Accounting Model

Diunggah oleh

kristine diosaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting Model

Diunggah oleh

kristine diosaHak Cipta:

Format Tersedia

Jericca Sunga III-Honesty Ms.

Remedios Dela Cruz

Financial statements consist of a Balance Sheet and Profit & Loss Statement. These two reports act as a “container”

for all your business transactions. Each transaction is recorded according to a set of rules called “The Accounting

Model”.

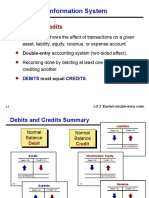

The Accounting Model is made up of three very simple parts:

Led ger Pa ge

The first part is a ledger page with a line drawn down the middle (like a big T) automatically creating a left and right

side of the dividing line. However, in accounting language the word “debit” is used instead of “left” and the word

“credit” is used instead of “right”. The trick here is to not make this anymore complicated than it really is. Don’t try to

use the words debit and credit to mean increase or decrease like you see on your bank statement. You can do this

later when you fully understand how to work with these terms.

Sections

The second part is that there are five of these ledger T’s that relate to the five sections found in a set of financial

statements. They are: 1) Assets; 2) Liabilities; 3) Equity; 4) Revenue; 5) Expense. The first three relate to the Balance

Sheet and last two relate to the Profit & Loss Statement.

Records

The third part is a rule that states: Any transaction that pertains to a section (Assets, Liabilities, etc.) that results in an

increase or decrease has to be recorded on either the left or right side of the ledger page. Review the following

example of a completed accounting model to see what I am talking about:

Debit 1. All Asset Accounts Credit

Increase Decrease

Debit 2. All Liability Accounts Credit

Decrease Increase

Debit 3. All Equity Accounts Credit

Decrease Increase

Debit 4. All Revenue Accounts Credit

Decrease Increase

Debit 5. All Expense Accounts Credit

Increase Decrease

Aira Jean Cunanan III-Honesty Ms. Remedios Dela Cruz

Financial statements consist of a Balance Sheet and Profit & Loss Statement. These two reports act as a

“container” for all your business transactions. Each transaction is recorded according to a set of rules

called “The Accounting Model”.

The Accounting Model is made up of three very simple parts:

Ledger Page

The first part is a ledger page with a line drawn down the middle (like a big T) automatically creating a

left and right side of the dividing line. However, in accounting language the word “debit” is used instead

of “left” and the word “credit” is used instead of “right”. The trick here is to not make this anymore

complicated than it really is. Don’t try to use the words debit and credit to mean increase or decrease like

you see on your bank statement. You can do this later when you fully understand how to work with these

terms.

Sections

The second part is that there are five of these ledger T’s that relate to the five sections found in a set of

financial statements. They are: 1) Assets; 2) Liabilities; 3) Equity; 4) Revenue; 5) Expense. The first three

relate to the Balance Sheet and last two relate to the Profit & Loss Statement.

Records

The third part is a rule that states: Any transaction that pertains to a section (Assets, Liabilities, etc.) that

results in an increase or decrease has to be recorded on either the left or right side of the ledger page.

Review the following example of a completed accounting model to see what I am talking about:

Debit 1. All Asset Accounts Credit

Increase Decrease

Debit 2. All Liability Accounts Credit

Decrease Increase

Debit 3. All Equity Accounts Credit

Decrease Increase

Debit 4. All Revenue Accounts Credit

Decrease Increase

Debit 5. All Expense Accounts Credit

Increase Decrease

Heaven Nicole Mercado III-Honesty Ms. Remedios Dela

Cruz

Financial statements consist of a Balance Sheet and Profit & Loss Statement.

These two reports act as a “container” for all your business transactions. Each

transaction is recorded according to a set of rules called “The Accounting

Model”.

The Accounting Model is made up of three very simple parts:

Ledger Page

The first part is a ledger page with a line drawn down the middle (like a big T)

automatically creating a left and right side of the dividing line. However, in

accounting language the word “debit” is used instead of “left” and the word

“credit” is used instead of “right”. The trick here is to not make this anymore

complicated than it really is. Don’t try to use the words debit and credit to

mean increase or decrease like you see on your bank statement. You can do

this later when you fully understand how to work with these terms.

Sections

The second part is that there are five of these ledger T’s that relate to the five

sections found in a set of financial statements. They are: 1) Assets; 2)

Liabilities; 3) Equity; 4) Revenue; 5) Expense. The first three relate to the

Balance Sheet and last two relate to the Profit & Loss Statement.

