Revenue Regulations No. 2-2003

Diunggah oleh

Lyceum Lawlibrary0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

190 tayangan0 halamanBureau of Internal Revenue, Taxation,

Revenue Regulations no. 2-2003

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniBureau of Internal Revenue, Taxation,

Revenue Regulations no. 2-2003

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

190 tayangan0 halamanRevenue Regulations No. 2-2003

Diunggah oleh

Lyceum LawlibraryBureau of Internal Revenue, Taxation,

Revenue Regulations no. 2-2003

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 0

REVENUE REGULATIONS NO.

2-2003 issued on January 17, 2003 consolidates all

Revenue Regulations issued on Estate Tax and Donors Tax, incorporating the

amendments introduced by the Tax Reform Act of 1997.

Estate taxation is governed by the statute in force at the time of death of the

decedent. The Estate Tax accrues as of the death of the decedent and the accrual of the

tax is distinct from the obligation to pay the same. Upon the death of the decedent,

succession takes place and the right of the State to tax the privilege to transmit the estate

vests instantly upon death.

The application of the rates prescribed in the Regulations and the procedures in

determining the Estate Tax due shall apply to Estate Taxes falling due or have accrued

beginning January 1, 1998.

The gross estate of a decedent shall be comprised of the following properties and

the interest therein at the time of his death, including revocable transfers and transfers for

insufficient consideration, etc: 1) for residents and citizens all properties, real and

personal, tangible or intangible, wherever situated; and 2) for non-resident aliens only

properties situated in the Philippines provided, that, with respect to intangible personal

property, its inclusion in the gross estate is subject to the rule of reciprocity provided for

under Sec. 104 of the Tax Code.

The properties comprising the gross estate shall be valued based on their fair

market value as of the time of the death. If the property is a real property, the fair market

value shall be the fair market value as determined by the Commissioner or the fair market

value as shown in the schedule of values fixed by the provincial and city assessors,

whichever is higher.

In the case of shares of stocks, the fair market value shall depend on whether the

shares are listed or unlisted in the stock exchanges. Unlisted common shares are valued

based on their book value while unlisted preferred shares are valued at par value. In

determining the book value of common shares, appraisal surplus shall not be considered

as well as the value assigned to preferred shares, if there are any.

For shares, which are listed in the stock exchanges, the fair market value shall be

the arithmetic mean between the highest and lowest quotation at a date nearest the date of

death, if none is available on the date of death itself.

To determine the value of the right to usufruct, use or habitation, as well as that of

annuity, there shall be taken into account the probable life of the beneficiary in

accordance with the latest basic standard mortality table, to be approved by the Secretary

of Finance, upon recommendation of the Insurance Commissioner.

Items of deduction in the computation of the net estate of a decedent, who is

either a citizen or resident of the Philippines and a non-resident alien of the Philippines,

are specified in the Regulations.

The Estate Tax return shall be filed within six (6) months from the decedents

death. The Court approving the project of partition shall furnish the Commissioner with a

certified copy thereof and its order within thirty (30) days after promulgation of such

order. The Commissioner or any Revenue Officer authorized by him shall have the

authority to grant, in meritorious cases, a reasonable extension, not exceeding thirty (30)

days, for filing the return.

When the Commissioner finds that the payment of the Estate tax or of any part

thereof would impose undue hardship upon the estate or any of the heirs, he may extend

the time for payment of such tax or any part thereof not to exceed five (5) years in case

the estate is settled through the courts, or two (2) years in case the estate is settled

extrajudicially.

If an extension is granted, the Commissioner or his duly authorized representative

may require the executor, or administrator, or beneficiary to furnish a bond in such

amount, not exceeding double the amount of the tax and with such sureties as the

Commissioner deems necessary, conditioned upon the payment of the said tax in

accordance with the terms of the extension. Any amount paid after the statutory due date

of the tax, but within the extension period, shall be subject to interest but not to

surcharge.

In case the available cash of the estate is not sufficient to pay its total Estate Tax

liability, the estate may be allowed to pay the tax by installment and a clearance shall be

released only with respect to the property the corresponding/computed tax on which has

been paid. The computation of the Estate Tax, however, shall always be on the

cumulative amount of the net taxable estate.

