Understanding Hotel Valuation Techniques

Diunggah oleh

Jamil FakhriHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Understanding Hotel Valuation Techniques

Diunggah oleh

Jamil FakhriHak Cipta:

Format Tersedia

UnderstandingHotelValuationTechniques

GiulianoGasparini

October2011

Objectives

Whydowedovaluations?

Wh h t l diff t f th l t t ? Whyhotelaredifferentfromanyotherrealestate?

Whatisvalue?

Understanding hotel valuation techniques Understandinghotelvaluationtechniques

Conclusion:whatisimportanttohaveinordertoproducea

goodhotelvaluation?

Conclusion

Whydowedovaluations?

Because:

i i th t k h k t d t d t th companiesinthestockexchangemarketneedtoupdatethe

valueoftheirassetseveryyear;

hotelownersmightbegoingtoabankto askforaloanoffering g g g g

thehotelascollateral;

hotelinvestorsmightbeinterestedinpurchasingaspecific

h t l hotel;

hotelownersmightbewillingtoselltheirhotel;

A company would like to merge with another company and Acompanywouldliketomergewithanothercompany and

needtounderstandhowmuchcapitaltheyarebringingthrough

theirassets;

Manyotherreasons

Whyhotelaredifferentfromanyotherreal

estate? estate?

We have always been told that Wehavealwaysbeentoldthat

thepriceofanhotelisequalto

thepriceoffivelittlegreen

houses

.ITISNOTTRUE!

Whyhotelaredifferentfromanyotherreal

estate? estate?

OFFICE = valued on m

2

basis OFFICE=valuedonm

2

basis

RENTEDONAm

2

BASIS

GENERATESCASHFLOWONAM

2

BASIS

RESIDENTIAL=valuedonm

2

basis

2

RENTEDONAm

2

BASIS

GENERATESCASHFLOWONAM

2

BASIS

Whyhotelaredifferentfromanyotherreal

estate? estate?

Hotelsarenotrentedonam

2

basis

astheydonotgeneratecashflowonam

2

basis

Whatisthebasisofhotelincomegeneration?

Yotel,LondonGatwick(UK)

BanfiCastle,Tuscany(Italy) WHotel,Barcelona(Spain)

Whyhotelaredifferentfromanyotherreal

estate? estate?

Hotelscashflowisgeneratedby:

Rooms

Food & Beverage

Gym / Spa / Health Centre

Minor Operating Department Minor Operating Department

Whatisavalue?

Open Market Value

Fair Value

Likely Future Value

Investment Value

Market Value

Residual Land Value Residual Land Value

Cal c ul at i on of Wor t h

Mortgage Landing Value

Whatisavalue?

Market Value is the estimated amount for which a

property should exchange on the date of valuation

between a willing buyer and a willing seller in an

arms-length transaction after proper marketing

wherein the parties had each acted knowledgeably,

prudently and without compulsion.

IVSC 1

Hotelvaluationtechniques

Fun

10,000Rule

Basic

EBITDAmultiplier

Yield

Expert

ReplacementCost

SalesComparables onaperroombasis

NetPresentValueoffuturecashflows

Hotelvaluationtechniques

Fun

10,000Rule

Takethepriceofatinofcoke

fromthehotelminibarand

multiply it for 10 000 multiplyitfor10,000

Example

k Cokeprice=4Euro

Hotelvalue=40,000Europer

room room

Hotelvaluationtechniques

Example p

Cokeprice=4Euro

Hotelvalue=40,000Europerroom

Limitations

P i f k i i i b d i i h Priceofcokeinminibardonotincreaseinthesamewayas

hotelcashflows(imaginea3staranda5starhotel)

This methodology does not take into consideration any Thismethodologydoesnottakeintoconsiderationany

performanceresultsforthehotel.Ifthehotelismakingor

loosingmoney,roompriceisthesame.

! DONOTTAKEITTOOSERIOUSLY!

Hotelvaluationtechniques

Basic

EBITDAmultiplier

Yield

Hotelvaluationtechniques

Basic

EBITDAmultiplier p

Yield

TakehotelsEBITDAandmultiplyitbyamultiplierinaccordance

tohotelsmarket,position,location,pastperformances,etc

Example

EBITDA=2,000,000US$

Multiplier=12

HotelValue=24,000,000US$

Hotelvaluationtechniques

Basic

EBITDAmultiplier p

Yield

E l

TakehotelsEBITDAanddivideitbyyourexpectedyield

Example

EBITDA=1,000,000Euro

Expected level of yield= 7% Expectedlevelofyield 7%

HotelValue= =14,285,000

1,000,000

7%

Hotelvaluationtechniques

Expert

ReplacementCost

SalesComparables onaperroombasis

NetPresentValueoffuturecashflows

Hotelvaluationtechniques

Expert

ReplacementCost aidealaveragepurchaser,havinganaverage

levelofinformation,willverylikelybuyapropertyatamaximum

price that is equivalent to the cost of building a similar property pricethatisequivalenttothecostofbuildingasimilarproperty

