Accounting For Managers

Diunggah oleh

bhfunJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting For Managers

Diunggah oleh

bhfunHak Cipta:

Format Tersedia

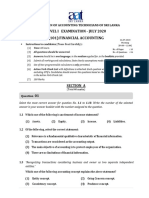

Seat No.

: _____

Enrolment No.______

GUJARAT TECHNOLOGICAL UNIVERSITY

MBA. Sem-I Remedial Examination April 2010

Subject code: 810001 Subject ame: Accounting for Managers

Date: 03 / 04 / 2010 Total Marks: 70 Time: 12.00 noon 02.30 pm

Instructions:

1. Attempt all questions. 2. Make suitable assumptions wherever necessary. 3. Figures to the right indicate full marks. Q.1 (a) Describe briefly various steps of accounting process. (b) Describe briefly various concepts of accounting. (a) What are intangible assets? How is goodwill valued? (b) Give abridged format of a corporate Balance sheet. 07 07 07 07

Q.2

Also give its statement form.

OR (b) What are the contents of a corporate Governance report? Q.3 07

Q.3

(a) Write a brief note on IFRS. 07 (b) Prepare an Accounting Policy Statement. 07 OR (a) Describe the Provisions of the Companies Act. 1956 regarding 07

accounts of a company. (b) What are the various tools of financial statement analysis?

Q.4

07

(a) What is the managerial need of a Cash Flow Statement? 07

How is it prepared? (b) How is Cash Flow Statement interpreted ?Explain Using 07 imaginary data.

OR

Q.4

(a) ABC Ltd. Co. purchased second hand machinery on April 07

1,1996 for Rs.3,70,000and installed it at a cost of Rs.30,000. On October 1, 1977, it purchased another machine for Rs.1,00,000 and on October 1,1998,sold off the first machine purchased in 1996, Rs.2,80,000. On the same date , it purchased machinery for Rs.2,50,000. On October 1, 1999, the second machinery purchased for Rs.1,00,000 was sold off for Rs.20,000 In the beginning, depreciation was provided on machinery at the rate of 10% p.a. on the original cost each year on March 31. From the year 1997-98, however, the company changed the method of providing depreciation and adopted the W.D.V. method, the rate of depreciation being 15%. Give machinery account for the period 1996-2000.

1

(b) Explain LIFO and FIFO methods of inventory valuation with

07

comparison. Give suitable illustration.

Q.5 (a) Explain liquidity, solvency and profitability ratios. 07 (b) The following ratios with industry ratios are presented before 07

you. Prepare a note analyzing them along with suggested action plan for consideration and approval by your companys Board of Directors. Sr.No. Ratio Company Industry Ratio Ratio 1. Current Ratio 2.67 2.50 2. Debtors Turnover 10.00 8.00 (Time) 3. Stock 3.33 9.00 Turnover(Times) 4. Net Sales Margin (%) 2.10 3.50 5. Net Profit to Total 3.00 7.00 Assets(%) 6. ROI(%) 4.81 10.00 7. 8.

Q.5

Total Debts to Total Assets (%) Total Assests Turnover

OR

37.00 1.43

60.00 2.00

07 07

(a) Explain Responsibility Accounting. (b) Describe Inflation Accounting.

*************

Anda mungkin juga menyukai

- QBDokumen34 halamanQBAadeel NooraniBelum ada peringkat

- MEFA Important QuestionsDokumen14 halamanMEFA Important Questionstulasinad123Belum ada peringkat

- QuesDokumen12 halamanQuesRajesh UsBelum ada peringkat

- Bcss & Faa Que - PaperDokumen3 halamanBcss & Faa Que - PaperNaresh GuduruBelum ada peringkat

- P7 - Financial Accounting and Tax Principles: Financial Management Pillar Managerial Level PaperDokumen20 halamanP7 - Financial Accounting and Tax Principles: Financial Management Pillar Managerial Level PaperlunoguBelum ada peringkat