The Estate Tax imposed shall be paid by the executor or administrator before the

delivery of the distributive share in the inheritance to any heir or beneficiary. Where there

are two or more executors or administrators, all of them are severally liable for the

payment of the tax. The estate clearance issued by the Commissioner or the Revenue

District Officer having jurisdiction over the estate will serve as the authority to distribute

the remaining/distributable properties/share in the inheritance to the heir or beneficiary.

The executor or administrator of an estate has the primary obligation to pay the

Estate Tax but the heir or beneficiary has subsidiary liability for the payment of that

portion of the estate, which his distributive share bears to the value of the total net estate.

The extent of his liability, however, shall in no case exceed the value of his share in the

inheritance.

For donors tax purposes, donations made before January 1, 1998 shall be subject

to Donors Tax computed on the basis of the old rates imposed under the Tax Code of

1977, while donations made on or after January 1, 1998 shall be subject to the Donors

Tax computed in accordance with the amended schedule of rates prescribed under the

Tax Code of 1997. The computation of the Donors Tax is on a cumulative basis over a

period of one calendar year.

The Donors Tax return shall be filed within thirty (30) days after the date the gift

is made or completed and the tax due thereon shall be paid at the same time that the

return is filed.

In order to be exempt from Donors Tax and to claim full deduction of the

donation given to qualified-donee institutions duly accredited by the Philippine Council

for NGO Certification, Inc., the donor engaged in business shall give a notice of donation

on every donation worth at least Fifty Thousand Pesos (P 50,000) to the RDO which has

jurisdiction over his place of business within thirty (30) days after receipt of the qualified

donee institutions duly issued Certificate of Donation.

Anda mungkin juga menyukai

- Rodriguez Vs PeopleDokumen2 halamanRodriguez Vs PeopleT Cel MrmgBelum ada peringkat

- 17 Com. of Customs v. CTA & Campos Rueda Co.Dokumen1 halaman17 Com. of Customs v. CTA & Campos Rueda Co.Gain DeeBelum ada peringkat

- Bisaya Land Transportation Co., Vs CIRDokumen2 halamanBisaya Land Transportation Co., Vs CIRKeshaBelum ada peringkat

- COA Vs HinampasDokumen2 halamanCOA Vs HinampasBryan-Charmaine ZamboBelum ada peringkat

- Noveras vs. NoverasDokumen18 halamanNoveras vs. NoverasVKBelum ada peringkat

- Suplico Vs NEDADokumen1 halamanSuplico Vs NEDAChe Poblete CardenasBelum ada peringkat

- 12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFDokumen8 halaman12 - Ericsson Telecommunications, Inc. v. City of Pasig GR No 176667 PDFEmelie Marie DiezBelum ada peringkat

- 161-Republic v. Gancayco, June 30, 1964Dokumen4 halaman161-Republic v. Gancayco, June 30, 1964Jopan SJBelum ada peringkat

- Digested CasesDokumen36 halamanDigested CasesJepoy Nisperos ReyesBelum ada peringkat

- Escheats - Guardianship - AdoptionDokumen9 halamanEscheats - Guardianship - AdoptionIrish AnnBelum ada peringkat

- COA v. HinampasDokumen4 halamanCOA v. HinampasStradivariumBelum ada peringkat

- Anie - Tax ReviewDokumen28 halamanAnie - Tax ReviewAnie Guiling-Hadji GaffarBelum ada peringkat

- Heirs of Pedro Escanlar vs. Court of AppealsDokumen19 halamanHeirs of Pedro Escanlar vs. Court of AppealsRheacel LojoBelum ada peringkat

- VAT Refund CaseDokumen1 halamanVAT Refund Casekaira marie carlosBelum ada peringkat

- People Vs DucosinDokumen8 halamanPeople Vs Ducosinautumn moonBelum ada peringkat

- Morales vs Court of Appeals: Implied Trust CaseDokumen7 halamanMorales vs Court of Appeals: Implied Trust CaseDomie AbataBelum ada peringkat

- FBDC vs. CIR Ruling on Transitional Input Tax CreditDokumen2 halamanFBDC vs. CIR Ruling on Transitional Input Tax CreditNikki Diane CadizBelum ada peringkat

