Vic Roads Transfer Form

Diunggah oleh

jikoljiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Vic Roads Transfer Form

Diunggah oleh

jikoljiHak Cipta:

Format Tersedia

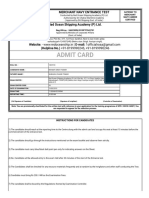

FORM

Application for transfer of registration

What is a transfer of registration?

A transfer of registration is a change of the registered operator of a registered vehicle. VicRoads records the identification details of each vehicle and the current registered operator of the vehicle.

1

Do I need to use this form?

Yes: To buy or sell a vehicle with number plates attached and current registration2. 8 No: To buy or sell a vehicle without number plates and/or with cancelled registration,

VicRoads vehicle register is not a register of title (vehicle ownership).

do not use this form. Instead, a receipt should be issued from the seller to the buyer. For further information please visit vicroads.vic.gov.au

Seller instructions

You need to provide complete and accurate information so the registration can be transferred successfully. Otherwise, you may be liable for any traffic offences that the buyer (new registered operator) may incur.

Buyer instructions

You need to provide complete and accurate information so the registration can be transferred successfully. Otherwise, the registration will not be transferred and may be suspended. You should receive confirmation by mail within 14 days if your transfer is processed successfully.

What do I need to do?

Tell the buyer if your vehicle is recorded on the Victorian or an interstate writtenoff vehicles register. You must disclose this to the buyer in writing (by answering Yes or No to this question in the Vehicle details section and provide any other details to the buyer). Ensure your vehicle registration is still current (not suspended or cancelled). You can also check that you do not have any outstanding fines, warrants or sanctions issued by the Sheriff which may prevent this transfer more information at fines.vic.gov.au Do I need to get a Certificate of Roadworthiness (RWC)? In most cases, yes. Give the buyer a RWC issued in Victoria no more than 30 days before the date of sale13. The registration number on the RWC must match the number plates on the vehicle. You do not need to provide a RWC if you transfer: to your spouse or domestic partner a caravan or light trailer under 4.5 tonnes GVM a recreational motorcycle to a Licensed Motor Car Trader (LMCT) for re-sale, demo or provision to a secondary educational institution for driver education purposes certain types of vehicles that are not designed primarily for carrying passengers or goods (eg. tractor, forklift, mobile plant) For evidence requirements and other exemptions please check VicRoads website. Write a receipt for the buyer as proof of purchase and ownership (this form cannot be used as a register of title). Agree on the market value12 with the buyer and complete the Transfer details section. Complete the Seller details and Vehicle details sections and sign this form with the buyer.

3

How do I transfer with current registration?

If you buy a vehicle with number plates attached and current registration2, rights relating to the use of the number plates will pass to you.

How do I check the vehicle details?

Confirm the seller has the right to transfer the vehicle (ask the seller for evidence, eg. a certificate of registration, receipt or bill of sale) and their identity. Confirm registration status is current (not suspended or cancelled). Check these details online at vicroads.vic.gov.au/vre with the registration number or Vehicle Identification Number (VIN)10.

Confirm that the vehicle is not reported stolen, not recorded written-off and is free of encumbrance, outstanding fines, warrants or sanctions issued by the Sheriff (eg. money owing). Check these details by contacting the Personal Property Security Register (PPSR) online at ppsr.gov.au or call on 1300 007 777 (1300 00PPSR) Make sure you will be able to renew the registration. If the registration is close to expiry, a renewal notice may have already been issued to the seller. After the transfer is processed successfully, a new one should be sent to you by mail.

How do I complete the transfer?

Ask the seller if the vehicle is recorded on the Victorian or an interstate written-off vehicles register. If it is, they must disclose this to you in writing (see Vehicle details section on form). Ensure number plates are attached to the vehicle. Check the VIN10, chassis, frame or engine number matches the registration label and/or certificate. Ask the seller for a Certificate of Roadworthiness (RWC)11. The registration number on the RWC must match the number plates on the vehicle.

Authorised and published by VicRoads - 60 Denmark Street, Kew, Victoria, 3101. VRPIN00613 07.13 9 8426

OR: If you sell to an LMCT, you will need to complete the form provided by them. If the buyer does not possess a Victorian driver licence, advise the buyer that they must present original evidence of identity documents along with this application at a VicRoads Customer Service Centre. Give the original copy to the buyer to submit to VicRoads. Keep one of the copies as a record of the application for transfer and date of sale.

