Formulas

Diunggah oleh

Kevin BaterinaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Formulas

Diunggah oleh

Kevin BaterinaHak Cipta:

Format Tersedia

Engineering Economy Formulas

A. Break Even Points

B. Optimization Conditions (Continuous Case)

F.O.C.

S.O.C.

C. Single Payment Conversion Factors (Discrete Compounding, Discrete Flows)

Tabulated values are available

D. Uniform Series Payments Conversion Factors (Discrete Compounding, Discrete Flows)

Tabulated values are available

BEQuantity

Fixed ts

Sales ice AverageVariableCosts

=

cos

Pr

BECapacityUtilization

FixedCosts

Sales venue TotalVariableCosts

%

( Re )

=

100

dy

dx

f x at x = ' = ( )

*

0

'' < > f x for for ( ) max; min

*

0 0

( / , %, ) ( ) F P i N i i

N

= +

( / , %, ) ( ) P F i N i i

N

= +

( / , %, )

( )

( / , %, )

( )

( / , %, )

( )

( )

( / , %, )

( )

( )

F A i N

i

i

A F i N

i

i

P A i N

i

i i

A P i N

i i

i

N

N

N

N

N

N

=

+

=

+

=

+

+

=

+

+

1 1

1 1

1 1

1

1

1 1

E. Uniform Arithmetic Gradient Series Payments Conversion Factors (Discrete Compounding,

Discrete Flows)

Tabulated values are available for (P/G,i%,N) and (A/G,i%,N), but not for (F/G,i%,N).

F. Geometric Gradient Series Payments Conversion Factors (Discrete Compounding, Discrete Flows)

Tabulated values are not available.

f = the average rate at which cash flows are changing

A

1

= the cash flow at the end of the first year

G. Varying Interest Rate Conversion Factors (Discrete Compounding, Discrete Flows)

Tabulated values are not available.

H. Effective Interest Rates (Discrete Compounding, Discrete Flows)

r = nominal annual interest rate

M = number of compounding periods in a year

i = effective annual interest rate

( / , %, ) ( )

( / , %, )

( / , %, )

( )

( ) ( )

( / , %, )

( )

F G i N

i

i

N

i

F A i N

i

N

i

P G i N

i

i i

N

i i

A G i N

i

N

i

k

k

N

N

N N

N

= +

(

=

=

+

+

+

=

+

=

1

1

1 1

1 1

1

1 1

0

1

2

1

1

1 1

0

1

0

+ =

+

+

=

+

=

=

i

i

f

and A

A

f

P G i N A P A i N

A G i N P G i N A P i N

CR

CR

( )

( / , %, ) ( / , %, )

( / , %, ) ( / , %, ) ( / , %, )

F P F P i P i

P F P F i F i

N k

k

N

k

k

N

N k

k

N

N k

k

N

=

|

\

|

.

| = +

|

\

|

.

|

=

|

\

|

.

| = +

|

\

|

.

|

= =

=

=

[ [

[ [

( / , %, ) ( )

( / , %, ) ( )

1 1

1 1

1 1

1

1

1

i

r

M

F P

r

M

M

M

= +

|

\

|

.

| = 1 1 1 ( / , %, )

I. Continuous Compounding Discrete Flows Conversion Factors

Tabulated values are available.

r = nominal annual interest rate with continuous compounding

i = effective annual interest rate if compounded annually

J. Continuous Compounding Continuous Flows Conversion Factors

Tabulated values are available.

K. Evaluation of Projects

PW = PW of cash inflows - PW of cash outflows

FW = FW of cash inflows - FW of cash outflows

AW = AW of cash inflows - AW of cash outflows

IRR = internal rate of return or, the interest rate at which PW = 0

Let

PW(@i

1

%) = + a

PW(@i

2

%) = - b (note: i

2

> i

1

)

Then

ERR = the external rate of return or, the interest rate at which

FW of P (@ERR%) = FW of all net cash inflows (@ e%), where P is the PW of net cash outflows

(@e%) and e is the interest rate that could be earned if cash is invested elsewhere (external

reinvestment rate)

L. Payback Period

Simple payback period is the minimum number of years when PW (@0%) = 0.

