GuideStar's IRS Tax Exempt Org Codes PDF

Diunggah oleh

aleta356Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

GuideStar's IRS Tax Exempt Org Codes PDF

Diunggah oleh

aleta356Hak Cipta:

Format Tersedia

IRS Subsection Codes for Tax-Exempt Organizations

11/27/13 11:23 PM

Internal Revenue Service Subsection Codes for TaxExempt Organizations

The following chart lists the different kinds of tax-exempt organizations and whether or not contributions to them are tax deductible. It is based on IRS Publication 557 and T.D. 8818. For more information, see IRS Publication 557 and T.D. 8818 or consult your tax advisor. Section of Code Description of Categories Annual Return Required to Be Filed None Disclosure Requirements Contributions Allowable

501(c) (1)

Corporations Organized under Act of Congress (including Federal Credit Unions) Title Holding Corporation for Exempt Organization Religious, Educational, Charitable, Scientific, Literary, Testing for Public Safety, to Foster National or International Amateur Sports Competition, or Prevention of Cruelty to Children or Animals Organizations Civic Leagues, Social Welfare Organizations, and Local

None

Yes, if made for exclusively public purposes No2

501(c) (2) 501(c) (3)

Form 9901 or 990EZ8 Form 9901, 990EZ8, or 990-PF

Form 990 or 990-EZ Form 1024 Form 990, 990-EZ, or 990-PF Form 1023

Yes, generally

501(c) (4)

Form 9901 or 990-

Form 990 or 990-EZ

No, generally2,3

Page 1 of 5

http://www.guidestar.org/rxg/help/irs-subsection-codes.aspx

IRS Subsection Codes for Tax-Exempt Organizations

11/27/13 11:23 PM

501(c) (5) 501(c) (6) 501(c) (7) 501(c) (8)

Associations of Employees Labor, Agricultural, and Horticultural Organizations Business Leagues, Chambers of Commerce, Real Estate Boards, Etc. Social and Recreational Clubs

EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8

Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024

No2

No2

No2

Fraternal Beneficiary Societies and Associations

Yes, for certain Sec. 501(c)(3) purposes No2

501(c) (9) 501(c) (10)

Voluntary Employees Beneficiary Associations Domestic Fraternal Societies and Associations

Yes, for certain Sec. 501(c)(3) purposes No2

501(c) (11) 501(c) (12)

Teacher's Retirement Fund Associations Benevolent Life Insurance Associations, Mutual Ditch or Irrigation Companies, Mutual or Cooperative Telephone Companies, Etc. Cemetery Companies

No2

501(c) (13) 501(c) (14)

Form 9901 or 990EZ8 Form 9901 or 990EZ8

Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024

Yes, generally

State Chartered Credit Unions, Mutual Reserve Funds

No2

http://www.guidestar.org/rxg/help/irs-subsection-codes.aspx

Page 2 of 5

IRS Subsection Codes for Tax-Exempt Organizations

11/27/13 11:23 PM

501(c) (15)

Mutual Insurance Companies or Associations

Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 990BL Form 990 or 990EZ8 Form 990 or 990EZ8 Form 990 or 990-EZ Form 9901 or 990EZ8 Form 9901 or 990EZ8

Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990-BL (except Schedule A) Form 990 or 990-EZ Form 990 or 990-EZ Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ Form 1024 Form 990 or 990-EZ

No2

501(c) (16) 501(c) (17) 501(c) (18) 501(c) (19) 501(c) (21) 501(c) (22) 501(c) (23) 501(c) (25) 501(c) (26) 501(c) (27)11

Cooperative Organizations to Finance Crop Operations Supplemental Unemployment Benefit Trusts Employee Funded Pension Trust (created before June 25, 1959) Post or Organization of Past or Present Members of the Armed Forces Black Lung Benefit Trusts

No2

No2

No2

No, generally7

No4

Withdrawal Liability Payment Fund Veterans Organizations (created before 1880) Title Holding Corporations or Trusts with Multiple Parents State-Sponsored Organization Providing Health Coverage for High-Risk Individuals State-Sponsored Workers' Compensation Reinsurance Organization

