Bank and External Borrowings of The Corporate Sector

Diunggah oleh

RAGHUBALAN DURAIRAJUJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bank and External Borrowings of The Corporate Sector

Diunggah oleh

RAGHUBALAN DURAIRAJUHak Cipta:

Format Tersedia

ECONOMIC NOTES

EPW Research Foundation

Bank and External Borrowings of the Corporate Sector

Bipin K Deokar, Ramesh Jangili

Large Indian corporate rms went on a borrowing spree abroad a few years ago attracted by the lower interests that came on external commercial loans. But sluggish protability and currency depreciation are making it difcult for the rms to meet repayment obligations. In domestic borrowings, the corporate stress has led to higher non-performing assets of banks but there has been no sign of systemic risk to the banking sector.

1 Introduction ndias corporate sectors debt has become a cause for concern as the mounting debts of major companies are now at an unsustainable level. In recent years some of the companies have been entangled in a debt trap as their debt payment requirements have grown at a higher pace compared to their sales and prots leading to their inability to service debt. In the last two years industrial growth has been nearly stagnant due to multiple factors, the more important being the investment cycle downturn, slowing private consumption growth, supply-side bottlenecks and weak external demand. The analysis of corporate nancials suggests that stress levels are high, as the margins of the corporate sector have come under pressure and their aggregate debt levels have increased. The mounting debt of the corporate sector has translated into twin crises, (a) the corporate performance has weakened as the stress levels continued to be high, and (b) the banking sector has come under stress as it has witnessed a sharp rise in stressed assets (bad loans and restructured loans). This note attempts to review the borrowings of the corporate sector in recent years, with a particular focus on overseas borrowings and the spillover effect on the banking sector. In order to review the trend and composition of the corporate borrowings the aggregate debt of Indias large-cap 100 companies listed on National Stock Exchange (NSE) by market value known as the CNX 1001 has been evaluated. 2 Corporate borrowings

debt increase in 2012-13 has outpaced capital expenditure. The steep growth in borrowings has stretched the nancials of major companies leading to a decline in net prots. Although the growth in total borrowings of the 100 companies has decelerated from 20.9% in 2010-11 to 18.4% in 2012-13 the average growth of the total borrowings during the last three years has been 19.6%. The leverage ratio of the 100 companies, as measured by the total borrowings to equity ratio has increased during the review period (Table 1).

Table 1: Major Performance Indicators of the CNX 100 Companies

Year 2010-11 2011-12 2012-13

y-o-y growth (in %) Net sales Expenditure Profit after tax Total assets Total borrowings 1) Bank borrowings 2) Overseas borrowings 3) Other borrowings Ratios Borrowings to total assets Leverage ratio

21.5 20.9 14.1 19.8 20.9 11.4 41.2 15.8 18.7 78.2

23.6 25.7 9.4 14.7 19.5 -5.3 24.8 28.4 19.5 85.7

10.7 12.7 13 14.3 18.4 5.5 22.2 20.9 20.2 91.8

Source: Compiled using Prowess database of CMIE.

Bipin K Deokar is with the EPW Research Foundation and Ramesh Jangili is with the Reserve Bank of India. The views expressed by the authors are personal.

Economic & Political Weekly EPW

In recent years, the borrowings of the corporate sector have been increasing signicantly, particularly overseas borrowings. For some of the companies the

vol xlvIiI no 50

Reecting the general slowdown in the macroeconomy, rising ination, monetary tightening, and growing input and wage costs, the performance of the corporate sector in 2012-13 has witnessed moderation in overall activity in the manufacturing and services sectors. As a result the aggregate net sales of the sample companies have decelerated signicantly to 10.7% in 2012-13 from 23.6% in 2011-12. The CNX 100 companies turnover, operating prot and net prot have all grown at a slower pace than their debt over the last two years. In 2012-13, the borrowings of the CNX 100 companies increased substantially in comparison to net sales. As a result, the borrowings to total assets ratio increased to 20.2% in 2012-13 from 18.7% in 2010-11. In 201213 the operating prot to debt ratio also fell, which could have had an adverse impact on the ability of companies to service debt with the prot generated from operations.

