Conversion of instrument statute

Diunggah oleh

Anthony F. PerroneDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Conversion of instrument statute

Diunggah oleh

Anthony F. PerroneHak Cipta:

Format Tersedia

673.4201.

Conversion of instrument

West's Florida Statutes Annotated | Title XXXIX. Commercial Relations (Chapters 668-688)

Appended Content Search Details

Search Query: Jurisdiction: florida ucc endorsement formalities Florida Notes of Decisions (p.9) Versions (p.15) Editor's and Revisor's Notes (p.16) Citing References (p.18) Context & Analysis (p.25)

Delivery Details

Date: Delivered By: Client ID: Status Icons: April 12, 2013 at 4:25PM JOHNSON

2013 Thomson Reuters. No claim to original U.S. Government Works.

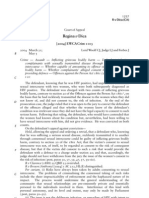

673.4201. Conversion of instrument, FL ST 673.4201

*** Start Section ... West's Florida Statutes Annotated Title XXXIX. Commercial Relations (Chapters 668-688) (Refs & Annos) Chapter 673. Uniform Commercial Code: Negotiable Instruments (Refs & Annos) Article 3. Negotiable Instruments (Refs & Annos) Part IV. Liability of Parties West's F.S.A. 673.4201 673.4201. Conversion of instrument Currentness (1) The law applicable to conversion of personal property applies to instruments. An instrument is also converted if it is taken by transfer, other than a negotiation, from a person not entitled to enforce the instrument or a bank makes or obtains payment with respect to the instrument for a person not entitled to enforce the instrument or receive payment. An action for conversion of an instrument may not be brought by:

(a) The issuer or acceptor of the instrument; or

(b) A payee or indorsee who did not receive delivery of the instrument either directly or through delivery to an agent or a copayee.

(2) In an action under subsection (1), the measure of liability is presumed to be the amount payable on the instrument, but recovery may not exceed the amount of the plaintiff's interest in the instrument.

(3) A representative, other than a depositary bank, who has in good faith dealt with an instrument or its proceeds on behalf of one who was not the person entitled to enforce the instrument is not liable in conversion to that person beyond the amount of any proceeds that it has not paid out.

Credits Laws 1992, c. 92-82, 2.

Editors' Notes UNIFORM COMMERCIAL CODE COMMENT 1. Section 3-420 is a modification of former Section 3-419. The first sentence of Section 3-420(a) states a general rule that the law of conversion applicable to personal property also applies to instruments. Paragraphs (a) and (b) of former Section 3-419(1) are deleted as inappropriate in cases of noncash items that may be delivered for acceptance or payment in collection letters that contain varying instructions as to what to do in the event of nonpayment on the day of delivery. It is better to allow such cases to be governed by the general law of conversion that would address the issue of when, under the circumstances prevailing, the presenter's right to possession has been denied. The second sentence of Section 3-420(a) states that an instrument is converted if it is taken by transfer other than a negotiation from a person not entitled to enforce the instrument or taken for collection or payment from a person not entitled to enforce the instrument or receive payment. This covers cases in which a depositary or

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

payor bank takes an instrument bearing a forged indorsement. It also covers cases in which an instrument is payable to two persons and the two persons are not alternative payees, e.g., a check payable to John and Jane Doe. Under Section 3-110(d) the check can be negotiated or enforced only by both persons acting jointly. Thus, neither payee acting without the consent of the other, is a person entitled to enforce the instrument. If John indorses the check and Jane does not, the indorsement is not effective to allow negotiation of the check. If Depositary Bank takes the check for deposit to John's account, Depositary Bank is liable to Jane for conversion of the check if she did not consent to the transaction. John, acting alone, is not the person entitled to enforce the check because John is not the holder of the check. Section 3-110(d) and Comment 4 to Section 3-110. Depositary Bank does not get any greater rights under Section 4-205(1). If it acted for John as its customer, it did not become holder of the check under that provision because John, its customer, was not a holder. Under former Article 3, the cases were divided on the issue of whether the drawer of a check with a forged indorsement can assert rights against a depositary bank that took the check. The last sentence of Section 3-420(a) resolves the conflict by following the rule stated in Stone & Webster Engineering Corp. v. First National Bank & Trust Co., 184 N.E.2d 358 (Mass.1962). There is no reason why a drawer should have an action in conversion. The check represents an obligation of the drawer rather than property of the drawer. The drawer has an adequate remedy against the payor bank for recredit of the drawer's account for unauthorized payment of the check. There was also a split of authority under former Article 3 on the issue of whether a payee who never received the instrument is a proper plaintiff in a conversion action. The typical case was one in which a check was stolen from the drawer or in which the check was mailed to an address different from that of the payee and was stolen after it arrived at that address. The thief forged the indorsement of the payee and obtained payment by depositing the check to an account in a depositary bank. The issue was whether the payee could bring an action in conversion against the depositary bank or the drawee bank. In revised Article 3, under the last sentence of Section 3-420(a), the payee has no conversion action because the check was never delivered to the payee. Until delivery, the payee does not have any interest in the check. The payee never became the holder of the check nor a person entitled to enforce the check. Section 3-301. Nor is the payee injured by the fraud. Normally the drawer of a check intends to pay an obligation owed to the payee. But if the check is never delivered to the payee, the obligation owed to the payee is not affected. If the check falls into the hands of a thief who obtains payment after forging the signature of the payee as an indorsement, the obligation owed to the payee continues to exist after the thief receives payment. Since the payee's right to enforce the underlying obligation is unaffected by the fraud of the thief, there is no reason to give any additional remedy to the payee. The drawer of the check has no conversion remedy, but the drawee is not entitled to charge the drawer's account when the drawee wrongfully honored the check. The remedy of the drawee is against the depositary bank for breach of warranty under Section 3-417(a)(1) or 4-208(a)(1). The loss will fall on the person who gave value to the thief for the check. The situation is different if the check is delivered to the payee. If the check is taken for an obligation owed to the payee, the last sentence of Section 3-310(b)(4) provides that the obligation may not be enforced to the extent of the amount of the check. The payee's rights are restricted to enforcement of the payee's rights in the instrument. In this event the payee is injured by the theft and has a cause of action for conversion. The payee receives delivery when the check comes into the payee's possession, as for example when it is put into the payee's mailbox. Delivery to an agent is delivery to the payee. If a check is payable to more than one payee, delivery to one of the payees is deemed to be delivery to all of the payees. Occasionally, the person asserting a conversion cause of action is an indorsee rather that the original payee. If the check is stolen before the check can be delivered to the indorsee and the indorsee's indorsement is forged, the analysis is similar. For example, a check is payable to the order of A. A indorses it to B and puts it into an envelope addressed to B. The envelope is never delivered to B. Rather, Thief steals the envelope, forges B's indorsement to the check and obtains payment. Because the check was never delivered to B, the indorsee, B has no cause of action for conversion, but A does have such an action. A is the owner of the check. B never obtained rights in the check. If A intended to negotiate the check to B in payment of an obligation, that obligation was not affected by the conduct of Thief. B can enforce that obligation. Thief stole A's property not B's.

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

2. Subsection (2) of former Section 3-419 is amended because it is not clear why the former law distinguished between the liability of the drawee and that of other converters. Why should there be a conclusive presumption that the liability is face amount if a drawee refuses to pay or return an instrument or makes payment on a forged indorsement, while the liability of a maker who does the same thing is only presumed to be the face amount? Moreover, it was not clear under former Section 3-419(2) what face amount meant. If a note for $10,000 is payable in a year at 10% interest, it is common to refer to $10,000 as the face amount, but if the note is converted the loss to the owner also includes the loss of interest. In revised Article 3, Section 3-420(b), by referring to amount payable on the instrument, allows the full amount due under the instrument to be recovered. The but clause in subsection (b) addresses the problem of conversion actions in multiple payee checks. Section 3-110(d) states that an instrument cannot be enforced unless all payees join in the action. But an action for conversion might be brought by a payee having no interest or a limited interest in the proceeds of the check. This clause prevents such a plaintiff from receiving a windfall. An example is a check payable to a building contractor and a supplier of building material. The check is not payable to the payees alternatively. Section 3-110(d). The check is delivered to the contractor by the owner of the building. Suppose the contractor forges supplier's signature as an indorsement of the check and receives the entire proceeds of the check. The supplier should not, without qualification, be able to recover the entire amount of the check from the bank that converted the check. Depending upon the contract between the contractor and the supplier, the amount of the check may be due entirely to the contractor, in which case there should be no recovery, entirely to the supplier, in which case recovery should be for the entire amount, or part may be due to one and the rest to the other, in which case recovery should be limited to the amount due to the supplier. 3. Subsection (3) of former Section 3-419 drew criticism from the courts, that saw no reason why a depositary bank should have the defense stated in the subsection. See Knesz v. Central Jersey Bank & Trust Co., 477 A.2d 806 (N.J.1984). The depositary bank is ultimately liable in the case of a forged indorsement check because of its warranty to the payor bank under Section 4-208(a)(1) and it is usually the most convenient defendant in cases involving multiple checks drawn on different banks. There is no basis for requiring the owner of the check to bring multiple actions against the various payor banks and to require those banks to assert warranty rights against the depositary bank. In revised Article 3, the defense provided by Section 3-420(c) is limited to collecting banks other than the depositary bank. If suit is brought against both the payor bank and the depositary bank, the owner, of course, is entitled to but one recovery.

