Cbo Aca Tables Feb 2014

Diunggah oleh

iggybauDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cbo Aca Tables Feb 2014

Diunggah oleh

iggybauHak Cipta:

Format Tersedia

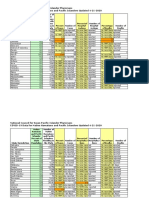

Insurance Coverage Provisions of the Affordable Care Act CBOs February 2014 Baseline

Table 1. Effects on the Deficit of the Insurance Coverage Provisions of the Affordable Care Act Table 2. Effects of the Affordable Care Act on Health Insurance Coverage Table 3. Enrollment in, and Budgetary Effects of, Health Insurance Exchanges Table 4. Comparison of CBOs Current and Previous Estimates of the Effects of the Insurance Coverage Provisions of the Affordable Care Act

Table 1.

Effects on the Deficit of the Insurance Coverage Provisions of the Affordable Care Act

(Billions of dollars, by fiscal year)

Total, 20152014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2024

Exchange Subsidies and Related Spendinga Medicaid and CHIP Outlaysb Small-Employer Tax Creditsc Gross Cost of Coverage Provisions Penalty Payments by Uninsured People Penalty Payments by Employersc Excise Tax on High-Premium Insurance Plansc Other Effects on Revenues and Outlaysd

Net Cost of Coverage Provisions Memorandum:

20 19 1 ___ 40 0 0 0 1 ___

41

47 41 2 ___ 90 -2 0 0 1 ___

88

85 62 1 ___ 148 -4 -11 0 -6 ___

127

104 70 1 ___ 175 -5 -14 0 -14 ___

142

118 76 1 ___ 195 -5 -15 -5 -20 ___

151

123 80 1 ___ 205 -5 -16 -9 -23 ___

151

129 83 1 ___ 214 -5 -17 -11 -24 ___

156

137 87 2 ___ 226 -6 -18 -14 -26 ___

161

143 92 2 ___ 237 -6 -19 -18 -28 ___

166

151 98 2 ___ 250 -6 -20 -22 -31 ___

170

159 1,197 103 792 2 _____ 15 ___ 263 2,004 -7 -52 -21 -151 -28 -108 -34 _____ -206 ___

173 1,487

Changes in Mandatory Spending Changes in Revenuese

37 -4

103 15

156 29

186 44

196 45

207 55

217 61

229 68

241 75

254 84

267 2,056 94 570

Sources: Congressional Budget Office; staff of the Joint Committee on Taxation. Notes: These numbers exclude effects on the deficit of provisions of the Affordable Care Act that are not related to insurance coverage. They also exclude federal administrative costs subject to appropriation. (CBO has previously estimated that the Internal Revenue Service would need to spend between $5 billion and $10 billion over the 20102019 period to implement the Affordable Care Act and that the Department of Health and Human Services and other federal agencies would also need to spend $5 billion to $10 billion over that period.) In addition, the Affordable Care Act included explicit authorizations for spending on a variety of grant and other programs; that funding is also subject to future appropriation action. Unless otherwise noted, positive numbers indicate an increase in the deficit, and negative numbers indicate a decrease in the deficit. Numbers may not add up to totals because of rounding. CHIP = Childrens Health Insurance Program. a. Includes spending for exchange grants to states and net collections and payments for risk adjustment, reinsurance, and risk corridors. b. Under current law, states have the flexibility to make programmatic and other budgetary changes to Medicaid and CHIP . CBO estimates that state spending on Medicaid and CHIP over the 20152024 period will be about $70 billion higher because of the coverage provisions of the Affordable Care Act than it would be otherwise. c. These effects on the deficit include the associated effects of changes in taxable compensation on revenues. d. Consists mainly of the effects of changes in taxable compensation on revenues. CBO estimates that outlays for Social Security benefits will increase by about $8 billion over the 20152024 period and that the coverage provisions will have negligible effects on outlays for other federal programs. e. Positive numbers indicate an increase in revenues, and negative numbers indicate a decrease in revenues.

