Health Forever Brochure

Diunggah oleh

Satyarohini SravanthiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Health Forever Brochure

Diunggah oleh

Satyarohini SravanthiHak Cipta:

Format Tersedia

24-Hour CitiPhone the bills directly with the hospital.

In case of an emergency hospitalization, you can call MediCare up to 48 hours after being admitted to take the authorization. 2. In case you have to be admitted to any other hospital, you need to send all the bills along with supporting documentation to Royal Sundaram who will then reimburse you. The list of hospitals that are currently part of Health Forever network is available in the Policy Summary booklet. 6. Any treatment relating to change of life. 7. The cost of spectacles, contact lenses and hearing aids. 8. Dental treatment or surgery of any kind unless requiring hospitalization. *The above is the important list of exclusions. For detailed list refer to the policy wordings which will he made available on request.

Ahmedabad Aurangabad Bangalore Bhopal Bhubaneshwar Chandigarh Chennai Coimbatore Delhi (Gurgaon) Hyderabad Indore Jaipur Jalandhar Kochi Kolkata Lucknow Ludhiana Mumbai Nasik Noida Pondicherry Pune Surat Vadodara Vapi : : : : : : : : : : : : : : : : : : : : : : : : : 2642-2484 1800-180-2484* 2227-2484 1800-180-2484* 1800-180-2484* 508-2484 2852-2484 989402-2484 95124-254-2484 5566-2484 1800-180-2484* 237-2484 506-2484 989502-2484 2283-2484 220-1022 501-2484 2823-2484 1800-180-2484* 255-2484 989402-2484 6601-2484 553-2484 232-2484 95-265-232-2484

Citibank invites you to a healthier future with Royal Sundaram's Health Forever.

*

Important Definition

Pre-Existing condition: Any condition, ailment or injury or related condition(s) for which you had signs or symptoms, and / or were diagnosed, and / or received medical advice/treatment, within 48 months prior to your first Health Forever policy with us.

Important Exclusions

The Company shall not be liable to make any payment under this Policy in respect of any expenses whatsoever incurred by any Insured Person in connection with or in respect of: 1. Pre-Existing conditions at the time of applying for insurance. However these shall be covered after 48 months of continuous insurance under this policy.

Even in the event of CitiBank not renewing the master policy or the individual ceasing to be a customer of Citi Bank,the existing health policy shall be renewed under normal circumstances on the terms and conditions prevailing at the time of expiry of the policy This brochure is only a brief summary of Health Forever. This is not an insurance contract or an offer of insurance. The coverage will be subject to the Terms & Conditions of the Health Forever Master Policy No. HLCITI0022 issued to Citibank N.A. by Royal Sundaram Alliance Insurance Company.

(* Please call this number from a BSNL/MTNL Landline phone only.)

visit us at : www.citibank.com/india

2. 30 Days Waiting Period: Any disease contracted by the Insured Person during the first 30 days from the commencement date of the Policy. 3. First Year Exclusions: Treatment of Cataract, Benign Prostatic Hypertrophy, Hysterectomy for Menorrhagia or Fibromyoma, Hernia, Hydrocele, Congenital Internal Diseases, Fistula in Anus, Piles, Sinusitis for all Insured Persons for one year from the Commencement Date of the cover. If these diseases are pre-existing at the time of proposal they shall not be covered even during subsequent period of renewal. Note: For Insured Persons upto the age of 40 years, 30 Days Waiting Period Exclusion and First Year Exclusion shall be waived for Insured Persons holding an existing Health Insurance Policy provided the Policy is renewed before the expiry date of the existing Health Insurance Policy.

ABOUT ROYAL SUNDARAM

Royal Sundaram is the first private non-life Insurance company licensed to operate in India. A joint-venture between Sundaram Finance and the RSA Group, Royal Sundaram, draws on the global expertise and best practices of the RSA Group and the local understanding of Sundaram Finance. This expertise and experience helps Royal Sundaram in offering its customers bestin- class service and insurance solutions.

Insurance is the subject matter of solicitation Disclaimer:

Insurance products are obligations only of the Insurance company. They are not bank deposits or obligations of or guaranteed by Citibank N.A., Citigroup, Inc or any of its affiliates or subsidiaries or any Governmental agency. All Claims under the policy will be solely decided upon by the Insurance Company. Citibank, Citigroup or any of their affiliates and group entities hold no warranty and do not make any representation about the insurance, the quality of claims processing and shall not be responsible for claims, recovery of claims, or for processing of or clearing of claims, in any manner whatsoever. Insurance is the subject matter of solicitation. This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation. Investment products are not available to US persons and may not be available in all jurisdictions.

