Israel - Expenditure Rule - Review of The Bank of Israel

Diunggah oleh

Eduardo PetazzeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Israel - Expenditure Rule - Review of The Bank of Israel

Diunggah oleh

Eduardo PetazzeHak Cipta:

Format Tersedia

BANK OF ISRAEL Office of the Spokesperson and Economic Information December 29, 2013

Press Release

The Bank of Israels comment on the governments decision on the update of the expenditure rule The economic program adopted by the government when it approved the budget for 201314 reduced the deficit significantly, rehabilitated public trust and market trust in the governments commitment to the deficit targets it set, and contributed to a decline in the risk premium of the Israeli economy and to a decline in the interest rate on the public debt. It is important that the government continue adhering to the deficit path that it adoptedby which the deficit is to decline to 2.5 percent of GDP in 2015 and 2 percent in 2016in order to enable a consistent decline in the debt to GDP ratio and to maintain the markets trust that has been achieved with significant effort. As part of the process to ensure meeting the multiyear deficit targets, and in order to avoid a marked increase in the tax burden, the Bank of Israel supports updating the expenditure rule to slow the rate of growth of public expenditure. This is in view of the assessment that the growth potential of the economy in the next few years, against the background of demographic changes, is expected to be lower than it was in the past decade. As the Bank of Israel has previously noted, the cost of the programs that the government has adopted requires significant adjustments in the 2015 budget in order to meet the deficit target. The rule proposed by the government and the moderate expenditure growth rate derived from it bring into clearer focus the challenge in setting budgetary priorities. Since the budget reserve has been reduced from the 2014 budget onward with the reduction in the expenditure ceiling that accompanied the decision to cancel the tax increase, and given the limited flexibility in reducing defense expenditures, it will be necessary to cancel some of the plans that the government has adopted. Should the reduction include plans that deal with areas that are important to long-term growthsuch as improving the level of education, and particularly for population groups whose integration into the labor market is limited, growth-supporting infrastructure, and encouraging growth engines such as support for R&Dthe ability to support long-term economic growth will be reduced. The State budget is also a main tool for dealing with inequality and poverty. It is important to make sure that the lower expenditure path set by the new rule will enable the government, inter alia, to support the successful integration into employment of population groups whose level of employment and earning power are low, and to reduce poverty among workers, also through an expansion of the Earned Income Tax Credit grant (negative income tax) program. In summation, it is desirable that the continued adjustment of budget aggregates to the required deficit level achieve a balance between adjustment on the expenditure side and adjustment on the revenue side. In other words, it is desirable that the adjustment also come from an increase in tax revenues, in particular by way of cancelling exemptions, in view of the fact that total public expenditure in Israel is already not high, and the share of primary civilian expenditure in GDP is lower in Israel than in almost all of the other OECD countries, alongside a low tax burden compared to other advanced economies. Also see: The IMF Consultation Mission - Preliminary report on Israel's economy pdf, 3 pages Government Revenue and expenditures Budget Deficit

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

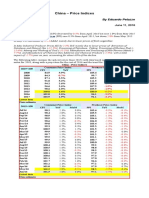

- China - Price IndicesDokumen1 halamanChina - Price IndicesEduardo PetazzeBelum ada peringkat

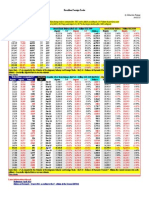

- WTI Spot PriceDokumen4 halamanWTI Spot PriceEduardo Petazze100% (1)

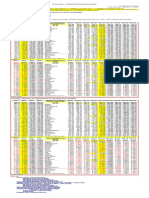

- México, PBI 2015Dokumen1 halamanMéxico, PBI 2015Eduardo PetazzeBelum ada peringkat

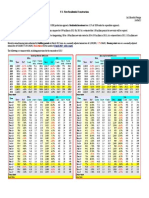

- Brazilian Foreign TradeDokumen1 halamanBrazilian Foreign TradeEduardo PetazzeBelum ada peringkat

- Retail Sales in The UKDokumen1 halamanRetail Sales in The UKEduardo PetazzeBelum ada peringkat

- U.S. New Residential ConstructionDokumen1 halamanU.S. New Residential ConstructionEduardo PetazzeBelum ada peringkat

- Euro Area - Industrial Production IndexDokumen1 halamanEuro Area - Industrial Production IndexEduardo PetazzeBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Bahaging Ginagampanan NG Igo'sDokumen24 halamanBahaging Ginagampanan NG Igo'sEdrei Jehezekel Javier100% (1)

