PRP Scheme

Diunggah oleh

ihateu1Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PRP Scheme

Diunggah oleh

ihateu1Hak Cipta:

Format Tersedia

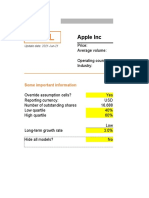

SCHEME FOR PERFORMANCE RELATED PAY As per DPE Instruction Vide (i) (ii) (iii) (iv) DPE O&M

dated 26th Nov., 2008. DPE O&M dated 9th Feb., 2009. DPE O&M dated 2nd April, 2009. 2nd Pay Revision Committee recommendation of CPSUs (chapter-6).

1.0 Title The Scheme shall be called Scheme for Performance Related Pay. 2.0 2.1 2.2 2.3 2.4 2.5 3.0 3.1 Objective Promoting motivation, morale and team spirit among the employees to achieve the goals of the organization. Inculcating performance oriented culture across the organization. Encouraging high level performance by employees linking their performance to pay. Motivating employees for maximizing MoU score of the organization and achieving the targets set in MoU. Retaining talents within the organization. Factors for Performance Related Pay Following are the factors for Performance Related Pay : Rating of the performance based on Memorandum of Understanding (MOU) entered between NHDC and NHPC for the corresponding year. MOU is a performance measuring tool containing number of parameters including weightages assigned to each parameter. Profitability of the Company during the corresponding year. Incremental Profit of the Corporation i.e. increase in profit in comparison to previous years profit. Performance of the individuals in achievements of the company Targets.

3.2 3.3 3.4

4.0 Scope and Coverage The improved performance is a result of collective contribution therefore Performance Related Pay / Variable Pay Scheme is designed covering whole time Directors and all levels of executives who are directly and indirectly contributing to the performance of the business. The scheme shall be applicable to :Whole time Directors, all NHDC Executives including Trainee Engineer / Officer who are on regular rolls of the Corporation including Executives of other organizations who have been deputed to NHDC but excluding Trainees, Apprentice, Executives of NHDC who are on deputation to other organizations & Executives on Fixed Tenure Basis (FTB).

5.0

Features of the Scheme

5.1. The PRP has been directly linked to the MOU rating, Profits of the Organization and individual performance of the executives. The percentage ceiling of PRP for different levels of Executives termed as Grade Factor and expressed as percentage of Basic Pay are indicated below :Grade CMD Director E9 to E7 E6 & E5 E4 & E3 E2A to E1 PRP Percentage of Basic Pay (Grade Factor) 200% 150% 70% 60% 50% 40%

5.2. The PRP shall be based on the Physical and Financial Performance and will come out of the profits of the organization. 60% of the PRP shall be given with the ceiling of 3% of the Profit Before Tax (PBT) and 40% of the PRP shall be from 10% of the Incremental Profit. Incremental profit shall mean increase in profit as compared to previous years profit. The total PRP shall be limited to 5% of the years PBT, which shall be for Executives & non-unionized supervisors. The Scheme for PRP shall begin from the Financial Year 200708. As per the DPE Guidelines, there shall be no incremental profit for the year 2007-08 as it will be the first year of the introduction of scheme for PRP. The amount available for PRP shall be 3% of PBT of 2007-08. For the purpose of calculating the incremental profit, the starting year would be 2007-08. 6.0 PRP will be based on i) ii) 6.1. Company Performance / MOU Rating (Mo). Individual Performance factor (Pi).

Company Performance / MOU Rating (Mo). The PRP shall be payable on the eligibility levels depending on the achievement of Memorandum of Understanding (MoU) rating. Different eligibility of PRP in percentage against different MOU rating is given hereunder :MOU Rating Eligibility of PRP Mo Excellent 100% 1.00 Very Good 80% 0.80 Good 60% 0.60 Fair 40% 0.40 Poor NIL 0.00 In case Company achieves Poor MoU Rating, no PRP shall be admissible.

2

6.2.