Table 2.

Effects of the Affordable Care Act on Health Insurance Coverage

(Millions of nonelderly people, by calendar year)

2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024

Insurance Coverage Under Prior Law Medicaid and CHIP Employment-based coverage Nongroup and other coverageb Uninsuredc Total

34 157 25 57 ____ 274 6 8 * -2 -13

34 159 26 57 ____ 276 13 12 -2 -3 -20

33 161 26 56 ____ 277 22 12 -6 -4 -25

33 164 27 56 ____ 279 24 12 -6 -5 -25

33 165 27 55 ____ 281 25 12 -7 -5 -25

33 166 27 55 ____ 282 25 12 -7 -5 -25

34 167 27 56 ____ 284 24 13 -7 -5 -25

34 167 28 56 ____ 285 25 13 -7 -5 -25

34 168 28 56 ____ 286 24 13 -7 -5 -25

34 169 28 56 ____ 288 24 13 -7 -5 -25

35 169 28 57 ____ 289 24 13 -7 -5 -25

Change in Insurance Coverage Under the ACA Insurance exchanges Medicaid and CHIP Employment-based coveraged Nongroup and other coverageb Uninsuredc Uninsured Under the ACA Number of uninsured nonelderly peoplec Insured as a percentage of the nonelderly population Including all U.S. residents Excluding unauthorized immigrants

Memorandum:

45

37

31

30

30

30

30

31

31

31

31

84 86

86 89

89 91

89 92

89 92

89 92

89 92

89 92

89 92

89 92

89 92

Exchange Enrollees and Subsidies Number with unaffordable offer from employere Number of unsubsidized exchange enrolleesf Average exchange subsidy per subsidized enrollee (Dollars)

* 1 4,700

* 2 5,330

* 4 5,350

1 4 5,590

1 5 5,990

1 5 6,240

1 5 6,720

1 5 7,060

1 5 7,460

1 5 7,900

1 5 8,370

Sources: Congressional Budget Office; staff of the Joint Committee on Taxation. Notes: Figures for the nonelderly population include residents of the 50 states and the District of Columbia who are younger than 65. Numbers may not add up to totals because of rounding. CHIP = Childrens Health Insurance Program; ACA = Affordable Care Act; * = between -500,000 and 500,000. a. Figures reflect average enrollment over the course of a year and include spouses and dependents covered under family policies; people reporting multiple sources of coverage are assigned a primary source. To illustrate the effects of the Affordable Care Act, which is part of current law, changes in coverage are compared with coverage projections in the absence of that legislation, or prior law. b. The effects are almost entirely for nongroup coverage; other includes Medicare. c. The number of uninsured people includes unauthorized immigrants as well as people who are eligible for, but not enrolled in, Medicaid. d. The change in employment-based coverage is the net result of projected increases and decreases in offers of health insurance from employers and changes in enrollment by workers and their families. For example, in 2019, an estimated 11 million people who would have had an offer of employment-based coverage under prior law will lose their offer under current law, and an estimated 3 million people who would have enrolled in employment-based coverage will still have such an offer but will choose to no longer enroll in that coverage. Those decreases in employment-based coverage will be partially offset by an estimated 7 million people who will newly enroll in employmentbased coverage under the Affordable Care Act. e. Workers who would have to pay more than a specified share of their income (9.5 percent in 2014) for employment-based coverage could receive subsidies through an exchange. f. Excludes coverage purchased directly from insurers outside of an exchange.

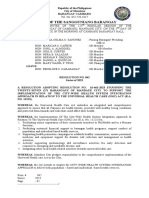

Table 3.

