Who Are Not Required To File Income Tax Returns

Diunggah oleh

Carolina VillenaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Who Are Not Required To File Income Tax Returns

Diunggah oleh

Carolina VillenaHak Cipta:

Format Tersedia

Who are not required to file Income Tax returns?

The following individuals are not required to file income tax returns: 1. An individual who is a minimum wage earner 2. An individual whose gross income does not exceed his total personal and additional exemptions 3. An individual whose compensation income derived from one employer does not exceed P 60,000 and the income tax on which has been correctly withheld 4. An individual whose income has been subjected to final withholding tax (alien employee as well as Filipino employee occupying the same position as that of the alien employee of regional headquarters and regional operating headquarters of multinational companies, petroleum service contractors and sub-contractors and offshore-banking units, non-resident aliens not engaged in trade or business) 5. Those who are qualified under substituted filing. However, substituted filing applies only if all of the following requirements are present : a) the employee received purely compensation income (regardless of amount) during the taxable year b) the employee received the income from only one employer in the Philippines during the taxable year c) the amount of tax due from the employee at the end of the year equals the amount of tax withheld by the employer d) the employees spouse also complies with all 3 conditions stated above e) the employer files the annual information return (BIR Form No. 1604-CF) f) the employer issues BIR Form No. 2316 (Oct 2002 ENCS version ) to each employee.

1. BIR Form 1700 Annual Income Tax Return (For Individual Earning Purely Compensation Income Including NonBusiness/Non-Profession Related Income) Please check the links at the bottom of this post for the new and revised BIR 1700 form as of November 2011. Documentary Requirements: a) Certificate of Income Tax Withheld on Compensation (BIR Form 2316) b) Waiver of the Husbands right to claim additional exemption, if applicable c) Duly approved Tax Debit Memo, if applicable d) Proof of Foreign Tax Credits, if applicable e) Income Tax Return previously filed and proof of payment, if filing an amended return for the same taxable year Steps and procedures for filing income tax return 1. Fill-up corresponding BIR Form (BIR Form 1700, 1701 or 1702) in triplicate. 2. Attach the corresponding documentary requirements 3. If there is payment: a) Proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you are registered and present the duly accomplished BIR Form (return), together with the required attachments and your payment. b) In places where there are no AABs, proceed to the Revenue Collection Officer or duly Authorized City or Municipal Treasurer located within the Revenue District Office where you are registered and present the duly accomplished BIR Form, together with the required attachments and your payment. c) Receive your copy of the duly stamped and validated form from the teller of the AABs/Revenue Collection Officer/duly Authorized City or Municipal Treasurer. 4. For No Payment Returns including refundable returns, and for tax returns qualified for second installment: a) Proceed to the Revenue District Office where you are registered or to any Tax Filing Center established by the BIR

and present the duly accomplished BIR Form, together with the required attachments. b) Receive your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

Anda mungkin juga menyukai

- Slavery - The West IndiesDokumen66 halamanSlavery - The West IndiesThe 18th Century Material Culture Resource Center100% (2)

- Adr Notes 1 PDFDokumen9 halamanAdr Notes 1 PDFYanhicoh CySa100% (6)

- Secretary's Certificate (Metrobank Business Online Solutions)Dokumen2 halamanSecretary's Certificate (Metrobank Business Online Solutions)Rajni Ramchand88% (8)

- Ra 7941 - Party List System ActDokumen5 halamanRa 7941 - Party List System Act文子Belum ada peringkat

- Garcia Fule vs. CA DigestDokumen1 halamanGarcia Fule vs. CA DigestPMV100% (1)

- North Davao Mining V NLRCDokumen3 halamanNorth Davao Mining V NLRCPeanutButter 'n JellyBelum ada peringkat

- Estate Tax Return: MandatoryDokumen1 halamanEstate Tax Return: MandatoryYna Yna100% (1)

- Autosweep Rfid Subscription AgreementDokumen2 halamanAutosweep Rfid Subscription AgreementDerrick Jan Lim100% (1)

- Nino SawtDokumen2 halamanNino SawtCarolina VillenaBelum ada peringkat

- Sallys Struthers - Answer KeyDokumen7 halamanSallys Struthers - Answer KeyLlyod Francis LaylayBelum ada peringkat

