Sherman Kelsey Assignment6

Diunggah oleh

kelseyalshHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sherman Kelsey Assignment6

Diunggah oleh

kelseyalshHak Cipta:

Format Tersedia

To: Dr.

Andy Pennock From: Kelsey Sherman Date: November 5, 2012 Subject: Statistics Assignment 6 Scatter Plots and Line Graphs 1. Price of Residential Electricity and Number of Customers with an Ifit Line

Figure 1 compares the price of electricity for residential customers, in cents per kilowatt-hour, and the number of residential customers, in thousands, for each of the 50 states. The data used was taken from the U.S. Energy Information Administration, Detailed State Data for 2011. This data is released every year. This data was released on October 2, 2012. The x-axis represents the number of residential electricity customers, in thousands. The y-axis represents the price paid by residential electricity customers, in cents per kilowatt-hour. The number of residential customers in each state (x-axis) is the Independent variable because price does not usually change the demand for electricity. Electricity is a necessity. This being said, the price (y-axis) is the dependent variable. According to basic economic modeling, the price of electricity to residential customers should increase as the demand for electricity increases. The scatter plot and ifit line are intended to show the relationship between the number of residential electricity customers and the price paid by those customers per

kilowatt-hour in 2011. Theoretically, the more residential demand for electricity, the more residential customers should pay per kilowatt-hour. The scatter plot indicates that there is no real relationship between the number of customers and the price paid by those customers. This is demonstrated by the fact that a large number of the points that lie in the 0 to 2,000 residential customer, in thousands, region pay anywhere between $.07 and $.19 per kilowatt-hour. If there were a relationship, then, those states with only 0 to 2,000 residential customers, in thousands, would be paying less for electricity than those states with 8,000 to 10,000 residential customers, in thousands. Roughly speaking, the slope of the ifit line is slightly above zero or .19. If the number of residential customers was increased by 1,000, there would be little effect on the dependent variable, price. Its also important to note that 46 of the 51 states observed in this data set lie within the 0 to 6,000 customer, in thousands, range and also within the $.07 to $.19 per kilowatt-hour range. There are 5 outliers, Hawaii who has very few residential customers and pays nearly $.35 per kilowatt-hour for electricity. The remaining 4 states all have more than 6,000 customers, in thousands, and pay between $.11 and $.19 per kilowatthour. 2. Price of Residential Electricity and Number of Customers Changing Over Time

Every year, the U.S. Energy Information Administration releases a document entitled Electric Power Annual. The data used here was taken from the most recent release of Electric Power Annual which includes data thru 2010. Figure 2 also compares the price of electricity for residential consumers in cents per kilowatt-hour and the number of residential customers in millions but over a span of 11 years (1999 to 2010). The x-axis represents the years from 1999 to 2010. The left yaxis represents the price paid by residential consumers in cents per kilowatt-hour. The right y-axis represents the number of residential customers in millions. The aim of this graph is to demonstrate whether or not the demand for electricity and price of electricity changed over time. I would hypothesize that as the demand (number of customers) for electricity increases over time, that the price of electricity also increases. The general trend of these lines upholds my hypothesis that as the number of customers increases over time that the price of electricity increases. There are, however, a few exceptions. First, the price of electricity did not rise as much as the number of customers did, between 2002 and 2004. This accounts for the larger gap between the two lines during this time period. Also, Both the price of electricity and the number of customers did not change much between 2009 and 2010. The lines are relatively horizontal for that time period. Lastly, it is interesting to note that the relationship between price and number of customers in 1999 was opposite of what it is now. The relationship between average price and number of customers was inverted in 2000. This relationship has not inverted again since then. This change could be attributed to a steep growth in the number of residential electric customers.

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Hi Force CatalogDokumen124 halamanHi Force Cataloganjangandak2932Belum ada peringkat

- Protection Application - An Overview: Part 2ADokumen128 halamanProtection Application - An Overview: Part 2AinsanazizBelum ada peringkat

- Enron CorporationDokumen8 halamanEnron CorporationNadine Clare FloresBelum ada peringkat

- 04 Gas Turbine TurbomachDokumen42 halaman04 Gas Turbine Turbomachlalit92112760Belum ada peringkat

- Sherman Resume CLEFedDokumen2 halamanSherman Resume CLEFedkelseyalshBelum ada peringkat

- Sherman Resume CLEFedDokumen2 halamanSherman Resume CLEFedkelseyalshBelum ada peringkat

- Nick Williams PGE Bill 01.2023Dokumen3 halamanNick Williams PGE Bill 01.2023César Dávila0% (1)

- Steel & Wire Products Manufacturing MulugetaDokumen38 halamanSteel & Wire Products Manufacturing MulugetaTesfaye Degefa100% (3)

- Compact Air and Gas Insulated SSDokumen25 halamanCompact Air and Gas Insulated SSPartha Sarathi MannaBelum ada peringkat

- 700 150 Corrected PDFDokumen40 halaman700 150 Corrected PDFRamakrishnan Ramachandran57% (7)

- Jtekt e Report2016Dokumen142 halamanJtekt e Report2016Amit AryaBelum ada peringkat

