Sss Benefits

Diunggah oleh

jerick16Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sss Benefits

Diunggah oleh

jerick16Hak Cipta:

Format Tersedia

SSS BENEFITS: Monthly Pension is granted only to the primary beneficiaries of a deceased member who had paid 36 monthly

contributions before the semester of death. How much monthly pension will a retiree receive? The monthly pension depends on the members paid contributions, including the credited years of service (CYS) and the number of dependent minor children but not to exceed five. The amount of monthly pension will be the highest of: 1. 2. 3. The sum of P300 plus 20 percent of the average monthly salary credit plus 2 per cent of the average monthly salary credit for each accredited year of service (CYS) in excess of ten years; or 40 per cent of the average monthly salary credit; or P1,000 if the member had less than 10 credited years of service (CYS); P1,200 if with at least 10 CYS; or P2,400 if with at least 20 CYS. The monthly pension is paid for not less than 60 months.

If the deceased member is survived by legitimate, legitimated, or legally adopted and illegitimate children, how is the monthly pension divided? If a deceased member is survived by less than five minor legitimate, legitimated, or legally adopted children, the illegitimate minor children will be entitled to 50 percent of the share of the legitimate, legitimated or legally adopted children in the basic pension and 100 percent of the dependents' pension. In cases where there are no legitimate, legitimated, or legally adopted children, the illegitimate minor children shall be entitled to 100 percent of the basic pension. How is the monthly pension paid? The monthly pension is paid thru the beneficiarys designated bank. The beneficiary is allowed to choose the bank nearest his residence thru which he wishes to receive his pension benefits under the Mag-impok sa Bangko program. This became mandatory effective September 1, 1993. The beneficiary must open a single savings account and must submit to the SSS his saving account number and a photocopy of his passbook upon filing of application. The original passbook must be presented for authentication purposes. Upon approval of the claim, the SSS will mail a notice voucher to the beneficiary informing him when to withdraw his benefit from the bank. Dependent Pension: "SEC. 12A. Dependents' Pension. Where monthly pension is payable on account of death, permanent total disability or retirement, dependents' pension equivalent to ten percent (10%) of the monthly pension or Two hundred fifty pesos (P250.00), whichever is higher, shall also be paid for each dependent child conceived on or before the date of the contingency but not exceeding five (5), beginning with the youngest and without substitution: Provided, That where there are legitimate and illegitimate children, the former shall be preferred. Retirement Benefits: It is a cash benefit either in monthly pension or lump sum paid to a member who can no longer work due to old age. Who may qualify for a retirement benefit? 1. 2. A member who is 60 years old, separated form employment or ceased to be self-employed, and has paid at least 120 monthly contributions prior to the semester of retirement. A member who is 65 years old whether employed or not and has paid at least 120 monthly contributions prior to the semester of retirement.

(b) A covered member who is sixty (60) years old at retirement and who does not qualify for pension benefits under paragraph (a) above, shall be entitled to a lump sum benefit equal to the total contributions paid by him and on his behalf: Provided, That he is separated from employment and is not continuing payment of contributions to the SSS on his own. The lump sum amount - The lump sum amount is granted to a retiree who has not paid the required 120 monthly contributions. It is equal to the total contributions paid by the member and by the employer including interest. Upon the Death of the Retired Member: "(d) Upon the death of the retired member, his primary beneficiaries as of the date of his retirement shall be entitled to receive the monthly pension: Provided, That if he has no primary beneficiaries and he dies within sixty (60) months from the start of his monthly pension, his secondary beneficiaries shall be entitled to a lump sum benefit equivalent to the total monthly pensions corresponding to the balance of the fiveyear guaranteed period, excluding the dependents' pension. "(e) The monthly pension of a member who retires after reaching age sixty (60) shall be the higher of either: (1) the monthly pension computed at the earliest time he could have retired had he been separated from employment or ceased to be selfemployed plus all adjustments thereto; or (2)the monthly pension computed at the time when he actually retires. Suspension of Monthly Pension:

"(c) The monthly pension shall be suspended upon the reemployment or resumption of selfemployment of a retired member who is less than sixtyfive (65) years old. Basic requirements to avail: You must be at least 60 years old and retired from work to avail of this benefit. You should have paid at least 120 monthly contributions prior to retirement. If not, youll get a lump sum amount instead of the monthly pension. At age 65, you may claim the retirement benefit regardless if youre employed or not. A retiree is entitled to a 13th month pension paid every December. Children of a retiree conceived on or before retirement date are also entitled to a dependents pension equal to 10% of the members monthly pension or 250 pesos whichever is higher. This stops when the child reaches age 21, gets married or gets employed.

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- CC: Undersecretary For GASSG and Deputy Project Director For Finance, Pantawid PamilyaDokumen1 halamanCC: Undersecretary For GASSG and Deputy Project Director For Finance, Pantawid Pamilyajerick16Belum ada peringkat

- Memo Change Grantees-MLDokumen1 halamanMemo Change Grantees-MLjerick16Belum ada peringkat

- Calendar of Act FebDokumen1 halamanCalendar of Act Febjerick16Belum ada peringkat

- Coa TransmittalDokumen2 halamanCoa Transmittaljerick16Belum ada peringkat

- 29 Anak V Executive Secretary CDDokumen4 halaman29 Anak V Executive Secretary CDjerick16Belum ada peringkat

- Letter To Lilibeth DulinDokumen1 halamanLetter To Lilibeth Dulinjerick16Belum ada peringkat

- Certification - For Rescheduling - UnpaidDokumen1 halamanCertification - For Rescheduling - Unpaidjerick16Belum ada peringkat