Enrollment in, and Budgetary Effects of, Health Insurance Exchanges

Total, 20152014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2024 Exchange Enrollment a (Millions of nonelderly people, by calendar year)

Individually Purchased Coverage Subsidized Unsubsidizedb

Total

5 1 __

6

11 2 ___

13

19 4 ___

22

20 4 ___

24

20 5 ___

25

20 5 ___

25

20 5 ___

24

20 5 ___

25

19 5 ___

24

19 5 ___

24

19 5 ___

24

n.a. n.a.

n.a.

Employment-Based Coverage Purchased Through Exchangesb

n.a.

Budgetary Effects (Billions of dollars, by fiscal year)

Changes in Mandatory Spending Premium credit outlays Cost-sharing subsidies Exchange grants to states Payments for risk adjustment, reinsurance, and risk corridors

Total

13 3 2 0 ___ 18 -2 0 ___ -2 20

33 8 1 20 ___ 62 -6 21 ___ 14 47

63 13 * 19 ___ 95 -11 21 ___ 10 85

79 15 * 23 ___ 118 -13 27 ___ 14 104

88 16 0 17 ___ 121 -14 17 ___ 3 118

92 17 0 19 ___ 127 -15 19 ___ 4 123

97 17 0 21 ___ 135 -15 21 ___ 6 129

103 18 0 21 ___ 143 -15 21 ___ 6 137

109 19 0 22 ___ 150 -15 22 ___ 7 143

115 21 0 23 ___ 158 -16 23 ___ 7 151

121 22 0

899 167 2

23 _____ 208 ___ 166 1,275 -16 23 ___ 7 -137 215 ____ 78

Changes in Revenues Premium credit revenues Collections for risk adjustment, reinsurance, and risk corridors

Total

Net Increase in the Deficit From Exchange Subsidies and Related Spending

Memorandum:

159 1,197

Total Exchange Subsidies (Billions of dollars, by calendar year) Average Exchange Subsidy per Subsidized Enrollee (Dollars)

25

57

100

112

121

124

132

139

145

153

162 1,244 n.a.

4,700 5,330 5,350 5,590 5,990 6,240 6,720 7,060 7,460 7,900 8,370

Sources: Congressional Budget Office; staff of the Joint Committee on Taxation. Notes: Numbers may not add up to totals because of rounding. n.a. = not applicable; * = between zero and $500 million. a. Figures reflect average enrollment over the course of a year and include spouses and dependents covered under family policies. Figures for the nonelderly population include residents of the 50 states and the District of Columbia who are younger than 65. b. Excludes coverage purchased directly from insurers outside of an exchange.

Table 4.

Comparison of CBOs Current and Previous Estimates of the Effects of the Insurance Coverage Provisions of the Affordable Care Act

May 2013 Baseline February 2014 Baseline Difference Change in Insurance Coverage Under the ACA in 2014 a (Millions of nonelderly people, by calendar year)

Insurance Exchanges Medicaid and CHIP Employment-Based Coverageb Nongroup and Other Coveragec Uninsuredd

7 9 * -2 -14

6 8 * -2 -13

-1 -1 * * 1

Effects on the Cumulative Federal Deficit, 2014 to 2023 e (Billions of dollars)

Exchange Subsidies and Related Spendingf Medicaid and CHIP Outlays Small-Employer Tax Creditsg Gross Cost of Coverage Provisions Penalty Payments by Uninsured People Penalty Payments by Employersg Excise Tax on High-Premium Insurance Plansg Other Effects on Revenues and Outlaysh

Net Cost of Coverage Provisions Memorandum:

1,075 710 14 _____ 1,798 -45 -140 -80 -171 _____

1,363

1,058 708 14 _____ 1,780 -45 -130 -80 -171 _____

1,354

-16 -2 ** ___ -18 ** 10 0 -1 ___

-9

Net Collections and Payments for Risk Adjustment, Reinsurance, and Risk Corridorsi