Cashless facility for hospitalization expenses due to illness or accident 30 day pre and 60 day post-hospitalisation expenses Extra benefits for critical illness, ICU admission, hospital cash and convalescence Cumulative bonus of 15% for every claim free year upto 60% Defined day care expense coverage

FOS/PT9298/IRDSEP09PNO 025/BRANCH

IRS Circular 230 Disclosure: Citigroup, Inc., its affiliates, and its employees are not in the business of providing tax or legal advice to any taxpayer outside of Citigroup, Inc. and its affiliates. This brochure and any attachments are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties. Any such taxpayer should seek advice based on the taxpayer's particular circumstances from an independent tax advisor, Tax benefits are subject to changes in the laws.

Citibank is a licensed Corporate Agent of Birla Sun Life Insurance Company Limited and Royal Sundaram Alliance Insurance Company Limited under the composite license number 1137144. This policy is underwritten by Royal Sundaram Alliance Insurance Company Limited with its registered office at No. 21, Patullos Road, Chennai 600 002. For more datails on risk factors, terms and conditions please read the sales brochure carefully before concluding the sale.

Tax benefit under section 80D of income tax act

*Family Discount of 10% is available for covering 3 or more people in a single policy

#

Royal Sundaram Alliance Insurance Company Limited

Corporate Office : Sundaram Towers, 45&46, Whites Road, Chennai - 600 014. Registered Office : 21, Patullos Road, Chennai - 600 002.

Section 41 of the insurance act 1938 Prohibition of rebates

1) No person shall allow or offer to allow either directly or indirectly as an inducement to any person to take out or renew or continue an insurance in respect of any kind of risk relating to lives or property in India any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy nor shall any person taking out or renewing or continuing the policy accept any rebate except such rebate as may be allowed in accordance with the published prospectus or tables of the insurer. 2) If any person fails to comply with regulation above he shall be liable to payment of fine, which may extend to five hundred rupees.

4. Treatment arising from or traceable to pregnancy childbirth. 5. Circumcision unless necessary for treatment of a disease not excluded hereunder or as may be necessitated due to an accident.

In the 2 year plan, you get 20% discount on the second year premium.

Write: customer.services@royalsundaram.in

Visit: www.royalsundaram.in

policy. This benefit is payable for up to a maximum of 10 days of hospitalization Health Forever is a comprehensive healthcare insurance package brought to you by Citibank through Royal Sundaram Alliance Insurance Company. Health Forever is not just a hospitalization cover because being treated in a hospital also means incurring related expenses that need to be taken care of. This will be payable over and above hospitalisation expenses.

24-Hour Medicare Helpline

As a Health Forever Customer, you get access to a 24-hour MediCare helpline. MediCare is the appointed third-party administrator (TPA) for Royal Sundaram. You can call any time and find out which hospitals near you are part of our network or take a pre-authorization for admission.

For example, if you buy Health Forever for yourself, your spouse and 2 children, the net premium payable will be 10% less than the total cost as per the table above. Besides your spouse, children & parents, you can also insure your close relatives viz, brother, sister, father in law, mother in law, brother in law, sister in law, uncle, aunty, grand son, grand daughter, grand father, grand mother, nephew, niece.

ICU Benefit

Often hospitalization expenses shoot up if you need to undergo intensive Care treatment. In case you are admitted for 7 days or more in an Intensive Care Unit in a hospital, which has got a minimum of 300 beds, you will receive a lump sum benefit or Rs.10,000. This will be payable over and above the hospitalisation expenses.

Eligibility

Health Forever is available for persons aged from 3 months to 75 years of age. For people between the age of 61 and 75 years, the following medical reports are needed: ! ECG ! Blood sugar - fasting & PP ! Urine sugar These reports should be dated not prior to 30 days from the date of application * Renewals accepted till the age of 80

Free 24-Hour Ambulance Referral Facility

Free 24-hour ambulance referral facility is available to you as a Health forever customer

Tax Benefits**

Premium paid towards Health Forever will be eligible for Income tax benefits under Section 80 D in the assessment year in which the premium is paid. This is available on premium paid by you on behalf of yourself, your spouse and dependent children upto a maximum of Rs. 15,000* per year. In case of premium paid towards dependent parents you can avail an additional benefit of Rs. 15,000* and if they are senior citizens the benefit is extended to upto a maximum of Rs. 20,000*

# The above exemption is as per the Income tax act 1961 and is subject to change as per amendments made there to from time to time

Critical Illness/Surgery Benefit

If you are diagnosed with cancer, stroke or need to undergo coronary bypass surgery or an organ transplant surgery, Health Forever pays you a lump sum of Rs. 15,000. This benefit is available from the 2nd year of your policy and is payable once in a policy year. This will be payable over and above the hospitalisation expenses.

