PIT Illustrations

Diunggah oleh

Bảo BờmDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PIT Illustrations

Diunggah oleh

Bảo BờmHak Cipta:

Format Tersedia

PERSONAL INCOME TAX ILLUSTRATIONS

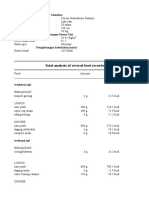

Illustration for PIT on salary and wage PR1. Ms. Thuy is a Vietnamese citizen. In 2013, Ms. Thuys monthly income is as follows: salary from Rich textile company VND20 mil (after deducting compulsory insurance 9.5%); VND0.4 mil phone allowances, and VND 2mil responsibility allowances. Thuy has to take care of her parents out of working age who have pension VND400,000 per person per month. Compute Thuys PIT for Oct 2013, noted that her deductible charity contribution in Oct 2013 was VND 7 mil. b. Recalculate Thuys PIT for Oct 2013 if her parent pension is VND 2mil per person per month. c. Compute Thuys PIT for May 2013 if her parent pension is VND550,000 per person per month. a. PR2. Mr. Anhis a Vietnamese citizen. In Sep 2013, his income included: salary from the Bean Co. VND 20 million (after deducting compulsory insurance 9.5%); received a motorcycle as a gift from his aunt worth VND40 mil; VND 0.5 mil phone allowances, VND 2 mil position allowances. His wife is a state official, and they have two children under 18 years old. Compute Mr. Ans PIT in Sep 2013, noted that two children are registered as Ans dependents. Recalculate Mr. Ans PIT for Sep 2013 if salary from the Bean Co. VND 20 million (before deducting the compulsory insurance 9.5%)

Illustration for PIT on Business income PR3. Mr. X, Mr. Y and Mr. Z join in a business registed in HCM City (business groups and individuals). Their capital contribution rate is X 40%, Y 35%, and Z 25%. Tthe income subjected to personal income tax for the year 2012 was VND900 mil. Mr. X has a wife in the working age but prefer to stay at home doing housework, and they have 2 children under 18 years old. Mr. Y is divorced and has a son enrolling a college in the U.S. and parents over working age who dont have any income. Mr. Z has to take care of a younger brother who is disabled to work and does not have any income. Compute personal income tax of each person for the year 2012. PR4. Mr. Duc and his wife, Ms. Linh, Vietnamese citizens, have 2 children (2 and 5 years old). They have hired a house maid with VND 2 mil per month salary and taken care of a 76-year-old mother who has no income. In 2013, Ms. Linhs salary is $900 per month (before deducting the compulsory insurance 9.5%) while Mr. Ducs salary is $1000 per month (before deducting the compulsory insurance 9.5%). They also rent a house for VND40 mil per month with fixed taxable income ratio of 35% on the turnover. This house is the private

property of Mr. Duc before getting married. Compute monthly personal income tax for each person. Assume that the dependents registered under Ms.Linh. Given that the exchange rate is USD 1 = VND21,000. Do you have any advice for Mr. Duc and his wife on their tax savings? PR5. Mr. Tuan and Ms. Nga, Vietnamese citizens, have two children: a 10-year-old son and a 20-year-old daughter enrolling university who has no income. Ms. Nga has to take care of a 77-year-old father-in-law and 66 years old mother-in-law. Her mother in law has a small grocery store with monthly income of VND1.5 mil Ms. Ngas salary is VND9 mil per month (before deducting the compulsory insurance 9.5%). Mr. Tuans monthly income includes VND40 mil salary (before deducting the compulsory insurance 9.5%) and VND 3 mil travel and telephone allowance. They have a house for rent at VND 20 mil per month with fixed taxable income ratio of 40% on the turnover. This house is their property after getting married. The rent contract was signed under their names. Monthly, the spouse receive VND 4 mil interest on savings deposits at Vietcombank, and Ms. Nga receives $800 from her mom who lives in the U.S. a. Advise them a tax strategy for optimal tax savings. Basing on this strategy, compute monthly PIT of each person in Oct 2013. Assume that the exchange rate is USD 1 = VND21,000. b. How the answer changes if Mr. Tuans employer is unable to pay him the 3 months salary (Oct, Nov, Dec) until Jan 2014?