thatfeaturesthesamelevelofutility

SalesComparables onaperroombasis

NetPresentValueoffuturecashflows

Hotelvaluationtechniques

Expert

ReplacementCost aidealaveragepurchaser,havinganaverage

levelofinformation,willverylikelybuyapropertyatamaximum

price equivalent to the cost of building a similar property that priceequivalenttothecostofbuildingasimilarpropertythat

featuresthesamelevelofutility

Example

Weneedmanyinformationsuchas:

Constructioncostperm

2

FF&E

Y f t ti Yearofconstruction

ReplacementCost

Past

Constructioncosts

Today

Constructioncosts

Laborcosts

FF&E

Laborcosts

FF&E

ReplacementCost

Past

Constructioncosts

Today

Constructioncosts

Laborcosts

FF&E

Laborcosts

FF&E

Technologyhasadvancedandnewbuildingtechniquesmakes

buildingtodaycheaperthanyesterday.

ReplacementCost

Past

Constructioncosts

Today

Constructioncosts

Laborcosts

FF&E

Laborcosts

FF&E

Laborcostshaschangeddrasticallyinthelast1020years.

Thisisevenmoredrasticindevelopingcountries. p g

ReplacementCost

Past

Constructioncosts

Today

Constructioncosts

Laborcosts

FF&E

Laborcosts

FF&E

Priceoffurnitureandfixinghasreduced

extensivelyinthelastdecade. y

ReplacementCost

Depreciation Depreciation

Past

Constructioncosts

Today

Constructioncosts

Laborcosts

FF&E

Laborcosts

FF&E

Aftertakingallthisintoaccountwestillhavetodiscountthe

resultbackintimetoreflectthatthehotelwearevaluing

isnotbrandnew(depreciation)

ReplacementCost

Depreciation Depreciation

Ifvaluationmethodologyisthis,howwouldyouvaluethese?

DunboyCastleResort,Cork(Ireland)

CiraganPalaceKempinski,Istanbul(Turkey)

LakePalaceHotel,Udaipur(India)

ReplacementCost limitations

Derivingahotelsvaluebycalculatingthecostofreplacingitand

deductinganallowanceforcumulativedepreciation g p

USES USES

Easytobeunderstood

Usefulfornewproperties

LIMITATIONS

Notalwayspossible,especiallyforhistoricalhotels

Doesnotreflectinvestorrationale

D i ti b h i l f ti l d/ t l Depreciationcanbephysical,functionaland/orexternal

Hotelvaluationtechniques

Expert

Replacement Cost ReplacementCost

SalesComparables onaperroombasis:apotentialstandard

buyer,featuringastandardlevelofinformation,willpurchasea

propertyatamaximumpriceequivalenttothesalepriceofa

similarpropertywiththesamelevelofutility

Net Present Value of future cash flows NetPresentValueoffuturecashflows

Hotelvaluationtechniques

Expert

Sales Comparables on a per room basis: a potential standard SalesComparables onaperroombasis:apotentialstandard

buyer,featuringastandardlevelofinformation,willpurchasea

propertyatamaximumpriceequivalenttothesalepriceofa

i il t ith th l l f tilit similarpropertywiththesamelevelofutility.

Example p

Wearewillingto

purchasetheHotel

Rit i P i RitzinParis

Category:5starluxury

161 rooms 161rooms

SaleComparables

Weinvestigatethemarkettofindwhichhotelhasbeensoldin

2010andatwhichprice:

HotelLutetia,5star

231rooms

Priceperroom=627,000

145,000,000Euro

RenaissanceArcdeTriomphe,5star p ,

118rooms

114,000,000Euro

Priceperroom=966,000

HoteldeCrillon,5starluxury

147 rooms 147rooms

250,000,000Euro

Priceperroom=1,700,000

SaleComparables

Consideringtheabove,howmuchwouldyoubewillingtopay?

HotelLutetia

627,000

RenaissanceArcdeTriomphe

966,000

HoteldeCrillon

1,700,000

SaleComparables

Consideringtheabove,howmuchwouldyoubewillingtopay?