- No law impairing contractsDokumen9 halamanNo law impairing contractsKleyr De Casa AlbeteBelum ada peringkat

- 24 Camp John Hay Development Corp. v. CBAA, 706 SCRA 547Dokumen2 halaman24 Camp John Hay Development Corp. v. CBAA, 706 SCRA 547Raymond MedinaBelum ada peringkat

- Annulment, Divorce and Legal Separation in The PhilsDokumen5 halamanAnnulment, Divorce and Legal Separation in The PhilsJocelyn HerreraBelum ada peringkat

- CIR Vs CIR and CASTANEDA G.R. No. 96016, October 17, 1991Dokumen2 halamanCIR Vs CIR and CASTANEDA G.R. No. 96016, October 17, 1991Gwen Alistaer CanaleBelum ada peringkat

- Spouses Buado Vs Court of Appeals - DigestDokumen2 halamanSpouses Buado Vs Court of Appeals - DigestJohn Leo SolinapBelum ada peringkat

- Facts:: Anpc (Vs BirDokumen2 halamanFacts:: Anpc (Vs BirDNAABelum ada peringkat

- Position Paper Guide: Introduction and General GuidelinesDokumen5 halamanPosition Paper Guide: Introduction and General GuidelinesAllexa De GuzmanBelum ada peringkat

- Admin Digest 2Dokumen10 halamanAdmin Digest 2rheyneBelum ada peringkat

- CIR vs. Metro Star SuperamaDokumen15 halamanCIR vs. Metro Star SuperamaKwini RojanoBelum ada peringkat

- G.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Dokumen2 halamanG.R. L-15290 - May 31, 1963: Cases Nos. L-15290 and L-15280Aila AmpBelum ada peringkat

- Commissioner of Internal Revenue vs. Seagate Technology (Philippines)Dokumen33 halamanCommissioner of Internal Revenue vs. Seagate Technology (Philippines)Giuliana FloresBelum ada peringkat

- Income Taxation Case Digests Donalvo 2016 v02 COMPLETEDokumen24 halamanIncome Taxation Case Digests Donalvo 2016 v02 COMPLETESanchez RomanBelum ada peringkat

- TCLC Vs VillanuevaDokumen1 halamanTCLC Vs VillanuevaJeffrey Ahmed SampulnaBelum ada peringkat

- CIR vs. Magsaysay LinesDokumen1 halamanCIR vs. Magsaysay Lineskaira marie carlosBelum ada peringkat

- 2a Tolentino v. MendozaDokumen3 halaman2a Tolentino v. MendozaRioBelum ada peringkat

- Fugitive from JusticeDokumen4 halamanFugitive from JusticeCarina Amor ClaveriaBelum ada peringkat

- Manila Prince Hotel v. GSISDokumen1 halamanManila Prince Hotel v. GSISrebeccajordan5Belum ada peringkat

- Sy Chim and Felicidad Chan Sy V Sy Siy Ho & Sons, IncDokumen7 halamanSy Chim and Felicidad Chan Sy V Sy Siy Ho & Sons, IncJohn YeungBelum ada peringkat

- First E-Bank Tower Condominium Corp v. BIRDokumen35 halamanFirst E-Bank Tower Condominium Corp v. BIRAdi SalvadorBelum ada peringkat

- Fort Bonifacio Development Corporation vs. Commissioner of Internal Revenue - Transitional Input Value Added TaxDokumen1 halamanFort Bonifacio Development Corporation vs. Commissioner of Internal Revenue - Transitional Input Value Added TaxFrances Grace ParconBelum ada peringkat

- Admin Law Cantillo V ArrietaDokumen1 halamanAdmin Law Cantillo V ArrietaKlaire EsdenBelum ada peringkat

- (Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFDokumen6 halaman(Commissioner of Internal Revenue vs. Pineda, 21 SCRA 105 (1967) ) PDFJillian BatacBelum ada peringkat

- De Belen v. Collector of CustomsDokumen2 halamanDe Belen v. Collector of CustomsJNMGBelum ada peringkat

- Deutsche Bank V CIR DigestDokumen2 halamanDeutsche Bank V CIR DigestJImlan Sahipa IsmaelBelum ada peringkat

