Implementare Plata Card

Diunggah oleh

undrayHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Implementare Plata Card

Diunggah oleh

undrayHak Cipta:

Format Tersedia

N E T O P I A SRL Bucuresti, Romania www.mobilpay.

ro

Preface

About This Guide

The API Developer Reference describes the mobilPay API for generating mobilPay purchases and understanding the mobilPay API response

Intended Audience

This guide is written for developers who are implementing mobilPay's card and bank transfer processing services using the API.

Documentation Feedback

elp us improve this guide by sending feedback to! documentation"mobilPay.ro

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

mobilPay API Basics

mobilPay offers a set of application programming interfaces #APIs$ that give you the means to incorporate mobilPay functionality into your website applications and mobile apps. This document describes how to make calls to mobilPay API and how to interpret the instant payment notification #IP%$ from mobilPay.

mobilPay API Client-Server Architecture

The mobilPay API uses a client&server model in which your website is a client of the mobilPay server. A page on your website initiates an action on a mobilPay API server by sending a re'uest to the server. This re'uest will always be send using the method P()T to one of the payment *R+ #service endpoints$ specified. The mobilPay server processes the credit card information presented by the cardholder and responds with an IP% to a callback *R+ previously specified in the re'uest.

Security

The mobilPay API service is protected to ensure that only authori,ed mobilPay members use it. There are three levels of security! -. Re'uest authentication using an API )ignature included in the re'uest #)ignature field$ .. The data e/changed between the client 0 mobilPay server and back is encrypted using R)A keys 1. )ecure )ockets +ayer #))+$ data transport for the re'uest2 optional2 if available on the merchant side2 for the response.

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

Payment Request/Response Flow

3ou will redirect the client to mobilPay together with a payment re'uest. This re'uest will have two variables! env_key 4 this is the envelope associated with the public key generated upon payment encryption data 4 this is the 56+ structure presented below2 signed with the public certificate mobilPay has provided. The certificate is available upon seller account creation in Admin 4 )eller accounts 4 7dit 4 )ecurity settings.

Service Endpoints

3ou should always start the payment by using P()T method for redirecting the client to one of these endpoints! standard payment2 live mode 4 https!88secure.mobilpay.ro cvv only payment2 live mode 4 https!88secure.mobilpay.ro8card1 prefilled card data payment2 live mode 4 https!88secure.mobilpay.ro8card9 standard payment2 live mode 4 http!88sandbo/secure.mobilpay.ro cvv only payment2 live mode 4 http!88sandbo/secure.mobilpay.ro8card1 prefilled card data payment2 live mode 4 http!88sandbo/secure.mobilpay.ro8card9 If you want to display the payment interface in a different language2 you should append the language identifier to the specific endpoint2 i.e. https!88secure.mobilpay.ro8en for 7nglish.

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

Payment

e!uest Structure

The following annotated description of the 56+ re'uest structure shows the elements re'uired by the mobilPay API. <?xml version="1.0" encoding="utf-8"?> <order type="card|transfer" id="string64" timestamp="YYYYmmddHHiiss"> <signature>XXXX-XXXX-XXXX-XXXX-XXXX</signature> <invoice currency="RON" amount="XX.YY" installments=R1,R2 selected_installments=R2 customer_type=2 customer_id=internal_id token_id=token_identifier pan_masked=NNNN> <details>Payment Details</details> <contact_info> <billing type="company|person"> <first_name>first_name</first_name> <last_name>last_name</last_name> <email>email_address</email> <address>address</address> <mobile_phone>mobile_phone</mobile_phone> </billing> </contact_info> </invoice> <recurrence payments_no=NN interval_day=DD> </recurrence> <params> <param> <name>param1Name</name> <value>param1Value</value> </param> </params> <url> <confirm>http://www.your_website.com/confirm</confirm> <return>http://www.your_website.com/return</return> </url> </order>