Illustration for Double Tax Treaties PR6. Fred, a Singapore citizen, have been working as a specialist for a branch of a foreign company in Vietnam since 2011. In 2013, Fred has the following income: total income from salary was $40,000 at the branch in Vietnam (after deducting the compulsory insurance 9.5%); $50,000 in the parent company abroad ($5,000 personal income tax has been paid in Singapore); $2,000 round-trip flight to Singapore. In addition, Fred stayed at a house rent by the branch with a total cost of $ 12,000. He contribute d to the SOS village orphans $5,000. Fred has 2 children under 15 years old and a working-age housewife. Compute PIT of Fred for the year 2013. PR7. Ms. Jenny is an Australian expert working for the RapidNotify corporation in Australia. In the year 2012, she worked for an invitation of the corporation's subsidiary in Vietnam from May 4th to Jul 25th. Ms. Jennys income received in the year 2012 included $30,000 paid by the subsidiary for the work in Vietnam (exclude for compulsory insurance 9.5%), $2,000 one way ticket flight to Australia. Ms. Jenny was also supported by the subsidiary with house rental at $9,000, $2,000 travel allowance. Ms. Jenny is a widowed raising three children under 18 years old. Compute personal income tax payable of Ms. Jenny in Vietnam for the year 2012. Assume that the foreign exchange rate is 20,000 VND /USD

Anda mungkin juga menyukai

- COLLOIDAL GOLD RECIPE - CitrateDokumen9 halamanCOLLOIDAL GOLD RECIPE - CitrateDevon Narok100% (4)

- Questions To Client On SAP HCMDokumen19 halamanQuestions To Client On SAP HCMeurofighterBelum ada peringkat

- 56.vocal Warmup Log For Belt Your FaceDokumen5 halaman56.vocal Warmup Log For Belt Your FaceAlinutza AlinaBelum ada peringkat

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksDari EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksBelum ada peringkat

- Publication 4491 Examples and CasesDokumen54 halamanPublication 4491 Examples and CasesNorma WahnonBelum ada peringkat

- Writing Workshop G7 PDFDokumen12 halamanWriting Workshop G7 PDFJobell AguvidaBelum ada peringkat

- Monitor Zoncare - PM-8000 ServicemanualDokumen83 halamanMonitor Zoncare - PM-8000 Servicemanualwilmer100% (1)

- Msla Business FeesDokumen1 halamanMsla Business FeesNBC MontanaBelum ada peringkat

- Tutorial 10-2021-PIT2 ProblemsDokumen8 halamanTutorial 10-2021-PIT2 ProblemsHien Bach Thi Tra QTKD-3KT-18Belum ada peringkat

- SPIT Abella SamplexDokumen5 halamanSPIT Abella SamplexJasperAllenBarrientosBelum ada peringkat

- Income Taxation-IndividualDokumen118 halamanIncome Taxation-Individualjovelyn labordoBelum ada peringkat

- Chapter Review Problem 19.1 - Assignment # 2: Fundamentals of Income Tax Workbook 2019 - Volume 2 243Dokumen6 halamanChapter Review Problem 19.1 - Assignment # 2: Fundamentals of Income Tax Workbook 2019 - Volume 2 243Nam Tran0% (3)

- Daikin Sky Air (RZQS-DV1) Outdoor Technical Data BookDokumen29 halamanDaikin Sky Air (RZQS-DV1) Outdoor Technical Data Bookreinsc100% (1)

- My Phil Tax FinalDokumen11 halamanMy Phil Tax FinalRochelle Ann DianeBelum ada peringkat

- PIT HomeworkDokumen2 halamanPIT HomeworkNhi Nguyen0% (1)

- Personal Income Tax Illustrations: Illustration For PIT On Salary and WageDokumen3 halamanPersonal Income Tax Illustrations: Illustration For PIT On Salary and WageThu ThuBelum ada peringkat

- 3-Pit ExercisesDokumen4 halaman3-Pit Exercisesngothanhthuy829Belum ada peringkat

- Individual Inc Tax BUHA CH3Dokumen23 halamanIndividual Inc Tax BUHA CH3Mary TolBelum ada peringkat

- Week4 - Assignment and Presentation - 2Dokumen3 halamanWeek4 - Assignment and Presentation - 2ErnaFitrianaBelum ada peringkat

- Taxation Law Review Final ExaminationsDokumen4 halamanTaxation Law Review Final ExaminationsRufino Gerard MorenoBelum ada peringkat

- Practice Test Chapter 3 With AnswersDokumen8 halamanPractice Test Chapter 3 With AnswersDimpZ Patel100% (1)

- Tax 1 AssignmentDokumen3 halamanTax 1 AssignmentKira YamashiBelum ada peringkat

- Homework - Set - 10 - Spring 2013Dokumen4 halamanHomework - Set - 10 - Spring 2013bizinichiBelum ada peringkat

- Quiz 9+10 TaxDokumen7 halamanQuiz 9+10 TaxĐào Huyền Trang 4KT-20ACNBelum ada peringkat

- My Phil Tax Final PDF FreeDokumen11 halamanMy Phil Tax Final PDF Freepaolo suaresBelum ada peringkat

- 407 Exam 2 CH 4 5 Spr13 W o AnswDokumen7 halaman407 Exam 2 CH 4 5 Spr13 W o AnswMolly SmithBelum ada peringkat