CROSS REFERENCES Restrictive indorsement, form and effect, see 673.2061. LAW REVIEW AND JOURNAL COMMENTARIES Double forgeries and loss allocation under UCC. 7 Stetson L.Rev. 241 (1978). Expansion of lender liability in Florida. Kendall Coffey, 40 U.Fla.L.Rev. 85 (1988). Forged and unauthorized indorsements. Daniel E. Murray, 20 U.Miami L.Rev. 236 (1965). Forged or unauthorized endorsement of checks under articles III and IV of the uniform commercial code. David E. Platte, 5 Fla.B.J. 231 (1981). Handling checks bearing forged indorsements? 45 U.Colo.L.Rev. 281 (1974). Perini Case: Double forgery revisited. Donald W. Baker, 10 UCC L.J. 309 (1978); (part II). 11 UCC L.J. 41 (1978). Uniform Commercial Code Section 3-419 and the battle to preserve a payee's right to sue directly a depositary or collecting bank that pays on a forged indorsement. Barbara Singer, 15 Seton Hall Legis.J. 39 (1991). RESEARCH REFERENCES Encyclopedias Recovery by Depositor from Bank Collecting on Forged Indorsement, FL Jur. 2d Banks & Lending Institutions 281.

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

When Instrument is Paid on Forged Indorsement, FL Jur. 2d Bills, Notes, & Other Commercial Paper 370. Forms Florida Pleading and Practice Forms 77:55, Conversion--In General. Florida Pleading and Practice Forms 77:56, Conversion--Liability of Innocent Representative or Intermediary or Payor Bank. Florida Pleading and Practice Forms 77:58, Complaint--Against Collecting Bank--To Recover Amount of Forged Checks. La Coe's Forms for Pleading Under Fla. Rules of Civ. Pro. R 1.110, Form for Complaint for Damages Improper Actions by Personal Representative; Form for Complaint Against Bank for Improper Disbursement from Frozen Account; Alleging... Relevant Notes of Decisions (36)

View all 54 Notes of Decisions listed below contain your search terms.

Construction and application Under Florida law, drawee's liability for conversion of a draft does not depend upon acceptance of the draft prior to the appropriation thereof. Federal Deposit Ins. Corp. v. Marine Nat. Bank of Jacksonville, 1970, 431 F.2d 341. Conversion And Civil Theft 115 Genuine issue of material fact as to scope of company employee's authority precluded summary judgment for bank into which checks endorsed by employee were deposited by endorsee, on company's claim against bank for conversion. Sykes Corp. v. Eastern Metal Supply, Inc., App. 4 Dist., 659 So.2d 475 (1995). Judgment 181(17) Payees of negotiable instrument bearing forged endorsement were entitled to sue drawee, despite drawee's claim that, if required to pay face value of check to payee, it would be paying twice; drawee had already paid face value of check to forger. Bloempoort v. Regency Bank of Florida, App. 2 Dist., 567 So.2d 923 (1990). Banks And Banking 148(2) Under this section having effect of eliminating liability when it might otherwise exist, it was necessary for defendant bank, on motion for summary judgment in action against it for its allowing collection of check payable to plaintiff upon forged endorsement, to file appropriate proofs that bank had in good faith and in accordance with reasonable commercial standards applicable to the business of such representative dealt with instrument or its proceeds on behalf of one who was not the true owner. Robert A. Sullivan Const. Co., Inc. v. Wilton Manors Nat. Bank, App. 4 Dist., 290 So.2d 561 (1974). Judgment 185(2) In an action by drawer for conversion against a collecting bank which has honored a check on a forged or unauthorized endorsement, essential element of conversion is lacking in that drawer does not have right to immediate possession of the check since beneficial ownership of the check is in the payee. Jett v. Lewis State Bank, App. 1 Dist., 277 So.2d 37 (1973). Banks And Banking 174

Missing endorsement Under Florida law, where bank accepted for deposit a draft, payable to two payees, which lacked indorsement of second payee and bank paid proceeds of draft to depositing payee, bank's disposal of the draft was analogous to payment on a forged indorsement and amounted to a conversion and rendered bank liable to second payee's assignee. Federal Deposit Ins. Corp. v. Marine Nat. Bank of Jacksonville, 1970, 431 F.2d 341. Banks And Banking 131 Under Florida law, where bank failed to comply with its own commercial standards by accepting for deposit a draft which lacked indorsement of a payee, bank was not excused from liability to true owner of draft by statute providing that depository

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

who has, in good faith and in accordance with reasonable commercial standards, dealt with instrument or its proceeds on behalf of one who is not true owner is not liable in conversion or otherwise to true owner beyond amount of any proceeds remaining in its hands. Federal Deposit Ins. Corp. v. Marine Nat. Bank of Jacksonville, 1970, 431 F.2d 341. Banks And Banking 131 Although bank knew that three-man law firm had dissolved, it was logical for the firm's account to be kept open for the purpose of depositing fees which were subsequently collected for services rendered by the old firm, the bank's acceptance for deposit of check, payable to withdrawn partner and another, with the rubber stamp endorsement of the old firm and the payment of the check drawn on the old firm's account did not render the bank liable to the withdrawn partner for conversion of the amount of the check. Keane v. Pan Am. Bank, App. 2 Dist., 309 So.2d 579 (1975). Banks And Banking 148(2)

Unauthorized endorsement An unauthorized endorsement on draft does not operate to bar an action by a payee against drawee which ultimately pays the draft. Messeroff v. Kantor, App. 3 Dist., 261 So.2d 553 (1972). Bills And Notes 279 Where a payee of drafts representing settlement proceeds of personal injury claim unauthorizedly endorsed copayees' signatures on drafts and deposited them in his trust account at Miami Beach bank via Winter Haven bank, and where ultimate drawees of drafts were insurance companies, Miami Beach bank was a collecting bank within purview of statute providing that banks which operate as intermediary or collection banks shall bear no liability to true owner of draft or check except for those proceeds which may remain in possession of said bank. Messeroff v. Kantor, App. 3 Dist., 261 So.2d 553 (1972). Banks And Banking 174 Under this section where a payee of drafts, which were payable through a Winter Haven bank, unauthorizedly endorsed copayees' signatures on drafts and deposited drafts in such payee's trust account at Miami Beach bank via the Winter Haven bank and where insurance company and not Winter Haven bank was the drawee, the Winter Haven bank was a collecting bank within statute providing that banks which operate as intermediary or collecting banks shall bear no liability to true owner of a draft or check except for those proceeds which may remain in possession of said bank. Messeroff v. Kantor, App. 3 Dist., 261 So.2d 553 (1972). Banks And Banking 174

Forged endorsement--In general Under Florida's version of Uniform Commercial Code (UCC), injured parties may bring common law actions for negligence against banks that pay on forged endorsements, provided plaintiff can actually prove that it was the holder of an instrument as to which bank failed to exercise ordinary care and dealt with in way that was not commercially reasonable. Racso Diagnostic, Inc. v. Community Bank of Homestead, App. 3 Dist., 735 So.2d 519 (1999), rehearing denied. Banks And Banking 191.30 For purposes of action for conversion of check, there is little difference between unauthorized endorsement and forged endorsement. Sykes Corp. v. Eastern Metal Supply, Inc., App. 4 Dist., 659 So.2d 475 (1995). Banks And Banking 148(2) Payee has cause of action against drawee bank if bank pays check on forged endorsement, but payee acquires no rights on check before delivery. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2); Bills And Notes 63 Payee can recover against drawee bank for payment on forged endorsement of check only if payee received actual or constructive delivery of checks which occurs when maker in some way shows intention to make check enforceable obligation against himself, according to its terms, by surrendering control over it and intentionally placing it under power of payee or some third person for his use. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2); Bills And Notes 63

