Alcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLD

Diunggah oleh

ekidenJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Alcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLD

Diunggah oleh

ekidenHak Cipta:

Format Tersedia

ALCOA NYSE-AA

TIMELINESS

SAFETY

TECHNICAL

5

3

5

RECENT

PRICE

High:

Low:

Lowered 11/7/08

22.4

16.1

20.3

14.5

41.7

18.0

LEGENDS

12.0 x Cash Flow p sh

Lowered 12/12/08 . . . . Relative Price Strength

2-for-1 split 2/99

BETA 1.40 (1.00 = Market)

2-for-1 split 6/00

Options: Yes

2011-13 PROJECTIONS

Shaded area: prior recession

Annl Total Latest recession began 12/07

5.7 RELATIVE

DIVD

Median: 20.0) P/E RATIO 3.62 YLD 5.6%

12.12 P/ERATIO 44.9(Trailing:

43.6

23.1

45.7

27.4

39.8

17.6

38.9

18.5

39.4

28.5

32.3

22.3

37.0

26.4

48.8

28.1

44.8

6.8

VALUE

LINE

Target Price Range

2011 2012 2013

Lowered 2/2/96

64

48

40

32

24

20

16

12

2-for-1

Price

Gain

Return

High

30 (+150%) 29%

Low

20 (+65%) 17%

Insider Decisions

to Buy

Options

to Sell

F

0

1

1

M

0

0

0

A

1

0

0

M

0

2

3

J

0

0

0

J

1

0

0

A

0

0

1

S

0

0

0

O

1

0

0

8

6

% TOT. RETURN 12/08

Institutional Decisions

1Q2008

2Q2008

3Q2008

289

303

280

to Buy

to Sell

392

374

391

Hlds(000) 651965 651801 627430

Percent

shares

traded

24

16

8

1 yr.

3 yr.

5 yr.

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

13.84 12.81 13.86 17.72 18.93 19.79 20.91 22.19 26.50 26.97 23.99 24.76 26.96 30.06

1.28

1.07

1.21

2.13

1.88

2.25

2.33

2.66

3.13

2.97

2.25

2.56

2.92

2.90

.28

.10

.27

1.11

.79

1.09

1.21

1.41

1.81

1.46

.92

1.21

1.53

1.43

.20

.20

.20

.23

.33

.25

.38

.40

.50

.60

.60

.60

.60

.60

1.15

1.07

.86

1.26

1.44

1.36

1.27

1.25

1.30

1.39

1.50

.99

1.31

2.44

5.17

4.99

5.52

6.22

6.39

6.48

8.18

8.51 13.13 12.46 11.69 13.84 15.21 15.30

685.84 706.89 714.85 705.26 690.04 673.10 733.62 735.50 865.52 847.59 844.82 868.49 870.98 870.27

31.0

87.1

36.3

11.0

18.9

17.1

14.8

20.4

17.6

25.3

32.3

21.6

21.5

19.5

1.88

5.15

2.38

.74

1.18

.99

.77

1.16

1.14

1.30

1.76

1.23

1.14

1.04

2.3%

2.3%

2.1%

1.8%

2.2%

1.3%

2.1%

1.4%

1.6%

1.6%

2.0%

2.3%

1.8%

2.1%

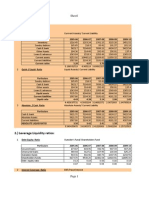

CAPITAL STRUCTURE as of 9/30/08

Total Debt $8424.0 mill. Due in 5 Yrs $2800.0 mill.

LT Debt $8370.0 mill. LT Interest $400.0 mill.

(Long-term interest earned: 11.9x)

(Total interest coverage: 11.3x)

(36% of Capl)

Uncapitalized Annual rentals $315.0 mill.

Pension Assets 12/07 $10.7 bill. Oblig. $11.6

bill.

Pfd Stock $55.0 mill. Pfd Divd $2.0 mill.

Common Stock 800,317,368 shs.

MARKET CAP: $9.7 billion (Large Cap)

CURRENT POSITION 2006

2007

($MILL.)

Cash Assets

506

483

Receivables

3435

3053

Inventory (LIFO)

3805

3326

Other

1411

1224

Current Assets

9157

8086

Accts Payable

2680

2787

Debt Due

510

202

Other

4091

4177

Current Liab.

