Disinheritance PDF

Diunggah oleh

Bill TaylorJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Disinheritance PDF

Diunggah oleh

Bill TaylorHak Cipta:

Format Tersedia

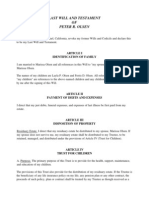

Disinheritance

Aaron J. Lyttle September 2013 B-1250.7

Disinheritance

Author: Aaron J. Lyttle, attorney with Long, Reimer, Winegar, Beppler, LLP Cheyenne, Wyoming University of Wyoming Extension Financial Literacy Issue Team: Cole Ehmke Mary Martin Bill Taylor

Issued in furtherance of extension work, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture. Glen Whipple, director, University of Wyoming Extension, University of Wyoming, Laramie, Wyoming 82071. The University of Wyoming is an affirmative action/equal opportunity employer and institution and does not discriminate on the basis of race, color, religion, sex, national origin, disability, age, veteran status, sexual orientation, or political belief in any aspect of employment or services. The institutions educational programs, activities, and services offered to students and/or employees are administered on a nondiscriminatory basis subject to the provisions of all civil rights laws and statutes. Evidence of practices that are not consistent with this policy should be reported to the Employment Practices Office at (307) 766-6721. Be aware that due to the dynamic nature of the World Wide Web, Internet sources may be difficult to find. Addresses change and pages can disappear over time.

he Wyoming Probate Code provides the default manner in which property will pass from a deceased person (also known as a decedent) to his or her surviving spouse and heirs. An heir is a person who may be entitled to receive the property of a person who dies without a will. A will is a document that describes the wishes of a deceased person with respect to the distribution of his or her estate and other arrangements, including funeral arrangements. A persons estate consists of all property, possessions, belongings, and obligations held in that persons name at the time of death. Wyoming law describes a person who dies without having executed a valid will as having died intestate. Wyoming law provides a default pattern of inheritance for the property of decedents who die intestate.1 After the estate has paid the decedents debts and funeral and estate-administration expenses, the decedents property typically passes to his or her surviving spouse or children, or his or her childrens descendents, depending on who is living at the time of the decedents death. If the decedent has a surviving spouse, but no surviving descendents, then the surviving spouse receives what remains of the decedents estate. If the decedent has a surviving spouse and surviving descendents, then the surviving spouse will receive half of the deceaseds estate and the surviving children (or their descendants) will receive the other half. If there are no surviving spouse or children, then other relatives may receive the deceaseds estate, including parents, siblings, nieces, nephews, grandparents, uncles, aunts, and so on.

Inheritance

the right to receive property under the testators will. The testator will usually include language acknowledging the disinheritance of unnamed or specied individuals. It is common practice to list the names of a testators spouse and children in order to clarify that the testator was aware of such persons existence when drafting the will. The will may also provide the reason for the heirs disinheritance. It is often a good idea to expressly acknowledge the disinheritance in some fashion to clarify that someone was not mistakenly omitted from the terms of the will. For example, a mother who is dissatised with the manner in which her son lives his life may expressly provide for distributions of her estate to her other children, but not to her son. In another example, a grandfather may provide that a granddaughter is not entitled to receive any of his estate because he has otherwise provided for her care during his life. One approach to disinheritance is for the testators will to provide for the distribution of a nominal sum to an heir, such as $1. Many clients mistakenly believe that this is necessary to disinherit an heir. You should carefully discuss with your attorney the advisability and possible drawbacks (such as increased notication duties) of leaving a nominal sum to an heir.

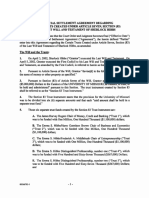

Disinheritance Through Trusts

Some people may elect to use a trust as the primary means of distributing their property after death. A trust is usually a legal agreement in which a person, known as the settlor, appoints a certain individual or individuals, known as trustees, to hold and distribute particular property for the benet of specied third parties known as beneciaries. It is increasingly common for individuals to use revocable trusts as will substitutes in order to avoid costly probate proceedings. Such a person will typically transfer the bulk of his or her property to the trust during life and execute what is known as a pour over will to transfer any property remaining in his or her name to the trust at death. Like wills, trusts can be used to disinherit heirs. In this situation, the settlor will simply not name specied individuals as beneciaries of the trust. The trust may also describe the reasons for not naming a specied individual as a beneciary.