No5

No, generally7

No

No

No

http://www.guidestar.org/rxg/help/irs-subsection-codes.aspx

Page 3 of 5

IRS Subsection Codes for Tax-Exempt Organizations

11/27/13 11:23 PM

501(c) (28)12 501(d)

National Railroad Retirement Investment Trust Religious and Apostolic Associations Cooperative Hospital Service Organizations Cooperative Service Organizations of Operating Educational Organizations Child Care Organizations

Not yet determined Form 10659 Form 9901 or 990EZ8 Form 9901 or 990EZ8 Form 990 or 990EZ8 Form 9901 or 990EZ8 Form 990C Form 990PF Form 5227 None

None

No

Form 1065 (except Schedule K-1) Form 990 or 990-EZ Form 1023 Form 990 or 990-EZ Form 1023 Form 990 or 990-EZ Form 1023 Form 990 or 990-EZ Form 1023 Form 990-C Form 990-PF None None

No2

501(e)

Yes

501(f)

Yes

501(k)

Yes

501(n)

Charitable Risk Pools

Yes

521(a) 4947(a) (1) 4947(a) (2) 170(c) (1)

Farmers' Cooperative Associations Non-Exempt Charitable Trusts Split-Interest Trust Government Entity

No No13 No14 Yes, if made for exclusively public purposes

1. For exceptions to the filing requirement see chapter 2 of Publication 557 and the general instructions for Form 990. 2. An organization exempt under a subsection of Code sec. 501 other than 501(c)(3) may establish a charitable fund, contributions to which are deductible. Such a fund must itself meet the requirements of section 501(c)(3) and the related notice requirements of section 508(a).

http://www.guidestar.org/rxg/help/irs-subsection-codes.aspx Page 4 of 5

IRS Subsection Codes for Tax-Exempt Organizations

11/27/13 11:23 PM

3. Contributions to volunteer fire companies and similar organizations are deductible, but only if made for exclusively public purposes. 4. Deductible as a business expense to the extent allowed by Code section 192. 5. Deductible as a business expense to the extent allowed by Code section 194A. 6. Application is by letter to the address shown on Form 8718. A copy of the organizing document should be attached and the letter should be signed by an officer. 7. Contributions to these organizations are deductible only if 90% or more are of the organization's members are war veterans. 8. For limits on the use of Form 990-EZ, see chapter 2 of Publication 557 and the general instructions for Form 990-EZ (or Form 990). 9. Although the organization files a partnership return, all distributions are deemed dividends. The members are not entitled to pass-through treatment of the organization's income or expenses. 10. Form 1120-POL is required only if the organization has taxable income as defined in IRC 527(c). 11. 501(c)(27) organizations (State-Sponsored Workers' Compensation Reinsurance Organizations) do not appear on GuideStar because they are not included on the I.R.S. Business Master File (BMF). 12. There is only one 501(c)(28) organization (the National Railroad Retirement Investment Trust), which was created by an act of Congress. It is not included on the BMF and therefore does not appear on GuideStar. 13. Only the person(s) who established a 4947(a)(1) non-exempt charitable trust may contribute to it. 14. Only the person(s) who established a split-interest trust may contribute to it.

GuideStar is a 501(c)(3) nonprofit organization. Copyright 2013, GuideStar USA, Inc. All rights reserved.

Follow Us

http://www.guidestar.org/rxg/help/irs-subsection-codes.aspx

Page 5 of 5

Anda mungkin juga menyukai

- Tax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, Procedures - 2015 Cumulative SupplementDari EverandTax Planning and Compliance for Tax-Exempt Organizations: Rules, Checklists, Procedures - 2015 Cumulative SupplementBelum ada peringkat

- The Law of Tax-Exempt Healthcare Organizations 2016 SupplementDari EverandThe Law of Tax-Exempt Healthcare Organizations 2016 SupplementBelum ada peringkat

- Annual Form 990 Filing Requirements For Tax-Exempt OrganizationsDokumen2 halamanAnnual Form 990 Filing Requirements For Tax-Exempt OrganizationsAngalakurthy Vamsi KrishnaBelum ada peringkat