Ask the seller for a written receipt as proof of purchase and ownership (this form cannot be used as a register of title). Agree on the market value12 with the seller and calculate the motor vehicle duty (see how to calculate overleaf). Complete the Buyer4 details, Transfer details and Payment sections, check the Vehicle details section and sign this form with the seller. Give one copy to the seller and keep the other for your own records. Submit the original copy with relevant documents and applicable payment (see overleaf) to VicRoads within 14 days of sale. You may need to pay a penalty or additional fees if this is late or not submitted.

How do I transfer with custom or personalised plates?

If you sell your vehicle with custom or personalised number plates attached and current registration2, rights relating to the use of the number plates will pass to the buyer. If you want to keep the rights to your custom or personalised number plates for future use, you need to tell VicRoads and get new number plates for your vehicle to sell it as registered.

OR: If you buy from an LMCT you will need to complete the form provided by them, and pay your transfer fee and applicable motor vehicle duty to the LMCT who may forward this to VicRoads on your behalf.

BUYER INSTRUCTIONS CONTINUED OVERLEAF

VicRoads, GPO Box 1644, Melbourne Victoria 3001 Telephone: 13 11 71 TTY (for hearing impaired): 1300 652 321 Website: vicroads.vic.gov.au

Application for transfer of registration

Denitions

1. Registered operator either an individual or corporation who owns or manages a vehicle and has the right to register it. To register a vehicle the individual must be at least 17 years for a light vehicle, 17 years and 9 months for a motorcycle, and 18 years for a heavy vehicle. There can only be one registered operator per vehicle (no joint registration). 2. Current registration registration expires at midnight of the registration expiry date. VicRoads will cancel the registration if it is not renewed within three months after expiry. The registration can still be transferred during this three month period, but the vehicle must not be driven until registration is renewed. If the vehicle does not meet this definition, do not use this form and check VicRoads website on buying and selling (not a transfer). For heavy vehicles registered under part-year registration see VicRoads website. 3. Seller the individual or corporation who is disposing of the vehicle (current registered operator). It may be sold or given away for free. 4. Buyer the individual or corporation who is acquiring the vehicle (proposed registered operator). It may be paid for or received as a gift. 5. Surname and given name(s) must match the name on an individuals Victorian licence or evidence of identity documents. 6. Company name the name of a corporation registered with the Australian Securities and Investments Commission (ASIC). For example, Sample Cars Pty Ltd. Trading names cannot be used to register a vehicle. 7. Australian Company Number (ACN) a unique nine digit number issued to a company by Australian Securities and Investments Commission (ASIC). Australian Business Numbers (ABNs) cannot be used to register a vehicle. 8. Victorian licence / client number provide a Victorian licence number for a licensed individual or a client number for a corporation. A client number is a unique nine digit number issued by VicRoads to corporations, and individuals without a Victorian licence or learner permit. If you do not know your client number, please ensure all other details are completed. Individuals who do not have a Victorian licence number need to provide evidence of identity documents. See VicRoads website for details.

Buyer instructions continued

Do I need to provide evidence of identity?

Individuals: Yes, if you do not have a Victorian licence or learner permit, you must present full original evidence of identity documentation with this application at a VicRoads Customer Service Centre. Companies: Yes, if you do not have a client number with VicRoads, you will need to present evidence of your company with this application at a VicRoads Customer Service Centre. Please check vicroads.vic.gov.au/evidenceofidentity for requirements.

How do I lodge this application?

You must submit this form with relevant documents (eg. RWC) and applicable payment within 14 days of sale by: mail (credit card, debit card, cheque or money order) to: GPO Box 1644, Melbourne Victoria 3001 If paying by credit or debit card, provide your card details on the back of the coloured form. A confirmation advice will be sent to you within 14 days of a successful transfer of the vehicle registration. Important: If you need to provide evidence of identity, present your original documents along with this application in person at a VicRoads Customer Service Centre. If you are required to provide evidence of identity, your application for a transfer of registration will be processed at the VicRoads Customer Service Centre that you attend. Check vicroads.vic.gov.au/locations or the White Pages.

How do I apply on behalf of someone else or a company?

You must provide evidence of identity and an original signed letter of authority to act on behalf of another person or a company at a VicRoads Customer Service Centre. The letter must nominate the vehicle to be transferred. For deceased estates, refer to the Deceased Estate Information Pack or VicRoads website for further information.

Do I need to pay fees?

Yes, the buyer needs to pay a transfer fee, declare market value of the vehicle and pay motor vehicle duty (if applicable).

