Notes On Accounts: The Braithwaite Burn and Jessop Construction Co. LTD

Diunggah oleh

Chethan VenkateshJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Notes On Accounts: The Braithwaite Burn and Jessop Construction Co. LTD

Diunggah oleh

Chethan VenkateshHak Cipta:

Format Tersedia

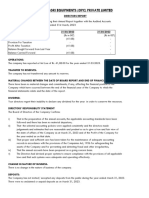

THE BRAITHWAITE BURN AND JESSOP CONSTRUCTION CO.

LTD

NOTES ON ACCOUNTS

Current Year Rs. Lakhs 1.(a) Capital Commitment:Estimated amount of contracts remaining to be executed. NIL (b) Contingent liability not provided for as under :Claims not acknowledged as debt:Disputed Sales Tax demand for which appeal is pending considered to be untenable Disputed Income Tax under appeal considered to be untenable .

Previous Year Rs.Lakhs

NIL

42.32

12.20

146.72

143.99

Impact of pay scale revision in salary w.e.f 1.09.1997 to 31.01.2002 for Executives. Impact of pay scale revision in salary to Unionised Staff & Sub-staff on settlement of Bipartite Agreement dt. 30.10.2000 w.e.f 01.09.1997.

214.12

191.13(approx)

146.23

137.72(approx)

(c ) Unexpired Bank Guarantees

2155.68

267.32

2(a) The physical verification of Inventories of Raw materials, stores etc.have been carried out at the end of the year and test verified by Internal Auditor. The discrepancies between physical and book stock, not being significant, have been properly dealt with in the Books of Accounts.

(b) Inventory of raw materials includes residual value of bearing slab and blooms amounting to Rs.16.86 lakh. (Previous Year Rs.16.86 lakh)

(c) Inventory of raw materials includes steel for major contracts calculated on theoretical weight.

3. Bank balance include the amount of Rs. 0.36 lakh (previous year Rs.0.50 lakh ) which is subject to Banks confirmation.

THE BRAITHWAITE BURN AND JESSOP CONSTRUCTION CO. LTD

4(a) Loans and Advances include the amount of Rs.0.50 lakh (Previous year Rs.0.50 lakh) as loss of cash by theft for which the FIR with the proper authorities has been lodged on 26-07-2001 and adequate provision has been made in accounts in 2001-2002 for such loss. (b) Administrative charges amounting to Rs.0.36 lakh (Previous year Rs.0.36 lakh) receivable from Bhagirathi Bridge Construction Co.Ltd. will be accounted for on cash basis and as such the unaccounted receivable aggregated to Rs.10.28 lakhs (Previous Year Rs.9.92 lakhs) (c) The realisation/adjustment on the balance lying with sub-contractor/supplier amounting to Rs.301.14 lakhs (previous year Rs.292.88 lakhs) are under continuous follow-up. (d) The realisation/adjustments of Sundry Debtors, majority of whom are Government Parties including Railways, are under continuous follow up.

5. The security Deposits (Schedule-11) with clients are refundable subject to completion/final settlement of the contracts.

6.The name of the small scale industrial undertakings (based on the information provided by suppliers) to whom the Company owes sums exceeding Rs.1 lakh outstanding for more than 30 days is Bengal Rivets & Bolts Co. 7(a). Consequent to the Companys financial restructuring (Govt. of India approval No.12 (4)/04-PE-iii dated 4-7-2005) and on allotment of (a) 13,88,000 equity shares of Rs.100/each for consideration other than cash on conversion of Govt. of India Loan, interest & penal interest and (b) 16,240 equity shares of Rs.100/-each, the entire amount has been shown as fully paid up equity shares pending completion of other formalities. 7(b) Pursuant to Govt of India approval no. 8(11)/2005-PEIII dated 02.11.2005 the amount of Rs 100 lakhs received as equity for meeting the plan expenditure for construction of fabrication shop at Heavy plant yard, on allotment, has been shown as fully paid up equity shares pending completion of other formalities. 8(a) 1,00,000 Zero Rate Debenture of Rs.1000 each issued (pending allotment) for the consideration other than cash. 8(b) Zero Rate Debentures include the amount of Rs.214.62 lakhs (Previous year Rs.214.62 lakhs) which are pending for allotment due to non-receipt of term governing the issue and relevant approval for waiver of stamp duty from Govt. of West Bengal through Burn Standard Co.Ltd.