Similarlocation

Similarcategoryandservice

Similarnumberofrooms

Roompricing(12

th

September):

Crillon: 680 Euro

HoteldeCrillon

1,700,000

Crillon:680Euro

Ritz:850Euro(25%higher)

Weshouldexpecttopaymore/lessthanHoteldeCrillon?

+25%=2,125,000perroom161rooms=342,125,000 , , p , ,

Pricerange:1,700,000 2,125,000

SalesComparable limitations

USES

Provides a range of values Providesarangeofvalues

Comparehotelscurrentlyforsaletoexistingpropertiesthathave

beenalreadysoldonthemarket(themarkethasbeentestedfor

theseslevelsofprices)

Givesanindicationofrealbuyersmotivation(marketdrivenprice)

LIMITATIONS

No hotel is truly comparable Nohotelistrulycomparable

Valueisdependentonbuyermotivation(whatifspecial

motivation?)

Economicenvironmentmaydiffer(location,time)

Reliablehotelsalesdatanotalwaysavailable

Hotelvaluationtechniques

Expert

Replacement Cost ReplacementCost

SalesComparables onaperroombasis

NetPresentValueoffuturecashflows:NetPresentValueof

futurecashflowsgeneratedbytheproperty

Hotelvaluationtechniques

Expert

Replacement Cost ReplacementCost

SalesComparables onaperroombasis

NetPresentValueoffuturecashflows:NetPresentValueof

futurecashflowsgeneratedbytheproperty

Conversionoftheanticipatedbenefitsofpropertyownership

(annualincome)intoanestimateofpresentvalue

Hotelvaluationtechniques

Property with trading potential, such as hotels, fuel

stations, restaurants, or the like, the Market Value

of which may include assets other than land and

buildings alone. These properties are commonly

sold in the market as operating assets and with

regard to their trading potential. Also called property

ith t di t ti l with trading potential.

IVSC GN 12, para 3.5

Hotelvaluationtechniques

NetPresentValueoffuturecashflows:NetPresentValueof

futurecashflowsgeneratedbytheproperty g y p p y

Thiscanbedonethroughthebasicmethodsexplained:

SingleCapRate

Multipliers

C i li i C h IncomeCapitalization DCFApproach

Hotelvaluationtechniques

NetPresentValueoffuturecashflows:NetPresentValueof

futurecashflowsgeneratedbytheproperty. g y p p y

Thiscanbedonethroughtheeasymethodsexplained:

SingleCapRate:derivingahotelsvaluebyapplyinga

capitalizationratetothehotelsnetincome

Multipliers Multipliers

IncomeCapitalization DCFApproach

SingleCapRate example

2010

N of rooms 100 N. of rooms 100

Hotel Occupancy 67%

Average Room Rate 130

Total Revenue 4,768,000

House Profit / GOP 2,335,000

Net Operating income / EBITDA 1,478,000

Capitalization Rate 9%

HotelValue:16,400,000

Valueperroom:164,000

SingleCapRate limitations

USES

Lead to quick results Leadtoquickresults

Usedcommonlyandwidelyunderstood

LIMITATIONS

Itisbasedonone(last)incomeyearonly

Donotreflectpropensityofincometoriseorfall

Notalwaysreliable(smallchangesinthecaprateproducelarge

effect on value) effectonvalue)

Hotelvaluationtechniques

NetPresentValueoffuturecashflows:NetPresentValueof

futurecashflowsgeneratedbytheproperty g y p p y

Thiscanbedonethroughtheeasymethodsexplained:

SingleCapRate

Multipliers:derivingahotelsvaluebyapplyingacapitalization

rate to an estimate of the hotels stabilized net income ratetoanestimateofthehotel sstabilizednetincome

IncomeCapitalization DCFApproach

Multiplier example

2010 2015

N of rooms 100 100 N. of rooms 100 100

Hotel Occupancy 67% 75%

Average Room Rate 130 155

Total Revenue 4,768,000 6,360,000

House Profit / GOP 2,335,000 3,180,000

Net Operating income / EBITDA 1,478,000 1,910,000

Capitalization Rate 9% 10%

Value

16,400,000

19,100,000

Value per Room

164,000

191,000

Multiplier limitations

USES

More comprehensive approach (take into account management Morecomprehensiveapproach(takeintoaccountmanagement

factors)