9. Garage address where the vehicle will normally be kept (eg. home, office or heavy vehicle depot). VicRoads will only register vehicles garaged in Victoria. If the garage address is (or will be) in another state you must register the vehicle there. If you change any of your details you must notify VicRoads within 14 days. 10. Vehicle Identification Number (VIN) a unique 17 digit identifier made up of numbers and letters on a vehicle. If there is no VIN (eg. on pre 1989 vehicles), provide a chassis, frame or engine number. 11. Certificate of Roadworthiness (RWC) also known as a Roadworthy Certificate, issued by a Victorian Licensed Vehicle Tester to certify if a vehicle is in roadworthy condition. It is valid for 30 days from the date of issue, unless a defect notice is issued within the period of validity. The seller must give the buyer a current RWC to apply for transfer of registration (some exemptions apply, see seller instructions on the previous page).

Transfer fees

Motor Vehicle - $35.30 Motorcycle/Trailer/Caravan - $5.90 Fees are subject to change, please check VicRoads website.

Market value

You must declare the correct market value (the price at which the vehicle might reasonably be sold, free from encumbrances, on the open market; or the purchase price whichever is greater). Both the seller and buyer must agree and declare the market value of the vehicle.

Do I need to pay motor vehicle duty?

In most cases, yes. The amount of motor vehicle duty payable is $8 for every $200 or part thereof of the market value. This equates to the market value (rounded up to the next multiple of $200) multiplied by 4%. You do not need to pay motor vehicle duty if the transfer falls under one of the following categories: Motor vehicle duty common exemptions between spouses or domestic partners a caravan or light trailer under 4.5 tonnes GVM to a Licensed Motor Car Trader (LMCT) for re-sale, demo or provision to a secondary educational institution for driver education purposes to a primary producer (a special vehicle, special purpose vehicle, tractor, trailer or item of agricultural equipment only) For evidence requirements and other exemptions please check VicRoads website. You can calculate motor vehicle duty online at vicroads.vic.gov.au/feecalculators

12. Market value also known as dutiable value, is the price at which the vehicle might reasonably be sold, free from encumbrances, on the open market; or the purchase price whichever is greater.

For example, if you paid $4000 but it would normally be worth $5000, the market value is $5000. For example, if you paid $6000, but it would normally be worth $5000, the market value is $6000.

13. Date of sale refers to the date of transfer or delivery, when the buyer acquires the vehicle from the seller.

Penalties

The seller (disposer) must inform the buyer in writing if the vehicle is recorded on the Victorian or an interstate written-off vehicles register. Failure to do so may result in a penalty of over $1000. The buyer (acquirer) must complete and sign this application with the seller and submit to VicRoads with relevant documents and pay the applicable motor vehicle duty and transfer fee within 14 days of sale. Failure to do so may result in a penalty of over $500. If the buyer is not a Licensed Motor Car Trader (dealer) and acquires a vehicle from a dealer, the buyer must, at the time of acquiring the vehicle, complete an application for transfer of registration form as acquirer, sign it and give it to the dealer; and unless the dealer otherwise agrees, pay to the dealer the applicable motor vehicle duty and transfer fee. Failure to do so may result in a penalty of over $1000. (Road Safety (Vehicles) Regulations 2009) This application for transfer of registration of a motor vehicle is an assessment of duty (section 217A). A person who under declares the market value is liable to a penalty equal to double the amount of duty underpaid (section 215). A person who underpays the motor vehicle duty is also liable to a penalty equal to the amount underpaid plus interest (section 217). (Duties Act 2000) A person who underpays the motor vehicle duty may be also liable to penalty tax and interest. (Taxation Administration Act 1997) VicRoads, GPO Box 1644, Melbourne Victoria 3001 Telephone: 13 11 71 TTY (for hearing impaired): 1300 652 321

How to calculate

motor vehicle duty

Market value $ 200 = A

Example calculation

Market value $ 12,420 200 = 62.1 A

ROUND UP A to the next whole number Motor (no decimals) vehicle duty x8= $

ROUND UP A to the next whole number Motor (no decimals) vehicle duty

63

x8= $

504

Website: vicroads.vic.gov.au

FORM

Application for transfer of registration

This form must be completed and signed by both the seller 3 and buyer4 and returned to VicRoads within 14 days of sale. For correct processing, please print clearly in ink using BLOCK letters. All details should be provided including the licence number for all Victorian licence holders. VicRoads vehicle register is not a register of title (vehicle ownership).

