Ace Hardware 2012

Diunggah oleh

Diah SuryaningrumHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ace Hardware 2012

Diunggah oleh

Diah SuryaningrumHak Cipta:

Format Tersedia

ACES Ace Hardware Indonesia Tbk.

[S]

COMPANY REPORT : FEBRUARY 2013

Main Board

Industry Sector : Trade, Services & Investment (9)

Industry Sub Sector : Retail Trade (93)

As of 28 February 2013

:

890.244

Individual Index

17,150,000,000

:

Listed Shares

Market Capitalization : 12,519,500,000,000

66 | 13.0T | 0.31% | 81.40%

88 | 2.44T | 0.22% | 88.03%

COMPANY HISTORY

Established Date : 03-Feb-1995

Listing Date

: 06-Nov-2007

Under Writer IPO :

PT CLSA Indonesia

PT Dinamika Usaha Jaya

Securities Administration Bureau :

PT Adimitra Transferindo

Plaza Property 2nd Fl. Komp. Pertokoan Pulomas Blok VIII No. 1

Jln. Perintis Kemerdekaan Jakarta 13210

Phone : 478-81515 (Hunting)

Fax

: 470-9697

BOARD OF COMMISSIONERS

1. Kuncoro Wibowo

2. Ijek Widya Krisnadi

3. Tarub *)

4. Teddy Hartono Setiawan *)

*) Independent Commissioners

BOARD OF DIRECTORS

1. Prabowo Widyakrisnadi

2. Hartanto Djasman

3. Rudy Hartono

4. Tarisa Widya Krisnadi

AUDIT COMMITTEE

1. Teddy Hartono Setiawan

2. Iskandar Baha

3. Ngaku Putu Adhiriana

CORPORATE SECRETARY

Helen R. Tanzil

HEAD OFFICE

Gedung Kawan Lama Lt. 5

Jln. Puri Kencana No. 1 Meruya Kembangan

Jakarta - 11610

Phone : (021) 582-2222

Fax

: (021) 582-1520, 582-4022

Homepage

: www.acehardware.co.id

: helen_tanzil@acehardware.co.id

SHAREHOLDERS (February 2013)

1. PT Kawan Lama Sejahtera

2. Public (<5%)

DIVIDEND ANNOUNCEMENT

Bonus

Cash

Year Shares Dividend Cum Date

2007

3.49 16-Apr-08

2008

7.60 06-May-09

9.20 27-May-10

2009

2010

51.85 03-Jun-11

2011

25.00 08-Jun-12

10,284,900,000 :

6,865,100,000 :

Ex Date

17-Apr-08

07-May-09

31-May-10

06-Jun-11

11-Jun-12

Recording

Date

21-Apr-08

11-May-09

02-Jun-10

08-Jun-11

13-Jun-12

59.97%

40.03%

Payment

Date

06-May-08

26-May-09

16-Jun-10

22-Jun-11

27-Jun-12

F/I

I

F

F

F

F

ISSUED HISTORY

No.

1.

2.

3.

Type of Listing

First Issue

Company Listing

Stock Splits

Shares

515,000,000

1,200,000,000

15,435,000,000

Listing

Date

06-Nov-07

06-Nov-07

01-Nov-12

Trading

Date

06-Nov-07

04-May-08

01-Nov-12

ACES Ace Hardware Indonesia Tbk. [S]

Closing

Price*

Closing Price

Volume

(Mill. Sh)

1,000

72.0

875

63.0

750

54.0

625

45.0

500

36.0

375

27.0

250

18.0

125

9.0

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Closing Price*, Jakarta Composite Index (IHSG) and

Trade, Sevices and Investment Index

January 2009 - February 2013

Month

Jan-09

Feb-09

Mar-09

Apr-09

May-09

Jun-09

Jul-09

Aug-09

Sep-09

Oct-09

Nov-09

Dec-09

High

810

650

800

800

930

950

1,090

1,110

1,230

1,510

1,600

1,550

Low

610

610

650

680

800

900

920

1,030

1,090

1,220

1,480

1,480

Close

630

650

690

800

920

920

1,090

1,110

1,230

1,510

1,550

1,510

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

1,530

1,470

1,670

1,720

1,730

1,810

1,870

1,870

2,275

2,700

2,825

2,950

1,400

1,320

1,360

1,610

1,700

1,730

1,810

1,780

1,760

2,025

2,200

2,400

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

2,950

2,600

2,650

2,700

2,700

3,200

3,575

3,500

3,350

3,525

3,900

4,400

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

Dec-12

Jan-13

Feb-13

Volume

Value

Freq.

