HW 6

Diunggah oleh

urbuddy542Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

HW 6

Diunggah oleh

urbuddy542Hak Cipta:

Format Tersedia

UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN Actuarial Science Program DEPARTMENT OF MATHEMATICS

Math 210 Theory of Interest Prof. Rick Gorvett Fall, 2011

Homework Assignment # 6 (max. points = 10) Due at the beginning of class on Tuesday, October 25, 2011 You are encouraged to work on these problems in groups of no more than 3 or 4. However, each student must hand in her/his own answer sheet. Please show your work enough to show that you understand how to do the problem and circle your final answer. Full credit can only be given if the answer and approach are appropriate. Please give answers to two decimal places e.g., xx.xx% and $xx,xxx.xx . Note: Homework assignments are due at the beginning of the class. If you arrive at the class after it has started, you must hand in your assignment upon entering the classroom. Assignments will not be accepted at the end of the class period.

(1)

Suppose a project requires you to invest $150 now, and $60 two years from now. The project returns $192 one year from now. Find all the yield rates (internal rates of return) of this project. For problem (2) above, find the range of annual interest rates which will produce a net present value greater than zero. For an investment of $1,000 now and $500 five years from now, you can receive a 10year $200 annual payment annuity, with the first payment occurring one year from now. The effective annual interest rate is 10%. Find the net present value of tis investment opportunity. What is the internal rate of return on a project that requires a $10,000 investment now, and provides returns to the investor of $7,000 one year from now and $7,000 two years from now? On 1/1/11 (month/day/year), you deposit $1,000 into a mutual fund. On 1/1/12, the value of your fund is $800. On 1/1/13, the value of your fund is $1,200. On 1/1/14, the value of your fund is $1,500. Find both the geometric and the arithmetic average annual rates of return during your three-year investment period. On 1/1/11, you deposit $40,000 into an account. At the end of each of the next four calendar quarters, the value of the account and the deposit/withdrawal activity is as follows:

1

(2)

(3)

(4)

(5)

(6)

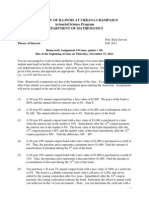

Date 3/31/11 6/30/11 9/30/11 12/31/11

Account Value $ 44,000 32,000 46,000 44,000

Activity $ 6,000 withdrawal 8,000 deposit 4,000 withdrawal -----

(The account values represent the amount in the account immediately before the deposit or withdrawal activity on that date.) Find the time-weighted rate of return on the account during 2011. (7) For problem (6) above, find the dollar-weighted rate of return on the account during 2011. On 1/1/11, you deposit $8,000 into an account. On 8/19/11, your account is worth $10,000, and you then either deposit or withdraw (youll have to determine which) X into or from the account. On 12/31/11, your account is worth $14,000. Your time-weighted rate of return on the account during 2011 was 25%. Find X (and identify whether X was deposited or withdrawn). You invest $5,000 into a fund on 1/1/11. On 7/1/11, you deposit another $2,000 into the fund. On 10/1/11, you withdraw $3,000 from the fund. On 12/31/11, your fund is worth $6,000. What was the annual dollar-weighted rate of return on your investment? You have just inherited an endowment with a principal of $1,000,000. At the end of each year, in perpetuity, you are paid the interest from this endowment; the endowment earns an annual effective interest rate of 7.5% on this $1,000,000 principal. (You cannot touch the principal of the endowment.) You invest each of these interest payments into an account earning an annual effective interest rate of 5%. How much do you have in this account after 20 years (not including the endowment principle)?

(8)

(9)

(10)

Anda mungkin juga menyukai

- HW 1Dokumen2 halamanHW 1urbuddy542Belum ada peringkat

- Optional Maths Revision Tutorial Questions: X X X A A A A A ADokumen44 halamanOptional Maths Revision Tutorial Questions: X X X A A A A A ASaizchiBelum ada peringkat

- HW 2Dokumen2 halamanHW 2urbuddy542Belum ada peringkat

- Sequences and SeriesDokumen3 halamanSequences and SeriesPrachiBelum ada peringkat

- tb301 PDFDokumen60 halamantb301 PDFDarmin Kaye PalayBelum ada peringkat

- Testbank Financial Management Finance 301Dokumen60 halamanTestbank Financial Management Finance 301منیر ساداتBelum ada peringkat