KRA / PAR Rating of Individuals (Pi).

6.2.1. As per DPE recommendation, KRA Score of performance rating shall come from Performance Management System (PMS) and shall be converted to Score of 100 as given below : Individual PMS Score 100 81 80 61 60 41 40 21 20 and below Individual Performance Rating Pi 1.00 0.80 0.60 0.40 0.00

6.2.2. Figures regarding PMS Score after rounding off to two decimal places shall be converted to nearest whole number e.g. 85.50 shall be treated as 85 and 85.51 shall be treated as 86. 6.2.3. Wherever KRA Scores as mentioned above are not available, PAR ratings in the form of Outstanding, Very Good, Good, Satisfactory and Unsatisfactory (Poor), the following criteria shall be followed :

PAR Rating Individual Performance Rating Pi

Outstanding Very Good Good Satisfactory Unsatisfactory (Poor)

1.00 0.80 0.60 0.40 0.00

6.2.4. In case of employee having KRA Score as 20 and below or PAR rating as Unsatisfactory (Poor), no PRP shall be admissible. 7.0 7.1. Methodology of calculation and quantum of PRP payment : The PRP shall be worked out based on the following formula for all levels of executives.

Total PRP = PRP from Current Year Profit + PRP from Incremental Profit.

PRP from Current Year Profit=0.60 x Annual Basic Pay x Mo x Pi x Grade Factor x Available Amount Required Amount PRP from Incremental Profit=0.40 x Annual Basic Pay x Mo x Pi x Grade Factor x Available Amount Required Amount

Where Mo = Company Performance / MOU Rating (as mentioned at S.No.6.1) Pi = Individual Performance (as mentioned at S.No.6.2). Grade Factor (as mentioned at S.No.5.1). Maximum limit of Available Amount to Required Amount shall not be more than 1. 3

7.2. Calculation of available amount and required amount. 7.2.1. Calculation of required amount : PRP amount of each individual is calculated taking maximum entitled percentage of PRP of each level defined by DPE on the actual performance of Company and Individual. Total PRP amount required is calculated for all the Executives & Supervisors by adding PRP amount. This total amount is divided in the proportion of 60% and 40%. 60% portion of total PRP Amount is taken as Required Amount in PRP available from Profit Before Tax (PBT) for the year. 40% portion of total PRP Amount is taken as Required Amount in PRP available from Incremental Profit for the year.

7.2.2. Calculation of available amount : 3% of current years PBT is taken as Share of PBT from Current Years Profit available for PRP. 10% of Incremental profit is calculated. Total amount of PRP needs to be restricted to 5% of PBT of the current year, hence in case 10% of incremental profit is more than 2% of PBT of current year, then the amount whichever is less (10% of incremental or 2% of current year PBT) shall be taken as Amount available from incremental profit.

7.2.3. Illustration : Total Amount Required for PRP = Rs. 52.725 Cr. 60% of Amount Required (for Current Year PBT Portion) = 31.635 Cr. 40% of Amount Required (for Incremental PBT Portion) = 21.090 Cr. Current year PBT = Rs. 2402.08 Cr. Previous year PBT = Rs. 1178.34 Cr. 3% of Current year PBT = 72.0624 Cr. 10% of Incremental Profit = 10% of (Rs.2402.08 Cr. 1178.34 Cr) = Rs.122.374 Cr. 2% of Current year PBT = Rs. 48.0416 Cr. Available Amount for Current Year PBT portion = Rs. 72.0624 Cr. 4