7281

7166

9/30/08

15340

17.3%

856.2

853.0

32.0%

5.6%

1756.8

2877.0

6055.9

10.6%

14.1%

9.8%

31%

16323

17.3%

901.0

1054.0

29.9%

6.5%

1797.0

2657.0

6318.0

12.8%

16.7%

12.1%

28%

22936

18.8%

1219.0

1489.0

33.5%

6.5%

d376.0

4987.0

11422

10.3%

13.0%

9.4%

28%

22859

15.4%

1253.0

1263.0

33.3%

5.5%

1789.0

6388.0

10614

8.5%

11.9%

7.1%

41%

20263

13.1%

1116.0

785.0

33.8%

3.9%

1852.0

8365.0

9927.0

5.2%

7.9%

2.8%

65%

21504

13.4%

1194.0

1034.0

24.2%

4.8%

1656.0

6692.0

12075

6.3%

8.6%

4.3%

50%

23478

14.4%

1204.0

1340.6

25.5%

5.7%

1195.0

5346.0

13300

7.8%

10.1%

6.2%

39%

26159

14.0%

1267.0

1259.3

34.6%

4.8%

1422.0

5279.0

13373

7.6%

9.4%

5.5%

42%

THIS

STOCK

VL ARITH.

INDEX

-68.3

-59.2

-67.0

-37.4

-26.7

-8.2

VALUE LINE PUB., INC.

11-13

34.94 37.16 34.65 29.40 Sales per sh

4.39

4.63

2.85

2.20 Cash Flow per sh

2.90

2.95

1.25

.60 Earnings per sh A

.60

.68

.68

.68 Divds Decld per sh B

3.68

4.39

4.00

3.50 Capl Spending per sh

16.76 19.29 20.00 19.65 Book Value per sh C

869.54 827.40 800.00 800.00 Common Shs Outstg D

10.4

12.4

22.9

Avg Annl P/E Ratio

.56

.65

1.44

Relative P/E Ratio

2.0%

1.9%

2.4%

Avg Annl Divd Yield

35.00

3.35

1.65

.74

3.15

21.20

800.00

15.0

1.00

3.0%

30379 30748

17.9% 15.5%

1280.0 1268.0

2540.0 2564.0

25.1% 37.8%

8.4%

8.3%

1876.0 920.0

4778.0 6371.0

14631 16016

14.0% 12.3%

17.4% 16.0%

13.8% 12.4%

21%

23%

28000

13.0%

1250

1325

30.0%

4.7%

900

5825

17075

6.5%

7.8%

4.5%

45%

27700

12.0%

1275

1015

30.0%

3.7%

950

7570

16115

5.0%

6.3%

3.0%

54%

23500

11.0%

1275

470

29.0%

2.0%

925

7510

15825

3.0%

3.0%

NMF

NMF

Sales ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Capl ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Capl

Return on Shr. Equity

Retained to Com Eq

All Divds to Net Prof

BUSINESS: Alcoa is a global leader in aluminum production, serving the aerospace, automotive, building and construction, commercial transportation and industrial markets. Sold the consumer and

packaging division during 1Q 2008. Has more than 300 operating

and sales locations in over 40 countries. 2007 revenues by segment: Alumina and Aluminum, 30%; Transportation, 25%; Packag-

ing, 24%; other, 21%. Foreign sales : 45% of total. Has about

107,000 employees. Capital World Investors owns 5.8% of common stock, State Street Global Advisors, 4.2%, officers and directors own less than 2% (3/08 Proxy). Chairman: Alain J.P. Belda. Incorporated: PA. Address: 201 Isabella St., Pittsburgh, PA. 15212.

Telephone: 412-553-4545. Internet: www.alcoa.com.

Alcoa is cutting costs. It will eliminate

about 15,000 jobs, close more plants, sell

ANNUAL RATES Past

Past Estd 05-07 assets, and cut expenditures to cope with

of change (per sh)

10 Yrs.

5 Yrs.

to 11-13

tough economic times. In essence, the comSales

6.0%

5.5%

.5%

pany is reducing capacity to meet declinCash Flow

6.5%

7.5%

-3.0%

Earnings

9.5% 11.5%

-6.0%

ing demand for aluminum, especially in

Dividends

9.0%

2.0%

3.0%

the automotive sector.

Book Value

10.5%

6.5%

3.5%

Lowered demand for aluminum is

QUARTERLY SALES ($ mill.)

CalFull decreasing the price paid to Alcoa.

endar Mar.31 Jun.30 Sep.30 Dec.31 Year The automotive, aerospace, and construc2005 6226 6698 6566 6669 26159 tion industries are going through cyclical

2006 7244 7664 7631 7840 30379 downturns. The depth and length of the

2007 7908 8066 7387 7387 30748 pullback are uncertain.