- Skills Training on Catering Services cum Provision of Starter KitDokumen4 halamanSkills Training on Catering Services cum Provision of Starter KitKim Boyles Fuentes100% (1)

- Achtung Panzer Production BookDokumen18 halamanAchtung Panzer Production Bookapi-231127108100% (1)

- SSS Employer Data Change Request Form R-8Dokumen2 halamanSSS Employer Data Change Request Form R-8Jolas E. Brutas50% (2)

- Math 1100 - Chapter 9-12Dokumen42 halamanMath 1100 - Chapter 9-12tangwanlu91770% (1)

- Pas 19Dokumen20 halamanPas 19Princess Jullyn ClaudioBelum ada peringkat

- Business Math Quarter 3 Week 2Dokumen8 halamanBusiness Math Quarter 3 Week 2Gladys Angela ValdemoroBelum ada peringkat

- Merchandising Accounting Cycle: Periodic: Subject-Descriptive Title Subject - CodeDokumen22 halamanMerchandising Accounting Cycle: Periodic: Subject-Descriptive Title Subject - CodeRose LaureanoBelum ada peringkat

- JFC Financial Analysis Highlights Q4 Profitability After LossesDokumen6 halamanJFC Financial Analysis Highlights Q4 Profitability After LossesJudi CruzBelum ada peringkat

- Break Even Analysis PDFDokumen2 halamanBreak Even Analysis PDFMohammed Raees0% (1)

- FUNDACC1 - Reviewer (Theories)Dokumen12 halamanFUNDACC1 - Reviewer (Theories)MelvsBelum ada peringkat

- Account Titles and Its ElementsDokumen3 halamanAccount Titles and Its ElementsJeb PampliegaBelum ada peringkat

- Basic Acctg 4th SatDokumen11 halamanBasic Acctg 4th SatJerome Eziekel Posada PanaliganBelum ada peringkat

- Chapter 6: Corporation Formation and Shareholder'S EquityDokumen11 halamanChapter 6: Corporation Formation and Shareholder'S EquityHoneyfruitPlays GamesBelum ada peringkat

- Guidelines On Basic Accounting Principles and ConceptsDokumen15 halamanGuidelines On Basic Accounting Principles and ConceptsCrisMedionaBelum ada peringkat

- Perpetual Help: Calculate Future Value and Present Value of Money andDokumen8 halamanPerpetual Help: Calculate Future Value and Present Value of Money andDennis AlbisoBelum ada peringkat

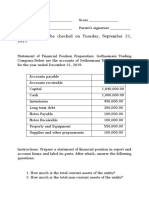

- Answer This To Be Checked On Tuesday, September 21, 2021Dokumen2 halamanAnswer This To Be Checked On Tuesday, September 21, 2021Teresa Mae OrquiaBelum ada peringkat

- PDF Journal Entries Tradingdocx CompressDokumen79 halamanPDF Journal Entries Tradingdocx CompressMaskter TwinsetsBelum ada peringkat

- Financial AnalysisDokumen3 halamanFinancial AnalysisJasmine ActaBelum ada peringkat

- Theory of Consumer BehaviorDokumen32 halamanTheory of Consumer Behaviorkiesha pastranaBelum ada peringkat

- Aglaea Moisturizer Situation AnalysisDokumen3 halamanAglaea Moisturizer Situation AnalysisVince VisayaBelum ada peringkat

- Managing Inventory Records in Small BusinessesDokumen14 halamanManaging Inventory Records in Small BusinessesLutfi MualifBelum ada peringkat

- GHI Company Comparative Balance Sheet For The Year 2015 & 2016Dokumen3 halamanGHI Company Comparative Balance Sheet For The Year 2015 & 2016Kl HumiwatBelum ada peringkat

- Peanutroll MANUSCRIPTDokumen24 halamanPeanutroll MANUSCRIPTJhazreel Biasura100% (1)

- Accrued Revenue: This Is Handout 020 Accruals Please Use This Handout For Lesson 020 Adjusting Entries 4 - AccrualsDokumen3 halamanAccrued Revenue: This Is Handout 020 Accruals Please Use This Handout For Lesson 020 Adjusting Entries 4 - AccrualsCaryl May Esparrago MiraBelum ada peringkat