Wills and the Right to Disinherit

If a decedent has executed a valid will, then property will generally pass according to the instructions provided in the will, subject to the decedents valid debts and nal expenses. A person who has executed a valid will is known as a testator. While a woman who executes a will has traditionally been referred to as a testatrix, some people view such language as archaic and use the term testator to refer to persons of either sex. A person who is entitled to receive property under a will is known as a distributee. Disinheritance generally refers to the practice of drafting a will in a manner that prevents another person from becoming an heir or distributee of an estate. A testator is generally free to draft the terms of a will in the manner of his or her choosing.2 This eectively allows decedents to draft their wills in a manner that disinherits possible heirs by depriving heirs of the share they would have received if the testator had died intestate. Typically, a testator disinherits an heir by intentionally excluding the person from

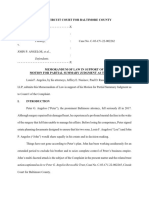

No Contest Clauses

Litigation can result from situations in which it is unclear which heirs or distributees are entitled to receive the decedents estate. There may be questions about the proper interpretation of a will or whether it is even valid in the rst place. Such challenges (called will contests) are sometimes brought by heirs or distributees who are unhappy

with their share of the estate, some specic aspect of the will, or the manner in which the personal representative or trustee has managed the estate. These contests can interfere with the decedents intended plan of distribution, delay nal settlement, strain family relations, and require the payment of costly court costs and attorneys fees from the estate. Some individuals place no contest clauses (also known as in terrorem clauses) in their wills and trusts to discourage will and trust contests. Such clauses seek to deter challenges by eectively disinheriting an heir, distributee, or beneciary who unsuccessfully challenges the deceaseds estate plan. No contest clauses are generally enforceable in Wyoming. However, the law varies in dierent states and you should consult an attorney regarding the eectiveness of specic will and trust clauses. While many form books will provide formulaic no contest clauses, it is important to consult with an attorney when drafting the clauses language to carry out the clients specic goals. What precise behavior should be enough to trigger disinheritance? Must the heir directly challenge the validity of the will in court? What if an heir conspires with another heir to indirectly challenge the wills terms? What about challenges to the bad faith conduct of a personal representative or trustee? Individuals desiring to use no contest clauses in their estate plans should carefully consider their overriding goals when reviewing their estate plans with their attorneys. One of the major issues with no contest clauses is whether a testator is giving an heir a sucient inheritance to deter a potential will or trust contest. Heirs who successfully contest a will or trust may receive a larger share of the estate than they would have originally received. An heir may be more willing to risk losing a small inheritance to create the possibility of receiving a larger share of the estate. There are alternative ways of avoiding costly will contests, including binding arbitration and eective communication with ones heirs. While nothing is guaranteed, it may be easier (not to mention cheaper) for family members to explain their estate plans to each other and address any resulting hurt feelings or family divisions while they are still alive.

deceased spouses estate. Practically all states have repealed such sex-based inheritance statutes. Wyoming law provides a surviving spouse of any sex to claim a right to receive an elective share of the deceased spouses probate estate.3 An elective share is a specied fraction of the deceased spouses property, normally onehalf or one-quarter of the estate, depending on whether or not the spouse has surviving children. There are time limits within which a spouse must claim his or her elective share. Furthermore, a spouse may waive his or her right to take an elective share before or after marriage, often through a prenuptial (also known as premarital) agreement. In late 2011, in the groundbreaking In re Estate of George case, the Wyoming Supreme Court ruled that property transferred to a deceased spouses trust is not included when determining a surviving spouses right to an elective share.4 Unless the Legislature amends the statute, this decision may allow Wyoming testators to use trusts to sidestep the elective share statute. However, Wyoming may be in the minority of jurisdictions on this question and the law is subject to change. Disinheritance through a trust can raise a variety of complex questions that may require the advice of a licensed attorney.

Do You Need an Attorney to Disinherit Someone?

While it is possible for a person to draft and execute a will or trust without legal assistance, these documents, including disinheritance provisions, can raise complex legal questions. It is, therefore, advisable to employ a licensed attorney to assist in drafting and executing wills, trusts, and other legal instruments. Wyo. Stat. Ann. 2-4-101 et seq. Wyo. Stat. Ann. 2-6-101. 3 Wyo. Stat. Ann. 2-5-101. 4 2011 WY 157.

1 2

This brochure is for information purposes only. It does not constitute legal advice. You should not act or rely on this brochure without seeking the advice of an attorney.

