Foreign Entry & Banking-Thiland

Diunggah oleh

Ghulam MujtabaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Foreign Entry & Banking-Thiland

Diunggah oleh

Ghulam MujtabaHak Cipta:

Format Tersedia

ECONOMICS AND FINANCE NO.

5(2000)

Impact of Foreign Entry on the Thai Banking Sector: Initial Stage of Bank Restructuring

Sakulrat Montreevat

ECONOMICS AND FINANCE NO. 5(2000) August 2000

Impact of Foreign Entry on the Thai Banking Sector: Initial Stage of Bank Restructuring

Sakulrat Montreevat ISEAS Fellow

2000 Institute of Southeast Asian Studies ISSN 0218-8937

IMPACT OF FOREIGN ENTRY ON THE THAI BANKING SECTOR: INITIAL STAGE OF BANK RESTRUCTURING Abstract In the wake of the 1997 crisis, Thai authorities have allowed foreign investors to hold more than 49% of the share in Thai commercial banks for a period of 10 years. The guidelines for equity holding were announced in November 1997. The requirement on loan-loss provisioning and capital adequacy standard have led Thai banking sector to a radical change with giant foreign banks acquiring controlling stakes in Thai local banks. As a result, shares of family ownership in Thai banks have declined considerably. A mix of family, foreign and government ownership has become an image of the banking sector. Among the current 13 commercial banks, the four Thai banks acquired by giant foreign banks are medium- to small-sized banks. In aggregate, the banks hold only 7 % shares in terms of total capitals, total assets, loans and deposits, and 9% share in terms of number of domestic bank branches in the Thai banking sector. In this initial stage of foreign entry, operational improvements of the banks have focused on cost cutting, introducing new banking products/services, and staff training. As a result, other Thai banks have revamped their corporate management and technology base to maintain their market shares. I. Introduction

The financial crisis that started in mid-1997 has driven a dramatic change in Thai financial sector. Weakness in the financial sector caused the International Monetary Fund (IMF) to impose stringent measures on financial restructuring under the IMF reform programme. As a result, commercial banks, financial companies and credit foncier companies have been under tightened supervisions and regulations in line with international standards. Among the financial institutions, commercial banks have played the most important role in Thai financial sector. In terms of market structure, more than 75% of total financial sector assets over 1996-1999 were in the banking sector. In terms of providing corporate finance, bank lending dominated domestic capital market over 1996-1999 (World Bank, 2000). Thai authorities, then,

intervened where necessary but mainly adopted a market approach to banking restructuring. As a part of banking restructuring, Thai authorities have allowed foreign banks that already has a full branch or a Bangkok International Banking Facility (BIBF) to acquire a majority stake in Thai commercial banks. Guidelines for equity holding in financial institutions were announced in November 1997, followed by measures on bank intervention in August 1998. Since the opening up to foreign banks, local banks have been sold to giant foreign banks. Benefits on recapitalization and an increase in competition of financial services are expected from the foreign entrants. This study analyses how the entry of foreign banks influences Thai banking market at the initial stage of bank restructuring. The next section reviews the banking sector before and during the crisis. Legislative changes and the opening up of the Thai banking sector are presented in the third section. Next, foreign entry in four Thai local banks is reviewed in the fourth section. Impact of foreign entry on Thai banking sector is analysed in the fifth section, followed by discussions on the challenges facing the foreign-owned banks in the sixth section. Finally, concluding remarks on near-term banking competition of Thai commercial banks is in the last section.

II.

Thai Banking Sector before and during the Crisis

The banking sector was brought into Thailand in 1888, with the establishment of a foreign bank branch. The Hong Kong and Shanghai Bank set up the first banking office in Bangkok in December 1888, followed by the Chartered Bank (1894) and Banque de LIndochine (1897). For Thai banks, the Book Club was established in 1904 and the name was changed to Siam Commercial Bank in 1906. It was the first domestic commercial bank in Thailand, followed by Wang Lee Bank (1933), Tan Peng Chuan Bank (1934), and Bank of Asia (1939). Over the decades, more Thai banks and foreign bank branches were established. The latest Thai banks was

Radanasin Bank in 1998. And, the latest foreign bank branch was Banque National de Paris in 1997. At the end of 1998, there were 13 Thai banks, with 3,246 full branches, and 21 full foreign bank branches as well as 37 bank representative offices operating in Thailand (Table 1). 2

Table 1: Number of Commercial Banks, 1993-1998 (unit: branches) Foreign Bank Branch Full Branches Representatives BIBF PIBF 14 41 23 14 37 29 14 44 30 26 14 45 30 30 20 40 36 30 21 37 35 23

1993 1994 1995 1996 1997 1998

Thai Commercial Banks No. Full Branches BIBF 15 2,658 11 15 2,823 11 15 2,957 12 15 3,138 12 15 3,284 12 13 3,246 10

PIBF

Source: Bank of Thailand

The Bank of Thailand (BOT) was established in 1942 to supervise the banks. Activities of banking business have expanded over time. Traditionally, banking

activities covered only acceptance of deposits, credit extension, and foreign exchange facilities. Vajaragupta and Vichyanond (2000) concluded that in the early 1970s Thailands financial system was dominated by a few sizeable Thai banks whose activities were rather clustered and centrally administered. Foreign bank branches had only a limited role. International transfers of funds were stringently controlled and monitored. The BOT set ceilings for interest rates on both deposits and credits. The banking system was required to allocate adequate credits for agricultural enterprises in proportion to total deposits. The countrys economic expansion over 1972-1987 was financed by mobilization of domestic savings. Financial liberalization began to take place in 1989 with interest rate liberalization. The BOT removed ceilings on time deposit rates in 1989, savings deposit rate and lending rates in 1992. At present, domestic interest rates respond to market condition. On foreign exchange control, non-resident baht accounts were permitted to accommodate foreign-borrowing settlements, stock transactions, and foreign investment in 1989. On the grounds of high economic expansion with fiscal cash balance in surplus, world-wide liberalization of trade and services, and Indochinas market orientation, Thailand accepted the obligations under the Article VIII of the IMFs Articles of Agreement in 1990. Exchange control deregulation started with

lifting of foreign exchange controls on current account transactions in 1990 and capital account transactions in 1991. To develop Thailand as a regional financial center, the BOT has allowed qualified financial institutions operating the International Banking Facilities in Bangkok (BIBFs) since 1993 and in other provinces (PIBFs) since 1994. A licence for international banking facilities permits domestic commercial banks and foreign bank branches to provide the following activities: acceptance of deposits in foreign currencies, lending in foreign currencies to both residents (out-in lending) and nonresidents (out-out lending), and foreign exchange transactions. That is, mobilization of foreign savings to finance the countrys economic growth has become more flexible. In 1998, 10 Thai banks and 35 foreign bank branches were granted

permission to establish BIBF offices and 23 foreign bank branches were allowed to get PIBF licences in other provinces (Table 1). Since the financial liberalization, Thai commercial banks can engage in all kinds of banking activities. Recently, the scope of banking activities covers not only traditional banking activities but also providing information and financial consulting services as well as feasibility studies; operating as selling agent for debt instruments issued by the government or state enterprises as well as undertaking mutual fund management; arranging, underwriting and dealing in debt securities; operating as securities registrar and representative of secured debenture holder. Each commercial bank must receive permission from the BOT before undertaking these activities. Benefits from the financial liberalization were in the form of lower domestic interest rates, availability of new capital with lower costs, and enhancement in competitiveness in Thai financial sector. However, the liberalization came to

Thailand too early as financial institutions were not ready to cope with imprudent banking management and dramatic changes in government policies. Commercial banks and finance companies based their lending decision upon collateral and connections. Moreover, they lacked skills in evaluating project feasibility. Excessive amount of lending went to non-viable projects, especially in real estate and heavy industries. Consequently, their asset quality was largely vulnerable to disturbances. Table 2 shows that total property credit increased more than 20% p.a. over 1990-1995 and more than 50% of the credit were released from commercial banks. In terms of 4

total credit, Table 3 indicates that total credit of commercial banks (both Thai and foreign banks) grew quite high over 1990-1995, of which Thai commercial banks held the major share. It is noted that credit share of foreign banks had increased

significantly after the establishment of BIBFs and PIBFs, however it dramatically dropped during the financial crisis.