Premium Plans

As a Citibank customer, the unique Health Forever package comes to you at attractive plan options with competitive rates & benefits.

Advantages of 2 year plan

1. In the 2 year plan you get 20% discount on the 2nd year premium. 2. More over you are assured of continuous coverage for 2 years and will need to renew only after 24 months. 3. The policy will be renewed every 2 years basis your consent and premium as applicable, depending on your age band, will be charged. The table below shows the premium payable depending on your age and coverage level for 1 /2 year plan options. Premium - 1 Year Plan

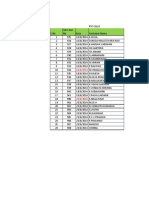

Plan Plan 1 Plan 2 Plan 3 Plan 4 Sum Insured 2,00,000 3,00,000 4,00,000 5,00,000 Age of Insured Person 91 days 18 years 1,781 2,428 3,194 3,962 19 - 45 years 3,015 4,101 5,428 6,754 46 - 60 years 4,560 6,401 8,493 10,583 61 - 75 years 6,540 9,343 12,435 15,524 76 - 80 years* 7,325 10,464 13,927 17,385

Key benefits

Hospitalization Expense Reimbursement

Health Forever takes care of your hospitalization expenses due to illness or accident. And we cover you every time your hospitalization period exceeds 24 hours. Once you sign-up, you will receive a personal Health Card that provides you access to the cashless facility in more than 3000 hospitals acrossIndia. The cashless facility, subject to conditions, enables you to undergo treatment in any of these hospitals and walk out without paying your bills upto admissible claim amount. All you have to do is call the 24-hour TPA Tollfree No. 1800 345 3322 helpline and take an authorisation. Royal Sundaram will settle all bills directly with the hospital. Please note that, the room rent payable will be limited to 1.5% of the Sum Insured per day and for ICU at 3% of the Sum Insured per day.

Convalescence Benefit

After a long period of hospitalization, you may not be able to get back to work quickly and will need some extra funds to take care of household expenses. Health Forever pays you a lump sum convalescence benefit of Rs. 15,000 in case your period of hospitalization exceeds 15 days. This will be payable over and above the hospitalisation expenses.

Enrollment

Once you instruct Citibank to enroll you for the plan, the applicable premium depending upon the plan chosen by you will be debited from your Citibank Credit Card or Bank Account. Your coverage begins from the date Citibank pays premium to Royal Sundaram towards your Health Forever Plan. Royal Sundaram will issue the policy certificate along with your Cashless Health Card and send it to your mailing address.

Day Care Expense Coverage

There are always certain medical procedures for which you may not need to get admitted to hospital for a long period. Health Forever pays for expenses towards cataract, tonsillectomy, eye surgeries, lithotripsy (kidney stone removal) and D&C procedures. Cataract operations are covered from the 2nd year and up to a limit of Rs. 7,500.

Exiting the plan

Should you wish to cancel your Health Forever coverage, you just need to write to Citibank N.A, P.O Box 4830, Anna Salai P.O, Chennai 600 002. In case you cancel your coverage before the end of a full policy year, Royal Sundaram will refund part of the premium paid after retaining premium as per applicable short period rates.

Pre/Post-Hospitalization Cover

All expenses related to condition for which hospitalisation happened and incurred up to 30 days before and up to 60 days after the hospitalization will be reimbursed under Health Forever.

Cumulative Bonus

Health Forever offers you 15% bonus on your sum insured for every claim-free year. This means that the Sum Insured under the policy stands increased by 15% for every claim free year up to a maximum of 60%.

Premium - 2 Year Plan

Plan Plan 1 Plan 2 Plan 3 Plan 4 Sum Insured 2,00,000 3,00,000 4,00,000 5,00,000 Age of Insured Person 91 days 18 years 3,205 4,370 5,748 7,131 19 - 45 years 5,427 7,381 9,771 12,158 46 - 60 years 8,207 11,521 15,287 19,050 61 - 75 years 11,771 16,817 22,383 27,942 76 - 80 years* 13,184 18,834 25,068 31,295

Claims

You can claim under your Health Forever coverage in two ways: 1. If you plan to get admitted to a hospital that is part of the Health Forever network, please call the 24-Hour MediCare helpline number in your city and take an authorization at least 72 hours in advance. This way you can avail of Health Forever's Cashless Hospitalization benefit. Once your treatment is over, you can simply walk out of the hospital without worrying about the bills. Royal Sundaram will settle

Hospital Cash Benefit

Health Forever pays you Rs. 150 for each day of hospitalization to cover incidental expenses like transportation, food etc. irrespective of the amount you actually spend, which is normally not covered under Standard Health Insurance

Extra Features

Health Forever not only takes care of your hospitalization expenses but also provides many value added benefits to support your and your family's health care:

* Age band 76- 80 years applicable only for renewal. The above rates are inclusive of 10% Service Tax and 3% Education Cess on Service Tax and are subject to change as and when there is an amendment passed by the government.