Discounted payback period is the minimum number of years when PW (@MARR)=0.

M. Evaluation of Independent Projects with no Budget Constraint on Investment

Accept all projects that have EW > 0 or the rate of return (IRR or ERR) > MARR.

i e

F P r N e

P F r N e

F A r N

e

e

P A r N

e

e e

r

rN

rN

rN

r

rN

r rN

=

=

=

=

1

1

1

1

1

( / , %, )

( / , %, )

( / , %, )

( / , %, )

( )

( / , %, )

( / , %, )

P A r N

e

re

F A r N

e

r

rN

rN

rN

=

=

1

1

IRR i

i i

a b

a = +

+

1

2 1

( )

( )

N. Evaluation of Mutually Exclusive Projects

1. When Projects have the same Useful Life

Choose the project with the highest positive EW

Or

Choose the highest investment project that has incremental EW(A) > 0

Or

Choose the highest investment project that has the incremental rate of return, i.e., IRR(A) or ERR(A) >

MARR

2. When Projects have different Useful Lives

If the projects are repeatable,

Calculate AW of each project from cash flows of its one useful life and choose the project with the

highest AW

Or

Choose the lowest common multiple of all useful lives as the common study period; assume that

the projects are repeated as many times necessary over the study period, develop cash flows for all

repeated useful lives, and calculate EW of each project. Choose the project with the highest EW

or choose the highest investment project that has positive incremental EW, or the choose the

highest investment project that has incremental ROR exceeding MARR.

If the projects are not repeatable,

Coterminate all projects in the same planning period, generate additional information that may be

necessary, and use any one of the methods that are discussed for evaluation of same useful life

alternatives.

O. Capitalized worth (CW) of an infinite stream of annual payments (A)

P. Depreciation Formulas

B = cost basis; N = useful life; SV

N

= Salvage value at the end of life N

d

k

= the depreciation in Year k; BV

k

= book value at the end of Year k

If an old machine is traded in while buying a new machine:

Cost Basis (B) =Actual Cash Paid +Book Value of the old machine

Straight Line Method

Declining Balance Method

R = the constant percentage of depreciation

Sum-of-the-Years-Digits (SYD) Method

CW

A

i

=

d

B SV

N

and BV B k d

k

N

k k

=

=

R

N

if Declining Balance

R

N

if Declining Balance

=

=

15

150%

2

200%

.

,

,

d R BV and BV R B

k k k

k

= =

1

1 ( )

SYD

N N

SYDfactor

N k

SYD

d B SV SYDfactor

k

k N

=

+

=

+

=

( )

( )

( )

1

2

1

Actual Usage, or Units of Production Method

Q = the estimated lifetime production in units

q

k

= the actual production in Year k in units

Q. Depreciable Assets and GDS and ADS Recovery Periods

Assets or Depreciable Assets Used in Business GDS Recovery

Period

ADS Recovery

Period

Office furniture and equipment 7 10

Information systems, computers 5 5

Automobile, taxis 5 5

Buses 5 9

Light general purpose trucks 5 5

Heavy general purpose trucks 5 6

Tractor units for use over the road 3 4

Mining 7 10

Production of petroleum and natural gas 7 14

Petroleum refining 10 16

Construction 5 6

Manufacture of carpets 5 9

Manufacture of wood products 7 10

Manufacture of chemicals and allied products 5 9.5

Manufacture of rubber products 7 14

Manufacture of cement 15 20

Manufacture of fabricated metal products 7 12

Manufacture of electronic components, products and systems 5 6

Manufacture of motor vehicles 7 12

Manufacture of aerospace products 7 10

Telephone central office equipment 10 18

Electric utility steam production plant 20 28

Gas utility distribution facilities 20 35

d

B SV

Q

q

k

N

k

=

|

\

|

.

|

R. GDS Recovery Rates for the Six Personal Property Classes

For a property class of X-year, the recovery period is X+1, because of the half-year time convention.