Reflectsthepossibilityofincometoriseorfall

Usedmoreandmoreoftenandunderstoodmoreandmore

widely

LIMITATIONS

The valuer needs more details regarding hotel operation and Thevaluerneedsmoredetailsregardinghoteloperationand

management

Thevaluerneedsabetterunderstatingofthemarketandthe

tradingpotentialoftheassetinthatmarket

Hotelvaluationtechniques

NetPresentValueoffuturecashflows:NetPresentValueof

futurecashflowsgeneratedbytheproperty g y p p y

SingleCapRate

Multipliers

IncomeCapitalization DCFApproach:derivingahotelsvalue

by applying an appropriate discount rate to a projection of the byapplyinganappropriatediscountratetoaprojectionofthe

hotelsestimatedfuturecashflow

IncomeCapitalization DCFApproach

Weassumeaholdingperiodof10years

Ineachyearweestimatethetradingpotentialoftheproperty

T i l A t

Ineachyearweestimatetheoperationalresultoftheproperty

Weassumeasaleattheendofyear10(TerminalAssetValue)

TerminalAsset

Value

$

EBITDAs

+

time

+

IncomeCapitalization DCFApproach

$

TerminalAsset

EBITDAs

Value

Years

0

10

IncomeCapitalization DCFApproach

$

TerminalAsset

EBITDAs

Value

Years

0

10

IncomeCapitalization DCFApproach

$

TerminalAsset

EBITDAs

Value

Years

0

10

IncomeCapitalization DCFApproach

$

TerminalAsset

Value

EBITDAs

10

Years

0

DiscountingFactor

IncomeCapitalization DiscountFactor

DISCOUNTFACTOR

Reflectthetimevalueofmoney

R fl h i k f h i Reflecttheriskoftheinvestment

WACC = Weighted Average Cost of Capital WACC=WeightedAverageCostofCapital

IncomeCapitalization Example

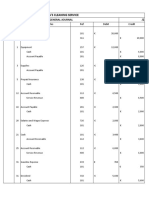

Year 1 2 3 4 5 6 7 8 9 10 Year 1 2 3 4 5 6 7 8 9 10

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

N.ofrooms 100 100 100 100 100 100 100 100 100 100

HotelOccupancy 67% 69% 71% 72% 72% 72% 72% 72% 72% 72%

AverageRoomRate 125 128 131 137 142 148 154 160 166 173

T l R 4 585 313 4 816 631 5 104 931 5 383 905 5 599 261 5 823 231 6 056 161 6 298 407 6 550 343 6 812 357 TotalRevenue 4.585.313 4.816.631 5.104.931 5.383.905 5.599.261 5.823.231 6.056.161 6.298.407 6.550.343 6.812.357

HouseProfit/GOP 2.246.803 2.360.149 2.501.416 2.638.113 2.743.638 2.853.383 2.967.519 3.086.219 3.209.668 3.338.055

NetOperatingincome/EBITDA 1.421.447 1.493.156 1.582.529 1.669.010 1.735.771 1.805.202 1.877.410 1.952.506 2.030.606 2.111.831

CapRate 9,0%

TerminalAssetValue 23.464.786

WACCCalculation

Cashflow 1.421.447 1.493.156 1.582.529 1.669.010 1.735.771 1.805.202 1.877.410 1.952.506 2.030.606 25.576.616

WACC 12,55%

V l 16 561 804

LTV 60%

Equity 40%

Interest 6%

EquityYield 22%

Value 16.561.804

say 16.600.000

WACC 12,55%

IncomeCapitalization limitations

USES

Providesabetteroverviewofthepropertystradingpotential

Reflectsavaluebasedonfutureandnotonpresentorpast

Takeintoaccountoperationsandmanagementcharacteristics

( ibili ) T k i k id h (Ol i (possibilityto)Takeintoaccountmarketwidechanges(Olympic,

Games,NewConferenceCentres,etc)

LIMITATIONS

Thevaluerneedstounderstandindepththemarketandthetrading

potential of the asset in that market potentialoftheassetinthatmarket

Thevaluerneedstounderstandindepththehotelspecificoperation

andmanagement

Thevaluerneedstobeexperiencedofthehospitalitysectorinorder

toestimateallcashflowsthatarethebasisofthevaluation

Valuationdatawishlist

Whatisimportanttohave:

Historicaldataforthelocalmarket

Historicaldataoftheproperty(Profit&LossStatements)

What is important to know: Whatisimportanttoknow:

understandingofthetradingpotentialofthemarket(demand

versussupply,newsupply)

Understatingoftradingpotentialoftheproperty(market

penetrationaprojectionsofmarketpenetration)

Understanding of the operational side in order to produce Understandingoftheoperationalsideinordertoproduce

representativecashflows

Understandingofthefinancialaspects(currentLTV,equityyield,

etc)andoftheriskconnectedtothisinvestment

Comparisonwithstockmarket

Twoapproachestovaluation: pp

IntrinsicValue:isdeterminedbythecashflowsyouexpect that

assettogenerateoveritslifeandhowuncertainyoufeelaboutthese

cashflows.Assetswithhighandstablecashflowsshouldworthmore

thanassetswithlowandvolatilecashflows.

