Goods Receipt Reversal

Diunggah oleh

Rahul JainHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Goods Receipt Reversal

Diunggah oleh

Rahul JainHak Cipta:

Format Tersedia

Goods Receipt Reversal

Use

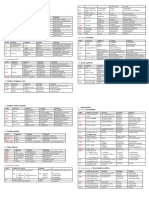

Goods-Receipt-Based Invoice Verification In the case of goods-receipt-based invoice verification, the system can assign the reversal of a goods receipt to the original document, thus the postings are generally reversed. No Goods-Receipt-Based Invoice Verification If goods-receipt-based invoice verification has not been defined and several goods receipts have been posted with different order prices, the system posts the reversal of the goods receipt with the average receipt value of the goods receipts, that is, the postings are not necessarily reversed. This type of valuation is used when posting in the following functions: Reversing delivery costs and negative delivery costs, such as rebate accruals Reversing goods receipts for returns items Reversing goods receipts for subcontracting orders that are valuated differently. The return delivery is valuated at the average value of the original postings. Reversing goods receipts with different values in the local currency. The order price has not changed, but various exchange rates between the local currency and the foreign currency are used for the goods receipts. The system valuates the return delivery with the average receipt value in local currency. The examples below show that when you reverse goods receipts, different postings can take place to those made at goods receipt. Postings Made when Reversing a Goods Receipt After Goods Receipts That Are Valuated Differently

First Goods Receipt The stock account is posted with the receipt value based on the purchase order price.

The offsetting entry is posted to the GR/IR clearing account. Value Calculation The stock and value in the material master record increase in proportion to the goods receipt quantity. The material price does not change. After the document is posted, the price in the purchase order is changed.

Second Goods Receipt The stock account is posted with the receipt value based on the changed purchase order price.

The offsetting entry is posted to the GR/IR clearing account. Value Calculation The purchase order price is different to the moving average price: The stock and value in the material master record do not increase in proportion to the goods receipt quantity, thus the moving average price changes. Goods Receipt Reversal The stock account is credited with the average receipt value.

The offsetting entry is posted to the GR/IR clearing account. Value Calculation The return delivery is posted based on the moving average price: The value and stock are reduced in proportion to the goods receipt quantity. The moving average price does not change. Invoice The GR/IR clearing account is cleared with the average receipt value. The offsetting entry is posted based on the invoice price on the vendor account. The difference between the GR/IR clearing account and the vendor account is posted to the stock account if there is sufficient stock coverage. Value Calculation The invoice price is different to the average receipt value: When the invoice is posted, the system corrects the value in the material master record, the stock level remains the same, so the price in the material master record changes.

Goods Receipt Reversal After Goods Receipt and Invoice Receipt

Goods Receipt

The stock account is posted with the receipt value based on the purchase order price.

The offsetting entry is posted to the GR/IR clearing account. Value Calculation The stock and value in the material master record increase in proportion to the goods receipt quantity. The material price does not change. Invoice The GR/IR clearing account is cleared on the basis of the purchase order price:

The posting for the offsetting entry is based on the invoice price on the vendor account. For a material with a moving average price, the difference between the GR/IR clearing account and the vendor account is posted to the stock account if there is sufficient stock coverage. Value Calculation The invoice price is different to the purchase order price: When the invoice is posted, the system corrects the value in the material master record, the stock level is unchanged, thus the moving average price in the material master record changes. Goods Receipt Reversal The GR/IR clearing account is cleared on the basis of the invoice price. The offsetting entry is posted to the stock account. Value Calculation The stock and value in the material master record are reduced in proportion to the goods receipt quantity reversed, so the moving average price does not change.

Goods Receipt Reversal with PO Price Quantity Variance

In the purchase order, a purchase order price unit (OPUn) different to the purchase order unit (OUn) has been defined. A variance in purchase order price quantity at goods receipt applies in the following cases: Goods Receipt Before Invoice Receipt The ratio (goods receipt quantity in purchase order price units) : (goods receipt quantity in purchase order units) is different to the ratio (ordered quantity in purchase order price units) : (ordered quantity in purchase order units). Invoice Receipt After Goods Receipt The ratio (goods receipt quantity in purchase order price units) : (goods receipt quantity in purchase order units) is different to the ratio (invoice quantity in purchase order price units) : (invoice quantity in purchase order units). The system posts goods receipts and return deliveries with a different purchase order price unit as follows:

Example 1:

Postings and Extract from Material Master Record for a Material with Moving Average Price

Invoice The invoice is posted before the goods receipt, so the posting to the GR/IR clearing account is based on the invoice price.

