Debt Securitization

Diunggah oleh

Nitin MahindrooHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Debt Securitization

Diunggah oleh

Nitin MahindrooHak Cipta:

Format Tersedia

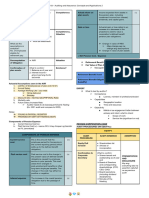

Debt Securitization Debt securitization is loan which is given from financial institution to borrowers.

But

this debt of loan is given in the form of security or marketable instrument. In other words, Debt securitization is a process of transformation of receivables into security which may be traded latter in the open market. Suppose, A gives loan to B. Loan is an Fixed asset for A and it is fixed liability of B. Now, B gives loan to C. But this loan is given in the form of marketable instrument. Now, it is current asset of B. We can see lots of car loan account in any financial company. Parties in Debt Securitization ORIGINATOR SPECIAL PURPOSE VEHICLE QUALIFIED INSTITUTIONAL BUYERS ORIGINATOR: This is the main organisation. It gives loan in the form of loan not in the form of debt

securitization.

In this party, we can include RBI or SBI. Qualified Institutional Buyers: A qualified institutional buyer is a purchaser of marketable

securities, that is deemed financially sophisticated and is legally recognized by security market regulators.

SPV advertises for his debt securitization product. But they did not sell to all. SPV sells to those who clear its condition. All these parties are called QIN. Suppose, SBI finds 10 SPV and gave loan of Rs. 200 Crores. Now, 10 SPV converts this Rs. 200 crore loan in the form of debt securitization and sells to different qualified buyers. These buyers may be 1000 or 100000. One of the best benefits of debt securitization is to reduce risk. If SBI gives Rs. 200 crores to one party. It may be risky. But to give 10 SPV is less risky. For SPV, market instruments are also less risky to give 100000 persons. SPECIAL PURPOSE VEHICLE: Special Purpose vehicle are that party who gets loan or pool of loan

from originator and convert it into marketable securities. After converting it in marketable securities or papers, it will become debt securitized. Now, SPV will sell it in the money or any other financial market.

These parties include private banks and other private financial institution which you can find their office in your local city. Advantages of Debt Securitization Standardization Diversification Flexibility Disadvantages of Debt Securitization The synchronization of the interest generated by the pool and the interest paid to the investors is a very arduous and tedious process. The transfer of mortgages may be difficult for legal, regulatory or tax reasons. It means that such transactions have to satisfy the requirements of regulatory authorities. The complexity of the transaction requires a very highly sophisticated documentation, and is very time consuming and costly process

Anda mungkin juga menyukai

- InvestmentDokumen1 halamanInvestmentNitin MahindrooBelum ada peringkat

- LighthouseDokumen1 halamanLighthouseNitin MahindrooBelum ada peringkat

- SUMMARYDokumen5 halamanSUMMARYNitin MahindrooBelum ada peringkat

- Some Aspects of Investment DecisionsDokumen5 halamanSome Aspects of Investment DecisionsNitin MahindrooBelum ada peringkat

- Decisions About Investment ExplainedDokumen2 halamanDecisions About Investment ExplainedNitin MahindrooBelum ada peringkat

- Penguin FamilyDokumen1 halamanPenguin FamilyNitin MahindrooBelum ada peringkat

- Difference Between Human Resource Management and Personnel ManagementDokumen2 halamanDifference Between Human Resource Management and Personnel ManagementNitin MahindrooBelum ada peringkat

- Derrivatives Financial SwapsDokumen12 halamanDerrivatives Financial SwapsNitin MahindrooBelum ada peringkat

- Ifm Financing of Foregn Trade MethodsDokumen21 halamanIfm Financing of Foregn Trade MethodsNitin MahindrooBelum ada peringkat

- International Trade FinanceDokumen14 halamanInternational Trade FinanceNitin MahindrooBelum ada peringkat

- Currency and Interest Rate Swaps: Chapter TenDokumen22 halamanCurrency and Interest Rate Swaps: Chapter TenNitin MahindrooBelum ada peringkat

- QuartileDokumen13 halamanQuartileNitin Mahindroo100% (3)

- Project Managemt Org SrtuctursDokumen16 halamanProject Managemt Org SrtuctursNitin MahindrooBelum ada peringkat

- Phases of Personnel ManagementDokumen2 halamanPhases of Personnel ManagementNitin MahindrooBelum ada peringkat

- Financial DervativeDokumen78 halamanFinancial DervativeNitin Mahindroo100% (1)

- Personnel ManagementDokumen1 halamanPersonnel ManagementNitin MahindrooBelum ada peringkat

- Difference Between Human Resource Management and Personnel ManagementDokumen2 halamanDifference Between Human Resource Management and Personnel ManagementNitin MahindrooBelum ada peringkat

- Financial Derivative2Dokumen87 halamanFinancial Derivative2Nitin MahindrooBelum ada peringkat

- International MarketingDokumen58 halamanInternational MarketingVeer Jawandha100% (1)

- Sales and Distribution MGTDokumen89 halamanSales and Distribution MGTNitin MahindrooBelum ada peringkat

- International Financial PPT PpresentationDokumen41 halamanInternational Financial PPT PpresentationSambeet ParidaBelum ada peringkat

- Tom HBSDokumen68 halamanTom HBSNitin MahindrooBelum ada peringkat

- Retail Management in IndiaDokumen6 halamanRetail Management in IndiaRajasekaranBelum ada peringkat