Seller details

Surname5 OR company name6

Buyer details

Surname5 OR company name6

Given name(s)5 OR ACN7 (if applicable)

Given name(s)5 OR ACN7 (if applicable)

Victorian licence / client no.8

Date of birth

Victorian licence / client no.8

Date of birth1

D

Home (or company) address

D M M

Y

Home (or company) address

D M M

Postcode Postal address (if different from above)

Postcode Garage address9 (if different from above)

Postcode Phone Email (optional)

Postcode Postal address (if different from above)

Postcode

Vehicle details

Registration number Date of registration expiry

Phone

D

Year Make

D M M

Transfer details

Market value12 of the vehicle Date of sale13 $

To avoid penalties do not under declare the market value.

Model

Body type

D M M Y

To avoid liability for traffic offences and penalties the exact date of sale must be shown.

VIN10 (chassis, frame or engine number if no VIN)

Payment

To avoid penalties the duty and fees should be paid when the application is lodged.

Exemption code (office use only)

Yes Further information about written-off vehicles is available at VicRoads website. No Have you attached an original Certificate of Roadworthiness (RWC)11 issued in Victoria not more than 30 days before the date of sale? Yes No You must attach a RWC for the form to be processed (unless exempt)11. RWC serial number RWC issue date

By signing this form, I declare that all information and/or documents provided by me is true and correct and I understand the Privacy statement. I acknowledge that a copy of this form may be provided by VicRoads to the seller (disposer) upon request. I have checked the vehicle details provided by the seller match the vehicle and agree on the market value of the vehicle as declared on this form.

Signature of buyer Date

D Y Y Y Y

M M

D

RWC testers licence number EX

D M M

Privacy statement

Providing false and/or misleading information or documents is a serious offence under the Road Safety Act 1986 and/or Marine Safety Act 2010 and can result in you being fined or imprisoned. Any authority or approval, given as a result of you providing such information/ documents, may be reversed and have no effect. Personal information VicRoads collects from you may be used for the purposes, and disclosed to persons, permitted by Section 92 of the Road Safety Act, and the Marine Safety Act 2010. It may be disclosed to various organisations and persons, including (without limitation) to contractors and agents of VicRoads, law enforcement agencies, other road and traffic authorities, the Transport Accident Commission, vehicle manufacturers (for safety recalls), road safety researchers, courts and other organisations or people authorised to collect it. You are required to provide this personal information. Failure to provide the information may result in this form not being processed, or records not being properly maintained. For further information about our use of your personal information and your right of access to it, see the VicRoads brochure Protecting your Privacy, or contact VicRoads on 13 11 71.

Signature of seller Date

D M M

THIS ORIGINAL MUST BE SUBMITTED TO VICROADS BY THE BUYER

VRPIN00613 07.1�

By signing this form, I declare that all information and/or documents provided by me is true and correct and I understand the Privacy statement. I acknowledge that a copy of this form may be provided by VicRoads to the buyer (acquirer) upon request. I have informed the buyer that this vehicle is recorded on the Victorian or an interstate written-off vehicles register (if applicable). I agree with the buyer on the market value of the vehicle as declared on this form. I declare that this vehicle is registered at the date of sale and acknowledge that any remaining period of registration of this vehicle is transferred to the buyer.

S98426

Authorised and published by VicRoads - 60 Denmark Street, Kew, Victoria, 3101.

Is this vehicle recorded on the Victorian or interstate written-off vehicles register?

Transfer fee

Motor vehicle duty

Total payable

FORM

Credit or debit card authorisation

For correct processing, please print clearly in ink using BLOCK letters. Credit or debit card authorisation (mailed payments only)

If paying by credit or debit card, please provide your card details and your authorisation for card payment here.

Card Type

Visa Mastercard

Name of cardholder

Credit or debit card no.

Total payable amount

Date of expiry

$

Signature

M M Y

Date

M M

Important: terms for credit card use

1. By signing the credit/debit card authority you have authorised VicRoads to deduct up to the total amount payable for the transfer of the vehicle registration. 2. VicRoads will arrange for funds to be debited from your nominated credit or debit card as authorised by you within fourteen (14) days of your form submission. 3. It is your responsibility to ensure that you have sufficient credit available on your credit or debit card within fourteen (14) days of submitting your form to cover your payment and that your card details are current and correct. 4. Should your credit or debit card payment default, VicRoads will notify you immediately and allow seven (7) days for you to respond with alternative payment. 5. If your declared payable amount is insufficient, VicRoads will notify you immediately and allow seven (7) days for you to pay the balance outstanding. 6. Should a response not be received within the seven (7) days allowed VicRoads may take action to suspend your registration. 7. VicRoads may charge an administration fee of $100 where payment cannot be processed based on information provided or credit card is declined. 8. If you believe that there has been an error in debiting your credit or debit card you should notify us immediately on 13 11 71 so that we can resolve your query promptly.