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

e!uest Parameters

order type 4 states the type of transaction that is to be initiated. It can be either card or transfer: order id 4 this is an internal identifier of your order. It should not have more than ;9 characters #string$ and should be uni'ue for a seller account. *nless you specifically want to make a payment re'uest for the same order2 this attribute should be refreshed on each payment re'uest. 3ou will use this identifier when you receive the payment response: timestamp 4 this is the timestamp of your server formatted as 333366DDhhmmss #i.e. .<-1<=.><.<1<9 is .<-12 )eptember .>th2 <.!<1!<9$ signature 4 uni'ue key assigned to your seller account for the payment process. ?an be obtained from mobilPay's merchant console and has to look like 5555& 5555&5555&5555: invoice 4 the details of the payment about to be initiated: currency 4 the currency in which the payment will be processed. )hould be the I)( code of the currency #i.e. R(% for Romanian +eu$. 3ou can also set whichever currency you want2 but if mobilPay's legal department hasn't cleared you for that currency2 the amount will be converted to R(% and displayed in dual currency2 with R(% first: amount the amount to be processed. A minimum of <.-< and a ma/imum of ===== units are permitted: installments 4 #optional$ this is the installments number available for the payment. This is an integer and needs to be previously set in the console by a mobilPay representative: selected_installments 4 #optional$ this is the number of installments that the client has selected on your web application. It should be an integer within the values specified in the installments attribute:

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

customer_type 4 this specifies the customer type within mobilPay. It is optional for standard payments2 but mandatory and always has the value @.A for ?BB only payments: customer_id 4 this is the internal identifier of your customer. It is mandatory for ?BB only payments2 and should be uni'ue. token_id this is the token you have previously received from mobilPay upon a first payment re'uest. It helps identify the customer and the payment instrument for ?BB only payments: pan_masked 4 the first - and last 9 digits of the credit card associated with the tokenCid above. 3ou may use this to present the client with the card he is about to use2 in a friendly manner: details 4 the details of the payment as they will appear in the mobilPay secure payment page: contact_info 4 information regarding the payer. The data here is optional2 but if you provide it in the re'uest2 the customer will be presented with a more fluent payment e/perience2 where the second step #asking for customer data$ will no longer be present: billing type 4 the type of customer. It can be either person or company: first_name 4 the first name of the customer: last_name 4 the last name of the customer: email 4 email address of the customer: mobile_phone 4 phone number of the customer: address 4 address of the customer: recurrence 4 this element is optional2 unless you want to generate recurrent payments: payments_no 4 the number of payments that are to be processed: interval_day 4 the time interval for processing a payment2 in days #ie every 1< days$:

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

params 4 you may send an array of custom parameters2 with as much data as needed in order to have a large enough number of details regarding the payer and8or the product being paid for: url 4 this element specifies where mobilPay will communicate the payment result confirm 4 a *R+ in your web application that will be called whenever the status of a payment changes or a manual IP% is being sent. This is a transparent asynchronous call2 however2 the first call is always synchronous: return 4 a *R+ in your web application where the client will be redirected to once the payment is complete. %ot to be confused with a success or cancel *R+2 the information displayed here is dynamic2 based on the information previously sent to confirm *R+.

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

Payment

esponse Structure

*pon every change in the status of a payment2 mobilPay will make a P()T to the *R+ you have set as confirm. mobilPay will construct the parameters in the same way you have done when making the payment re'uest. Data will be encrypted using a 5><= public certificate and you will use the private key provided by mobilPay to decrypt it. 3ou will receive all the parameters you have sent2 unchanged2 and mobilPay will add another element2 called mobilpay2 to the response 56+. The following annotated description of the 56+ response structure shows the elements sent by the mobilPay API. <?xml version="1.0" encoding="utf-8"?> <order type="card|transfer" id="string64" timestamp="YYYYMMDDHHMMSS"> {your_request_XML} <mobilpay timestamp="YYYYMMDDHHMMSS" crc="XXXXX"> <action>action_type</action> <customer type="person|company"> <first_name>first_name</first_name> <last_name>last_name</last_name> <address>address</address> <email>email_address</email> <mobile_phone>phone_no</mobile_phone> </customer> <purchase>mobilPay_purchase_no</purchase> <original_amount>XX.XX</original_amount> <processed_amount>NN.NN</processed_amount> <current_payment_count>X</current_payment_count> <pan_masked>X****YYYY</pan_masked> <payment_instrument_id>ZZZZZZZ</payment_instrument_id> <token_id>token_identifier</token_id> <token_expiration_date>YYYY-MM-DD HH:MM:SS</token_expiration_date> <error code="N">error_message</error> </mobilpay> </order>