Table 2: Credit to Real Estate Development and Sources of Credit, 1990-1998

Total Credit to Real Estate Development M illion B a h t % Growth

% S hare in Total Property Credit Commercial Banks 69.0 70.4 66.9 65.5 64.5 59.9 54.8 53.7 79.2 80.6 Finance Government Companies Housing Bank 28.8 2.2 28.6 1.0 32.1 0.9 33.4 0.8 34.8 0.4 39.5 0.3 44.6 0.3 45.7 0.3 20.0 0.5 18.7 0.3 Credit Foncier 0.0 0.0 0.0 0.3 0.3 0.3 0.3 0.3 0.4 0.4

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998

145,919 252,587 309,532 383,222 470,801 607,946 730,553 793,456 619,665 627,760

73.1 22.5 23.8 22.9 29.1 20.2 8.6 -21.9 1.3

Source: Bank of Thailand

Table 3: Bills, Loans and Overdrafts of Commercial Banks Classified by Thai and Foreign Banks, 1990-1999 Total Bills, Loans and Overdrafts of Commercial Banks % G r o w th % Share M illion Baht Thai Foreign Total Thai Foreign Banks Banks Banks Banks

Dec-90 Dec-91 Dec-92 Dec-93 Dec-94 Dec-95 Dec-96 Dec-97 Dec-98 Dec-99

1,481,954 1,789,385 2,161,945 2,669,142 3,430,532 4,230,519 4,825,057 6,037,464 5,372,260 5,119,043

34.4 20.2 21.2 21.2 22.0 20.0 14.8 17.2 -6.1 -2.9

17.9 31.0 14.7 64.6 115.6 48.1 9.7 75.7 -31.9 -15.2

33.4 20.7 20.8 23.5 28.5 23.3 14.1 25.1 -11.0 -4.7

94.9 94.5 94.8 93.0 88.3 85.9 86.5 81.0 85.4 87.1

5.1 5.5 5.2 7.0 11.7 14.1 13.5 19.0 14.6 12.9

Source: Bank of Thailand

Apart from the inefficiency in lending, maturity mismatching also generated a huge risk for commercial banks. Because of lower foreign interest rates, a tight monetary policy with high domestic interest rates as well as a hard time to tap a longterm financing, both banks and corporate firms tapped short-term foreign borrowings to finance long-term projects. As a result, the ratio of short-term foreign debt to foreign reserves of the country increased dramatically from 58% in 1990 to 133% in mid-1997 (www.bot.or.th). Anticipated baht devaluation triggered a flood of capital outflows to liquidate short-term foreign debts and to speculate against the baht. The capital outflows resulted in heavy loss of foreign reserves. With government

mismanagements in foreign reserves and foreign exchange regime after the financial liberalization, the basket of currency exchange rate system eventually could not be maintained. On July 2, 1997, baht was floated. A month later, IMF rescue package came in with a series of stringent conditions. With the drastic baht depreciation, banking and the corporate sectors plunged into a heavy foreign debt burden in terms of baht. Moreover, economic turndown, high inflation and tight liquidity gave rise to downsizing and bankruptcies in the corporate sector. As a result, domestic nonperforming loans (NPLs) of all commercial banks (both Thai and foreign banks) increased rapidly from 18.7% in December 1997 to the peak 46.8% of total loans in May 1999 (Table 4). Even though the NPL ratio has been on a declining trend since then, it still remains high at 35.2% in May 2000. Weakness and instability has become an image of Thai banks which has had high NPL ratios and held a big market share of lending and deposit services relative to those of foreign bank branches (Table 4). Bank restructuring as well as corporate debt restructuring are required to restore market confidence and banking sector soundness in order to support the full recovery of the economy.

Table 4 : Commercial Banks: NPL Ratio, Deposits, and Loans, 1997-2000 NPL Ratio (%) Deposits (% Share) Loans (% Share) Thai Commercial Banks Foreign Total Thai Foreign Thai Foreign Bank Commercial Bank Commercial Bank Branches Banks Branches Banks Branches Private StateTotal Commercial Owned Banks Banks Dec-97 19.4 29.3 22.6 1.9 18.7 94.4 5.6 81.0 19.0 Jan-98 20.8 31.3 24.2 2.1 19.7 94.2 5.8 79.4 20.6 Feb-98 22.9 34.0 26.6 2.7 22.3 95.1 4.9 82.3 17.7 Mar-98 25.2 37.7 29.4 4.0 25.3 95.6 4.4 83.7 16.3 Apr-98 27.2 41.4 32.0 4.4 27.5 95.8 4.2 83.7 16.3 May-98 29.4 44.8 34.6 5.1 29.9 96.0 4.0 83.4 16.6 Jun-98 30.2 47.2 35.9 5.5 31.0 95.6 4.4 83.0 17.0 Jul-98 32.6 49.0 38.2 6.3 33.2 95.4 4.6 83.6 16.4 Aug-98 33.9 50.3 39.5 6.6 34.4 95.5 4.5 83.4 16.6 Sep-98 36.9 55.1 43.2 7.5 37.9 95.3 4.7 84.1 15.9 Oct-98 39.5 58.3 46.0 8.1 40.5 95.4 4.6 84.6 15.4 Nov-98 41.7 60.9 48.5 9.0 42.9 95.4 4.6 85.1 14.9 Dec-98 40.5 62.5 48.2 9.8 42.9 95.7 4.3 85.4 14.6 Jan-99 42.0 65.1 49.7 10.1 44.0 95.6 4.4 85.3 14.7 Feb-99 42.5 67.8 51.3 10.3 45.8 95.6 4.4 85.5 14.5 Mar-99 42.3 68.3 51.6 11.5 46.2 95.5 4.5 85.5 14.5 Apr-99 42.5 67.7 51.5 11.6 46.2 95.5 4.5 85.6 14.4 May-99 42.8 69.4 52.3 11.7 46.8 95.3 4.7 85.4 14.6 Jun-99 41.0 70.4 51.7 12.4 46.5 95.6 4.4 85.9 14.1 Jul-99 40.9 70.1 51.4 12.7 46.3 95.4 4.6 85.7 14.3 Aug-99 40.7 68.6 50.8 13.4 45.9 95.4 4.6 86.0 14.0 Sep-99 38.1 66.8 48.8 11.5 43.9 95.4 4.6 85.9 14.1 Oct-99 37.3 66.5 48.1 11.5 43.5 95.3 4.7 86.4 13.6 Nov-99 35.7 65.4 46.4 10.9 41.9 95.0 5.0 86.4 13.6 Dec-99 30.6 62.9 42.5 9.9 38.6 94.7 5.3 87.1 12.9 Jan-00 30.7 62.0 42.2 9.4 38.2 94.8 5.2 86.9 13.1 Feb-00 30.3 61.2 41.6 9.2 37.7 94.8 5.2 87.1 12.9 Mar-00 29.3 60.6 40.8 8.8 36.9 94.5 5.5 87.2 12.8 Apr-00 28.7 59.8 40.1 7.2 36.1 94.6 5.4 87.2 12.8 May-00 28.5 57.9 39.2 6.8 35.2 94.6 5.4 87.0 13.0 Source: CEIC, July 2000

III.

Legislative Changes and the Opening up of the Thai Banking Sector

Since the financial liberalization, the BOT has upgraded supervisory functions in line with international standards. The Bank for International Settlements (BIS) capital adequacy standard was initially imposed in January 1993. Supervisions and

regulations became more strengthened during and after the financial turmoil of 1997. The IMFs prescriptions were to preserve stability of Thailands financial system and to restore investors confidence. In November 1997, the BOT announced a tightened loan classification and provisioning (LCP) for all loans more than six months overdue. Recognition of

accrued interest income was shortened from 12 months to 6 months while provisioning requirements were tightened in line with international best practices. A revised set of stringent regulatory and accounting standards were announced at the end of March 1998. All financial institutions have to stop accruing interest income after 3 months of non-payment. Interest recorded as income on nonaccrual accounts must be reversed out of income with effect from January 1, 2000. This new

classification rule cames together with the implementation of the new non-performing loans (NPLs) classification starting on July 1, 1998, which applies to 3 months or more of overdue payments. Based on the stricter rules on LCP, the BOT signed the Memoranda of Understanding (MOU) with undercapitalized banks in the early 1998. The

recapitalization aims at bringing capital adequacy ratios to a minimum of 8.5% based on loan classification and provisioning rules by the end of 2000. In connection with this, the regulation on foreign shareholding limit in Thai commercial banks was relaxed. The Commercial Banking Act B.E. 2505 was

amended in June 1997 and the guideline for foreign equity participation in Thai banks was announced in November 1997 (Box 1). Foreign investors, thereby, were allowed to acquire majority shareholding in Thai banks for up to 10 years. Prior to this, 25% shareholding limit was applied to foreign investors. After ten years, the foreign equity stake cannot be raised further, unless it is below 49%. Consequently, any subsequent capital injections into banks that have more than 49% foreign equity, conducted after the 10-year period, will necessitate the participation of Thai investors. With deepening economic recession in Thailand and other East Asia countries in 1998, recapitalization became a difficulty of Thai banks whose high NPLs problem was addressed. On August 14, 1998, Thai authorities, therefore, announced a The package provided: (i) the

comprehensive financial restructuring package.

opportunity for viable financial institutions to recapitalize using public funds under clear safeguards; (ii) incentives for accelerating corporate debt restructuring and new lending to private sector; (iii) a legal basis for establishing private Asset Management Companies (AMCs); and (iv) clear resolution strategies for all intervened financial institutions in line with long-term objective of strengthening the financial system.