-8

-8

Sources: Congressional Budget Office; staff of the Joint Committee on Taxation. Notes: Numbers may not add up to totals because of rounding. ACA = Affordable Care Act; CHIP = Childrens Health Insurance Program; * = between -500,000 and 500,000; ** = between -$500 million and $500 million. a. Figures for the nonelderly population include residents of the 50 states and the District of Columbia who are younger than 65. b. The change in employment-based coverage is the net result of projected increases and decreases in offers of health insurance from employers and changes in enrollment by workers and their families. c. The effects are almost entirely for nongroup coverage; other includes Medicare. d. The number of uninsured people includes unauthorized immigrants as well as people who are eligible for, but not enrolled in, Medicaid. e. Positive numbers indicate an increase in the deficit; negative numbers indicate a decrease in the deficit. They also exclude effects on the deficit of other provisions of the Affordable Care Act that are not related to insurance coverage. They also exclude federal administrative costs subject to appropriation. f. Includes spending for exchange grants to states and net collections and payments for risk adjustment, reinsurance, and risk corridors (see Memorandum). CBOs May 2013 baseline also included an estimated $1 billion in spending for high-risk pools, premium review activities, and loans to consumer-operated and -oriented plans over the 20142023 period. A similar total is included elsewhere in CBOs February 2014 baseline.

g. These effects on the deficit include the associated effects of changes in taxable compensation on revenues. h. Consists mainly of the effects of changes in taxable compensation on revenues. i. These effects are included in Exchange Subsidies and Related Spending.

Anda mungkin juga menyukai

- Boston Mayor Executive Order 6-12-2020Dokumen3 halamanBoston Mayor Executive Order 6-12-2020iggybauBelum ada peringkat

- Doe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctionDokumen97 halamanDoe v. Trump 9th Circuit Denial of Stay of Preliminary InjunctioniggybauBelum ada peringkat

- Bostock v. Clayton County, Georgia DecisionDokumen119 halamanBostock v. Clayton County, Georgia DecisionNational Content DeskBelum ada peringkat

- AAFP Letter To Domestic Policy Council 6-10-2020Dokumen3 halamanAAFP Letter To Domestic Policy Council 6-10-2020iggybauBelum ada peringkat

- COVID 19 FaceCovering 1080x1080 4 SPDokumen1 halamanCOVID 19 FaceCovering 1080x1080 4 SPiggybauBelum ada peringkat

- HR 6585 Equitable Data Collection COVID-19Dokumen18 halamanHR 6585 Equitable Data Collection COVID-19iggybauBelum ada peringkat

- HR 6437 Coronavirus Immigrant Families Protection AcfDokumen16 halamanHR 6437 Coronavirus Immigrant Families Protection AcfiggybauBelum ada peringkat

- HR 4004 Social Determinants Accelerator ActDokumen18 halamanHR 4004 Social Determinants Accelerator ActiggybauBelum ada peringkat

- S 3609 Coronavirus Immigrant Families Protection ActDokumen17 halamanS 3609 Coronavirus Immigrant Families Protection ActiggybauBelum ada peringkat

- 7th Circuit Affirming Preliminary Injunction Cook County v. WolfDokumen82 halaman7th Circuit Affirming Preliminary Injunction Cook County v. WolfiggybauBelum ada peringkat

- S 3721 COVID-19 Racial and Ethnic Disparities Task ForceDokumen11 halamanS 3721 COVID-19 Racial and Ethnic Disparities Task ForceiggybauBelum ada peringkat

- SF StayHome MultiLang Poster 8.5x11 032620Dokumen1 halamanSF StayHome MultiLang Poster 8.5x11 032620iggybauBelum ada peringkat

- A Bill: in The House of RepresentativesDokumen2 halamanA Bill: in The House of RepresentativesiggybauBelum ada peringkat

- HR 6763 COVID-19 Racial and Ethnic Disparities Task ForceDokumen11 halamanHR 6763 COVID-19 Racial and Ethnic Disparities Task ForceiggybauBelum ada peringkat