Year 3-year 5-year 7-year 10-year 15-year 20-year

1 0.3333 0.2000 0.1429 0.10000 0.0500 0.0375

2 0.4445 0.3200 0.2449 0.1800 0.0950 0.0722

3 0.1481 0.1920 0.1749 0.1440 0.0855 0.0668

4 0.0741 0.1152 0.1249 0.1152 0.0770 0.0618

5 0.1152 0.0893 0.0922 0.0693 0.0571

6 0.0576 0.0892 0.0737 0.0623 0.0528

7 0.0893 0.0655 0.0590 0.0489

8 0.0446 0.0655 0.0590 0.0452

9 0.0656 0.0591 0.0447

10 0.0655 0.0590 0.0447

11 0.0328 0.0591 0.0446

12 0.0590 0.0446

13 0.0591 0.0446

14 0.0590 0.0446

15 0.0591 0.0446

16 0.0295 0.0446

17 0.0446

18 0.0446

19 0.0446

20 0.0446

21 0.0223

1. The 3-year, 5-year, 7-year and 10-year property class recovery rates for GDS are calculated as

200% declining balance with switchover to straight line.

2. The 15-year and 20-year property class recovery rates for GDS are calculated as 150% declining

balance with switchover to straight line.

3. The 27.5-year property class (residential rental property) and the 39-year property class (non-

residential real property) are allowed straight-line depreciation; the recovery factors are not given

in the table.

4. Any depreciable personal property that does not fit into one of the defined asset classes is

depreciated as being in the 7-year property class for the GDS recovery.

S. Depreciation Methods used for the ADS Recovery

1. The straight-line method is used for the ADS recovery.

2. The ADS recovery period for nonresidential property is 40 years.

3. Any tangible personal property that does not fit into one of the asset classes is depreciated using a

12-year ADS recovery period.

T. Cost Method of Depletion Allowances

Note: Adjusted cost basis is the original cost basis, adjusted by allowable increases due to

improvements or decreases due to casualties, thefts and losses.

depletion unit

adjusted t basis

of units remaining to be ed harvested

=

cos $

# min /

Depletion allowance = # of units sold x depletion unit

U. Percentage Method of Depletion Allowances

Depletion allowance = the allowed % x gross income

1. Depletion allowance cannot exceed 50% of the net income (100% for oil and gas property) before

deduction of the depletion allowances.

2. Allowed percentages are

Sulfur, uranium, domestically mined lead, zinc, nickel and asbestos: 22%

Gold, silver, copper, iron ore, oil shale from U.S. deposits, geothermal wells in the U.S.: 15%

Coal, lignite and sodium chloride: 10%

Clay, gravel, sand and stone: 5%

V. Income Tax Formulas

Effective income tax rate (t) = state rate + federal rate (1 - state rate)

(Before-tax MARR)(1 - effective income tax rate) = after-tax MARR

Before-tax cash flow (BTCF) = Gross income (R)

- all expenses except capital investments (E)

Taxable income or Net income before taxes (NIBT)

= Before-tax cash flow (BTCF) - Depreciation (depletion) deductions (d)

Income taxes (T) = Effective income tax rate x Taxable income

Net income after taxes (NIAT) = Taxable income or NIBT - income taxes

Gain or loss on disposal of an asset = Market value - Book value

After-tax cash flow (ATCF) = BTCF - income taxes (T)

W. Cost Estimation Techniques

Cost in Year t: C C

Index

Index

t base

t

base

=

|

\

|

.

|

Composite index for multiple items (m = 1,, M), weight W

m

and cost C

m

( )

Composite Index I

W C C

W

I

t

m tm base m

m

M

m

m

M base

=

=

=

( )

1

1

Power-Sizing Technique (C: cost, S: size, and X the cost-capacity factor)

C

C

S

S

A

B

A

B

X

=

|

\

|

.

|

Learning and Improvement

u: the output unit number; Z

u

= # of units of input needed for the u

th

output;

K: # of units of input needed for the 1

st

output; s: the learning parameter

Z Ku where n

s

u

n

= = ,

log

log2

Cost Estimating Relationship: y = a + b x

b

n x y x y

n x x

a

y b x

n

observed y predicted y

n

R

x x y y

x x y y

i i

i

n

i

i

n

i

i

n

i

i

n

i

i

n

i

i

n

i

i

n

i i

i

n

i i

i

n

i

i

n

i

i

n

=

|

\

|

.