- Third Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BDokumen18 halamanThird Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BTHE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Belum ada peringkat

- MEFA Important Questions JWFILESDokumen14 halamanMEFA Important Questions JWFILESEshwar TejaBelum ada peringkat

- Accounting For Managers GTU Question PaperDokumen3 halamanAccounting For Managers GTU Question PaperbhfunBelum ada peringkat

- Accounting concepts and principles in financial statementsDokumen6 halamanAccounting concepts and principles in financial statementskartikbhaiBelum ada peringkat

- MEFA Unit Wise Imp QuestionsDokumen6 halamanMEFA Unit Wise Imp QuestionsSatya KumarBelum ada peringkat

- Gujarat Technological University: InstructionsDokumen2 halamanGujarat Technological University: InstructionspatelaxayBelum ada peringkat

- Accounting and Finance Concepts for ManagersDokumen3 halamanAccounting and Finance Concepts for Managersengg.satyaBelum ada peringkat

- BCom VI Analysis of Financial StatementsDokumen3 halamanBCom VI Analysis of Financial StatementsVaibhav BanjanBelum ada peringkat

- AIOU Financial Reporting Checklist Explains Key ConceptsDokumen9 halamanAIOU Financial Reporting Checklist Explains Key ConceptsarsalanssgBelum ada peringkat

- Question Papers Supplementary Exam 2007Dokumen24 halamanQuestion Papers Supplementary Exam 2007ce1978Belum ada peringkat

- Mefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Dokumen202 halamanMefa by Aarya Sri+ Imp Qustns (Uandistar - Org)Srilekha KadiyalaBelum ada peringkat

- Paper 1: AccountingDokumen30 halamanPaper 1: Accountingsuperdole83Belum ada peringkat

- Financial ManagementDokumen16 halamanFinancial ManagementManish FloraBelum ada peringkat

- Smu Mba Winter 2013 Solved AssignmentDokumen85 halamanSmu Mba Winter 2013 Solved AssignmentTusharr AhujaBelum ada peringkat

- Intermediate Exam Question Compilation for ICWAI Syllabus 2002Dokumen30 halamanIntermediate Exam Question Compilation for ICWAI Syllabus 2002Reshma RajBelum ada peringkat

- Acct1511 2013s2c2 Handout 2 PDFDokumen19 halamanAcct1511 2013s2c2 Handout 2 PDFcelopurpleBelum ada peringkat

- CMA April - 14 Exam Question PDFDokumen63 halamanCMA April - 14 Exam Question PDFArup Saha50% (2)

- Managerial Level Ias - 8 Financial Accounting: From The Desk of Ghulam Mustafa (FCMA), M.A. EconomicsDokumen4 halamanManagerial Level Ias - 8 Financial Accounting: From The Desk of Ghulam Mustafa (FCMA), M.A. EconomicsSundus HussainBelum ada peringkat

- FM12 Financial Management: Assignment No.IDokumen3 halamanFM12 Financial Management: Assignment No.ISrajan KhareBelum ada peringkat

- Maximum: 100 Marks Part A 40 Marks) : OCTOBER 2008Dokumen9 halamanMaximum: 100 Marks Part A 40 Marks) : OCTOBER 2008shikhatiwari777Belum ada peringkat

- CCE E MBA (Aviation Management) Assignment 1Dokumen6 halamanCCE E MBA (Aviation Management) Assignment 1Sukhi MakkarBelum ada peringkat

- Mefa Imp+ Arryasri Guide PDFDokumen210 halamanMefa Imp+ Arryasri Guide PDFvenumadhavBelum ada peringkat

- Important Questions KMBN103Dokumen8 halamanImportant Questions KMBN103Shivam ChandraBelum ada peringkat

- Gujarat Technological University: InstructionsDokumen1 halamanGujarat Technological University: InstructionsFaisal Malek0% (1)

- Accounting Test Paper 1: Key ConceptsDokumen30 halamanAccounting Test Paper 1: Key ConceptsSatyajit PandaBelum ada peringkat