The offsetting entry is posted to the vendor account. Value Calculation The value, stock, and material price in the material master record do not change. First Goods Receipt The invoice was posted before the goods receipt, so the GR/IR clearing account is cleared as follows:

The offsetting entry is posted to the stock account for a material with a moving average price with sufficient stock coverage. Second Goods Receipt The invoice was posted before the goods receipt, so the GR/IR clearing account is cleared as follows:

Value Calculation The stock and value in the material master record do not change in proportion to the goods receipt, so the moving average price changes as well. Return Delivery At the time of the return delivery, the stock account is reduced by the goods receipt reversal quantity based on the invoice price.

The offsetting entry is posted to the GR/IR clearing account. Value Calculation

The stock and value in the material master record are not reduced in proportion to the goods receipt, so the moving average price changes as well.

Example 2:

The following example shows a special case: If the goods receipt quantity in purchase order units is the same as the invoice quantity and the goods receipt quantity in purchase order price units is greater than the invoice quantity, the following account movements take place:

Reversing Goods Receipts Despite Invoice in GR-based Invoice Verification

When GR-based invoice verification has been defined, every goods receipt is settled separately. This means that an invoice always refers to a material document. If the invoice for a goods receipt has already been entered, but you reverse the goods receipt or return the goods, you have to ensure that either the relevant invoice is cancelled as well or another goods receipt which refers to the same invoice takes place.

In the Customizing System of Inventory Management, you can define for every movement type whether a GR reversal or a return delivery is allowed when GR-based invoice verification has been defined, even though the relevant invoice has already been entered. If a GR reversal or a return delivery is not allowed, you must cancel the invoice before entering the reversal of the goods receipt or the return delivery. If a GR reversal is allowed, you can post the material document and cancel the invoice later. If you do not wish to cancel the invoice, you can enter the next goods receipt with reference to the reversal document or the return delivery so that the reference to the invoice continues to exist.

To enter a goods receipt with reference to a reversal document, you have to carry out the following steps: From the Inventory management menu, choose Material document Cancel or Material document Return delivery. This takes you to the initial screen for this function. If you are working with the Return delivery command and do not know the number of the material document, you can also enter the delivery note number in the Delivery note input field. The system then automatically finds the material document for the delivery note. 2. In the Material document field, enter the number of the return delivery or reversal document. 3. Press ENTER. The item selection list is displayed. The list contains all items on the material document which were

1.

cancelled or returned. The system assigns movement type 101 (Goods receipt for purchase order) to the items. 4. Select and process the items for which you want to post a goods receipt. If you have chosen Return delivery, you can change the quantity. If you have chosen Cancel, you cannot . 5. Post the document.

Anda mungkin juga menyukai

- 2010 MaxxForce DT-9-10 DiagnosticDokumen1.329 halaman2010 MaxxForce DT-9-10 Diagnosticbullfly100% (8)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDari EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessPenilaian: 5 dari 5 bintang5/5 (5)

- Back-to-Back Setup White Paper R11 PDFDokumen18 halamanBack-to-Back Setup White Paper R11 PDFRahul JainBelum ada peringkat

- Differential Invoice ProcessDokumen8 halamanDifferential Invoice ProcessmadanvankaBelum ada peringkat

- Oracle LCM titleDokumen4 halamanOracle LCM titlephoganBelum ada peringkat

- PMP Certification Practice ExamDokumen19 halamanPMP Certification Practice ExamRahul Jain100% (3)

- Oracle R12 Student Guide PDFDokumen390 halamanOracle R12 Student Guide PDFsourabhparandeBelum ada peringkat

- Oracle R12 Student Guide PDFDokumen390 halamanOracle R12 Student Guide PDFsourabhparandeBelum ada peringkat