THE BRAITHWAITE BURN AND JESSOP CONSTRUCTION CO. LTD

9. A first charge on Fixed assets and stocks & book debts of the Company are created by way of mortgage & hypothecation in favour of Canara Bank for fund based and non-fund based facility (Bank Guarantee) for a total limit of Rs 2690 lakhs against 25% margin by way of Fixed deposit.

10. Remuneration paid to the Directors The remuneration of Managing Director: Salary & Allowances Contribution to P.F etc. Others 11. Miscellaneous expenses include the value of Fixed Assets discarded to the tune of Rs.3.18 lakhs. 12. In view of the carried forwarded loss, unabsorbed depreciation etc. the deferred tax adjustments have not been recognised in the Accounts as measure of prudence in keeping with the Accounting Standard (AS-22) issued by the Institute of Chartered Accountants of India. 13. Previous years figures have been re-grouped/ re-arranged wherever necessary.

Rs Lakhs 5.36 0.47

0.21

Anda mungkin juga menyukai

- 56.vocal Warmup Log For Belt Your FaceDokumen5 halaman56.vocal Warmup Log For Belt Your FaceAlinutza AlinaBelum ada peringkat

- Radiesthesia and The Major ArcanaDokumen72 halamanRadiesthesia and The Major ArcanaStere Stere67% (3)

- TM1 PresentationDokumen33 halamanTM1 PresentationJas Sofia90% (10)

- MDB Specs PDFDokumen9 halamanMDB Specs PDFAbdElrahman AhmedBelum ada peringkat

- CAF 5 FAR2 Spring 2022Dokumen7 halamanCAF 5 FAR2 Spring 2022Ushna RajputBelum ada peringkat

- Atr Cars - SBH S FormatDokumen71 halamanAtr Cars - SBH S FormatPraneeth CheruvupalliBelum ada peringkat

- CAF 1 FAR1 Autumn 2023Dokumen6 halamanCAF 1 FAR1 Autumn 2023z8qcsqfj8dBelum ada peringkat

- Final Mock by TSB CFAP6 S2020Dokumen5 halamanFinal Mock by TSB CFAP6 S2020Umar FarooqBelum ada peringkat

- Caf-01 Far-I (Mah SS)Dokumen4 halamanCaf-01 Far-I (Mah SS)Abdullah SaberBelum ada peringkat

- CA Final DT Super 30 QuestionsDokumen65 halamanCA Final DT Super 30 Questionsambica mahabhashyamBelum ada peringkat

- MTP 3 14 Questions 1680520270Dokumen7 halamanMTP 3 14 Questions 1680520270Umar MalikBelum ada peringkat

- Term Test 2 (QP)Dokumen4 halamanTerm Test 2 (QP)Ali OptimisticBelum ada peringkat

- 73507bos59335 Inter p1qDokumen7 halaman73507bos59335 Inter p1qRaish QURESHIBelum ada peringkat

- CAF 1 FAR1 Spring 2023Dokumen6 halamanCAF 1 FAR1 Spring 2023haris khanBelum ada peringkat

- Notes 2008-09Dokumen17 halamanNotes 2008-09Avinash BagadeBelum ada peringkat

- Sanction Letter Pages For TLDokumen5 halamanSanction Letter Pages For TLgtyhBelum ada peringkat

- 71484bos57500 p5Dokumen30 halaman71484bos57500 p5KingBelum ada peringkat

- Test Paper-2 Master Question PGBPDokumen3 halamanTest Paper-2 Master Question PGBPyeidaindschemeBelum ada peringkat

- 629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNDokumen19 halaman629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNMukesh kannan MahiBelum ada peringkat

- Ca Final (Advanced Auditing & Professional Ethics) Mock Test - IDokumen18 halamanCa Final (Advanced Auditing & Professional Ethics) Mock Test - ISrinivas RevankarBelum ada peringkat

- HSTL Annual-Report 2021Dokumen72 halamanHSTL Annual-Report 2021ums 3vikramBelum ada peringkat

- Far-I Autumn 2021 TsaDokumen3 halamanFar-I Autumn 2021 TsaUsman AhmedBelum ada peringkat