Available Amount for Incremental PBT portion = Rs. 48.0416 Cr. (Minimum of Rs. 122.374 Cr. And Rs. 48.0416 Cr) Ratio of Available to Required Amount for Current Year PBT = (72.0624 / 31.635 ) = 2.278 (Restricted to 1). Ratio of Available to Required Amount for Incremental PBT = (48.0416 / 21.090 ) = 2.278 (Restricted to 1). Procedure MoU rating of the organization of corresponding year shall be provided by Planning Division, Corporate Office. Corporate HR shall provide level wise KPA/PAR rating of all individuals of corresponding year. Annual Basic Pay of individuals, Profit before Tax of Corresponding and Previous year shall be provided by Corporate Finance Division. With the aforesaid data, the % PRP Amount shall be calculated w.r.t. Annual Basic of all executives by Finance Division for payment after approval of the Competent Authority. Total Performance Related Payments in a Financial Year shall be limited to ceiling specified by DPE from time to time. Presently, limit / ceiling of PRP prescribed by DPE is defined vide their OM No. 2(70)/08-DPE(WC) dated 26th November, 2008. General conditions The period of Training in India / abroad for not more than six weeks continuously, shall be counted for the purpose of PRP. In case, the training period is more than six weeks continuously, then employees shall be eligible for PRP on pro-rata basis. Employees sponsored for full time courses more than six weeks, shall be eligible for PRP on pro-rata basis for the period of presence of duty. The employee will be entitled to PRP on a pro-rata basis for actual period of attendance. The PRP shall not be paid for the period of leave without pay (LWP) / Extra Ordinary Leave (EOL) / Maternity Leave / Sick Leave / Child Care leave / Unauthorized absence. In case of resignation / VRS / lien / death, PRP shall be paid on pro-rata basis. The incentive for an executive whos PAR has not been accepted / received as yet, shall be paid after completion of his PARs. Bell curve approach would be adopted for grading of Executives so that not more than 10 to 15% executives are Outstanding / Excellent. Similarly 10% of the Executives should be graded as Below Par. Bell Curve Approach to be adopted for grading of Executives for the purpose of distribution of PRP 5

8.0 8.1.

8.2.

8.3.

8.4.

8.5.

9.0 9.1.

9.2. 9.3.

9.4. 9.5

through a methodology from the year 2010-11 onwards in line with Holding Company i.e. NHPC Ltd.

9.6

The payment of PRP to the executives who are suspended pending enquiry shall be withheld till conclusion of enquiry. The period of suspension shall not be counted for the calculation of PRP unless exonerated after conclusion of disciplinary proceedings. PRP shall be payable for the suspension period subject to the condition that the period of suspension is treated as on duty. The amount of PRP shall neither be termed as pay nor allowances, nor wages. Accordingly, this amount shall not count for any service benefits i.e. computation of House Rent Allowance, Compensatory Allowance, cash compensation, encashment of leave, pay fixation, Provident Fund, Pension or Gratuity, etc. The figures of achievement and other records as maintained by the management shall be final and binding based on the experience of running the scheme. The amount paid on account of Productivity Linked Group Incentive (PLGI) and Special Incentive / Ex-gratia in lieu of payment of Bonus Act (PLI) shall be adjusted from PRP. In case, the amount of PRP is less than the amount paid on account of PLGI + PLI, no recoveries shall be made.

*********

9.7

9.8

9.9

Anda mungkin juga menyukai

- Open Compensation Plan A Complete Guide - 2020 EditionDari EverandOpen Compensation Plan A Complete Guide - 2020 EditionBelum ada peringkat

- 3RD PRC Presentation-1Dokumen25 halaman3RD PRC Presentation-1sai krishna krishnaBelum ada peringkat

- Public Service Motivation A Complete Guide - 2021 EditionDari EverandPublic Service Motivation A Complete Guide - 2021 EditionBelum ada peringkat

- Annual Performance Bonus PolicyDokumen4 halamanAnnual Performance Bonus PolicyPankaj KumarBelum ada peringkat

- Npcil Plis SchemeDokumen9 halamanNpcil Plis SchemeSubhashis Chatterjee0% (1)

- The Fmla Compendium, a Comprehensive Guide for Complying with the Amended Family & Medical Leave Act 2011-2012Dari EverandThe Fmla Compendium, a Comprehensive Guide for Complying with the Amended Family & Medical Leave Act 2011-2012Belum ada peringkat

