49 Pdfsam IAS

Diunggah oleh

dskrishnaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

49 Pdfsam IAS

Diunggah oleh

dskrishnaHak Cipta:

Format Tersedia

Recognising and measuring an impairment loss If, and only if, the recoverable amount of an asset is less than

its carrying amount, the carrying amount of the asset shall be reduced to its recoverable amount. That reduction is an impairment loss. An impairment loss shall be recognised immediately in profit or loss, unless the asset is carried at revalued amount in accordance with another Standard (for example, in accordance with the revaluation model in IAS 16 Property, Plant and Equipment). Any impairment loss of a revalued asset shall be treated as a revaluation decrease in accordance with that other Standard. An impairment loss shall be recognised for a cash-generating unit (the smallest group of cash-generating units to which goodwill or a corporate asset has been allocated) if, and only if, the recoverable amount of the unit (group of units) is less than the carrying amount of the unit (group of units). The impairment loss shall be allocated to reduce the carrying amount of the assets of the unit (group of units) in the following order: (a) first, to reduce the carrying amount of any goodwill allocated to the cash-generating unit (group of units); and (b) then, to the other assets of the unit (group of units) pro rata on the basis of the carrying amount of each asset in the unit (group of units). However, an entity shall not reduce the carrying amount of an asset below the highest of: (a) its fair value less costs to sell (if determinable); (b) its value in use (if determinable); and (c) zero. The amount of the impairment loss that would otherwise have been allocated to the asset shall be allocated pro rata to the other assets of the unit (group of units). Goodwill For the purpose of impairment testing, goodwill acquired in a business combination shall, from the acquisition date, be allocated to each of the acquirers cash-generating units, or groups of cash-generating units, that is expected to benefit from the synergies of the combination, irrespective of whether other assets or liabilities of the acquiree are assigned to those units or groups of units. The annual impairment test for a cash-generating unit to which goodwill has been allocated may be performed at any time during an annual period, provided the test is performed at the same time every year. Different cashgenerating units may be tested for impairment at different times. However, if some or all of the goodwill allocated to a cash-generating unit was acquired in a business combination during the current annual period, that unit shall be tested for impairment before the end of the current annual period. The Standard permits the most recent detailed calculation made in a preceding period of the recoverable amount of a cash-generating unit (group of units) to which goodwill has been allocated to be used in the impairment test for that unit (group of units) in the current period, provided specified criteria are met.

Anda mungkin juga menyukai

- Tables SAPDokumen21 halamanTables SAPLeonardo PortelaBelum ada peringkat

- W8 BEN FormDokumen2 halamanW8 BEN FormJay100% (2)

- AR Everest IndsDokumen187 halamanAR Everest IndsPrakhar SaxenaBelum ada peringkat

- Multiple Choice Q & ADokumen56 halamanMultiple Choice Q & ADipanjan Dhar0% (1)

- AAFR by Sir Nasir Abbas BOOKDokumen665 halamanAAFR by Sir Nasir Abbas BOOKAbdul WaheedBelum ada peringkat

- Revaluation and ImpairmentDokumen4 halamanRevaluation and ImpairmentWertdie stanBelum ada peringkat

- Ra 8425 Poverty Alleviation ActDokumen14 halamanRa 8425 Poverty Alleviation ActZyldjyh C. Pactol-Portuguez0% (1)

- Module 4 - ImpairmentDokumen5 halamanModule 4 - ImpairmentLuiBelum ada peringkat

- Camarilla EquationDokumen6 halamanCamarilla EquationediBelum ada peringkat

- Ias 36 PDFDokumen4 halamanIas 36 PDFCarmela Joaquin Valbuena-PaañoBelum ada peringkat

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoDokumen8 halamanThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoEki OmallaoBelum ada peringkat

- IAS 36 Impairment of Assets PDFDokumen9 halamanIAS 36 Impairment of Assets PDFAmenyo GodknowsBelum ada peringkat

- IAS 36 Impairment of Assets: Technical SummaryDokumen4 halamanIAS 36 Impairment of Assets: Technical SummaryFoititika.net100% (2)

- Impairment of AssetDokumen6 halamanImpairment of AssetOLAWALE AFOLABI TIMOTHYBelum ada peringkat

- Umst MBA (B7) Finance IAS 36: Asset ImpairmentDokumen27 halamanUmst MBA (B7) Finance IAS 36: Asset ImpairmentHadina SafiBelum ada peringkat

- 50 Pdfsam IASDokumen1 halaman50 Pdfsam IASdskrishnaBelum ada peringkat

- Ent - of - Assets/$FILE/Impairment - Accounting - IAS - 36.pdf: Fasb Asc and Iasb Research CaseDokumen2 halamanEnt - of - Assets/$FILE/Impairment - Accounting - IAS - 36.pdf: Fasb Asc and Iasb Research CaseJoey LessardBelum ada peringkat

