improve Excel Data IntegrityDokumen2 halaman3 Ways To Improve Excel Data IntegrityJacinto Gomez EmbolettiBelum ada peringkat

- Cheese Concentrate MarketDokumen12 halamanCheese Concentrate MarketNamrataBelum ada peringkat

- Company Profile 2011Dokumen28 halamanCompany Profile 2011najibjaafarBelum ada peringkat

- Analysis of Transaction CostDokumen383 halamanAnalysis of Transaction CosthjsdBelum ada peringkat

- Dexlab OnePageDokumen1 halamanDexlab OnePageAlessio SorrentoBelum ada peringkat

- Mergers & Acquisitions Hostile & Competitive: DBS BankDokumen27 halamanMergers & Acquisitions Hostile & Competitive: DBS BankKiran ShindeBelum ada peringkat

- TVM Formulas Guide Business Math ProblemsDokumen7 halamanTVM Formulas Guide Business Math ProblemsAftab HossainBelum ada peringkat

- Cash Flow Forecast, Cost-Benefit Evaluation TechniquesDokumen15 halamanCash Flow Forecast, Cost-Benefit Evaluation Techniqueswaqar chBelum ada peringkat

- A Research Proposal On Application of Theories of Economics in Retail Super Shop Chain Business in Bangladesh: A Case Study On Agora™Dokumen6 halamanA Research Proposal On Application of Theories of Economics in Retail Super Shop Chain Business in Bangladesh: A Case Study On Agora™Zubayer Mahmud HasanBelum ada peringkat

- 30 Minute High Level Overview of R2RDokumen24 halaman30 Minute High Level Overview of R2Rdaluan2Belum ada peringkat

- Business InightsDokumen218 halamanBusiness InightsAbhishek GoelBelum ada peringkat

- Yogurberry Business Franchise Financials HyderabadDokumen5 halamanYogurberry Business Franchise Financials HyderabadBharath ReddyBelum ada peringkat

- NielsenDokumen17 halamanNielsenCanadianValue0% (1)

- ROI TecnologiasDokumen27 halamanROI TecnologiasDiego SornozaBelum ada peringkat

- Business Finance Week 5Dokumen5 halamanBusiness Finance Week 5Ahlam KassemBelum ada peringkat

- INSOFE-Comprehensive Curriculum On Big Data AnalyticsDokumen11 halamanINSOFE-Comprehensive Curriculum On Big Data AnalyticslokssaBelum ada peringkat

- Primavera P6: Project Monitoring DepartmentDokumen76 halamanPrimavera P6: Project Monitoring DepartmentMariam SaeedBelum ada peringkat

- Essentials of Content Marketing StrategyDokumen16 halamanEssentials of Content Marketing StrategySilvia Beatle SnapeBelum ada peringkat

- LCC FormulaDokumen3 halamanLCC Formulasomapala88Belum ada peringkat

- Azoth Analytics Company Profile and Research ReportsDokumen12 halamanAzoth Analytics Company Profile and Research ReportsAshish KumarBelum ada peringkat

- Pharmacy Closing ChecklistDokumen43 halamanPharmacy Closing ChecklistRedeye AsiaBelum ada peringkat

- BUSINESS STRATEGY PLANNINGDokumen34 halamanBUSINESS STRATEGY PLANNINGcinderella69Belum ada peringkat

- The United Arab Emirates and Africa: A Pivotal Partnership Amid A "South-South" Commercial RevolutionDokumen36 halamanThe United Arab Emirates and Africa: A Pivotal Partnership Amid A "South-South" Commercial RevolutionJoseph DanaBelum ada peringkat

- LR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004Dokumen36 halamanLR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004apzambonBelum ada peringkat

- Financial Model - Version 3 (03!10!2020)Dokumen41 halamanFinancial Model - Version 3 (03!10!2020)Fazal ImranBelum ada peringkat

- Investment Feasibility AssessmentDokumen27 halamanInvestment Feasibility Assessmentad001Belum ada peringkat

- Exporting To The UAE - The DHL Fact SheetDokumen3 halamanExporting To The UAE - The DHL Fact SheetDHL Express UKBelum ada peringkat

- Tollgate-Based Project Management TemplateDokumen9 halamanTollgate-Based Project Management TemplateKulanthaivelu RamasamyBelum ada peringkat