RelativeValue:inrelativevaluationsassetsarevaluedbylooking

athowthemarketpricessimilarassets.Thus,determiningwhat topay

for a house you would look at what similar houses in the forahouse,youwouldlookatwhatsimilarhousesinthe

neighbourhoodsoldfor.

TheLittleBookofValuation AswathDamodaran

ProfessorofFinanceattheSternSchoolofBusinessatNewYorkUniversity

Comparisonwithstockmarket

Inintrinsicvaluationsthereare4piecesofinformationthatdeterminevalue:

1. Cashflowsformexistingassets;

2. Expectedgrowthinthesecashflows;

3 Discount rate; 3. Discountrate;

4. Thelengthoftime beforethebusinessbecomesmature.

TheLittleBookofValuation AswathDamodaran

ProfessorofFinanceattheSternSchoolofBusinessatNewYorkUniversity

Havewereachedourobjectives?

Whydoweneedhotelvaluations?

Wh h t l l ti diff t? Whyhotelvaluationsaredifferent?

WhatisValue

Valuation techniques: Valuationtechniques:

ReplacementCost

SalesComparables onaperroombasis p p

NetPresentValueoffuturecashflows

EBITDAmultiplier

Yield

10,000Rule

U d li i i f h l i h i Usesandlimitationsforeachvaluationtechnique

Whatisimportanttohavetoproducegoodvaluations?

Whatelsewouldbepartofthecourse?

WhicharetheKPIsforhotelvaluation?

Howisitpossibletovaluehotelunderdevelopment?

Howisitpossibletovaluehotelsthatarenotyetbuilt?

Howisitpossibletovaluehotelsthatareloosingmoney?

Howthevalueofhotelschangesthroughoutlifecycle?

EffectofaBrand:howdoesthevaluechangeifthehotelbecomes

branded? branded?

WhatisthedifferentbetweenMarketValueandLiquidation

Value?

WhataretherequirementsofRICSforvaluations?

Whobuyswhat?Whichistheperfectbuyerforwhichhotel?

How can we value a Resort? (Resort business models) HowcanwevalueaResort?(Resortbusinessmodels)

Contacts

GiulianoGasparini

ggasparini@faculty.ie.edu

Anda mungkin juga menyukai

- Real Estate Development - 4th Edition: Principles and ProcessDari EverandReal Estate Development - 4th Edition: Principles and ProcessPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- Workbook Answers: AQA AS/A-level BusinessDokumen32 halamanWorkbook Answers: AQA AS/A-level BusinessSteven FowlerBelum ada peringkat

- How Real Estate Developers Think: Design, Profits, and CommunityDari EverandHow Real Estate Developers Think: Design, Profits, and CommunityPenilaian: 5 dari 5 bintang5/5 (8)

- AI Shopping Center Appraisal and Analysis 2ndDokumen300 halamanAI Shopping Center Appraisal and Analysis 2nddavydovda_213509369100% (5)

- Real Estate Interview QuestionsDokumen1 halamanReal Estate Interview QuestionstodipaBelum ada peringkat

- HVS - Historical Trends Hotel Management ContractsDokumen17 halamanHVS - Historical Trends Hotel Management Contracts*Maverick*Belum ada peringkat

- Making It in Real Estate: Starting Out as a DeveloperDari EverandMaking It in Real Estate: Starting Out as a DeveloperPenilaian: 3.5 dari 5 bintang3.5/5 (9)

- Hotels and Resorts - An Investor ' S GuideDokumen389 halamanHotels and Resorts - An Investor ' S GuideAnonymous 4YqvCTlds100% (2)

- How To Evaluate Private Real Estate InvestmentsDokumen22 halamanHow To Evaluate Private Real Estate InvestmentsVeronica Nanco100% (4)

- The Hotel Acquisition ProcessDokumen21 halamanThe Hotel Acquisition ProcessdrakovenyaBelum ada peringkat

- PWC Real Estate Monetization StrategiesDokumen28 halamanPWC Real Estate Monetization StrategiesAbdulkareem Tawili100% (1)

- CB Re Hotels Serviced Apartments Australia 1Dokumen32 halamanCB Re Hotels Serviced Apartments Australia 1Denver Esyaben Sin-otBelum ada peringkat

- JMBM Hotel Acquisition ChecklistDokumen25 halamanJMBM Hotel Acquisition ChecklistSODDEYBelum ada peringkat