THIS ORIGINAL MUST BE SUBMITTED TO VICROADS BY THE BUYER

Anda mungkin juga menyukai

- IELTS TRF Request Form: MD Muzammel HossainDokumen2 halamanIELTS TRF Request Form: MD Muzammel HossainMuzammel Hossian Matin100% (1)

- Denmark Business Invitation FormDokumen4 halamanDenmark Business Invitation FormKvgroup VschtBelum ada peringkat

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDokumen3 halamanIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vBelum ada peringkat

- Labour Market Impact Assessment Application Low-Wage PositionsDokumen17 halamanLabour Market Impact Assessment Application Low-Wage PositionsJessy TranBelum ada peringkat

- About Wipro: "Applying Thought"Dokumen4 halamanAbout Wipro: "Applying Thought"Rohit ChoudharyBelum ada peringkat

- Offer LetterDokumen2 halamanOffer LetterSid PatelBelum ada peringkat

- New ContractDokumen6 halamanNew ContractRowena BagarinoBelum ada peringkat

- Biometric Instruction Letter: Study Permit Work PermitDokumen3 halamanBiometric Instruction Letter: Study Permit Work PermitKrishna MittalBelum ada peringkat

- International Education Application For Admission: Application #: Student #: Date ReceivedDokumen2 halamanInternational Education Application For Admission: Application #: Student #: Date ReceivedLilia Rosa Martinez LopezBelum ada peringkat

- OfferDokumen15 halamanOfferSarahJillGalapagoCodillaBelum ada peringkat

- Form C1 Single Work Permit Renewal ApplicationDokumen5 halamanForm C1 Single Work Permit Renewal ApplicationNaveen SoysaBelum ada peringkat

- NEW C5 - Still - AbroadDokumen3 halamanNEW C5 - Still - Abroadwork permitofficeBelum ada peringkat

- Joining Ajman Free Zone New ProcedureDokumen6 halamanJoining Ajman Free Zone New ProcedureclauraBelum ada peringkat

- Honda Job Electrical Aliston OntarioDokumen4 halamanHonda Job Electrical Aliston OntariobarnamahBelum ada peringkat

- Biometric Instruction Letter: Study Permit Work PermitDokumen3 halamanBiometric Instruction Letter: Study Permit Work Permitizaias soaresBelum ada peringkat

- TCS India Announcement - Health Insurance Coverage (HIS) and Premiums For 2008-09Dokumen2 halamanTCS India Announcement - Health Insurance Coverage (HIS) and Premiums For 2008-09Ajit KumarBelum ada peringkat

- British Council IELTS Prize 2016 17 Application FormDokumen5 halamanBritish Council IELTS Prize 2016 17 Application FormRafiBelum ada peringkat

- DZHABBAROVDokumen2 halamanDZHABBAROVfaaaafBelum ada peringkat

- PDFDokumen1 halamanPDFAnonymous aOIgRVXx57Belum ada peringkat

- Skilled Occupation List (SOL)Dokumen5 halamanSkilled Occupation List (SOL)dewminiBelum ada peringkat

- WP Contentuploads201810Form ID 10 Application For ID Card - PDF 4Dokumen8 halamanWP Contentuploads201810Form ID 10 Application For ID Card - PDF 4markattard1001Belum ada peringkat

- Employee Residents PermitDokumen16 halamanEmployee Residents PermitAnimesh JhaBelum ada peringkat

- Appointment Letter For Mahender PalDokumen4 halamanAppointment Letter For Mahender PalViraj ChaudharyBelum ada peringkat

- Electronic Travel Authorization (ETA) : Indian E-VisaDokumen1 halamanElectronic Travel Authorization (ETA) : Indian E-VisaquynhhueBelum ada peringkat

- 621571-Uddin 2Dokumen12 halaman621571-Uddin 2masumuddin440Belum ada peringkat

- Request For Health Examinations - KLYZRDokumen4 halamanRequest For Health Examinations - KLYZRKyle MerillBelum ada peringkat

- Electronic Visa: Applicant DetailsDokumen2 halamanElectronic Visa: Applicant DetailsAfghan pathan BoysBelum ada peringkat