- Music GcseDokumen45 halamanMusic GcseAimee DohertyBelum ada peringkat

- Bookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)Dari EverandBookkeeping: Learning The Simple And Effective Methods of Effective Methods Of Bookkeeping (Easy Way To Master The Art Of Bookkeeping)Belum ada peringkat

- Discrete and Process Manufacturing Setups in Fusion Manufacturing PDFDokumen29 halamanDiscrete and Process Manufacturing Setups in Fusion Manufacturing PDFRahul JainBelum ada peringkat

- Discrete and Process Manufacturing Setups in Fusion Manufacturing PDFDokumen29 halamanDiscrete and Process Manufacturing Setups in Fusion Manufacturing PDFRahul JainBelum ada peringkat

- ML Actual CostingDokumen3 halamanML Actual CostingViswanath RudraradhyaBelum ada peringkat

- Standard Price & Moving Average Price in SAPDokumen5 halamanStandard Price & Moving Average Price in SAPvSravanakumar100% (1)

- Procure To Pay-Accounting EntriesDokumen5 halamanProcure To Pay-Accounting EntriesNirmala SriramdossBelum ada peringkat

- Accounting EntriesDokumen16 halamanAccounting EntriesphonraphatBelum ada peringkat

- SAP Logistic Invoice VerificationDokumen29 halamanSAP Logistic Invoice VerificationPraveen KumarBelum ada peringkat

- Oracle Outside Processing GuideDokumen28 halamanOracle Outside Processing GuideArunkumar RajaBelum ada peringkat

- Non Valuated StockDokumen4 halamanNon Valuated StockGK SKBelum ada peringkat

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDari EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsPenilaian: 5 dari 5 bintang5/5 (1)

- AutoCAD Mechanical 2015 Overview Brochure - A4Dokumen4 halamanAutoCAD Mechanical 2015 Overview Brochure - A4Raul ReynosoBelum ada peringkat

- SAP MM - Material ValuationDokumen6 halamanSAP MM - Material ValuationYani LieBelum ada peringkat

- GRIRDokumen3 halamanGRIRNakul GautamBelum ada peringkat

- SAP Purchase ReturnDokumen2 halamanSAP Purchase Returnshikha1986Belum ada peringkat

- Unplanned Delivery CostsDokumen5 halamanUnplanned Delivery CostsRajeev GuptaBelum ada peringkat

- Bellin, E. H. (1984) - The Psychoanalytic Narrative On The Transformational Axis Between Writing and SpeechDokumen15 halamanBellin, E. H. (1984) - The Psychoanalytic Narrative On The Transformational Axis Between Writing and SpeechofanimenochBelum ada peringkat

- Accounting Entries in Oracle Purchasing and PayablesDokumen15 halamanAccounting Entries in Oracle Purchasing and PayablesmuradBelum ada peringkat

- 200 PMP Sample QuestionsDokumen122 halaman200 PMP Sample QuestionsKusum Bugalia100% (2)

- 200 PMP Sample QuestionsDokumen122 halaman200 PMP Sample QuestionsKusum Bugalia100% (2)

- Inventory Average Cost TransactionsDokumen70 halamanInventory Average Cost TransactionsMuhammad Wasim QureshiBelum ada peringkat

- SAP - Procurement of Consumable MaterialDokumen9 halamanSAP - Procurement of Consumable MaterialGabriele P.100% (16)

- Accounts Payable Process ExplainedDokumen2 halamanAccounts Payable Process ExplainedCaterina De Luca100% (1)

- Oracle AP Invoices & Hold DetailsDokumen12 halamanOracle AP Invoices & Hold DetailsDinesh Kumar Sivaji100% (1)

- D100 Test 2Dokumen7 halamanD100 Test 2Viola LeviBelum ada peringkat

- SAP B1 Preparation GuideDokumen10 halamanSAP B1 Preparation GuideSujit DhanukaBelum ada peringkat

- Sales Proc w 3rd Party (w/wo NotifDokumen3 halamanSales Proc w 3rd Party (w/wo NotifAnonymous sJyYzABelum ada peringkat