(X) (Thou. Sh.) (Million Rp)

Day

TRADING ACTIVITIES

Closing Price* and Trading Volume

Ace Hardware Indonesia Tbk. [S]

January 2009 - February 2013

86

15

15

48

84

125

114

143

138

249

233

115

40,658

4,365

2,097

4,325

13,994

130,683

41,619

8,475

17,661

42,821

2,601

2,119

29,279

2,775

1,403

3,000

12,240

122,136

40,316

8,811

20,461

56,768

3,982

3,229

14

6

7

18

16

17

19

16

17

20

20

18

1,450

1,360

1,640

1,710

1,730

1,800

1,840

1,780

2,025

2,700

2,675

2,950

144

122

286

101

179

57

76

160

695

1,072

737

319

1,509

5,031

17,451

15,962

16,781

6,436

17,404

4,622

12,591

8,743

8,660

7,314

2,221

6,826

25,872

25,857

28,964

11,240

31,564

8,405

25,648

19,300

22,580

19,161

19

12

20

17

14

16

18

17

16

21

21

20

2,425

2,250

2,400

2,400

2,600

2,600

2,850

3,000

3,025

3,050

3,150

3,600

2,650

2,500

2,550

2,650

2,700

3,025

3,450

3,300

3,300

3,375

3,800

4,100

137

238

180

1,341

176

575

118

209

204

809

509

918

6,258

5,988

5,169

31,938

11,835

16,298

33,523

7,917

54,383

37,519

41,307

14,813

16,397

14,841

13,345

83,313

31,637

48,534

102,238

25,540

178,871

126,446

149,661

57,833

18

16

20

18

17

20

19

17

19

20

21

20

4,250

4,800

4,650

5,200

6,100

5,500

6,250

6,300

6,700

7,150

760

840

3,800

4,100

4,025

4,300

4,900

4,875

5,050

5,550

5,750

6,100

690

710

4,150

4,325

4,450

5,150

5,500

5,050

5,900

5,700

6,150

7,000

750

820

436

1,118

1,290

1,746

2,752

3,253

3,242

3,033

3,706

4,491

7,796

7,353

5,546

30,112

23,254

53,843

47,009

33,023

50,818

52,432

21,309

34,381

433,997

334,657

22,460

130,298

104,761

245,743

246,898

166,671

282,666

313,951

131,483

226,667

315,631

255,087

20

20

21

20

21

21

22

18

20

22

20

18

880

790

700

710

760

730

14,877

17,914

424,483

524,462

333,200

387,776

21

20

1,120%

960%

886.5%

800%

640%

480%

420.5%

320%

233.7%

160%

-160%

Jan 09

Jan 10

Jan 11

Jan 12

Jan 13

SHARES TRADED

2009

2010

2011

Volume (Million Sh.)

Value (Billion Rp)

Frequency (Thou. X)

Days

311

304

1

188

123

228

4

211

267

849

5

225

1,120

2,442

40

243

949

721

33

41

1,600

610

1,510

151

2,950

1,320

2,950

295

4,400

2,250

4,100

410

7,150

690

820

820

880

700

730

730

16.77

28.45

PER (X)

16.33

21.27

PER Industry (X)

2.98

4.91

PBV (X)

* Adjusted price after corporate action

25.16

16.89

5.71

40.77

19.08

9.71

36.29

19.88

8.65

Price (Rupiah)

High

Low

Close

Close*

2012 Feb-13

ACES Ace Hardware Indonesia Tbk. [S]

Financial Data and Ratios

Public Accountant : RSM Aryanto, Amir Jusuf, Mawar & Saptoto (Member of RSM International)