- Legal Agreement DemoDokumen17 halamanLegal Agreement DemoAmandeepBelum ada peringkat

- Your Application For Visa Is Registered Online: WWW - Udi.no/checklistsDokumen2 halamanYour Application For Visa Is Registered Online: WWW - Udi.no/checklistsw8ndblidBelum ada peringkat

- Public AdvisoryDokumen5 halamanPublic AdvisoryManish TomarBelum ada peringkat

- ESDC Employment ContractDokumen3 halamanESDC Employment ContractMang JoseBelum ada peringkat

- Visa Services Platform (Enjaz) PDFDokumen1 halamanVisa Services Platform (Enjaz) PDFTufail RahmaniBelum ada peringkat

- Application Number: E290701480: DocumentnumberDokumen2 halamanApplication Number: E290701480: DocumentnumberPankaj MehraBelum ada peringkat

- Appointment LetterDokumen1 halamanAppointment LetterAwais WahlaBelum ada peringkat

- Terms and Conditions DirectDokumen4 halamanTerms and Conditions DirectV S Verma SurajBelum ada peringkat

- Appointment Confirmation LetterDokumen2 halamanAppointment Confirmation LetterJhangir AwanBelum ada peringkat

- Airi Bin Subari - CoEDokumen2 halamanAiri Bin Subari - CoES. AiriBelum ada peringkat

- GWF065847157Dokumen1 halamanGWF065847157Riya100% (1)

- Visa Online Application PDFDokumen2 halamanVisa Online Application PDFcreadorcitoBelum ada peringkat

- NdlsDokumen4 halamanNdlsFavio MendezBelum ada peringkat

- Imm5621gen052022 2-106dmxbyDokumen2 halamanImm5621gen052022 2-106dmxbySteven ReyesBelum ada peringkat

- Work Permit UkDokumen18 halamanWork Permit UkDiana BlackBelum ada peringkat

- VISA9659702886 Agreement 1707565420Dokumen20 halamanVISA9659702886 Agreement 1707565420Er Tapanta MukherjeeBelum ada peringkat

- Australia Template New 2015Dokumen3 halamanAustralia Template New 2015Sachin BansalBelum ada peringkat

- FWD Your Flight Receipt - TOJU ANDREA OMAYUKU 11SEP22 PDFDokumen11 halamanFWD Your Flight Receipt - TOJU ANDREA OMAYUKU 11SEP22 PDFOluwafunmilayo OmayukuBelum ada peringkat

- C.S.A (Customer Service Associate) : For TheDokumen9 halamanC.S.A (Customer Service Associate) : For Theanmol singhBelum ada peringkat

- Labour Market Impact Assessment Application Higher-Skilled OccupationsDokumen13 halamanLabour Market Impact Assessment Application Higher-Skilled Occupationsyilongwei.comBelum ada peringkat

- Dubai Visa ApplicationDokumen2 halamanDubai Visa ApplicationMakim ThakurBelum ada peringkat

- Assessment Report FormatDokumen8 halamanAssessment Report FormatFREE LANCERBelum ada peringkat

- Rfi - 2023-01-20Dokumen3 halamanRfi - 2023-01-20Mitchie PantonialBelum ada peringkat

- 2022-07-01-10-17 ChecklistDokumen6 halaman2022-07-01-10-17 ChecklistAdam Azmi100% (1)

- Police Clearance Certificate FormDokumen1 halamanPolice Clearance Certificate FormDeepesh RathiBelum ada peringkat

- 120210979077Dokumen1 halaman120210979077blue lineBelum ada peringkat

- IMMI Acknowledgement of Application ReceivedDokumen2 halamanIMMI Acknowledgement of Application ReceivedlinasaiedBelum ada peringkat

- Roundcube Webmail - Biometric Appointment Letter - Do Not ReplyDokumen1 halamanRoundcube Webmail - Biometric Appointment Letter - Do Not ReplyER.shivshanker upadhyayBelum ada peringkat

- Canara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Dokumen8 halamanCanara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Santosh KumarBelum ada peringkat

- Company Profile ENTIQA LTDDokumen8 halamanCompany Profile ENTIQA LTDnizarBelum ada peringkat

- PCL Construction Company CanadaDokumen6 halamanPCL Construction Company CanadaHarish Kumar MahavarBelum ada peringkat

- Application For Transfer of RegistrationDokumen6 halamanApplication For Transfer of RegistrationAqwBelum ada peringkat

- Application For Transfer of RegistrationDokumen6 halamanApplication For Transfer of RegistrationAnand KumarBelum ada peringkat