- Store PlanningDokumen12 halamanStore PlanningGladwin JosephBelum ada peringkat

- Modular Product Families: Chris Hoag and Ted RadtkeDokumen24 halamanModular Product Families: Chris Hoag and Ted RadtkeRavi PilgarBelum ada peringkat

- Answers - Capital Budgeting TechniquesDokumen44 halamanAnswers - Capital Budgeting Techniquesjacks ocBelum ada peringkat

- Investment Appraisal - Payback ComputationDokumen3 halamanInvestment Appraisal - Payback Computation411hhapBelum ada peringkat

- WHO - HMN HIS Tools To Support GFR10 - Template For Costing The HIS GapDokumen202 halamanWHO - HMN HIS Tools To Support GFR10 - Template For Costing The HIS GapHarumBelum ada peringkat

- Excel Project Timesheet FullDokumen4 halamanExcel Project Timesheet Fullprateekchopra1Belum ada peringkat

- Analytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningMarketelligentBelum ada peringkat

- Roles Responsibilities Matrix - LMS Application NewDokumen18 halamanRoles Responsibilities Matrix - LMS Application NewunnikallikattuBelum ada peringkat

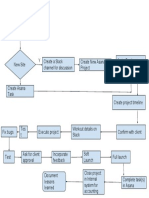

- Project WorkflowDokumen1 halamanProject WorkflowAnnaBelum ada peringkat

- Investigating The Value of An MBA Education Using NPV Decision ModelDokumen72 halamanInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriBelum ada peringkat

- 2GO Excel Calculation 1Dokumen60 halaman2GO Excel Calculation 1w_fibBelum ada peringkat

- Integrated Profit and Loss, Balance Sheet & Cash Flow Financial Model For HotelsDokumen67 halamanIntegrated Profit and Loss, Balance Sheet & Cash Flow Financial Model For HotelsHa TruongBelum ada peringkat

- Performance Evaluation of Construction PDokumen10 halamanPerformance Evaluation of Construction PMarioBelum ada peringkat

- Building Balanced Scorecard Strategy MapsDokumen18 halamanBuilding Balanced Scorecard Strategy MapsRaviram NaiduBelum ada peringkat

- C C & &$ c0cDokumen38 halamanC C & &$ c0ckrismmmmBelum ada peringkat

- Core Chapter 04 Excel Master 4th Edition StudentDokumen150 halamanCore Chapter 04 Excel Master 4th Edition StudentDarryl WallaceBelum ada peringkat

- Political: Pestel Analysis TemplateDokumen6 halamanPolitical: Pestel Analysis TemplateSubham PalBelum ada peringkat

- Break Even AnalysisDokumen1 halamanBreak Even AnalysisRama KrishnaBelum ada peringkat

- 01 Valuation ModelsDokumen24 halaman01 Valuation ModelsMarinaGorobeţchiBelum ada peringkat

- Artificial Neural NetworkDokumen3 halamanArtificial Neural NetworkmUZABelum ada peringkat

- Selling Forward Contract Analysis and Profit FactorsDokumen4 halamanSelling Forward Contract Analysis and Profit FactorsAnandBelum ada peringkat

- Market Segmentation Strategies and CharacteristicsDokumen19 halamanMarket Segmentation Strategies and CharacteristicsfarazsaifBelum ada peringkat

- Ch13 Evans BA1eDokumen35 halamanCh13 Evans BA1eyarli7777Belum ada peringkat

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsDari EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsBelum ada peringkat

- Making A StandDokumen22 halamanMaking A StandQueens Nallic Cillan100% (2)

- Inspection and Testing of Knapsack SprayersDokumen8 halamanInspection and Testing of Knapsack Sprayersangelo lorenzo tamayoBelum ada peringkat

- DLP-Physical ScienceDokumen3 halamanDLP-Physical ScienceFloreann Basco100% (1)

- GeneralMusic synthesizer service manual section titlesDokumen16 halamanGeneralMusic synthesizer service manual section titlesAnonymous Syjpyt4Mo100% (1)

- Brochure DRYVIEW 5700 201504 PDFDokumen4 halamanBrochure DRYVIEW 5700 201504 PDFRolando Vargas PalacioBelum ada peringkat

- 8 State Based or Graph Based TestingDokumen4 halaman8 State Based or Graph Based TestingZINNIA MAZUMDER 19BIT0155Belum ada peringkat