Dec-08

Dec-09

Dec-10

Dec-11

Sep-12

Cash & Cash Equivalents

98,688

395,772

366,378

210,454

150,344

Receivable

21,142

13,966

377,073

52,394

62,591

Inventories

197,984

95,569

135,198

290,356

489,020

Current Assets

619,284

775,772

862,190

846,867

1,109,367

Fixed Assets

82,784

105,122

226,465

361,381

417,712

Other Assets

21,856

22,872

38,281

59,081

63,168

Total Assets

790,277

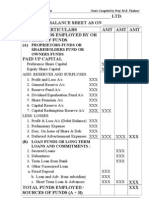

BALANCE SHEET

(Million Rp except Par Value)

Book End : December

TOTAL ASSETS AND LIABILITIES (Bill. Rp)

Assets

Liabilities

1,875

1,500

Growth (%)

970,556

1,191,333

1,451,755

1,797,694

22.81%

22.75%

21.86%

23.83%

73,186

110,310

166,524

251,305

1,125

750

375

-

Current Liabilities

91,853

20,966

29,601

36,437

53,358

98,518

112,819

102,787

146,747

219,882

349,823

-8.89%

42.77%

49.84%

59.10%

14,449

Authorized Capital

480,000

480,000

480,000

480,000

480,000

Paid up Capital

171,500

171,500

171,500

171,500

171,500

Long Term Liabilities

Total Liabilities

Growth (%)

2008

2009

2010

2011

Sep-12

TOTAL EQUITY (Billion Rupiah)

1,448

Minority Interest

1,715

1,715

1,715

1,715

1,715

100

100

100

100

100

Retained Earnings

186,135

328,146

490,275

666,785

887,851

Total Equity

677,458

Paid up Capital (Shares)

1,232

868

857

Par Value

867,768

1,030,138

1,231,874

1,447,871

28.09%

18.71%

19.58%

17.53%

Dec-08

Dec-09

Dec-10

Dec-11

Sep-12

1,279,834

1,358,775

1,641,122

2,426,438

2,296,448

6.17%

20.78%

47.85%

Growth (%)

INCOME STATEMENTS

Total Revenues

Growth (%)

Expenses

777,113

806,337

932,519

1,290,264

1,173,408

Gross Profit

502,721

552,437

708,603

1,136,175

1,123,040

Operating Expenses

338,244

374,236

490,710

765,309

788,074

Operating Profit

164,477

178,201

217,893

370,866

334,966

8.34%

22.27%

70.21%

1,030

1,153

677

562

266

-29

2008

2009

2010

2011

TOTAL REVENUES (Billion Rupiah)

2,426

2,426

Growth (%)

1,931

1,436

Other Income (Expenses)

Income before Tax

Tax

18,980

28,129

11,275

12,588

183,458

206,330

229,167

370,866

347,555

52,815

51,888

54,628

91,361

88,835

3,312

258,719

Sep-12

2,296

1,641

1,280

1,359

941

446

Minority Interest

154,443

177,851

279,505

18.22%

15.16%

57.16%

Dec-08

Dec-09

Dec-10

Dec-11

Sep-12

674.21

1,060.00

781.61

508.56

441.44

7.60

9.20

51.85

25.00

76.18

90.05

103.70

162.98

150.86

BV (Rp)

395.02

505.99

600.66

718.29

844.24

DAR (X)

0.14

0.11

0.12

0.15

0.19

DER(X)

0.17

0.12

0.14

0.18

0.24

Net Income

130,643

Growth (%)

RATIOS

Current Ratio (%)

Dividend (Rp)

EPS (Rp)

-49

2008

23.21

21.26

19.24

25.55

19.33

ROE (%)

27.08

23.78

22.25

30.11

24.00

GPM (%)

39.28

40.66

43.18

46.82

48.90

OPM (%)

12.85

13.11

13.28

15.28

14.59

NPM (%)

10.21

11.37

10.84

11.52

11.27

Payout Ratio (%)

9.98

10.22

50.00

15.34

Yield (%)

1.01

0.61

1.76

0.61

2010

2011

Sep-12

NET INCOME (Billion Rupiah)

280

259

280

222

178

154

165

ROA (%)