- Subject: Risk & Insurance Management: Submitted By: Nitin Mahindroo Roll-No-617 Submitted To: Mr. Naresh SharmaDokumen18 halamanSubject: Risk & Insurance Management: Submitted By: Nitin Mahindroo Roll-No-617 Submitted To: Mr. Naresh SharmaNitin MahindrooBelum ada peringkat

- QuartileDokumen13 halamanQuartileNitin Mahindroo100% (3)

- Fundamental AnalysisDokumen27 halamanFundamental AnalysisNitin Mahindroo100% (1)

- Introductiontoservices 111011090236 Phpapp01Dokumen22 halamanIntroductiontoservices 111011090236 Phpapp01Nitin MahindrooBelum ada peringkat

- MfsDokumen16 halamanMfsNitin MahindrooBelum ada peringkat

- Chap 17Dokumen11 halamanChap 17Nitin MahindrooBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Comparison of Selected Equity Capital and Mutual Fund Schemes in Respect Their RiskDokumen7 halamanComparison of Selected Equity Capital and Mutual Fund Schemes in Respect Their RiskSuman V RaichurBelum ada peringkat

- 12 Accountancy - Goodwill - Nature and Valuation-Notes and Video LinkDokumen10 halaman12 Accountancy - Goodwill - Nature and Valuation-Notes and Video LinkEshan KotteBelum ada peringkat

- General Motors Transactional Translational ExposuresDokumen5 halamanGeneral Motors Transactional Translational ExposuresRaghavendra Somasundaram100% (3)

- Harris Seafoods Case Rev2 PDFDokumen40 halamanHarris Seafoods Case Rev2 PDFgem gem100% (1)

- FINANCE FOR EXECUTIVES (AutoRecovered)Dokumen5 halamanFINANCE FOR EXECUTIVES (AutoRecovered)suruchi singhBelum ada peringkat

- 12 BibliographyDokumen12 halaman12 BibliographyAn Zel SBelum ada peringkat

- HedgingDokumen7 halamanHedgingSachIn JainBelum ada peringkat

- Aec64 Audit 2 Notes-22-24Dokumen3 halamanAec64 Audit 2 Notes-22-24Althea RubinBelum ada peringkat

- DocxDokumen40 halamanDocxJamaica DavidBelum ada peringkat

- FIN 433 - Exam 1 SlidesDokumen146 halamanFIN 433 - Exam 1 SlidesNayeem MahmudBelum ada peringkat

- 2010 07 06 - 010528 - Byp1 4Dokumen3 halaman2010 07 06 - 010528 - Byp1 4Muhammad RamadhanBelum ada peringkat

- Buscom 2ND Sem Prelims and Midterms Reviewer 1Dokumen13 halamanBuscom 2ND Sem Prelims and Midterms Reviewer 1Accounting MaterialsBelum ada peringkat

- Lecture 1A Introduction and Understanding Cash FlowsDokumen20 halamanLecture 1A Introduction and Understanding Cash FlowsJohnBelum ada peringkat

- Fins2624 Problem Set 5 Tutorial QuestionDokumen5 halamanFins2624 Problem Set 5 Tutorial QuestionPhebieon MukwenhaBelum ada peringkat

- Study of Risk Perception and Potfolio Management of Equity InvestorsDokumen58 halamanStudy of Risk Perception and Potfolio Management of Equity InvestorsAqshay Bachhav100% (1)

- BKSL PDFDokumen4 halamanBKSL PDFyohannestampubolonBelum ada peringkat

- InfinityPools WPDokumen8 halamanInfinityPools WPAndong LiuBelum ada peringkat

- Financial Analysis - Maruti Udyog Limited - FinalDokumen100 halamanFinancial Analysis - Maruti Udyog Limited - FinalVarun KalraBelum ada peringkat

- EtradeDokumen29 halamanEtradeRangga Try PutraBelum ada peringkat

- AggrivateDokumen14 halamanAggrivatemvtharish138Belum ada peringkat

- Gujarat Technological University: Syllabus For New MBA Program Effective From Academic Year 2011-12Dokumen23 halamanGujarat Technological University: Syllabus For New MBA Program Effective From Academic Year 2011-12poojaBelum ada peringkat

- CHAPTER 5 - Portfolio TheoryDokumen58 halamanCHAPTER 5 - Portfolio TheoryKabutu ChuungaBelum ada peringkat

- Corporate Finance - Project Report - Capital Structure TrendsDokumen18 halamanCorporate Finance - Project Report - Capital Structure TrendsNikhil PathakBelum ada peringkat

- Income-Tax-Calculator 2023-24Dokumen8 halamanIncome-Tax-Calculator 2023-24AlokBelum ada peringkat

- Country Wide Financial Case Study 1Dokumen3 halamanCountry Wide Financial Case Study 1Paul PhenixBelum ada peringkat

- Chapter Four Part Two: Importance of Capital BudgetingDokumen12 halamanChapter Four Part Two: Importance of Capital Budgetingnahu a dinBelum ada peringkat

- Depreciation Is A Term Used Reference To TheDokumen14 halamanDepreciation Is A Term Used Reference To TheMuzammil IqbalBelum ada peringkat

- Demat Account OpeningDokumen8 halamanDemat Account OpeningNivas NowellBelum ada peringkat

- Investment Planning (Asset Allocation - Concepts & Practices)Dokumen40 halamanInvestment Planning (Asset Allocation - Concepts & Practices)mkpatidarBelum ada peringkat

- Part Two: Fundamentals of Financial MarketsDokumen38 halamanPart Two: Fundamentals of Financial MarketsĐỗ Thanh SơnBelum ada peringkat