- Jewish Guild For The Blind 2008 TaxesDokumen77 halamanJewish Guild For The Blind 2008 TaxesSteven ThrasherBelum ada peringkat

- OR OUR Nformation: Information For Non-Profit OrganizationsDokumen8 halamanOR OUR Nformation: Information For Non-Profit OrganizationsFuji guruBelum ada peringkat

- Everytown Gun Safety Action Fund - 990 Tax FormDokumen118 halamanEverytown Gun Safety Action Fund - 990 Tax FormCNBC.comBelum ada peringkat

- US Internal Revenue Service: p3835Dokumen6 halamanUS Internal Revenue Service: p3835IRSBelum ada peringkat

- Form - 1040 - Schedule BDokumen2 halamanForm - 1040 - Schedule BEl-Sayed FarhanBelum ada peringkat

- Received: Return of Organization Exempt From Income TaxDokumen16 halamanReceived: Return of Organization Exempt From Income Taxcmf8926Belum ada peringkat

- Statement of Activities Outside The United States: Open To Public InspectionDokumen5 halamanStatement of Activities Outside The United States: Open To Public InspectionBilboDBagginsBelum ada peringkat

- Justice 990 2005 (Schedule A)Dokumen4 halamanJustice 990 2005 (Schedule A)TheSceneOfTheCrimeBelum ada peringkat

- United Against Nuclear Iran 2013 Schedule BDokumen3 halamanUnited Against Nuclear Iran 2013 Schedule BelicliftonBelum ada peringkat

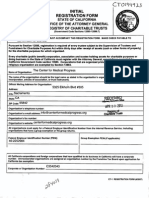

- Center For Medical Progress California RegistrationDokumen10 halamanCenter For Medical Progress California RegistrationelicliftonBelum ada peringkat

- FreedomWorks Foundation 521526916 2010 074FD753SearchableDokumen44 halamanFreedomWorks Foundation 521526916 2010 074FD753Searchablecmf8926Belum ada peringkat

- F 1040 SBDokumen2 halamanF 1040 SBapi-252942620Belum ada peringkat

- Statement of Activities Outside The United States: Open To Public InspectionDokumen5 halamanStatement of Activities Outside The United States: Open To Public InspectionFrancis Wolfgang UrbanBelum ada peringkat

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDokumen2 halamanRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRSBelum ada peringkat

- Annual Form 990 Filing Requirements For Tax-Exempt OrganizationsDokumen2 halamanAnnual Form 990 Filing Requirements For Tax-Exempt OrganizationsmwandrusBelum ada peringkat

- l111l l11l I L, 111I: Lil LilDokumen26 halamanl111l l11l I L, 111I: Lil Lilcmf8926Belum ada peringkat

- W9Dokumen4 halamanW9James-heatha GowersBelum ada peringkat

- Project Veritas Tax Exemption ApplicationDokumen22 halamanProject Veritas Tax Exemption ApplicationLachlan MarkayBelum ada peringkat

- Private Foundations Tax GuideDokumen48 halamanPrivate Foundations Tax GuideKyu Chang HanBelum ada peringkat

- f1024 PDFDokumen22 halamanf1024 PDFMonica GradyBelum ada peringkat

- IRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusDokumen16 halamanIRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusgeneisaacBelum ada peringkat

- 2012 Instructions For Schedule F: Profit or Loss From FarmingDokumen20 halaman2012 Instructions For Schedule F: Profit or Loss From FarmingRonnie QuimioBelum ada peringkat

- Attention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business DayDokumen3 halamanAttention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business Daypreston_40200350% (2)

- The Delta Chi Fraternity, IncDokumen4 halamanThe Delta Chi Fraternity, IncKevin CammBelum ada peringkat

- IRS-BIR On NGO'sDokumen5 halamanIRS-BIR On NGO'sgaryBelum ada peringkat

- Responsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 3/11/14Dokumen41 halamanResponsive Document - CREW: IRS: Regarding 501c Correspondence and Work Plan - 3/11/14CREWBelum ada peringkat