Box 1: Guidelines for Equity Holding in Financial Institutions The Ministry of Finance and the Bank of Thailand have recently announced the measure to restore confidence in the financial sector by requiring commercial banks and finance companies currently in operation to increase their capital as a cushion against any potential loss from asset deterioration. All financial institutions are encouraged to take early action so as to prevent problem in the future. . To facilitate and expedite financial institutions capital increase, the Bank of Thailand, with the approval of the Minister of Finance, has set the following guidelines for the financial institutions capital increase: 1. Guideline for foreign equity participation in Thai financial institutions 1.1 Foreign investors that have sound financial status and high potential to help increase the efficiency in the management of the financial institution shall be allowed to hold more than 49% of the share in the 15 commercial banks, 33 finance companies, and 12 credit foncier companies for a period of 10 years. After 10 years, foreign investors will not be forced to sell their shares but may not purchase any additional shares, unless the amount of foreign shareholdings is less than 49% of total shares. Additional shares may be acquired to bring foreign shareholdings to 49% of total shares. For the holding of shares of the 58 suspended finance companies, the Financial Sector Restructuring Agency (FRA) shall follow the guideline of the Committee to Supervise the Merger and Acquisition of Financial Institutions announced on 13 October 1997. The guideline allows unlimited amount of shareholding by foreign shareholders up to period of 10 years. After 10 years, foreign investors may not purchase any more shares unless the amount held is less than 49% of total shares in which case additional shares maybe acquired until the 49% mark is reached. 1.2 The guideline shall be the same for foreign investors that are banks. The foreign bank that already has a full branch or a Bangkok International Banking Facility will be allowed to continue their existing operation. However, the authorities reserve the right not to allow a foreign bank that has more than 49% stake in a Thai bank to have an additional full branch in Thailand. 2. Thai financial institutions' holdings of shares in other financial institutions The authorities have the intention to apply the same guideline for Thai commercial banks and finance companies with sound financial status that wish to hold shares in other banks and finance companies. Nonetheless, there are legal limitations which prohibit a domestically incorporated commercial bank from holding other banks shares unless approved by the Finance Minister on a case by case basis, and with a specified timeframe. Finance companies are also subject to the same legal constraints. Therefore, the guideline regarding the shareholding in other financial institutions by domestically incorporated banks and finance companies will be as follows: The authorities will allow domestically incorporated banks and finance companies with sound financial status to have more than 49% stake in other financial institutions for a period of 10 years. After 10 years if the banks or finance companies request to maintain their ownership, the extension will be approved on the ten-year basis. During the extension period, banks and finance companies will not be forced to sell their shares. Additional shares maybe acquired to bring their shareholdings to 49% of total shares. 3. Common directors Thai commercial banks and finance companies that are allowed to hold shares in other financial institutions according to 2 above may have the same directors as the financial institutions in which they hold shares for no more than 3 years. Further extension may be allowed if necessary. The Bank of Thailand believes that the above guidelines will assist in the capital increase of financial institutions and will provide equal treatment between Thai and foreign investors. The Bank of Thailand 11 November 1997

To facilitate the recapitalization, a series of measures was announced. The Tier 1 and Tier 2 Capital Support Facilities are for Thai financial institutions. Foreign bank branches are not eligible. On the Tier 1 scheme, the governments capital injection will be based on the conditions that institutions advance the end-2000 LCP rules, existing shareholders bear associated costs, and viable restructuring plans are approved by the BOT. Meanwhile, the Tier 2 capital injection will be based on the magnitude of the write-down resulting from corporate debt restructuring, net of previous provisioning, and the net increase in lending to the private sector. To

facilitate the resolution of NPLs, a variety of measures to encourage the establishment of private AMCs have been announced, including the removal of tax disincentives. Regarding intervention in financial institutions, the BOT announced track and plan for 6 Thai banks and 12 finance companies intervened. Laem Thong Bank (LTB) was integrated with Radanasin Bank (RAB). The combined RAB finally sought foreign investors/strategic partners through a privatization process. Union Bank of Bangkok (UBB) and the 12 finance companies were consolidated with Krungthai Thanakit (KTT) in the same manner as the merger of LTB and RAB. Bangkok Metropolitan Bank (BMB) and Siam City Bank (SCIB) were recapitalized according to end-2000 LCP rules to strengthen the banks and would be privatized with loss-sharing arrangements to be proposed by new investors. Bangkok Bank of Commerce (BBC) was turned into a non-bank, AMC, owned by the Financial Institutions Development Fund (FIDF).1 Last but not the least, First Bangkok City Bank (FBCB) was integrated with Krung Thai Bank (KTB). announced in August 1998. In July 1999, Nakorthon Bank (NTB) became the 7th bank to be intervened due to having negative shareholders equity and negative tier 1 capital after fulfilling the 40% NPL provisioning requirement for the first half of 1999. The BOT, Restructuring plan of the combined KTB were

therefore, ordered the NTB to write down its capital in order to reduce its accumulated losses prior to the FIDF purchase of their common shares. Thereafter, the NTB was instructed to increase its capital via common shares issuance to the FIDF, of which 75% would be subsequently resold to a strategic institutional investor. In the process, weak banks were taken over while others have gone through massive recaptialisation. Out of 15 Thai banks at the end of 1997, 13 Thai banks 10

remain (Box 2). Two nationalised banks, RAB and NTB, were privatised.

The

Financial Services Task Force formed by fiscal and monetary authorities is mandated to develop a five-year strategy for the financial sector. On legal reforms, Thailand is in the process of amending the Bank of Thailand Act and the new Financial Institutions Act to modernise the Thai financial system. The Currency Act is under review by the Ministry of Finance (MOF). The Deposit Insurance Act is in its fourth draft. The amendment to Bankruptcy Law and Foreclosure Law aims to facilitate corporate debt restructuring. Thailand has pursued a multipronged approach in Foreign banks/investors have also been Noticeably, foreign

tackling NPLs in the banking system.

encouraged to participate in the Thai banking system.

shareholdings have increased in Thai commercial banks (Table 5).

Box 2: List of Thai Commercial Banks, as of 10 May 2000

1. Bangkok Bank Public Company Ltd. (BBL) 2. Thai Farmers Bank Public Company Ltd. (TFB) 3. Krung Thai bank Public Company Ltd. (KTB) 4. DBS Thai Danu Bank Public Company Ltd. (DTDB) 5. The Thai Military Bank Public Company Ltd. (TMB) 6. The Siam Commercial Bank Public Company Ltd. (SCB) 7. Standard Chartered Nakornthon Bank Public Company Ltd. (SCNB) 8. Bank of Asia Public Company Ltd. (BOA) 9. Bank of Ayudhya Public Company Ltd. (BAY) 10. UOB Radanasin Bank Public Company Ltd. (UOB-RAB) 11. BankThai Public Company Ltd. (BankThai) 12. Siam City Bank Public Company Ltd. (SCIB) 13. Bangkok Metropolitan Bank Public Company Ltd. (BMB)

Source: Bank of Thailand

11

Table 5: Foreign Shareholdings in Thai Commercial Banks Banks Banks acquired by foreign banks Bank of Asia DBS Thai Danu Bank Standard Chartered Nakornthon Bank UOB Radanasin Bank Banks with Thai majority ownership Bangkok Bank Bang of Ayudhya Siam Commercial Bank Thai Farmers Bank Foreign Ownership (%) Mar-97 May-00 6 9 6 77 62 75 75

25 25 25 25

49 32 45 49

Sources: World Bank "Thailand Economic Monitor", February 2000 Thai Farmers Research Center's Database, May 2000

IV.