- Required:: Tutorial For BGGE2044 Project Management and Finance - FinanceDokumen3 halamanRequired:: Tutorial For BGGE2044 Project Management and Finance - FinanceTiang MingkitBelum ada peringkat

- Tutorial Problems 2013Dokumen29 halamanTutorial Problems 2013hollowkenshinBelum ada peringkat

- Time Value of MoneyDokumen19 halamanTime Value of MoneyGopal DasBelum ada peringkat

- Business Finance WorksheetsDokumen9 halamanBusiness Finance WorksheetsShiny NatividadBelum ada peringkat

- ProblemsDokumen28 halamanProblemsKevin NguyenBelum ada peringkat

- Tutorial Questions With AnswersDokumen8 halamanTutorial Questions With AnswersSashawn Douglas100% (1)

- Quiz - QuestionsDokumen20 halamanQuiz - QuestionsArturo ArbajeBelum ada peringkat

- Time Value of MoneyDokumen2 halamanTime Value of MoneyMohammad Aslam100% (2)

- Tutorial 2Dokumen3 halamanTutorial 2jhagantiniBelum ada peringkat

- 449b11 - Lecture 05 EEDokumen30 halaman449b11 - Lecture 05 EEMuhammad SalmanBelum ada peringkat

- Lec1 2 Disc Nominal ProbhandoutDokumen3 halamanLec1 2 Disc Nominal ProbhandoutkidBelum ada peringkat

- AnnuityDokumen10 halamanAnnuityJiru Kun0% (1)

- TVM ExamplesDokumen1 halamanTVM ExamplesBrafiel Claire Curambao LibayBelum ada peringkat

- Midterm RevisionDokumen27 halamanMidterm RevisionTrang CaoBelum ada peringkat

- Final Quiz EDokumen3 halamanFinal Quiz ETimothy JonesBelum ada peringkat

- FINA 6274 Time Value of Money Practice ProblemsDokumen1 halamanFINA 6274 Time Value of Money Practice ProblemsFaran KhanBelum ada peringkat

- Two Dollars Earned: Using Timelines To Visualize Cash FlowsDokumen23 halamanTwo Dollars Earned: Using Timelines To Visualize Cash FlowsBella Jean ObaobBelum ada peringkat

- Compound Interest WSDokumen3 halamanCompound Interest WSthaisyteaBelum ada peringkat

- Shs Genmath q2 w1 Studentsversion v1Dokumen10 halamanShs Genmath q2 w1 Studentsversion v1Hanna Zaina AlveroBelum ada peringkat

- F.A - 4: Basic Test Bank For FinanceDokumen3 halamanF.A - 4: Basic Test Bank For FinanceRAsel FaRuqueBelum ada peringkat

- Time Value MoneyDokumen7 halamanTime Value Moneypravin963Belum ada peringkat

- Engineering Economy - Individual AssignmentDokumen3 halamanEngineering Economy - Individual AssignmentNguyễn QuỳnhBelum ada peringkat

- 1.0 Time Value of MoneyDokumen54 halaman1.0 Time Value of MoneyAbuBakerBelum ada peringkat

- Topic: Time Value of Money: AssignmentDokumen3 halamanTopic: Time Value of Money: AssignmentAntoniaBelum ada peringkat

- FM PracticeDokumen1 halamanFM PracticeNaveed NawazBelum ada peringkat

- Discount, Denoted by D Which Is A Measure of Interest Where The Interest IsDokumen3 halamanDiscount, Denoted by D Which Is A Measure of Interest Where The Interest IsNguyễn Quang TrườngBelum ada peringkat

- Exam in StatDokumen11 halamanExam in StatA-nn Castro NiquitBelum ada peringkat

- TUTORIAL TVM Feb17Dokumen15 halamanTUTORIAL TVM Feb17Phong DươngBelum ada peringkat

- FIN220 - Time Value of Money Practice QuestionsDokumen2 halamanFIN220 - Time Value of Money Practice QuestionsMatt ZaheadBelum ada peringkat

- Chap 9: Present ValueDokumen4 halamanChap 9: Present ValueDouglas M. DougyBelum ada peringkat

- XM400 2smDokumen11 halamanXM400 2smAldrin TamayoBelum ada peringkat

- ECO AssignmentDokumen2 halamanECO AssignmentChin-Chin AbejarBelum ada peringkat

- TUTORIALDokumen10 halamanTUTORIALViễn QuyênBelum ada peringkat

- Instructions: Please Answer Each of The Seven (7) Practice Problems Below. Also, Please AlsoDokumen2 halamanInstructions: Please Answer Each of The Seven (7) Practice Problems Below. Also, Please AlsoShameem KhaledBelum ada peringkat

