Different Committees

Diunggah oleh

Mohit BhansaliJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Different Committees

Diunggah oleh

Mohit BhansaliHak Cipta:

Format Tersedia

1|Page

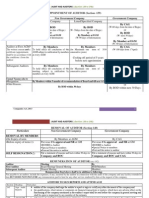

DIFFERENT COMMITTEES AS PER THE COMPANIES ACT, 2013

The historic Companies Bill which had received the Presidents assent on 29th August, 2013 became the Companies Act, 2013, (hereinafter the new Act) by notification in the Official Gazette on 30th August, 2013. Furthermore, the Ministry also made effective 98 sections of the same by notification in the Official Gazette w.e.f. 12th September, 2013. The Ministry laid the rules for the remaining sections of the new Act in different tranches for public opinions. Till date, the Ministry had released the rules in SIX phases together with the related draft forms. The new Companies Act, 2013 read with the draft rules prescribes the formation of different Committees of the Board of Directors of the Company for different purposes. The Committees mandated by the new Act are: 1. CORPORATE SOCIAL RESPONSIBILITY(CSR) COMMITTEE-Section 135 2. AUDIT COMMITTEE-Section 177 3. NOMINATION & REMUNERATION COMMITTEE-Section 178 4. STAKEHOLDERS RELATIONSHIP COMMITTEE-Section 178

It is to be noted that none of the above sections have been made effective as yet. Let us take a look into each of the mandated Committee.

CORPORATE SOCIAL RESPONSIBILITY(CSR) COMMITTEE:

2|Page

The guiding principle behind this Committee is the Corporate Social Responsibility of a Company. CSR is a way of conducting business, by which corporate entities visibly contribute to the social good. Socially responsible companies do not limit themselves to using resources to engage in activities that increase only their profits. They use CSR to integrate economic, environmental and social objectives with the companys operations and growth.

Section 135(1) of the new Act states that a Company having Net Worth of Rupees Five Hundred Crore or more, or Turnover of Rupees One Thousand Crore or more or a Net Profit of Rupees Five Crore or more

during any financial year, shall constitute a Corporate Social Responsibility Committee of the Board.

Now, what is meant by Net Worth, Turnover and Net Profit. Subsection 57 of Section 2 of the new Act defines Net Worth as the aggregate value of the paid-up share capital and all reserves created out of the profits and securities premium account, after deducting the aggregate value of the accumulated losses, deferred expenditure and miscellaneous expenditure not written off, as per the audited balance sheet, but does not include reserves created out of revaluation of assets, writeback of depreciation and amalgamation. Section 2 (91) further defines Turnover as the aggregate value of the realisation of amount made from the sale, supply or distribution of goods or on account of services rendered, or both, by the

3|Page

company during a financial year. W.e.f. 12th September, 2013, the above two subsections have already became effective. The draft CSR rules define Net Profit as the net profit before tax as per books of accounts excluding profits arising from branches outside India.

Such a Committee shall consist of three or more directors, out of which at least one director shall be an independent director. Subsection 3 of Section 135 of the new Act states the role of the Committee which will be to formulate, recommend and oversee the Corporate Social Responsibility Policy of the Company. The Ministry has further laid down the activities which are required to be undertaken by a Company for the same in Schedule VII to the new Act. It has further released draft rules, which once notified will be known as the Corporate Social Responsibility Rules, 2013 and shall be applicable from the FY 2014-15. These rules prescribe the process and requirements of the CSR Policy of a Company.

THE AUDIT COMMITTEE

At present, section 292A of the Companies Act, 1956 requires public companies having paid-up capital of more than Rs. 5 Crore to constitute an audit committee, consisting of minimum three directors and two-third of the total members to be directors other than the Managing Director or the Whole Time Directors of the company. Further, Listing agreement mandates listed entities to constitute audit committee with two-third of the members to be Independent Directors. It also

4|Page

states that all the members of the audit committee should be financially literate (i.e. should have the ability to read and understand the financial statements) and at least one should have accounting or related financial management expertise.

In tune with the present regulations, subsection 1 of section 177 of the new Act, read with the relevant draft rules, states that the Board of Directors of every listed company and every other public company (i) having paid up capital of One Hundred Crore Rupees or more; or (ii) having, in aggregate, outstanding loans or borrowings or debentures or deposits exceeding Two Hundred Crore Rupees

shall constitute an Audit Committee consisting of a minimum of three directors with independent directors forming a majority. Further, the chairperson and the majority of the members of the audit committee should have the ability to read and understand the financial statements (financially literate).