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

Mere fact that endorsement would have been sufficient if made by payee, without addition of remainder of language identifying payee as custodian for minor son's account, in no way relieved bank of its liability for accepting forged endorsement. Snow v. Byron, App. 1 Dist., 580 So.2d 238 (1991). Banks And Banking 174 Evidence in payee's action against payor and collecting banks for conversion of checks due to their payment on a forged endorsement raised genuine issues of material fact as to whether there was delivery or constructive delivery of checks to the payee, and whether banks acted within reasonable commercial standards in paying the checks, precluding summary judgment. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 560 So.2d 1203 (1990). Judgment 185.3(5) Payee cannot recover from a collecting bank that pays on a forged endorsement if the check was never delivered to the payee; delivery to the forger is not sufficient delivery; payee must at least show that the drawer surrendered the instrument to the power of the payee or to some third person for the payee's use. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 560 So.2d 1203 (1990). Banks And Banking 174 Where employee of payee of drafts issued by insurance companies forged endorsements to the drafts and obtained payment thereon from bank, bank was not liable to payee for conversion of an instrument paid on a forged endorsement. Larkin General Hosp., Ltd. v. Bank of Florida in South Florida, App. 3 Dist., 464 So.2d 635 (1985). Banks And Banking 148(2) Payee had cause of action against insurance companies for conversion of instrument paid on forged endorsement where employee of payee of drafts issued by insurance companies forged endorsements to the drafts and obtained payment thereon from bank. Larkin General Hosp., Ltd. v. Bank of Florida in South Florida, App. 3 Dist., 464 So.2d 635 (1985). Banks And Banking 155 Insurance companies were not liable to payee for conversion of instrument paid on forged endorsement where employee of payee of checks issued by insurance companies forged endorsements to the checks and obtained payment thereon from bank. Larkin General Hosp., Ltd. v. Bank of Florida in South Florida, App. 3 Dist., 464 So.2d 635 (1985). Bills And Notes 279 In order to recover against collecting bank under this section providing that instrument is converted when it is paid on forged endorsement, payee must establish that payment on forged endorsement occurred and that bank did not act in good faith and in accordance with reasonable commercial standards. Forys v. McLaughlin, App. 5 Dist., 436 So.2d 280 (1983). Banks And Banking 148(2) In action against bank for conversion of instrument paid on forged endorsement, bank's good-faith and reasonable commercial standards were factual issues to be determined by trier of fact. Forys v. McLaughlin, App. 5 Dist., 436 So.2d 280 (1983). Banks And Banking 154(9) Where, in settlement of legal actions, insurer drew drafts payable through bank to clients and attorney as copayees, and authorized payment of drafts to attorney who had forged clients' signatures on drafts, attorney's endorsement of clients' names were nothing more than forgeries, and, therefore, when insurer, as drawee of drafts, paid drafts on those endorsements, insurer was liable for conversion. The Florida Bar v. Allstate Ins. Co., App. 3 Dist., 391 So.2d 238 (1980), petition for review denied 399 So.2d 1140. Bills And Notes 279 Where checks payable to company were stolen from company and deposited in account opened with bank through forged endorsement of company's name, collector bank was not liable to company for conversion for sums withdrawn from account by forger, in that, under provision of this section, collector bank is not liable to true payee for payment of forged endorsements when bank has acted in good faith and in accordance with reasonable commercial standards. Jackson Vitrified China Co. v. People's American Nat. Bank of North Miami, App. 3 Dist., 388 So.2d 1059 (1980). Banks And Banking 174

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

Where surety, indemnifying depositor against loss by employees' dishonesty, paid amount of depositor's loss sustained by bank's wrongful payment of checks on which endorsement had been forged by employee and depositor subrogated and assigned all its rights against bank to surety thereby allowing surety to become subrogee under conventional subrogation, amended complaint alleging conditional subrogation should not have been dismissed for failure to state cause of action on equitable grounds. Dispatch Services, Inc. v. Airport Bank of Miami, App. 3 Dist., 266 So.2d 127 (1972). Insurance 3526(9)

---- Attorney fees, forged endorsement Provision of statute, which holds bank liable in conversion when it pays an instrument on forged endorsement does not allow awards of attorney fees. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Banks And Banking 154(9) Drawee bank's action of failing to pay purchaser of cashier's check on his claim which had arisen out of payment of check on forged signature and instead accepting assignment of claim as collateral security for loan to purchaser to allow him to consummate original land purchase did not constitute bad faith under Uniform Commercial Code as enacted in Florida, and therefore, drawee was entitled to recover from depositor bank, which had warranted forged endorsement, attorney fees expended in defense against purchaser's conversion claim. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Banks And Banking 189

Good faith and in accordance with commercial standards To avoid liability for conversion of check after collecting bank failed to detect improper endorsement and erroneously deposited check into account of company with name similar to payee's name, collecting bank was required to show that it acted in good faith and in accordance with reasonable commercial banking standards; payee was required only to prove conversion and did not have burden of showing that bank did not act in good faith and in accordance with reasonable commercial banking standards. Landmark Bank of Brevard v. Hegeman-Harris Co., Inc., App. 5 Dist., 522 So.2d 1051 (1988). Banks And Banking 175(3) Where payee argued to jury that payment by teller of $7,000 check approximately one-month old at time of transaction without obtaining initials of bank officer was not sound banking principles and bank failed to present evidence concerning applicable standards of banking industry, jury determination that bank's blind reliance on endorsement amounted to negligence was not erroneous in action by payee of check against bank for conversion of check by payment over forged endorsements. Barnett Bank of Miami Beach, N.A. v. Lipp, App. 3 Dist., 364 So.2d 28 (1978). Banks And Banking 175(3) Good faith and reasonable commercial standards are factual issues to be determined by trier of fact where bank claims it was relieved of liability for cashing check over forged endorsement because it acted in good faith, in accordance with reasonable commercial standards and did not retain check or proceeds. Barnett Bank of Miami Beach, N.A. v. Lipp, App. 3 Dist., 364 So.2d 28 (1978). Banks And Banking 175(4) Bank sued because it had allowed collection of check, payable to plaintiff, upon forged endorsement did not, by showing that it had paid forged check in course of business, establish the statutory defense that bank had in good faith and in accordance with reasonable commercial standards applicable to business of such representative dealt with instrument or its proceeds on behalf of one who was not the true owner. Robert A. Sullivan Const. Co., Inc. v. Wilton Manors Nat. Bank, App. 4 Dist., 290 So.2d 561 (1974). Banks And Banking 148(2)

Delivery Florida law precludes a payee from bringing a claim for conversion of a negotiable instrument absent delivery, actual or constructive, of the instrument to either the payee, a copayee, or the payee's agent. Attorney's Title Ins. Fund, Inc. v. Regions Bank, S.D.Fla.2007, 491 F.Supp.2d 1087. Conversion And Civil Theft 106; Conversion And Civil Theft 124

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

Where maker issued check to payee and gave it to company which had outstanding obligation to payee in exact amount of obligation and where maker surrendered checks to company for use and benefits of payee, constructive delivery to payee occurred sufficient for payee to have cause of action against bank for paying forged instrument. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2); Bills And Notes 63 Constructive delivery occurred for purposes of action against bank for paying forged instrument where maker intended bank drafts to be enforceable obligation and surrendered checks to company for further delivery to payee for payee's use or benefit; maker needed specific authority from bank to issue bank drafts, company presented commercial invoices and bills of lading to bank which authorized issuance, and maker was aware of extent of company's obligations to payee when it issued bank drafts to payee in exact amount of invoices. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2); Bills And Notes 63

Parties Purchaser of cashier's check may bring suit directly against collecting bank for cashing check on forged endorsement. Lawrence v. Central Plaza Bank and Trust Co., App. 2 Dist., 469 So.2d 201 (1985). Banks And Banking 189

West's F. S. A. 673.4201, FL ST 673.4201 Current with chapters in effect from the 2013 1st Reg. Sess. of the 23rd Legislature through April 2, 2013

End of Document 2013 Thomson Reuters. No claim to original U.S. Government Works.

...