Limitation: The Surviving Spouses Elective Share

Like many jurisdictions, Wyoming places limits on a testators right to disinherit a surviving spouse. Traditionally, this took the form of dower and curtesy, which entitled a surviving wife or husband to a lifetime interest in the

Anda mungkin juga menyukai

- SuretyDokumen2 halamanSuretyNiño Rey LopezBelum ada peringkat

- Not Funding Your Revocable TrustDokumen3 halamanNot Funding Your Revocable TrustCA_KenBelum ada peringkat

- Banking Terms and DefinitionsDokumen36 halamanBanking Terms and DefinitionsARULSHANMUGAVEL S VBelum ada peringkat

- Introduction To TrustDokumen35 halamanIntroduction To TrustALI SHAMMOONBelum ada peringkat

- Practical Guidance at Lexis Practice Advisor: Personal Trusts Under New York LawDokumen21 halamanPractical Guidance at Lexis Practice Advisor: Personal Trusts Under New York LawPhilAeonBelum ada peringkat

- Feudalism Alias American CapitalismDokumen160 halamanFeudalism Alias American CapitalismElianMBelum ada peringkat

- EnforcingDokumen39 halamanEnforcingRoy BhardwajBelum ada peringkat

- CH - 5 Nonjudicial Settlement AgreementsDokumen25 halamanCH - 5 Nonjudicial Settlement Agreementsbuckybad2Belum ada peringkat

- Law of ContractDokumen58 halamanLaw of ContractSiva Fisher100% (2)

- Presentation ON: "Commercial Banking"Dokumen22 halamanPresentation ON: "Commercial Banking"dont_forgetme2004Belum ada peringkat

- Conflicts of Interest FlowchartDokumen1 halamanConflicts of Interest Flowchartvarshnis20% (1)

- Blank Az TrustDokumen10 halamanBlank Az TrustSam TurnerBelum ada peringkat

- With Trust Law.Dokumen76 halamanWith Trust Law.John ReedBelum ada peringkat

- Kinds of Legal DocumentsDokumen16 halamanKinds of Legal Documents✬ SHANZA MALIK ✬100% (1)

- O'Sullivan V Management Agency & Music LTDDokumen4 halamanO'Sullivan V Management Agency & Music LTDJoey WongBelum ada peringkat

- Stonebridge Trustee Notices Combined FileDokumen35 halamanStonebridge Trustee Notices Combined Filethe kingfishBelum ada peringkat

- 3 ProbateDokumen40 halaman3 ProbateTin TinBelum ada peringkat

- Trusts and PowerDokumen20 halamanTrusts and PowerChina WeiBelum ada peringkat

- Retainer Engagement 3Dokumen5 halamanRetainer Engagement 3Ma. Berna Joyce M. SilvanoBelum ada peringkat

- RESULTING AND CONSTRUCTIVEDokumen17 halamanRESULTING AND CONSTRUCTIVEMei AbigailBelum ada peringkat

- Nature of TrustsDokumen64 halamanNature of TrustsJainam11Belum ada peringkat

- Constitution of TrustDokumen3 halamanConstitution of TrustveercasanovaBelum ada peringkat

- The Declaration of Independence: A Play for Many ReadersDari EverandThe Declaration of Independence: A Play for Many ReadersBelum ada peringkat

- The 12 Equitable Maxims - Law Is CoolDokumen21 halamanThe 12 Equitable Maxims - Law Is CoolWarriorpoet100% (1)

- Letter of Wishes: Guiding Principles and IntentDokumen5 halamanLetter of Wishes: Guiding Principles and IntentEdangela Velasco100% (2)

- Trust Deed of Indian Institute of Public Policy (Iipp)Dokumen8 halamanTrust Deed of Indian Institute of Public Policy (Iipp)Ramana KumarBelum ada peringkat

- Massachusetts Last Will and Testament TemplateDokumen5 halamanMassachusetts Last Will and Testament TemplateRamana DaliparthyBelum ada peringkat

- Affidavit of Lost NoteDokumen2 halamanAffidavit of Lost NoteRocketLawyer100% (1)

- Spouses Ermino vs. Golden Village Homeowners Association, Inc. DigestDokumen4 halamanSpouses Ermino vs. Golden Village Homeowners Association, Inc. DigestEmir MendozaBelum ada peringkat

- Contract of BailmentDokumen5 halamanContract of BailmentSesa GillBelum ada peringkat

- Cash DonationDokumen3 halamanCash Donationion sniperBelum ada peringkat

- Last Will and TestamentDokumen3 halamanLast Will and TestamentDarkJV TVBelum ada peringkat

