TheSun 2009-07-27 Page14 Make Annual Reports Easier To Read

Diunggah oleh

Impulsive collectorDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

TheSun 2009-07-27 Page14 Make Annual Reports Easier To Read

Diunggah oleh

Impulsive collectorHak Cipta:

Format Tersedia

14 theSun | MONDAY JULY 27 2009

business

‘Make annual reports easier to read’

by Eva Yeong

newsdesk@thesundaily.com

Bushon said as an example, annual reports

disclose a lot of information but are not

continuously educate shareholders, mak-

ing them knowledgeable and responsible

tors,” she said.

She advises investors to take on a more

transparent. to raise relevant questions to the board of proactive role by going to AGMs and asking

KUALA LUMPUR: The Minority Share- “Transparency to me is ease of informa- directors during annual general meetings. relevant questions in order for companies to

holder Watchdog Group (MSWG) has tion reading,” she said, adding that sev- “As you know, MSWG is a body set up be more transparent.

underlined the importance of companies eral companies have taken the initiative to to enhance shareholder activism and to “If you care, the company will respond. You

to be transparent and to disclose as much provide condensed versions of its annual protect minority interest. We aim to reach cannot be complacent,” she told theSun in a

information as possible and in a clearer reports for easier reading. out to the community at large to play its recent interview.

Bushon ... transparency manner so that investors can make well- Bushon, who joined MSWG as its part in raising investor education standard On the economic outlook, Bushon said

to me is ease of informed decisions. CEO on Jan 1 this year, said for effective in Malaysia, to support and complement the market is already taking a slightly upturn

information reading. Its chief executive officer Rita Benoy shareholder activism, there is a need to other initiatives undertaken by the regula- swing.

“Malaysia has the advantage of having palm

oil, and oil and gas. Now our service industry

has to be upgraded which is already going

towards that direction,” she said, adding that

several aspects such as liberalisation of the

financial sector and capital market bode well

for the economy.

“The prime minister’s efforts are all good,

but it will take time before we see any relief,”

she said.

Bushon, who remains optimistic about the

economy, feels that it is a “well-kept secret”.

“I believe we are a blessed nation. We are a

secret well-kept. Only companies who see the

fundamentals of our country will enjoy it. Now, we

need to expose the secret, tell it to the world.”

She also had some words of advice for

investors.

“Investing is different from speculating.

Some people take it as speculation but I think

everyone should have risk averseness. Inves-

tors must be savvy when making decisions on

investments, don’t just go by rumours. Look

into the company’s fundamentals,” she said.

“An investor with the right knowledge and

information can make a difference between

losing his capital in bad investments and reap-

ing steady profits from the ones with strong

fundamentals.”

Therefore, the best way to safeguard one’s

investment is to be a well-informed investor.

Investors who do not understand the invest-

ment risks may stand to lose their hard earned

money in bad investments, or can become

gullible to be easily taken advantage of by

unscrupulous market players, she added.

According to Bushon, this is the best time

to buy with the economy at a downturn and

investors should look at companies with strong

fundamentals despite having its prices bashed.

“Investors should take advantage of this

situation to accumulate for the longer term.

In the next few years, prices should come up

again. Don’t go on short-term basis.”

Bushon also advised investors to look at

their financial planning and their age profile

before making any investments.

“When you are younger, you can afford to take

risks because you’ve got a longer time period,

and in whatever circumstances, a certain amount

must be set aside for your retirement, for your

children’s education and for everyday living.

“Use your spare money to invest, and you can

invest in property so that at the end of the day,

you have a roof over your head,” said the former

executive director of Land & General Bhd.

Al-Rajhi Bank to

set up branch in

Sabah next year

KOTA KINABALU: In proving their commitment

to expand its banking network into Sabah, a

group of Al-Rajhi Bank staff are attempting to

set a record for being the first bank in Malaysia

to perform online transactions today from the

peak of Mount Kinabalu.

Once successful, the bank will be endorsed

as the first bank in Malaysia to perform online

banking transactions from the country’s high-

est altitude.

The manager for the record-breaking project,

Mohd Najid Yahya, who is also Al-Rajhi Bank’s

senior vice-president for business intelligence,

said one the objectives of the project was to

send a message to Sabahans that the bank was

coming to the state soon.

“We plan to have at least one branch in

Sabah by the first quarter of next year,” he told

Bernama in an interview yesterday.

Najid said the bank had been given licences

to open 50 branches throughout the country by

Bank Negara Malaysia.