- Tutorial 9 - PIT1 QuestionDokumen5 halamanTutorial 9 - PIT1 QuestionHien Bach Thi Tra QTKD-3KT-18Belum ada peringkat

- Tutorial Solution Chap 5Dokumen4 halamanTutorial Solution Chap 5Nurul AriffahBelum ada peringkat

- Notes Exam 2Dokumen13 halamanNotes Exam 2Maria GabrielaBelum ada peringkat

- First AssessmentDokumen3 halamanFirst AssessmentCilBelum ada peringkat

- Activity 2Dokumen1 halamanActivity 2Brixter AdvientoBelum ada peringkat

- Tutorial Chapter 10Dokumen2 halamanTutorial Chapter 10Princess AdaleaBelum ada peringkat

- Quiz Chapter 3 SolutionDokumen4 halamanQuiz Chapter 3 SolutionAde MumboBelum ada peringkat

- Case Study 1 - 5Dokumen5 halamanCase Study 1 - 5u2000124Belum ada peringkat

- 1 Joan A Single Mother Has Agi of 85 000 inDokumen2 halaman1 Joan A Single Mother Has Agi of 85 000 inhassan taimourBelum ada peringkat

- Maths From CH-06 Salary IncomeDokumen2 halamanMaths From CH-06 Salary IncomeFozle Rabby 182-11-5893Belum ada peringkat

- Worksheet No2Dokumen2 halamanWorksheet No2juvaniecamerino462Belum ada peringkat

- F6 PIT-QuestionsDokumen15 halamanF6 PIT-QuestionsChippu AnhBelum ada peringkat

- AssignmentDokumen5 halamanAssignmentMd. Alif HossainBelum ada peringkat

- 4.4 Simple Interest Word ProblemsDokumen1 halaman4.4 Simple Interest Word Problems陳韋佳Belum ada peringkat

- ACC315A JAN 2023 Taxation CAT 1Dokumen2 halamanACC315A JAN 2023 Taxation CAT 1Abuk AyulBelum ada peringkat

- Download: Acc 307 Final Exam Part 1Dokumen2 halamanDownload: Acc 307 Final Exam Part 1AlexBelum ada peringkat

- F6 PIT-AnswersDokumen21 halamanF6 PIT-AnswersChippu Anh100% (1)

- لقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مDokumen4 halamanلقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مAhmed RokaBelum ada peringkat

- Simple Interest WKST HWDokumen2 halamanSimple Interest WKST HWambulafiaBelum ada peringkat

- Assessment of FirmDokumen9 halamanAssessment of FirmJitendra VernekarBelum ada peringkat

- Estate TutorialDokumen4 halamanEstate TutorialpremsuwaatiiBelum ada peringkat

- Tutorial - Time Value of Money and Applications PDFDokumen4 halamanTutorial - Time Value of Money and Applications PDFHà ThưBelum ada peringkat

- PBT1 Mock ExamDokumen8 halamanPBT1 Mock ExamLee NguyenBelum ada peringkat

- TQ U6 Salaries 4 2019 PDFDokumen3 halamanTQ U6 Salaries 4 2019 PDFhelenBelum ada peringkat

- PrintDokumen28 halamanPrintTanvir MahmudBelum ada peringkat

- Sum On Salary 27.08.2022Dokumen3 halamanSum On Salary 27.08.2022Nilay ShethBelum ada peringkat

- PALOMARIA-MODULE 4 - Consumer MathDokumen16 halamanPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIABelum ada peringkat

- Donors Tax QuizDokumen3 halamanDonors Tax QuizPrecious Diamond DeeBelum ada peringkat

- Time Value of Money (Sample Questions) (1) 2Dokumen2 halamanTime Value of Money (Sample Questions) (1) 2mintakhtsBelum ada peringkat

- Activity 7Dokumen1 halamanActivity 7hanna enadBelum ada peringkat

- Assignment - Simple InterestDokumen2 halamanAssignment - Simple InterestJOHN REY FABILLOBelum ada peringkat

- UAE Dubai Migrant Rights - MBZ Human Rights - Abu DHabiDokumen4 halamanUAE Dubai Migrant Rights - MBZ Human Rights - Abu DHabiWar Crimes in MENABelum ada peringkat

- 2017 Jun Q-7Dokumen1 halaman2017 Jun Q-7何健珩Belum ada peringkat

- Dac 212:principles of Taxation Revision Questions Topics 1-4Dokumen6 halamanDac 212:principles of Taxation Revision Questions Topics 1-4Nickson AkolaBelum ada peringkat

- DDD Bamm 6202 Long Quiz 002 1 15Dokumen5 halamanDDD Bamm 6202 Long Quiz 002 1 15Jomari ManiponBelum ada peringkat

- Comprehensive Case Study - 2021Dokumen7 halamanComprehensive Case Study - 2021Ledger PointBelum ada peringkat