- Rince Agri Equipments (Opc) Private Limited - Bs 2022-23Dokumen10 halamanRince Agri Equipments (Opc) Private Limited - Bs 2022-23Gyanendra jhaBelum ada peringkat

- Notes To Accounts Year EndDokumen15 halamanNotes To Accounts Year EndSantosh AntonyBelum ada peringkat

- 1 2 3 4 5 6 7 8 MergedDokumen78 halaman1 2 3 4 5 6 7 8 MergedKartik GuptaBelum ada peringkat

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDokumen7 halamanTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaBelum ada peringkat

- 007 - Chapter 04 - IAS 16 Property, Plant and EquipmentDokumen7 halaman007 - Chapter 04 - IAS 16 Property, Plant and EquipmentHaris ButtBelum ada peringkat

- CAF 2 TAX Spring 2022Dokumen6 halamanCAF 2 TAX Spring 2022Sumair IqbalBelum ada peringkat

- Audit Papers DecDokumen164 halamanAudit Papers DecKeshav SethiBelum ada peringkat

- Crescent All CAF Mocks With Solutions Compiled by Saboor AhmadDokumen123 halamanCrescent All CAF Mocks With Solutions Compiled by Saboor AhmadsheldonjabrazaBelum ada peringkat

- CAF1 ModelPaperDokumen7 halamanCAF1 ModelPaperahmedBelum ada peringkat

- Entity Name: Zodiac Power Chittagong Limited Financial Statement Date: 30 June 2021Dokumen12 halamanEntity Name: Zodiac Power Chittagong Limited Financial Statement Date: 30 June 2021Shohag RaihanBelum ada peringkat

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDokumen8 halamanIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalBelum ada peringkat

- Case Study 14 IbsDokumen9 halamanCase Study 14 Ibsnerises364Belum ada peringkat

- CAF 2 TAX Autumn 2022Dokumen6 halamanCAF 2 TAX Autumn 2022QasimBelum ada peringkat

- Mid Term QPDokumen8 halamanMid Term QPawaisawais95138Belum ada peringkat

- CFAP 6 AARS Winter 2020Dokumen4 halamanCFAP 6 AARS Winter 2020ABelum ada peringkat

- Financial Accounting and Reporting-IDokumen6 halamanFinancial Accounting and Reporting-IBrown KheerBelum ada peringkat

- Andhra Pradesh State Financial Corporation: Hyderabad Special Terms and Conditions of The Sanction (Term Loans) : M/s.Gemini Digital PressDokumen48 halamanAndhra Pradesh State Financial Corporation: Hyderabad Special Terms and Conditions of The Sanction (Term Loans) : M/s.Gemini Digital PressAnonymous EjJ7JFBelum ada peringkat

- Auditors Report of BSNL Resultcomplete - 06Dokumen25 halamanAuditors Report of BSNL Resultcomplete - 06g c agnihotriBelum ada peringkat

- CAF 1 FAR1 Autumn 2022Dokumen6 halamanCAF 1 FAR1 Autumn 2022QasimBelum ada peringkat

- CA Inter Adv Accounts Suggested Answer May 2022Dokumen30 halamanCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTBelum ada peringkat

- Indian Accounting Standard 101Dokumen19 halamanIndian Accounting Standard 101RITZ BROWNBelum ada peringkat

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDokumen8 halamanTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287Belum ada peringkat

- Far Sir Khalil Batch 1Dokumen7 halamanFar Sir Khalil Batch 1Asim MahmoodBelum ada peringkat

- Sanction Letter MitaBrickDokumen15 halamanSanction Letter MitaBricktarique2009Belum ada peringkat

- Mock 6 - CFAP 6 - June 23Dokumen5 halamanMock 6 - CFAP 6 - June 23Dawood ZahidBelum ada peringkat

- FINANCIAL ACCOUNTING & REPORTING - MA-2022 - QuestionDokumen5 halamanFINANCIAL ACCOUNTING & REPORTING - MA-2022 - QuestionRakib KhanBelum ada peringkat

- Ilovepdf MergedDokumen15 halamanIlovepdf MergedRakib KhanBelum ada peringkat

- CFAP-4-BFD-Summer-2021Dokumen6 halamanCFAP-4-BFD-Summer-2021muhammad osamaBelum ada peringkat