- Property DevelopmentDokumen273 halamanProperty Developmentkrishnak_49100% (2)

- Property & Real Estate Textbooks USDokumen16 halamanProperty & Real Estate Textbooks USOlivierBelum ada peringkat

- FL CCIM - Retail Feasibility Analysis PDFDokumen111 halamanFL CCIM - Retail Feasibility Analysis PDFsaundersrealestateBelum ada peringkat

- Valuation MethodsDokumen42 halamanValuation MethodsRajwinder Singh Bansal67% (3)

- Flow Chart of Property Development - 171107Dokumen5 halamanFlow Chart of Property Development - 171107David LimBelum ada peringkat

- Real Estate Investment AnalysisDokumen67 halamanReal Estate Investment AnalysisRheneir MoraBelum ada peringkat

- Hotel Build Cost GuideDokumen80 halamanHotel Build Cost GuideAaditya Pratap SanyalBelum ada peringkat

- Colliers International KSA-Construction Cost in The Kingdom of Saudi ArabiaDokumen3 halamanColliers International KSA-Construction Cost in The Kingdom of Saudi ArabiaJamil Fakhri100% (1)

- Production and Cost in The Long Run: Multiple ChoiceDokumen50 halamanProduction and Cost in The Long Run: Multiple ChoicePatil YacoubianBelum ada peringkat

- Functions of Financial ManagementDokumen15 halamanFunctions of Financial ManagementCarla B. JimenezBelum ada peringkat

- GIO+Course 3 Email Marketing Tahir AshrafDokumen17 halamanGIO+Course 3 Email Marketing Tahir AshrafSayed tahir Ashraf100% (1)

- Hotel Marketing KPIsDokumen45 halamanHotel Marketing KPIsSPHM HospitalityBelum ada peringkat

- Buy and Optimize: A Guide to Acquiring and Owning Commercial PropertyDari EverandBuy and Optimize: A Guide to Acquiring and Owning Commercial PropertyBelum ada peringkat

- The Valuation of Hotels and Motels For Ass PurposeDokumen20 halamanThe Valuation of Hotels and Motels For Ass PurposeglowrinnBelum ada peringkat

- Applying Value Drivers To Hotel ValuationDokumen20 halamanApplying Value Drivers To Hotel ValuationErsan YildirimBelum ada peringkat

- Hotel Versus Serviced ApartmentDokumen6 halamanHotel Versus Serviced ApartmentsamairaBelum ada peringkat

- HVS - Art Science of Hotel Valuation in An Economic DownturnDokumen12 halamanHVS - Art Science of Hotel Valuation in An Economic DownturnSoftkillerBelum ada peringkat

- Hotel Valuation TechniquesDokumen20 halamanHotel Valuation Techniquesgallu35Belum ada peringkat

- Hotel Cap Rates Hold Steady - Values Under PressureDokumen10 halamanHotel Cap Rates Hold Steady - Values Under PressureManvinderBelum ada peringkat

- Residual Land Valuation MethodDokumen7 halamanResidual Land Valuation Methodrajeshjadhav89100% (1)

- PWC Real Estate 2020Dokumen40 halamanPWC Real Estate 2020jcschiaffino100% (1)

- Evolution of The Hospitality Asset Management - 6-7-8 - FinalDokumen27 halamanEvolution of The Hospitality Asset Management - 6-7-8 - FinalĐàoMinhPhươngBelum ada peringkat

- Watg ReportDokumen15 halamanWatg ReportRenata DoralievaBelum ada peringkat

- Commercial Real Estate Case StudyDokumen2 halamanCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- 5 Star HotelDokumen9 halaman5 Star HotelAlex Airivirklz'Lx IanBelum ada peringkat

- INDUSTRY - REPORT - The Wellness Real Estate Development Process ExplainedDokumen13 halamanINDUSTRY - REPORT - The Wellness Real Estate Development Process ExplainedSendrea Monica100% (1)

- Our Guide To Valuation TerminologyDokumen8 halamanOur Guide To Valuation Terminologysonia87Belum ada peringkat

- 19 - Real Estate Thesis PDFDokumen206 halaman19 - Real Estate Thesis PDFPriyanka MBelum ada peringkat

- Hotel Asset Management 2Dokumen48 halamanHotel Asset Management 2Nguyễn Thế PhongBelum ada peringkat

- Boutique Hotels: A Superficial Analysis (v1)Dokumen8 halamanBoutique Hotels: A Superficial Analysis (v1)Jan HautersBelum ada peringkat