- CA (Final) Financial Reporting: InstructionsDokumen4 halamanCA (Final) Financial Reporting: InstructionsNakul GoyalBelum ada peringkat

- Answer ALL Questions A (10 × 2 20 Marks)Dokumen3 halamanAnswer ALL Questions A (10 × 2 20 Marks)Vem Baiyan CBelum ada peringkat

- Accounting Title for Document on Financial Accounting ExamDokumen10 halamanAccounting Title for Document on Financial Accounting ExamjamespotheadBelum ada peringkat

- Attempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100Dokumen15 halamanAttempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100GENIUS1507Belum ada peringkat

- Ms 4Dokumen2 halamanMs 4Dickie SangmaBelum ada peringkat

- VEC Dept of Mgt Studies BA7106 QBDokumen12 halamanVEC Dept of Mgt Studies BA7106 QBSRMBALAABelum ada peringkat

- F AccountDokumen39 halamanF AccountChandra Prakash SoniBelum ada peringkat

- Question Paper-S4Dokumen2 halamanQuestion Paper-S4Titus ClementBelum ada peringkat

- Business and Finance June 2012Dokumen2 halamanBusiness and Finance June 2012Saiful IslamBelum ada peringkat

- Model Paper Financial AccountingDokumen6 halamanModel Paper Financial AccountingzurwahmirzaBelum ada peringkat

- Question Bank Sem IIDokumen16 halamanQuestion Bank Sem IIPrivate 4uBelum ada peringkat

- Financial SimplyDokumen2 halamanFinancial SimplyAj sathesBelum ada peringkat

- MB0045 FinancialDokumen2 halamanMB0045 FinancialAj sathesBelum ada peringkat

- Accounts Preliminary Paper No 8Dokumen6 halamanAccounts Preliminary Paper No 8AMIN BUHARI ABDUL KHADERBelum ada peringkat

- Gujarat Technological University: InstructionsDokumen2 halamanGujarat Technological University: InstructionsVasim ShaikhBelum ada peringkat

- NCERT Solutions for Class 11 AccountancyDokumen4 halamanNCERT Solutions for Class 11 AccountancyAnonymous VaYaLmoX4Belum ada peringkat

- Afm 2810001 Dec 2019Dokumen4 halamanAfm 2810001 Dec 2019PILLO PATELBelum ada peringkat

- AssignmentsDokumen7 halamanAssignmentspratikshakurhade04Belum ada peringkat

- Allama Iqbal Open University, Islamabad Warning: (Department of Commerce)Dokumen7 halamanAllama Iqbal Open University, Islamabad Warning: (Department of Commerce)Ubedullah DahriBelum ada peringkat

- Gujarat Technological University: InstructionsDokumen4 halamanGujarat Technological University: InstructionsMuvin KoshtiBelum ada peringkat

- PPC Question BankDokumen20 halamanPPC Question BankMyameSirameBelum ada peringkat

- First Question BankDokumen16 halamanFirst Question BankviradiyajatinBelum ada peringkat

- Public Administration (Mains) Last 34 Years Papers by Mrunal - Org (1979-2012)Dokumen79 halamanPublic Administration (Mains) Last 34 Years Papers by Mrunal - Org (1979-2012)Sujeet Kumar0% (2)

- R05 - Financial Accounting and AnalysisDokumen3 halamanR05 - Financial Accounting and AnalysisSrinivas NallamalliBelum ada peringkat

- MEFA Most Important QuestionsDokumen15 halamanMEFA Most Important Questionsapi-26548538100% (5)

- Guide to Management Accounting CCC (Cash Conversion Cycle) for ManagersDari EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for ManagersBelum ada peringkat

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportDari EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportBelum ada peringkat

- Guide to Management Accounting CCC for managers 2020 EditionDari EverandGuide to Management Accounting CCC for managers 2020 EditionBelum ada peringkat

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionDari EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionBelum ada peringkat