- CA Final Direct Tax Suggested Answer Nov 2020 OldDokumen25 halamanCA Final Direct Tax Suggested Answer Nov 2020 OldBhumeeka GargBelum ada peringkat

- FAR MA-2023 QuestionDokumen4 halamanFAR MA-2023 QuestionMd HasanBelum ada peringkat

- ARM - FAR 1 Mock For March 2024 With Solution - FinalDokumen26 halamanARM - FAR 1 Mock For March 2024 With Solution - FinalTooba MaqboolBelum ada peringkat

- Audit Paras 2021-22Dokumen16 halamanAudit Paras 2021-22ismailsiksaviBelum ada peringkat

- Otes To AccountsDokumen8 halamanOtes To Accountsnaveennx17Belum ada peringkat

- Fa May June 2011Dokumen3 halamanFa May June 2011xodic49847Belum ada peringkat

- CFAP 6 AARS Winter 2017Dokumen3 halamanCFAP 6 AARS Winter 2017shakilBelum ada peringkat

- Bank Audit Program 2024Dokumen12 halamanBank Audit Program 2024faganas398Belum ada peringkat

- Leading Cases of SCourtDokumen3 halamanLeading Cases of SCourtKashish JhambBelum ada peringkat

- Annual Report 2021-22 PDFDokumen179 halamanAnnual Report 2021-22 PDFMohnish KhianiBelum ada peringkat

- Problems On PPEDokumen8 halamanProblems On PPEDibyansu KumarBelum ada peringkat

- BCM 2104 - Intermediate Accounting I - October 2013Dokumen12 halamanBCM 2104 - Intermediate Accounting I - October 2013Behind SeriesBelum ada peringkat

- Aa RTP M24Dokumen32 halamanAa RTP M24luvkumar3532Belum ada peringkat

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisDari EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisBelum ada peringkat

- Project Report and AppraisalDokumen26 halamanProject Report and AppraisalChethan VenkateshBelum ada peringkat

- 06 MPBF PDFDokumen3 halaman06 MPBF PDFMayank JainBelum ada peringkat

- Professional Opportunities For CAsDokumen14 halamanProfessional Opportunities For CAsChethan VenkateshBelum ada peringkat

- Salient Features of GNDokumen10 halamanSalient Features of GNChethan VenkateshBelum ada peringkat

- Indicative Syllabus Discipline: Finance: 01. Financial AccountingDokumen1 halamanIndicative Syllabus Discipline: Finance: 01. Financial AccountingChethan VenkateshBelum ada peringkat

- 50 Common Interview Questions and Answers: 1. Tell Me About YourselfDokumen7 halaman50 Common Interview Questions and Answers: 1. Tell Me About YourselfChethan VenkateshBelum ada peringkat

- AOA FOrmat - Public Limited CompanyDokumen10 halamanAOA FOrmat - Public Limited CompanyChethan VenkateshBelum ada peringkat

- Issues in Tax AuditDokumen15 halamanIssues in Tax AuditChethan VenkateshBelum ada peringkat

- Form 29B - MAT Report Under Sec 115JDokumen4 halamanForm 29B - MAT Report Under Sec 115JChethan VenkateshBelum ada peringkat

- Letter of Representation FormatDokumen5 halamanLetter of Representation FormatChethan VenkateshBelum ada peringkat

- Service Tax AmendmentDokumen3 halamanService Tax AmendmentChethan VenkateshBelum ada peringkat

- Variance AnalysisDokumen13 halamanVariance AnalysisRatnesh Singh100% (1)

- Form 29B - MAT Report Under Sec 115JDokumen4 halamanForm 29B - MAT Report Under Sec 115JChethan VenkateshBelum ada peringkat

- 1 Accounting For Mutual FundDokumen1 halaman1 Accounting For Mutual FundChethan Venkatesh100% (1)

- Candidate Application Form - KPMGDokumen6 halamanCandidate Application Form - KPMGChethan VenkateshBelum ada peringkat

- Mutual Fund-1: Think Before You ActDokumen6 halamanMutual Fund-1: Think Before You ActChethan VenkateshBelum ada peringkat