- Bankers Adda - SBI - Salary Structure and PerksDokumen4 halamanBankers Adda - SBI - Salary Structure and PerksSushant GargBelum ada peringkat

- State Bank of India ZO Chennai: Annual/Stagnation IncrementDokumen1 halamanState Bank of India ZO Chennai: Annual/Stagnation IncrementKeerthi SruthiBelum ada peringkat

- Salary Structure For 2008-2009Dokumen28 halamanSalary Structure For 2008-2009anon-289280Belum ada peringkat

- Reward System and Employee Performance in The Oil and Gas Industry in Rivers StateDokumen19 halamanReward System and Employee Performance in The Oil and Gas Industry in Rivers StateInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- SalaryDokumen7 halamanSalarysajid bhattiBelum ada peringkat

- Benefits For Employees in IndiaDokumen3 halamanBenefits For Employees in IndiaYerragola PrakashBelum ada peringkat

- Leave EncashmentDokumen1 halamanLeave EncashmentParamita SarkarBelum ada peringkat

- PMRS - Salary & Wages Intro - DhavalDokumen49 halamanPMRS - Salary & Wages Intro - Dhavalricha24Belum ada peringkat

- Human Resource Management: InductionDokumen68 halamanHuman Resource Management: Inductionraj chauhanBelum ada peringkat

- Performance Management Course Facilitator: Sana Mumtaz - Mohammad Junaid Hussain REG# (1735202) Rahat Jaan Mohammad REG# (1835148) MBA (36-E)Dokumen26 halamanPerformance Management Course Facilitator: Sana Mumtaz - Mohammad Junaid Hussain REG# (1735202) Rahat Jaan Mohammad REG# (1835148) MBA (36-E)Rahat JaanBelum ada peringkat

- Rewards, Incentives and Pay For PSDokumen77 halamanRewards, Incentives and Pay For PSAvinaw KumarBelum ada peringkat

- Salary Break Up - DamanDokumen16 halamanSalary Break Up - Damanvirag_shahsBelum ada peringkat

- Pay Scales For Executives and Non-Executives at RINLDokumen1 halamanPay Scales For Executives and Non-Executives at RINLbanchodaBelum ada peringkat

- Presented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreDokumen30 halamanPresented By,: Shraddha Dhatrak (01) Priyanka Ghatrat Mayuri Koli Sneha MoreshraddhavanjariBelum ada peringkat

- HR ChecklistDokumen8 halamanHR ChecklistVivek ViswanathanBelum ada peringkat

- R.R. Ispat (A Unit of Gpil) : Recruitment PolicyDokumen3 halamanR.R. Ispat (A Unit of Gpil) : Recruitment PolicyVinod KumarBelum ada peringkat

- Shri Harini Media Ltd. Business Development Incentive Plan PolicyDokumen7 halamanShri Harini Media Ltd. Business Development Incentive Plan PolicyGayathri EthirajBelum ada peringkat

- Performance Evaluation FormDokumen3 halamanPerformance Evaluation Formjitu20febBelum ada peringkat

- Whichever Is Lower Is Exempt From Tax. For ExampleDokumen13 halamanWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedBelum ada peringkat

- Bonus Shares and EsopDokumen4 halamanBonus Shares and EsopRon FlemingBelum ada peringkat

- Staff HandbookDokumen29 halamanStaff Handbookapi-317193133Belum ada peringkat

- HRM RecruitmentDokumen15 halamanHRM RecruitmenthahireBelum ada peringkat

- Power To People: Indiafirst Employee Benefit PlanDokumen14 halamanPower To People: Indiafirst Employee Benefit PlanBhawzBelum ada peringkat

- Employee Joining Form: A-238 (N), Oppo. Mangala Sariya Road No. 09, VKI Area, Jaipur-302013Dokumen2 halamanEmployee Joining Form: A-238 (N), Oppo. Mangala Sariya Road No. 09, VKI Area, Jaipur-302013VAIBHAV JAKHALIABelum ada peringkat