Having started operations in Malaysia for

almost two years now, the bank currently has

19 branches in the country, 14 in the Klang Val-

ley and one branch each in Kota Baru, Johor

Baru, Malacca, Penang and Kuching.

Anda mungkin juga menyukai

- Book Financing Sustainability 2Dokumen225 halamanBook Financing Sustainability 2KEHKASHAN NIZAMBelum ada peringkat

- Postgraduate - 19 February 2019Dokumen8 halamanPostgraduate - 19 February 2019Times MediaBelum ada peringkat

- Role of Cfo in Value GenerationDokumen3 halamanRole of Cfo in Value GenerationRajyaLakshmiBelum ada peringkat

- PWC Ir Practical GuideDokumen32 halamanPWC Ir Practical GuideAleksandra KowalikBelum ada peringkat

- GovernanceDokumen12 halamanGovernanceRyu Ardhana Ch.Belum ada peringkat

- Thesun 2009-05-06 Page15 Asian Lender Under Scrutiny After Capital BoostDokumen1 halamanThesun 2009-05-06 Page15 Asian Lender Under Scrutiny After Capital BoostImpulsive collectorBelum ada peringkat

- MoneyWeek 28 July 2023Dokumen40 halamanMoneyWeek 28 July 2023Vijay RathodBelum ada peringkat

- Thesun 2009-07-14 Page16 Banks Need Clear Strategy To Ensure Viability PWCDokumen1 halamanThesun 2009-07-14 Page16 Banks Need Clear Strategy To Ensure Viability PWCImpulsive collectorBelum ada peringkat

- The Opportunity: For PractitionersDokumen14 halamanThe Opportunity: For PractitionersPatricia BecerraBelum ada peringkat

- 25-27 Great Place To WorkDokumen3 halaman25-27 Great Place To WorkMeeta MohapatraBelum ada peringkat

- Tugas Presentasi GCGDokumen33 halamanTugas Presentasi GCGArdhani SetyoajiBelum ada peringkat

- TheSun 2008-11-07 Page28 Inflation Dents Retirement PlansDokumen1 halamanTheSun 2008-11-07 Page28 Inflation Dents Retirement PlansImpulsive collectorBelum ada peringkat

- Dark Side of WFHDokumen24 halamanDark Side of WFHMohd Ilham AdamBelum ada peringkat

- Manage Income & Expenses GuideDokumen11 halamanManage Income & Expenses GuideDanna PedrazaBelum ada peringkat

- FM302 Tutorial 1Dokumen17 halamanFM302 Tutorial 1Roselyn PrakashBelum ada peringkat

- 2021 ANDE MemberBroch ENGLISHDokumen5 halaman2021 ANDE MemberBroch ENGLISHLouby OscarBelum ada peringkat

- Analysis of Performance and Commitment As Intervening of Motivation, Employee Satisfaction and Transformational Leadership at BAZNASDokumen5 halamanAnalysis of Performance and Commitment As Intervening of Motivation, Employee Satisfaction and Transformational Leadership at BAZNASInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Budget To Pave Way For Sustainable Economic Growth'Dokumen1 halamanBudget To Pave Way For Sustainable Economic Growth'salma aifnaBelum ada peringkat

- GIIN Roadmap BrieferDokumen3 halamanGIIN Roadmap BrieferJRomanBelum ada peringkat

- Determinants_of_Micro_and_Small_EnterpriDokumen5 halamanDeterminants_of_Micro_and_Small_Enterprikoricho lemmaBelum ada peringkat

- The Bank of UgandaDokumen1 halamanThe Bank of UgandaTimothy KawumaBelum ada peringkat

- B.E - Corporate Governance & CSRDokumen53 halamanB.E - Corporate Governance & CSRjammy1234567Belum ada peringkat

- ACI Annual Report 2017-18Dokumen223 halamanACI Annual Report 2017-18Tasnim Tasfia SrishtyBelum ada peringkat

- Binuangan: Executive Legislative AgendaDokumen30 halamanBinuangan: Executive Legislative AgendaAsyed Silayan ZaportizaBelum ada peringkat

- Determinants of Banks Profitability Empirical Evidence From Banks in EthiopiaDokumen16 halamanDeterminants of Banks Profitability Empirical Evidence From Banks in EthiopiaLiana AngeliaBelum ada peringkat

- Building Back Better with Local Green EnterprisesDokumen4 halamanBuilding Back Better with Local Green EnterprisesSaundharaya KhannaBelum ada peringkat

- High School CPABC BrochureDokumen3 halamanHigh School CPABC Brochurepoet229realBelum ada peringkat