|

|

\

|

.

|

|

\

|

.

|

=

=

=

= = =

= =

= =

=

=

= =

1 1 1

2

1 1

2

1 1

2

2

1

1

2

1

2

1

o

( )

( )( )

( ) ( )

(

(

X. Price Changes and Exchange Rates

Inflation rate % in Year k:

Average annual inflation rate % in the period Year b through Year k:

Real $ (R$) and Actual $ (A$):

Real interest rate (i

r

) and the combined, or nominal, interest rate (i

c

):

(note: the same formula can be used for IRR or MARR also)

f

PI

PI

k

b

k b

=

|

\

|

.

|

(

(

1

1 100

( ) ( ) ( )

( ) R A

f

A P F f k b

k k

k b

k

$ $ $ / , %, =

+

|

\

|

.

| =

1

1

i

i f

f

r

c

=

+ 1

f

PI PI

PI

k

k k

k

=

1

1

100

Total price change (e

j

) and relative, or differential, price change (e

'

j

):

Convenience Rate (i

CR

) for Geometric Sequence of Cash Flows:

When doing A$ analysis:

When doing R$ analysis:

Foreign Exchange Rate Devaluation (f

e

):

Y. Replacement Analysis

Before-Tax Total Marginal Cost in any year k (TC

k

) =

Change in the market value of assets if sold in year k instead of year k-1 (MV

k-1

- MV

k

)

+

Opportunity cost of capital tied up by delaying sale of assets by one year (i MV

k-1

)

+

Operating expenses in year k (E

k

)

After-Tax Total Marginal Cost in any year k (TMC

k

) =

Change in the market value of assets if sold in year k instead of year k-1

(1-t)(MV

k-1

- MV

k

)

+

Opportunity cost of capital tied up by delaying sale of assets by one year

(1-t)(i MV

k-1

) + i t (BV)

k-1

Or

i {MV

k-1

- t (MV

k-1

- BV

k-1

)}

+

Operating expenses in year k

(1-t)E

k

Economic life of an asset = Minimum equivalent uniform annual cost (EUAC) period (For each year,

consider that year's and prior years' TMCs and convert into the EUAC of the year and then, find the year

when EUAC is minimum)

( ) ( ) k MARR P A j MARR F P TMC EUAC

k

j

j k

%, , / %, , /

1

(

=

=

How long should you keep using a defender, before replacing with a challenger?

Use the defender till its TMC < the minimum EUAC of the best challenger

When should you abandon a project without any replacement?

Keep using the project as long as its PW is not decreasing.

i

i e

e

CR

c j

j

=

+ 1

i

i e

e

C R

r j

j

=

+

'

'

1

i

i f

f

us

fc e

e

=

+ 1

e

e f

f

j

j

'

=

+ 1

Z. Benefit-Cost Ratio Method

Any disbenefits (nonmonetary negative consequences) can either be deducted from benefits in the

numerator or be added to costs in the denominator.

Choice among independent projects: choose all project with B/C > 1.

Choice among mutually exclusive projects:

Do incremental B/C ratio method. Choose the highest PW(costs) project that has incremental B/C

> 1. If life periods are different, compare the projects over the same planning period. If the

repeatability assumption holds, it is relatively more convenient to compare the incremental B/C

ratios calculated from AW of cash flows in a single useful life.

Conventional B C

PW B

I PW S PW O M

or

AW B

AW I AW S AW O M

/

( )

( ) ( & )

( )

( ) ( ) ( & )

=

+ +

Modified B C

PW B PW O M

I PW S

or

AW B AW O M

AW I AW S

/

( ) ( & )

( )

( ) ( & )

( ) ( )

=

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- FM PY MCQs by CA CMA Suraj TatiyaDokumen26 halamanFM PY MCQs by CA CMA Suraj TatiyaTathagat AdalatwaleBelum ada peringkat

- USPADokumen18 halamanUSPAtayyebaBelum ada peringkat

- Performance MGMT Discussion QuestionsDokumen7 halamanPerformance MGMT Discussion QuestionsSritel Boutique HotelBelum ada peringkat