- David and BathsebaDokumen2 halamanDavid and Bathsebajerick16100% (1)

- Feedeback Report - June 2012Dokumen2 halamanFeedeback Report - June 2012jerick16Belum ada peringkat

- ReversionDokumen4 halamanReversionjerick16Belum ada peringkat

- September 2012 CalendarDokumen1 halamanSeptember 2012 Calendarjerick16Belum ada peringkat

- Handy Scanner For AndroidDokumen1 halamanHandy Scanner For Androidjerick16Belum ada peringkat

- Arnel D. Garcia, Ceso IiiDokumen1 halamanArnel D. Garcia, Ceso Iiijerick16Belum ada peringkat

- Change of Mop MCCTDokumen1 halamanChange of Mop MCCTjerick16Belum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Financial Times Europe - 28 03 2020 - 29 03 2020 PDFDokumen52 halamanFinancial Times Europe - 28 03 2020 - 29 03 2020 PDFNikhil NainBelum ada peringkat

- Medical Application FormDokumen5 halamanMedical Application FormRaz De NeiBelum ada peringkat

- Assignment On Time Value of MoneyDokumen2 halamanAssignment On Time Value of MoneyVijay NathaniBelum ada peringkat

- Universiti Teknologi MaraDokumen2 halamanUniversiti Teknologi MaraAZRIL HAIRIE CHAIRIL ASYRAFBelum ada peringkat

- CH 16 - Staff Loans - Provisions BGVBDokumen17 halamanCH 16 - Staff Loans - Provisions BGVBpritt2010Belum ada peringkat

- Contoh Format QuotationDokumen1 halamanContoh Format QuotationBenjaminOmar100% (1)

- 2008 Auditing Released MC QuestionsDokumen50 halaman2008 Auditing Released MC QuestionsOpiey RofiahBelum ada peringkat

- The Statutory Audit Report of ITC LTDDokumen8 halamanThe Statutory Audit Report of ITC LTDsvrbchaudhariBelum ada peringkat

- Business CaseDokumen26 halamanBusiness CaseujiwaraBelum ada peringkat

- ASX Schools Share Market Game Lesson PlansDokumen78 halamanASX Schools Share Market Game Lesson Plansstjm9999Belum ada peringkat

- FloatDokumen8 halamanFloatريم الميسريBelum ada peringkat

- Sebi Notifies Stricter Norms For RPTS: 1. Definition of Related Party WidenedDokumen9 halamanSebi Notifies Stricter Norms For RPTS: 1. Definition of Related Party WidenedhareshmsBelum ada peringkat

- IIBF Annual Report 2018-19 PDFDokumen111 halamanIIBF Annual Report 2018-19 PDFanantBelum ada peringkat

- Cost Pools: Activity-Based CostingDokumen9 halamanCost Pools: Activity-Based CostingsulthanhakimBelum ada peringkat

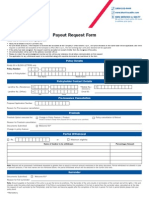

- Payout Request FormDokumen2 halamanPayout Request FormSATHISHLATEST2005100% (11)

- How To Use Ichimoku Charts in Forex TradingDokumen14 halamanHow To Use Ichimoku Charts in Forex Tradinghenrykayode4Belum ada peringkat

- 1 Working Capital Management & Cash ManagementDokumen41 halaman1 Working Capital Management & Cash ManagementAibhy Cacho YapBelum ada peringkat

- Tax Planning in Case of Foreign Collaborations and Joint VentureDokumen3 halamanTax Planning in Case of Foreign Collaborations and Joint VentureDr Linda Mary SimonBelum ada peringkat

- Fringe Benefit FSLGDokumen92 halamanFringe Benefit FSLGkashfrBelum ada peringkat

- 2010-10-22 003512 Yan 8Dokumen19 halaman2010-10-22 003512 Yan 8Natsu DragneelBelum ada peringkat

- Post Trade Investment Banking OutsourcingDokumen40 halamanPost Trade Investment Banking Outsourcingdemkol002Belum ada peringkat

- q3. Fs QuizzerDokumen13 halamanq3. Fs QuizzerClaudine DuhapaBelum ada peringkat

- High Probability Trading Triggers For Gold & SilverDokumen52 halamanHigh Probability Trading Triggers For Gold & Silverabrar_90901Belum ada peringkat

- Stock Price Prediction Using Machine Learning With PythonDokumen13 halamanStock Price Prediction Using Machine Learning With Pythonlatest tecthBelum ada peringkat

- U.S. Retail: Taxes On Taxes - The Fiscal Cliff & Potential Implications For The Consumer OutlookDokumen38 halamanU.S. Retail: Taxes On Taxes - The Fiscal Cliff & Potential Implications For The Consumer Outlookwjc711Belum ada peringkat

- Quiz Question and Answers of Ratio Analysis Class 12 AccountancyDokumen89 halamanQuiz Question and Answers of Ratio Analysis Class 12 AccountancybinodeBelum ada peringkat

- Mock Licensure Examination For CPA Final Room AssignmentDokumen3 halamanMock Licensure Examination For CPA Final Room AssignmentAndrew ManaloBelum ada peringkat

- DR Ambedkar: An Economist With Revolutionary Mindset: R S Deshpande and Anup HivraleDokumen29 halamanDR Ambedkar: An Economist With Revolutionary Mindset: R S Deshpande and Anup HivraleR S DeshpandeBelum ada peringkat

- Crisil Sme Connect Dec11Dokumen60 halamanCrisil Sme Connect Dec11Lao ZhuBelum ada peringkat

- 5) Advanced AccountingDokumen40 halaman5) Advanced AccountingKshitij PatilBelum ada peringkat