2008 7375 7620 7234 5471 27700

2009 5300 5700 6000 6500 23500 Rising aluminum inventories may

mean that pricing will remain soft for

EARNINGS PER SHARE A

CalFull some time. High-cost production is being

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

replaced

with

lower-cost

production

2005

.40

.46

.33

.24

1.43 worldwide. While this suggests that the

2006

.70

.84

.62

.74

2.90 price of aluminum may stay relatively low

2007

.76

.81

.63

.75

2.95

2008

.37

.66

.33 d.11

1.25 into 2010, we believe that this will also en2009

d.05

.10

.20

.35

.60 courage more consumption by enabling

end-product pricing to come down.

B

QUARTERLY

DIVIDENDS

PAID

CalFull Current results are less certain than

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

usual. The company was scheduled to

2005

.15

.15

.15

.15

.60 release its year-end 2008 results shortly

2006

.15

.15

.15

.15

.60 after we went to press. We expect that

2007

.17

.17

.17

.17

.68 fourth-quarter results and managements

2008

.17

.17

.17

.17

.68

guidance will be subdued, at best.

2009

The global economic slowdown suggests that difficult times may extend

well into 2009. Aluminum pricing has

declined particularity in response to

severe demand weakness in the auto and

truck industry, which is a large user of the

metal. Too, the fall in prices reflects the

lack of credit available in the financial system, making purchases more difficult.

The dividend may need to be scaled

back. Alcoa is now on credit watch at a

major bond-rating agency, likely reflecting

the prospects for lower earnings and cash

flows. Indeed, the current dividend payout

exceeds our lowered earnings-per-share estimate for 2009.

These shares carry our Lowest ranking for Timeliness. The very sluggish

global economic conditions pushed the

shares significantly lower throughout

2008. Various policy initiatives will stimulate economic activity, but the big-ticket,

credit-dependent nature of Alcoas end

markets suggests that demand will improve only slowly. We believe that these

shares are most appropriate for multiyear

investors as part of a diversified portfolio.

Douglas G. Maurer, CFA January 16, 2009

831

3288

3844

1309

9272

2791

54

4198

7043

(A) Primary shares through 96, diluted after.

Excludes nonrecurring items: 92, ($3.91); 93,

(18); 94, 52; 96, (12); 97, 13; 01, (41);

02, 43; 03, (7); 04, (4); 05 (3); 06,

(33). Next earnings report due early April.

(C) Includes intangibles: At 12/31/07 $5888.0

(B) Dividends historically paid in late Feb., mill., $7.12/sh. (D) In millions, adjusted for

May, Aug., Nov. Dividend reinvestment plan stock splits.

available.

2009, Value Line Publishing, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscribers own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Companys Financial Strength

Stocks Price Stability

Price Growth Persistence

Earnings Predictability

A

50

25

60

To subscribe call 1-800-833-0046.

Anda mungkin juga menyukai

- SMT Quick Reference Guide - April 2020 PDFDokumen11 halamanSMT Quick Reference Guide - April 2020 PDFESLAM AHMED0% (1)

- Superstocks Final Advance Reviewer'sDokumen250 halamanSuperstocks Final Advance Reviewer'sbanman8796% (24)

- Superstocks Final Advance Reviewer'sDokumen250 halamanSuperstocks Final Advance Reviewer'sbanman8796% (24)

- Asian PaintsDokumen22 halamanAsian Paintsardiab100% (1)

- Ek VLDokumen1 halamanEk VLJohn Aldridge ChewBelum ada peringkat

- Ukrainian Gypsy Fortune TellingDokumen20 halamanUkrainian Gypsy Fortune Tellingekiden88% (8)

- Ted Weschler 2002 InterviewDokumen3 halamanTed Weschler 2002 InterviewekidenBelum ada peringkat

- Finance Assignment Case AnalysisDokumen6 halamanFinance Assignment Case AnalysisBinayak GhimireBelum ada peringkat

- Action Notes: Trican Well Service LTDDokumen4 halamanAction Notes: Trican Well Service LTDkanith0Belum ada peringkat

- United Engineers - CIMBDokumen7 halamanUnited Engineers - CIMBTheng RogerBelum ada peringkat

- GSPL, 11th February, 2013Dokumen10 halamanGSPL, 11th February, 2013Angel BrokingBelum ada peringkat