- Chapter 5Dokumen31 halamanChapter 5Emi NguyenBelum ada peringkat

- Lecture 7 9Dokumen106 halamanLecture 7 9Nguyễn Thúy KiềuBelum ada peringkat

- Problems For Practice - Portal Upload - 01 - Oct - 2019Dokumen1 halamanProblems For Practice - Portal Upload - 01 - Oct - 2019Yasir MalikBelum ada peringkat

- Solutions Extra PDFDokumen36 halamanSolutions Extra PDFRaghuveer ChandraBelum ada peringkat

- Homeworks FIN1101-144510Dokumen6 halamanHomeworks FIN1101-144510MBelum ada peringkat

- General Mathematics Teaching Guide Solving Situational Word Problems Involving FunctionsDokumen3 halamanGeneral Mathematics Teaching Guide Solving Situational Word Problems Involving FunctionsVhiinXoii BeriosoBelum ada peringkat

- Calculus 2 - Chapter 3Dokumen8 halamanCalculus 2 - Chapter 3Silverwolf CerberusBelum ada peringkat

- Foundations of Engineering EconomyDokumen50 halamanFoundations of Engineering EconomyOrangeBelum ada peringkat

- Time Value of MoneyDokumen29 halamanTime Value of MoneyAzim Samnani100% (1)

- Review Material BSDokumen55 halamanReview Material BSRoan Eam TanBelum ada peringkat

- Activity Set - 1Dokumen5 halamanActivity Set - 1Eunice AmorantoBelum ada peringkat

- MATHINVS - Simple Annuities 3.5Dokumen7 halamanMATHINVS - Simple Annuities 3.5Kathryn SantosBelum ada peringkat

- General Ordinary Annuity ExperimentalDokumen6 halamanGeneral Ordinary Annuity Experimentalbobbyforteza92Belum ada peringkat

- Compound InterestDokumen3 halamanCompound InterestmirkazimBelum ada peringkat

- Math Skills PracticeDokumen5 halamanMath Skills Practiceapi-436873837Belum ada peringkat

- Business Maths - Must ReadDokumen17 halamanBusiness Maths - Must Readreddy iibfBelum ada peringkat

- How to Channel the Velocity of Money: And Take Control of Your Financial Outlook: Financial Freedom, #153Dari EverandHow to Channel the Velocity of Money: And Take Control of Your Financial Outlook: Financial Freedom, #153Belum ada peringkat

- Finance for Non-Financiers 1: Basic FinancesDari EverandFinance for Non-Financiers 1: Basic FinancesBelum ada peringkat

- HW 8Dokumen2 halamanHW 8urbuddy542Belum ada peringkat

- HW 8Dokumen2 halamanHW 8urbuddy542Belum ada peringkat

- HW 8Dokumen2 halamanHW 8urbuddy542Belum ada peringkat

- University of Illinois at Urbana-Champaign Actuarial Science Program Department of MathematicsDokumen2 halamanUniversity of Illinois at Urbana-Champaign Actuarial Science Program Department of Mathematicsurbuddy542Belum ada peringkat

- HW 8Dokumen2 halamanHW 8urbuddy542Belum ada peringkat

- HW 8Dokumen2 halamanHW 8urbuddy542Belum ada peringkat

- Old 1 AnsDokumen2 halamanOld 1 Ansurbuddy542Belum ada peringkat

- Old 6 AnsDokumen2 halamanOld 6 Ansurbuddy542Belum ada peringkat

- Old 5 AnsDokumen2 halamanOld 5 Ansurbuddy542Belum ada peringkat

- Old 2 AnsDokumen4 halamanOld 2 Ansurbuddy542Belum ada peringkat

- HW 1 AnsDokumen2 halamanHW 1 Ansurbuddy542Belum ada peringkat

- HW 2 AnsDokumen2 halamanHW 2 Ansurbuddy542Belum ada peringkat

- Modernism: Muyuan Zhang, Jamey Stolbom, Maisy PorterDokumen7 halamanModernism: Muyuan Zhang, Jamey Stolbom, Maisy Porterurbuddy542Belum ada peringkat

- HW 5 AnsDokumen2 halamanHW 5 Ansurbuddy542Belum ada peringkat

- Econ303 hw1 Spring13 PDFDokumen9 halamanEcon303 hw1 Spring13 PDFurbuddy542Belum ada peringkat