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

Notes Of Decisions (54) Construction and application Under Florida law, drawee's liability for conversion of a draft does not depend upon acceptance of the draft prior to the appropriation thereof. Federal Deposit Ins. Corp. v. Marine Nat. Bank of Jacksonville, 1970, 431 F.2d 341. Conversion And Civil Theft 115 Clearing bank had not converted drawer's property by honoring forged checks; jury had come to inconsistent verdict by finding in response to interrogatory that bank had converted checks when it accepted them for deposit and on the other hand had acted in good faith in accepting those checks. Sunbank and Trust Co. of Brooksville v. Transcontinental Ins. Co., App. 5 Dist., 666 So.2d 198 (1995), rehearing denied. Banks And Banking 175(4) Genuine issue of material fact as to scope of company employee's authority precluded summary judgment for bank into which checks endorsed by employee were deposited by endorsee, on company's claim against bank for conversion. Sykes Corp. v. Eastern Metal Supply, Inc., App. 4 Dist., 659 So.2d 475 (1995). Judgment 181(17) Payees of negotiable instrument bearing forged endorsement were entitled to sue drawee, despite drawee's claim that, if required to pay face value of check to payee, it would be paying twice; drawee had already paid face value of check to forger. Bloempoort v. Regency Bank of Florida, App. 2 Dist., 567 So.2d 923 (1990). Banks And Banking 148(2) Under this section having effect of eliminating liability when it might otherwise exist, it was necessary for defendant bank, on motion for summary judgment in action against it for its allowing collection of check payable to plaintiff upon forged endorsement, to file appropriate proofs that bank had in good faith and in accordance with reasonable commercial standards applicable to the business of such representative dealt with instrument or its proceeds on behalf of one who was not the true owner. Robert A. Sullivan Const. Co., Inc. v. Wilton Manors Nat. Bank, App. 4 Dist., 290 So.2d 561 (1974). Judgment 185(2) In an action by drawer for conversion against a collecting bank which has honored a check on a forged or unauthorized endorsement, essential element of conversion is lacking in that drawer does not have right to immediate possession of the check since beneficial ownership of the check is in the payee. Jett v. Lewis State Bank, App. 1 Dist., 277 So.2d 37 (1973). Banks And Banking 174 Missing endorsement Under Florida law, where bank accepted for deposit a draft, payable to two payees, which lacked indorsement of second payee and bank paid proceeds of draft to depositing payee, bank's disposal of the draft was analogous to payment on a forged indorsement and amounted to a conversion and rendered bank liable to second payee's assignee. Federal Deposit Ins. Corp. v. Marine Nat. Bank of Jacksonville, 1970, 431 F.2d 341. Banks And Banking 131 Under Florida law, where bank failed to comply with its own commercial standards by accepting for deposit a draft which lacked indorsement of a payee, bank was not excused from liability to true owner of draft by statute providing that depository who has, in good faith and in accordance with reasonable commercial standards, dealt with instrument or its proceeds on behalf of one who is not true owner is not liable in conversion or otherwise to true owner beyond amount of any proceeds remaining in its hands. Federal Deposit Ins. Corp. v. Marine Nat. Bank of Jacksonville, 1970, 431 F.2d 341. Banks And Banking 131 Although bank knew that three-man law firm had dissolved, it was logical for the firm's account to be kept open for the purpose of depositing fees which were subsequently collected for services rendered by the old firm, the bank's acceptance for deposit of check, payable to withdrawn partner and another, with the rubber stamp endorsement of the old firm and the payment of the check drawn on the old firm's account did not render the bank liable to the withdrawn partner for conversion of the amount of the check. Keane v. Pan Am. Bank, App. 2 Dist., 309 So.2d 579 (1975). Banks And Banking 148(2) Unauthorized endorsement

2013 Thomson Reuters. No claim to original U.S. Government Works.

673.4201. Conversion of instrument, FL ST 673.4201

In action against decedent's stepson and bank alleging that stepson converted to his own use certificates of deposit, bank deposits and various negotiable instruments which had been property of decedent, summary judgment against bank was improper where reasonable inference could be drawn that signatures on power of attorney and appointment of deputy documents obtained by stepson were not decedent's signature and issue of intent to defraud required full explanation of facts and circumstances. Forys v. McLaughlin, App. 5 Dist., 436 So.2d 280 (1983). Judgment 185.3(5) Bank which opened account in name of payee's employee and deposited in that account checks bearing stamp for deposit only and showing payee's name and address was liable to payee for full amount of loss resulting from employee's deposit of such checks to her account over period of 13 months. O.K. Moving & Storage Co., Inc. v. Eglin Nat. Bank, App. 1 Dist., 363 So.2d 160 (1978). Banks And Banking 138 An unauthorized endorsement on draft does not operate to bar an action by a payee against drawee which ultimately pays the draft. Messeroff v. Kantor, App. 3 Dist., 261 So.2d 553 (1972). Bills And Notes 279 Where a payee of drafts representing settlement proceeds of personal injury claim unauthorizedly endorsed copayees' signatures on drafts and deposited them in his trust account at Miami Beach bank via Winter Haven bank, and where ultimate drawees of drafts were insurance companies, Miami Beach bank was a collecting bank within purview of statute providing that banks which operate as intermediary or collection banks shall bear no liability to true owner of draft or check except for those proceeds which may remain in possession of said bank. Messeroff v. Kantor, App. 3 Dist., 261 So.2d 553 (1972). Banks And Banking 174 Under this section where a payee of drafts, which were payable through a Winter Haven bank, unauthorizedly endorsed copayees' signatures on drafts and deposited drafts in such payee's trust account at Miami Beach bank via the Winter Haven bank and where insurance company and not Winter Haven bank was the drawee, the Winter Haven bank was a collecting bank within statute providing that banks which operate as intermediary or collecting banks shall bear no liability to true owner of a draft or check except for those proceeds which may remain in possession of said bank. Messeroff v. Kantor, App. 3 Dist., 261 So.2d 553 (1972). Banks And Banking 174 Forged endorsement Forged endorsement - In general Under Florida's version of Uniform Commercial Code (UCC), injured parties may bring common law actions for negligence against banks that pay on forged endorsements, provided plaintiff can actually prove that it was the holder of an instrument as to which bank failed to exercise ordinary care and dealt with in way that was not commercially reasonable. Racso Diagnostic, Inc. v. Community Bank of Homestead, App. 3 Dist., 735 So.2d 519 (1999), rehearing denied. Banks And Banking 191.30 For purposes of action for conversion of check, there is little difference between unauthorized endorsement and forged endorsement. Sykes Corp. v. Eastern Metal Supply, Inc., App. 4 Dist., 659 So.2d 475 (1995). Banks And Banking 148(2) Payee has cause of action against drawee bank if bank pays check on forged endorsement, but payee acquires no rights on check before delivery. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2) Bills And Notes 63 Payee can recover against drawee bank for payment on forged endorsement of check only if payee received actual or constructive delivery of checks which occurs when maker in some way shows intention to make check enforceable obligation against himself, according to its terms, by surrendering control over it and intentionally placing it under power of payee or some third person for his use. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2) Bills And Notes 63 Mere fact that endorsement would have been sufficient if made by payee, without addition of remainder of language identifying payee as custodian for minor son's account, in no way relieved bank of its liability for accepting forged endorsement. Snow v. Byron, App. 1 Dist., 580 So.2d 238 (1991). Banks And Banking 174