- Regulations for online ATP system and printing requirementsDokumen5 halamanRegulations for online ATP system and printing requirementsJA LogsBelum ada peringkat

- People Vs DiazDokumen7 halamanPeople Vs DiazMRBelum ada peringkat

- Aurbach V Sanitary WaresDokumen1 halamanAurbach V Sanitary WaresAices SalvadorBelum ada peringkat

- Sison Vs AnchetaDokumen4 halamanSison Vs AnchetaMaica Elaine BacurioBelum ada peringkat

- Philippine Commercial and Industrial Bank vs. Escolin, G.R. Nos. L-27860 and L-27896Dokumen2 halamanPhilippine Commercial and Industrial Bank vs. Escolin, G.R. Nos. L-27860 and L-27896Reynald CruzBelum ada peringkat

- 21 - Coca Cola Bottlers vs. CIRDokumen24 halaman21 - Coca Cola Bottlers vs. CIRJeanne CalalinBelum ada peringkat

- CIR Decision on Timely Filing of Appeal Deemed as Constructive Denial of ProtestDokumen2 halamanCIR Decision on Timely Filing of Appeal Deemed as Constructive Denial of ProtestMatt YagaBelum ada peringkat

- Pacificador V COMELECDokumen1 halamanPacificador V COMELECDan CarnaceteBelum ada peringkat

- Ancog Vs Tan - Case DigestDokumen1 halamanAncog Vs Tan - Case DigestOnilyn MolinoBelum ada peringkat

- Marcos II v. C.A. Et. Al. 273 SCRA 47Dokumen19 halamanMarcos II v. C.A. Et. Al. 273 SCRA 47rgomez_940509Belum ada peringkat

- C.E. Medina & Associates For Phil. National Bank. Jose W. Diokno and Sergio L. Guadiz For Other Petitioners. Ilagan & Bolcan For Private RespondentDokumen9 halamanC.E. Medina & Associates For Phil. National Bank. Jose W. Diokno and Sergio L. Guadiz For Other Petitioners. Ilagan & Bolcan For Private RespondentvalkyriorBelum ada peringkat

- Spouses Lambino Versus HonDokumen1 halamanSpouses Lambino Versus HonJessaMangadlaoBelum ada peringkat

- Jose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Dokumen2 halamanJose B. Aznar v. Court of Tax Appeals, G.R No. L - 20569Iris Mikaela P. RamosBelum ada peringkat

- PUBLIC CORPORATION POLICE POWERS UNDER REVIEWDokumen8 halamanPUBLIC CORPORATION POLICE POWERS UNDER REVIEWMark MagnoBelum ada peringkat

- Judicial Jurisdiction and Forum Non ConviniensDokumen3 halamanJudicial Jurisdiction and Forum Non ConviniensDave OcampoBelum ada peringkat

- Ac No. 10438Dokumen2 halamanAc No. 10438Xiena Marie Ysit, J.DBelum ada peringkat

- Digest RR 12-2018Dokumen5 halamanDigest RR 12-2018Jesi CarlosBelum ada peringkat

- Estate Tax RatesDokumen5 halamanEstate Tax RatesJohn Carlos WeeBelum ada peringkat

- Documentary Requirements: Estate TaxDokumen19 halamanDocumentary Requirements: Estate TaxAubrey CaballeroBelum ada peringkat

- M - Brillante vs. CA & PeopleDokumen14 halamanM - Brillante vs. CA & PeopleLyceum LawlibraryBelum ada peringkat

- M - Fermin vs. PeopleDokumen12 halamanM - Fermin vs. PeopleLyceum LawlibraryBelum ada peringkat

- M - Alcantara vs. PonceDokumen4 halamanM - Alcantara vs. PonceLyceum LawlibraryBelum ada peringkat

- CA ruling on land dispute overturnedDokumen9 halamanCA ruling on land dispute overturnedLyceum LawlibraryBelum ada peringkat

- Court Upholds Partition of Property Among Siblings Despite Claims of OwnershipDokumen13 halamanCourt Upholds Partition of Property Among Siblings Despite Claims of OwnershipVictor VarelaBelum ada peringkat

- K - People vs. CayananDokumen2 halamanK - People vs. CayananLyceum LawlibraryBelum ada peringkat