- ACC501 Solved FinaltermDokumen96 halamanACC501 Solved Finaltermdani100% (1)

- Group10 CapitalbudgetingDokumen75 halamanGroup10 CapitalbudgetingYna CabreraBelum ada peringkat

- Simulation and Evaluation of Flare Gas Recovery Unit For RefineriesDokumen7 halamanSimulation and Evaluation of Flare Gas Recovery Unit For RefineriesJohnBelum ada peringkat

- CH 13Dokumen29 halamanCH 13black_zillaBelum ada peringkat

- Cap Bud ProbDokumen9 halamanCap Bud ProbJulie Mark JocsonBelum ada peringkat

- Profitability AnalysisDokumen29 halamanProfitability AnalysisJocelyn CorpuzBelum ada peringkat

- Ugc Net Commerce: Unit SnapshotDokumen64 halamanUgc Net Commerce: Unit SnapshotParth TiwariBelum ada peringkat

- JNPT Final Volume2v2Dokumen311 halamanJNPT Final Volume2v2Samir DhrangdhariyaBelum ada peringkat

- PSB Tutorial Solutions Week 2Dokumen14 halamanPSB Tutorial Solutions Week 2Iqtidar KhanBelum ada peringkat

- Internal Rate of ReturnDokumen18 halamanInternal Rate of ReturnRiaz javedBelum ada peringkat

- Ch. 11 Test BankDokumen28 halamanCh. 11 Test BankMohamed Fathi Ali100% (1)

- Displaced Commercial RiskDokumen3 halamanDisplaced Commercial RiskSalman EjazBelum ada peringkat

- Irr and Incremental IrrDokumen10 halamanIrr and Incremental IrrrashiBelum ada peringkat

- Mirr NotesDokumen5 halamanMirr NotesSitaKumariBelum ada peringkat

- Intermediate Financing (Term Loan and Lease Financing)Dokumen41 halamanIntermediate Financing (Term Loan and Lease Financing)Soo CealBelum ada peringkat

- Module 6 CanvasDokumen9 halamanModule 6 CanvasMon RamBelum ada peringkat

- 8482041Dokumen23 halaman8482041Minh Tú HoàngBelum ada peringkat

- NET PRESENT VALUE AND OTHER INVESTMENT CRITERIA - Chapter 08Dokumen16 halamanNET PRESENT VALUE AND OTHER INVESTMENT CRITERIA - Chapter 08zordan100% (1)

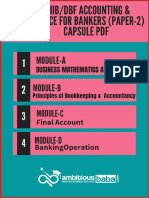

- JAIJAIIB Paper 2 CAPSULE PDF 2.O Accounting Finance For Bankers by Ambitious BabaDokumen159 halamanJAIJAIIB Paper 2 CAPSULE PDF 2.O Accounting Finance For Bankers by Ambitious BabaSaurabhBelum ada peringkat

- 31-Pre-Feasibility Calve Fattening 24-02-14Dokumen11 halaman31-Pre-Feasibility Calve Fattening 24-02-14khursheedBelum ada peringkat

- 07 APMP Study NotesDokumen52 halaman07 APMP Study Notessajni123Belum ada peringkat

- Investment Valuation and Appraisal.Dokumen342 halamanInvestment Valuation and Appraisal.Adeola AdeoyeBelum ada peringkat

- Group5 Capacity PlanningDokumen8 halamanGroup5 Capacity Planningmeghadahiya241050% (2)

- CAT Programme T10 Managing Finances: Mock Test Section A - ALL 10 Questions Are Compulsory and MUST Be Attempted. (20%)Dokumen8 halamanCAT Programme T10 Managing Finances: Mock Test Section A - ALL 10 Questions Are Compulsory and MUST Be Attempted. (20%)Thuy TranBelum ada peringkat

- IRR and NPVDokumen21 halamanIRR and NPVAbdul Qayyum100% (1)

- MTH302Dokumen21 halamanMTH302saqib_hakeemBelum ada peringkat

- A Study On Capital BudgetingDokumen80 halamanA Study On Capital BudgetingSparsh RastogiBelum ada peringkat