B2B Project

Diunggah oleh

karansangarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

B2B Project

Diunggah oleh

karansangarHak Cipta:

Format Tersedia

Business 2 Business Project

Customer Value Management at Dell

ePGP-04C-044 Karan Sangar, Senior Business Advisor, Dell India Pvt Ltd

ePGP-04C-055 Murali R, Senior Delivery Manager, Target Corporation

A little bit about Dell:

For more than 28 years, Dell has empowered countries, communities, customers and people everywhere to use technology to realize their dreams. Customers trust them to deliver technology solutions that help them do and achieve more, whether they're at home, work, school or anywhere in their world. From unconventional PC startup to global technology leader, the common thread in Dells heritage is an unwavering commitment to the customer. Dell has over period of time acquired companies & skills to become one of the forces as solutions provider in the growing solutions and services market. It has focused on four key growth areas: end user computing, enterprise solutions, software and services. Industry analysts recognize their strategic evolution and strength in PCs, the data center, software and services. Gartner positions Dell as a leader in 11 Magic Quadrant reports.

Our goal:

During this project, we will go through the Value Dell creates for the customer. We are all well familiar with Dell direct 2 customer approach enabling no middleman business model and creating a value for the customer through cost leadership achieved during this process. In recent past, Dells competitors has pushed them to look into not just direct but other well established models in the industry. HP has achieved substantial lead in overall PC sales due to long term relationships with LR (large retailers). Lenovo has built efficient distribution centers, low cost shipping methods & low cost structures especially in the consumer segment enabling them cost advantage. We will explore why and how dell could take advantage of the opportunities created from inside to mitigate risk from competitors, build relationship with LR & MR (medium retailers) and ensure smooth supply chain through less complexity that can be converted to value for the customer. We will look at understanding & creating value in direct & reseller channels by: -

Target Market segmentation through in house modeling capabilities & effective positioning & customer value propositions Products rationalization through complexity reduction Monitoring & assessing customer value by benchmarking against competition through effective product competitive analysis Working with Suppliers and across functions to enable benefit achieved through complexity reduction

Dell Recent performance:

Dell saw shipments decline by more than -10% globally and -14% in the United States. The vendor continued to face tough competition and struggled with customer uncertainty about the direction of its restructuring. Nevertheless, the decline in shipments was smaller than the past few quarters, and its sales to Asia/Pacific returned to positive growth.

Global PC Market Recent performance:

Worldwide PC shipments totaled 76.3 million units in the first quarter of 2013 (1Q13), down -13.9% compared to the same quarter in 2012 and worse than the forecast decline of -7.7%, according to the International Data Corporation. The extent of the year-on-year contraction marked the worst quarter since

IDC began tracking the PC market quarterly in 1994. The results also marked the fourth consecutive quarter of year-on-year shipment declines.

US PC Market Recent Performance:

The impact of slow demand has been magnified by the restructuring and reorganizing efforts impacting HP and Dell. Lenovo remains a notable exception as it continues to execute on a solid "attack" strategy. Mid- and bottom-tier vendors are also struggling to identify growth markets within the U.S.

Dells Next best Competitors Globally (Lenovo) & in US (HP) Recent Performance:

HP remained the top vendor, but posted a substantial double-digit decline in shipments after an aggressive fourth quarter kept growth flat during the holidays. HP's worldwide shipments fell more than 23% year on year in 1Q13, with significant declines across all regions, as internal restructuring continued

to affect commercial sales. Although HP maintained its leadership position in the United States, the company saw U.S. shipments fall -22.9% from a year ago. Lenovo remained second in global shipments and nearly closed the gap with HP. Lenovo continued to outpace the market, notably expanding shipments with its attack strategy. In the United States, Lenovo outperformed the market with double digit year-on-year growth compared to the market's double-digit contraction. Shipments in Asia/Pacific declined, however, keeping Lenovo's overall growth flat.

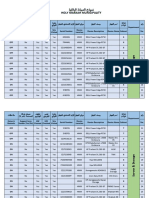

Dell historical performance:

Anda mungkin juga menyukai

- Case Analysis MicrosoftDokumen5 halamanCase Analysis MicrosoftkaransangarBelum ada peringkat

- PV Technologies Case Analysis - Gaining Favorable Evaluation for Major ProjectDokumen5 halamanPV Technologies Case Analysis - Gaining Favorable Evaluation for Major Projectkaransangar100% (1)

- QUIZ 1: 10 MinutesDokumen3 halamanQUIZ 1: 10 MinuteskaransangarBelum ada peringkat

- Lucent Control As Is V1Dokumen408 halamanLucent Control As Is V1karansangarBelum ada peringkat

- Case Analysis Precise SoftwareDokumen3 halamanCase Analysis Precise Softwarekaransangar75% (4)

- Case Analysis Kunst 1600Dokumen4 halamanCase Analysis Kunst 1600karansangarBelum ada peringkat

- Assignment 3 SAPDokumen6 halamanAssignment 3 SAPkaransangarBelum ada peringkat

- Case Analysis MicrosoftDokumen3 halamanCase Analysis MicrosoftkaransangarBelum ada peringkat