- Vehicle and Commercial Controls: Electrical Sector SolutionsDokumen197 halamanVehicle and Commercial Controls: Electrical Sector SolutionsVanderCastroBelum ada peringkat

- Cat DP150 Forklift Service Manual 2 PDFDokumen291 halamanCat DP150 Forklift Service Manual 2 PDFdiegoBelum ada peringkat

- Analysis, Design and Implementation of Zero-Current-Switching Resonant Converter DC-DC Buck ConverterDokumen12 halamanAnalysis, Design and Implementation of Zero-Current-Switching Resonant Converter DC-DC Buck Converterdaber_huny20Belum ada peringkat

- Cat Em58 Em58s Emc58 eDokumen3 halamanCat Em58 Em58s Emc58 eAdolfo SantoyaBelum ada peringkat

- HCTS Fabricated Products Group Empowers High Tech MaterialsDokumen12 halamanHCTS Fabricated Products Group Empowers High Tech MaterialsYoami PerdomoBelum ada peringkat

- 1-2 SemestrDokumen83 halaman1-2 SemestrАнтон СелезневBelum ada peringkat

- Ds Esprimo c910 LDokumen9 halamanDs Esprimo c910 Lconmar5mBelum ada peringkat

- Guidelines For The Operation of Digital FM Radio BroadcastDokumen3 halamanGuidelines For The Operation of Digital FM Radio BroadcastmiyumiBelum ada peringkat

- Build Ubuntu for Ultra-96 FPGA DevelopmentDokumen5 halamanBuild Ubuntu for Ultra-96 FPGA Developmentksajj0% (1)

- Resilience Advantage Guidebook HMLLC2014Dokumen32 halamanResilience Advantage Guidebook HMLLC2014Alfred Schweizer100% (3)

- Lion Dam Gate Seals - INTLDokumen3 halamanLion Dam Gate Seals - INTLIoannis SanoudosBelum ada peringkat

- 7 Basic Qualty Tools & Root Cause AnalysisDokumen42 halaman7 Basic Qualty Tools & Root Cause AnalysisRamonS.FernandezOrozco100% (1)

- Manual ElevatorsDokumen75 halamanManual ElevatorsThomas Irwin DsouzaBelum ada peringkat

- SKF TIH 240 Heater Instruction ManualDokumen134 halamanSKF TIH 240 Heater Instruction ManualWei Leng tehBelum ada peringkat

- Math 362, Problem Set 5Dokumen4 halamanMath 362, Problem Set 5toancaoBelum ada peringkat

- Leadership Styles - Types of Leadership Styles - BBA - MantraDokumen5 halamanLeadership Styles - Types of Leadership Styles - BBA - Mantrakarthik sarangBelum ada peringkat

- Quarter 1 - Module 1 Nature Goals and Perspectives in Anthropology Sociology and Political ScienceDokumen24 halamanQuarter 1 - Module 1 Nature Goals and Perspectives in Anthropology Sociology and Political Science완83% (12)

- Recommended Reading and Links On Public Bicycle SchemesDokumen13 halamanRecommended Reading and Links On Public Bicycle SchemesZé MiguelBelum ada peringkat

- Wesleyan University-Philippines Graduate SchoolDokumen6 halamanWesleyan University-Philippines Graduate SchoolRachel Joy RosaleBelum ada peringkat

- Dynamic Analysis of Loads and Stresses in Connecting RodsDokumen10 halamanDynamic Analysis of Loads and Stresses in Connecting RodsJuan Pablo Cano MejiaBelum ada peringkat

- CASE 2901: Inquiry: Under What Requirements May External Loads (Forces and Bending Moments) Be Evaluated ForDokumen2 halamanCASE 2901: Inquiry: Under What Requirements May External Loads (Forces and Bending Moments) Be Evaluated ForDijin MaroliBelum ada peringkat

- Sine and Cosine Functions WorksheetDokumen6 halamanSine and Cosine Functions WorksheetManya MBelum ada peringkat

- KPMG - India's Digital Future Media and Entertainment Report 2019Dokumen256 halamanKPMG - India's Digital Future Media and Entertainment Report 2019Online IngBelum ada peringkat

- Giving OpinionsDokumen3 halamanGiving OpinionsAndreea BudeanuBelum ada peringkat