133

december 14, 2013

ECONOMIC NOTES

EPW Research Foundation

continued from March 2010 to October 2011, 35 Overseas borrowing when it raised the repo Bank borrowings 30 rate 13 times from 4.75% to 8.50% to contain in25 ation that was hover20 ing near double-digits. After the RBI began to 15 raise the policy rate in 10 March 2010, there have 2009 2010 2011 2012 2013 been persistent increases in deposit and lending rates of schedThe total borrowings of the CNX 100 companies comprise bank, overseas and uled commercial banks (SCBs) (Shetty other borrowings. During the review 2013). As a result, the cost of bank period of 2010-11 to 2012-13, the share of borrowings was substantially higher in overseas borrowing has outpaced that of comparison to overseas borrowings as bank borrowings. The biggest advantage the lending rates of the domestic banks of tapping the overseas market is the rose. During the tightening phase, lower interest rate. Graph 1 indicates bank credit to the corporate sector that bank borrowings have been substi- decelerated considerably as companies tuted by overseas borrowings on account switched to overseas borrowings via of a widening of interest rates payable external commercial borrowings (ECBs) on borrowings from the domestic over and foreign currency convertible bonds external markets, with the latter being (FCCBs). low-cost. The average growth of the bank borrowings for the review period 3 External Commercial was the lowest (around 4%) whereas the Borrowings overseas borrowings growth was the highest (around 29%). The Reserve Bank of Indias (RBI) phase of tightening monetary policy In the last two to three years ECBs have emerged as a major source of funds for the corporate sector. Interest rate arbitrage has been the biggest incentive

Graph 1: Percentage Share Bank and Overseas Borrowings to Total to Total Graph 1: Percentage Share of of Bank and Overseas Borrowings Borrowings(End-March) Borrowings (End-March)

for companies. For instance, companies can raise funds in the international market at 300 basis points above the London Interbank Offered Rate (Libor), enabling rms to borrow loans at just about 4-5% per annum, while the cost of borrowing for a similar tenor in the domestic market will be around 10%12% (Kumar 2012). ECBs by corporates are allowed through the automatic and approval routes. On a

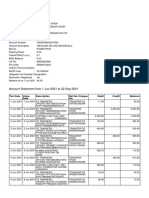

Table 2: Month-wise Amount Raised through ECBs/FCCBs (in $ million)

Month 2010-11 2011-12 2012-13 2013-14

Percentage

April May June July August September October November December January February March

2,818 696 1,791 1,165 1,089 3,091 800 1,129 3,416 2,709 1,441 5,631

2,065 2,653 3,335 4,169 3,708 2,362 2,475 1,588 4,469 2,702 2,604 3,837

2,732 3,370 1,997 1,070 2,369 2,776 4,299 1,347 1,146 3,514 2,343 5,082

1,125 2,487 1,953 3,706 2,305 3,346

Cumulative April-September 10,650 18,292 14,314 14,922 October-March Annual 15,125 17,674 17,731 25,776 35,967 32,045

Source: Compiled using RBIs monthly data on ECBs and FCCBs.

SAMEEKSHA TRUST BOOKS

China after 1978: Craters on the Moon

The breathtakingly rapid economic growth in China since 1978 has attracted world-wide attention. But the condition of more than 350 million workers is abysmal, especially that of the migrants among them. Why do the migrants put up with so much hardship in the urban factories? Has post-reform China forsaken the earlier goal of socialist equality? What has been the contribution of rural industries to regional development, alleviation of poverty and spatial inequality, and in relieving the grim employment situation? How has the meltdown in the global economy in the second half of 2008 affected the domestic economy? What of the current leaderships call for a harmonious society? Does it signal an important course correction? A collection of essays from the Economic & Political Weekly seeks to find tentative answers to these questions, and more. Pp viii + 318 ISBN 978-81-250-3953-2 Available from 2010 Rs 350