Foreign Entry in Thai Commercial Banks

DBS Thai Danu Bank Thai Danu Bank (TDB) was established in 1949. Its founders included members of the Thai royal family, senior government officials and well-know merchants. Due to the tightened regulations on loan classification and loan-loss provisioning in 1997, the bank needed to raise its capital to meet the mandatory requirement on capital adequacy ratio. Singapore-based Development Bank of Singapore (DBS) agreed to take a majority stake in the TDB in December 1997 (Dolven, 1999). As a result, the DBS increased its share in the TDB from 3.4% to 52%. The TDB was renamed DBS Thai Danu Bank Public Company Limited (DTDB) in April 1999. The DBS and its subsidiaries form the largest banking group in Singapore in terms of shareholders funds and total assets. It has 168 branches in Singapore;

banking subsidiaries in Thailand, the Philippines and Indonesia; and branches and offices in the United States, United Kingdom, Japan, Hong Kong S.A.R., India, Indonesia, Malaysia, Myanmar, the People Republic of China, Taiwan, Korea and Thailand. Internationally, the DBS is ranked among the top 100 banks in the world (www.dbs.co.th). The DBS has established a regional integration centre in Bangkok

12

to improve ties among DBS branches in Hong Kong, Indonesia, the Philippines, and Thailand. The centre would apply the same guideline for management policies, risk management system and delivering technology throughout the region. The DBS aims to become the biggest regional bank in Southeast Asia providing a full range of banking services (Bangkok Post, 29 February 2000). The DBS has pledged to fully support the recapitalisation of DTDB which is expected to be completed by 2000. The DTDB had set aside an 81% provision against NPLs at the end of 1999. The bank posted NPL of 39.8 billion baht, or 40% of total loans, at the end of first quarter 2000 down from a peak of 60% in early 1999 (Bangkok Post, 29 April 2000). Restructuring bad loans remains a priority. On marketing strategy, the DTDB plans to extend 13 billion baht in new loans in 2000, of which 8 billion is to corporate customers. The focus will be on multinationals or top corporations which have completed restructuring. The bank plans to lend the

remainder, 5 billion baht, to mortgage and personal-loan clients. New alternative delivery channels will be used to reach customers, such as internet banking, mobile and telephone banking and ATMs (Bangkok Post, 10 March 2000). Moreover, the bank is set to launch mini-bank branches in some shopping areas (The Nation, 13 Jan 2000). On Performance, the DTDB reported a loss of 12.9 billion baht in 1999. With strong financial support from the DBS, the bank expects to return to profitability in 2000. On cost cutting, the bank aims to close 35 branches nationwide, which will reduce its branches to 60 by 2000, and to shed 700 staff from 2,427 at the end of 1999. The bank hopes the cutbacks will trim 100 million baht or as much as 15% off operating costs for 2000 (Bangkok Post, 29 February 2000).

Bank of Asia Bank of Asia (BOA) was established in 1939. Thammasat University under the leadership of Dr Preedee Panomyong held a major stake of the bank at that time. In 1965, Euarchukiati and Kantamanond families took a major stake. As a result, the failure of family-business management became an image of the bank. The

Euarchukiati family looked for new partner and the Phatrapasit family replaced the Kantamanond family. The bank returned to a check and balance system when the 13

Ektanakij Finance Company bought a 15% stake in 1993. Later, the Phatrapasit family increased its shareholding in the BOA and invested largely in Chaopraya Finance and Securities Company. Unfortunately, the finance company was

completely closed down in December 1997 (Saengthong, 1998). In mid-1998, The Netherlands-based ABN Amro Bank acquired a 75% stake in the BOA. As a result, the ABN Amro Bank becomes the largest foreign bank in Thailand. With over 100 branches in Thailand, this gives the Dutch bank an

enormous advantage over foreign competitors. The ABN Amro Bank is the 8th largest bank in the world in terms of tier 1 capital, and as an universal bank offers consumers commercial and investment banking services through a global network of over 3,500 officers in 76 countries and territories. It currently operates more than 170 branches and officers in 16 countrys in the region. The bank has been named Best Foreign Bank of 1999 in Thailand and Indonesia, and Best Foreign Securities Firm in Taiwan in Euromoneys Annual Awards for Excellence (www.boa.co.th/news). The BOA posted NPL of 57 billion baht, or 45% of total outstanding loans, at the end of 1999. The bank has completed 100% provisioning. On market strategy, retail customers are considered as flush with cash and confidence. The bank aggressively plans to boost retail customers by 50% in 2000 by promoting credit-debit cards and residential mortgage loans (The Nation, 1 February 2000). The BOA will continue to expand service channels such as its ATM network and supermarket branches. The bank will also install an additional 40 ATMs in Bangkok in 2000 to improve customer services as well as open three new branches in supermarket and shopping malls. The BOA plans to join up with specialised state-owned banks to offer new cash management services in the provinces, allowing the bank significant opportunites to expand its market reach nationwide. Thus, the Government Savings Bank and the Bank for Agriculture and Agricultural Co-operatives, in turn, would benefit from the deal through fees gained from each transaction (Bangkok Post, 14 February 2000). On performance, the BOA reported a loss of 11.6 billion baht in 1999, compared with a loss of 7.7 billion baht in 1998. With strong marketing and sale teams, the bank expects to increase its market share to reach the top five in the retail banking market of Thailand within the next 3 years. 14

Standard Chartered Nakornthon Bank Nakornthon Bank (NTB) was established in 1933 under the name Wanglee Bank. It is the second oldest bank after Siam Commercial Bank. The Wanglee family had run the business since it started. During 1973-1980, the CITIBANK held 40%

shareholding of the bank. Banking know-how was the benefits of the joint venture. Large investment in real estate projects, especially in the name of Sathornthani projects, in the early 1990s made the Wanglee family become one of the largest investors in the business. Over-investment in real estate projects in 1995 and the slump in asset prices in 1996 caused a liquidity problem to the family business (Saengthong, 1998). The NTB, therefore, looked for foreign partners to raise its capital. Standard Chartered Bank (SCB) was the foreign investor with which the NTB had discussed a recaptialization plan since 1998. Even though the NTB managed to evade intervention by the government on August 14, 1998, its negative tier 1 capital was shown up after fulfilling the 40% NPL provisioning requirement. On July12, 1999, the BOT ordered the NTB to write down its capital from 2 billion baht to 2 million baht to reduce its accumulated losses. Afterwards, the NTB was instructed to increase its capital by 7 billion baht via common share issuance to the FIDF, of which 75% would be subsequently resold to a strategic investor. The process of selling NTBs common shares to a strategic investor had to be completed within 60 days. In July 1999, the FIDF signed a preliminary agreement with the SCB. The agreement contains the following features: the SCB agreed to purchase 75% of NTBs common shares at a price notified to the FIDF. Under the deal, the FIDF agreed to compensate for lost revenue and potential losses due to increase in NPL to NTB in the form of yield maintenance and loss gain sharing for a period of five years. On September 10, 1999, the SCB officially acquired a 75% shareholding in the NTB as a part of Thai bank restructuring program. The NTB was renamed Standard Chartered Nakornthon Bank Public Company Limited (SCNB). The investment in SCNB will enable the UK-based SCB to build a business of substantial scale. The SCB holds a 70% market share in Asia with 250 branches over Asia. The bank sees Thailand as fourth core market in Asia, after Hong Kong S.A.R., Singapore and Malaysia. The SCB is also preparing to expand in Taiwan, the

Philippines, China and India. Seventy percent of the banks assets and profits are 15

derived from Asia. In Thailand, the SCB set up a foreign bank branch in Bangkok and a Provincial International Banking Facility (PIBF) in Chiangmai. The integration between the SCB and the NTB is moving well ahead of schedule. The SCNB would become the groups network for the Greater Mekong Area, serving as a launch-pad and centre for operations in Myanmar, Vietnam, Cambodia and Laos

(www.ntb.co.th). The SCBN plans to complete the restruturing of 36 billion baht worth of NPL within 3 years instead of the 5 years mentioned in the agreement with the FIDF. The fulfilment of 100% of NPL provisioning is expected by the first half of 2000. To gain an edge in the increasingly competitive world of financial services, staff training will be a key strategy to help it stay ahead of competitors. E-banking, cash management and providing business-to-business solutions would be major tools in the banks fight for market share. Staff training at the SCNB will be a major part of SCBs investment budget for the coming years. On performance, the SCBN posted losses of 1.92 billion baht for its 1999 operation, compared with a loss of almost a billion baht in the previous year. The SCBN does not expect any profit in the near term as it needs to make additional investments to improve its technology and branch layout, as well as to implement an early retirement scheme. It was expected that 932 out of its 1,932 employees would join the scheme.