- Cederholm Celta Lesson Plan5 PDFDokumen6 halamanCederholm Celta Lesson Plan5 PDFjikoljiBelum ada peringkat

- IELTS Task 1 VocabDokumen5 halamanIELTS Task 1 VocabjikoljiBelum ada peringkat

- ODD ONE OUT - Vowels: (: One Word in Each Group Does Not Have The Same Vowel Sound As The Other Words. Find It!Dokumen2 halamanODD ONE OUT - Vowels: (: One Word in Each Group Does Not Have The Same Vowel Sound As The Other Words. Find It!jikoljiBelum ada peringkat

- Humpty Dumpty Explains JabberwockyDokumen3 halamanHumpty Dumpty Explains JabberwockyjikoljiBelum ada peringkat

- Birthday Survey - What Do You Do?: Questions Classmate AnswersDokumen1 halamanBirthday Survey - What Do You Do?: Questions Classmate AnswersjikoljiBelum ada peringkat

- Idiot Six Times LimitDokumen2 halamanIdiot Six Times LimitjikoljiBelum ada peringkat

- Sales Pitches: A AnswersDokumen2 halamanSales Pitches: A AnswersjikoljiBelum ada peringkat

- Inferences Worksheet 3: NameDokumen1 halamanInferences Worksheet 3: NamejikoljiBelum ada peringkat

- VU21463 - Explore Transport OptionsDokumen7 halamanVU21463 - Explore Transport OptionsjikoljiBelum ada peringkat

- VU21297 - Develop and Document A Learning Plan and Portfolio With GuidanceDokumen9 halamanVU21297 - Develop and Document A Learning Plan and Portfolio With GuidancejikoljiBelum ada peringkat

- VU21450 - Give and Respond To Short, Simple Verbal Instructions and InformationDokumen13 halamanVU21450 - Give and Respond To Short, Simple Verbal Instructions and InformationjikoljiBelum ada peringkat

- Aries March 21 - April 20Dokumen2 halamanAries March 21 - April 20jikoljiBelum ada peringkat

- VU21451 - Participate in Short, Simple ExchangesDokumen12 halamanVU21451 - Participate in Short, Simple ExchangesjikoljiBelum ada peringkat

- VU21444 - Identify Australian Leisure ActivitiesDokumen9 halamanVU21444 - Identify Australian Leisure ActivitiesjikoljiBelum ada peringkat

- AstrologyDokumen1 halamanAstrologyjikoljiBelum ada peringkat

- VU21454 - Plan Language Learning With SupportDokumen10 halamanVU21454 - Plan Language Learning With Supportjikolji100% (1)

- VU21448 - Read and Write Short, Simple Informational and Instructional TextsDokumen13 halamanVU21448 - Read and Write Short, Simple Informational and Instructional TextsjikoljiBelum ada peringkat

- Places in A City Wordsearch Puzzle Vocabulary WorksheetDokumen2 halamanPlaces in A City Wordsearch Puzzle Vocabulary Worksheetpepac41473% (15)

- Food Fruit Vocabulary Wordsearch Puzzle WorksheetDokumen2 halamanFood Fruit Vocabulary Wordsearch Puzzle Worksheetpepac41478% (9)

- Changing WorldDokumen11 halamanChanging WorldjikoljiBelum ada peringkat

- Hello Is Nando ThereDokumen1 halamanHello Is Nando TherejikoljiBelum ada peringkat

- To Her Door - Paul KellyDokumen2 halamanTo Her Door - Paul KellyjikoljiBelum ada peringkat

- Band 6 IELTS Sample EssayDokumen2 halamanBand 6 IELTS Sample EssayjikoljiBelum ada peringkat

- Education Hub Band 8 IELTS Essay - Grammarly ReportDokumen3 halamanEducation Hub Band 8 IELTS Essay - Grammarly ReportjikoljiBelum ada peringkat

- Transcript of Albert NamatjiraDokumen6 halamanTranscript of Albert NamatjirajikoljiBelum ada peringkat

- Utmost Good Faith Principle & Cause ProximaDokumen4 halamanUtmost Good Faith Principle & Cause ProximaTONG SHU ZHEN100% (1)

- Ivan's FAM SummaryDokumen70 halamanIvan's FAM SummaryjhseowBelum ada peringkat

- REW-Global-CTC 2.001 Room Benefits ProgramDokumen5 halamanREW-Global-CTC 2.001 Room Benefits ProgramfariasBelum ada peringkat