- Self Evaluation QuestionsDokumen4 halamanSelf Evaluation QuestionsNeeraj KhatriBelum ada peringkat

- HRA-004 Time and Attendance Monitoring Rev 1 v2Dokumen4 halamanHRA-004 Time and Attendance Monitoring Rev 1 v2Emmanuel C. DumayasBelum ada peringkat

- Biometric-Based Attendance Policy - V1Dokumen2 halamanBiometric-Based Attendance Policy - V1Aditya SoniBelum ada peringkat

- Edinburgh Napier University: Maternity PolicyDokumen14 halamanEdinburgh Napier University: Maternity PolicyTejinder Singh BajajBelum ada peringkat

- Process of HR Dept.Dokumen5 halamanProcess of HR Dept.VINAY SINGHBelum ada peringkat

- ANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFDokumen1 halamanANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFRovic OrdonioBelum ada peringkat

- 2020 HQ Holidays CircularDokumen1 halaman2020 HQ Holidays CircularSumanth Gundeti0% (1)

- Business - Gov.au: Succession Plan Template and GuideDokumen16 halamanBusiness - Gov.au: Succession Plan Template and GuideMax MaraBelum ada peringkat

- Code of Conduct: PoliciesDokumen74 halamanCode of Conduct: PoliciesSandeep YadavBelum ada peringkat

- Retention Strategies in ITESDokumen12 halamanRetention Strategies in ITESmunmun4Belum ada peringkat

- Driving Performance and Retention Through Employee EngagementDokumen20 halamanDriving Performance and Retention Through Employee EngagementAngela WhiteBelum ada peringkat

- A Study On Evaluation of Performance Appraisal System at Gunidy Machine Tools LimitedDokumen19 halamanA Study On Evaluation of Performance Appraisal System at Gunidy Machine Tools LimitedP Elumalai SevenBelum ada peringkat

- Payroll Procedure Manual-As of 09-14-11Dokumen16 halamanPayroll Procedure Manual-As of 09-14-11PaksmilerBelum ada peringkat

- Employee Benefits IndiaDokumen2 halamanEmployee Benefits Indiabaskarbaju1Belum ada peringkat

- Appraisal ProcessDokumen6 halamanAppraisal ProcessSushan GanasanBelum ada peringkat

- Tulane Compensation Resource Guide v2 4Dokumen24 halamanTulane Compensation Resource Guide v2 4Aishah Al NahyanBelum ada peringkat

- Employee Accommodation Policy: Ramana Gounder Medical TrustDokumen22 halamanEmployee Accommodation Policy: Ramana Gounder Medical TrustAaju KausikBelum ada peringkat

- Salary Revision Proposal PDFDokumen10 halamanSalary Revision Proposal PDFADNAN NAJEEB PKBelum ada peringkat

- Employee Referral Scheme - Cite HRDokumen3 halamanEmployee Referral Scheme - Cite HRAthiq MohamedBelum ada peringkat

- Skills MatrixDokumen3 halamanSkills Matrixjagansd3Belum ada peringkat

- Compensation and BenefitsDokumen10 halamanCompensation and Benefitsapi-226053416Belum ada peringkat

- Investment Declaration Form F.Y. 2016-17Dokumen2 halamanInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- Kra Kpa Kai SheetDokumen4 halamanKra Kpa Kai SheetVikram Khatri100% (1)

- Performance AppraisalDokumen3 halamanPerformance AppraisalJohny George MalayilBelum ada peringkat

- HR Manual 2021 PDFDokumen65 halamanHR Manual 2021 PDFekraam mohammedBelum ada peringkat

- Components Under Flexible BenefitsDokumen3 halamanComponents Under Flexible BenefitsPrajay MathurBelum ada peringkat