- Boeing Company: 14.0 21.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokumen1 halamanBoeing Company: 14.0 21.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDsonystdBelum ada peringkat

- 3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDokumen1 halaman3M Company: 20.1 15.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDasdzxcv1234Belum ada peringkat

- Development Sales Lacking: Wheelock Properties (S)Dokumen7 halamanDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerBelum ada peringkat

- Csco VLDokumen1 halamanCsco VLiver2340_729926247Belum ada peringkat

- Fed Refocus: Sector WatchDokumen5 halamanFed Refocus: Sector WatchSokhomBelum ada peringkat

- New Malls Contribute: Capitamalls AsiaDokumen7 halamanNew Malls Contribute: Capitamalls AsiaNicholas AngBelum ada peringkat

- Gujarat State Petronet: Performance HighlightsDokumen10 halamanGujarat State Petronet: Performance HighlightsAngel BrokingBelum ada peringkat

- Tesla (TSLA) - WedbushDokumen9 halamanTesla (TSLA) - WedbushpachzevelBelum ada peringkat

- Crompton Greaves: Performance HighlightsDokumen12 halamanCrompton Greaves: Performance HighlightsAngel BrokingBelum ada peringkat

- 23 12 11 Yanzhou Coal NomuraDokumen14 halaman23 12 11 Yanzhou Coal NomuraMichael BauermBelum ada peringkat

- Bukit Sembawang EstatesDokumen7 halamanBukit Sembawang EstatesNicholas AngBelum ada peringkat

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutDokumen2 halamanKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasBelum ada peringkat

- Q2FY2013 InvestorsDokumen31 halamanQ2FY2013 InvestorsRajesh NaiduBelum ada peringkat

- Crompton GreavesDokumen12 halamanCrompton GreavesAngel BrokingBelum ada peringkat

- Arch Communication Inc.: Bf-2 Case StudyDokumen3 halamanArch Communication Inc.: Bf-2 Case Studyk_Dashy8465Belum ada peringkat

- Chart Title: About The IndustryDokumen9 halamanChart Title: About The IndustryChandramouli GanapathyBelum ada peringkat

- Mixed Use JK PDFDokumen9 halamanMixed Use JK PDFAnkit ChaudhariBelum ada peringkat

- Technics Oil & Gas: 3QFY12 Results ReviewDokumen4 halamanTechnics Oil & Gas: 3QFY12 Results ReviewtansillyBelum ada peringkat

- First Resources: Singapore Company FocusDokumen7 halamanFirst Resources: Singapore Company FocusphuawlBelum ada peringkat

- DMX Technologies: OverweightDokumen4 halamanDMX Technologies: Overweightstoreroom_02Belum ada peringkat

- GfiDokumen17 halamanGfiasfasfqweBelum ada peringkat

- Conference Call: 3rd Quarter 2013Dokumen26 halamanConference Call: 3rd Quarter 2013LightRIBelum ada peringkat

- Hindalco: Performance HighlightsDokumen14 halamanHindalco: Performance HighlightsAngel BrokingBelum ada peringkat

- EC203 Tutorial 12 Time Series 16Dokumen4 halamanEC203 Tutorial 12 Time Series 16R and R wweBelum ada peringkat

- Wet Seal - VLDokumen1 halamanWet Seal - VLJohn Aldridge ChewBelum ada peringkat

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Large 200 Index ComponentsDokumen401 halamanFundamental Equity Analysis & Analyst Recommendations - STOXX Large 200 Index ComponentsQ.M.S Advisors LLCBelum ada peringkat

- SDRLDokumen1 halamanSDRLmiscrandomBelum ada peringkat

- Misc (Hold, Eps ) : HLIB ResearchDokumen3 halamanMisc (Hold, Eps ) : HLIB ResearchJames WarrenBelum ada peringkat

- Name of Company STUDENT NAME: - : Ratio ComparisonsDokumen5 halamanName of Company STUDENT NAME: - : Ratio ComparisonslenovojiBelum ada peringkat

- Gas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Dokumen3 halamanGas Price Escalated at 5% Per Annum OPEX Is Escalated at % Per Annum Heating Value IS 900 BTU/SCF Income Tax Is 42.5 %Kazmi Qaim Ali ShahBelum ada peringkat

- Bmo 8.1.13 PDFDokumen7 halamanBmo 8.1.13 PDFChad Thayer VBelum ada peringkat

- Valu TraderDokumen16 halamanValu TraderRichard SuttmeierBelum ada peringkat

- Project On JSW Financial Statement AnalysisDokumen24 halamanProject On JSW Financial Statement AnalysisRashmi ShuklaBelum ada peringkat