- 12 Pdfsam IASDokumen1 halaman12 Pdfsam IASdskrishnaBelum ada peringkat

- Property, Plant and Equipment Are Tangible Items ThatDokumen2 halamanProperty, Plant and Equipment Are Tangible Items ThatnasirBelum ada peringkat

- MODULE 4: Impairment of AssetsDokumen3 halamanMODULE 4: Impairment of AssetsPauline Joy GenalagonBelum ada peringkat

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDokumen35 halamanIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimBelum ada peringkat

- IAS 16 SummaryDokumen7 halamanIAS 16 SummaryCharmaine LogaBelum ada peringkat

- IAS 36 - ImpairmentDokumen4 halamanIAS 36 - ImpairmentAiman TuhaBelum ada peringkat

- IAS 36 - ImpairmentDokumen4 halamanIAS 36 - ImpairmentAiman TuhaBelum ada peringkat

- Lecture 12 Impairment of Non-Current Assets and GoodwillDokumen23 halamanLecture 12 Impairment of Non-Current Assets and GoodwillWinston 葉永隆 DiepBelum ada peringkat

- Summary of Pas 36Dokumen5 halamanSummary of Pas 36Elijah MontefalcoBelum ada peringkat

- IAS 16 Property, Plant and EquipmentDokumen4 halamanIAS 16 Property, Plant and EquipmentSelva Bavani SelwaduraiBelum ada peringkat

- Impairment of GoodwillDokumen2 halamanImpairment of GoodwillZes OBelum ada peringkat

- Accounting GuidanceDokumen5 halamanAccounting GuidanceVibha MittalBelum ada peringkat

- IAS-16 (Property, Plant & Equipment)Dokumen20 halamanIAS-16 (Property, Plant & Equipment)Nazmul HaqueBelum ada peringkat

- Ch9 Impairment of AssetsDokumen20 halamanCh9 Impairment of AssetsiKarloBelum ada peringkat

- Property, Plant and EquipmentDokumen35 halamanProperty, Plant and EquipmentNimona BeyeneBelum ada peringkat

- IAS 36 Chapter TextDokumen10 halamanIAS 36 Chapter Textkashan.ahmed1985Belum ada peringkat

- IAS16Dokumen2 halamanIAS16Atif RehmanBelum ada peringkat

- IPSASB Exposure Draft 57 Impairment of Revalued AssetsDokumen17 halamanIPSASB Exposure Draft 57 Impairment of Revalued AssetskhichimutiurrehmanBelum ada peringkat

- Technical SummaryDokumen2 halamanTechnical Summarysza_13100% (2)

- Oracle Fusion Assets Asset Impairment: Oracle White Paper - March 2018Dokumen27 halamanOracle Fusion Assets Asset Impairment: Oracle White Paper - March 2018satyaBelum ada peringkat

- As 28Dokumen14 halamanAs 28Harsh PatelBelum ada peringkat

- ImpairmentDokumen45 halamanImpairmentnati100% (1)

- Chapter 35-Impairment of Asset Cash Generating Unit: (Par. 76, PFRS 36) .Dokumen6 halamanChapter 35-Impairment of Asset Cash Generating Unit: (Par. 76, PFRS 36) .Konrad Lorenz Madriaga UychocoBelum ada peringkat

- Theory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesDokumen5 halamanTheory of Accounts L. R. Cabarles Toa.112 - Impairment of Assets Lecture NotesPia DagmanBelum ada peringkat

- Impairment of AssetsDokumen6 halamanImpairment of AssetsMendoza KlariseBelum ada peringkat

- Property, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Dokumen37 halamanProperty, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Eshetie Mekonene AmareBelum ada peringkat

- TA07b - Current AssetsDokumen11 halamanTA07b - Current AssetsMarsha Sabrina LillahBelum ada peringkat

- Ias 16Dokumen21 halamanIas 16Arshad BhuttaBelum ada peringkat

- Cfas - Reviewer PDFDokumen21 halamanCfas - Reviewer PDFMira Monica D. VillacastinBelum ada peringkat

- Ias 36 ImpairementDokumen24 halamanIas 36 Impairementesulawyer2001Belum ada peringkat

- SM ch06Dokumen61 halamanSM ch06salehin1969Belum ada peringkat

- Unit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingDokumen18 halamanUnit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingRobin G'koolBelum ada peringkat

- HSBC0469, D, Priyansh - Group D11Dokumen14 halamanHSBC0469, D, Priyansh - Group D11Priyansh KhatriBelum ada peringkat