- State Street Trust Company, Executors v. United States, 263 F.2d 635, 1st Cir. (1959)Dokumen10 halamanState Street Trust Company, Executors v. United States, 263 F.2d 635, 1st Cir. (1959)Scribd Government DocsBelum ada peringkat

- Bond PowerDokumen2 halamanBond PowerLegal FormsBelum ada peringkat

- Will For Parents of Minor ChildrenDokumen10 halamanWill For Parents of Minor ChildrenRocketLawyerBelum ada peringkat

- Chairing A Difficult MeetingDokumen3 halamanChairing A Difficult MeetingBill TaylorBelum ada peringkat

- Standstill AgreementDokumen3 halamanStandstill AgreementLegal Forms100% (1)

- Differences Between Chapters 7, 11, 12, & 13Dokumen3 halamanDifferences Between Chapters 7, 11, 12, & 13prubiouk100% (1)

- Settlement Terms Between Mizzou, Hillsdale Over Conservative Donor's InstructionsDokumen74 halamanSettlement Terms Between Mizzou, Hillsdale Over Conservative Donor's InstructionsThe College FixBelum ada peringkat

- Orioles Trust MotionDokumen11 halamanOrioles Trust MotionTim SwiftBelum ada peringkat

- SHARPER IMAGE AssetPurchaseAgreementDokumen85 halamanSHARPER IMAGE AssetPurchaseAgreementEric MooreBelum ada peringkat

- National Insurance Company Limited v. Boghara Polyfab Private LimitedDokumen5 halamanNational Insurance Company Limited v. Boghara Polyfab Private LimitedSandeep Singh BhandariBelum ada peringkat

- Caltex Vs CBAA DigestDokumen3 halamanCaltex Vs CBAA DigestSaab Abelita100% (1)

- AsservationDokumen1 halamanAsservationcrazybuttfulBelum ada peringkat

- Oblicon Digests (Articles 1156-1192)Dokumen23 halamanOblicon Digests (Articles 1156-1192)annedefrancoBelum ada peringkat

- Jose - Reply To OppositionDokumen4 halamanJose - Reply To OppositionMecs NidBelum ada peringkat

- E TrustsDokumen10 halamanE TrustsEduardo AnerdezBelum ada peringkat

- Fernandez vs. Atty. NoveroDokumen2 halamanFernandez vs. Atty. NoveroRob100% (3)

- Florida's New Statutory Presumption of Undue Influence-Does It Change The Law or Merely Clarify? - The Florida Bar 2003Dokumen10 halamanFlorida's New Statutory Presumption of Undue Influence-Does It Change The Law or Merely Clarify? - The Florida Bar 2003ValSBelum ada peringkat

- Marty Elberg - Revocable Living Trust Lawyer in Fort LauderdaleDokumen1 halamanMarty Elberg - Revocable Living Trust Lawyer in Fort LauderdaleEstate Law LawyersBelum ada peringkat

- 12 31 21 Rule Set 4b Probate Court Forms 2021Dokumen49 halaman12 31 21 Rule Set 4b Probate Court Forms 2021TuggBelum ada peringkat

- Trust and Estate OutlineDokumen64 halamanTrust and Estate Outlineonly1mBelum ada peringkat

- Assignment of Partnership InterestDokumen5 halamanAssignment of Partnership InterestIrin200Belum ada peringkat

- FNMA Form 3269-44Dokumen2 halamanFNMA Form 3269-44rapiddocsBelum ada peringkat

- Sample of Will PDFDokumen11 halamanSample of Will PDFParkEdJop100% (1)

- TRUSTEE - Docx Transfer Ing Property Trust To KevinDokumen3 halamanTRUSTEE - Docx Transfer Ing Property Trust To KevinKevin Alspach100% (1)

- Henson TrustDokumen34 halamanHenson TrustCamberwell HouseBelum ada peringkat

- Family Trust Q A For Download PDFDokumen9 halamanFamily Trust Q A For Download PDFphil8984Belum ada peringkat

- A Land Trust Is An AgreementDokumen10 halamanA Land Trust Is An AgreementReal TrekstarBelum ada peringkat

- Trust ActDokumen21 halamanTrust Actks136Belum ada peringkat

- Getting Evicted: How Can I Prevent It, or What Do I Do Next?Dokumen15 halamanGetting Evicted: How Can I Prevent It, or What Do I Do Next?Anonymous GF8PPILW5Belum ada peringkat

- New Jersey Living WillDokumen4 halamanNew Jersey Living WillRocketLawyer100% (1)