- Practice Problem 1 Simple Interest and DiscountDokumen2 halamanPractice Problem 1 Simple Interest and Discountmpet2815Belum ada peringkat

- VAT IllustrationsDokumen2 halamanVAT IllustrationsBảo BờmBelum ada peringkat

- VatDokumen37 halamanVatBảo BờmBelum ada peringkat

- Vietnamese Tax SystemDokumen19 halamanVietnamese Tax SystemBảo BờmBelum ada peringkat

- Taxation Syllabus Fall 2013Dokumen9 halamanTaxation Syllabus Fall 2013Bảo BờmBelum ada peringkat

- Personal Income TaxDokumen87 halamanPersonal Income TaxBảo BờmBelum ada peringkat

- Illustration For CITDokumen3 halamanIllustration For CITBảo BờmBelum ada peringkat

- CIT Corporate Income TaxDokumen53 halamanCIT Corporate Income TaxBảo BờmBelum ada peringkat

- Econometrics With Financial Application Version3 TestDokumen4 halamanEconometrics With Financial Application Version3 TestBảo BờmBelum ada peringkat

- I. Completion Questions 1. Normal Distributions: W E E K 1 - P R A C T I C EDokumen10 halamanI. Completion Questions 1. Normal Distributions: W E E K 1 - P R A C T I C EBảo BờmBelum ada peringkat

- Medicina 57 00032 (01 14)Dokumen14 halamanMedicina 57 00032 (01 14)fauzan nandana yoshBelum ada peringkat

- Education - Khóa học IELTS 0đ Unit 3 - IELTS FighterDokumen19 halamanEducation - Khóa học IELTS 0đ Unit 3 - IELTS FighterAnna TaoBelum ada peringkat

- EarthmattersDokumen7 halamanEarthmattersfeafvaevsBelum ada peringkat

- Apport D Un Fonds de Commerce en SocieteDokumen28 halamanApport D Un Fonds de Commerce en SocieteJezebethBelum ada peringkat

- CA500Dokumen3 halamanCA500Muhammad HussainBelum ada peringkat

- Molecular MechanicsDokumen26 halamanMolecular MechanicsKarthi ShanmugamBelum ada peringkat

- Sim Medium 2 (English)Dokumen2 halamanSim Medium 2 (English)TheLobitoBelum ada peringkat

- 09B Mechanical Properties of CeramicsDokumen13 halaman09B Mechanical Properties of CeramicsAhmed AliBelum ada peringkat

- CR-7iA CR-4iA Installation and Setup Guide (B-83774JA-1 01)Dokumen1 halamanCR-7iA CR-4iA Installation and Setup Guide (B-83774JA-1 01)lidiia.pavlkukBelum ada peringkat

- Network Access Control Quiz3 PDFDokumen2 halamanNetwork Access Control Quiz3 PDFDaljeet SinghBelum ada peringkat

- BU2508DFDokumen3 halamanBU2508DFRaduBelum ada peringkat

- Quarter 2 Week 5Dokumen54 halamanQuarter 2 Week 5rixzylicoqui.salcedoBelum ada peringkat

- WB Food Processing IndustryDokumen13 halamanWB Food Processing IndustryRakesh KumarBelum ada peringkat

- Tugas Gizi Caesar Nurhadiono RDokumen2 halamanTugas Gizi Caesar Nurhadiono RCaesar 'nche' NurhadionoBelum ada peringkat

- Audio AmplifierDokumen8 halamanAudio AmplifierYuda Aditama100% (2)

- Annual Sustainability Report 2022-23 FinalDokumen93 halamanAnnual Sustainability Report 2022-23 FinalLakshay JajuBelum ada peringkat

- Eim s2000 Series Brochure PDFDokumen16 halamanEim s2000 Series Brochure PDFHumbertoOtaloraBelum ada peringkat

- Application of Knowledge QuestionsDokumen16 halamanApplication of Knowledge QuestionsElllie TattersBelum ada peringkat

- Chapter 23Dokumen9 halamanChapter 23Trixie Myr AndoyBelum ada peringkat

- Screenshot 2019-10-30 at 12.44.00Dokumen25 halamanScreenshot 2019-10-30 at 12.44.00Miền VũBelum ada peringkat

- LIST OF REGISTERED DRUGS As of December 2012: DR No Generic Brand Strength Form CompanyDokumen2 halamanLIST OF REGISTERED DRUGS As of December 2012: DR No Generic Brand Strength Form CompanyBenjamin TantiansuBelum ada peringkat

- Revised Man As A Biological BeingDokumen8 halamanRevised Man As A Biological Beingapi-3832208Belum ada peringkat

- Governance, Business Ethics, Risk Management and Internal ControlDokumen4 halamanGovernance, Business Ethics, Risk Management and Internal ControlJosua PagcaliwaganBelum ada peringkat