UOB Radanasin Bank The Laem Thong Bank (LTB) was established by Nantapiwat family in 1948. In late 1988, the bank was taken over by Mr Sura Chansrichawara. Land-price

speculation was the main investment strategy under his management. In June 1997, the banks NPL in real estate sector reached the highest, or about 3 times of the average of Thai banks (Saengthong, 1998). The LTB was intervened by government on August 14, 1998, because of negative networth and severe liquidity shortage with large borrowing from the FIDF. It was merged with Radanasin Bank (RAB). The RAB actually just started its operation in March 1998 and was originally mandated to purchase and manage the good assets of financial institutions. The initial government

16

ownership was later diluted through the selling of shares to the public (The Bank of Thailand, 1997). The restructuring policy also called for the privatization of RAB through the sale of majority equity stake to a strategic partner under the modalities approved by the Cabinet on March 16, 1999. Proposals to acquire the RAB were submitted by interested parties in July 1999. The United Overseas Banks proposal was finally selected and the Share Purchase Agreement was approved. In November 1999,

Singapore-based United Overseas Bank (UOB) officially acquired a 75% stake in the RAB to the tune of 3.5 billion baht. The RABs name was changed to UOB

Radanasin Bank Public Company Limited (UOB-RAB). The remaining 25% is held by the FIDF. The UOB-RAB and the FIDF agreed on gain/loss sharing arrangement along the same structure as the sale of the Nakornthon Bank (NTB). The UOB is one of the major four banks in Singapore, with an extensive network of branches and offices worldwide. Within ASEAN, the UOB Group has a 100% owned bank subsidiary in Malaysia, an 80% owned joint venture bank in Indonesia, and a 60% owned joint venture bank in the Philippines. In Thailand, the UOB has a Bangkok International Banking Facility (BIBF) and a 75% ownership of the UOB-RAB. The Group also has a branch in Vietnam and a representative office in Myanmar. In the other countries of Asia, the Group has three branches and a

representative office in China, four branches in Hong Kong S.A.R., and a branch each in Tokyo, Taipei and Seoul. The UOBs objectives include expanding its regional presence in key businesses and to be a premier bank in the Asia-Pacific region (www.uob.com.sg). Since the acquisition by the UOB Group in late 1999, the UOB-RAB has restructured its internal organisation, particularly its top management. In addition, the bank chose to set up a separate asset management structure to manage the ring-fenced NPLs. Its agreed amount of NPLs at the gross book value was transferred to

Radanasin Asset Management Company (RAMC). As of May 5, 2000, the banks NPLs was below 5 million baht. The bank is moving ahead with its investment expansion for 2000, especially in technology and employee training. The UOB-RAB registered a profit of 10.1 billion baht in 1999. It was the only commercial bank that earned an operating profit in 1999. With an ambitious target to 17

extend fresh loans of 15 billion baht for 2000 (400% growth over the previous year), the bank plans to launch a special programme for mortgage loans in the second quarter and a credit card product in the following quarter of 2000. Without early retirement program, the bank plans to reduce employee 30% from the total 1,250 employees (The Nation, 28 April 2000).

V.

Impact of Foreign Entry on Thai Banking Sector

After the government relaxed the limit of foreign ownership on Thai banks in late 1997, the banking sector attracted US$ 2.3 billion and US$ 2.5 billion in foreign direct investment (FDI) in 1998 and 1999 respectively, or 46% and 77% of total FDI in the corresponding years (www.bot.or.th). By the end of 1999, four commercial banks had majority foreign ownership, DBS Thai Danu Bank (DTDB) in January 1998, Bank of Asia (BOA) in June 1998, Standard Chartered Nakornthon Bank (SCBN) in September 1999, and UOB Radanasin Bank (UOB-RAB) in November 1999. Siam City Bank (SCIB) and Bangkok Metropolitan Bank (BMB) as

nationalised banks are to be privatized. In May 2000, the government agreed, in principle, to sell 75% of the BMB to London-based Hong Kong and Shanghai Banking Corporation (HSBC) for 36.6 billion baht. Completion of the sale is subject to approval of the Minister of Finance (MOF) and finalisation of legal issues (Bangkok Post, 17 May 2000). For the SCIB, Morgan Stanley is serving as an adviser to the Bank of Thailand (BOT), gauging interest in buying the bank among foreign and local investors (The Nation, 4 July 2000). On structure of Thai banking sector, the four foreign banks, DBS, ABN Amro Bank, Standard Chartered Bank and UOB, bought stakes in the medium-to smallsized banks (Table 6). In terms of total capitals and total assets, each of the four Thai banks with foreign major shareholders hold only 1-3% of total capitals/total assets in the banking sector before and after the crisis. In total, the four banks hold only 7% of total capitals/total assets of the sector. They are in the bottom ranks of Thai

commercial banks. In terms of loans and deposits, their market shares are also low in the range of one-digit percentage share (Table 7). In terms of domestic branches, their numbers are small, amounting to only 354 branches or 9% of total bank branches in the banking sector. Their branches are more concentrated in Bangkok area 18

compared to the first five-largest Thai banks (Table 8). For the banks under the privatization process, the SCIB and the BMB are medium-sized banks, which are in the 7th-to-9th rank in terms of total capitals, total assets, loans, deposits, and number of domestic branches. Their branches are relatively concentrated in non-Bangkok areas. If these two banks are sold to foreign investors, the total number of foreignmajority-ownership banks will be six, out of the current 13 commercial banks. In aggregate, their market shares will be around 15% and in the 7th-to-13th rank. Almost 60% of their customer base will be scattered outside of Bangkok area. Meanwhile, the five largest banks with Thai majority shareholders hold around 70% of market shares and more than 70% of their branches are located in non-Bangkok areas. Regarding investment and management, the four banks controlled by foreigners have launched a similar programme as part of their efforts to reduce operating costs and sharpen competitiveness. On cost cutting, foreign partners Such

participation had brought a variety of new and efficient technologies.

technologies had helped reduce operating costs significantly. Among them, the BOA is leading the charge into the brave new world of consumer banking. The DTDB is clipping its total branch network by one-third and has already retrenched 500 employees with another 700 planned. The bank has recently increased its focus on ebanking. The SCBN is urging scores of redundant staff into early retirement, and emphasizing improvement in technology, and employee training. With evaluation of each employees performance, the UOB-RAB plans to reduce 30% of total employment. Before end-2000, the bank will launch cyber-banking, which will be used by all units of its group worldwide. All in all, e-banking, especially consumer banking and internet banking, seems to be the new battleground.2 It is removing the traditional entry barriers to Thailands banking market. Entry of foreign banks has been a catalyst for change in Thai banking sector. Local banks with Thai majority ownership have to move ahead to maintain their market share. The Thai Farmers Bank (TFB) launched an early retirement scheme setting a target at 2,000 employees. The Bangkok Metropolitan Bank (BMB)

launched the scheme in April 2000 with a target of more than 1,000 employees. The Bank of Ayudhya Bank (BAY) and the Bangkok Bank (BBL) plan to launch the

19

Table 6: Total Capital and Total Assets of Commercial Banks

Commercial Banks Total Capitals 1/ Dec-96 May-00 Rank % Share Rank % Share Total Assets 1/ Dec-96 May-00 Rank % Share Rank % Share

Thai Major Shareholders: First Five Largest Banks 2/

1-5

68.2

1-5

74.9

1-5

68.4

1-5

74.8

Foreign Major Shareholders: A. Viable Private Banks: - Bank of Asia 11 - DBS Thai Danu Bank 12 Sub-Total (A) 11-12 B. Privatized Banks: - Standard Chartered Nakornthon Bank 14 - UOB Radanasin Bank 15 Sub-Total (B) 14-15 C. Banks on Privatization Process: - Siam City Bank - Bankok Metropolitan Bank Sub-Total (C)

2.5 10 2.3 11 4.8 10-11

2.9 11 1.9 12 4.8 11-12

2.5 10 2.3 11 4.8 10-11

2.9 1.9 4.8

1.3 12 0.8 13 2.1 12-13

1.2 14 1.1 15 2.3 14-15

1.3 12 0.8 13 2.1 12-13

1.2 1.1 2.3

8 9 7-8

4.6 3.9 8.5

7 9 9-8

4.8 2.9 7.7

8 9 8-9

4.6 3.8 8.4

7 9 7-9

4.8 2.9 7.7 7.1 14.8

11-15 6.9 10-13 7.1 11-15 Sum (A) + (B) 7-15 15.4 8-13 14.8 8-15 Sum (A) + (B) + (C) Source: CEIC, July 2000. Notes: 1/ 15 banks in 1997 and 13 banks in 1998 2/ Bankok Bank, Thai Farmers Bank, Krung Thai Bank, Siam Commercial Bank, and Bank of Ayudhya Table 7: Loans and Deposits of Commercial Banks

Commercial Banks Loans 1/ 2/ Dec-96 May-00 Rank % Share Rank % Share

6.9 10-13 15.3 7-13

Deposits1/ Dec-96 May-00 Rank % Share Rank % Share

Thai Major Shareholders: First Five Largest Banks 3/

1-5

68.1

1-5

74.2

1-5

71.4

1-5

75.3

Foreign Major Shareholders: A. Viable Private Banks: - Bank of Asia 11 - DBS Thai Danu Bank 12 Sub-Total (A) 11-12 B. Privatized Banks: - Standard Chartered Nakornthon Bank 13 - UOB Radanasin Bank 15 Sub-Total (B) 13-15 C. Banks on Privatization Process: - Siam City Bank - Bankok Metropolitan Bank Sub-Total (C)