- MAP Without Stock Coverage PostingsDokumen2 halamanMAP Without Stock Coverage PostingsSilva SilvaBelum ada peringkat

- Consignment Stock ProcessingDokumen5 halamanConsignment Stock ProcessingShivaprakash Shastri Hiremath100% (1)

- GRIR Clearing ProcessDokumen6 halamanGRIR Clearing Processbernard murindaBelum ada peringkat

- Logic of price difference posting in MIRO for inventory and price accountsDokumen3 halamanLogic of price difference posting in MIRO for inventory and price accountspdjraoBelum ada peringkat

- Procurement of consumable materialDokumen3 halamanProcurement of consumable materialsharathbnsBelum ada peringkat

- SAP FICO Interview Questions on Logistics Invoice VerificationDokumen2 halamanSAP FICO Interview Questions on Logistics Invoice VerificationNabeelBelum ada peringkat

- Stock Overview (Russia) SAPDokumen8 halamanStock Overview (Russia) SAPjaspreet1989Belum ada peringkat

- Consigment ProcessDokumen4 halamanConsigment ProcessPrashanth ReddyBelum ada peringkat

- Inventory Org Account DetailsDokumen7 halamanInventory Org Account DetailsSyed MustafaBelum ada peringkat

- Consignment ProcessDokumen3 halamanConsignment Processrakesh_sapBelum ada peringkat

- Accounting PoDokumen4 halamanAccounting PoSherif Abdel MoneomBelum ada peringkat

- Periodic and Perpetual Inventory SystemDokumen19 halamanPeriodic and Perpetual Inventory SystemMichelle RotairoBelum ada peringkat

- 1 - Accounting For Sales and Purchasing - DemosDokumen5 halaman1 - Accounting For Sales and Purchasing - DemosMónica CacheuxBelum ada peringkat

- OBYC v2 15Dokumen131 halamanOBYC v2 15Francisco HerreraBelum ada peringkat

- Screen Field's DefinitionDokumen27 halamanScreen Field's Definitiondeepak soniBelum ada peringkat

- Transaction keys guideDokumen8 halamanTransaction keys guideKamleshSarojBelum ada peringkat

- Price Variance - Account MovementsDokumen1 halamanPrice Variance - Account MovementsAnis PathanBelum ada peringkat

- SAP Accounting EntriesDokumen7 halamanSAP Accounting EntriesJessica AlvarezBelum ada peringkat

- Cash Sales Document GuideDokumen28 halamanCash Sales Document GuideRanjeet SinghBelum ada peringkat

- PCA - Multiple ValuationsDokumen5 halamanPCA - Multiple ValuationscitigenxBelum ada peringkat

- Update Valuated Sales Order Stock PricesDokumen3 halamanUpdate Valuated Sales Order Stock PricesGK SKBelum ada peringkat

- Procure To PayDokumen2 halamanProcure To PayNaveen BhaiBelum ada peringkat

- Oracle Purchasing - & - Inventory - Standard - ReportsDokumen19 halamanOracle Purchasing - & - Inventory - Standard - Reportsfarhanahmed01Belum ada peringkat

- IMP Abt Oracle FinancialsDokumen12 halamanIMP Abt Oracle FinancialsRohit DaswaniBelum ada peringkat

- Stock Transfer Between Plants in One StepDokumen5 halamanStock Transfer Between Plants in One StepRahul JainBelum ada peringkat

- Basic Sales Process and Document Generation in SAP Business OneDokumen27 halamanBasic Sales Process and Document Generation in SAP Business OneJoanne DyanBelum ada peringkat

- Questions PDFDokumen106 halamanQuestions PDFPhani Indra100% (1)

- Chapter 5 SummaryDokumen38 halamanChapter 5 SummaryYshi Mae SantosBelum ada peringkat

- Retro-Billing Process OverviewDokumen8 halamanRetro-Billing Process OverviewHarish KumarBelum ada peringkat

- Purchasing DocumentsDokumen7 halamanPurchasing DocumentsJoy Angelique JavierBelum ada peringkat

- Inventory AccDokumen15 halamanInventory Accnewaybeyene5Belum ada peringkat

- Enterprise resource planning (ERP) in 40 charactersDokumen25 halamanEnterprise resource planning (ERP) in 40 charactersUmair AhmadBelum ada peringkat