Records

The third part is a rule that states: Any transaction that pertains to a section

(Assets, Liabilities, etc.) that results in an increase or decrease has to be

recorded on either the left or right side of the ledger page. Review the

following example of a completed accounting model to see what I am talking

about:

Debit 1. All Asset Accounts Credit

Increase Decrease

Debit 2. All Liability Accounts Credit

Decrease Increase

Debit 3. All Equity Accounts Credit

Decrease Increase

Debit 4. All Revenue Accounts Credit

Decrease Increase

Debit 5. All Expense Accounts Credit

Increase Decrease

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Compensation of General Partners of Private Equity FundsDokumen6 halamanCompensation of General Partners of Private Equity FundsManu Midha100% (1)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Finance Module 1 Intro To FinanceDokumen8 halamanFinance Module 1 Intro To FinanceJOHN PAUL LAGAOBelum ada peringkat

- Historical Volatility - The Holy Grail Found PDFDokumen5 halamanHistorical Volatility - The Holy Grail Found PDFAndrey Yablonskiy100% (5)

- Audit of Banks With The Help of FinacleDokumen8 halamanAudit of Banks With The Help of FinacleKartikey RanaBelum ada peringkat

- State Audit Code of The Philippines (P.D. 1445)Dokumen37 halamanState Audit Code of The Philippines (P.D. 1445)Monique del Rosario100% (3)

- CIR v. Suyoc MinesDokumen1 halamanCIR v. Suyoc MinesPatricia SulitBelum ada peringkat

- Reliance Industries Financial Report AnalysisDokumen52 halamanReliance Industries Financial Report Analysissagar029Belum ada peringkat

- OffentliggorelseDokumen59 halamanOffentliggorelsenot youBelum ada peringkat

- Journal On FACTORS AFFECTING VOLUNTARY COMPLIANCE PDFDokumen16 halamanJournal On FACTORS AFFECTING VOLUNTARY COMPLIANCE PDFFasika AbedomBelum ada peringkat

- RBI Master Circular On RestructuringDokumen120 halamanRBI Master Circular On RestructuringHarish PuriBelum ada peringkat

- Chapter 1+3+4 AhtDokumen25 halamanChapter 1+3+4 AhtAn Hoài ThuBelum ada peringkat

- Accounting Information System Debits and CreditsDokumen84 halamanAccounting Information System Debits and CreditsDavid Bradley BeckBelum ada peringkat

- Company Research Highlights: Plug Power IncDokumen4 halamanCompany Research Highlights: Plug Power Incapi-109061352Belum ada peringkat

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDokumen10 halamanCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaBelum ada peringkat

- 2281 w05 QP 1Dokumen12 halaman2281 w05 QP 1mstudy123456Belum ada peringkat

- Walmart Financial Ratio Analysis 2002-2003Dokumen1 halamanWalmart Financial Ratio Analysis 2002-2003Pamela WilliamsBelum ada peringkat

- Working Capital Project Report 2Dokumen48 halamanWorking Capital Project Report 2Evelyn KeaneBelum ada peringkat

- Economics Chapter 2 14Dokumen84 halamanEconomics Chapter 2 14Jarren BasilanBelum ada peringkat

- FSA On Infy With InterpretationDokumen22 halamanFSA On Infy With InterpretationayushBelum ada peringkat

- Income Taxation Chapter 14 SolutionsDokumen2 halamanIncome Taxation Chapter 14 SolutionsEBelum ada peringkat

- Cost Benefit AnalysisDokumen11 halamanCost Benefit AnalysisTnek OrarrefBelum ada peringkat

- John Case WorksheetDokumen10 halamanJohn Case Worksheetzeeshan33% (3)

- Intermediate Accounting I IntangiblesDokumen7 halamanIntermediate Accounting I IntangiblesGiny BenavidezBelum ada peringkat

- Cre8 Corp's Organizational StructureDokumen5 halamanCre8 Corp's Organizational StructureJhobelle JovellanoBelum ada peringkat

- Financial Management - Formula SheetDokumen8 halamanFinancial Management - Formula SheetHassleBustBelum ada peringkat

- Learning ObjectivesDokumen10 halamanLearning ObjectivesShraddha MalandkarBelum ada peringkat

- Audit Points Treasury Bills SystemDokumen37 halamanAudit Points Treasury Bills SystemRajaniseer SrinivasanBelum ada peringkat

- Actual Costing enDokumen8 halamanActual Costing enRajanBelum ada peringkat

- Individual Income Tax NOTESDokumen1 halamanIndividual Income Tax NOTESNavsBelum ada peringkat