2.5 10 2.4 11 4.9 10-11

3.0 11 2.2 12 5.2 11-12

2.3 10 2.2 11 4.5 10-11

2.9 1.7 4.6

1.2 12 0.8 13 2.0 12-13

1.3 13 0.1 15 1.4 14-15

1.3 12 0.8 13 2.1 12-13

1.0 0.9 1.9

8 9 8-9

4.4 3.8 8.2

7 9 7-9

4.5 3.3 7.8

8 9 8-9

4.6 3.9 8.5

7 9 7-9

5.1 3.5 8.6 6.5 15.1

11-15 6.9 7-13 6.6 11-15 Sum (A) + (B) 8-15 15.1 7-13 14.4 8-15 Sum (A) + (B) + (C) Source: CEIC, July 2000. Notes: 1/ 15 banks in 1997 and 13 banks in 1998 2/ Loans, less allowance for loan loss 3/ Bankok Bank, Thai Farmers Bank, Krung Thai Bank, Siam Commercial Bank, and Bank of Ayudhya

6.6 10-13 15.1 7-13

20

Table 8: Number of Domestic Branches of Commercial Banks

Commercial Banks Rank Number of Domestic Branches 1/ Dec-97 Mar-00 % Share Number Rank % Share Number Bangkok Others Bangkok Others

Thai Major Shareholders: First Five Largest Banks 2/ Foreign Major Shareholders: A. Viable Private Banks: - Bank of Asia - DBS Thai Danu Bank Sub-Total (A) B. Privatized Banks: - Standard Chartered Nakornthon Bank - UOB Radanasin Bank Sub-Total (B) C. Banks under the Privatization Process: - Siam City Bank - Bankok Metropolitan Bank Sub-Total (C)

1-5

27.5

72.5

2453

1-5

27.0

73.0

2584

9 11 9-11

53.2 45.3 49.8

46.8 54.7 50.2

110 95 205

7 11 7-11

51.8 45.3 48.8

48.2 54.7 51.2

124 95 219

13 15 13-15

56.7 45.6 51.1

43.3 54.4 48.9

67 12 54 13 121 12-13

55.2 46.3 51.2

44.8 53.7 48.8

67 68 135

7 8 7-8

30.3 36.7 33.2

69.7 63.3 66.8

209 173 382

9 8 9-8

30.6 37.0 33.5 49.7 41.0

69.4 63.0 66.5 50.3 59.0

211 177 388 354 742

Sum (A) + (B) 9-15 50.3 49.7 326 7-13 Sum (A) + (B) + (C) 7-15 41.4 58.6 708 7-13 Source: CEIC, July 2000. Notes: 1/ 15 banks in 1997 and 13 banks in 1998 2/ Bankok Bank, Thai Farmers Bank, Krung Thai Bank, Siam Commercial Bank, and Bank of Ayudhya

schemes at different targets.

The TFB and the Siam Commercial Bank (SCB) In addition, the Thai local

launched e-banking services in the first half of 2000.

banks team up to share resources, particularly in e-banking, know-how, customer information and staff training, aiming at cutting costs and boosting efficiency in the fact of foreign competition (IMF, 2000). On marketing strategy, the foreign-majority-shareholding banks with strong supporting capital could take advantage by expanding their customer base and winning customers from their counterparts. The BOA has launched mini-branches in subway stations and supermarkets, increased a number of ATMs in Bangkok area, and joined up with specialised state banks to increase its market share in non-Bangkok areas. The DTDB expects to extend 13 billion baht in new loans this year with five billion baht to retail customers. Housing loan products have been on campaign. The bank also plans to extend loans to small and medium-sized enterprises--SMEs (Bangkok Post, 8 July 2000). The SCBN started mini-branch project in July 2000

21

(Krungthepthurakij, 8 July 2000). The UOB-RAB launched a flexible mortgage-loan package with low interest rates. Another mortgage-loan package will be launched in the second half of 2000 (The Nation, 21 April 2000). Similarly, more than half of a commercial banks loans in the United State and Europe are consumer- or retail-based (Crispin et.al., 2000). Among Thai-majority-shareholding banks, the TFB, which successfully raised new capital in the last quarter of 1999, has also launched minibranches in subway stations and supermarkets. The bank aims to increase number of loans to medium- and large-sized corporate clients, focusing on export-oriented companies and those with good business potential (The Nation, 29 March 2000 and 15 May 2000). The BBL, the largest bank in terms of capitals/assets and market shares, lends about 40% of its credit to SMEs, with the balance lent to large corporations (Bangkok Post, 24 February 2000). Since the beginning of 2000, the bank has launched four mini-branches in supermarkets, three in Bangkok and one in Suratthani province (Krungthepthurakij, 10 May 2000).

VI.

Challenges Facing Foreign-owned Banks In the Nakornthon (NTB) and Radanasin (RAB) deals, bad assets remain with the banks and come under the management of Standard & Chartered Bank (SCB) and United Overseas Bank (UOB) respectively. As agreed, after five years, Standard Chartered Nakornthon (SCBN) and UOB Radanasin (UOBRAB) would share in 5% of any gains over the pre-agreed ring-fenced NPL pool amount or 15% of any losses. On NPLs, the four foreign-invested banks exhibited high NPL ratios: 41% for DTDB and 45% for BOA at the end of 1999, 56% for SCBN in mid-1999, and 51% for RAB in mid-1998 (CEIC, July 2000). Even though the UOB-RAB chose to set up a separate asset management company, named Radanasin Asset Management Company (RAMC), there would be the gain/loss sharing arrangement in order to encourage the UOB-RAB to efficiently manage the NPLs (Bank of Thailands New, 1999). On loan loss provision, BOA, SCBN and UOB-RAB completed 100% of the requirement in mid-2000. Under a recapitalization plan, the DTDB expects to complete the full provisioning in the second half of 2000.

22

During the initial stage of foreign entry, modern technology applications and the introduction of e-banking services requires high investment capital to bolster a broad base of businesses and customers. Moreover, a huge budget for public relations is needed to create public awareness of and interest in the novel banking services, including the running of corporate promotions to create good image of the banks among the general public. These would prompt the banks to raise service fees to better reflect the higher operation costs. Consumers, on the other hand, would gain more benefits from a wide variety of services in the long run.

To maintain operation costs at a low level, the foreign-owned banks as well as other Thai banks reduced their employment with/without early retirement programme. Employment level in the banking sector was at 109,526 persons in 1998 and declined to 94,202 persons in March 2000, or 13% down. The reduction is expected to be 30-35% in the next 3-5 years. As a result of the expansion of e-banking services, the modern technology will increasingly replace bank staff, so personnel expenses are likely to drop

(Krungthepthurakij, 15 April 2000).

Crispin et.al.(2000) have pointed out

that western banks across the world on average staffed their branches with 10 or fewer employees while the number in Thai banks was closer to 30 employees. High retrenchment in the banking sector has become a social issue. Moreover, since the acquisition by the UOB Group, fear about job security has been spread among staff of the foreign-owned banks. More than 60 employees of the UOB-RAB were laid off without any advance notice (Bangkok Post, 31 March 2000). At least for now, the foreign-owned banks hold a competitive advantage in the consumer-banking arena due to their advanced technology and consumermarketing skills. Based on the commodity nature of consumer-banking

products, they are very easy to replicate. Because they are high-profit, highmargin products, all banks will be pushed in that direction (Crispin et.al., 2000). The competitive advantage of foreign-owned banks may not last for long.

23

VII.