2009

131

108

51

-6

2008

2009

2010

2011

Sep-12

Anda mungkin juga menyukai

- Buva PDFDokumen3 halamanBuva PDFyohannestampubolonBelum ada peringkat

- Bull PDFDokumen3 halamanBull PDFyohannestampubolonBelum ada peringkat

- Bton PDFDokumen3 halamanBton PDFyohannestampubolonBelum ada peringkat

- BRPT PDFDokumen3 halamanBRPT PDFyohannestampubolonBelum ada peringkat

- Brau PDFDokumen3 halamanBrau PDFyohannestampubolonBelum ada peringkat

- Btek PDFDokumen3 halamanBtek PDFyohannestampubolonBelum ada peringkat

- Btel PDFDokumen3 halamanBtel PDFyohannestampubolonBelum ada peringkat

- Bumi Serpong Damai TBK.: January 2014Dokumen4 halamanBumi Serpong Damai TBK.: January 2014yohannestampubolonBelum ada peringkat

- BSSR PDFDokumen3 halamanBSSR PDFyohannestampubolonBelum ada peringkat

- BSWD PDFDokumen3 halamanBSWD PDFyohannestampubolonBelum ada peringkat

- Bsim PDFDokumen3 halamanBsim PDFyohannestampubolonBelum ada peringkat

- Brna PDFDokumen3 halamanBrna PDFyohannestampubolonBelum ada peringkat

- Bank CIMB Niaga TBK.: Company Report: January 2014 As of 30 January 2014Dokumen3 halamanBank CIMB Niaga TBK.: Company Report: January 2014 As of 30 January 2014yohannestampubolonBelum ada peringkat

- Bpfi PDFDokumen3 halamanBpfi PDFyohannestampubolonBelum ada peringkat

- BRMS PDFDokumen3 halamanBRMS PDFyohannestampubolonBelum ada peringkat

- BKSW PDFDokumen3 halamanBKSW PDFyohannestampubolonBelum ada peringkat

- Bram PDFDokumen3 halamanBram PDFyohannestampubolonBelum ada peringkat

- Born PDFDokumen3 halamanBorn PDFyohannestampubolonBelum ada peringkat

- Bank Mandiri (Persero) TBK.: January 2014Dokumen4 halamanBank Mandiri (Persero) TBK.: January 2014yohannestampubolonBelum ada peringkat

- Bnii PDFDokumen3 halamanBnii PDFyohannestampubolonBelum ada peringkat

- BNBR PDFDokumen3 halamanBNBR PDFyohannestampubolonBelum ada peringkat

- Bnli PDFDokumen3 halamanBnli PDFyohannestampubolonBelum ada peringkat

- BMTR PDFDokumen4 halamanBMTR PDFyohannestampubolonBelum ada peringkat

- Blta PDFDokumen3 halamanBlta PDFyohannestampubolonBelum ada peringkat

- Bank Bumi Arta TBK.: Company Report: January 2014 As of 30 January 2014Dokumen3 halamanBank Bumi Arta TBK.: Company Report: January 2014 As of 30 January 2014yohannestampubolonBelum ada peringkat

- BKDP PDFDokumen3 halamanBKDP PDFyohannestampubolonBelum ada peringkat

- BMSR PDFDokumen3 halamanBMSR PDFyohannestampubolonBelum ada peringkat

- BJTM PDFDokumen3 halamanBJTM PDFyohannestampubolonBelum ada peringkat

- BKSL PDFDokumen4 halamanBKSL PDFyohannestampubolonBelum ada peringkat

- BJBR PDFDokumen3 halamanBJBR PDFyohannestampubolonBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- CFA-Chapter 7 Relative ValuationDokumen62 halamanCFA-Chapter 7 Relative ValuationNoman MaqsoodBelum ada peringkat

- Practice Problems For Chapter 2 Part 1Dokumen3 halamanPractice Problems For Chapter 2 Part 1Elisha MonteroBelum ada peringkat

- L&T DemergerDokumen28 halamanL&T DemergerabcdeffabcdefBelum ada peringkat

- Google Sheets - Transaction Analysis SheetDokumen3 halamanGoogle Sheets - Transaction Analysis Sheetramenr227Belum ada peringkat

- Guerrero Advanced Accounting 1 PDFDokumen2 halamanGuerrero Advanced Accounting 1 PDFPritz Marc Bautista MorataBelum ada peringkat