- A Value-Based Management SystemDokumen5 halamanA Value-Based Management SystemAishwarya RaoBelum ada peringkat

- Thesun 2009-04-21 Page16 PNB Offers 5Dokumen1 halamanThesun 2009-04-21 Page16 PNB Offers 5Impulsive collectorBelum ada peringkat

- Thesun 2009-04-14 Page07 New Initiatives To Enhance Tourism IndustryDokumen1 halamanThesun 2009-04-14 Page07 New Initiatives To Enhance Tourism IndustryImpulsive collectorBelum ada peringkat

- Building Back Better with Local Green EnterprisesDokumen5 halamanBuilding Back Better with Local Green EnterprisesSaundharaya KhannaBelum ada peringkat

- From The Stockholder To The Stakeholder PDFDokumen62 halamanFrom The Stockholder To The Stakeholder PDFMatteo MarcantogniniBelum ada peringkat

- Building Finance Functions for the FutureDokumen18 halamanBuilding Finance Functions for the FutureDaniel SihotangBelum ada peringkat

- 505 3038 1 PBDokumen14 halaman505 3038 1 PBMarifatussyifaBelum ada peringkat

- BEI 2023 BUMN (Prof Rofikoh Rokhim)Dokumen24 halamanBEI 2023 BUMN (Prof Rofikoh Rokhim)Muhamad YasinBelum ada peringkat

- NBK Sustainability Report 2016 highlights progressDokumen33 halamanNBK Sustainability Report 2016 highlights progressزين العابدين راضيBelum ada peringkat

- Thesun 2009-09-09 Page14 Smes Need Attractive Incentives To Venture OffshoreDokumen1 halamanThesun 2009-09-09 Page14 Smes Need Attractive Incentives To Venture OffshoreImpulsive collectorBelum ada peringkat

- Gestion de AlmacenDokumen11 halamanGestion de Almacenjuan carlosBelum ada peringkat

- The Wealth Report 2020part 2Dokumen4 halamanThe Wealth Report 2020part 2NameBelum ada peringkat

- TheSun 2009-05-14 Page15 BNM Conducts Stress Tests On Banking SectorDokumen1 halamanTheSun 2009-05-14 Page15 BNM Conducts Stress Tests On Banking SectorImpulsive collectorBelum ada peringkat

- p9 SVGZDokumen1 halamanp9 SVGZJohn JohnsonBelum ada peringkat

- Thesun 2009-05-07 Page12 Opr Rate Appropriate Says BNM ChiefDokumen1 halamanThesun 2009-05-07 Page12 Opr Rate Appropriate Says BNM ChiefImpulsive collectorBelum ada peringkat

- Chapter 4Dokumen4 halamanChapter 4Maria Charise TongolBelum ada peringkat

- ASEAN SMEs: Transforming For The FutureDokumen30 halamanASEAN SMEs: Transforming For The FutureVarun MittalBelum ada peringkat

- OMZIL Mid Year 2022 Financial ResultsDokumen8 halamanOMZIL Mid Year 2022 Financial ResultsMandisi MoyoBelum ada peringkat

- Annual Review 2008: Global Standards: The Business BenefitsDokumen7 halamanAnnual Review 2008: Global Standards: The Business BenefitsWaqasBelum ada peringkat

- TblDokumen6 halamanTblKarilBelum ada peringkat

- The Relationship Between Dividend Policy and Earnings Quality: The Role of Accounting Information in Indonesia's Capital MarketDokumen24 halamanThe Relationship Between Dividend Policy and Earnings Quality: The Role of Accounting Information in Indonesia's Capital MarketRobbyShougaraBelum ada peringkat

- LBC Express Holdings, Inc. (LBCDokumen7 halamanLBC Express Holdings, Inc. (LBCAllyza RenoballesBelum ada peringkat

- PaxysDokumen181 halamanPaxysPhilip LarozaBelum ada peringkat

- NYL Diversity - Report - 2022Dokumen19 halamanNYL Diversity - Report - 2022vanuska sylesterBelum ada peringkat

- 2-3 December, 2020 Diponegoro, Jakarta, Indonesia: Gold Sponsor Water SponsorDokumen8 halaman2-3 December, 2020 Diponegoro, Jakarta, Indonesia: Gold Sponsor Water SponsorRicardo SmithBelum ada peringkat

- New Fund For Care Services, 6 Nov 2009, The New PaperDokumen1 halamanNew Fund For Care Services, 6 Nov 2009, The New PaperdbmcysBelum ada peringkat

- Factors Influencing Interest in Joining Tax Certification ProgramsDokumen12 halamanFactors Influencing Interest in Joining Tax Certification ProgramsL AdamBelum ada peringkat