Orient Blackswan Pvt Ltd

www.orientblackswan.com

Mumbai Chennai New Delhi Kolkata Bangalore Bhubaneshwar Ernakulam Guwahati Jaipur Lucknow Patna Chandigarh Hyderabad Contact: info@orientblackswan.com

134

december 14, 2013 vol xlvIiI no 50

EPW Economic & Political Weekly

EPW Research Foundation Graph 2: ECBs Debt Outstanding (End-March)

1,40,000 1,20,000 1,00,000 80,000 60,000 40,000 20,000 0 2007 2008 2009 2010 2011

24.0 27.8

ECONOMIC NOTES

as % to total external debt

27.8 27.1

28.9

ECBs Outstanding

cumulative basis, the borrowings of the corporate sector via ECBs have increased signicantly from $25,776 million in 2010-11 to $35,967 million in 2011-12. While the monthly data on ECBs released by the RBI reveals that compared with a total of $14,314 million borrowed in the rst half of 2012-13 cumulative borrowings have touched $14,922 million in H1:2013-14 (Table 2, p 134). Since 2010 there has been sizeable rise in ECBs and, as a result, the ECB debt outstanding has also increased drastically, shooting up to $1,20,893 million in 2012-13 from $70,726 million in 2009-10 (Table 3).

Table 3: External Commercial Borrowings ($ million)

End-March 1 Approvals# 2 Gross Disbursement* 3

steep exchange rate depreciation. The borrow30.3 31.0 30 ing companies have to 25 cope with substantial 20 exchange rate risks as 15 the debt service com10 mitments in rupee terms 5 can increase if there is 0 depreciation of the do2012 2013 mestic currency. Amid heightened volatility in global and Indian currency markets, the Indian rupee depreciated by 17.7% against the dollar during mid-May to end-August 2013. However, the rupee reversed this trend in September 2013 and appreciated by 6% (RBI 2013b). Overall in the rst four months of 2013-14, the rupee depreciated by around 11%. With the depreciation of the rupee, overseas borrowings have turned costly, translating into a higher interest outgo. Generally companies hedge their currency exposure up to one year as the overseas borrowings are exposed to currency uctuations. But despite hedging, the companies have

35 Interest* 5 Total Servicing 6=(4+5) ECB Debt Outstanding 7

Table 4: Indias External Debt Service Payments ($ million)

Year 2009-10 2010-11 2011-12 2012-13

ECBs Repayment Interest

14,472 13,959 11,498 10,451 3,244 3,508

25,198 19,782 5,416

23,224 16,914 6,310

Source: RBI, Bulletin, September 2013.

Amortisation* 4

2008-09 2009-10 2010-11R 2011-12PR 2012-13P

15,702 20,636 25,218 35,354 32,022

13,226 14,029 22,283 28,922 25,497

6,578 11,498 10,451 19,782 16,915

3,965 3,244 3,508 5,416 6,310

10,543 14,742 13,959 25,198 23,225

62,461 70,726 88,479 1,04,786 1,20,893

R: Revised. PR: Partially Revised and P: Provisional. # - Based on date of agreement of the loan which may differ from the date of granting the loan registration number by the RBI. Ceiling on ECB approvals is fixed on the basis of the latter, which may either be after or before the date of agreement of the loan. Hence, there may be some difference between the amount shown under approvals in the table and the amount of ceiling fixed for a particular year. * - Based on the balance of payment data. Source: RBI Bulletin, September 2013.

among corporates have together also increased the stress on asset quality of banks. The present level of restructured debt is alarming and is expected to rise if companies get even more stressed. Increasing stress in the corporate sector was reected in the sharp increase in the amount of debt restructured under the corporate debt restructuring mechanism. The slowdown in the economy coupled with a sharp rise in NPA s in the last few years pressed banks to actively resort to restructuring (Pandey, Tilak and Deokar 2013). As a result, restructured advances as a percentage of gross advances of SCBs were around 1.2% in 2008, which went up to 5.8% in 2013. The asset quality of the banking system deteriorated signicantly during the year, the gross NPA ratio at the aggregate level increasing to 3.6% at end-March 2013 up from 3.1% at endMarch 2012. However, the rising NPAs and restructuring of loans are not a systemic issue. Although the average leverage ratio for the corporate sector remains comfortable, stress is building up in some sectors. If a revival of these sectors does not quickly take place, it can have a domino effect on the asset quality of banks.