- Stock Posting (BSX) - This Transaction Is Used For All Postings To Stock AccountsDokumen3 halamanStock Posting (BSX) - This Transaction Is Used For All Postings To Stock AccountsRam ShankerBelum ada peringkat

- Procurement process in SAP Business One from purchase requisition to outgoing paymentDokumen3 halamanProcurement process in SAP Business One from purchase requisition to outgoing paymentNauman ZiaBelum ada peringkat

- Functional Documentation/Sales ManagementDokumen7 halamanFunctional Documentation/Sales ManagementM Fadzli Ab RahimBelum ada peringkat

- Allow Negative Balance and Negative On-Hand TxnsDokumen2 halamanAllow Negative Balance and Negative On-Hand TxnsRahul JainBelum ada peringkat

- Inventory AgDokumen280 halamanInventory AgRahul JainBelum ada peringkat

- Allow Item Description UpdateDokumen1 halamanAllow Item Description UpdateRahul JainBelum ada peringkat

- Life Time CalenderDokumen1 halamanLife Time CalenderRahul JainBelum ada peringkat

- Goods & Service Tax (OFI) White Paper On AccountingDokumen9 halamanGoods & Service Tax (OFI) White Paper On AccountingRahul JainBelum ada peringkat

- Decimal Precision ManufacturingDokumen1 halamanDecimal Precision ManufacturingRahul JainBelum ada peringkat

- Ability To Create Manual OSP Purchase RequisitionsDokumen2 halamanAbility To Create Manual OSP Purchase RequisitionsRahul JainBelum ada peringkat

- Costing Master NoteDokumen3 halamanCosting Master NoteRahul JainBelum ada peringkat

- Document Sequence in Receivables PDFDokumen1 halamanDocument Sequence in Receivables PDFRahul JainBelum ada peringkat

- RCV RTP in Fusion PDFDokumen5 halamanRCV RTP in Fusion PDFRahul JainBelum ada peringkat

- Document Sequence in Receivables PDFDokumen1 halamanDocument Sequence in Receivables PDFRahul JainBelum ada peringkat

- Applies To:: Manage Action Rules in Inspection Plan Not Working (Doc ID 2480521.1)Dokumen1 halamanApplies To:: Manage Action Rules in Inspection Plan Not Working (Doc ID 2480521.1)Rahul JainBelum ada peringkat

- Applies To:: How To Create A Basic Quality Inspection Plan For PO Receiving (Doc ID 2351234.1)Dokumen1 halamanApplies To:: How To Create A Basic Quality Inspection Plan For PO Receiving (Doc ID 2351234.1)Rahul JainBelum ada peringkat

- EnterpriseStructureForProcurementSharedServices V13 PDFDokumen32 halamanEnterpriseStructureForProcurementSharedServices V13 PDFRahul JainBelum ada peringkat

- SAP Material Management Profit Center Postings Ina IM Plant To Plant TransferDokumen10 halamanSAP Material Management Profit Center Postings Ina IM Plant To Plant TransferRahul JainBelum ada peringkat

- Asset Expense ItemsDokumen1 halamanAsset Expense ItemsRahul JainBelum ada peringkat

- Consigned Inventory DemoDokumen12 halamanConsigned Inventory Demosourabhparande100% (1)

- Period Close Pending Transactions ReportDokumen1 halamanPeriod Close Pending Transactions ReportRahul JainBelum ada peringkat

- SAP Goods Receipt from Production w/o Production Order but charge to Internal OrderDokumen27 halamanSAP Goods Receipt from Production w/o Production Order but charge to Internal OrderRahul JainBelum ada peringkat

- 2016-08-08 MM IM MIGO IMG ScreenDefaults .MultiMovType BloggedDokumen32 halaman2016-08-08 MM IM MIGO IMG ScreenDefaults .MultiMovType BloggedRahul JainBelum ada peringkat

- 2016-07-11 MM IMGNewPlantConfigA CheckAllPlantParamAfterDokumen44 halaman2016-07-11 MM IMGNewPlantConfigA CheckAllPlantParamAfterRahul JainBelum ada peringkat