- Review Questions: Click On The Questions To See AnswersDokumen10 halamanReview Questions: Click On The Questions To See AnswersJinjer Ann LanticanBelum ada peringkat

- Application: Details:: How To Get A Succession CertificateDokumen3 halamanApplication: Details:: How To Get A Succession CertificateGurbal TradingBelum ada peringkat

- Mostrade Compliance Information SheetDokumen13 halamanMostrade Compliance Information SheetFRANCISCORAFAELPARRA5738Belum ada peringkat

- IESChoiceof FundDokumen3 halamanIESChoiceof FundtedpopperBelum ada peringkat

- ATIYAH Introduction To The Law of ContractDokumen5 halamanATIYAH Introduction To The Law of ContractDanBelum ada peringkat

- 2019 National Transmission Corp. v. Bermuda20210424 12 15pq9ohDokumen9 halaman2019 National Transmission Corp. v. Bermuda20210424 12 15pq9ohAnonymous RabbitBelum ada peringkat

- Test Bank Law 2 DiazDokumen11 halamanTest Bank Law 2 DiazGray JavierBelum ada peringkat

- Look Into Deposits in Cases of General and Special Examination To Further Investigate TheDokumen4 halamanLook Into Deposits in Cases of General and Special Examination To Further Investigate TheJoanna MBelum ada peringkat

- Mayon Hotel V AdanaDokumen2 halamanMayon Hotel V AdanaJoeyBoyCruzBelum ada peringkat

- Mediation ProcessDokumen2 halamanMediation ProcessAsena MaseiBelum ada peringkat

- 1992 S C M R 1832Dokumen7 halaman1992 S C M R 1832MianArshidFarooqBelum ada peringkat

- Agueda de Vera vs. CA April 14, 1999 (CASE DIGEST)Dokumen4 halamanAgueda de Vera vs. CA April 14, 1999 (CASE DIGEST)Glen BasiliscoBelum ada peringkat

- Cheques Act 41 of 1968Dokumen7 halamanCheques Act 41 of 1968Diana WangamatiBelum ada peringkat

- Tarea para El Lunes 15Dokumen6 halamanTarea para El Lunes 15laura bermudezBelum ada peringkat

- Eskayef Pfi Ccin2010577Dokumen6 halamanEskayef Pfi Ccin2010577Abdul Al RajaBelum ada peringkat

- International Economics 13th Edition Carbaugh Test BankDokumen16 halamanInternational Economics 13th Edition Carbaugh Test BankHeidiMartinqofa100% (56)

- An Overview of Public Liability Insurance Act 1991+Dokumen4 halamanAn Overview of Public Liability Insurance Act 1991+raghavmayank886Belum ada peringkat

- Conditional OfferDokumen3 halamanConditional Offermandipkunwar369Belum ada peringkat

- App 44 2019 Guardall Security Group LTD Vs Reinford Kabwe APPEAL Coram Kondolo Makungu Siavwapa JJADokumen38 halamanApp 44 2019 Guardall Security Group LTD Vs Reinford Kabwe APPEAL Coram Kondolo Makungu Siavwapa JJALupapula MarianBelum ada peringkat

- Rent Deed or Lease AgreementDokumen8 halamanRent Deed or Lease AgreementNasir Bukhari100% (1)

- 5 - Data Room Procedure TemplatesDokumen8 halaman5 - Data Room Procedure TemplatesnajahBelum ada peringkat

- What Is Intellectual Property?Dokumen28 halamanWhat Is Intellectual Property?JiMBelum ada peringkat

- Filipina Samson V. Julia A. Restrivera: G.R. No. 178454 - March 28, 2011Dokumen1 halamanFilipina Samson V. Julia A. Restrivera: G.R. No. 178454 - March 28, 2011Verbena Daguinod - BalagatBelum ada peringkat

- Pil ReviewerDokumen5 halamanPil Reviewerlaw.school20240000Belum ada peringkat

- Easement of Right of WayDokumen2 halamanEasement of Right of WayRonbert Alindogan RamosBelum ada peringkat

- Pbcom vs. CirDokumen2 halamanPbcom vs. CirCaroline A. LegaspinoBelum ada peringkat

- Stipulated Price Contract: Kal Tire # - New 7-Bay Automotive Service Facility Westgrove Common, Spruce Grove, ABDokumen33 halamanStipulated Price Contract: Kal Tire # - New 7-Bay Automotive Service Facility Westgrove Common, Spruce Grove, ABNzar HamaBelum ada peringkat