Concluding Remarks

The acquisition by foreign banks has changed corporate governance structure of the banks. Leadership and top management were replaced. In this initial stage of foreign entry, operational improvements focus on cost cutting, especially through employment cut. Advantages of foreign majority shareholding include the availability of adequate funds for capital, infusion of advance technology and expertise to operate efficiently, introduction of new banking products, and acquisition of consumermarketing skills. Retail customers and small- and medium-sized enterprises have become target customers. However, there are also challenges, such as NPL problem which obstructs the four banks from extending fresh loans. High investment in

modern technology and equipment and a huge budget for public relations are also required. Public criticism over job insecurity in foreign-owned banks has been on the rise. As Thai local banks face new competition from international giants, they have revamped their corporate management, risk controls and technology base. On the other hand, the competitive advantage of foreign-owned banks may not last for long. In this early stage, the entry of the ABN Amro Bank increases both the size and market share of BOA (Table 6 and Table 7). There has been an increase in the size of UOB Radanasin Bank after the acquisition by the UOB. Overall, the share of the four foreign-owned banks in terms of total capitals and assets has slightly increased, but their market share in terms of loans and deposits has slightly decreased. Two and a half years after the acquisition by giant foreign banks, the market structure of Thai banking has slightly changed. The fist-five largest banks still hold a large market share, around 75% as of May 2000. After the crisis, their size and market share increased. It can be concluded that oligopoly is still the characteristic of Thai banking market. New bank entry is limited due to restriction on bank license issued by the monetary authority. Each bank has to consider individual reactions of the others to changes in its prices and types of services. To prevent losses, floating lending rates with minimum lending rate (MLR) are applied especially for housing loans. In the later stage, two nationalised banks, Bangkok Metropolitan Bank (BMB) and Siam City Bank (SCIB), will be privatized. The BMB may be sold to Londonbased Hong Kong and Shanghai Banking Corporation (HSBC). The SCIB may be 24

sold to foreign and local investors. Foreign acquisition of these medium-sized banks will increase the share of foreign banks/investors in Thai banking sector, from the current 7% to 15% in terms of both total capital/assets and market share. In total, 6 banks out of 13 Thai banks may belong to foreign banks/investors. Crispin et.al (2000) remark that regulators across the region are directly and indirectly encouraging banking industry consolidation, in part because it is easier to keep an eye on a dozen rather than several dozen banks and finance companies. The Philippines government has used a regulatory carrot to encourage a rapid market-led consolidation of the banking industry. In Singapore, the government has opened the door a little wider to foreign banks and urged local banks to smarten up fast, showing the way by hiring an American executive to overhaul the state-controlled Development Bank of Singapore. Malaysia, too, plans consolidation around 10

anchor banks, but there are serious doubts about the ability of local banks to survive if their long-standing protection against competition from foreign banks is lifted. An empirical evidence cited by Clasessens et.al (1998) indicates that, based on bank level data for 80 countries in the 1988-1995 period, a larger foreign-ownership-share of banks indeed reduces the profitability and the overall expenses of domestically owned banks. Entry of foreign banks has improved the functioning of national banking markets, with positive welfare implications for banking customers. The relaxation of restrictions on foreign bank entry may similarly reduce domestic banking profits, but with positive overall welfare implications for the domestic economy. An interesting finding is that the number of foreign entrants matters more than their market share. This indicates that foreign banks affect local bank competition upon entry rather than after they have gained substantial market share. Andrew Stotz at the SG Securities in Bangkok analyses that There are still 40 million people in Thailand who do not participate in the banking sector. Thats changing fast, meaning consumer banking has a guaranteed growth potential for may be the next 30 years (Crispin et.al., 2000). Retail customers have better potential in terms of growth and ability to pay. High competition in consumer banking is

expected in Thai banking market. At this stage, it is too early to evaluate the impact of foreign banks on the profitability of Thai local banks. Most banks remain

focussed on solving NPL problem and improving credit quality for their portfolios. 25

The foreign entrants are having a noticeable impact on new innovative distribution channels. Thai local banks are on the way to revamp management skills, risk controls and technology base. Consumer, on the other hand, would gain benefits from a wide variety of services in the long run.

NOTES

1.

The FIDF was established under the BOT in 1985. Its major roles are as follows: i) to provide liquidity assistance to financial institutions; ii) to provide guarantee to depositors and creditors; and iii) to act on behalf of the authorities in exchanging promissory notes for depositors and creditors, and sourcing liquidity for the scheme (Bank of Thailand, 1997).

2.

Consumer banking is phone banking and PC banking. A customer accesses his or her account and uses a computer keyboard or the telephone number keys to effect a transaction. Meanwhile, internet banking is a service on banks web site. Customers can check their account and can also click on an array of other services such as applying for a home mortgage, buying an insurance policy or investing in a mutual fund (Granitsas, 2000).

REFERENCES

Bangkok Post Newspaper (various issues). Bank of Thailands News (1997- present). Bank of Thailand (1992). 50 Years of the Bank of Thailand: 1942-1992. Bangkok: Amarin Printing Group. Bank of Thailand (1997). Financial Institutions and Markets in Thailand. (http://www.bot.or.th/govnr/public/BOT_Homepage/EnglishVersion/index_e. htm) Bank of Thailand (1999). Bank of Thailands News: No75/1999. (www.bot.or.th) CEIC (2000). CEIC Database. Hong Kong: McGrawhill, July 2000. 26

Claessens, Stijin, et.al. (1998) How does Foreign Entry Affect the Domestic Banking Market, World Bank working paper, May 1998. Crispin, Shawn, et. al. (2000) Banking on Change, Far Eastern Economic Review, 6 April 2000. (http://www.feer.com.sg) Dolven, Ben (2000). Offshore Ambitions, Far Eastern Economic Review, 4 February 2000. (http://www.feer.com.sg) Granitsas, Alkman (2000). Tangled in the Web, Far Eastern Economic Review, 4 May 2000. (http://www.feer.com.sg) International Monetary Fund (2000). Thailand: Selected Issues. IMF Staff Country Report. Washington: IMF, February 2000. Krungthepthurakij Newspaper (various issues). Saengthong, Viratana (1998). Puzzle: Collapse in Thai Banks. Bangkok: P. Press. (in Thai) The Nation Newspaper (various issues). The Thai Bankers Association (1979). ASEAN Fact Book: Banking in Thailand. Bangkok: Marketing Media. World Bank (2000). Thailand Economic Monitor, February 2000.

(http//www.worldbank.or.th/monitor). Yos Vajragupta and Pakorn Vichyanond (2000). Thailands Financial Evolution and the 1997 Crisis, Financial Resources for Development in Myanmar. Edited by Mya Than and Myat Thein. Singapore: Institute of Southeast Asian Studies.

About the author Dr Sakulrat Montreevat is a Fellow at the Institute of Southeast Asian Studies. E-mail: sakulrat@iseas.edu.sg

Acknowledgement The author would like to thank Dr Nick J. Freeman, Institute of Southeast Asian Studies, and Ms Raithiwa Narumon, Thai Farmers Research Center, for useful data/information and guidance.

27

ISEAS WORKING PAPERS

I. ISEAS Working Papers on Economics and Finance (ISSN 0218-8937) 1(96): Nick J. Freeman, Portfolio Investment in Vietnam: Coping Without a Bourse, February 1996 2(96): Reza Y. Siregar, Inflows of Portfolio Investment to Indonesia: Anticipating the Challenges Facing the Management of Macroeconomy, March 1996 3(96): Helen Hughes, Perspectives for an Integrating World Economy: Implications for Reform and Development, May 1996 4(96): Carolyn L. Gates, Enterprise Adjustment and Economic Transformation: Industrial Enterprise Behaviour and Performance in Vietnam during Stabilization and Liberalization, June 1996 5(96): Mya Than, The Golden Quadrangle of Mainland Southeast Asia: A Myanmar Perspective, July 1996 1(99): Myat Thein, Improving Resource Mobilization in Myanmar, January 1999 2(99): Anita G. Doraisami, The Malaysian Currency Crisis: Causes, Policy Response and Future Implications, February 1999 3(99): George Abonyi, Thailand: From Financial Crisis to Economic Renewal, March 1999 4(99): Carolyn L. Gates, The East Asian Crisis and Global Integration: Mismanagement and Panic Revisited or a New Beast?, March 1999 5(99): Tin Maung Maung Than, The Political Economy of Burmas (Myanmars) Development Failure 1948-1988, March 1999 6(99): Kim Ong-Giger, Southeast Asian Economies in Crisis: The Emergence of Pax Capitalia, April 1999 7(99): Carolyn L. Gates, ASEANs Foreign Economic Relations: An Evolutionary and Neo-Institutional Analysis, May 1999 8(99): Kim Ong-Giger, Japanese IT Development: Implications for FDI in Southeast Asia, September 1999

9(99): Frank L. Bartels and Nick J. Freeman, Multinational Firms and FDI in Southeast Asia: Post-Crisis Perception Changes in the Retail-Oriented Manufacturing Sector, December 1999. 1(2000): Nick J. Freeman, Constraints on Thailands Equity Market as an Allocator of Foreign Investment Capital: Some Implications for Post-Crisis Southeast Asia, January 2000. 2(2000): Nick J. Freeman, Foreign Portfolio Investors Approaches to Thailands Equity Market: Survey Findings and Preliminary Analysis, March 2000. 3(2000): Nick J. Freeman and Frank L. Bartels, Portfolio Investment in Southeast Asias Stock Markets: A Survey of Institutional Investors Current Perceptions and Practices, April 2000. 4(2000): Nick J. Freeman, A Regional Platform for Trading Southeast Asian Equities: Viable Option or Lofty Red Herring?, July 2000. 5(2000): Sakulrat Montreevat, Impact of Foreign Entry on the Thai Banking Sector: Initial Stage of Bank Restructuring, August 2000.