The old Companies Act, 1956 did not define the role and functions of the audit committee and generalized it by stating that the committee shall act in accordance with the terms of reference specified in writing by the Board. The listing agreement lists down the role of the audit committee in detail. The new act, though states the same as the 1956 act, also includes certain specific functions to be discharged by the committee. The role of the audit committee, inter alia, includes the following activities as per the new Act:

5|Page

a) the recommendation for appointment, remuneration and terms of appointment of auditors of the company; b) review and monitor the auditors independence and performance, and effectiveness of audit process; c) examination of the financial statement and the auditors report thereon; d) approval or any subsequent modification of transactions of the company with related parties; e) scrutiny of inter-corporate loans and investments; f) valuation of undertakings or assets of the company, wherever necessary; g) evaluation of internal financial controls and risk management systems; h) monitoring the end use of funds raised through public offers and related matters.

The audit committee shall have the authority to investigate into any matter in relation to the items specified above or any such matter referred to it by Board. For this purpose, it shall have power to obtain professional advice from external sources and have full access to information contained in the records of the company. Similar to the 1956 Act, the Audit Committee has the power to call for the comments of the auditors about internal control systems, the scope of audit, including the observations of the auditors and review of financial statement before their submission to the Board and may also discuss any related issues with the internal and statutory auditors and the management of the company. Furthermore, the recommendations of the Audit Committee shall be binding on the Board and where the Board has not had not accepted any recommendation of the Audit Committee, the same shall be disclosed in the Boards report along with the reasons therefor.

6|Page

The existing companies having audit committee are allowed a one-year timeline, from the commencement of this section, for reconstituting its audit committee in accordance with the new requirements.

Subsection 9 of Section 177 further states that each listed company and Companies 1. which accept deposits from the public; and 2. which have borrowed money from banks and public financial institutions in excess of Fifty Crore rupees; shall establish a vigil mechanism for directors and employees to report genuine concerns. This is similar to the whistle blower policy, under the listing agreement, though there it is a nonmandatory requirement. As per the new Act, the vigil mechanism will provide for adequate safeguards against victimization of persons who use such mechanism and make provision for direct access to the chairperson of the Audit Committee in appropriate or exceptional cases. Companies which are required to constitute an audit committee shall operate the vigil mechanism through the audit committee. Once established, the existence of the mechanism may be appropriately communicated within the organization shall be disclosed by the company on its website, if any, and in the Boards report.

Subsection 8 of Section 178 of the new Act further lays down the penalty for contravention of any of these provisions. In case of contravention, the company shall be punishable with fine which shall not be less than One Lakh rupees but which may extend to Five Lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which

7|Page

may extend to one year or with fine which shall not be less than Twenty-Five Thousand rupees but which may extend to One Lakh rupees, or with both.

NOMINATION & REMUNERATION COMMITTEE

Subsection 1 of Section 178 of the new Companies Act, 2013 (the Act) read with relevant draft rules stipulates that the Board of Directors of Every listed company and; every other public company (i) having paid up capital of One Hundred Crore rupees or more; or (ii) having in aggregate, outstanding loans or borrowings or debentures or deposits exceeding Two Hundred Crore rupees;

have to constitute a Nomination and Remuneration Committee. The Act further lays down the structure and role of the Committee. This Committee shall consist of three or more non-executive directors out of which not less than one-half shall be independent directors. It further provides that the chairperson of the company, irrespective of his/her status i.e. whether executive or nonexecutive may become a member of the Nomination and Remuneration Committee but shall not chair the Committee. Furthermore, the chairperson of this committee or, in his absence, any other member of the committee authorized by him in this behalf will be required to attend the general meetings of the Company.

8|Page

The role of the Nomination and Remuneration Committee shall be to identify persons having the desired qualifications for becoming directors or for appointment into the senior management level and to recommend their appointment and/or removal to the Board and also to carry out evaluation of every directors performance. The act further defines the expression senior management which means personnel of the company who are members of its core management team excluding Board of Directors comprising all members of management one level below the executive directors, including the functional head.