- CFAS 11 - Conceptual Framework and Accounting Standards Midterm - Week 3 (Pas 16, Pas 20 & Pas 23)Dokumen7 halamanCFAS 11 - Conceptual Framework and Accounting Standards Midterm - Week 3 (Pas 16, Pas 20 & Pas 23)Olive Jean TiuBelum ada peringkat

- Principle of SelectionDokumen16 halamanPrinciple of SelectionIsiyaku AdoBelum ada peringkat

- Property, Plant and EquipmentDokumen6 halamanProperty, Plant and EquipmenthemantbaidBelum ada peringkat

- Non-Current Assets Held For Sale and Discontinued OperationsDokumen4 halamanNon-Current Assets Held For Sale and Discontinued OperationsLatte MacchiatoBelum ada peringkat

- Depreciation in AccountingDokumen13 halamanDepreciation in AccountingNirmal PrasadBelum ada peringkat

- Chapter 27 PFRS 6 EXPLORATION 0 EVALUATION OF MINERAL RESOURCESDokumen8 halamanChapter 27 PFRS 6 EXPLORATION 0 EVALUATION OF MINERAL RESOURCESJoelyn Grace MontajesBelum ada peringkat

- Accounting For Public Sector Chap 3Dokumen82 halamanAccounting For Public Sector Chap 3fekadegebretsadik478729Belum ada peringkat

- Chapter 5Dokumen48 halamanChapter 5HelloWorldNowBelum ada peringkat

- 5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36Dokumen16 halaman5.9.2.6 Allocating Goodwill To Cash-Generating Units: Indian Accounting Standard 36RITZ BROWNBelum ada peringkat

- IAS 36 Impairment of Assets: Technical SummaryDokumen1 halamanIAS 36 Impairment of Assets: Technical SummarydskrishnaBelum ada peringkat

- Intangible Assets1Dokumen22 halamanIntangible Assets1hamarshi2010Belum ada peringkat

- PP (A) - Lect 2 - Ias 16 PpeDokumen19 halamanPP (A) - Lect 2 - Ias 16 Ppekevin digumberBelum ada peringkat

- DEPRECIATION AND DEPLETION Supplementary Review MaterialDokumen5 halamanDEPRECIATION AND DEPLETION Supplementary Review MaterialCaseylyn RonquilloBelum ada peringkat

- Ind AS 105Dokumen16 halamanInd AS 105JyotiBelum ada peringkat

- NPS ReturnsDokumen4 halamanNPS ReturnsdskrishnaBelum ada peringkat

- Page 2Dokumen1 halamanPage 2dskrishnaBelum ada peringkat

- Page 3Dokumen1 halamanPage 3dskrishnaBelum ada peringkat

- ESIC RD NotificationDokumen8 halamanESIC RD NotificationdskrishnaBelum ada peringkat

- Tax ReturnDokumen2 halamanTax ReturndskrishnaBelum ada peringkat

- Konkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडDokumen2 halamanKonkan Railway Corporation Ltd. क कण रेलवे कॉप रेशन ल मटेडdskrishnaBelum ada peringkat

- Bangaru KondaDokumen49 halamanBangaru KondadskrishnaBelum ada peringkat

- Ignou NT AdvertisementDokumen10 halamanIgnou NT AdvertisementdskrishnaBelum ada peringkat

- FSSAI Minutes 4Dokumen1 halamanFSSAI Minutes 4dskrishnaBelum ada peringkat

- Checklist ITR 7 PDFDokumen4 halamanChecklist ITR 7 PDFshaik nayazBelum ada peringkat

- Job Description 4Dokumen4 halamanJob Description 4dskrishnaBelum ada peringkat

- Print 1Dokumen1 halamanPrint 1dskrishnaBelum ada peringkat

- Konkan Railway MapDokumen15 halamanKonkan Railway MapdskrishnaBelum ada peringkat

- Ignou Act OrdinanceDokumen1 halamanIgnou Act OrdinancedskrishnaBelum ada peringkat

- Ministry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )Dokumen1 halamanMinistry of Health and Family Welfare Notification: The Gazette of India: Extraordinary (P Ii-S - 3 (I) )dskrishnaBelum ada peringkat

- Ministry of Health and Family Welfare Notification: ART ECDokumen1 halamanMinistry of Health and Family Welfare Notification: ART ECdskrishnaBelum ada peringkat