The premium mentioned above for either of the plans will be reduced by 10% if you cover 3 or more members of your family.

Anda mungkin juga menyukai

- Nammandi NammakapondiDokumen31 halamanNammandi NammakapondiViseshBelum ada peringkat

- Dhanvantaristotram - Dvi - DhanvantaristotramDokumen2 halamanDhanvantaristotram - Dvi - DhanvantaristotramSatyarohini SravanthiBelum ada peringkat

- Sep CallsDokumen16 halamanSep CallsSatyarohini SravanthiBelum ada peringkat

- Navagrahagayathr 021723 MBPDokumen64 halamanNavagrahagayathr 021723 MBPSatyarohini SravanthiBelum ada peringkat

- Cholamandalam Motor Insurance Cover NoteDokumen1 halamanCholamandalam Motor Insurance Cover NoteSatyarohini SravanthiBelum ada peringkat

- Gayathri Chalisa TeluguDokumen32 halamanGayathri Chalisa Telugustupid1112100% (1)

- ManasuthoDokumen4 halamanManasuthoSatyarohini SravanthiBelum ada peringkat

- GaniDokumen2 halamanGaniSatyarohini SravanthiBelum ada peringkat

- Mangla Chandi VratamDokumen2 halamanMangla Chandi VratamSatyarohini SravanthiBelum ada peringkat

- Sep CallsDokumen16 halamanSep CallsSatyarohini SravanthiBelum ada peringkat

- Gayathri Chalisa TeluguDokumen32 halamanGayathri Chalisa Telugustupid1112100% (1)

- Aditya Hrudayam in Telugu - Aditya-Hrudayam-In-TeluguDokumen5 halamanAditya Hrudayam in Telugu - Aditya-Hrudayam-In-TeluguSatyarohini SravanthiBelum ada peringkat

- CSI - Sales Dec'13Dokumen57 halamanCSI - Sales Dec'13Satyarohini SravanthiBelum ada peringkat

- To, PM Bykes Yamaha Show Room Kvs Function Hall Near RTC Bustand Anantapur PH: 9866677546Dokumen1 halamanTo, PM Bykes Yamaha Show Room Kvs Function Hall Near RTC Bustand Anantapur PH: 9866677546Satyarohini SravanthiBelum ada peringkat

- Work Jist ReportDokumen10 halamanWork Jist ReportSatyarohini SravanthiBelum ada peringkat

- Kamalathmika Dasa Maha Vidya Telugu PDFDokumen5 halamanKamalathmika Dasa Maha Vidya Telugu PDFKIRAN GARGYABelum ada peringkat

- Andhra Maha Bhagavatam Part 01Dokumen150 halamanAndhra Maha Bhagavatam Part 01KumarBelum ada peringkat

- Instant Feed Back SystemDokumen5 halamanInstant Feed Back SystemSatyarohini SravanthiBelum ada peringkat

- Reports FrequencyDokumen1 halamanReports FrequencySatyarohini SravanthiBelum ada peringkat

- SL No Name Designation Pants Shirt: Total 10 23Dokumen4 halamanSL No Name Designation Pants Shirt: Total 10 23Satyarohini SravanthiBelum ada peringkat

- Travel Expense Statement TemplateDokumen2 halamanTravel Expense Statement TemplateSatyarohini SravanthiBelum ada peringkat

- Kamalathmika Dasa Maha Vidya Telugu PDFDokumen5 halamanKamalathmika Dasa Maha Vidya Telugu PDFKIRAN GARGYABelum ada peringkat

- CV of SravanthiDokumen3 halamanCV of SravanthiSatyarohini SravanthiBelum ada peringkat

- 3S Customer Satisfaction FormDokumen4 halaman3S Customer Satisfaction FormSatyarohini SravanthiBelum ada peringkat