- N - Tabao vs. PeopleDokumen11 halamanN - Tabao vs. PeopleLyceum LawlibraryBelum ada peringkat

- Cabling Vs Joselin Tan LumapasDokumen5 halamanCabling Vs Joselin Tan LumapasLyceum LawlibraryBelum ada peringkat

- UN - Principles and Guidelines For The Protection of The Heritage of Indigenous PeopleDokumen7 halamanUN - Principles and Guidelines For The Protection of The Heritage of Indigenous PeopleLyceum LawlibraryBelum ada peringkat

- Department of Education Vs Mariano TuliaoDokumen6 halamanDepartment of Education Vs Mariano TuliaoLyceum LawlibraryBelum ada peringkat

- Sps Sombilon Vs GarayDokumen10 halamanSps Sombilon Vs GarayLyceum LawlibraryBelum ada peringkat

- Heirs of Francisco Narvasa Vs ImbornalDokumen13 halamanHeirs of Francisco Narvasa Vs ImbornalLyceum LawlibraryBelum ada peringkat

- Chavez, Vs Court of AppealsDokumen16 halamanChavez, Vs Court of AppealsLyceum LawlibraryBelum ada peringkat

- People Vs DayotDokumen5 halamanPeople Vs DayotLyceum LawlibraryBelum ada peringkat

- Philippine National Bank Vs GarciaDokumen9 halamanPhilippine National Bank Vs GarciaLyceum LawlibraryBelum ada peringkat

- Araullo Vs Aquino IIIDokumen2 halamanAraullo Vs Aquino IIILyceum Lawlibrary100% (1)

- Gadrinab Vs SalamancaDokumen12 halamanGadrinab Vs SalamancaLyceum LawlibraryBelum ada peringkat

- People Vs DacudaoDokumen5 halamanPeople Vs DacudaoLyceum LawlibraryBelum ada peringkat

- Civil Letter - For MergeDokumen1 halamanCivil Letter - For MergeLyceum LawlibraryBelum ada peringkat

- Miranda Vs TuliaoDokumen15 halamanMiranda Vs TuliaoLyceum LawlibraryBelum ada peringkat

- Bravo Vs BorjaDokumen4 halamanBravo Vs BorjaLyceum LawlibraryBelum ada peringkat

- People Vs DacudaoDokumen5 halamanPeople Vs DacudaoLyceum LawlibraryBelum ada peringkat

- BERNARDO V PEOPLE RULING ON TENANCY RIGHTSDokumen2 halamanBERNARDO V PEOPLE RULING ON TENANCY RIGHTSLyceum LawlibraryBelum ada peringkat

- Belgica vs Ochoa ruling on pork barrelDokumen2 halamanBelgica vs Ochoa ruling on pork barrelFeBrluadoBelum ada peringkat

- Crim Proc Outline-1Dokumen12 halamanCrim Proc Outline-1Lyceum LawlibraryBelum ada peringkat

- Wills and Succession (Draft)Dokumen11 halamanWills and Succession (Draft)Lyceum Lawlibrary0% (1)

- Miquibas Vs Commanding GeneralDokumen1 halamanMiquibas Vs Commanding GeneralLyceum LawlibraryBelum ada peringkat

- US Vs Ah ChongDokumen2 halamanUS Vs Ah ChongLyceum LawlibraryBelum ada peringkat

- SEC Opinion Romulo MabantaDokumen1 halamanSEC Opinion Romulo MabantaLyceum LawlibraryBelum ada peringkat

- US vs. Ah SingDokumen1 halamanUS vs. Ah Singgeh15Belum ada peringkat

- Ola Cabs DataDokumen1 halamanOla Cabs DataNeelabh Mishra100% (1)

- How To Create Your Own Paycheck Stub TemplateDokumen1 halamanHow To Create Your Own Paycheck Stub TemplatePaycheck Stub TemplatesBelum ada peringkat

- Screenshot 2023-07-23 at 9.53.56 AMDokumen1 halamanScreenshot 2023-07-23 at 9.53.56 AMGautam SinghBelum ada peringkat