Note

1 The CNX 100 index predominantly has a large-cap tilt to its holdings, accounting for about 82.8% of the free oat market capitalisation of the stocks listed on NSE as on 30 September 2013.

Amongst all the major components of external debt, the share of ECBs has continued to be the highest at 31% (Graph 2) of the countrys total external debt at the end of March 2013 followed by short-term debt (24.8%), as per the RBIs study, Indias External Debt (Table 4). The servicing of ECBs during 2012-13 accounted for 74.2% of the total debt service as against 80% during 2011-12, reecting lower principal repayment of ECBs (RBI 2013a). 4 Issues An additional factor that can increase the vulnerability of the corporate sector is the pressure of debt ser vicing following

Economic & Political Weekly EPW

to bear a higher cost for rolling over hedged positions. Another risk is the rise of interest rates in the international markets. At present, the interest rates in the international market are low on account of ample liquidity pumped in response to the crisis. In case interest rates rise in the international market, the cost of overseas borrowing will increase, making the rollover costlier. 4.1 Implications During 2012-13 the non-performing assets (NPA) ratio of all major sectors have weakened. Besides, credit concentration in certain sectors and higher leverage

vol xlvIiI no 50

References

Kumar, Rajesh (2012): De-jargoned: External Commercial borrowing, Mint, 19 December. Pandey, S, V Tilak and Bipin K Deokar (2013): Non-Performing Assets of Indian Banks: Phases and Dimensions, Economic & Political Weekly, June 15, Volume XLVIII No 24. RBI (2013a): Bulletin, September. (2013b): Macroeconomic and Monetary Developments Second Quarter Review 2013-14. (2013): Report on Trend and Progress of Banking in India 2012-13. (2013): Annual Report 2012-13. Shetty, S L (2013): Rajans Monetary Policy Foray: Pursuit of Low Ination, Economic & Political Weekly, 26 October, Volume XLVIII, No 43.

december 14, 2013

135

Anda mungkin juga menyukai

- Awards and Honours 2015Dokumen12 halamanAwards and Honours 2015SowmiyiaBelum ada peringkat

- Directions Bank WBDokumen2 halamanDirections Bank WBRAGHUBALAN DURAIRAJUBelum ada peringkat

- Cropping Patterns and Diversification - 11!13!2007Dokumen11 halamanCropping Patterns and Diversification - 11!13!2007RAGHUBALAN DURAIRAJUBelum ada peringkat

- Fraction Conversion Chart PDFDokumen2 halamanFraction Conversion Chart PDFRAGHUBALAN DURAIRAJUBelum ada peringkat

- (WWW - Entrance-Exam - Net) - UII AO Sample Paper IDokumen9 halaman(WWW - Entrance-Exam - Net) - UII AO Sample Paper IdeepthireddymBelum ada peringkat

- Free Logical Reasoning Questions AnswersDokumen13 halamanFree Logical Reasoning Questions AnswersIdhonna Abihay100% (1)

- Sbi Po Preliminary Quant 2016Dokumen9 halamanSbi Po Preliminary Quant 2016RAGHUBALAN DURAIRAJUBelum ada peringkat

- Know About Indian RailwaysDokumen7 halamanKnow About Indian RailwaysRAGHUBALAN DURAIRAJUBelum ada peringkat

- Puzzle Seating Arrangement CDokumen14 halamanPuzzle Seating Arrangement CdeepiaBelum ada peringkat