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

esponse Parameters

mobilpay this is mobilPay's response2 appended you your unchanged re'uest: timestamp 4 mobilPay's internal timestamp2 format 333366DD crc 4 mobilPay internal identifier check: action 4 the action attempted by mobilPay. Possible actions are @new2 paidCpending2 confirmedCpending2 paid2 confirmed2 credit2 canceledA. This is not the status of the transaction2 as all actions can either fail or succeed: customer type 4 the type of paying customer. This is the data provided to mobilPay by the customer. ?an be either person or company. first_name 4 the customer's first name2 as inserted in the payment page: last_name & the customer's first name2 as inserted in the payment page: address 4 the customer's address2 as inserted in the payment page: email 4 the customer's email address2 as inserted in the payment page: mobile_phone 4 the customer's phone2 as inserted in the payment page: purchase 4 mobilPay internal identifier. This is uni'ue for the entire mobilPay platform: original_amount 4 the original amount processed: processed_amount 4 the processed amount at the moment of the response. It can be lower than the original amount2 ie for capturing a smaller amount or for a partial credit: current_payment_count 4 for recurrent payments2 this is the number of the current payment: pan_masked 4 first - and last 9 digits of the credit card used. )tore this and use it for presenting the customer with a friendly way of identifying the payment instrument: payment_instrument_id 4 this is an internal mobilPay identifier of the payment instrument2 and allows you to check for its uni'ueness: token_id 4 this is the token associated with the payment instrument. 3ou can use it to initiate ?BB only payments:

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

)):

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

token_expiration_date 4 the e/piration date of the token. It is usually set to the e/piration date of the card: error code 4 the error code states whether the action has been successful or not. A < #,ero$ value states that the action has succeeded. A different value means it has not: error message 4 the error message associated to the error code. This is generally a message that can be presented to the user in order to help him understand why a transaction has been reDected2 or if it has been approved.

"erchant#s esponse

Eor each call to your confirm *R+2 you will need to send a response in 56+ format back to mobilPay2 in order to help us understand whether you have successfully recorded the response or not. Eor debugging purposes2 you may view your response in mobilPay console #(rder 4 Details 4 6erchant ?ommunication +og$ The following annotated description of the 56+ response structure shows the elements sent by you to the mobilPay API. <?xml version="1.0" encoding="utf-8" ?> <crc error_type=1|2 error_code={numeric}>{message}</crc> The attributes of the crc element are only sent if you had any problem recording the IP%2 and have the following meaning error_type 4 based on this mobilPay will activate a resend IP% mechanism or not. If its value is -2 it means you encountered a temporary error. )et it to . if you encountered a permanent error: error_code 4 this is your internal error code2 helping you to view the error generated by your web application: message 4 if you encountered an error while processing the IP%2 this should be your error message2 helping you find the error. If no error occurred2 you should set this to the crc value received in the IP%

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

N E T O P I A SRL Bucuresti, Romania www.mobilpay.ro

Error Code $alues

< 4 approved -; 4 card has a risk #i.e. stolen card$ -F 4 card number is incorrect -G 4 closed card -= 4 card is e/pired .< 4 insufficient funds .- 4 cBB. code incorrect .. 4 issuer is unavailable 1. 4 amount is incorrect 11 4 currency is incorrect 19 4 transaction not permitted to cardholder 1> 4 transaction declined 1; 4 transaction reDected by antifraud filters 1F 4 transaction declined #breaking the law$ 1G 4 transaction declined 9G 4 invalid re'uest 9= 4 duplicate PR7A*T >< 4 duplicate A*T >- 4 you can only ?A%?7+ a preauth order >. 4 you can only ?(%EIR6 a preauth order >1 4 you can only ?R7DIT a confirmed order >9 4 credit amount is higher than auth amount >> 4 capture amount is higher than preauth amount >; 4 duplicate re'uest == 4 generic error

Acest document este con idential. Acest document este proprietatea N E T O P I A SRL. !opierea sau reproducerea, partial sau in totalitate, olosind orice modalitate, "a i pedepsita con orm le#ii.