- Scribd Upload 6Dokumen22 halamanScribd Upload 6AnirudhBelum ada peringkat

- New Sustainability Commitments in The Environmental Social and Governance SupplementDokumen20 halamanNew Sustainability Commitments in The Environmental Social and Governance SupplementArpit GoelBelum ada peringkat

- Assignment 5 - Introduction To Business FunctionsDokumen15 halamanAssignment 5 - Introduction To Business FunctionsM IsmailBelum ada peringkat

- Reading ArticleDokumen1 halamanReading ArticleMuy KongBelum ada peringkat

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachDari EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachBelum ada peringkat

- Working Capital Management and FinanceDari EverandWorking Capital Management and FinancePenilaian: 3.5 dari 5 bintang3.5/5 (8)

- Islamic Financial Services Act 2013Dokumen177 halamanIslamic Financial Services Act 2013Impulsive collectorBelum ada peringkat

- Flexible Working Good Business - How Small Firms Are Doing ItDokumen20 halamanFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorBelum ada peringkat

- KPMG CEO StudyDokumen32 halamanKPMG CEO StudyImpulsive collectorBelum ada peringkat

- Coaching in OrganisationsDokumen18 halamanCoaching in OrganisationsImpulsive collectorBelum ada peringkat

- Megatrends Report 2015Dokumen56 halamanMegatrends Report 2015Cleverson TabajaraBelum ada peringkat

- Stanford Business Magazine 2013 AutumnDokumen68 halamanStanford Business Magazine 2013 AutumnImpulsive collectorBelum ada peringkat

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDokumen5 halamanIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorBelum ada peringkat

- HayGroup Job Measurement: An IntroductionDokumen17 halamanHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Emotional or Transactional Engagement CIPD 2012Dokumen36 halamanEmotional or Transactional Engagement CIPD 2012Impulsive collectorBelum ada peringkat

- HayGroup Rewarding Malaysia July 2010Dokumen8 halamanHayGroup Rewarding Malaysia July 2010Impulsive collectorBelum ada peringkat

- Global Added Value of Flexible BenefitsDokumen4 halamanGlobal Added Value of Flexible BenefitsImpulsive collectorBelum ada peringkat

- Developing An Enterprise Leadership MindsetDokumen36 halamanDeveloping An Enterprise Leadership MindsetImpulsive collectorBelum ada peringkat

- Global Talent 2021Dokumen21 halamanGlobal Talent 2021rsrobinsuarezBelum ada peringkat

- Futuretrends in Leadership DevelopmentDokumen36 halamanFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDokumen27 halamanHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDokumen4 halamanHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Strategy+Business - Winter 2014Dokumen108 halamanStrategy+Business - Winter 2014GustavoLopezGBelum ada peringkat

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDokumen15 halamanHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaBelum ada peringkat

- 2015 Summer Strategy+business PDFDokumen104 halaman2015 Summer Strategy+business PDFImpulsive collectorBelum ada peringkat

- Strategy+Business Magazine 2016 AutumnDokumen132 halamanStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDokumen117 halamanCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Compensation Fundamentals - Towers WatsonDokumen31 halamanCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Managing Conflict at Work - A Guide For Line ManagersDokumen22 halamanManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuBelum ada peringkat

- 2016 Summer Strategy+business PDFDokumen116 halaman2016 Summer Strategy+business PDFImpulsive collectorBelum ada peringkat

- HBR - HR Joins The Analytics RevolutionDokumen12 halamanHBR - HR Joins The Analytics RevolutionImpulsive collectorBelum ada peringkat

- 2012 Metrics and Analytics - Patterns of Use and ValueDokumen19 halaman2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorBelum ada peringkat

- Talent Analytics and Big DataDokumen28 halamanTalent Analytics and Big DataImpulsive collectorBelum ada peringkat

- IBM - Using Workforce Analytics To Drive Business ResultsDokumen24 halamanIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorBelum ada peringkat

- Deloitte Analytics Analytics Advantage Report 061913Dokumen21 halamanDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorBelum ada peringkat

- TalentoDokumen28 halamanTalentogeopicBelum ada peringkat

- Language Hub Student S Book Elementary Unit 1 1Dokumen9 halamanLanguage Hub Student S Book Elementary Unit 1 1Paulo MalheiroBelum ada peringkat

- GLORIADokumen97 halamanGLORIAGovel EzraBelum ada peringkat

- Application No. 2140 6100 0550: OJEE FORM F - Application Form For B.Tech (SPECIAL) 2021Dokumen1 halamanApplication No. 2140 6100 0550: OJEE FORM F - Application Form For B.Tech (SPECIAL) 2021Siba BaiBelum ada peringkat