- 97 GenrDokumen53 halaman97 Genrapi-248888837Belum ada peringkat

- Approximations Bank WBDokumen3 halamanApproximations Bank WBRAGHUBALAN DURAIRAJUBelum ada peringkat

- General KnowlwdgeDokumen115 halamanGeneral KnowlwdgeMUDASSAR IDRIS98% (44)

- Multiplicationpdf1 30all PDFDokumen3 halamanMultiplicationpdf1 30all PDFRAGHUBALAN DURAIRAJUBelum ada peringkat

- Puzzles WorkbookDokumen31 halamanPuzzles Workbookannu khandelwalBelum ada peringkat

- India (History) ChronologyDokumen70 halamanIndia (History) ChronologyAngel Zyesha50% (2)

- Ranking and Ordering Bank WBDokumen3 halamanRanking and Ordering Bank WBRAGHUBALAN DURAIRAJUBelum ada peringkat

- Current AffairsDokumen57 halamanCurrent AffairsSreesoumiya MuraliBelum ada peringkat

- PDF of 190 Vocabulary WordsDokumen6 halamanPDF of 190 Vocabulary WordsRAGHUBALAN DURAIRAJUBelum ada peringkat

- 200 Errors Committed in Everyday in English LanguageDokumen7 halaman200 Errors Committed in Everyday in English LanguagevijayaamaladeviBelum ada peringkat

- Fraction Conversion ChartDokumen2 halamanFraction Conversion ChartRAGHUBALAN DURAIRAJUBelum ada peringkat

- Coded Inequalities Bank WBDokumen5 halamanCoded Inequalities Bank WBRAGHUBALAN DURAIRAJUBelum ada peringkat

- Manual For ScienceDokumen49 halamanManual For ScienceRAGHUBALAN DURAIRAJUBelum ada peringkat

- A Flowering Tree and Other Oral Tales From IndiaDokumen3 halamanA Flowering Tree and Other Oral Tales From IndiaHarish Kumar MBelum ada peringkat

- GeopolrevDokumen8 halamanGeopolrevRAGHUBALAN DURAIRAJUBelum ada peringkat

- Directions Bank WBDokumen2 halamanDirections Bank WBRAGHUBALAN DURAIRAJUBelum ada peringkat

- Current Affairs Pocket PDF - January 2016 by AffairsCloud - FinalDokumen25 halamanCurrent Affairs Pocket PDF - January 2016 by AffairsCloud - FinalRAGHUBALAN DURAIRAJUBelum ada peringkat

- India Factsheet - 20151031Dokumen1 halamanIndia Factsheet - 20151031RAGHUBALAN DURAIRAJUBelum ada peringkat

- J.C. Kumarappa's Economic Philosophy and Vision for Rural IndiaDokumen10 halamanJ.C. Kumarappa's Economic Philosophy and Vision for Rural IndiaRAGHUBALAN DURAIRAJUBelum ada peringkat

- Reading List for Your India TripDokumen2 halamanReading List for Your India TripRAGHUBALAN DURAIRAJUBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Online Fees Account Indian Bank A/c No. 830641451 Indian Bank A/c No. 830641451 Online Fees Account Online Fees Account Indian Bank A/c No. 830641451Dokumen1 halamanOnline Fees Account Indian Bank A/c No. 830641451 Indian Bank A/c No. 830641451 Online Fees Account Online Fees Account Indian Bank A/c No. 830641451Shiva KumarBelum ada peringkat

- Case Study No. 1 Legal Structure and CapitalDokumen4 halamanCase Study No. 1 Legal Structure and CapitalStephen VisperasBelum ada peringkat

- Set Off & Carry Forward of Losses: Lecture NotesDokumen45 halamanSet Off & Carry Forward of Losses: Lecture Notesapi-3832224100% (1)

- Example Template C66.00 of Annex XXIVDokumen4 halamanExample Template C66.00 of Annex XXIVBrandon ChangusBelum ada peringkat