- Charitable TrustDokumen2 halamanCharitable TrustvipingplBelum ada peringkat

- Master Lease AgreementDokumen16 halamanMaster Lease AgreementDavid Robin100% (1)

- Bailment Is A RelationDokumen2 halamanBailment Is A RelationVishnu PathakBelum ada peringkat

- Filings Against Trusts and Trustees Under Revised Article 9Dokumen7 halamanFilings Against Trusts and Trustees Under Revised Article 9ravenmailmeBelum ada peringkat

- Better BylawsDokumen58 halamanBetter BylawsBill TaylorBelum ada peringkat

- Board EvaluationDokumen41 halamanBoard EvaluationBill Taylor100% (1)

- After A Death: What Steps Are Needed?Dokumen12 halamanAfter A Death: What Steps Are Needed?Bill TaylorBelum ada peringkat

- Further Vision For The Black HillsDokumen3 halamanFurther Vision For The Black HillsBill TaylorBelum ada peringkat

- Advance Health Care DirectivesDokumen12 halamanAdvance Health Care DirectivesBill TaylorBelum ada peringkat

- Estate Planning ChecklistDokumen8 halamanEstate Planning ChecklistBill TaylorBelum ada peringkat

- Personal Property MemorandumDokumen6 halamanPersonal Property MemorandumBill TaylorBelum ada peringkat

- Introduction To Wyoming Estate PlanningDokumen8 halamanIntroduction To Wyoming Estate PlanningBill TaylorBelum ada peringkat

- Wyoming WillsDokumen11 halamanWyoming WillsBill TaylorBelum ada peringkat

- A Walk Through Wyoming ProbateDokumen12 halamanA Walk Through Wyoming ProbateBill TaylorBelum ada peringkat

- Durable Power of AttorneyDokumen7 halamanDurable Power of AttorneyBill TaylorBelum ada peringkat

- Death CertificatesDokumen4 halamanDeath CertificatesBill TaylorBelum ada peringkat

- Guardianships and ConservatorshipsDokumen7 halamanGuardianships and ConservatorshipsBill TaylorBelum ada peringkat

- Copreneurs: Mixing Business and LoveDokumen3 halamanCopreneurs: Mixing Business and LoveBill TaylorBelum ada peringkat

- Management Succession: Where Are We?Dokumen3 halamanManagement Succession: Where Are We?Bill TaylorBelum ada peringkat

- Kasl Weston County Extension Report Bill Taylor 5/7/13 Plant CombinationsDokumen3 halamanKasl Weston County Extension Report Bill Taylor 5/7/13 Plant CombinationsBill TaylorBelum ada peringkat

- Choosing A Personal RepresentativeDokumen4 halamanChoosing A Personal RepresentativeBill TaylorBelum ada peringkat

- Guardians and ConservatorsDokumen4 halamanGuardians and ConservatorsBill TaylorBelum ada peringkat

- Is Your Family Owned Business Ready For The Next Generation?Dokumen2 halamanIs Your Family Owned Business Ready For The Next Generation?Bill TaylorBelum ada peringkat

- Creating An Ethical Culture in Your Small BusinessDokumen3 halamanCreating An Ethical Culture in Your Small BusinessBill TaylorBelum ada peringkat

- Spring Lawn CareDokumen3 halamanSpring Lawn CareBill TaylorBelum ada peringkat

- Who Gets My Personal Stuff (Part 2)Dokumen4 halamanWho Gets My Personal Stuff (Part 2)Bill TaylorBelum ada peringkat

- Responsibilities of A GuardianDokumen4 halamanResponsibilities of A GuardianBill TaylorBelum ada peringkat

- Is A Will Enough?Dokumen4 halamanIs A Will Enough?Bill TaylorBelum ada peringkat

- Why Prepare A Will?Dokumen3 halamanWhy Prepare A Will?Bill TaylorBelum ada peringkat

- Requirements For A Wyoming WillDokumen4 halamanRequirements For A Wyoming WillBill TaylorBelum ada peringkat

- Who Gets My Personal Stuff? (Part 1)Dokumen6 halamanWho Gets My Personal Stuff? (Part 1)Bill TaylorBelum ada peringkat

- Inventory and Assigment of Personal PropertyDokumen4 halamanInventory and Assigment of Personal PropertyBill TaylorBelum ada peringkat

- En Banc Decision Analyzes Conditional Obligations in Contract of SaleDokumen8 halamanEn Banc Decision Analyzes Conditional Obligations in Contract of SaleNiel DabuetBelum ada peringkat