2013 Thomson Reuters. No claim to original U.S. Government Works.

10

673.4201. Conversion of instrument, FL ST 673.4201

Genuine issues of material fact existed as to whether bank dealt with forged check in good faith and in accordance with reasonable commercial standards applicable to business of banks, precluding summary judgment in favor of bank on payee's claim that bank wrongfully accepted check. Snow v. Byron, App. 1 Dist., 580 So.2d 238 (1991). Judgment 181(17) Evidence in payee's action against payor and collecting banks for conversion of checks due to their payment on a forged endorsement raised genuine issues of material fact as to whether there was delivery or constructive delivery of checks to the payee, and whether banks acted within reasonable commercial standards in paying the checks, precluding summary judgment. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 560 So.2d 1203 (1990). Judgment 185.3(5) Payee cannot recover from a collecting bank that pays on a forged endorsement if the check was never delivered to the payee; delivery to the forger is not sufficient delivery; payee must at least show that the drawer surrendered the instrument to the power of the payee or to some third person for the payee's use. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 560 So.2d 1203 (1990). Banks And Banking 174 Where employee of payee of drafts issued by insurance companies forged endorsements to the drafts and obtained payment thereon from bank, bank was not liable to payee for conversion of an instrument paid on a forged endorsement. Larkin General Hosp., Ltd. v. Bank of Florida in South Florida, App. 3 Dist., 464 So.2d 635 (1985). Banks And Banking 148(2) Payee had cause of action against insurance companies for conversion of instrument paid on forged endorsement where employee of payee of drafts issued by insurance companies forged endorsements to the drafts and obtained payment thereon from bank. Larkin General Hosp., Ltd. v. Bank of Florida in South Florida, App. 3 Dist., 464 So.2d 635 (1985). Banks And Banking 155 Insurance companies were not liable to payee for conversion of instrument paid on forged endorsement where employee of payee of checks issued by insurance companies forged endorsements to the checks and obtained payment thereon from bank. Larkin General Hosp., Ltd. v. Bank of Florida in South Florida, App. 3 Dist., 464 So.2d 635 (1985). Bills And Notes 279 In action alleging that decedent's stepson converted to his own use certificates of deposit, bank deposits and various negotiable instruments which had been property of decedent, questions as to whether decedent's stepson signed power of attorney and appointment of deputy documents and whether he did so with intent to defraud were not proper for resolution by summary judgment. Forys v. McLaughlin, App. 5 Dist., 436 So.2d 280 (1983). Judgment 181(33) In order to recover against collecting bank under this section providing that instrument is converted when it is paid on forged endorsement, payee must establish that payment on forged endorsement occurred and that bank did not act in good faith and in accordance with reasonable commercial standards. Forys v. McLaughlin, App. 5 Dist., 436 So.2d 280 (1983). Banks And Banking 148(2) In action against bank for conversion of instrument paid on forged endorsement, bank's good-faith and reasonable commercial standards were factual issues to be determined by trier of fact. Forys v. McLaughlin, App. 5 Dist., 436 So.2d 280 (1983). Banks And Banking 154(9) Where, in settlement of legal actions, insurer drew drafts payable through bank to clients and attorney as copayees, and authorized payment of drafts to attorney who had forged clients' signatures on drafts, attorney's endorsement of clients' names were nothing more than forgeries, and, therefore, when insurer, as drawee of drafts, paid drafts on those endorsements, insurer was liable for conversion. The Florida Bar v. Allstate Ins. Co., App. 3 Dist., 391 So.2d 238 (1980), petition for review denied 399 So.2d 1140. Bills And Notes 279 Where checks payable to company were stolen from company and deposited in account opened with bank through forged endorsement of company's name, collector bank was not liable to company for conversion for sums withdrawn from account by forger, in that, under provision of this section, collector bank is not liable to true payee for payment of forged endorsements when bank has acted in good faith and in accordance with reasonable commercial standards. Jackson Vitrified China Co. v. People's American Nat. Bank of North Miami, App. 3 Dist., 388 So.2d 1059 (1980). Banks And Banking 174

2013 Thomson Reuters. No claim to original U.S. Government Works.

11

673.4201. Conversion of instrument, FL ST 673.4201

Even though depositor had subrogated and assigned to surety depositor's rights against bank which cashed forged checks, bank was liable to its depositor. Dispatch Services, Inc. v. Airport Bank of Miami, App. 3 Dist., 266 So.2d 127 (1972). Subrogation 6 Bank by cashing forged checks was guilty of negligence and breach of contract with its depositor. Dispatch Services, Inc. v. Airport Bank of Miami, App. 3 Dist., 266 So.2d 127 (1972). Banks And Banking 148(1) Bank must, at its peril, know the signatures of its depositors. Dispatch Services, Inc. v. Airport Bank of Miami, App. 3 Dist., 266 So.2d 127 (1972). Banks And Banking 148(1) Where surety, indemnifying depositor against loss by employees' dishonesty, paid amount of depositor's loss sustained by bank's wrongful payment of checks on which endorsement had been forged by employee and depositor subrogated and assigned all its rights against bank to surety thereby allowing surety to become subrogee under conventional subrogation, amended complaint alleging conditional subrogation should not have been dismissed for failure to state cause of action on equitable grounds. Dispatch Services, Inc. v. Airport Bank of Miami, App. 3 Dist., 266 So.2d 127 (1972). Insurance 3526(9) Attorney fees, forged endorsement Provision of statute, which holds bank liable in conversion when it pays an instrument on forged endorsement does not allow awards of attorney fees. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Banks And Banking 154(9) Drawee bank's action of failing to pay purchaser of cashier's check on his claim which had arisen out of payment of check on forged signature and instead accepting assignment of claim as collateral security for loan to purchaser to allow him to consummate original land purchase did not constitute bad faith under Uniform Commercial Code as enacted in Florida, and therefore, drawee was entitled to recover from depositor bank, which had warranted forged endorsement, attorney fees expended in defense against purchaser's conversion claim. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Banks And Banking 189 Forged endorsement - Attorney fees Provision of statute, which holds bank liable in conversion when it pays an instrument on forged endorsement does not allow awards of attorney fees. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Banks And Banking 154(9) Drawee bank's action of failing to pay purchaser of cashier's check on his claim which had arisen out of payment of check on forged signature and instead accepting assignment of claim as collateral security for loan to purchaser to allow him to consummate original land purchase did not constitute bad faith under Uniform Commercial Code as enacted in Florida, and therefore, drawee was entitled to recover from depositor bank, which had warranted forged endorsement, attorney fees expended in defense against purchaser's conversion claim. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Banks And Banking 189 Good faith and in accordance with commercial standards To avoid liability for conversion of check after collecting bank failed to detect improper endorsement and erroneously deposited check into account of company with name similar to payee's name, collecting bank was required to show that it acted in good faith and in accordance with reasonable commercial banking standards; payee was required only to prove conversion and did not have burden of showing that bank did not act in good faith and in accordance with reasonable commercial banking standards. Landmark Bank of Brevard v. Hegeman-Harris Co., Inc., App. 5 Dist., 522 So.2d 1051 (1988). Banks And Banking 175(3) In action by payee and its subrogor against collecting bank for conversion of checks, trial court erred in taking issue of collecting bank's good faith and compliance with reasonable commercial standards from jury and deciding it as matter of law since good faith and compliance with standards were factual questions to be determined by trier of fact and where jury rendered verdict for collecting bank which was incompatible with prior ruling of court. Travelers Ins. Co. v. Jefferson Nat. Bank at Kendall, App. 3 Dist., 404 So.2d 1131 (1981). Conversion And Civil Theft 233 Where payee argued to jury that payment by teller of $7,000 check approximately one-month old at time of transaction without obtaining initials of bank officer was not sound banking principles and bank failed to present