- Assistant Professor Gift University Gujranwala: Job DescriptionDokumen3 halamanAssistant Professor Gift University Gujranwala: Job DescriptionAli AslamBelum ada peringkat

- Corporate ChanakyaDokumen2 halamanCorporate Chanakyanikhil tolambe100% (1)

- IS 13517 - Rock Bolts - Resin Type - Bureau of Indian Standards - Free Download, Borrow, and Streaming - Internet ArchiveDokumen2 halamanIS 13517 - Rock Bolts - Resin Type - Bureau of Indian Standards - Free Download, Borrow, and Streaming - Internet Archiveihateu1Belum ada peringkat

- DGMS-2020 - Exam Scheme and InstructionDokumen6 halamanDGMS-2020 - Exam Scheme and Instructionihateu1Belum ada peringkat

- Calculate Postage: Sign in RegisterDokumen3 halamanCalculate Postage: Sign in Registerihateu1Belum ada peringkat

- Answer Data 1608607135Dokumen1 halamanAnswer Data 1608607135ihateu1Belum ada peringkat

- Advt Ferro Scrap 2021 E (N)Dokumen5 halamanAdvt Ferro Scrap 2021 E (N)ihateu1Belum ada peringkat

- Advt Ferro Scrap 2021 E (N)Dokumen5 halamanAdvt Ferro Scrap 2021 E (N)ihateu1Belum ada peringkat

- IS 14778 - Portable Methanometer (Interferometer Type) - Bureau of Indian Standards - F - Internet Archive22Dokumen2 halamanIS 14778 - Portable Methanometer (Interferometer Type) - Bureau of Indian Standards - F - Internet Archive22ihateu1Belum ada peringkat

- Number of Questions 23 Number of Questions To Answer 20Dokumen4 halamanNumber of Questions 23 Number of Questions To Answer 20Engr. Zahid Ur RehmanBelum ada peringkat

- GT Questions - 6Dokumen1 halamanGT Questions - 6ihateu1Belum ada peringkat

- GT Questions - 4Dokumen1 halamanGT Questions - 4ihateu1Belum ada peringkat

- Leadership Quiz Questions Answers - Quiz 1Dokumen3 halamanLeadership Quiz Questions Answers - Quiz 1ihateu1Belum ada peringkat

- GT Questions - 5 PDFDokumen1 halamanGT Questions - 5 PDFihateu1Belum ada peringkat

- gAS - Google SearchDokumen1 halamangAS - Google Searchihateu1Belum ada peringkat

- GT Questions - 3Dokumen1 halamanGT Questions - 3ihateu1Belum ada peringkat

- Mining Technology - Engineering Notes IndiaDokumen4 halamanMining Technology - Engineering Notes Indiaihateu1Belum ada peringkat

- GT Questions - 5Dokumen1 halamanGT Questions - 5ihateu1Belum ada peringkat

- GT Questions - 1Dokumen1 halamanGT Questions - 1ihateu1Belum ada peringkat

- MiningDokumen1 halamanMiningihateu1Belum ada peringkat

- 03202018145834coal and Lig - AR - 2017Dokumen29 halaman03202018145834coal and Lig - AR - 2017ihateu1Belum ada peringkat

- GT Questions - 2Dokumen1 halamanGT Questions - 2ihateu1Belum ada peringkat

- Stability Analysis of A Mine Waste Dump Over An Existing DumpDokumen10 halamanStability Analysis of A Mine Waste Dump Over An Existing Dumpihateu1Belum ada peringkat

- GoglebDokumen1 halamanGoglebihateu1Belum ada peringkat

- Stability Analysis of A Mine Waste Dump Over An Existing DumpDokumen10 halamanStability Analysis of A Mine Waste Dump Over An Existing Dumpihateu1Belum ada peringkat

- Upload A DocumentDokumen2 halamanUpload A Documentihateu1Belum ada peringkat

- Document For ScribdDokumen2 halamanDocument For Scribdihateu1Belum ada peringkat