Anda mungkin juga menyukai

- Contract of SaleDokumen4 halamanContract of Salecorvinmihai591Belum ada peringkat

- CedoDokumen11 halamanCedoMircea GrozavuBelum ada peringkat

- Alin Popescu - Romania - Stolen Vehicles TraffickingDokumen21 halamanAlin Popescu - Romania - Stolen Vehicles TraffickingAurelian Buliga-StefanescuBelum ada peringkat

- Efectuarea Urmăririi Penale de Către Parchetul European The Criminal Investigation Conducted by The European Public Prosecutor's OfficeDokumen21 halamanEfectuarea Urmăririi Penale de Către Parchetul European The Criminal Investigation Conducted by The European Public Prosecutor's OfficeIonut StuparuBelum ada peringkat

- Gherdan Sergiu Valentin Raspunderea DelictualaDokumen82 halamanGherdan Sergiu Valentin Raspunderea Delictualamarius.peter2399Belum ada peringkat

- Unele Probleme Privind Excepţia de NeconstituţionalitateDokumen13 halamanUnele Probleme Privind Excepţia de NeconstituţionalitateVasea OpreaBelum ada peringkat

- Legislația Uniunii Europene: Recunoașterea Și Executarea Hotărârilor Din Perspectiva Regulamentului (UE) ... 227Dokumen17 halamanLegislația Uniunii Europene: Recunoașterea Și Executarea Hotărârilor Din Perspectiva Regulamentului (UE) ... 227ZenaidaIsculescuBelum ada peringkat

- Procesual PenalDokumen6 halamanProcesual PenalBlanky OfBelum ada peringkat

- Content Chapter I: Definition of Bar-Code. Common Types Chapter II: Usage of Bar-Code in Marketing Conclusion ReferencesDokumen21 halamanContent Chapter I: Definition of Bar-Code. Common Types Chapter II: Usage of Bar-Code in Marketing Conclusion ReferencesCray AlisterBelum ada peringkat

- E COMMERCE FINAL COVERAGE MODULE 1 and 2Dokumen9 halamanE COMMERCE FINAL COVERAGE MODULE 1 and 2BRIAN CORPUZ INCOGNITOBelum ada peringkat

- Contract Prestari Servicii AC EUROCOMPANYDokumen5 halamanContract Prestari Servicii AC EUROCOMPANYAndrusKaAndrEiBelum ada peringkat

- Documentatie MobilpayDokumen12 halamanDocumentatie MobilpayMihai IsvoranuBelum ada peringkat

- 1.1 Introduction of E-BankingDokumen33 halaman1.1 Introduction of E-BankingahmedtaniBelum ada peringkat

- Easypay Web Service IntegrationDokumen16 halamanEasypay Web Service IntegrationTrkić AmerBelum ada peringkat

- Implementare Plata Prin SMS - OfflineDokumen8 halamanImplementare Plata Prin SMS - OfflinedernukerBelum ada peringkat

- 1.1 Introduction of E-BankingDokumen33 halaman1.1 Introduction of E-BankingahmedtaniBelum ada peringkat

- Easypay Web Service Integration - Annex 2Dokumen10 halamanEasypay Web Service Integration - Annex 2Trkić AmerBelum ada peringkat

- PayUMoney Technical Integration DocumentDokumen14 halamanPayUMoney Technical Integration Documentschiranjeevi2007100% (1)

- Java Midlet SpecDokumen7 halamanJava Midlet SpeccarlettuBelum ada peringkat

- Ar and ApDokumen3 halamanAr and ApTamal BiswasBelum ada peringkat

- Project of E-Banking Definition of E-BankingDokumen28 halamanProject of E-Banking Definition of E-Bankingniraliparekh27Belum ada peringkat

- Ipay88 Multicurrency GatewayDokumen12 halamanIpay88 Multicurrency GatewayWLK89Belum ada peringkat

- Review of Some Online Banks and Visa/Master Cards IssuersDari EverandReview of Some Online Banks and Visa/Master Cards IssuersBelum ada peringkat

- Documentatie Card Payment MobilPayDokumen11 halamanDocumentatie Card Payment MobilPayOvidiu AlexBelum ada peringkat

- Im Mini ProjectDokumen10 halamanIm Mini Projectsrividya balajiBelum ada peringkat

- ATM Reporting System ReportDokumen6 halamanATM Reporting System ReportTabish AlmasBelum ada peringkat

- Canteen Ordering System For Unilever: StakeholdersDokumen10 halamanCanteen Ordering System For Unilever: StakeholderstheunspokenlegendBelum ada peringkat

- Question What Could Be The Probable Reason For Not Showing The Taxes in Project Draft Invoices?Dokumen16 halamanQuestion What Could Be The Probable Reason For Not Showing The Taxes in Project Draft Invoices?rasemahe4Belum ada peringkat

- Synd e PassbookDokumen4 halamanSynd e PassbookUday GopalBelum ada peringkat

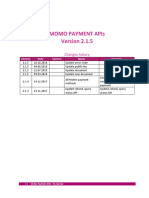

- MoMo Payment APIs v2.1.5Dokumen39 halamanMoMo Payment APIs v2.1.5Trịnh Hùng Anh100% (1)