- 5230 - E Motores ElectricosDokumen118 halaman5230 - E Motores Electricoslubricacion100% (1)

- India's Largest Coal Miner Coal India ContactsDokumen5 halamanIndia's Largest Coal Miner Coal India ContactsRathinder RathiBelum ada peringkat

- OTE Slurry Sampling Eng WebDokumen8 halamanOTE Slurry Sampling Eng Webjazz_2012Belum ada peringkat

- Flyback SMPS Design GuideDokumen16 halamanFlyback SMPS Design GuideRevathy100% (1)

- Docklands: A Decade of TransformationDokumen47 halamanDocklands: A Decade of TransformationWill Ntrix Postlethwaite100% (1)

- W To Project OutlineDokumen2 halamanW To Project OutlinekelseyalshBelum ada peringkat

- Sherman Resume LinkedInDokumen1 halamanSherman Resume LinkedInkelseyalshBelum ada peringkat

- Sherman Memo 3Dokumen6 halamanSherman Memo 3kelseyalshBelum ada peringkat

- Sherman Memo 2Dokumen6 halamanSherman Memo 2kelseyalshBelum ada peringkat

- Sherman Kelsey Assignment5Dokumen2 halamanSherman Kelsey Assignment5kelseyalshBelum ada peringkat

- Sherman Memo 1 RewriteDokumen6 halamanSherman Memo 1 RewritekelseyalshBelum ada peringkat

- Strategic PLN For Ric CDokumen11 halamanStrategic PLN For Ric CkelseyalshBelum ada peringkat

- Strategic PLN For Ric CDokumen11 halamanStrategic PLN For Ric CkelseyalshBelum ada peringkat

- Econometric Analysis - Childhood ObesityDokumen15 halamanEconometric Analysis - Childhood ObesitykelseyalshBelum ada peringkat

- 2013 Challenge - Memo - Brown UniversityDokumen17 halaman2013 Challenge - Memo - Brown UniversitykelseyalshBelum ada peringkat

- Policy Analysis - Student Loan DebtDokumen12 halamanPolicy Analysis - Student Loan DebtkelseyalshBelum ada peringkat

- The Alliance Business ModelDokumen1 halamanThe Alliance Business ModelkelseyalshBelum ada peringkat

- Case Study Analysis - Institute For Study and Practice of NonviolenceDokumen9 halamanCase Study Analysis - Institute For Study and Practice of NonviolencekelseyalshBelum ada peringkat

- Keeping Students in Rhode Island Post GraduationDokumen6 halamanKeeping Students in Rhode Island Post GraduationkelseyalshBelum ada peringkat

- Step Up To A CARESTREAM Film ProcessorDokumen2 halamanStep Up To A CARESTREAM Film ProcessorJose Aldrin Climacosa SerranoBelum ada peringkat

- Bhatinda O&m TGDokumen897 halamanBhatinda O&m TGDeepak Gupta100% (2)

- Yarega FeltetDokumen1 halamanYarega Feltetapi-3698374Belum ada peringkat

- Tata Motors SWOT analysis highlights opportunities and threatsDokumen7 halamanTata Motors SWOT analysis highlights opportunities and threatsKarthik K Janardhanan50% (2)

- All BDokumen146 halamanAll BChristian Joshua TalaveraBelum ada peringkat

- Reclaimed Water BC Calculator IrrigationDokumen198 halamanReclaimed Water BC Calculator IrrigationMxplatform Mx PlatformBelum ada peringkat

- Design of A Separation ProcessDokumen8 halamanDesign of A Separation Processdario delmoralBelum ada peringkat

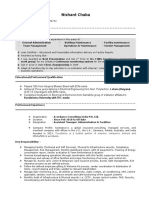

- Nishant Chaba: Mobile: 91-9990078569,8130736734Dokumen4 halamanNishant Chaba: Mobile: 91-9990078569,8130736734Wedding FilmBelum ada peringkat

- CVDokumen5 halamanCVNewaz KabirBelum ada peringkat

- Auto-Adaptive Fault Passage IndicatorDokumen4 halamanAuto-Adaptive Fault Passage IndicatortunghtdBelum ada peringkat

- Acoustix Forest FX Product SpecDokumen1 halamanAcoustix Forest FX Product SpecFloorkitBelum ada peringkat

- Assignment No 11 EDEDokumen2 halamanAssignment No 11 EDEomkarchate204Belum ada peringkat

- Catalogo Bombas PedrolloDokumen80 halamanCatalogo Bombas PedrolloChesster EscobarBelum ada peringkat

- Plant Optimization & Performance SoftwareDokumen59 halamanPlant Optimization & Performance SoftwarePatrickpong PongBelum ada peringkat

- Aurum Consulting Engineers Monterey Bay Inc.-Electrical Engineering - RedactedDokumen17 halamanAurum Consulting Engineers Monterey Bay Inc.-Electrical Engineering - RedactedL. A. Paterson100% (1)

- Sample Resume-Mechanical EngineerDokumen1 halamanSample Resume-Mechanical Engineersanjay_lingotBelum ada peringkat