- Slide 2Dokumen1 halamanSlide 2ihateu1Belum ada peringkat

- Mining 1Dokumen4 halamanMining 1ihateu1100% (1)

- Noticemt2019advt17122019 PDFDokumen1 halamanNoticemt2019advt17122019 PDFChandan KumarBelum ada peringkat

- Para 4 PDFDokumen1 halamanPara 4 PDFihateu1Belum ada peringkat

- 181639Dokumen7 halaman181639ihateu1Belum ada peringkat

- Hicm Format For Writting Business PlanDokumen10 halamanHicm Format For Writting Business Planafoninadin81Belum ada peringkat

- Government Accounting and AuditingDokumen190 halamanGovernment Accounting and AuditingCharles John Palabrica CubarBelum ada peringkat

- CH 03Dokumen38 halamanCH 03Albert CruzBelum ada peringkat

- Kier Ar 2023 Final PDFDokumen248 halamanKier Ar 2023 Final PDFrab.nawaz1625Belum ada peringkat

- 2.1 Salary UpdatedDokumen11 halaman2.1 Salary UpdatedSk Salim JanBelum ada peringkat

- The Galaxy Dividend Income Growth FundDokumen8 halamanThe Galaxy Dividend Income Growth FundAshlesh MangrulkarBelum ada peringkat

- A Study On Financial Analysis of IOCLDokumen48 halamanA Study On Financial Analysis of IOCLAayush kumarBelum ada peringkat

- Ias 16Dokumen17 halamanIas 16david_thapaBelum ada peringkat

- Items of Gross IncomeDokumen5 halamanItems of Gross IncomeYeshua SantosBelum ada peringkat

- The+Pizza+Food+Truck+ +exercise+Dokumen15 halamanThe+Pizza+Food+Truck+ +exercise+SADHANA KUMARIBelum ada peringkat

- Problems EPSDokumen3 halamanProblems EPShukaBelum ada peringkat

- PowerPoint PresentationDokumen221 halamanPowerPoint PresentationPutri jayantiBelum ada peringkat

- ValueInvesting - Io - Financials & Models TemplateDokumen66 halamanValueInvesting - Io - Financials & Models TemplatekrishnaBelum ada peringkat

- Questionnaire On Capital Budgeting TechniquesDokumen3 halamanQuestionnaire On Capital Budgeting TechniquesHasibul IslamBelum ada peringkat

- 11 NIQ Soil Testing PatharkandiDokumen2 halaman11 NIQ Soil Testing Patharkandiexecutive engineer1Belum ada peringkat

- Franchise Application Form 3Dokumen12 halamanFranchise Application Form 3Muhammad SyahirBelum ada peringkat

- 101 Financial RatiosDokumen39 halaman101 Financial Ratiosanon_915672869Belum ada peringkat

- Leverage PPTDokumen13 halamanLeverage PPTamdBelum ada peringkat

- Recitation Parco AcDokumen13 halamanRecitation Parco AcHoney MuliBelum ada peringkat

- Extremely Important Proforma of Projected P L Balance Sheet of Both Partnership Firm Sole Proprietorship Business With Cma Data Analysis For Cash Credit LoanDokumen31 halamanExtremely Important Proforma of Projected P L Balance Sheet of Both Partnership Firm Sole Proprietorship Business With Cma Data Analysis For Cash Credit LoanMonty 20Belum ada peringkat

- Expencess For JAN - 2023Dokumen3 halamanExpencess For JAN - 2023sravan BattulaBelum ada peringkat

- Akun Pt. CahayaDokumen2 halamanAkun Pt. CahayaBudiantoBelum ada peringkat

- Fosbel India Private Limited: Attendance Details ValueDokumen1 halamanFosbel India Private Limited: Attendance Details ValuePrabhanjan BeheraBelum ada peringkat

- Executive SummaryDokumen43 halamanExecutive SummaryapplerafeeBelum ada peringkat