- GGRM Ar 2020Dokumen156 halamanGGRM Ar 2020Gheta GhettoBelum ada peringkat

- AFM 101 Midterm Exam Study GuideDokumen33 halamanAFM 101 Midterm Exam Study GuiderqzhuBelum ada peringkat

- Leverage MaterialsDokumen9 halamanLeverage MaterialsRahul SehgalBelum ada peringkat

- 63ea52fcc0dcd Quickbooks Online Exams AnsDokumen149 halaman63ea52fcc0dcd Quickbooks Online Exams AnsCarlo Cariaso0% (1)

- TOA QuizDokumen4 halamanTOA QuizGian GarciaBelum ada peringkat

- Moneycontrol. P&L of Liberty ShoesDokumen2 halamanMoneycontrol. P&L of Liberty ShoesSanket Bhondage100% (1)

- Principles of Auditing and Other Assurance Services 20th Edition Whittington Solutions Manual 1Dokumen24 halamanPrinciples of Auditing and Other Assurance Services 20th Edition Whittington Solutions Manual 1evelyn100% (50)

- Vertical Balance SheetDokumen6 halamanVertical Balance Sheethaseeb_tankiwalaBelum ada peringkat

- Solved The Statement of Cash Flows For The Year Ended DecemberDokumen1 halamanSolved The Statement of Cash Flows For The Year Ended DecemberAnbu jaromiaBelum ada peringkat

- ACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8Dokumen28 halamanACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8rodell pabloBelum ada peringkat

- Chapter 2 AbvDokumen52 halamanChapter 2 AbvVienne MaceBelum ada peringkat

- PBC List 23.11.2022 - HUAWEI Intérim 2022Dokumen19 halamanPBC List 23.11.2022 - HUAWEI Intérim 2022Selmane DjeddaBelum ada peringkat

- Solved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFDokumen1 halamanSolved Citron Enters Into A Type C Restructuring With Ecru Ecru PDFAnbu jaromiaBelum ada peringkat

- The Trial Balance of Harmonica LTD at 31 December 20x1Dokumen1 halamanThe Trial Balance of Harmonica LTD at 31 December 20x1Bube KachevskaBelum ada peringkat

- Chapter 1 ReviewerDokumen4 halamanChapter 1 ReviewerAyla Mae TimtimBelum ada peringkat

- Jollibee Foods Corp - Comparative AnalysisDokumen15 halamanJollibee Foods Corp - Comparative AnalysisJ. Kylene C. Lumusad100% (1)

- What is Proration in Mergers & AcquisitionsDokumen2 halamanWhat is Proration in Mergers & AcquisitionsDanica BalinasBelum ada peringkat

- Market Efficiency and Stock BehaviorDokumen4 halamanMarket Efficiency and Stock Behaviorali marhoonBelum ada peringkat

- ACCA Financial Reporting Workbook June 2022Dokumen864 halamanACCA Financial Reporting Workbook June 2022muhammad iman bin kamarudin100% (2)

- Corporate Securites Classes of Corporate Securities: Ownership Securities and Creditor Ship SecuritiesDokumen11 halamanCorporate Securites Classes of Corporate Securities: Ownership Securities and Creditor Ship SecuritiesSanjeev KumarBelum ada peringkat

- Discussion 2 Second SemDokumen8 halamanDiscussion 2 Second SemEmey Calbay100% (1)

- The SEBI Was Established in 1988 But Was Only Given Regulatory Powers On April 12, Board of India Act, 1992Dokumen13 halamanThe SEBI Was Established in 1988 But Was Only Given Regulatory Powers On April 12, Board of India Act, 1992Bishal RoyBelum ada peringkat

- ADIT TP 2022-12 QuestionsDokumen6 halamanADIT TP 2022-12 QuestionsSalih MansoorBelum ada peringkat

- Kaya 2011Dokumen19 halamanKaya 2011Armeiko TanayaBelum ada peringkat

- Can Pre-Packaged Insolvency Resolution Process For MSMEs Prove To Be A Game ChangerDokumen2 halamanCan Pre-Packaged Insolvency Resolution Process For MSMEs Prove To Be A Game ChangerRomit ChandrakarBelum ada peringkat