It has also been delegated the task of formulating the criteria for determining the qualifications, positive attributes and independence of a director and recommending to the Board a policy, which is to be disclosed in the Board's report, relating to the remuneration for the directors, key managerial personnel and other employees. While formulating and recommending the abovementioned policy, the Committee shall specifically ensure that-

(a) the level and composition of remuneration is reasonable and sufficient to attract, retain and motivate directors of the quality required to run the company successfully;

(b) relationship of remuneration to performance is clear and meets appropriate performance benchmarks; and

(c) remuneration to directors, key managerial personnel and senior management involves a balance between fixed and incentive pay reflecting short and long-term performance objectives appropriate to the working of the company and its goals.

9|Page

In addition, it shall also take into account the financial position of the company, the industrial trend, appointees experience, past performance, past remuneration, etc. and should also strive to bring about objectivity in determining the remuneration package while striking a balance between the interest of the company and the shareholders. The Act further lays down the penalty for contravention of any of these provisions. In case of contravention, the company shall be punishable with fine which shall not be less than One Lakh rupees but which may extend to Five Lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to one year or with fine which shall not be less than Twenty-Five Thousand rupees but which may extend to One Lakh rupees, or with both.

THE STAKEHOLDERS RELATIONSHIP COMMITTEE

Subsection 5 of Section 178 of the Act stipulates that if a Company has a combined total of, all its shareholders, debenture-holders, deposit-holders and any other security holders, greater than one thousand members at any time during a financial year, than its Board of Directors shall constitute a Committee to be known as the Stakeholders Relationship Committee. It further states that such a Committee will consist of a chairperson who shall be a non-executive director and such other members as may be decided by the Board. As stated above, in addition to the shareholders, debenture-holders, deposit-holders, there is also a term other security holders used. To understand the scope of this term, it is necessary to know

10 | P a g e

the different types of securities. Section 2 (81) of the new Act, read with Section (h) of the Securities Contracts (Regulation) Act, 1956 states that the term securities includes the following(i) shares, scrips, stocks, bonds, debentures, debenture stock or other marketable of a like nature in or of any incorporated company or other body corporate; (ia) (ib) derivative; units or any other instrument issued by any collective investment scheme to the investors in such schemes; (ic) security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002; Accordingly, security receipt" means a receipt or other security, issued by a securitisation company or reconstruction company to any qualified institutional buyer pursuant to a scheme, evidencing the purchase or acquisition by the holder thereof, of an undivided right, title or interest in the financial asset involved in securitisation; (id) units or any other such instrument issued to the investors under any mutual fund scheme; (ii) (iia) Government securities; such other instruments as may be declared by the Central Government to be securities; and (iii) rights or interest in securities. securities

Thus, the above definition of securities widens the scope of the term other security holders.

11 | P a g e

Subsection 6 of Section 178 further lays down the role of the Committee which shall be to consider and resolve the grievances, if any, of all the security holders of the Company. Furthermore, the chairperson of this committee or, in his absence, any other member of the committee authorized by him in this behalf will be required to attend the general meetings of the Company. The Act further lays down the penalty for contravention of any of these provisions. In case of contravention, the company shall be punishable with fine which shall not be less than One Lakh rupees but which may extend to Five Lakh rupees and every officer of the company who is in default shall be punishable with imprisonment for a term which may extend to one year or with fine which shall not be less than Twenty-Five Thousand rupees but which may extend to One Lakh rupees, or with both. However, there is also provision that in case a resolution of any grievance is not considered by this Committee in good faith, it shall not constitute a contravention of this section and the penalty clause would not be applicable.

Conclusion: Dubious accounting practices, abuses of corporate power, unequal voting rights, conflict of interest, etc. have been subjects of active debate in the media in the last few years thereby highlighting the vulnerability of the stakeholders of the Company. To overcome such practices and to safeguard the interest of the investors, a number of measures are being undertaken by the regulators. A recent step taken in this direction by the Securities & Exchange Board of India (SEBI) is the SCORES (Sebi COmplaints REdress System) system introduced by it. Also, for the first time, the role of whistle-blowers has been legislated. Though maximum provisions of the new Act are not yet effective, it is expected to be in full force from Financial Year 2014-15. As

12 | P a g e

evident, transparency with self -reporting and disclosure is the foundation of the new Act. Lets hope the new Companies Act, 2013 is successful in achieving effective corporate governance and transparency as intended by the law makers.