- Cement and Steel IndustryDokumen16 halamanCement and Steel IndustryGanesh BankarBelum ada peringkat

- A - Area Code ListDokumen2 halamanA - Area Code ListMahakaal Digital PointBelum ada peringkat

- General Agreement On Tariffs and Trade: From Wikipedia, The Free EncyclopediaDokumen5 halamanGeneral Agreement On Tariffs and Trade: From Wikipedia, The Free EncyclopediasaipratapbecBelum ada peringkat

- Haier PakistanDokumen3 halamanHaier PakistanU$M@NBelum ada peringkat

- Chapter 7 - Classification of BusinessDokumen4 halamanChapter 7 - Classification of BusinessDiya SandeepBelum ada peringkat

- Tax InvoiceDokumen1 halamanTax InvoiceSunny SinghBelum ada peringkat

- About The IMFDokumen6 halamanAbout The IMFkiranaishaBelum ada peringkat

- DPWHDokumen9 halamanDPWHMohammad Ali Salem MaunaBelum ada peringkat

- Foreign Aid, Investment and DevelopmentDokumen37 halamanForeign Aid, Investment and DevelopmentAshib Uddin EmoBelum ada peringkat

- 2006891000138441-Sep-2022 3Dokumen5 halaman2006891000138441-Sep-2022 3Nooraesnirah Juleman100% (1)

- IBE Unit-5 Opne Economy Management - Updated-1Dokumen57 halamanIBE Unit-5 Opne Economy Management - Updated-1VanshBelum ada peringkat

- This ForDokumen2 halamanThis ForChapter 11 DocketsBelum ada peringkat

- Mepco Full BillDokumen1 halamanMepco Full BillIftakhar HussainBelum ada peringkat

- 12 Economics-Indian Economy 1950-1990 - AssignmentDokumen2 halaman12 Economics-Indian Economy 1950-1990 - AssignmentSiddharthBelum ada peringkat

- Company Profille PT - Timah TBKDokumen2 halamanCompany Profille PT - Timah TBKAbrar RamadhanBelum ada peringkat

- UntitledDokumen2 halamanUntitledGunvi AroraBelum ada peringkat

- Rapidly Developing Economies (RDE)Dokumen20 halamanRapidly Developing Economies (RDE)Gobinda sahaBelum ada peringkat

- Approved ExportersDokumen3 halamanApproved ExportersambseoulBelum ada peringkat

- Ch. 1 - The Global Marketing ImperativeDokumen12 halamanCh. 1 - The Global Marketing ImperativeLuca-John De Grossi50% (2)

- Statement of Account Central Bank of India: Vasna Branch, Ahmedabad Branch Code: 281463Dokumen2 halamanStatement of Account Central Bank of India: Vasna Branch, Ahmedabad Branch Code: 281463jainam100% (2)

- NR #2421B, 05.31.2011, Cooperatives Banking ActDokumen1 halamanNR #2421B, 05.31.2011, Cooperatives Banking Actpribhor2Belum ada peringkat

- Address - 1KFHE7w8BhaENAswwryaoccDb6qcT6DbYY - Mempool - Bitcoin ExplorerDokumen9 halamanAddress - 1KFHE7w8BhaENAswwryaoccDb6qcT6DbYY - Mempool - Bitcoin Explorermike100% (2)

- Principle 9: Prices Rise When The Government Prints Too Much MoneyDokumen5 halamanPrinciple 9: Prices Rise When The Government Prints Too Much MoneyJapaninaBelum ada peringkat

- Economic Systems in EthiopiaDokumen1 halamanEconomic Systems in EthiopiaMeti GudaBelum ada peringkat

- BNP Paribas Uk-Student-Housing-Market-Update - Compressed-1Dokumen2 halamanBNP Paribas Uk-Student-Housing-Market-Update - Compressed-1hamza3iqbalBelum ada peringkat

- International Business Nature, Characteristics, FeaturesDokumen8 halamanInternational Business Nature, Characteristics, FeaturesainasafiaBelum ada peringkat

- Nep 1991Dokumen47 halamanNep 1991NIHARIKA PARASHARBelum ada peringkat

- OG Data, BratDokumen2 halamanOG Data, BratAntonBelum ada peringkat

- Rubber Industry in Indonesia - Halcyon Agri Corp Enhances Position - Indonesia InvestmentsDokumen6 halamanRubber Industry in Indonesia - Halcyon Agri Corp Enhances Position - Indonesia Investmentsnoel.manroeBelum ada peringkat