- Ema 312 Unit 4Dokumen22 halamanEma 312 Unit 4Ahbyna AmorBelum ada peringkat

- Power Cable Installation ManualDokumen50 halamanPower Cable Installation ManualAnn DodsonBelum ada peringkat

- Goniophotometer T1: OxytechDokumen6 halamanGoniophotometer T1: OxytechGustavo CeccopieriBelum ada peringkat

- VSD Operacion ControlDokumen138 halamanVSD Operacion ControlLeon PerezBelum ada peringkat

- Spesifikasi ACER Travelmate P2-P245Dokumen12 halamanSpesifikasi ACER Travelmate P2-P245Sebastian Fykri AlmuktiBelum ada peringkat

- College of Information Technology Dmmmsu-Mluc City of San FernandoDokumen9 halamanCollege of Information Technology Dmmmsu-Mluc City of San FernandoZoilo BagtangBelum ada peringkat

- Affixation (Landscape)Dokumen4 halamanAffixation (Landscape)difafalahudinBelum ada peringkat

- Practical-10: AIM: Installing Active Directory and Creating AD ObjectsDokumen4 halamanPractical-10: AIM: Installing Active Directory and Creating AD ObjectsnisuBelum ada peringkat

- Gallium Nitride Materials and Devices IV: Proceedings of SpieDokumen16 halamanGallium Nitride Materials and Devices IV: Proceedings of SpieBatiriMichaelBelum ada peringkat

- Reliability EngineeringDokumen9 halamanReliability Engineeringnvaradharajan1971Belum ada peringkat

- SIEMENS-7SA522 Setting CalculationDokumen20 halamanSIEMENS-7SA522 Setting Calculationnaran19794735Belum ada peringkat

- Eltek PSR 327Dokumen2 halamanEltek PSR 327fan liuBelum ada peringkat

- Velocity profiles and incompressible flow field equationsDokumen2 halamanVelocity profiles and incompressible flow field equationsAbdul ArifBelum ada peringkat

- Example 3 - S-Beam CrashDokumen13 halamanExample 3 - S-Beam CrashSanthosh LingappaBelum ada peringkat

- DS Ac0801 GBDokumen20 halamanDS Ac0801 GBHossein Jalali MoghaddamBelum ada peringkat

- 8086 Instruction SetDokumen66 halaman8086 Instruction SetRaj KumarBelum ada peringkat

- Baidu - LeetCodeDokumen2 halamanBaidu - LeetCodeSivareddyBelum ada peringkat

- GenEd Mathematics LLL PDFDokumen32 halamanGenEd Mathematics LLL PDFArmely NiedoBelum ada peringkat

- Measurements/ Specifications: Torque Wrench Selection GuideDokumen5 halamanMeasurements/ Specifications: Torque Wrench Selection GuideSylvester RakgateBelum ada peringkat

- Development of A Highway Performance Index For Upgrading Decision Making - Case Study For A Provincial Road Network in A Developing CountryDokumen6 halamanDevelopment of A Highway Performance Index For Upgrading Decision Making - Case Study For A Provincial Road Network in A Developing CountryAshen MinolBelum ada peringkat

- Ms-Dos Device Drivers: Device Drivers Are The That in File atDokumen13 halamanMs-Dos Device Drivers: Device Drivers Are The That in File atJass GillBelum ada peringkat

- c1Dokumen19 halamanc1vgnagaBelum ada peringkat

- Rodi TestSystem EZSDI1 Iom D603Dokumen25 halamanRodi TestSystem EZSDI1 Iom D603Ricardo AndradeBelum ada peringkat

- Classification of Differential Equations For Finding Their SolutionsDokumen2 halamanClassification of Differential Equations For Finding Their SolutionsakhileshBelum ada peringkat

- A Design and Analysis of A Morphing Hyper-Elliptic Cambered Span (HECS) WingDokumen10 halamanA Design and Analysis of A Morphing Hyper-Elliptic Cambered Span (HECS) WingJEORJEBelum ada peringkat

- Winegard Sensar AntennasDokumen8 halamanWinegard Sensar AntennasMichael ColeBelum ada peringkat