Act up and

.

T T

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Player-Agency AgreementDokumen4 halamanPlayer-Agency AgreementNour Mohamed100% (1)

- Synopsis of Hotel Management SystemDokumen33 halamanSynopsis of Hotel Management Systemgupta_archi84% (67)

- Liban v. GordonDokumen3 halamanLiban v. GordonNoreenesse SantosBelum ada peringkat

- Case DigestDokumen3 halamanCase DigestTeacherEli33% (3)

- Affidavit of Undertaking and WaiverDokumen1 halamanAffidavit of Undertaking and WaiverTumasitoe Bautista Lasquite50% (2)

- Utulo V PasionDokumen1 halamanUtulo V PasionElaizza ConcepcionBelum ada peringkat

- Broker and Salesperson Agreement - Sample OnlyDokumen3 halamanBroker and Salesperson Agreement - Sample Onlychris ajero100% (4)

- Androidcodingworld Blogspot in 2012 05 Android Video StreamiDokumen14 halamanAndroidcodingworld Blogspot in 2012 05 Android Video StreamiMohit BhansaliBelum ada peringkat

- Absence & Illness in Public ExamsDokumen1 halamanAbsence & Illness in Public ExamsMohit BhansaliBelum ada peringkat

- Doubly ListDokumen5 halamanDoubly ListMohit BhansaliBelum ada peringkat

- Cursor TriggerDokumen7 halamanCursor TriggerMohit BhansaliBelum ada peringkat

- Practice SQL JoinsDokumen5 halamanPractice SQL JoinsMohit BhansaliBelum ada peringkat

- Class Action SuitsDokumen5 halamanClass Action SuitsMohit BhansaliBelum ada peringkat

- DEC 2013 Cost and Financial Managment CC PaperDokumen21 halamanDEC 2013 Cost and Financial Managment CC PaperMohit BhansaliBelum ada peringkat

- Application StateDokumen2 halamanApplication StateMohit BhansaliBelum ada peringkat

- CA13Dokumen294 halamanCA13Knowitall77Belum ada peringkat

- SQL Queries and AnswersDokumen15 halamanSQL Queries and Answerskaruna1342100% (1)

- Provisions Under Companies Act Which Every Director Needs To KnowDokumen16 halamanProvisions Under Companies Act Which Every Director Needs To KnowMohit BhansaliBelum ada peringkat

- CPT M Law by Madan SirDokumen49 halamanCPT M Law by Madan SirMohit BhansaliBelum ada peringkat

- 40 59696 Buy Back of Securities Under Sebi Companies Act 2013 in IndiaDokumen2 halaman40 59696 Buy Back of Securities Under Sebi Companies Act 2013 in IndiaMohit BhansaliBelum ada peringkat

- Section 103Dokumen1 halamanSection 103Mohit BhansaliBelum ada peringkat

- CA13Dokumen294 halamanCA13Knowitall77Belum ada peringkat

- BM Via Video ConferencingDokumen5 halamanBM Via Video ConferencingMohit BhansaliBelum ada peringkat

- ResponseDokumen1 halamanResponseNajib MadriléneBelum ada peringkat

- 98 Applicable Sections of Ca 2013 NewDokumen21 halaman98 Applicable Sections of Ca 2013 NewMohit BhansaliBelum ada peringkat

- New Annual Return Form Companies Act 2013Dokumen2 halamanNew Annual Return Form Companies Act 2013Mohit BhansaliBelum ada peringkat

- LOAN TO DIRECTORS-Under Section 185 of The Companies Act, 2013Dokumen1 halamanLOAN TO DIRECTORS-Under Section 185 of The Companies Act, 2013Mohit BhansaliBelum ada peringkat

- Guide To Audit and Auditor Under Companies Act 2013Dokumen7 halamanGuide To Audit and Auditor Under Companies Act 2013Mohit BhansaliBelum ada peringkat

- Insparc Projects List 2010Dokumen26 halamanInsparc Projects List 2010Mohit BhansaliBelum ada peringkat

- MIT6 087IAP10 Assn01 SolDokumen4 halamanMIT6 087IAP10 Assn01 SolMohit BhansaliBelum ada peringkat

- Guide To Audit and Auditor Under Companies Act 2013Dokumen7 halamanGuide To Audit and Auditor Under Companies Act 2013Mohit BhansaliBelum ada peringkat