- US Internal Revenue Service: F990sa - 1996Dokumen6 halamanUS Internal Revenue Service: F990sa - 1996IRSBelum ada peringkat

- IRS Publication 334 2010Dokumen55 halamanIRS Publication 334 2010mtn3077Belum ada peringkat

- 501 CDokumen20 halaman501 CEn Mahaksapatalika0% (1)

- FDD 1023Dokumen23 halamanFDD 1023eliclifton100% (1)

- FW 9Dokumen4 halamanFW 9api-268381837Belum ada peringkat

- 2012 Building Intl Bridges (03!28!2013)Dokumen17 halaman2012 Building Intl Bridges (03!28!2013)Jk McCreaBelum ada peringkat

- Instructions For Form 1120-L: U.S. Life Insurance Company Income Tax ReturnDokumen20 halamanInstructions For Form 1120-L: U.S. Life Insurance Company Income Tax ReturnIRSBelum ada peringkat

- IRS Publication Form Instructions 1099 MiscDokumen10 halamanIRS Publication Form Instructions 1099 MiscFrancis Wolfgang UrbanBelum ada peringkat

- Study For Tax DeductionsDokumen4 halamanStudy For Tax DeductionsHei Nah MontanaBelum ada peringkat

- Employer Identification Number (EIN) Application / RegistrationDokumen3 halamanEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- Clinton Foundation Revised Filing 2013Dokumen108 halamanClinton Foundation Revised Filing 2013Daily Caller News FoundationBelum ada peringkat

- ST Ending:: CincinnatiDokumen3 halamanST Ending:: CincinnatiMassiBelum ada peringkat

- US Internal Revenue Service: f1120sn AccessibleDokumen2 halamanUS Internal Revenue Service: f1120sn AccessibleIRS100% (1)

- US Internal Revenue Service: f1120sn - 2002Dokumen2 halamanUS Internal Revenue Service: f1120sn - 2002IRSBelum ada peringkat

- IRS Form W-9Dokumen8 halamanIRS Form W-9SAHASec8Belum ada peringkat

- 2016 OVF 990EZ With SchedulesDokumen7 halaman2016 OVF 990EZ With SchedulesDaniel R. Gaita, MA, LMSWBelum ada peringkat

- Instructions For Form 1099-MISC: Future DevelopmentsDokumen9 halamanInstructions For Form 1099-MISC: Future Developmentspiz84Belum ada peringkat

- Heartland Institute 363309812 2009 063E9EE8SearchableDokumen34 halamanHeartland Institute 363309812 2009 063E9EE8Searchablecmf8926Belum ada peringkat

- W8-BEN PaypalDokumen3 halamanW8-BEN PaypalKarol Machajewski67% (6)

- How To Register A Foundation in The PhilippinesDokumen2 halamanHow To Register A Foundation in The PhilippinesArlene Estrebillo100% (1)

- I. Taxation & Tax Rebates For Donors: F & R I P N - P O IDokumen19 halamanI. Taxation & Tax Rebates For Donors: F & R I P N - P O IdpfsopfopsfhopBelum ada peringkat

- Request For Taxpayer Identification Number and CertificationDokumen4 halamanRequest For Taxpayer Identification Number and CertificationLogan BairdBelum ada peringkat

- Irs 990-Ez 2007Dokumen3 halamanIrs 990-Ez 2007api-18678301Belum ada peringkat

- Fw8eci PDFDokumen1 halamanFw8eci PDFAnonymous qaI31HBelum ada peringkat

- Private Foundations: Tax Law and Compliance, 2016 Cumulative SupplementDari EverandPrivate Foundations: Tax Law and Compliance, 2016 Cumulative SupplementBelum ada peringkat

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnDari EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnBelum ada peringkat

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleDari EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductiblePenilaian: 3 dari 5 bintang3/5 (1)

- ABHA Coil ProportionsDokumen5 halamanABHA Coil ProportionsOctav OctavianBelum ada peringkat

- Lecture 19 Code Standards and ReviewDokumen27 halamanLecture 19 Code Standards and ReviewAdhil Ashik vBelum ada peringkat