- Milwaukee Board of Supervisors Ordinance 20-174Dokumen9 halamanMilwaukee Board of Supervisors Ordinance 20-174iggybauBelum ada peringkat

- NCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020Dokumen23 halamanNCAPIP Recommendations For Culturally and Linguistically Appropriate Contact Tracing May 2020iggybauBelum ada peringkat

- Doe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceDokumen48 halamanDoe v. Trump Preliminary Injunction Against Proclamation Requiring Private Health InsuranceiggybauBelum ada peringkat

- Cook County v. Wolf Denial Motion To Dismiss Equal ProtectionDokumen30 halamanCook County v. Wolf Denial Motion To Dismiss Equal ProtectioniggybauBelum ada peringkat

- ND California Order On Motion To CompelDokumen31 halamanND California Order On Motion To CompeliggybauBelum ada peringkat

- WA v. DHS Order On Motion To CompelDokumen21 halamanWA v. DHS Order On Motion To CompeliggybauBelum ada peringkat

- COVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFDokumen2 halamanCOVID-19 Data For Native Hawaiians and Pacific Islanders UPDATED 4-21-2020 PDFiggybauBelum ada peringkat

- Doe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationDokumen9 halamanDoe v. Trump Denial of All Writs Injunction Against April 2020 Presidential ProclamationiggybauBelum ada peringkat

- Covid-19 Data For Asians Updated 4-21-2020Dokumen2 halamanCovid-19 Data For Asians Updated 4-21-2020iggybauBelum ada peringkat

- Tri-Caucus Letter To CDC and HHS On Racial and Ethnic DataDokumen3 halamanTri-Caucus Letter To CDC and HHS On Racial and Ethnic DataiggybauBelum ada peringkat

- Physician Association Letter To HHS On Race Ethnicity Language Data and COVID-19Dokumen2 halamanPhysician Association Letter To HHS On Race Ethnicity Language Data and COVID-19iggybauBelum ada peringkat

- CDC Covid-19 Report FormDokumen2 halamanCDC Covid-19 Report FormiggybauBelum ada peringkat

- Booker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseDokumen4 halamanBooker-Harris-Warren Letter To HHS Re Racial Disparities in COVID ResponseStephen LoiaconiBelum ada peringkat

- Democratic Presidential Candidate Positions On ImmigrationDokumen10 halamanDemocratic Presidential Candidate Positions On ImmigrationiggybauBelum ada peringkat

- MMMR Covid-19 4-8-2020Dokumen7 halamanMMMR Covid-19 4-8-2020iggybauBelum ada peringkat

- Pete Buttigieg Douglass PlanDokumen18 halamanPete Buttigieg Douglass PlaniggybauBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- 2016 Disarmament and Security Committee at Bhavan's MUNDokumen8 halaman2016 Disarmament and Security Committee at Bhavan's MUNRamakrishnan LokanathanBelum ada peringkat

- Asean EssayDokumen2 halamanAsean Essaystardusts98Belum ada peringkat

- Qed DP 275Dokumen25 halamanQed DP 275Sergio ContrerasBelum ada peringkat

- Oner New DN After 20% CDDokumen2 halamanOner New DN After 20% CDUjjwal GuptaBelum ada peringkat

- AssignmentDokumen10 halamanAssignmentmicheal adebayoBelum ada peringkat

- Building A Data Culture in MOFDokumen136 halamanBuilding A Data Culture in MOFwowo100% (1)

- GE 217 STS Course PackDokumen86 halamanGE 217 STS Course PackDianne Sophia PACA�ABelum ada peringkat

- Psicología Comunitaria y Políticas Sociales: Institucionalidad y Dinámicas de Actores - Jaime Alfaro InzunzaDokumen10 halamanPsicología Comunitaria y Políticas Sociales: Institucionalidad y Dinámicas de Actores - Jaime Alfaro InzunzaNatalia Teresa Quintanilla MoyaBelum ada peringkat

