Summary Graham and Harvey

Diunggah oleh

Jingwen WangDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Summary Graham and Harvey

Diunggah oleh

Jingwen WangHak Cipta:

Format Tersedia

Article Summary: The theory and practice of corporate finance Introduction In this article, the authors conducted a comprehensive

survey that describes the current practice of corporate finance. They sampled about 4440 firms and got the responses from 392 chief financial officers. Methodology In their survey, the authors analyzed the responses conditional on the firm characteristics, which includes firm size, P/E ratio, leverage, credit rating, dividend policy, industry, management ownership, CEO age, CEO tenure and the education of CEO. According to their analyzed, they found these kinds of characteristics are variant, which can help them get a rich description of the practice and can conclude that the sample is representative. Content Summary By using these related characteristics, the authors study capital budgeting and had some findings: CAPM and NPV rule are widely used and the result suggest increased prominence of net present value as an evaluation technique. Also, the likelihood of using specific evaluation techniques is linked to firm size, firm leverage and CEO characteristics. For the small firms, they found that they prefer to use supplementary sensitivity and VaR analyses rather than use net present value. Next, the authors took this analysis further by detailing the specific methods

firms use to obtain the cost of capital and some other important risk factors. They found that large firms and public corporations are much more like to use the CAPM and risk-matched discount rate than are small firms. Also, the firms with high growth, foreign exposure are more likely to use the company-wide discount rate. So they conclude that the practice of corporate finance differs based on firm size could be an underlying cause of size-related asset pricing anomalies. According to analysis the capital structure, the authors also had some findings: some informal criteria such as financial flexibility and credit ratings are the most important debt policy factors. Also, the EPS dilution and recent stock price appreciation are the most important factors as well as the degree of stock undervaluation. They found some support for the pecking-order and trade-off capital structure hypotheses. Conclusion Large firms rely on present value techniques and capital asset pricing model, but small firms use the payback criterion. A surprising number of firms use firm risk rather than project risk in evaluating new investment. Firms are concerned about financial flexibility, credit ratings, earnings per share dilution and stock price.

Anda mungkin juga menyukai

- Lessons from Private Equity Any Company Can UseDari EverandLessons from Private Equity Any Company Can UsePenilaian: 4.5 dari 5 bintang4.5/5 (12)

- Investment Appraisal ThesisDokumen31 halamanInvestment Appraisal Thesisjanakadisa86% (7)

- Bank Statement FinalDokumen2 halamanBank Statement FinalShemeem SBelum ada peringkat

- 10 Principles of EconomicsDokumen4 halaman10 Principles of EconomicsA.Vignaeshwar50% (2)

- CF SummaryDokumen1 halamanCF SummaryVikram RatneBelum ada peringkat

- Literature Review On Capital Budgeting PDFDokumen7 halamanLiterature Review On Capital Budgeting PDFc5g10bt2100% (1)

- FM Asgnmnt CBDokumen13 halamanFM Asgnmnt CBAmardeepkaurchabbraBelum ada peringkat

- Title - Different Valuation Models On Jet Airways and SpicejetDokumen4 halamanTitle - Different Valuation Models On Jet Airways and SpicejetMohd MudassirBelum ada peringkat

- Case Study of Capital BudetingDokumen4 halamanCase Study of Capital BudetingMaunilShethBelum ada peringkat

- Capital StructureDokumen16 halamanCapital StructureankitakumBelum ada peringkat

- Article - How Do CFOs Make Capital Budgeting and Capital Structure DecisionsDokumen16 halamanArticle - How Do CFOs Make Capital Budgeting and Capital Structure DecisionsmssanBelum ada peringkat

- School of Management StudiesDokumen13 halamanSchool of Management StudiesRanjith KumarBelum ada peringkat

- Literature Review On Accounting SystemDokumen4 halamanLiterature Review On Accounting Systemafdtlfbfp100% (1)

- Graham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The FieldDokumen53 halamanGraham & Harvey 2001 The Theory and Practice of Corporate Finance Evidence From The Fielder4sall100% (1)

- Acc JACF How Do CFOs Make Capital Budgeting and Capital Structure Decisions?Dokumen18 halamanAcc JACF How Do CFOs Make Capital Budgeting and Capital Structure Decisions?Herleif HaavikBelum ada peringkat

- Estimating The Cost of CapitalDokumen2 halamanEstimating The Cost of CapitalTabassum TariqBelum ada peringkat

- Capital Budgeting Practices A Study of Companies Listed On The Colombo Stock Exchange Sri LankaDokumen9 halamanCapital Budgeting Practices A Study of Companies Listed On The Colombo Stock Exchange Sri LankamhldcnBelum ada peringkat

- Capital Budgeting Practices in PunjabDokumen20 halamanCapital Budgeting Practices in PunjabChandna MaryBelum ada peringkat

- Thesis Capital Structure and Firm PerformanceDokumen8 halamanThesis Capital Structure and Firm Performancelaurasmithkansascity100% (2)

- Capital Structure DecisionDokumen2 halamanCapital Structure DecisionsushantscalperBelum ada peringkat