- 7 P's of Real Estate (Vol 14) - Jul'10Dokumen3 halaman7 P's of Real Estate (Vol 14) - Jul'10Jindal Shivam0% (3)

- 2018 Expectations and Market Realities in Real Estate 03-05-2018Dokumen62 halaman2018 Expectations and Market Realities in Real Estate 03-05-2018National Association of REALTORS®Belum ada peringkat

- Valley Village Apartment ProjectDokumen27 halamanValley Village Apartment ProjectSFValleyblogBelum ada peringkat

- Budget Hotels in Europe Feasibility Study UK Consultant LondonDokumen18 halamanBudget Hotels in Europe Feasibility Study UK Consultant LondonbhupathireddyoBelum ada peringkat

- How To Buy A Hotel HandbookDokumen140 halamanHow To Buy A Hotel HandbookShivam Patel100% (1)

- Due Diligence For Commercial Real EstateDokumen4 halamanDue Diligence For Commercial Real Estateshilpi pandey100% (1)

- Hotel Management Contracts - To Lease or Not To Lease PDFDokumen10 halamanHotel Management Contracts - To Lease or Not To Lease PDFraj tanwarBelum ada peringkat

- Real Estate Financial Modeling Training BrochureDokumen21 halamanReal Estate Financial Modeling Training Brochurebkirschrefm50% (6)

- Real Estate Appraisal A Review of Valuation Methods Vassilis AssimakopoulosDokumen25 halamanReal Estate Appraisal A Review of Valuation Methods Vassilis AssimakopoulosBianca SferleBelum ada peringkat

- Assessors HandbookDokumen161 halamanAssessors HandbookwbalsonBelum ada peringkat

- Commercial Appraisal OverviewDokumen61 halamanCommercial Appraisal OverviewahmedBelum ada peringkat

- Step by Step Guide: Release Version 14.0 - August 21, 2008Dokumen119 halamanStep by Step Guide: Release Version 14.0 - August 21, 2008rovvy85Belum ada peringkat

- Private Equity Real Estate FirmsDokumen13 halamanPrivate Equity Real Estate FirmsgokoliBelum ada peringkat

- Real Estate Pro FormaDokumen19 halamanReal Estate Pro FormaDarrell SaricBelum ada peringkat

- Private Real Estate Investment: Data Analysis and Decision MakingDari EverandPrivate Real Estate Investment: Data Analysis and Decision MakingPenilaian: 5 dari 5 bintang5/5 (2)

- Golf Course Development Costs Survey EMA 2014 PDFDokumen28 halamanGolf Course Development Costs Survey EMA 2014 PDFgasbbound1100% (1)

- Real Estate StrategyDokumen17 halamanReal Estate StrategyLesWozniczkaBelum ada peringkat

- Icsc 2012Dokumen117 halamanIcsc 2012Pareeksha ScribdBelum ada peringkat

- Intermediate Excel For Real EstateDokumen109 halamanIntermediate Excel For Real Estateda_yt_boi100% (3)

- Commercial Real Estate Valuation Model1Dokumen6 halamanCommercial Real Estate Valuation Model1Sajib JahanBelum ada peringkat

- EY Africa Attractiveness Survey 2015 Making ChoicesDokumen64 halamanEY Africa Attractiveness Survey 2015 Making ChoicesJamil FakhriBelum ada peringkat

- Dairy Statistics 2014Dokumen80 halamanDairy Statistics 2014Jamil FakhriBelum ada peringkat

- GCC Food Industry Report June 2011Dokumen73 halamanGCC Food Industry Report June 2011Jamil FakhriBelum ada peringkat

- Africa Energy Outlook Slides PDFDokumen16 halamanAfrica Energy Outlook Slides PDFJamil FakhriBelum ada peringkat

- Middle East Hotels ReportDokumen44 halamanMiddle East Hotels ReportJamil FakhriBelum ada peringkat

- European Union Dairy IndustryDokumen16 halamanEuropean Union Dairy IndustryJamil FakhriBelum ada peringkat

- Al KhafjiShoppingMall CompleteDraftReportDokumen107 halamanAl KhafjiShoppingMall CompleteDraftReportJamil Fakhri100% (2)

- Linking Farmers Markets and TourismDokumen14 halamanLinking Farmers Markets and TourismJamil FakhriBelum ada peringkat

- Abu Dhabi City Report 2013 PDFDokumen62 halamanAbu Dhabi City Report 2013 PDFJamil FakhriBelum ada peringkat

- Capital Improvements Without The CapitalDokumen10 halamanCapital Improvements Without The CapitalJamil FakhriBelum ada peringkat