- Retailer's ManualDokumen3 halamanRetailer's ManualAndrew FranciscoBelum ada peringkat

- R12 SEPA Core Direct Debit WhitepaperDokumen12 halamanR12 SEPA Core Direct Debit WhitepaperAliBelum ada peringkat

- Paynow: Fact Sheet What Is Paynow: September 2021 Page 1 of 8Dokumen8 halamanPaynow: Fact Sheet What Is Paynow: September 2021 Page 1 of 8Баро АбуискандерBelum ada peringkat

- Level Up Your CardingDokumen114 halamanLevel Up Your Cardinggiopapiashvili9Belum ada peringkat

- PM Challenge Case Study: Problem DefinitionDokumen6 halamanPM Challenge Case Study: Problem DefinitionBhavenParakhBelum ada peringkat

- Payment Gateway: at Indiamart Intermesh LimitedDokumen147 halamanPayment Gateway: at Indiamart Intermesh LimitedArchit Khandelwal50% (2)

- SRS and Design For Banking MGT SystemDokumen16 halamanSRS and Design For Banking MGT Systemiboy TechBelum ada peringkat

- Srs FinalDokumen11 halamanSrs FinalQUDDUS LARIKBelum ada peringkat

- SnapScan Payments GuideDokumen7 halamanSnapScan Payments GuideNaomi SmartBelum ada peringkat

- Quick Installation Guide For PayGate OpenPayAPI PDFDokumen13 halamanQuick Installation Guide For PayGate OpenPayAPI PDFPaygateBelum ada peringkat

- Chapter 1: - E-BankingDokumen74 halamanChapter 1: - E-Bankingashishpuri313772Belum ada peringkat

- SEPA MandanteDokumen14 halamanSEPA MandanteAnonymous IpnRP293Belum ada peringkat

- Project of E-Banking Definition of E-BankingDokumen28 halamanProject of E-Banking Definition of E-Bankingsangeetar28129Belum ada peringkat

- Bo de Thi CK EPaymentDokumen7 halamanBo de Thi CK EPaymentNguyên Đoàn Thị KhánhBelum ada peringkat

- Synd E-Passbook User ManualDokumen3 halamanSynd E-Passbook User ManualAryan yadavBelum ada peringkat

- APPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesDokumen4 halamanAPPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesKevin JacobBelum ada peringkat

- Content Project 3Dokumen46 halamanContent Project 3ram73110Belum ada peringkat

- Echallan User ManualDokumen16 halamanEchallan User ManualSatish NookalaBelum ada peringkat

- User Guide-Estamps: S T A M P SDokumen16 halamanUser Guide-Estamps: S T A M P SSaahiel SharrmaBelum ada peringkat

- Ecommerce PresentationDokumen9 halamanEcommerce PresentationSurabhi AgrawalBelum ada peringkat

- EinvoiceapisandboxDokumen4 halamanEinvoiceapisandboxgagansapbasis9590Belum ada peringkat

- Electronic Cash1Dokumen4 halamanElectronic Cash1AtharvaBelum ada peringkat

- Single Euro Payments Area in SAPDokumen12 halamanSingle Euro Payments Area in SAPRicky Das100% (1)

- QR PH P2P FAQsDokumen5 halamanQR PH P2P FAQsArman D. VillarascoBelum ada peringkat

- Registration For NADRA Verisys /biometric Facility by SECP Regulated EntitiesDokumen9 halamanRegistration For NADRA Verisys /biometric Facility by SECP Regulated EntitiesZain BabaBelum ada peringkat

- Mobile & DTH Recharge API DocumentationDokumen7 halamanMobile & DTH Recharge API DocumentationPankaj KumarBelum ada peringkat

- Payment Gateway Original DataDokumen6 halamanPayment Gateway Original DataAshrithaBelum ada peringkat

- Faq Mobile BankingDokumen4 halamanFaq Mobile Bankingrezina pokhrelBelum ada peringkat

- 2018uit2584 S.E. LabDokumen15 halaman2018uit2584 S.E. Labhello motoBelum ada peringkat

- Eselectplus PHP Ig-MpiDokumen15 halamanEselectplus PHP Ig-MpiMuhammad AzeemBelum ada peringkat