- BRM ProjectDokumen23 halamanBRM ProjectimaalBelum ada peringkat

- Jurnal 3Dokumen22 halamanJurnal 3Evii Nur'dianaBelum ada peringkat

- Research Paper Dividend PolicyDokumen5 halamanResearch Paper Dividend Policyl1wot1j1fon3100% (3)

- 13MgmtLibrary USDokumen3 halaman13MgmtLibrary UShdfcblgoaBelum ada peringkat

- Research Paper On International Capital BudgetingDokumen4 halamanResearch Paper On International Capital Budgetingefeh4a7zBelum ada peringkat

- Business Valuation and Advanced Corporate Finance: Ketan Gujarathi, Roll No 208Dokumen1 halamanBusiness Valuation and Advanced Corporate Finance: Ketan Gujarathi, Roll No 208pj12pumbaBelum ada peringkat

- An Evaluation of Capital Structure and Profitability of Business OrganizationDokumen16 halamanAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- Review of Real Earnings Management Literature PDFDokumen6 halamanReview of Real Earnings Management Literature PDFafmzyodduapftb100% (1)

- Research Project On Financial LeverageDokumen42 halamanResearch Project On Financial LeverageMarryam Majeed63% (8)

- Finance Dissertation StructureDokumen5 halamanFinance Dissertation StructurePayToDoPaperNewHaven100% (1)

- BM1602 013Dokumen7 halamanBM1602 013Intel One-pieceBelum ada peringkat

- Capital BudgetingDokumen15 halamanCapital BudgetingKiki Sidharta TahaBelum ada peringkat

- Research Paper in Finance ManagementDokumen8 halamanResearch Paper in Finance Managementggsmsyqif100% (1)

- A Survey On Capital Structure Decision oDokumen10 halamanA Survey On Capital Structure Decision oAbhishek ModakBelum ada peringkat

- Thesis Business ValuationDokumen7 halamanThesis Business Valuationpamelawilliamserie100% (2)

- Capital Structure On Bank Performance Report.Dokumen25 halamanCapital Structure On Bank Performance Report.Aniba ButtBelum ada peringkat

- Thesis On Determinants of Capital StructureDokumen4 halamanThesis On Determinants of Capital Structuredwbeqxpb100% (2)

- Company Valuation ThesisDokumen4 halamanCompany Valuation Thesisangelaweberolathe100% (1)

- Capital Budgeting Techniques and Decision Making in PakistanDokumen11 halamanCapital Budgeting Techniques and Decision Making in Pakistanafridi65Belum ada peringkat

- Literature Review On Optimal Capital StructureDokumen6 halamanLiterature Review On Optimal Capital Structureafmzaoahmicfxg100% (2)

- Fundamental of ValuationDokumen39 halamanFundamental of Valuationkristeen1211Belum ada peringkat

- MAS 2 - Optimal Capital StructureDokumen5 halamanMAS 2 - Optimal Capital StructureNathallie CabalunaBelum ada peringkat

- Final Empirical AnalysisDokumen14 halamanFinal Empirical AnalysisOnyango StephenBelum ada peringkat

- Financial Analysis of Amararaja BatteriesDokumen4 halamanFinancial Analysis of Amararaja BatteriesdeegaurBelum ada peringkat

- Thesis On Equity ValuationDokumen6 halamanThesis On Equity Valuationmelanieericksonminneapolis100% (2)

- Literature Review On Ratio Analysis EssaysDokumen8 halamanLiterature Review On Ratio Analysis Essayseowcnerke100% (1)

- Chapter - 2 Review of LiteratureDokumen39 halamanChapter - 2 Review of LiteratureMannuBelum ada peringkat

- Project Report on Capital Budgeting @KesoramDokumen75 halamanProject Report on Capital Budgeting @KesoramRajesh BathulaBelum ada peringkat

- Capital Structure Analysis HeritageDokumen91 halamanCapital Structure Analysis HeritageKavitha LuckyBelum ada peringkat

- GROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsDokumen5 halamanGROUP 1 Article Review FM 8 The Relationship Between The Cash Flow and InvestmentsJUDIL BANASTAOBelum ada peringkat

- Rashmika - Capital Structure - UltratechDokumen10 halamanRashmika - Capital Structure - UltratechkhayyumBelum ada peringkat

- Ratio Analysis Thesis PDFDokumen8 halamanRatio Analysis Thesis PDFoeczepiig100% (2)

- 12 Chapter6 PDFDokumen42 halaman12 Chapter6 PDFMotiram paudelBelum ada peringkat

- Allocate Capital and Measure Performances in A Financial InstitutionDokumen20 halamanAllocate Capital and Measure Performances in A Financial InstitutionsamadbilgiBelum ada peringkat

- Accounting and Finance Dissertation QuestionsDokumen6 halamanAccounting and Finance Dissertation QuestionsSomeoneToWriteMyPaperUK100% (1)

- Review of LiteratureDokumen14 halamanReview of LiteratureMohanMahi100% (2)