- CandyDokumen24 halamanCandySjdb FjfbBelum ada peringkat

- Fce Use of English 1 Teacher S Book PDFDokumen2 halamanFce Use of English 1 Teacher S Book PDFOrestis GkaloBelum ada peringkat

- JMC MSDS Puraspec 1173 (GB)Dokumen10 halamanJMC MSDS Puraspec 1173 (GB)Benny Samsul B.Belum ada peringkat

- Worked Solution Paper5 A LevelDokumen8 halamanWorked Solution Paper5 A LevelBhoosan AncharazBelum ada peringkat

- What Is The PCB Shelf Life Extending The Life of PCBsDokumen9 halamanWhat Is The PCB Shelf Life Extending The Life of PCBsjackBelum ada peringkat

- Kortz Center GTA Wiki FandomDokumen1 halamanKortz Center GTA Wiki FandomsamBelum ada peringkat

- DG Oil SpecificationDokumen10 halamanDG Oil SpecificationafsalmohmdBelum ada peringkat

- Aircraft Wiring Degradation StudyDokumen275 halamanAircraft Wiring Degradation Study320338Belum ada peringkat

- How To Change Front Suspension Strut On Citroen Xsara Coupe n0 Replacement GuideDokumen25 halamanHow To Change Front Suspension Strut On Citroen Xsara Coupe n0 Replacement Guidematej89Belum ada peringkat

- Dist - Propor.danfoss PVG32Dokumen136 halamanDist - Propor.danfoss PVG32Michal BujaraBelum ada peringkat

- PathologyDokumen31 halamanPathologyStudy Usmle100% (1)

- APJ Abdul Kalam Success StoryDokumen1 halamanAPJ Abdul Kalam Success StorySanjaiBelum ada peringkat

- Study and Interpretation of The ScoreDokumen10 halamanStudy and Interpretation of The ScoreDwightPile-GrayBelum ada peringkat

- Assignment November11 KylaAccountingDokumen2 halamanAssignment November11 KylaAccountingADRIANO, Glecy C.Belum ada peringkat

- 1KHW001492de Tuning of ETL600 TX RF Filter E5TXDokumen7 halaman1KHW001492de Tuning of ETL600 TX RF Filter E5TXSalvador FayssalBelum ada peringkat

- Assignment - 1 AcousticsDokumen14 halamanAssignment - 1 AcousticsSyeda SumayyaBelum ada peringkat

- MegaMacho Drums BT READ MEDokumen14 halamanMegaMacho Drums BT READ MEMirkoSashaGoggoBelum ada peringkat

- PCM Cables: What Is PCM Cable? Why PCM Cables? Application?Dokumen14 halamanPCM Cables: What Is PCM Cable? Why PCM Cables? Application?sidd_mgrBelum ada peringkat

- JIMMA Electrical&ComputerEngDokumen219 halamanJIMMA Electrical&ComputerEngTewodros71% (7)

- 02 CT311 Site WorksDokumen26 halaman02 CT311 Site Worksshaweeeng 101Belum ada peringkat

- Rapp 2011 TEREOS GBDokumen58 halamanRapp 2011 TEREOS GBNeda PazaninBelum ada peringkat

- Chemical & Ionic Equilibrium Question PaperDokumen7 halamanChemical & Ionic Equilibrium Question PapermisostudyBelum ada peringkat

- Optical Transport Network SwitchingDokumen16 halamanOptical Transport Network SwitchingNdambuki DicksonBelum ada peringkat

- Fertilisation and PregnancyDokumen24 halamanFertilisation and PregnancyLopak TikeBelum ada peringkat

- Ferobide Applications Brochure English v1 22Dokumen8 halamanFerobide Applications Brochure English v1 22Thiago FurtadoBelum ada peringkat

- P01 - PT in Building & Its AdvantagesDokumen11 halamanP01 - PT in Building & Its AdvantagesPartha Pratim RoyBelum ada peringkat

- BSNL BillDokumen3 halamanBSNL BillKaushik GurunathanBelum ada peringkat

- Art Integrated ProjectDokumen14 halamanArt Integrated ProjectSreeti GangulyBelum ada peringkat