II. ISEAS Working Papers on International Politics and Security Issues (ISSN 0218-8953) 1(96): Derek da Cunha, The Need for Weapons Upgrading in Southeast Asia: Present and Future, March 1996 1(97): Simon J. Hay, ASEANs Regional Security Dialogue Process: From Expectation to Reality?, March 1997 1(99): Sorpong Peou, The ASEAN Regional Forum and Post-Cold War IR Theories: A Case for Constructive Realism?, January 1999 2(99): Sheng Li Jun, China and the United States as Strategic Partners into the Next Century, February 1999 3(99): Jrgen Haacke, Flexible Engagement: On the Significance, Origins and Prospects of a Spurned Policy Proposal, February 1999 4(99): Derek da Cunha, Southeast Asias Security Dynamics: A Multiplicity of Approaches Amidst Changing Geopolitical Circumstances, July 1999

III. ISEAS Working Papers on Social and Cultural Issues (ISSN 0218-8961) 1(96): Federico V. Magdalena, Ethnicity, Identity and Conflict: The Case of the Philippine Moros, April 1996 1(98): Patricia Lim, Myth and Reality: Researching the Huang Genealogies, June 1998 2(98): M. Thien Do, Charity and Charisma: The Dual Path of the Tinh D Cu Si, a Popular Buddhist Group in Southern Vietnam, September 1998 1(99): JoAnn Aviel, Social and Environmental NGOs in ASEAN, August 1999

IV. ISEAS Working Papers by Visiting Researchers (ISSN 0219-3582) 1(2000): Ramkishen S Rajan, Examining the Case for Currency Basket Regimes for Southeast Asia, January 2000 2(2000): P Lim Pui Huen, Continuity and Connectedness: The Ngee Heng Kongsi of Johor, 1844-1916, January 2000 3(2000): Ramkishen S Rajan, Examining the Case for an Asian Monetary Fund, February 2000 4(2000): Thawatchai Jittrapanun, The SIMEX Experience: Implications for Thailands Futures Exchange, February 2000 5(2000): Le Minh Tam, Reforming Vietnams Banking System: Singapores Model, February 2000 Learning from

6(2000): Gao Haihong, Liberalising Chinas Capital Account: Lessons Drawn From Thailands Experience, February 2000 7(2000): Liliana Halim, Reviving the Indonesian Banking Sector? Indonesias Economic Crisis: Impact on Financial and Corporate Sectors 1997-1999, February 2000 8(2000): Ngiam Kee Jin, Coping with the Asian Financial Crisis: The Singapore Experience, March 2000 9(2000): Ramkishen S. Rajan and Iman Sugema, Capital Flows, Credit Transmission and the Currency Crisis in Southeast Asia, March 2000 10(2000): Wang Xiaomin, Zhongguancun Science Park: A SWOT Analysis, May 2000 11(2000): Doan Phuong Lan, The Asian Financial Crisis and its Implication for Vietnams Financial System, May 2000

12(2000): Tracy Yang Su-Chin, Regulatory Reforms in the Asia-Pacific Region: A Preliminary Study, May 2000 13(2000): Akhmad Bayhaqi, Education and Macroeconomic Performance in Indonesia: A Comparison with Other ASEAN Economies, May 2000 14(2000): Ai-Gek Beh and George Abonyi, Structure of the Asset Management Industry: Organizational Factors in Portfolio Investment Decisions, June 2000

Editorial Committee

Derek da Cunha Nick J. Freeman Lee Hock Guan Sakulrat Montreevat Leonard Sebastian Tin Maung Maung Than Tracy Yang

Papers in this series are preliminary in nature and are intended to stimulate discussion and critical comment. The Editorial Committee accepts no responsibility for facts presented and views expressed, which rests exclusively with the individual author. No part of this publication may be produced in any form without permission. Comments are welcomed and may be sent to the author.

ISSN 0218-8937

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Lloyds Metals and Energy 19aug2021Dokumen9 halamanLloyds Metals and Energy 19aug2021praveen kumarBelum ada peringkat

- Bank of America StatementDokumen12 halamanBank of America StatementAmin Sahil0% (1)

- Guidelines On Risk Appetite Practices For BanksDokumen34 halamanGuidelines On Risk Appetite Practices For BanksPRIME ConsultoresBelum ada peringkat

- Role & Importance of Financial Management in The Banking SectorDokumen18 halamanRole & Importance of Financial Management in The Banking SectorAjit DasBelum ada peringkat

- Chapter 2 The Financial Market EnvironmentDokumen35 halamanChapter 2 The Financial Market EnvironmentJames Kok67% (3)

- Oman Limited Liability CompanyDokumen9 halamanOman Limited Liability Companyadeel asgharBelum ada peringkat

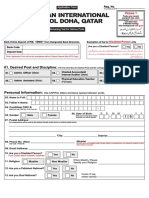

- Do Ha Qatar FormDokumen4 halamanDo Ha Qatar FormsajidBelum ada peringkat

- NIFM Fundamental Analysis Book PDF (Editing 09.07.2016) - 190619115830Dokumen147 halamanNIFM Fundamental Analysis Book PDF (Editing 09.07.2016) - 190619115830Mohammed FarooqBelum ada peringkat

- Ifamr2019 0030Dokumen22 halamanIfamr2019 0030RizkiMartoba SitanggangBelum ada peringkat

- L&T Fi PDFDokumen127 halamanL&T Fi PDFkaran pawarBelum ada peringkat

- STMDokumen72 halamanSTMKiran ReddyBelum ada peringkat

- Organisational Study Report OnDokumen70 halamanOrganisational Study Report OnÂbîjîţh KBBelum ada peringkat

- A Project Report On Online BankingDokumen18 halamanA Project Report On Online BankingSourav PaulBelum ada peringkat

- BP 22 ResearchDokumen4 halamanBP 22 ResearchRey BicolBelum ada peringkat

- BBP - 7.1.1. Chart of Accounts-Master DataDokumen15 halamanBBP - 7.1.1. Chart of Accounts-Master DataManoj KumarBelum ada peringkat

- Assignment 2 (Risk Management) Group 4Dokumen5 halamanAssignment 2 (Risk Management) Group 4LAURENSTIUS STEFANUSBelum ada peringkat

- Depository Institutions FMDokumen37 halamanDepository Institutions FMEricBelum ada peringkat

- Oracle Treasury: Make Smarter DecisionsDokumen3 halamanOracle Treasury: Make Smarter Decisionsbalaje99 kBelum ada peringkat

- PIONEER Current Account SOB Eff 1st Dec 2022Dokumen2 halamanPIONEER Current Account SOB Eff 1st Dec 2022Rajat AgarwalBelum ada peringkat

- Financial Inclusion Policy - An Inclusive Financial Sector For AllDokumen118 halamanFinancial Inclusion Policy - An Inclusive Financial Sector For AllwBelum ada peringkat

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDokumen1 halamanGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzBelum ada peringkat

- International Competition 12th Citta Di TREVISO 20200327 - 29Dokumen5 halamanInternational Competition 12th Citta Di TREVISO 20200327 - 29Nóra AntóniaBelum ada peringkat

- Concept Note Template (For Graduate Research)Dokumen2 halamanConcept Note Template (For Graduate Research)Saroj Koirala100% (6)

- 18BCP012 - (MAIN PROJECT) PDFDokumen51 halaman18BCP012 - (MAIN PROJECT) PDFMukesh GuptaBelum ada peringkat

- JPM Reliance Industries 2022-07-20 4150945Dokumen8 halamanJPM Reliance Industries 2022-07-20 4150945Abhishek SaxenaBelum ada peringkat

- Guidance On AML CFT Controls in Trade Finance and Correspondent Banking PDFDokumen29 halamanGuidance On AML CFT Controls in Trade Finance and Correspondent Banking PDFTodwe Na MurradaBelum ada peringkat

- Mba 410: Commercial Banking Credit Units: 03 Course ObjectivesDokumen6 halamanMba 410: Commercial Banking Credit Units: 03 Course ObjectivesakmohideenBelum ada peringkat

- Nabil - Bank - Report - Final (Fianancial - Performance - Analysis) )Dokumen45 halamanNabil - Bank - Report - Final (Fianancial - Performance - Analysis) )Kishan SahBelum ada peringkat

- Chapter-3-Liberalisation, Privatisation and Globalisation - An AppraisalDokumen32 halamanChapter-3-Liberalisation, Privatisation and Globalisation - An AppraisalRiti PaniBelum ada peringkat

- 43B Certain Deductions To Be Only On Actual PaymentDokumen2 halaman43B Certain Deductions To Be Only On Actual PaymentNISHANTH JOSEBelum ada peringkat