2013 Thomson Reuters. No claim to original U.S. Government Works.

12

673.4201. Conversion of instrument, FL ST 673.4201

evidence concerning applicable standards of banking industry, jury determination that bank's blind reliance on endorsement amounted to negligence was not erroneous in action by payee of check against bank for conversion of check by payment over forged endorsements. Barnett Bank of Miami Beach, N.A. v. Lipp, App. 3 Dist., 364 So.2d 28 (1978). Banks And Banking 175(3) Good faith and reasonable commercial standards are factual issues to be determined by trier of fact where bank claims it was relieved of liability for cashing check over forged endorsement because it acted in good faith, in accordance with reasonable commercial standards and did not retain check or proceeds. Barnett Bank of Miami Beach, N.A. v. Lipp, App. 3 Dist., 364 So.2d 28 (1978). Banks And Banking 175(4) Bank could not be held blameless in conversion for dealing with instrument and its proceeds on behalf of one who was not true owner unless bank acted in good faith and in accordance with reasonable commercial standards applicable to banking business. Siegel Trading Co., Inc. v. Coral Ridge Nat. Bank, App. 4 Dist., 328 So.2d 476 (1976). Banks And Banking 172 In action against bank for conversion arising out of its dealing with instrument or its proceeds on behalf of one who is not true owner, defense of payment in good faith and in accordance with reasonable commercial standards is affirmative defense and is waived unless set forth in bank's answer to complaint, unless issue, though not raised by pleadings, is tried by implied consent of parties. Siegel Trading Co., Inc. v. Coral Ridge Nat. Bank, App. 4 Dist., 328 So.2d 476 (1976). Conversion And Civil Theft 164 Conversion And Civil Theft 166 Bank sued because it had allowed collection of check, payable to plaintiff, upon forged endorsement did not, by showing that it had paid forged check in course of business, establish the statutory defense that bank had in good faith and in accordance with reasonable commercial standards applicable to business of such representative dealt with instrument or its proceeds on behalf of one who was not the true owner. Robert A. Sullivan Const. Co., Inc. v. Wilton Manors Nat. Bank, App. 4 Dist., 290 So.2d 561 (1974). Banks And Banking 148(2) Delivery Florida law precludes a payee from bringing a claim for conversion of a negotiable instrument absent delivery, actual or constructive, of the instrument to either the payee, a copayee, or the payee's agent. Attorney's Title Ins. Fund, Inc. v. Regions Bank, S.D.Fla.2007, 491 F.Supp.2d 1087. Conversion And Civil Theft 106 Conversion And Civil Theft 124 Where maker issued check to payee and gave it to company which had outstanding obligation to payee in exact amount of obligation and where maker surrendered checks to company for use and benefits of payee, constructive delivery to payee occurred sufficient for payee to have cause of action against bank for paying forged instrument. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2) Bills And Notes 63 Constructive delivery occurred for purposes of action against bank for paying forged instrument where maker intended bank drafts to be enforceable obligation and surrendered checks to company for further delivery to payee for payee's use or benefit; maker needed specific authority from bank to issue bank drafts, company presented commercial invoices and bills of lading to bank which authorized issuance, and maker was aware of extent of company's obligations to payee when it issued bank drafts to payee in exact amount of invoices. Florida Nat. Bank v. Isaac Industries, Inc., App. 3 Dist., 610 So.2d 57 (1992). Banks And Banking 148(2) Bills And Notes 63 Plaintiff named as payee on check, which was never given to plaintiff, but, rather, was deposited and credited to maker's account that the check had been drawn on, could not recover face amount of check from collectingand-drawee bank on theory of conversion, in light of fact that delivery of check to plaintiff was a prerequisite to the existence of any right on her part to possession, ownership or recovery for conversion of the check and that there had been no actual or constructive delivery of the check to plaintiff. City Nat. Bank of Miami, N. A. v. Wernick, App. 3 Dist., 368 So.2d 934 (1979), certiorari denied 378 So.2d 350. Bills And Notes 63 Rule that a manual delivery of instrument is not required when a valid constructive delivery has occurred only applies if maker in some way evinces an intention to make it an enforceable obligation against himself,

2013 Thomson Reuters. No claim to original U.S. Government Works.

13

673.4201. Conversion of instrument, FL ST 673.4201

according to its terms, by surrendering control over it and intentionally placing it under power of payee or some third person for his use. City Nat. Bank of Miami, N. A. v. Wernick, App. 3 Dist., 368 So.2d 934 (1979), certiorari denied 378 So.2d 350. Bills And Notes 63 Parties Litigation could proceed in absence of individuals named as copayees on sued-upon checks, and thus, copayees were not indispensible parties to payee's negligence suit against bank arising from bank's alleged cashing of checks containing payee's forged signatures, where absence of copayees to suit did not preclude litigating whether bank was negligent as to payee, and statute pertaining to conversion of instruments limited payee's recovery to amount of his interest in the instrument, even though the interests of judicial economy might have been served by joining other copayees named in sued-upon checks. Glancy v. First Western Bank, App. 4 Dist., 802 So.2d 498 (2001). Banks And Banking 155 Generally, as beneficial owner of check, payee can maintain action against bank for conversion of check. Sykes Corp. v. Eastern Metal Supply, Inc., App. 4 Dist., 659 So.2d 475 (1995). Banks And Banking 155 Purchaser of cashier's check may bring suit directly against collecting bank for cashing check on forged endorsement. Lawrence v. Central Plaza Bank and Trust Co., App. 2 Dist., 469 So.2d 201 (1985). Banks And Banking 189 Purchaser of cashier's check had ownership interest in funds represented by check which interest was subject to conversion by collecting bank until purchaser delivered check to payee. Lawrence v. Central Plaza Bank and Trust Co., App. 2 Dist., 469 So.2d 201 (1985). Banks And Banking 189 Instructions In action by payee and surety against collecting bank for conversion of check, trial court did not err in refusing to instruct jury that surety for hire occupied inferior position in law to that of other litigant. Travelers Ins. Co. v. Jefferson Nat. Bank at Kendall, App. 3 Dist., 404 So.2d 1131 (1981). Principal And Surety 162(3) Interest on judgment Purchaser of cashier's check was not entitled to prejudgment interest against drawee bank in action for conversion of an instrument under statute. Perkins State Bank v. Connolly, 1980, 632 F.2d 1306. Interest 39(2.50)

2013 Thomson Reuters. No claim to original U.S. Government Works.

14

673.4201. Conversion of instrument, FL ST 673.4201

Versions (1) 673.4201. Conversion of instrument FL ST 673.4201 Effective [See Text Amendments] Enacted Legislation Laws 1992, c. 92-82, 2

2013 Thomson Reuters. No claim to original U.S. Government Works.

15

673.4201. Conversion of instrument, FL ST 673.4201

Editor's and Revisor's Notes (11)

UNIFORM COMMERCIAL CODE COMMENT 1. Section 3-420 is a modification of former Section 3-419. The first sentence of Section 3-420(a) states a general rule that the law of conversion applicable to personal property also applies to instruments. Paragraphs (a) and (b) of former Section 3-419(1) are deleted as inappropriate in cases of noncash items that may be delivered for acceptance or payment in collection letters that contain varying instructions as to what to do in the event of nonpayment on the day of delivery. It is better to allow such cases to be governed by the general law of conversion that would address the issue of when, under the circumstances prevailing, the presenter's right to possession has been denied. The second sentence of Section 3-420(a) states that an instrument is converted if it is taken by transfer other than a negotiation from a person not entitled to enforce the instrument or taken for collection or payment from a person not entitled to enforce the instrument or receive payment. This covers cases in which a depositary or payor bank takes an instrument bearing a forged indorsement. It also covers cases in which an instrument is payable to two persons and the two persons are not alternative payees, e.g., a check payable to John and Jane Doe. Under Section 3-110(d) the check can be negotiated or enforced only by both persons acting jointly. Thus, neither payee acting without the consent of the other, is a person entitled to enforce the instrument. If John indorses the check and Jane does not, the indorsement is not effective to allow negotiation of the check. If Depositary Bank takes the check for deposit to John's account, Depositary Bank is liable to Jane for conversion of the check if she did not consent to the transaction. John, acting alone, is not the person entitled to enforce the check because John is not the holder of the check. Section 3-110(d) and Comment 4 to Section 3-110. Depositary Bank does not get any greater rights under Section 4-205(1). If it acted for John as its customer, it did not become holder of the check under that provision because John, its customer, was not a holder. Under former Article 3, the cases were divided on the issue of whether the drawer of a check with a forged indorsement can assert rights against a depositary bank that took the check. The last sentence of Section 3-420(a) resolves the conflict by following the rule stated in Stone & Webster Engineering Corp. v. First National Bank & Trust Co., 184 N.E.2d 358 (Mass.1962) . There is no reason why a drawer should have an action in conversion. The check represents an obligation of the drawer rather than property of the drawer. The drawer has an adequate remedy against the payor bank for recredit of the drawer's account for unauthorized payment of the check. There was also a split of authority under former Article 3 on the issue of whether a payee who never received the instrument is a proper plaintiff in a conversion action. The typical case was one in which a check was stolen from the drawer or in which the check was mailed to an address different from that of the payee and was stolen after it arrived at that address. The thief forged the indorsement of the payee and obtained payment by depositing the check to an account in a depositary bank. The issue was whether the payee could bring an action in conversion against the depositary bank or the drawee bank. In revised Article 3, under the last sentence of Section 3-420(a), the payee has no conversion action because the check was never delivered to the payee. Until delivery, the payee does not have any interest in the check. The payee never became the holder of the check nor a person entitled to enforce the check. Section 3-301. Nor is the payee injured by the fraud. Normally the drawer of a check intends to pay an obligation owed to the payee. But if the check is never delivered to the payee, the obligation owed to the payee is not affected. If the check falls into the hands of a thief who obtains payment after forging the signature of the payee as an indorsement, the obligation owed to the payee continues to exist after the thief receives payment. Since the payee's right to enforce the underlying obligation is unaffected by the fraud of the thief, there is no reason to give any additional remedy to the payee. The drawer of the check has no conversion remedy, but the drawee is not entitled to charge the drawer's account when the drawee wrongfully honored the check. The remedy of the drawee is against the depositary bank for breach of warranty under Section 3-417(a)(1) or 4-208(a)(1). The loss will fall on the person who gave value to the thief for the check. The situation is different if the check is delivered to the payee. If the check is taken for an obligation owed to the payee, the last sentence of Section 3-310(b)(4) provides that the obligation may not be enforced to the extent of the amount of the check. The payee's rights are restricted to enforcement of the payee's rights in the instrument. In this event the payee is injured by the theft and has a cause of action for conversion.

