Individual Investor Behavior

Diunggah oleh

akatako130 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

30 tayangan2 halamanyes

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Iniyes

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

30 tayangan2 halamanIndividual Investor Behavior

Diunggah oleh

akatako13yes

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

There is no guarantee that the average stock fund will continue to outperform the average stock fund investor

in the future. Equity markets are volatile and

average stock funds and/or average stock fund investors may lose money.

Avoid Self-Destructive Investor Behavior

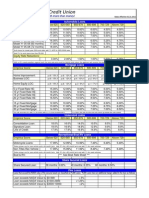

Source: Quantitative Analysis of Investor Behavior by Dalbar, Inc. (March 2012) and Lipper. Dalbar computed

the average stock fund investor return by using industry cash ow reports from the Investment Company

Institute. The average stock fund return gures represent the average return for all funds listed in Lippers

U.S. Diversied Equity fund classication model. Dalbar also measured the behavior of a systematic

equity and asset allocation investor. The annualized return for these investor types was 3.2% and 2.1%

respectively over the time frame measured. All Dalbar returns were computed using the S&P 500 Index.

Returns assume reinvestment of dividends and capital gain distributions. The fact that buy and hold has

been a successful strategy in the past does not guarantee that it will continue to be successful in the future.

The performance shown is not indicative of any particular Davis Fund investment. Past performance is not

a guarantee of future results.

Average Stock Fund Return vs. Average Stock Fund Investor Return

nvestor 8ehuvior Penulty

99220

0%

2%

4%

8%

6%

l0%

Averuge Stocl lund Peturn Averuge Stocl lund nvestor Peturn

8.2%

A

v

e

r

u

g

e

A

n

n

u

u

l

P

e

t

u

r

n

3.5%

A study by Dalbar underscores the

importance of controlling emotions

and avoiding self-destructive investor

behavior. From 19922011, the average

stock fund returned 8.2% annually while

the average stock fund investor earned

only 3.5%. We call the gap between these

results the investor behavior penalty.

Why have investors historically

sacriced more than half their potential

return? Driven by emotions like fear

and greed, they succumbed to negative

behavior such as:

Pouring money into the latest

top-performing manager or asset

class, expecting the winning streak

to continue

Avoiding areas of the market that

have performed poorly, assuming

recovery will never occur

Abandoning their investment plan by

attempting to successfully time moves

in and out of the market, a near

impossible feat

Successful investors throughout

history have understood that building

long-term wealth requires the ability

to control emotions and avoid self-

destructive investor behavior.

Individuals who cannot master their emotions are ill-suited to prot

from the investment process.

Benjamin Graham

Father of Value Investing

This material may be shared with existing and

potential clients to provide information concerning

market conditions and the investment strategies

and techniques used by Davis Advisors to manage

its client accounts. Please refer to Davis Advisors

Form ADV Part 2 for more information regarding

investment strategies, risks, fees, and expenses.

Clients should also review other relevant material,

including a schedule of investments listing

securities held in their account.

All investments contain risk and may lose value.

There is no guarantee that these investment

strategies will work under all market conditions,

and each investor should evaluate their ability to

invest for the long term, especially during periods

of downturn in the market.

Davis Advisors investment professionals make

candid statements and observations regarding

economic conditions and current and historical

market conditions. However, there is no guarantee

that these statements, opinions or forecasts will

prove to be correct. All investments involve some

degree of risk, and there can be no assurance

that Davis Advisors investment strategies will be

successful. The value of equity investments will

vary so that, when sold, an investment could be

worth more or less than its original cost.

Dalbar, a Boston-based nancial research

rm that is independent from Davis Advisors,

researched the result of actively trading mutual

funds in a report entitled Quantitative Analysis

of Investor Behavior (QAIB). The Dalbar report

covered the time periods from 19922011.

The Lipper Equity LANA Universe includes all

U.S. registered equity and mixed-equity mutual

funds with data available through Lipper. The fact

that buy and hold has been a successful strategy

in the past does not guarantee that it will continue

to be successful in the future.

The chart in this material is used to illustrate

specic points. No chart, formula or other

device can, by itself, guide an investor as to what

securities should be bought or sold or when

to buy or sell them. Although the facts in this

material have been obtained from and are based

on sources we believe to be reliable, we do not

guarantee their accuracy, and such information

is subject to change without notice.

Benjamin Graham is not associated in any way

with Davis Selected Advisers, Davis Advisors or

their afliates.

The S&P 500 Index is an unmanaged index of

500 selected common stocks, most of which are

listed on the New York Stock Exchange. The

Index is adjusted for dividends, weighted towards

stocks with large market capitalizations and

represents approximately two-thirds of the total

market value of all domestic common stocks.

Investments cannot be made directly in an index.

Broker-dealers and other nancial intermediaries

may charge Davis Advisors substantial fees for

selling its products and providing continuing

support to clients and shareholders. For example,

broker-dealers and other nancial intermediaries

may charge: sales commissions; distribution

and service fees; and record-keeping fees. In

addition, payments or reimbursements may be

requested for: marketing support concerning

Davis Advisors products; placement on a list of

ofered products; access to sales meetings, sales

representatives and management representatives;

and participation in conferences or seminars,

sales or training programs for invited registered

representatives and other employees, client and

investor events, and other dealer-sponsored

events. Financial advisors should not consider

Davis Advisors payment(s) to a nancial

intermediary as a basis for recommending

Davis Advisors.