- Gayathri Chalisa TeluguDokumen32 halamanGayathri Chalisa Telugustupid1112100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Baf3106 Banking Law and Practice - CatDokumen7 halamanBaf3106 Banking Law and Practice - Catmusajames100% (1)

- List of Kenya Counties and WardsDokumen199 halamanList of Kenya Counties and WardsAnonymous E9xmcrKgSkBelum ada peringkat

- Opcom: February 2013 Monthly Market ReportDokumen4 halamanOpcom: February 2013 Monthly Market ReportioanitescumihaiBelum ada peringkat

- Titan AR 2002-03Dokumen10 halamanTitan AR 2002-03bondamiBelum ada peringkat

- Order Details: M.UlaganathanDokumen1 halamanOrder Details: M.UlaganathanulaganathanBelum ada peringkat

- Financial Accounting and Reporting Chapter 4 Problem 3Dokumen1 halamanFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaBelum ada peringkat

- Central Bank Statement From 22-Apr-2023 To 22-Jul-2023.Dokumen20 halamanCentral Bank Statement From 22-Apr-2023 To 22-Jul-2023.Shafi MuhimtuleBelum ada peringkat

- Value Plus Current AccountDokumen5 halamanValue Plus Current AccountmalikzaidBelum ada peringkat

- Customers and Account HoldersDokumen23 halamanCustomers and Account HoldersMAHESH VBelum ada peringkat

- ObjectionBACHomeLoansClaim 11 12Dokumen3 halamanObjectionBACHomeLoansClaim 11 12GrammaWendyBelum ada peringkat

- MetLife Enroll Form All ProductDokumen5 halamanMetLife Enroll Form All ProducttxceoBelum ada peringkat

- Universal Banking HDFCDokumen16 halamanUniversal Banking HDFCrajesh bathulaBelum ada peringkat

- BSP ReactionDokumen1 halamanBSP ReactionReymond Lovendino100% (2)

- Bank Statement2023 12 02 15 56 04 7980Dokumen5 halamanBank Statement2023 12 02 15 56 04 7980kazeemshaikBelum ada peringkat

- SimCorp Journal Credit+Ratings Apr09Dokumen2 halamanSimCorp Journal Credit+Ratings Apr09richardwillsherBelum ada peringkat

- Comparative Analysis of HDFC Bank and SBIDokumen37 halamanComparative Analysis of HDFC Bank and SBIsiddhantkamdarBelum ada peringkat

- Quarterly Value-Added Tax Declaration: Kawanihan NG Rentas InternasDokumen1 halamanQuarterly Value-Added Tax Declaration: Kawanihan NG Rentas Internaschiahwalousette100% (1)

- Rely on Internal Audit WorkDokumen4 halamanRely on Internal Audit WorkFahmi Abdulla100% (3)

- SOP - Front OfficeDokumen114 halamanSOP - Front Officetomzayco100% (8)

- For Resident Individual Account Holder: Page 1 of 6Dokumen6 halamanFor Resident Individual Account Holder: Page 1 of 6MOHAN SBelum ada peringkat

- Susana Glaraga Vs Sun LifeDokumen4 halamanSusana Glaraga Vs Sun Lifecrisanto perezBelum ada peringkat

- Roland Berger Study Banking Myanmar Sept PDFDokumen28 halamanRoland Berger Study Banking Myanmar Sept PDFYosia SuhermanBelum ada peringkat

- Final Reports by SunilDokumen34 halamanFinal Reports by Sunilryu_clan100% (3)

- Unit-1 Introduction To Indian Banking SystemDokumen40 halamanUnit-1 Introduction To Indian Banking SystemKruti BhattBelum ada peringkat

- Associated Bank V. CA (1996) : G.R. No. 107382/G.R. No. 107612Dokumen14 halamanAssociated Bank V. CA (1996) : G.R. No. 107382/G.R. No. 107612MiguelBelum ada peringkat

- Meralco Bill 325458600101 07272020 - 3 (3591)Dokumen2 halamanMeralco Bill 325458600101 07272020 - 3 (3591)Ave de GuzmanBelum ada peringkat

- Ca P GirirajDokumen15 halamanCa P GirirajSugunasugiBelum ada peringkat

- 08580XXX1871 2017jun23 2017jul21 PDFDokumen1 halaman08580XXX1871 2017jun23 2017jul21 PDFAdenBelum ada peringkat

- Digital Adoption in The Insurance Sector: From Ambition To Reality?Dokumen12 halamanDigital Adoption in The Insurance Sector: From Ambition To Reality?Ivan GrgićBelum ada peringkat

- TDS ChallanDokumen1 halamanTDS ChallanJainsanjaykumarBelum ada peringkat