2013 Thomson Reuters. No claim to original U.S. Government Works.

16

673.4201. Conversion of instrument, FL ST 673.4201

The payee receives delivery when the check comes into the payee's possession, as for example when it is put into the payee's mailbox. Delivery to an agent is delivery to the payee. If a check is payable to more than one payee, delivery to one of the payees is deemed to be delivery to all of the payees. Occasionally, the person asserting a conversion cause of action is an indorsee rather that the original payee. If the check is stolen before the check can be delivered to the indorsee and the indorsee's indorsement is forged, the analysis is similar. For example, a check is payable to the order of A. A indorses it to B and puts it into an envelope addressed to B. The envelope is never delivered to B. Rather, Thief steals the envelope, forges B's indorsement to the check and obtains payment. Because the check was never delivered to B, the indorsee, B has no cause of action for conversion, but A does have such an action. A is the owner of the check. B never obtained rights in the check. If A intended to negotiate the check to B in payment of an obligation, that obligation was not affected by the conduct of Thief. B can enforce that obligation. Thief stole A's property not B's. 2. Subsection (2) of former Section 3-419 is amended because it is not clear why the former law distinguished between the liability of the drawee and that of other converters. Why should there be a conclusive presumption that the liability is face amount if a drawee refuses to pay or return an instrument or makes payment on a forged indorsement, while the liability of a maker who does the same thing is only presumed to be the face amount? Moreover, it was not clear under former Section 3-419(2) what face amount meant. If a note for $10,000 is payable in a year at 10% interest, it is common to refer to $10,000 as the face amount, but if the note is converted the loss to the owner also includes the loss of interest. In revised Article 3, Section 3-420(b), by referring to amount payable on the instrument, allows the full amount due under the instrument to be recovered. The but clause in subsection (b) addresses the problem of conversion actions in multiple payee checks. Section 3-110(d) states that an instrument cannot be enforced unless all payees join in the action. But an action for conversion might be brought by a payee having no interest or a limited interest in the proceeds of the check. This clause prevents such a plaintiff from receiving a windfall. An example is a check payable to a building contractor and a supplier of building material. The check is not payable to the payees alternatively. Section 3-110(d). The check is delivered to the contractor by the owner of the building. Suppose the contractor forges supplier's signature as an indorsement of the check and receives the entire proceeds of the check. The supplier should not, without qualification, be able to recover the entire amount of the check from the bank that converted the check. Depending upon the contract between the contractor and the supplier, the amount of the check may be due entirely to the contractor, in which case there should be no recovery, entirely to the supplier, in which case recovery should be for the entire amount, or part may be due to one and the rest to the other, in which case recovery should be limited to the amount due to the supplier. 3. Subsection (3) of former Section 3-419 drew criticism from the courts, that saw no reason why a depositary bank should have the defense stated in the subsection. See Knesz v. Central Jersey Bank & Trust Co., 477 A.2d 806 (N.J.1984) . The depositary bank is ultimately liable in the case of a forged indorsement check because of its warranty to the payor bank under Section 4-208(a)(1) and it is usually the most convenient defendant in cases involving multiple checks drawn on different banks. There is no basis for requiring the owner of the check to bring multiple actions against the various payor banks and to require those banks to assert warranty rights against the depositary bank. In revised Article 3, the defense provided by Section 3-420(c) is limited to collecting banks other than the depositary bank. If suit is brought against both the payor bank and the depositary bank, the owner, of course, is entitled to but one recovery. HISTORICAL AND STATUTORY NOTES Prior Laws: Fla.St.1991, 673.419 . Laws 1965, c. 65-254, 1. Uniform Law: This section is similar to 3-420 of the Uniform Commercial Code . Edition. See 2 Uniform Laws Annotated, Master

2013 Thomson Reuters. No claim to original U.S. Government Works.

17

673.4201. Conversion of instrument, FL ST 673.4201

Citing References (64)

Title 1. Banking Law Journal Digest P 116.10, LIABILITY, IN GENERAL Banking Law Journal Digest U.S. Court of Appeals, 1st Circuit Fairbanks, an attorney and coadministrator of the estate of Kenerson, opened an account for the estate with Dean Witter Reynolds, Inc. Fairbanks... 2. Industrial Park Development Corp. v. American Exp. Bank, FSB 2013 WL 406815, *3+ , M.D.Fla. This cause comes before the Court upon Defendant American Express Centurion Bank's (Defendant) Motion to Dismiss Complaint (Motion to Dismiss) (Doc. 10). Plaintiff Industrial... 3. Fla. Jur. 2d Banks and Lending Institutions s 281, Recovery by depositor from bank collecting on forged indorsement Fla. Jur. 2d Banks and Lending Institutions In some instances, the drawer of a check which is paid on a forged indorsement seeks to recover not from the drawee or payor bank of which it is the depositor but from a bank which... 4. Fla. Jur. 2d Banks and Lending Institutions s 282, Generally; rights against drawee or payor bank Fla. Jur. 2d Banks and Lending Institutions It is generally recognized that a drawee bank which pays a check upon the unauthorized indorsement of the payee becomes liable to the payee whose indorsement is forged or to the... 5. Fla. Jur. 2d Banks and Lending Institutions s 284, Rights against cashing or collecting bank Fla. Jur. 2d Banks and Lending Institutions Under the law preceding the Uniform Commercial Code (U.C.C.), where the payee's indorsement on a check was forged and the check was cashed by a bank which was not the drawee, the... 6. Fla. Jur. 2d Banks and Lending Institutions s 320, Effect of instructions given to collecting bank Fla. Jur. 2d Banks and Lending Institutions Article 4 of the Uniform Commercial Code (U.C.C.) provides that subject to the provisions of U.C.C. Article 3 concerning the conversion of instruments and restrictive indorsements,... 7. Fla. Jur. 2d Bills, Notes, and Other Commercial Paper s 248, Holder Fla. Jur. 2d Bills, Notes, and Other Commercial Paper An instrument is paid to the extent payment is made by or on behalf of a party obliged to pay the instrument and to a person entitled to enforce the instrument. To the extent of... 8. Fla. Jur. 2d Bills, Notes, and Other Commercial Paper s 369, Generally Fla. Jur. 2d Bills, Notes, and Other Commercial Paper The law applicable to conversion of personal property applies to instruments. An instrument is converted if it is taken by transfer, other than a negotiation, from a person not... 2013 Other Secondary Source 2013 Other Secondary Source 2013 Other Secondary Source 2013 Other Secondary Source 2013 Other Secondary Source 2013 Other Secondary Source Feb. 01, 2013 Case 2012 Date NOD Topics Type Other Secondary Source

2013 Thomson Reuters. No claim to original U.S. Government Works.

18

673.4201. Conversion of instrument, FL ST 673.4201

Title 9. Fla. Jur. 2d Bills, Notes, and Other Commercial Paper s 370, When instrument is paid on forged indorsement Fla. Jur. 2d Bills, Notes, and Other Commercial Paper An instrument is converted when it is paid on a forged indorsement. This rule gives the payee of a draft or check whose indorsement is forged a cause of action against the drawee... 10. Fla. Jur. 2d Bills, Notes, and Other Commercial Paper s 375, 2013 Who is barred from bringing conversion action Fla. Jur. 2d Bills, Notes, and Other Commercial Paper An action for conversion of an instrument may not be brought by: (1) the issuer or acceptor of the instrument; or (2) a payee or indorsee who did not receive delivery of the... 11. Fla. Jur. 2d Bills, Notes, and Other Commercial Paper s 377, 2013 Damages for conversion Fla. Jur. 2d Bills, Notes, and Other Commercial Paper In an action for conversion, the measure of liability is presumed to be the amount payable on the instrument, but recovery may not exceed the amount of the plaintiff's interest in... 12. Fla. Jur. 2d Bills, Notes, and Other Commercial Paper s 378, 2013 Liability of representative Fla. Jur. 2d Bills, Notes, and Other Commercial Paper A representative, other than a depository bank, who has in good faith dealt with an instrument or its proceeds on behalf of one who was not the person entitled to enforce the... 13. Fla. Jur. 2d Conversion and Replevin s 8, Securities and other commercial paper Fla. Jur. 2d Conversion and Replevin An action may be maintained for the conversion of documents that embody an intangible right, such as bonds, corporate stock, and other forms of commercial paper. For example, where... 14. Florida Pleading and Practice Forms s 77:55, Conversion-In general Florida Pleading and Practice Forms An instrument is converted when a drawee to whom it is delivered for acceptance refuses to return it on demand, any person to whom it is delivered for payment refuses on demand... 15. Florida Pleading and Practice Forms s 77:56, ConversionLiability of innocent representative or intermediary or payor bank Florida Pleading and Practice Forms Subject to the provisions of Chapter 673 of the Florida Statutes relating to restrictive indorsements, a representative, other than a depository who has in good faith dealt with an... 16. Florida Pleading and Practice Forms s 77:58, ComplaintAgainst collecting bank-To recover amount of forged checks Florida Pleading and Practice Forms An instrument is converted when it is paid on a forged indorsement. 673.4201(1), Fla. Stat. However, a depositary or collecting bank, which has in good faith and in accordance... 17. La Coe's Forms for Pleading Under Fla. Rules of Civ. Pro. R 1.110(526), Rule 1.110(526). Form for complaint for damages improper actions by personal r... La Coe's Forms for Pleading Under Fla. Rules of Civ. Pro. This form is adapted from the amended complaint filed in the action. Counts against the individual first personal representative and investment company were upheld. The trial... 2012 2012 2012 2012 2013 2013