Shares of the Davis Funds are not deposits or

obligations of any bank, are not guaranteed by

any bank, are not insured by FDIC or any other

agency, and involve investment risks, including

possible loss of the principal amount invested.

Davis Advisors

2949 East Elvira Road, Suite101, Tucson, AZ 85756

800-279-0279

Item #45559/12

Over 40 Years of Reliable Investing

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Daniel Want Prerequisite RVTVDokumen14 halamanDaniel Want Prerequisite RVTVakatako13Belum ada peringkat

- 8492Dokumen3 halaman8492akatako13Belum ada peringkat

- Ashtanga - Its Yoga - Larry SchultzDokumen74 halamanAshtanga - Its Yoga - Larry Schultzakatako13100% (1)

- Introduction To FuturesTradingDokumen31 halamanIntroduction To FuturesTradingakatako13Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- ACCT451 Assignment 1: QUESTION 1A) Cost MethodDokumen7 halamanACCT451 Assignment 1: QUESTION 1A) Cost MethodsmaBelum ada peringkat

- Role of Information Technology in Indian Banking Sector: Dr.G.Tulasi Rao, T.Lokeswara RaoDokumen5 halamanRole of Information Technology in Indian Banking Sector: Dr.G.Tulasi Rao, T.Lokeswara RaoNikhil patilBelum ada peringkat

- WSS 9 Case Studies Blended FinanceDokumen36 halamanWSS 9 Case Studies Blended FinanceAbdullahi Mohamed HusseinBelum ada peringkat

- FM Books Solution - Nov 23Dokumen78 halamanFM Books Solution - Nov 23Arnik AgarwalBelum ada peringkat

- Profit MaximizationDokumen42 halamanProfit MaximizationSwarnima SinghBelum ada peringkat

- Insurance & Risk ManagementDokumen4 halamanInsurance & Risk ManagementTeju PaputejBelum ada peringkat

- Cash CA NCA CLDokumen8 halamanCash CA NCA CL15vinayBelum ada peringkat

- BankDokumen73 halamanBankSunil NikamBelum ada peringkat

- HDFC LifeDokumen1 halamanHDFC Lifevirendra singhBelum ada peringkat

- Essentials of Investments 9th Edition Bodie Solutions ManualDokumen10 halamanEssentials of Investments 9th Edition Bodie Solutions Manualmarciahubbardenpkmtdxrb100% (13)

- Indusind Bank Platinum Aura Edge Credit Card StatementDokumen3 halamanIndusind Bank Platinum Aura Edge Credit Card Statementsubroto78Belum ada peringkat

- Online Check WriterDokumen1 halamanOnline Check WriterJohnson WilliamBelum ada peringkat

- Providing Manpower For Landscaping Works at Manama: Capital MunicipalityDokumen2 halamanProviding Manpower For Landscaping Works at Manama: Capital MunicipalityTina SubinBelum ada peringkat

- Đề 2022 2023Dokumen11 halamanĐề 2022 2023buitrantuuyen2003Belum ada peringkat

- Super Cash GainDokumen2 halamanSuper Cash GainElangovan PurushothamanBelum ada peringkat

- Impactof Capitalstructureon Financial PerformanceanditsdeterminantsDokumen11 halamanImpactof Capitalstructureon Financial PerformanceanditsdeterminantsLehar GabaBelum ada peringkat

- Manager Selection - CFADokumen148 halamanManager Selection - CFAJuliano VieiraBelum ada peringkat

- Salary Slip TemplateDokumen1 halamanSalary Slip TemplateDeepa Darshini0% (1)

- Loan RatesDokumen1 halamanLoan RatesAndrew ChambersBelum ada peringkat

- CSEC PoA P1 (MCQ) 2006 05 (May) - SPECDokumen11 halamanCSEC PoA P1 (MCQ) 2006 05 (May) - SPECBoppy VevoBelum ada peringkat

- Non QM Underwriting GuideDokumen50 halamanNon QM Underwriting GuidevijayambaBelum ada peringkat

- Private WealthDokumen4 halamanPrivate WealthKunal DesaiBelum ada peringkat

- Charges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids CardDokumen5 halamanCharges & Fee - IDBI Bank Card Products: 1) Classic Debit Card/Women's Debit Card/Being Me Card/Kids Cardrose thomsan thomsanBelum ada peringkat

- Accounting For Joint OperationDokumen4 halamanAccounting For Joint OperationMaurice AgbayaniBelum ada peringkat

- AOM 2023-004 Understated Due To NGADokumen4 halamanAOM 2023-004 Understated Due To NGAKean Fernand BocaboBelum ada peringkat

- Deposit Mobilization of Himalayan Bank Limited: Srijana PandeyDokumen9 halamanDeposit Mobilization of Himalayan Bank Limited: Srijana PandeygopalBelum ada peringkat

- Quezon City University: Bachelor of Science in AccountancyDokumen13 halamanQuezon City University: Bachelor of Science in AccountancyRiza Mae Alce50% (2)

- Fundamentals of AccountancyDokumen3 halamanFundamentals of AccountancySheena RobiniolBelum ada peringkat

- Tabel Bunga Ekonomi TeknikDokumen32 halamanTabel Bunga Ekonomi TeknikTdaBelum ada peringkat

- JPMorgan Chase London Whale GDokumen15 halamanJPMorgan Chase London Whale GMaksym ShodaBelum ada peringkat