- Situation A (Agree) B (Disagree) C (Justification) : Activity 5 (W2)Dokumen10 halamanSituation A (Agree) B (Disagree) C (Justification) : Activity 5 (W2)Patricia Anne RiveraBelum ada peringkat

- Ethical analysis of a tragic road rage incidentDokumen7 halamanEthical analysis of a tragic road rage incidentEzekylah AlbaBelum ada peringkat

- Business Mathematics - Module 14 - Overtime PayDokumen6 halamanBusiness Mathematics - Module 14 - Overtime PayLovely Joy Hatamosa Verdon-DielBelum ada peringkat

- 2 CHAPTER Lesson 2 1 AssetsDokumen6 halaman2 CHAPTER Lesson 2 1 AssetsRegine BaterisnaBelum ada peringkat

- 2.0assessment ExamDokumen2 halaman2.0assessment ExamyeshaBelum ada peringkat

- Preview of Chapter 6: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldDokumen84 halamanPreview of Chapter 6: Intermediate Accounting IFRS 2nd Edition Kieso, Weygandt, and WarfieldLong TranBelum ada peringkat

- Accounting PointsDokumen4 halamanAccounting PointsLovely IñigoBelum ada peringkat

- Post Quiz Chapter 10Dokumen1 halamanPost Quiz Chapter 10joanna supresenciaBelum ada peringkat

- Six C's of Effective MessagesDokumen40 halamanSix C's of Effective MessagessheilaBelum ada peringkat

- Conceptual Framework - Capital Maintenance ConceptsDokumen4 halamanConceptual Framework - Capital Maintenance ConceptsAllaine ElfaBelum ada peringkat

- Summary Notes - PAS 1 - Presentation of Financial Statements Financial PositionDokumen3 halamanSummary Notes - PAS 1 - Presentation of Financial Statements Financial PositionEDMARK LUSPEBelum ada peringkat

- Main components of a computer systemDokumen6 halamanMain components of a computer systemLarry RicoBelum ada peringkat

- Financial factors affecting students' spending habitsDokumen2 halamanFinancial factors affecting students' spending habitsXienaBelum ada peringkat

- Exercise 3 Leah GarciaDokumen12 halamanExercise 3 Leah GarciaMa Sophia Mikaela EreceBelum ada peringkat

- ABM 3 Quarterly ExamDokumen2 halamanABM 3 Quarterly ExamLenyBarrogaBelum ada peringkat

- Grade 12 PracticumDokumen2 halamanGrade 12 PracticumRaven Andrea AtienzaBelum ada peringkat

- Business Finance: Mrs. Leah O. RualesDokumen28 halamanBusiness Finance: Mrs. Leah O. RualesCleofe Sobiaco100% (1)

- Research: Defining Key Terms and ObjectivesDokumen5 halamanResearch: Defining Key Terms and Objectivesvarun v sBelum ada peringkat

- Swot Analysis Argentina Corned BeefDokumen8 halamanSwot Analysis Argentina Corned BeefBeverly ParianBelum ada peringkat

- Quiz Cpa EsDokumen4 halamanQuiz Cpa Esmusic niBelum ada peringkat

- Fabm2 Q1 M4Dokumen23 halamanFabm2 Q1 M4Beverly ComamoBelum ada peringkat

- Far Prelims Week 1Dokumen3 halamanFar Prelims Week 1hat dawgBelum ada peringkat

- Standard Normal Distribution Table ProbabilitiesDokumen25 halamanStandard Normal Distribution Table ProbabilitiesMarcy BoralBelum ada peringkat

- SAP B1 Fundamentals AccountingDokumen33 halamanSAP B1 Fundamentals AccountingJosef SamoranosBelum ada peringkat

- Fudgee Bar Ice Cream Cake Business PlanDokumen9 halamanFudgee Bar Ice Cream Cake Business PlanDeath StrokeBelum ada peringkat

- Explicit vs. ImplicitDokumen2 halamanExplicit vs. ImplicitLeene D. Dilao0% (1)

- Module 3 - Personal Entrepreneurial CompetenciesDokumen8 halamanModule 3 - Personal Entrepreneurial CompetenciesReziahmay GocotanoBelum ada peringkat

- Merchandising ActivityDokumen12 halamanMerchandising ActivityCherie Soriano Ananayo100% (2)

- Minimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)Dokumen57 halamanMinimum Corporate Income Tax (MCIT), Improperly Accumulated Earnings Tax (IAET), and Gross Income Tax (GIT)kyleramosBelum ada peringkat

- Quiz SolutionDokumen3 halamanQuiz SolutionKim Patrick VictoriaBelum ada peringkat

- Name: - Year and Section: - Industry and Environmental Analysis Business Opportunity Identification ExercisesDokumen3 halamanName: - Year and Section: - Industry and Environmental Analysis Business Opportunity Identification ExercisesAngelyn LingatongBelum ada peringkat

- Lesson 26: EntrepreneurshipDokumen9 halamanLesson 26: EntrepreneurshipEasy WriteBelum ada peringkat

- Fabm 4 PDFDokumen2 halamanFabm 4 PDFgk concepcionBelum ada peringkat

- Accounting Practice SetDokumen8 halamanAccounting Practice SetZyn Marie OccenoBelum ada peringkat

- 1st Freshmen Tutorial Activity 2Dokumen3 halaman1st Freshmen Tutorial Activity 2Stephanie Diane SabadoBelum ada peringkat

- Intermediate Accounting 1 by Sir ChuaDokumen22 halamanIntermediate Accounting 1 by Sir ChuaAnalyn LafradezBelum ada peringkat

- BIR 2019 Income Tax DescriptionDokumen20 halamanBIR 2019 Income Tax DescriptionRiselle Ann SanchezBelum ada peringkat

- Spa - TinDokumen1 halamanSpa - TinCarolina VillenaBelum ada peringkat

- BIR Change of Civil StatusDokumen1 halamanBIR Change of Civil StatusCarolina VillenaBelum ada peringkat

- NegoKart Assistance for Meycauayan MuslimsDokumen3 halamanNegoKart Assistance for Meycauayan MuslimsCarolina VillenaBelum ada peringkat

- Sample UCPB - Biz Secretary's CertificateDokumen2 halamanSample UCPB - Biz Secretary's CertificateBrikkzBelum ada peringkat

- SingleWindow Annex C1 C2 C3Dokumen7 halamanSingleWindow Annex C1 C2 C3EduardoBelum ada peringkat

- CONTRACT OF LEASE - JuniorDokumen3 halamanCONTRACT OF LEASE - JuniorCarolina VillenaBelum ada peringkat

- Contract of LeaseDokumen3 halamanContract of LeaseCarolina VillenaBelum ada peringkat

- Last Name First Name Middle NameDokumen2 halamanLast Name First Name Middle NameCarolina VillenaBelum ada peringkat

- Web Employer RegistrationDokumen1 halamanWeb Employer RegistrationCarolina VillenaBelum ada peringkat

- Special Power of AttorneyDokumen1 halamanSpecial Power of AttorneyCarolina VillenaBelum ada peringkat

- General Account Update FormDokumen1 halamanGeneral Account Update FormCarolina VillenaBelum ada peringkat

- SSS MLP Special Power of AttorneyDokumen1 halamanSSS MLP Special Power of AttorneyCarolina VillenaBelum ada peringkat

- Rapid Pass Instructions: Required FieldsDokumen5 halamanRapid Pass Instructions: Required FieldsKreig123Belum ada peringkat

- How to Apply for RCBC Cash Express Merchant in 4 Easy StepsDokumen1 halamanHow to Apply for RCBC Cash Express Merchant in 4 Easy StepsCarolina VillenaBelum ada peringkat

- Morion For Reduction of Bail For TordilloDokumen1 halamanMorion For Reduction of Bail For TordilloCarolina VillenaBelum ada peringkat

- LET LINGUISTICS GMG PDFDokumen11 halamanLET LINGUISTICS GMG PDFCarolina VillenaBelum ada peringkat

- VatDokumen1 halamanVatCarolina VillenaBelum ada peringkat

- SSS MLP Loan Restructuring ApplicationDokumen3 halamanSSS MLP Loan Restructuring ApplicationCarolina VillenaBelum ada peringkat

- Regional Trial Court: Urgent MotionDokumen1 halamanRegional Trial Court: Urgent MotionCarolina VillenaBelum ada peringkat