Date

NOD Topics

Type Other Secondary Source

Other Secondary Source

Other Secondary Source

Other Secondary Source

Other Secondary Source

Other Secondary Source

Other Secondary Source

Other Secondary Source

Other Secondary Source

2013 Thomson Reuters. No claim to original U.S. Government Works.

19

673.4201. Conversion of instrument, FL ST 673.4201

Title 18. Conversion of Instrument, UCC Local Code Variations s 3-420 [Rev] UCC Local Code Variations ALABAMA, Ala. Code 7-3-420(a): Replaces ''The law applicable to conversion of personal property applies to instruments'' with ''An instrument is converted under circumstances... 19. Florida Uniform Commercial Code Forms s 673.2061 Form 4, 2012 Restrictive Indorsement-For Indorser's Benefit Florida Uniform Commercial Code Forms Restrictive indorsements for the benefit of the indorser are commonly used. Provisions relating to the effect of such indorsements are found in F.S.A. 673.2061 and 673.4201. 20. Florida Uniform Commercial Code Forms CH. 673 ART. 3 INTRO., 3 Negotiable Instruments Florida Uniform Commercial Code Forms Of The Florida Bar And Professor Emeritus Of Law, Florida State University College Of Law. 21. Supreme Const. Corp. v. Bank of America Corp. 2012 WL 78511, *1+ , S.D.Fla. THIS CAUSE came before the Court upon Defendants's Motion to Dismiss for Lack of Jurisdiction (D.E. No. 35), filed on December 20, 2011. Defendant Bank of America argues that there... 22. Groom v. Bank of America 2012 WL 50250, *7+ , M.D.Fla. Before the Court are Defendants' motions to dismiss (Dkts.150, 156, 163, 164, 169) and Plaintiffs' response in opposition (Dkt.175). Upon consideration, the motions are GRANTED.... 23. Supreme Const. Corp. v. Bank of America Corp. 2011 WL 6070044, *2 , S.D.Fla. THIS CAUSE came before the Court upon Defendant's Motion to Dismiss Plaintiff's First Amended Complaint (D.E. No. 27), filed on May 10, 2011. Defendant Bank of America argues that... 24. Springer v. Wachovia Bank, N.A. 2009 WL 2151294, *1+ , M.D.Fla. This matter comes before the Court on the Motion to Dismiss Plaintiffs' Amended Complaint (Doc. 29) filed by the Defendant, Wachovia Bank, N.A. (Wachovia) and the response (Doc.... 25. Lopes v. Mellon Investor Services LLC 2007 WL 4258189, *2+ , S.D.N.Y. This action arises out of a fraudulent scheme perpetrated by an unknown person. The plaintiff, Carlos Lopes (''Lopes'') filed this action on June 21, 2007 against Wachovia Bank,... 26. Attorney's Title Ins. Fund, Inc. v. Regions Bank 491 F.Supp.2d 1087, 1089+ , S.D.Fla. TORTS - Conversion. Claim for conversion of negotiable instrument will not lie absent delivery to payee, a copayee, or the payee's agent. 27. Glancy v. First Western Bank 802 So.2d 498, 499+ , Fla.App. 4 Dist. LITIGATION - Parties. Allegedly forged checks' copayees were dispensable parties to payee's negligence action against bank. 2012 2012

Date

NOD Topics

Type Other Secondary Source

Other Secondary Source

Other Secondary Source

Jan. 10, 2012

Case

Jan. 09, 2012

Case

Dec. 06, 2011

Case

Jul. 15, 2009

Case

Dec. 03, 2007

Case

Apr. 11, 2007

7. Delivery

Case

Dec. 26, 2001

8. Parties

Case

2013 Thomson Reuters. No claim to original U.S. Government Works.

20

673.4201. Conversion of instrument, FL ST 673.4201

Title 28. Racso Diagnostic, Inc. v. Community Bank of Homestead 735 So.2d 519, 519+ , Fla.App. 3 Dist. FINANCE AND BANKING - Accounts. Injured parties may bring common law actions for negligence against banks that pay on forged endorsements. 29. Ishii v. Welty 1998 WL 1064846, *4+ , M.D.Fla. This cause comes before the Court on Defendant Barnett Bank's Motion to Dismiss Plaintiff's Second Amended Complaint and Supporting Memorandum (Dkt.141), and Plaintiff's Corrected... 30. In re Jones 219 B.R. 631, 635+ , Bankr.M.D.Fla. Claims. Amended proof of claim that Chapter 11 debtor's former wife sought to file post-confirmation was a new claim, which was barred by debtor's confirmed plan. 31. Sunbank and Trust Co. of Brooksville v. Transcontinental Ins. Co. 666 So.2d 198 , Fla.App. 5 Dist. Forgeries. Clearing bank not liable for losses from forged checks. 32. Sykes Corp. v. Eastern Metal Supply, Inc. 659 So.2d 475 , Fla.App. 4 Dist. Conversion. Fact dispute as to scope of company employee's authority precluded summary judgment on conversion claim against bank into which checks endorsed by employee were... 33. Sykes Corp. v. Eastern Metal Supply, Inc. 659 So.2d 475 , Fla.App. 4 Dist. Conversion. Fact dispute as to scope of company employee's authority precluded summary judgment on conversion claim against bank into which checks endorsed by employee were... 34. Sykes Corp. v. Eastern Metal Supply, Inc. 659 So.2d 475 , Fla.App. 4 Dist. Conversion. Fact dispute as to scope of company employee's authority precluded summary judgment on conversion claim against bank into which checks endorsed by employee were... 35. NEGOTIABLE INSTRUMENTS (U.C.C. ARTICLES 3 & 4): 1993 LEADING CASES AND SIGNIFICANT DEVELOPMENTS IN FLORIDA LAW, 18 Nova L. Rev. 581, 595+ C1-3Table of Contents I. Introduction. 581 II. Background. 582 III. Scope and Coverage of Revisions. 584 A. Definitional Changes. 586 IV. Accord and Satisfaction. 587 V.... 36. Florida Nat. Bank v. Isaac Industries, Inc. 610 So.2d 57 , Fla.App. 3 Dist. Conversion. Constructive delivery to payee occurred sufficient for company to have cause of action against bank for paying forged instrument. 37. Florida Nat. Bank v. Isaac Industries, Inc. 610 So.2d 57 , Fla.App. 3 Dist. Conversion. Constructive delivery to payee occurred sufficient for company to have cause of action against bank for paying forged instrument. 1993

Date May 05, 1999

NOD Topics 4. Forged endorsement--In general Case

Type

Sep. 30, 1998

Case

Mar. 30, 1998

Case

Dec. 22, 1995

1. Construction and application

Case

Aug. 23, 1995

1. Construction and application

Case

Aug. 23, 1995

4. Forged endorsement--In general

Case

Aug. 23, 1995

8. Parties

Case

Law Review

Dec. 08, 1992

4. Forged endorsement--In general

Case

Dec. 08, 1992

7. Delivery

Case

2013 Thomson Reuters. No claim to original U.S. Government Works.

21

673.4201. Conversion of instrument, FL ST 673.4201