- Analysis of Factors Affecting The Company's Debt Policy With Pecking Order Theory in Wholesale and Retail Companies in IndonesiaDokumen5 halamanAnalysis of Factors Affecting The Company's Debt Policy With Pecking Order Theory in Wholesale and Retail Companies in Indonesiareza gunawanBelum ada peringkat

- Research Paper On Ratio Analysis in IndiaDokumen6 halamanResearch Paper On Ratio Analysis in Indiafzqs7g1d100% (1)

- Valuation Matters The Complete Guide to Company Valuation TechniquesDari EverandValuation Matters The Complete Guide to Company Valuation TechniquesBelum ada peringkat

- Degree of Leverage: Empirical Analysis from the Insurance SectorDari EverandDegree of Leverage: Empirical Analysis from the Insurance SectorBelum ada peringkat

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationDari EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationBelum ada peringkat

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationDari EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationBelum ada peringkat

- Accounting Terminology GuideDokumen125 halamanAccounting Terminology GuideRam Cherry VMBelum ada peringkat

- Balance Sheet AnalysisDokumen6 halamanBalance Sheet AnalysisSatishBelum ada peringkat

- My Project of Vijaya BankDokumen103 halamanMy Project of Vijaya Banktamizharasid100% (1)

- The Mathematics of Finance Chapter 6 GuideDokumen55 halamanThe Mathematics of Finance Chapter 6 GuideGil John Awisen100% (1)

- JEONGDokumen4 halamanJEONGITBelum ada peringkat

- Activities On Module 1 - Partnership AccountingDokumen4 halamanActivities On Module 1 - Partnership AccountingANDI TE'A MARI SIMBALABelum ada peringkat

- Anzelika Cintana - Tugas Minggu Ke-9 - AM-S1 ManajemenDokumen9 halamanAnzelika Cintana - Tugas Minggu Ke-9 - AM-S1 ManajemenApes Together Strongs ATSBelum ada peringkat

- Better Tax Regime in 10sDokumen3 halamanBetter Tax Regime in 10sSaurabh PantBelum ada peringkat

- ACCT 6011 Assignment #2 Template W21Dokumen5 halamanACCT 6011 Assignment #2 Template W21patel avaniBelum ada peringkat

- 03005003622Dokumen24 halaman03005003622AJK Engineers-PVTBelum ada peringkat

- Class 12 CBSE Economics Sample Paper 2023Dokumen8 halamanClass 12 CBSE Economics Sample Paper 2023yazhinirekha4444Belum ada peringkat

- IGCSE Year 11 Mock Exam - Accounting Paper 2Dokumen15 halamanIGCSE Year 11 Mock Exam - Accounting Paper 2Voon Chen WeiBelum ada peringkat

- Xyz 123Dokumen36 halamanXyz 123David BriggsBelum ada peringkat

- NRB Monetary Policy 2020-21 Review Focuses on Loan Relief and Economic RecoveryDokumen3 halamanNRB Monetary Policy 2020-21 Review Focuses on Loan Relief and Economic Recoveryaswin adhikariBelum ada peringkat

- Credit Repair Made Easy Through Expert AdviceDokumen3 halamanCredit Repair Made Easy Through Expert AdviceCredit Repair Made Easy Through Expert AdviceBelum ada peringkat

- Canadian Mortgage CalculatorDokumen33 halamanCanadian Mortgage Calculatorvijay sainiBelum ada peringkat

- BANKDokumen25 halamanBANKAnand SharmaBelum ada peringkat

- FSA4&5-Analysis of AssetsDokumen110 halamanFSA4&5-Analysis of AssetsjasonprasetioBelum ada peringkat

- Report On MNGT 8Dokumen15 halamanReport On MNGT 8Rhea Mae CarantoBelum ada peringkat

- LeverageDokumen64 halamanLeveragePRECIOUSBelum ada peringkat

- General and Subsidiary Ledgers ExplainedDokumen57 halamanGeneral and Subsidiary Ledgers ExplainedSavage NicoBelum ada peringkat

- Practice Problems On Incidence of TaxDokumen3 halamanPractice Problems On Incidence of TaxPratik DesaiBelum ada peringkat

- MacroEconomics GDP ConceptsDokumen14 halamanMacroEconomics GDP Conceptssaif ur rehmanBelum ada peringkat

- Module 5 - Cost of Capital - QuestionsDokumen7 halamanModule 5 - Cost of Capital - QuestionsLAKSHYA AGARWALBelum ada peringkat

- EMBA1Dokumen7 halamanEMBA1lfz15855102061Belum ada peringkat

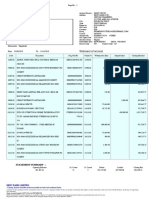

- Vihaan Direct Selling (India) Pvt. Ltd. - Account SummaryDokumen22 halamanVihaan Direct Selling (India) Pvt. Ltd. - Account SummaryBhavin ShahBelum ada peringkat

- Financial Calculators in ExcelDokumen7 halamanFinancial Calculators in ExcelbrijsingBelum ada peringkat

- Tobin's Portfolio Approach To Demand For MoneyDokumen15 halamanTobin's Portfolio Approach To Demand For MoneyKushagra Pratap SinghBelum ada peringkat