- 2023-042 Universal Health CareDokumen2 halaman2023-042 Universal Health CareramsBelum ada peringkat

- Macro Chapter 24 - Govt and Fiscal PolicyDokumen34 halamanMacro Chapter 24 - Govt and Fiscal PolicyGenesis CagubcobBelum ada peringkat

- Basic Concepts of Public AdministrationDokumen6 halamanBasic Concepts of Public Administrationrupa_201094% (18)

- Book Reviews: Foreign Policy Analysis: A Comparative IntroductionDokumen20 halamanBook Reviews: Foreign Policy Analysis: A Comparative IntroductionDaniela DanielaBelum ada peringkat

- SF-1-10 - Cover PageDokumen10 halamanSF-1-10 - Cover PageRomeda ValeraBelum ada peringkat

- Alexa Ilagan Report For SRGGDokumen31 halamanAlexa Ilagan Report For SRGGALEXA MAE ILAGANBelum ada peringkat

- Social Work and Social PolicyDokumen209 halamanSocial Work and Social PolicyKiki Pranowo50% (2)

- Memo To The President-Elect On NGO PartnershipsDokumen1 halamanMemo To The President-Elect On NGO PartnershipsInterActionBelum ada peringkat

- Name of PupilsDokumen40 halamanName of PupilsDimpna GervacioBelum ada peringkat

- Joe Biden Voting RecordDokumen79 halamanJoe Biden Voting Recordmg0314aBelum ada peringkat

- Individual Daily Log Accomplishment Report Idlar 1Dokumen3 halamanIndividual Daily Log Accomplishment Report Idlar 1Jeferson SardengBelum ada peringkat

- Test Bank For Texas Politics: Ideal and Reality, Enhanced, 13th Edition, Charldean Newell, David F. Prindle, James RiddlespergerDokumen36 halamanTest Bank For Texas Politics: Ideal and Reality, Enhanced, 13th Edition, Charldean Newell, David F. Prindle, James Riddlespergertannery.eurusp0p2b6100% (20)

- Executive Legislative Agenda 2019-2022 Briefing / OrientationDokumen76 halamanExecutive Legislative Agenda 2019-2022 Briefing / OrientationVoltaire VillanuevaBelum ada peringkat

- Energy Efficiency Act SummaryDokumen9 halamanEnergy Efficiency Act SummaryMARVIN DE GUZMANBelum ada peringkat

- Pas Module 3Dokumen4 halamanPas Module 3Ar Jay Ar Jay100% (1)

- Conceptualising The Commercial Determinants of Suicide - Broadening The Lens On Suicide and Self-Harm PreventionDokumen8 halamanConceptualising The Commercial Determinants of Suicide - Broadening The Lens On Suicide and Self-Harm PreventionDouglas SantosBelum ada peringkat

- GPPB Resolution No. 04 2023Dokumen2 halamanGPPB Resolution No. 04 2023Aerol Bryan DaquerBelum ada peringkat

- Monetary Fiscal Policy MCQsDokumen17 halamanMonetary Fiscal Policy MCQsrohanBelum ada peringkat

- ASEAN Countries Lead in Establishing Energy Efficiency LawsDokumen19 halamanASEAN Countries Lead in Establishing Energy Efficiency LawsRemington SalayaBelum ada peringkat

- Questions Multiplier Model With KeyDokumen2 halamanQuestions Multiplier Model With Keyaditi shukla100% (1)

- Crowding out explainedDokumen3 halamanCrowding out explainedsattysattuBelum ada peringkat

- DepEd MAKATI Advisory 155 NESTLE WELLNESS CAMPUS PROGRAM S.Y. 2022 2023Dokumen4 halamanDepEd MAKATI Advisory 155 NESTLE WELLNESS CAMPUS PROGRAM S.Y. 2022 2023Krisha Gem Tanare-MalateBelum ada peringkat