- FY 2011-12 Third Quarter Results: Investor PresentationDokumen34 halamanFY 2011-12 Third Quarter Results: Investor PresentationshemalgBelum ada peringkat

- Chapter 6 ExhibitsDokumen8 halamanChapter 6 ExhibitsKuntalDekaBaruahBelum ada peringkat

- JP Associates: Performance HighlightsDokumen12 halamanJP Associates: Performance HighlightsAngel BrokingBelum ada peringkat

- Reliance Communication Result UpdatedDokumen11 halamanReliance Communication Result UpdatedAngel BrokingBelum ada peringkat

- Hexaware 1Q CY 2013Dokumen13 halamanHexaware 1Q CY 2013Angel BrokingBelum ada peringkat

- National Aluminium Result UpdatedDokumen12 halamanNational Aluminium Result UpdatedAngel BrokingBelum ada peringkat

- ACC Result UpdatedDokumen11 halamanACC Result UpdatedAngel BrokingBelum ada peringkat

- Maruti Suzuki: Performance HighlightsDokumen12 halamanMaruti Suzuki: Performance HighlightsAngel BrokingBelum ada peringkat

- Bank Vs LicDokumen15 halamanBank Vs LicPraveen AsokaranBelum ada peringkat

- Annualreport 2011Dokumen78 halamanAnnualreport 2011DrSues02Belum ada peringkat

- Lincoln Crowne Engineering Mining Services Research 26 July 2013Dokumen2 halamanLincoln Crowne Engineering Mining Services Research 26 July 2013Lincoln Crowne & CompanyBelum ada peringkat

- Sarin Technologies: SingaporeDokumen8 halamanSarin Technologies: SingaporephuawlBelum ada peringkat

- Analysis (Click Here) : Year 2007-2008 Year 2008-2009Dokumen42 halamanAnalysis (Click Here) : Year 2007-2008 Year 2008-2009Chandan KathuriaBelum ada peringkat

- Discounted Cash Flow ModelDokumen9 halamanDiscounted Cash Flow ModelMohammed IrfanBelum ada peringkat

- Source: MWCOG Round 6.3 Forecasts, Prepared by The Research & Technology Center, M-NCPPCDokumen11 halamanSource: MWCOG Round 6.3 Forecasts, Prepared by The Research & Technology Center, M-NCPPCM-NCPPCBelum ada peringkat

- Applied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions ManualDokumen5 halamanApplied Corporate Finance A Users Manual 2nd Edition Damodaran Solutions ManualAmandaNoblegqiez100% (18)

- GSPL 4Q Fy 2013Dokumen10 halamanGSPL 4Q Fy 2013Angel BrokingBelum ada peringkat

- Subros Result UpdatedDokumen10 halamanSubros Result UpdatedAngel BrokingBelum ada peringkat

- Sarda Energy 4Q FY 2013Dokumen12 halamanSarda Energy 4Q FY 2013Angel BrokingBelum ada peringkat

- Automotive Axles 2Q SY 2013Dokumen10 halamanAutomotive Axles 2Q SY 2013Angel BrokingBelum ada peringkat

- Ratio 1Dokumen35 halamanRatio 1niranjanusmsBelum ada peringkat

- Example 6.1 - The Little Manufacturing Company: MonthDokumen41 halamanExample 6.1 - The Little Manufacturing Company: MonthclementiBelum ada peringkat

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioDari EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioBelum ada peringkat

- Weak El Niño Strengthens Chicken Price: UpdateDokumen9 halamanWeak El Niño Strengthens Chicken Price: UpdateekidenBelum ada peringkat

- ST Petersburg Paradox and Tech Stocks 2000Dokumen7 halamanST Petersburg Paradox and Tech Stocks 2000ekidenBelum ada peringkat

- Comments On The 15 Growth IllusionDokumen4 halamanComments On The 15 Growth IllusionekidenBelum ada peringkat

- Similarities and Differences GAAPDokumen44 halamanSimilarities and Differences GAAPskyahead1003Belum ada peringkat

- May 2557 Samart AnalysisDokumen8 halamanMay 2557 Samart AnalysisekidenBelum ada peringkat

- Grand Strategy - KEYNOTEDokumen17 halamanGrand Strategy - KEYNOTEekidenBelum ada peringkat