- TAX ADVISORY - BIR Form 1701Q Availability PDFDokumen1 halamanTAX ADVISORY - BIR Form 1701Q Availability PDFCarolina VillenaBelum ada peringkat

- Cokep 12Dokumen1 halamanCokep 12Carolina VillenaBelum ada peringkat

- Shonen JidaiDokumen1 halamanShonen JidaiCarolina VillenaBelum ada peringkat

- Abstract On Coffee SeedsDokumen1 halamanAbstract On Coffee SeedsCarolina VillenaBelum ada peringkat

- The Riddle LyricsDokumen1 halamanThe Riddle LyricsCarolina VillenaBelum ada peringkat

- Basketball in The Philippines - Wikipedia, The Free Encyclopedia PDFDokumen17 halamanBasketball in The Philippines - Wikipedia, The Free Encyclopedia PDFCarolina Villena50% (2)

- Republic of The PhilippinesDokumen3 halamanRepublic of The PhilippinesVin Grace Tiqui - GuzmanBelum ada peringkat

- Page2Dokumen1 halamanPage2The Myanmar TimesBelum ada peringkat

- (G.R. No. 115245, July 11, 1995)Dokumen3 halaman(G.R. No. 115245, July 11, 1995)rommel alimagnoBelum ada peringkat

- HR 332 CCT PDFDokumen3 halamanHR 332 CCT PDFGabriela Women's PartyBelum ada peringkat

- Mariano Jr. v. Comelec DigestDokumen3 halamanMariano Jr. v. Comelec DigestAnonymousBelum ada peringkat

- KKDAT Form 1Dokumen2 halamanKKDAT Form 1brivashalimar12Belum ada peringkat

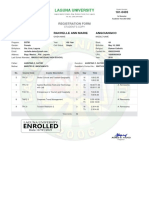

- Laguna University: Registration FormDokumen1 halamanLaguna University: Registration FormMonica EspinosaBelum ada peringkat

- Agnes Henderson InfoDokumen2 halamanAgnes Henderson Infopaul nadarBelum ada peringkat

- S.B. 43Dokumen22 halamanS.B. 43Circa NewsBelum ada peringkat

- Hindutva As A Variant of Right Wing ExtremismDokumen24 halamanHindutva As A Variant of Right Wing ExtremismSamaju GuptaBelum ada peringkat

- U.S. v. Arizona - Lawsuit Re Arizona Immigration Law (SB 1070)Dokumen25 halamanU.S. v. Arizona - Lawsuit Re Arizona Immigration Law (SB 1070)skuhagenBelum ada peringkat

- Claro M. Recto: The Great Dissenter who fought pro-American politicsDokumen28 halamanClaro M. Recto: The Great Dissenter who fought pro-American politicsJohn Jacob TandangBelum ada peringkat

- WW 3Dokumen12 halamanWW 3ayesha ziaBelum ada peringkat

- By Senator Rich Alloway: For Immediate ReleaseDokumen2 halamanBy Senator Rich Alloway: For Immediate ReleaseAnonymous CQc8p0WnBelum ada peringkat

- People Vs YauDokumen7 halamanPeople Vs YauMark DungoBelum ada peringkat

- A Fresh Start? The Orientation and Induction of New Mps at Westminster Following The Parliamentary Expenses ScandalDokumen15 halamanA Fresh Start? The Orientation and Induction of New Mps at Westminster Following The Parliamentary Expenses ScandalSafaa SaddamBelum ada peringkat

- Eng PDFDokumen256 halamanEng PDFCarmen RodriguezBelum ada peringkat

- UntitledDokumen70 halamanUntitledkrishatanu ghoshBelum ada peringkat

- Ungs 1301 Section 18 Conference ReportDokumen14 halamanUngs 1301 Section 18 Conference ReportShamil AsyrafBelum ada peringkat

- The Battle of Murten - The Invasion of Charles The Bold PDFDokumen28 halamanThe Battle of Murten - The Invasion of Charles The Bold PDFAlex ReasonerBelum ada peringkat

- Capital PunishmentDokumen3 halamanCapital PunishmentAnony MuseBelum ada peringkat

- Analysis of 'Travel and Drugs in Twentieth-Century LiteratureDokumen4 halamanAnalysis of 'Travel and Drugs in Twentieth-Century LiteratureMada AnandiBelum ada peringkat