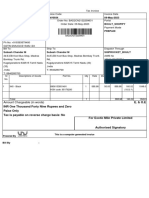

- Exotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyDokumen1 halamanExotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyMellodie GamingBelum ada peringkat

- Boodmo Invoice SPDokumen1 halamanBoodmo Invoice SPDilip MishraBelum ada peringkat

- PDF GST ppt1 PDFDokumen7 halamanPDF GST ppt1 PDFPraveen JoeBelum ada peringkat

- Sample Computaion of Estate TaxDokumen6 halamanSample Computaion of Estate TaxlheyniiBelum ada peringkat

- BBA 6th Semester Study Material For GST (Unit III)Dokumen6 halamanBBA 6th Semester Study Material For GST (Unit III)Priya SinghBelum ada peringkat

- Taxation Comprehensive Exam TosDokumen2 halamanTaxation Comprehensive Exam Tosaccounting probBelum ada peringkat

- Ezra Daniels TaxDokumen11 halamanEzra Daniels TaxJulio Romero100% (1)

- Ambardy Heru Prayoga (Salary Slip Agustus 2019)Dokumen1 halamanAmbardy Heru Prayoga (Salary Slip Agustus 2019)Fitrah RamadlanBelum ada peringkat

- CIR vs. Ayala Securities Corp., GR No. L-29485Dokumen1 halamanCIR vs. Ayala Securities Corp., GR No. L-29485Alyza Montilla BurdeosBelum ada peringkat

- Garcia Arby Jay D. Ba 223-Income Taxation Midterm ExaminationDokumen4 halamanGarcia Arby Jay D. Ba 223-Income Taxation Midterm ExaminationfssdsddsfdsfsdBelum ada peringkat

- Tax II CasesDokumen3 halamanTax II CasesRichardEnriquezBelum ada peringkat

- CONFIDENTIAL TAX DOCUMENTDokumen7 halamanCONFIDENTIAL TAX DOCUMENTPutri Nurin Hasnida HassanBelum ada peringkat

- Property List - ST - Bernard - Parish-Lien-2022-06-22Dokumen21 halamanProperty List - ST - Bernard - Parish-Lien-2022-06-22Sai KesavBelum ada peringkat

- Capital Gains Q&A Solution To Question 34 As Per PY 2022 23 AYDokumen1 halamanCapital Gains Q&A Solution To Question 34 As Per PY 2022 23 AYMehul GuptaBelum ada peringkat

- IT Declaration Form FY 2018-19Dokumen3 halamanIT Declaration Form FY 2018-19sgshekar3050% (2)

- History of Taxation in the PhilippinesDokumen2 halamanHistory of Taxation in the PhilippinesDaniel ZuniegaBelum ada peringkat

- Module 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsDokumen66 halamanModule 2 Transcript Federal Taxation I Individuals Employees and Sole ProprietorsFreddy MolinaBelum ada peringkat

- Tax InvoiceDokumen3 halamanTax InvoicerangersuhaibBelum ada peringkat

- Michigan Property Assessment FormDokumen2 halamanMichigan Property Assessment FormIsabelle PasciollaBelum ada peringkat

- Moneth - COE Rev.1Dokumen2 halamanMoneth - COE Rev.1Isabel AbadBelum ada peringkat

- Mayur Infotech: Party DetailsDokumen1 halamanMayur Infotech: Party DetailsHiten AhujaBelum ada peringkat

- Tax Law 2 ProjectDokumen16 halamanTax Law 2 Projectrelangi jashwanthBelum ada peringkat

- MGPTaxReturn 2021Dokumen93 halamanMGPTaxReturn 2021KGW NewsBelum ada peringkat

- HP Square - 0213 (22-23) (Harsh Priya Constructions)Dokumen1 halamanHP Square - 0213 (22-23) (Harsh Priya Constructions)Ravikant MishraBelum ada peringkat

- Gross Reportable Compensation Income 285,000Dokumen3 halamanGross Reportable Compensation Income 285,000WenjunBelum ada peringkat

- HDFC Credit Card Limit Enhancement FormDokumen1 halamanHDFC Credit Card Limit Enhancement Formranju93Belum ada peringkat

- West Bengal govt pay slip breakdownDokumen1 halamanWest Bengal govt pay slip breakdownArkit BasuBelum ada peringkat