- Ps 8Dokumen1 halamanPs 8Yoni GefenBelum ada peringkat

- SDI - Diaphragm Analysis With Skewed WallsDokumen68 halamanSDI - Diaphragm Analysis With Skewed WallsswoinkerBelum ada peringkat

- Symmetrical Components & Faults CalculationsDokumen26 halamanSymmetrical Components & Faults CalculationsRTBelum ada peringkat

- FPGA Simon Game With VGA PDFDokumen46 halamanFPGA Simon Game With VGA PDFBryan ToapaxiBelum ada peringkat

- Grade 11 1st Quarter Module 4 Representing Real Life Situations Using Rational FunctionsDokumen5 halamanGrade 11 1st Quarter Module 4 Representing Real Life Situations Using Rational FunctionsGezelle Cunanan91% (11)

- Ieee Risk AssessmentDokumen9 halamanIeee Risk AssessmentEdgar ChecaBelum ada peringkat

- Seminar 5, 6,7,8Dokumen28 halamanSeminar 5, 6,7,8Євгеній БондаренкоBelum ada peringkat

- BCA2021Dokumen78 halamanBCA2021CBSE-Bhavana SureshBelum ada peringkat

- Ensemble Learning Algorithms With Python Mini CourseDokumen20 halamanEnsemble Learning Algorithms With Python Mini CourseJihene BenchohraBelum ada peringkat

- What Is SQL1Dokumen62 halamanWhat Is SQL1goldybatraBelum ada peringkat

- External FlowDokumen27 halamanExternal Flowraghu.entrepreneurBelum ada peringkat

- VenaDokumen328 halamanVenasujithaBelum ada peringkat

- General Mathematics DLP: Knowledge: Skills: AttitudesDokumen3 halamanGeneral Mathematics DLP: Knowledge: Skills: AttitudesVicencia Galbizo100% (1)

- Audit Sampling: Quiz 2Dokumen8 halamanAudit Sampling: Quiz 2weqweqwBelum ada peringkat

- Basic Technical Mathematics With Calculus Si Version Canadian 10th Edition Washington Solutions ManualDokumen39 halamanBasic Technical Mathematics With Calculus Si Version Canadian 10th Edition Washington Solutions Manualpatentlymoietypuhae100% (14)

- Design of Shear Walls Using ETABSDokumen97 halamanDesign of Shear Walls Using ETABSYeraldo Tejada Mendoza88% (8)

- Year 7 Angles and Shapes WorkbookDokumen37 halamanYear 7 Angles and Shapes Workbookapi-291565828Belum ada peringkat

- 1st National Elimination Metrobank-MTAP-DepEd Math Challenge Grade 6Dokumen8 halaman1st National Elimination Metrobank-MTAP-DepEd Math Challenge Grade 6Michael FactorBelum ada peringkat

- Selina Solutions For Class 9 Physics Chapter 2 Motion in One DimensionDokumen39 halamanSelina Solutions For Class 9 Physics Chapter 2 Motion in One DimensionABHISHEK THAKURBelum ada peringkat

- VTU ThermodynamicsDokumen2 halamanVTU ThermodynamicsVinay KorekarBelum ada peringkat

- Geometric Group Theory NotesDokumen58 halamanGeometric Group Theory NotesAllenBelum ada peringkat

- Math9 Module 9Dokumen21 halamanMath9 Module 9Diane Reign MianaguaBelum ada peringkat

- PDSP ArchitectureDokumen95 halamanPDSP ArchitecturekrajasekarantutiBelum ada peringkat

- LCA BI - Financial Report UsageDokumen13 halamanLCA BI - Financial Report UsageJackBelum ada peringkat

- What Is Exception: in Java, EventDokumen7 halamanWhat Is Exception: in Java, EventSHARATHBelum ada peringkat

- Lec2 AC Circuit Analysis S12Dokumen34 halamanLec2 AC Circuit Analysis S12Jenica Dela CruzBelum ada peringkat

- Gérard DebreuDokumen7 halamanGérard Debreuthomas555Belum ada peringkat

- Strategic Intervention Material - Speed and VelocityDokumen24 halamanStrategic Intervention Material - Speed and VelocityRhonnel Manatad Alburo98% (194)

- Dynamics And: Flexible Robot ControlsDokumen18 halamanDynamics And: Flexible Robot ControlsLarbi ElbakkaliBelum ada peringkat