- Amicable Resolution of Civil Litigation in Malaysia by Abu Haniffa Mohamed AbdullahDokumen10 halamanAmicable Resolution of Civil Litigation in Malaysia by Abu Haniffa Mohamed AbdullahgivamathanBelum ada peringkat

- A FFIDAVITDokumen18 halamanA FFIDAVITMaria Beatriz AzarconBelum ada peringkat

- El Chapo (Joaquin Guzman) Letter To Judge Cogan - Exhibit 1a Full Letter Version Spanish and EnglishDokumen6 halamanEl Chapo (Joaquin Guzman) Letter To Judge Cogan - Exhibit 1a Full Letter Version Spanish and EnglishChivis MartinezBelum ada peringkat

- Traders Royal Bank vs. NLRCDokumen2 halamanTraders Royal Bank vs. NLRCRem SerranoBelum ada peringkat

- Omalin v. Gonzales, 4th Cir. (2005)Dokumen3 halamanOmalin v. Gonzales, 4th Cir. (2005)Scribd Government DocsBelum ada peringkat

- Tesla CaseDokumen8 halamanTesla CaseKate TaylorBelum ada peringkat

- Aguiar v. Webb Et Al - Document No. 108Dokumen8 halamanAguiar v. Webb Et Al - Document No. 108Justia.comBelum ada peringkat

- Motion For Stay Exh BDokumen306 halamanMotion For Stay Exh BAndi MoronyBelum ada peringkat

- Allan Seckel's Letter To Mary Ellen Turpel-LafondDokumen2 halamanAllan Seckel's Letter To Mary Ellen Turpel-LafondSean HolmanBelum ada peringkat

- WithdrawalDokumen4 halamanWithdrawalKavitha VasuBelum ada peringkat

- Baltimore Afro-American Newspaper, July 31, 2010Dokumen20 halamanBaltimore Afro-American Newspaper, July 31, 2010The AFRO-American NewspapersBelum ada peringkat

- Unpublish Disposition Johnny Wayne Laforce v. R. M. Muncy, Warden Attorney General of Virginia, 823 F.2d 547, 4th Cir. (1987)Dokumen2 halamanUnpublish Disposition Johnny Wayne Laforce v. R. M. Muncy, Warden Attorney General of Virginia, 823 F.2d 547, 4th Cir. (1987)Scribd Government DocsBelum ada peringkat

- Petition For Leave To Resume Practice of Law, Benjamin Dacanay Petition For Leave To Resume Practice of Law, Benjamin DacanayDokumen2 halamanPetition For Leave To Resume Practice of Law, Benjamin Dacanay Petition For Leave To Resume Practice of Law, Benjamin DacanayANDREA JOSES TANBelum ada peringkat

- Bucks County League of Women Voters Guide: Primary Election 2015Dokumen101 halamanBucks County League of Women Voters Guide: Primary Election 2015BucksLocalNews.comBelum ada peringkat

- State Reporting Bureau: Transcript of ProceedingsDokumen11 halamanState Reporting Bureau: Transcript of Proceedingsapi-152749678Belum ada peringkat

- Perri Reid v. Viacom Order On MSJDokumen51 halamanPerri Reid v. Viacom Order On MSJEric MooreBelum ada peringkat

- United States v. Tom Crutchfield, Penny Crutchfield, 26 F.3d 1098, 11th Cir. (1994)Dokumen10 halamanUnited States v. Tom Crutchfield, Penny Crutchfield, 26 F.3d 1098, 11th Cir. (1994)Scribd Government DocsBelum ada peringkat

- United States Court of Appeals, Third Circuit, 952 F.2d 742, 3rd Cir. (1991)Dokumen22 halamanUnited States Court of Appeals, Third Circuit, 952 F.2d 742, 3rd Cir. (1991)Scribd Government DocsBelum ada peringkat

- The Egg TheoryDokumen5 halamanThe Egg TheoryKevin Omar SidhartaBelum ada peringkat

- IBASCO v. CADokumen18 halamanIBASCO v. CADanielle AngelaBelum ada peringkat

- William Reber, L.L.C. v. Helio L.L.C. - Document No. 13Dokumen5 halamanWilliam Reber, L.L.C. v. Helio L.L.C. - Document No. 13Justia.comBelum ada peringkat

- Superior Court of The State of California For The County of OrangeDokumen5 halamanSuperior Court of The State of California For The County of OrangebrancronBelum ada peringkat