- Intermediate Macro 1st Edition Barro Solutions ManualDokumen8 halamanIntermediate Macro 1st Edition Barro Solutions Manualkietcuongxm5100% (22)

- 1170.2-2011 (+a5)Dokumen7 halaman1170.2-2011 (+a5)Adam0% (1)

- Sabbia Food MenuDokumen2 halamanSabbia Food MenuNell CaseyBelum ada peringkat

- Godbolt RulingDokumen84 halamanGodbolt RulingAnthony WarrenBelum ada peringkat

- Handout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceDokumen8 halamanHandout On Reed 1 Initium Fidei: An Introduction To Doing Catholic Theology Lesson 4 Naming GraceLEILA GRACE MALACABelum ada peringkat

- Olimpiada Engleza 2010 Etapa Locala IXDokumen4 halamanOlimpiada Engleza 2010 Etapa Locala IXAdrian TufanBelum ada peringkat

- Ngo Burca Vs RP DigestDokumen1 halamanNgo Burca Vs RP DigestIvy Paz100% (1)

- Asset To LiabDokumen25 halamanAsset To LiabHavanaBelum ada peringkat

- Grace Song List PDFDokumen11 halamanGrace Song List PDFGrace LyynBelum ada peringkat

- Global BF Scorecard 2017Dokumen7 halamanGlobal BF Scorecard 2017sofiabloemBelum ada peringkat

- VI Sem. BBA - HRM Specialisation - Human Resource Planning and Development PDFDokumen39 halamanVI Sem. BBA - HRM Specialisation - Human Resource Planning and Development PDFlintameyla50% (2)

- Christ The Redemers Secondary SchoolDokumen36 halamanChrist The Redemers Secondary Schoolisrael_tmjesBelum ada peringkat

- Fabric Test ReportDokumen4 halamanFabric Test ReportHasan MustafaBelum ada peringkat

- Action Plan for Integrated Waste Management in SaharanpurDokumen5 halamanAction Plan for Integrated Waste Management in SaharanpuramitBelum ada peringkat

- Sefer Yetzirah PDFDokumen32 halamanSefer Yetzirah PDFWealthEntrepreneur100% (1)

- Religious Marriage in A Liberal State Gidi Sapir & Daniel StatmanDokumen26 halamanReligious Marriage in A Liberal State Gidi Sapir & Daniel StatmanR Hayim BakaBelum ada peringkat

- Cost of DebtDokumen3 halamanCost of DebtGonzalo De CorralBelum ada peringkat

- Influencing Decisions: Analyzing Persuasion TacticsDokumen10 halamanInfluencing Decisions: Analyzing Persuasion TacticsCarl Mariel BurdeosBelum ada peringkat

- Student Majoriti Planing After GrdaduationDokumen13 halamanStudent Majoriti Planing After GrdaduationShafizahNurBelum ada peringkat

- Music Business PlanDokumen51 halamanMusic Business PlandrkayalabBelum ada peringkat

- APWU Contract Effective DatesDokumen5 halamanAPWU Contract Effective DatesPostalReporter.comBelum ada peringkat

- Taylor Swift Tagalig MemesDokumen34 halamanTaylor Swift Tagalig MemesAsa Zetterstrom McFly SwiftBelum ada peringkat

- TallerDokumen102 halamanTallerMarie RodriguezBelum ada peringkat

- 11 Days Banner Advertising Plan for Prothom AloDokumen4 halaman11 Days Banner Advertising Plan for Prothom AloC. M. Omar FaruqBelum ada peringkat

- A Recurrent Quest For Corporate Governance in India Revisiting The Imbalanced Scales of Shareholders' Protection in Tata Mistry CaseDokumen17 halamanA Recurrent Quest For Corporate Governance in India Revisiting The Imbalanced Scales of Shareholders' Protection in Tata Mistry CaseSupriya RaniBelum ada peringkat

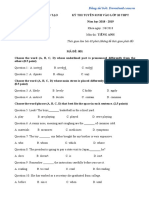

- Đề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangDokumen5 halamanĐề thi tuyển sinh vào lớp 10 năm 2018 - 2019 môn Tiếng Anh - Sở GD&ĐT An GiangHaiBelum ada peringkat

- PPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerDokumen40 halamanPPAC's Snapshot of India's Oil & Gas Data: Abridged Ready ReckonerVishwajeet GhoshBelum ada peringkat