- Financial Services in IndiaDokumen4 halamanFinancial Services in Indiamanoj aggarwalBelum ada peringkat

- General Awareness 2015 For All Upcoming ExamsDokumen59 halamanGeneral Awareness 2015 For All Upcoming ExamsJagannath JagguBelum ada peringkat

- O2C Cycle Accounting EntriesDokumen3 halamanO2C Cycle Accounting Entriessudharsan49100% (1)

- List Down The Terminologies Which Were Mentioned in The Movie and Define Each Based On Your Own Research and UnderstandingDokumen5 halamanList Down The Terminologies Which Were Mentioned in The Movie and Define Each Based On Your Own Research and UnderstandingvonnevaleBelum ada peringkat

- Thabat Fund Fact Sheet - January 2021Dokumen4 halamanThabat Fund Fact Sheet - January 2021ResourcesBelum ada peringkat

- Stated Objective: Dow Jones Stoxx Tmi IndexDokumen2 halamanStated Objective: Dow Jones Stoxx Tmi IndexMutimbaBelum ada peringkat

- Income Tax Guide On E-CommerceDokumen11 halamanIncome Tax Guide On E-CommerceRoby TamamiBelum ada peringkat

- Natwest - Student Living Index 2015Dokumen54 halamanNatwest - Student Living Index 2015Pedro BertonciniBelum ada peringkat

- Semester FeeDokumen1 halamanSemester FeeMeghal SivanBelum ada peringkat

- What is a Holding CompanyDokumen2 halamanWhat is a Holding CompanyOshim Adhar100% (1)

- 5.2. Investmnt-FunctionDokumen21 halaman5.2. Investmnt-FunctionAbhishek VermaBelum ada peringkat

- Mortgage Backed Securities ExplainedDokumen3 halamanMortgage Backed Securities Explainedmaria_tigasBelum ada peringkat

- Factors Determining Capital StructureDokumen2 halamanFactors Determining Capital StructureMostafizul HaqueBelum ada peringkat

- Trading, Profit & Loss, Balance Sheet Ledger AccountsDokumen20 halamanTrading, Profit & Loss, Balance Sheet Ledger AccountsRaghavendra ShivaramBelum ada peringkat

- CSS Solved MCQS from 2000 to 2011Dokumen32 halamanCSS Solved MCQS from 2000 to 2011Umar NasirBelum ada peringkat

- Republic v. SunlifeDokumen2 halamanRepublic v. SunlifeBananaBelum ada peringkat

- N 7 Venj S89 RJ 2 Z KCBDokumen14 halamanN 7 Venj S89 RJ 2 Z KCBShoeb KhanBelum ada peringkat

- Unit 2 - Project AnalysisDokumen46 halamanUnit 2 - Project Analysissandy candyBelum ada peringkat

- AF5102 Accounting Theory Efficient Securities MarketsDokumen9 halamanAF5102 Accounting Theory Efficient Securities MarketsXinwei GuoBelum ada peringkat

- Merger and Acquisition NotesDokumen9 halamanMerger and Acquisition NotesYuvraj kumarBelum ada peringkat

- Government Economic Objectives and Policies: Textbook, Chapter 26 (PG 317-328)Dokumen10 halamanGovernment Economic Objectives and Policies: Textbook, Chapter 26 (PG 317-328)Vincent ChurchillBelum ada peringkat

- 33 SITXFIN003 Student Version AnswersDokumen62 halaman33 SITXFIN003 Student Version AnswersShopee Lazada0% (2)

- Africa Weekly 20052011Dokumen63 halamanAfrica Weekly 20052011skywalker4uBelum ada peringkat

- SAN PABLO SubaybayanDokumen3 halamanSAN PABLO SubaybayanCA T HeBelum ada peringkat

- Treasury Management BookDokumen109 halamanTreasury Management BookJennelyn MercadoBelum ada peringkat

- Byf Student Book 4Dokumen53 halamanByf Student Book 4sritraderBelum ada peringkat