- NPU ReplacementDokumen6 halamanNPU ReplacementImran MalikBelum ada peringkat

- Soekarno Hatta International Airport Terminal 3: Hak Cipta © PT Pixel KomunitasDokumen13 halamanSoekarno Hatta International Airport Terminal 3: Hak Cipta © PT Pixel KomunitasRefriBelum ada peringkat

- RecoverPoint Vs SRDFDokumen3 halamanRecoverPoint Vs SRDFPruthvi999Belum ada peringkat

- Lab 11 Optional Practice Error HandlingDokumen40 halamanLab 11 Optional Practice Error HandlingManigandan SivarajBelum ada peringkat

- RPi USB WebcamsDokumen7 halamanRPi USB WebcamsManoj MadushanthaBelum ada peringkat

- Operating System Concepts (Linux) : Lab InstructorDokumen29 halamanOperating System Concepts (Linux) : Lab InstructorMUHAMMAD ADNAN SALEEMBelum ada peringkat

- Top 10 Futura Alternatives For 2017 TypewolfDokumen5 halamanTop 10 Futura Alternatives For 2017 TypewolfluisricardosantosBelum ada peringkat

- Avneet Singh: Professional SummaryDokumen3 halamanAvneet Singh: Professional SummaryAvneetBelum ada peringkat

- ITVFusion 5.7 STB User GuideDokumen98 halamanITVFusion 5.7 STB User GuideVilasak ItptBelum ada peringkat

- Assignment 3 - Advanced Project in Axure RPDokumen4 halamanAssignment 3 - Advanced Project in Axure RPSarahWangBelum ada peringkat

- College Management SystemDokumen34 halamanCollege Management SystemAkshita Pillai50% (10)

- Liferay DXP 7.2 Features Overview PDFDokumen27 halamanLiferay DXP 7.2 Features Overview PDFJuan Víctor Martínez SierraBelum ada peringkat

- 2.1.4.8 Packet Tracer - Navigating The IOS InstrucDokumen5 halaman2.1.4.8 Packet Tracer - Navigating The IOS InstrucVanessa MorochoBelum ada peringkat

- Pulkit Arora ResumeDokumen3 halamanPulkit Arora Resumepulkitism1586Belum ada peringkat

- Amazon Integration With OsCommerceDokumen10 halamanAmazon Integration With OsCommercemmalam81Belum ada peringkat

- LAB 02a Manage Subscriptions and RBACDokumen5 halamanLAB 02a Manage Subscriptions and RBACSec AboutBelum ada peringkat

- Operating System MCQ Questions With Answer - OS Question - Computer FundamentalDokumen3 halamanOperating System MCQ Questions With Answer - OS Question - Computer FundamentalSojol KumarBelum ada peringkat

- Windows Vista Installation GuideDokumen8 halamanWindows Vista Installation GuideThi HaBelum ada peringkat

- SCORE Oracle v3.1Dokumen149 halamanSCORE Oracle v3.1Quốc TuấnBelum ada peringkat

- Parents Can Sign Up As An Observer in CanvasDokumen3 halamanParents Can Sign Up As An Observer in Canvasapi-353567032Belum ada peringkat

- 1.1.16 Lab - Install A Virtual Machine On A Personal Computer - Answer KeyDokumen4 halaman1.1.16 Lab - Install A Virtual Machine On A Personal Computer - Answer KeyPradeepkhanth BBelum ada peringkat

- STi7105 PDFDokumen313 halamanSTi7105 PDFkernuBelum ada peringkat

- Operating System English PowerpointDokumen12 halamanOperating System English PowerpointZaferBelum ada peringkat

- Transfer FSMO Roles Using The GUI: Emulator, Follow The Steps BelowDokumen8 halamanTransfer FSMO Roles Using The GUI: Emulator, Follow The Steps Belowmateigeorgescu80Belum ada peringkat

- SaasDokumen6 halamanSaasrameshkoutarapuBelum ada peringkat

- Hilary's One Page DevOps Engineer ResumeDokumen1 halamanHilary's One Page DevOps Engineer ResumeHilary Holz100% (1)

- Fallout4custom IniDokumen7 halamanFallout4custom IniTobias MrBelum ada peringkat

- Setup LogDokumen221 halamanSetup LogCarlos MendezBelum ada peringkat

- Growth Hacking Activation WorkshopDokumen147 halamanGrowth Hacking Activation Workshopaspireist100% (2)

- PruebaDokumen15 halamanPruebafernandoBelum ada peringkat