- Police Personal File: 2 X 2 PictureDokumen6 halamanPolice Personal File: 2 X 2 PicturePuma Base CcpsBelum ada peringkat

- Reg Flash CardsDokumen3.562 halamanReg Flash Cardsmohit2ucBelum ada peringkat

- Containing Multitudes: The Many Impacts of Kickstarter FundingDokumen13 halamanContaining Multitudes: The Many Impacts of Kickstarter FundingCrowdfundInsiderBelum ada peringkat

- National Tobacco Administration v. CommissionDokumen12 halamanNational Tobacco Administration v. CommissionChristian Edward CoronadoBelum ada peringkat

- Marketing Cost and Profitability AnalysisDokumen39 halamanMarketing Cost and Profitability AnalysisShahid Ashraf100% (3)

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionDari EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- Building Construction Technology: A Useful Guide - Part 1Dari EverandBuilding Construction Technology: A Useful Guide - Part 1Penilaian: 4 dari 5 bintang4/5 (3)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideDari Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuidePenilaian: 3.5 dari 5 bintang3.5/5 (7)

- A Place of My Own: The Architecture of DaydreamsDari EverandA Place of My Own: The Architecture of DaydreamsPenilaian: 4 dari 5 bintang4/5 (242)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseDari EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HousePenilaian: 5 dari 5 bintang5/5 (3)

- Field Guide for Construction Management: Management by Walking AroundDari EverandField Guide for Construction Management: Management by Walking AroundPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Building Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesDari EverandBuilding Physics -- Heat, Air and Moisture: Fundamentals and Engineering Methods with Examples and ExercisesBelum ada peringkat

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedDari EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedPenilaian: 5 dari 5 bintang5/5 (1)

- THE PROPTECH GUIDE: EVERYTHING YOU NEED TO KNOW ABOUT THE FUTURE OF REAL ESTATEDari EverandTHE PROPTECH GUIDE: EVERYTHING YOU NEED TO KNOW ABOUT THE FUTURE OF REAL ESTATEPenilaian: 4 dari 5 bintang4/5 (1)

- Practical Power Distribution for IndustryDari EverandPractical Power Distribution for IndustryPenilaian: 2.5 dari 5 bintang2.5/5 (2)

- Post Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&ADari EverandPost Weld Heat Treatment PWHT: Standards, Procedures, Applications, and Interview Q&ABelum ada peringkat

- Welding for Beginners in Fabrication: The Essentials of the Welding CraftDari EverandWelding for Beginners in Fabrication: The Essentials of the Welding CraftPenilaian: 5 dari 5 bintang5/5 (5)

- Nuclear Energy in the 21st Century: World Nuclear University PressDari EverandNuclear Energy in the 21st Century: World Nuclear University PressPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialDari EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialBelum ada peringkat

- The Everything Woodworking Book: A Beginner's Guide To Creating Great Projects From Start To FinishDari EverandThe Everything Woodworking Book: A Beginner's Guide To Creating Great Projects From Start To FinishPenilaian: 4 dari 5 bintang4/5 (3)

- Shipping Container Homes: How to build a shipping container home, including plans, cool ideas, and more!Dari EverandShipping Container Homes: How to build a shipping container home, including plans, cool ideas, and more!Belum ada peringkat

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsDari EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- The Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyDari EverandThe Complete Guide to Building With Rocks & Stone: Stonework Projects and Techniques Explained SimplyPenilaian: 4 dari 5 bintang4/5 (1)

- Civil Engineer's Handbook of Professional PracticeDari EverandCivil Engineer's Handbook of Professional PracticePenilaian: 4.5 dari 5 bintang4.5/5 (2)

- Traditional Toolmaking: The Classic Treatise on Lapping, Threading, Precision Measurements, and General ToolmakingDari EverandTraditional Toolmaking: The Classic Treatise on Lapping, Threading, Precision Measurements, and General ToolmakingPenilaian: 5 dari 5 bintang5/5 (2)