- AT Kearney - Achieving Excellence in Retail Operations - May 2013 PDFDokumen13 halamanAT Kearney - Achieving Excellence in Retail Operations - May 2013 PDFJamil FakhriBelum ada peringkat

- LuxuryDokumen9 halamanLuxuryJamil Fakhri100% (1)

- MENA Hotel Market - Focus On Fundamentals: MENA House View - May 2009Dokumen6 halamanMENA Hotel Market - Focus On Fundamentals: MENA House View - May 2009Jamil FakhriBelum ada peringkat

- Electronics Sector in LebanonDokumen17 halamanElectronics Sector in LebanonJamil FakhriBelum ada peringkat

- Lagardere Services SAS - Strategic SWOT Analysis ReviewDokumen17 halamanLagardere Services SAS - Strategic SWOT Analysis ReviewJamil FakhriBelum ada peringkat

- Hoskisson and HITT Strategic Management All ChaptersDokumen376 halamanHoskisson and HITT Strategic Management All ChaptersNikunj Patel100% (3)

- Account TitlesDokumen28 halamanAccount TitlesTom FernandoBelum ada peringkat

- DBB2104 Unit-14Dokumen23 halamanDBB2104 Unit-14anamikarajendran441998Belum ada peringkat

- Anya's Cleaning ServiceDokumen22 halamanAnya's Cleaning ServiceArya HerdiansyahBelum ada peringkat

- Kathryn Newman Chapter 6 Questions 1 16Dokumen3 halamanKathryn Newman Chapter 6 Questions 1 16Kim FloresBelum ada peringkat

- Consumer Behaviour Implications For Marketing Strategy 7th Edition Quester Test BankDokumen44 halamanConsumer Behaviour Implications For Marketing Strategy 7th Edition Quester Test Bankthomasramosdkfgzxyati100% (17)

- Assessing The Adequacy 2010Dokumen17 halamanAssessing The Adequacy 2010Diego BermudezBelum ada peringkat

- Test Bank For Intermediate Microeconomics A Modern Approach 9th Edition Hal R Varian DownloadDokumen11 halamanTest Bank For Intermediate Microeconomics A Modern Approach 9th Edition Hal R Varian DownloadGinaBrownsjtm93% (28)

- TYBFMDokumen20 halamanTYBFMshoaib8682Belum ada peringkat

- LATEST Jeremi Napoli Siregar ResumeDokumen2 halamanLATEST Jeremi Napoli Siregar Resumeyunita firdianaBelum ada peringkat

- Strategic Management Chapter-10Dokumen22 halamanStrategic Management Chapter-10Towhidul HoqueBelum ada peringkat

- OTC Exchange of IndiaDokumen17 halamanOTC Exchange of IndiaJigar_Dedhia_8946Belum ada peringkat

- 07 BibliographyDokumen5 halaman07 BibliographyMaha RajaBelum ada peringkat

- Marija Kalosheva - CVDokumen2 halamanMarija Kalosheva - CVFit Mom KaloshevaBelum ada peringkat

- Tutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862Dokumen112 halamanTutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862THABO CLARENCE MohleleBelum ada peringkat

- Chapter 14Dokumen19 halamanChapter 14Yuxuan Song100% (1)

- Syllabus III IVDokumen181 halamanSyllabus III IVKumar KisBelum ada peringkat

- Spot Rates: Chapter 13 - The Foreign-Exchange MarketDokumen8 halamanSpot Rates: Chapter 13 - The Foreign-Exchange Marketzeebee17Belum ada peringkat

- MADM Study Sheet - GDADokumen2 halamanMADM Study Sheet - GDAJoyal ThomasBelum ada peringkat

- University of Mauritius: Faculty of Law and ManagementDokumen4 halamanUniversity of Mauritius: Faculty of Law and ManagementAyush GowriahBelum ada peringkat

- Accounting 101Dokumen17 halamanAccounting 101Jenne Santiago BabantoBelum ada peringkat

- Subsidiary BooksDokumen6 halamanSubsidiary BooksBamidele AdegboyeBelum ada peringkat

- Career in CommerceDokumen29 halamanCareer in CommerceNaman TiwariBelum ada peringkat

- Discretionary Revenues As A Measure of Earnings ManagementDokumen22 halamanDiscretionary Revenues As A Measure of Earnings ManagementmaulidiahBelum ada peringkat

- Akash Kumar Singh : ProfileDokumen1 halamanAkash Kumar Singh : ProfileZamirtalent TrBelum ada peringkat

- DAYAG Advac SolutionChapter6Dokumen21 halamanDAYAG Advac SolutionChapter6N JoBelum ada peringkat