- Mech Drying EquipmentDokumen3 halamanMech Drying EquipmentkaransangarBelum ada peringkat

- MA Project - IT Firms Financial Report AnalysisDokumen6 halamanMA Project - IT Firms Financial Report AnalysiskaransangarBelum ada peringkat

- Project Product MixDokumen26 halamanProject Product MixkaransangarBelum ada peringkat

- Indian Institute of Management Kozhikode: Assignment QuestionsDokumen4 halamanIndian Institute of Management Kozhikode: Assignment QuestionskaransangarBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Analizador de Co, Co2 y O2 en Linea Innovantis Tech. #6017380 Nov 13Dokumen376 halamanAnalizador de Co, Co2 y O2 en Linea Innovantis Tech. #6017380 Nov 13Anonymous u0wETydFBelum ada peringkat

- HP CPFRDokumen10 halamanHP CPFRShoaib MominBelum ada peringkat

- Q1Dokumen4 halamanQ1Aviratna Kumar100% (5)

- Video Configuration IndexDokumen12 halamanVideo Configuration Indexptaka123Belum ada peringkat

- HP Channel StrategyDokumen10 halamanHP Channel StrategyMohammad Delowar Hossain100% (5)

- An Integrated Marketing Communication Mix Strategy For Hewlett Packard (HP) in ChinaDokumen7 halamanAn Integrated Marketing Communication Mix Strategy For Hewlett Packard (HP) in ChinaStephen OndiekBelum ada peringkat

- HP P6000 EVA Compatibility ReferenceDokumen38 halamanHP P6000 EVA Compatibility Referencermydin6564Belum ada peringkat

- HL-1060 User, Parts, and Service Manual 01Dokumen5 halamanHL-1060 User, Parts, and Service Manual 01วรพงษ์ กอชัชวาลBelum ada peringkat

- Real Estate Leads - BangaloreDokumen10 halamanReal Estate Leads - BangaloreAbdul RakibBelum ada peringkat

- KM@HPDokumen9 halamanKM@HPSunita KumariBelum ada peringkat

- Brosur HP LaserJet Pro M102a PrinterDokumen7 halamanBrosur HP LaserJet Pro M102a PrinterTri Febrianto PamungkasBelum ada peringkat

- Lenovo: Challenger To LeaderDokumen3 halamanLenovo: Challenger To LeaderRazeen Ameen100% (1)

- MonitoresDokumen1 halamanMonitoresGustavo RanceBelum ada peringkat

- JATIM - POE POSM - (19 Oktober 2018)Dokumen32 halamanJATIM - POE POSM - (19 Oktober 2018)ria susantiBelum ada peringkat

- Servers - Preventive Maintenance Report 3 April 2023Dokumen7 halamanServers - Preventive Maintenance Report 3 April 2023Muhammad UsmanBelum ada peringkat

- Consumer Behaviour and Perception Toward Dell Devices.Dokumen76 halamanConsumer Behaviour and Perception Toward Dell Devices.Gautam TupeBelum ada peringkat

- Materijal Za ReciklazuDokumen46 halamanMaterijal Za Reciklazuzadruga1100% (1)

- Instruction Manual: Setting and AdjustmentsDokumen133 halamanInstruction Manual: Setting and AdjustmentsMario UsaiBelum ada peringkat

- Warranty HP enDokumen9 halamanWarranty HP enRakesh jhaBelum ada peringkat

- LaserJet Managed MFP E72425-HPDokumen4 halamanLaserJet Managed MFP E72425-HPDavideDeRubeisBelum ada peringkat

- Studi Kasus HPDokumen5 halamanStudi Kasus HPDery 'Otonk' AfrianBelum ada peringkat

- Organizational Behavior Report On HP PDFDokumen22 halamanOrganizational Behavior Report On HP PDFharoonBelum ada peringkat

- HP Deskjet 1220: User'S GuideDokumen49 halamanHP Deskjet 1220: User'S GuideHenk SoubryBelum ada peringkat

- LeadsDokumen28 halamanLeadsMattias WikingBelum ada peringkat

- IT Marketing in China: How To Master The ChannelDokumen12 halamanIT Marketing in China: How To Master The ChannelBudi UtomoBelum ada peringkat

- Abuse of Technology Can Reduce UK Workers IntelligenceDokumen4 halamanAbuse of Technology Can Reduce UK Workers Intelligenceapi-3705546100% (1)

- Volume Direct Prime Services: Nicoleta Sima VDPS Project Manager March, 2016Dokumen25 halamanVolume Direct Prime Services: Nicoleta Sima VDPS Project Manager March, 2016Nicoleta SimaBelum ada peringkat

- Precision Group Corporate BrochureDokumen8 halamanPrecision Group Corporate Brochureanto9940682568Belum ada peringkat

- P 2723Dokumen76 halamanP 2723FlorenceBelum ada peringkat

- HP LaserJet Enterprise M606dnDokumen2 halamanHP LaserJet Enterprise M606dnKlaas ButerBelum ada peringkat