- Michael Burry Case StudyDokumen1 halamanMichael Burry Case StudyekidenBelum ada peringkat

- The Origins of Michael Burry, OnlineDokumen2 halamanThe Origins of Michael Burry, OnlineekidenBelum ada peringkat

- With Time Running Short, Steve Jobs Managed His Farewells - NYTimesDokumen4 halamanWith Time Running Short, Steve Jobs Managed His Farewells - NYTimesekidenBelum ada peringkat

- Executive Summary Period 1Dokumen2 halamanExecutive Summary Period 1Огнян ГеоргиевBelum ada peringkat

- R2003D10581013 Assignment 1 - Finance & Strategic ManagementDokumen10 halamanR2003D10581013 Assignment 1 - Finance & Strategic ManagementMandy Nyaradzo MangomaBelum ada peringkat

- Deutsche Bank (7 February, 2020)Dokumen17 halamanDeutsche Bank (7 February, 2020)Ishita GuptaBelum ada peringkat

- The Use of Content Analysis in Quantitative ResearchDokumen17 halamanThe Use of Content Analysis in Quantitative ResearchTerry College of BusinessBelum ada peringkat

- Ratio Analysis ITCDokumen15 halamanRatio Analysis ITCVivek MaheshwaryBelum ada peringkat

- Avon Products Inc - 2009Dokumen22 halamanAvon Products Inc - 2009Charisse L. SarateBelum ada peringkat

- Assignment of PoonamDokumen73 halamanAssignment of PoonamPinky ChowdhuryBelum ada peringkat

- Stock ValuationDokumen17 halamanStock Valuationsankha80Belum ada peringkat

- Far 340: Financial Analysis Statement Petronas Gas BerhadDokumen26 halamanFar 340: Financial Analysis Statement Petronas Gas BerhadaishahBelum ada peringkat

- Chapter 16-Financial Statement Analysis: Multiple ChoiceDokumen19 halamanChapter 16-Financial Statement Analysis: Multiple ChoiceRodBelum ada peringkat

- Proposed Merger: Building A Leader For A New Era in Sustainable MobilityDokumen27 halamanProposed Merger: Building A Leader For A New Era in Sustainable Mobilityfajar_k2001Belum ada peringkat

- Chapter 3 Fs AnalysisDokumen8 halamanChapter 3 Fs AnalysisYlver John YepesBelum ada peringkat

- Chapter 15 Solutions: Solutions To Questions For Review and DiscussionDokumen28 halamanChapter 15 Solutions: Solutions To Questions For Review and DiscussionAlbert CruzBelum ada peringkat

- YubarajDokumen4 halamanYubarajYubraj ThapaBelum ada peringkat

- Overview of Financial Statement AnalysisDokumen25 halamanOverview of Financial Statement Analysisxxcocxine100% (1)

- Ratios Formulas CommentsDokumen5 halamanRatios Formulas CommentsMariano DumalaganBelum ada peringkat

- Case 1Dokumen6 halamanCase 1Yafei Zhang100% (1)

- Entre November 16Dokumen42 halamanEntre November 16Charlon GargantaBelum ada peringkat

- CorpoDokumen16 halamanCorpoErica JoannaBelum ada peringkat

- Final ProjectDokumen55 halamanFinal ProjectAnjan KumarBelum ada peringkat

- HPA 14 Assignemnt Due October 26thDokumen3 halamanHPA 14 Assignemnt Due October 26thcBelum ada peringkat

- Roha Dyechem Private Limited: Rating RationaleDokumen8 halamanRoha Dyechem Private Limited: Rating RationaleForall PainBelum ada peringkat

- Yangshan Port Project ManagementDokumen34 halamanYangshan Port Project ManagementChiranjibi Mohanty100% (1)

- MIDTERM-MAS Responsibility Accounting Transfer PricingDokumen9 halamanMIDTERM-MAS Responsibility Accounting Transfer PricingbangtansonyeondaBelum ada peringkat

- Comparative Analysis of Financial Statements 1Dokumen44 halamanComparative Analysis of Financial Statements 1The onion factory100% (1)

- ACCA Interpreting Financial Statements Requires Analysis and Appraisal of The Performance and Position of An EntityDokumen6 halamanACCA Interpreting Financial Statements Requires Analysis and Appraisal of The Performance and Position of An Entityyung kenBelum ada peringkat

- Valuasi Saham MppaDokumen29 halamanValuasi Saham MppaGaos FakhryBelum ada peringkat