Derivative 29 October 2013 by Mansukh Investment and Trading Solution

Diunggah oleh

Mansukh Investment & Trading SolutionsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Derivative 29 October 2013 by Mansukh Investment and Trading Solution

Diunggah oleh

Mansukh Investment & Trading SolutionsHak Cipta:

Format Tersedia

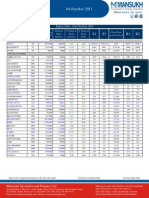

Daily Derivative Report

NIFTY FUTURE : 6101.10 -43.80 0.71%

29 October 2013

Nifty Sentiment Indicators

Put Call Ratio-Nifty Options Put Call Ratio-Bank Nifty Options 1.4 1.05

NIFTY FUTURES HIGHLIGHTS Nifty October 2013 futures closed at 6107.05 on Monday at a premium of 6.05 points over spot closing of 6101.10, while Nifty November 2013 futures ended at 6159.55 at a premium of 58.45 points over spot closing. Nifty October futures saw contraction of 1.99 million (mn) units taking the total outstanding open interest (OI) to 14.12 mn units. The near month October 2013 derivatives contract will expire on October 31, 2013. From the most active contracts, Tata Steel October 2013 futures last traded at a premium of 1.70 points at 313.20 compared with spot closing of 311.50. The number of contracts traded was 14,855. ITC October 2013 futures were at a premium of 1.65 points at 328.35 compared with spot closing of 326.70. The number of contracts traded was 17,913. DLF October 2013 futures were at a premium of 0.20 points at 146.25 compared with spot closing of 146.05. The number of contracts traded was 20,350. Yes Bank October 2013 futures last traded at a premium of 1.85 points at 347.25 compared with spot closing of 345.40. The number of contracts traded was 21,270.

Product

Index Futures Stock Futures Index Options Stock Options Total F&O

25.10.13

440819 690795 3850747 307675 5290036

Volume 28.10.13

458309 906962 3514901 286976 5167148

% Chg

3.97% 31.29% -8.72% -6.73% -2.32%

Index

NIFTY BANK NIFTY CNXIT

Spot

6,101.10 10,773.20 8,783.20

Future

6,107.05 10,779.40 8,784.25

Basis

6 6 1

Increase in Open Interest with Increase in price Symbol UBL MARUTI RENUKA Last price 972.35 1516.25 24.3 Chg (%) 1.58 0.33 4.07 OI ('000') 77 1800.5 20484 20.78 8.91 5.37 Increase (%)

Increase in Open Interest with Decrease in price Symbol Last price Chg (%) OI ('000')

GLENMARK 532.7 -3.1 272.5

Increase (%)

0.93

400000000 350000000 300000000 250000000 200000000 150000000 100000000 50000000 0

CP

In d u stry

AUTO BAN KS CO N STRUCTIO N FIN AN CE FMCG IT MEDIA & EN T METAL S O IL & GAS PHARMACEUTICAL S PO W ER

OI

45665250 189491250 337549000 51780250 31167500 24820750 4112000 90614500 51181500 44587500 91143000

OI C h an ge(% )

2 .9 4 -0 .3 1 .6 2 -2 .1 2 1 3 .1 7 2 .7 5 -1 0 4 .4 2 .4 5 2 .4 9 2 .1 5

For Our Clients Only

For Private circulation Only

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

AU TO NS BA TR NK UC S TIO FIN N AN CE FM CG M ED IA IT & EN M T ET PH AR OIL ALS M & AC G EU AS TIC A PO LS W ER CO

SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

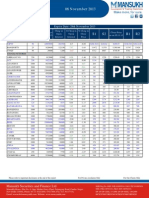

Daily Derivative Report

NIFTY OUTLOOK :Nifty dropped 43.80 points in a choppy session as investor exercised caution against RBI policy tomorrow . For the upcoming session market seems Volatile, however 6235/6280 could be its crucial resistance levels. On the flip side 6105/6032 could be its near term supports levels.

MOST ACTIVE CALLS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY BANKNIFTY Expiry Date Strike Price 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 6200 6300 6100 6400 6150 6250 6500 6000 11000 Contracts Traded 27277250 15814300 13928150 8566500 1705200 1449950 1406150 1337250 1006950 Open Interest 5726150 6427600 3204300 3647250 788000 852200 2466800 2086350 321850

MOST ACTIVE PUTS Symbol NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY NIFTY Expiry Date Strike Price 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 31-Oct-13 6100 6000 6200 5900 5800 5700 6150 6300 6050 Contracts Traded 26242400 16750350 11287300 7227450 3449150 1450350 1253250 1233550 1228650 Open Interest 4429200 6596400 2316100 4845700 4230550 4438550 631850 686400 522950

OPTION STRATEGY AS ON 28 OCTOBER 2013 UNDERLYING ASSET CMP STRATEGY MAX LOSS MAX PROFIT LOT SIZE NIFTY 6144.9 SELL NIFTY OCT. CALL 6150 @ 50.90 SELL NIFTY OCT. PUT 6150 @ 56.30 UNLIMITED 107.2 50

150 100 50 0 -5 0 -1 0 0 -1 5 0 -2 0 0 -2 5 0 5900 6000

N E T IN F L O W

6100

6150

6200

6300

6400

6500

6600

For any information or suggestion, please send your query at research@moneysukh.com

For Private circulation Only For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Daily Derivative Report

STRATEGY TRACKER DATE OF STRATEGY UNDERLYING ASSET STRATEGY IN/OUT FLOW NET PROFIT/ LOSS AS ON 25/10/2013 REMARK

28/9/2013

NIFTY

SELL NIFTY OCTOBER 6150 PUT@56.30 SELL NIFTY OCTOBER 6150 CALL@50.90 BUY NIFTY OCTOBER 6200 PUT@57 BUY NIFTY OCTOBER 6200 CALL@83 SELL NIFTY OCTOBER. FUTURE SELL NIFTY OCT.5700 PUT@ 95.00 SELL NIFTY AUGUST 5500 PUT@76.10 SELL NIFTY AUGUST 5900 CALL@ 84

107.2

1.35

HOLD POSITION

25/9/2013

NIFTY

140

(28.00)

EXIT POSITION

30/9/2013

NIFTY

95

55.85

BOOK PARTIAL PROFIT

10/8/2013

NIFTY

170.1

75.30

BOOK FULL PROFIT

NAME

Varun Gupta Mohit Taneja

DESIGNATION

Head - Research Research Analyst

E-MAIL

varungupta@moneysukh.com mohit.t@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

For Private circulation Only

For Our Clients Only SEBI Reg.No: BSE: INB 010985834, F&O: INF 010985834 NSE: INB BSE: 230781431, F&O: INF /230781431, DP: IN-DP-CDSL-73-2000, INSEBI Regn No. INB010985834 NSE: INB230781431 DP-NSDL-140-2000 PMS Regn No. INP000002387 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

Mansukh Securities and Finance Ltd Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar and Marg, Finance New Delhi-110002 Mansukh Securities Ltd

Phone: 011-30123450/1/3/5 Fax:Pratap 011-30117710 Email: research@moneysukh.com Office: 306, Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Website: www.moneysukh.com Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

Anda mungkin juga menyukai

- Results Tracker 09.11.2013Dokumen3 halamanResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker 08.11.2013Dokumen3 halamanResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker 07.11.2013Dokumen3 halamanResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)