- 40 59102 Directors Role LiabilitiesDokumen75 halaman40 59102 Directors Role LiabilitiesMohit BhansaliBelum ada peringkat

- 40 58857 Companies Act 2013 Chapter XiDokumen27 halaman40 58857 Companies Act 2013 Chapter XiMohit BhansaliBelum ada peringkat

- C Progrm SCDLDokumen3 halamanC Progrm SCDLKamal DewalBelum ada peringkat

- Enjoyyourstudy Com Gniit Sem D Mt1 Exam QuestionDokumen36 halamanEnjoyyourstudy Com Gniit Sem D Mt1 Exam QuestionMohit BhansaliBelum ada peringkat

- Kinds of ObligationDokumen21 halamanKinds of Obligationjeraldtomas12Belum ada peringkat

- Centre For Research: Dr.V.Murugesan DirectorDokumen2 halamanCentre For Research: Dr.V.Murugesan Directornellai kumarBelum ada peringkat

- Soliman V FernandezDokumen5 halamanSoliman V FernandezarnyjulesmichBelum ada peringkat

- Trust Test Answer ShenaDokumen7 halamanTrust Test Answer ShenaShena JaiBelum ada peringkat

- Delegated Legislation Development and Parliamentary ControlDokumen18 halamanDelegated Legislation Development and Parliamentary ControlAkshit SinghBelum ada peringkat

- Rome Convention. ContractsDokumen15 halamanRome Convention. ContractsBipluv JhinganBelum ada peringkat

- Final NAAG Letter To Expand MFCUDokumen5 halamanFinal NAAG Letter To Expand MFCURuss LatinoBelum ada peringkat

- Father Convicted of Raping DaughterDokumen2 halamanFather Convicted of Raping DaughterLiana AcubaBelum ada peringkat

- Contributor Agreement Form - AMPSDokumen10 halamanContributor Agreement Form - AMPSEntorque RegBelum ada peringkat

- 10k Direct Payments Pro 1Dokumen5 halaman10k Direct Payments Pro 1ofallsstoresBelum ada peringkat

- Opening Doors The Untold Story of Cornelia Sorabji Reformer Lawyer and ChampionDokumen14 halamanOpening Doors The Untold Story of Cornelia Sorabji Reformer Lawyer and ChampionKaramvir DahiyaBelum ada peringkat

- G.R. No. L-11002 Supreme Court Case on Omission of Taxable PropertyDokumen5 halamanG.R. No. L-11002 Supreme Court Case on Omission of Taxable PropertyCJ N PiBelum ada peringkat

- Bulding Regulations PDF ADK 1998Dokumen0 halamanBulding Regulations PDF ADK 1998Sugumar N ShanmugamBelum ada peringkat

- Tua 1959Dokumen3 halamanTua 1959Simone SegattoBelum ada peringkat

- NJ Compost Operator Certification & Alternate Recycling Certification Programs - 2012-13Dokumen2 halamanNJ Compost Operator Certification & Alternate Recycling Certification Programs - 2012-13RutgersCPEBelum ada peringkat

- Cacho V CADokumen11 halamanCacho V CAGladys BantilanBelum ada peringkat

- Atty. Chico - Civil Law - Torts and DamagesDokumen56 halamanAtty. Chico - Civil Law - Torts and DamagesErick Paul de VeraBelum ada peringkat

- Memo For All RDs On Memo Order No 17-2520 Series of 2017 PDFDokumen1 halamanMemo For All RDs On Memo Order No 17-2520 Series of 2017 PDFCatherine BenbanBelum ada peringkat

- TK8A50D Field Effect Transistor SpecificationsDokumen6 halamanTK8A50D Field Effect Transistor Specifications劉毛毛Belum ada peringkat

- UBC Vs Agaba KamukamaDokumen6 halamanUBC Vs Agaba KamukamaKellyBelum ada peringkat

- 2010 Michigan Fishing Guide RulesDokumen40 halaman2010 Michigan Fishing Guide Rulesjimmbu1046Belum ada peringkat

- Marcos Vs ManglapusDokumen18 halamanMarcos Vs ManglapusJappy AlonBelum ada peringkat

- Villahermosa Sr. v. CaracolDokumen6 halamanVillahermosa Sr. v. CaracolVener Angelo MargalloBelum ada peringkat