- Pengaruh Pembangunan Center Point of IndDokumen11 halamanPengaruh Pembangunan Center Point of IndSumitro SafiuddinBelum ada peringkat

- CV Ilham AP 2022 CniDokumen1 halamanCV Ilham AP 2022 CniAzuan SyahrilBelum ada peringkat

- Pelatihan Olahan Pangan Ukm LamselDokumen6 halamanPelatihan Olahan Pangan Ukm LamselCalista manda WidyapalastriBelum ada peringkat

- Dryden, 1994Dokumen17 halamanDryden, 1994Merve KurunBelum ada peringkat

- DS Flow SwitchesDokumen51 halamanDS Flow SwitchesAnonymous Xnaj1g8Y3100% (1)

- Music Recognition, Music Listening, and Word.7Dokumen5 halamanMusic Recognition, Music Listening, and Word.7JIMENEZ PRADO NATALIA ANDREABelum ada peringkat

- Nepal Health Research CouncilDokumen15 halamanNepal Health Research Councilnabin hamalBelum ada peringkat

- Materials Management in Hospital Industry Nandi ProjectDokumen27 halamanMaterials Management in Hospital Industry Nandi Projectkumaraswamy226Belum ada peringkat

- Io (Jupiter Moon)Dokumen2 halamanIo (Jupiter Moon)FatimaBelum ada peringkat

- B028-Sayli Kapse B029-Surya Teja B030-Taranum Kaur B032-Yashesh Kothari B034-Sathish Kumar B035-ManeeshDokumen24 halamanB028-Sayli Kapse B029-Surya Teja B030-Taranum Kaur B032-Yashesh Kothari B034-Sathish Kumar B035-ManeeshTaranum RandhawaBelum ada peringkat

- Oral PresentationDokumen4 halamanOral PresentationYaddie32Belum ada peringkat

- API Filter Press - Test ProcedureDokumen8 halamanAPI Filter Press - Test ProcedureLONG LASTBelum ada peringkat

- GCU 0103 Computer PlatformsDokumen5 halamanGCU 0103 Computer PlatformsArani NavaratnarajahBelum ada peringkat

- Stas Final ReviewerDokumen8 halamanStas Final ReviewerShane SaynoBelum ada peringkat

- Itc AccDokumen24 halamanItc AccSuraj PatelBelum ada peringkat

- 15-Statutory Report Statutory Define Law (Legal Protection) Statutory MeetingDokumen2 halaman15-Statutory Report Statutory Define Law (Legal Protection) Statutory MeetingRaima DollBelum ada peringkat

- Child-Centered and Progressive EducationDokumen2 halamanChild-Centered and Progressive EducationDibyendu ChoudhuryBelum ada peringkat

- Ronnel Del RioDokumen5 halamanRonnel Del Rioamity balweg100% (2)

- Man Wah Ranked As Top 10 Furniture Sources For U.S. MarketDokumen2 halamanMan Wah Ranked As Top 10 Furniture Sources For U.S. MarketWeR1 Consultants Pte LtdBelum ada peringkat

- Public Health Interventions: Applications For Public Health Nursing PracticeDokumen249 halamanPublic Health Interventions: Applications For Public Health Nursing PracticeJemimah AdaclogBelum ada peringkat

- WWW - Devicemanuals.eu: GardenaDokumen6 halamanWWW - Devicemanuals.eu: GardenapotoculBelum ada peringkat

- Resume Rough DraftDokumen1 halamanResume Rough Draftapi-392972673Belum ada peringkat

- Cardiovascular Pharmacology: DR Muhamad Ali Sheikh Abdul Kader MD (Usm) MRCP (Uk) Cardiologist, Penang HospitalDokumen63 halamanCardiovascular Pharmacology: DR Muhamad Ali Sheikh Abdul Kader MD (Usm) MRCP (Uk) Cardiologist, Penang HospitalCvt RasulBelum ada peringkat

- Governance, Business Ethics, Risk Management and Internal ControlDokumen4 halamanGovernance, Business Ethics, Risk Management and Internal ControlJosua PagcaliwaganBelum ada peringkat

- TestDokumen233 halamanTestye rightBelum ada peringkat

- FRMUnit IDokumen17 halamanFRMUnit IAnonBelum ada peringkat