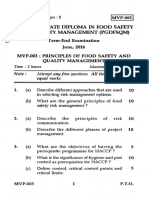

- MVP-003 June 2016Dokumen2 halamanMVP-003 June 2016dskrishnaBelum ada peringkat

- FSSAI Minutes 78Dokumen1 halamanFSSAI Minutes 78dskrishnaBelum ada peringkat

- FSSAI Minutes 82Dokumen1 halamanFSSAI Minutes 82dskrishnaBelum ada peringkat

- FSSAI Minutes 18Dokumen1 halamanFSSAI Minutes 18dskrishnaBelum ada peringkat

- FSSAI Minutes 17Dokumen1 halamanFSSAI Minutes 17dskrishnaBelum ada peringkat

- FSSAI Minutes 83Dokumen1 halamanFSSAI Minutes 83dskrishnaBelum ada peringkat

- FSSAI Minutes 20Dokumen1 halamanFSSAI Minutes 20dskrishnaBelum ada peringkat

- FSSAI Minutes 8Dokumen1 halamanFSSAI Minutes 8dskrishnaBelum ada peringkat

- FSSAI Minutes 7Dokumen1 halamanFSSAI Minutes 7dskrishnaBelum ada peringkat

- FSSAI Minutes 6Dokumen1 halamanFSSAI Minutes 6dskrishnaBelum ada peringkat

- FSSAI Minutes 5Dokumen1 halamanFSSAI Minutes 5dskrishnaBelum ada peringkat

- FSSAI Minutes 19Dokumen1 halamanFSSAI Minutes 19dskrishnaBelum ada peringkat

- FSSAI Minutes 13Dokumen1 halamanFSSAI Minutes 13dskrishnaBelum ada peringkat

- FSSAI Minutes 9Dokumen1 halamanFSSAI Minutes 9dskrishnaBelum ada peringkat

- Final Term MADS 6601 Financial AdministrationDokumen81 halamanFinal Term MADS 6601 Financial AdministrationPavan Kumar VadlamaniBelum ada peringkat

- (The Second Schdule) : (See Section 4 (B) ) Computation of Gross ProfitsDokumen11 halaman(The Second Schdule) : (See Section 4 (B) ) Computation of Gross ProfitsYoga GuruBelum ada peringkat

- Cash Flow StatementDokumen9 halamanCash Flow StatementLovely Mae LacasteBelum ada peringkat

- F650 CaseDokumen44 halamanF650 CaseRohan SinghBelum ada peringkat

- FE Review Engineering EconomicsDokumen54 halamanFE Review Engineering EconomicsJERRISON BRUCEBelum ada peringkat

- Week 6 Revision QuestionsDokumen3 halamanWeek 6 Revision QuestionsDavid Tayla McCarthyBelum ada peringkat

- Csgag Csag Ar 2019 enDokumen588 halamanCsgag Csag Ar 2019 enThaís Ribeira de PaulaBelum ada peringkat

- Accounting Theory NoteDokumen9 halamanAccounting Theory NoteYusuf HusseinBelum ada peringkat

- Strategy Paper IbizsimDokumen10 halamanStrategy Paper Ibizsimcharu.chopra3237Belum ada peringkat

- Active and Passive Portfolio Management Evidences From Emerging and Developed MarketsDokumen24 halamanActive and Passive Portfolio Management Evidences From Emerging and Developed MarketsRahul PinnamaneniBelum ada peringkat

- Investment Banking Resume II - AfterDokumen1 halamanInvestment Banking Resume II - AfterbreakintobankingBelum ada peringkat

- SICL Draft Prospectus P 258Dokumen258 halamanSICL Draft Prospectus P 258Rumana SharifBelum ada peringkat

- Far Probs - EvaluationDokumen7 halamanFar Probs - EvaluationArvin John Masuela100% (1)

- EnglishDokumen38 halamanEnglishAndreea Mihaela ComanBelum ada peringkat

- Fixed DepositsDokumen1 halamanFixed DepositsTiso Blackstar GroupBelum ada peringkat

- MACROECONomicsDokumen411 halamanMACROECONomicsVince Orebey BelarminoBelum ada peringkat

- 3cet FinalDokumen30 halaman3cet FinalhimanshusangaBelum ada peringkat

- J P Morgan Finance CapitalismDokumen2 halamanJ P Morgan Finance CapitalismgeronimlBelum ada peringkat

- Ajinomoto DocumentDokumen30 halamanAjinomoto Documentandy0% (2)

- Thesis On Non Performing LoansDokumen7 halamanThesis On Non Performing LoansWriteMyPaperJackson100% (2)

- Business Valuations: Net Asset Value (Nav)Dokumen9 halamanBusiness Valuations: Net Asset Value (Nav)Artwell ZuluBelum ada peringkat

- Forex Market - 2Dokumen18 halamanForex Market - 2Emad TabassamBelum ada peringkat

- FEDERAL PACER DOCKET Chapter 11 in Re Magellan Health Services IncDokumen173 halamanFEDERAL PACER DOCKET Chapter 11 in Re Magellan Health Services IncRobert Davidson, M.D., Ph.D.100% (2)

- Multi Manager Funds PDFDokumen320 halamanMulti Manager Funds PDFVeronique MabogeBelum ada peringkat